Have you had problems with payday loans? You can get a refund of the interest you paid on "unaffordable" loans. It’s easy to ask for a payday loan refund using the free template here. This works if your payday loans were repaid or you still owe money. What are “unaffordable” loans? The regulator says: “the borrower should be able to make the required repayments without undue difficulty, … [Read more...]

Payday loans

Payday loans - easy to take out - hard to escape from. This page has all Debt Camel's articles about them, the most recent first.

If you think you were given a payday loan which was unaffordable - you could only repay it if you borrowed again soon afterwards, read How to ask for a payday loan refund which has step by step instructions and free template letter.

Tens of thousands of people have got a refund of the interest they paid on some of their loans using this approach!

Loans2Go – the worst loans in Britain – ask for a refund

Loans2Go offers what I have called the worst loans in Britain. Since 2021 they have been charging 770% APR. See the representative example Loans2Go quotes on its website: £550 borrowed for 18 months is a monthly payment of £113 this adds up to £2035, a bit less than four times what was borrowed. MUCH cheaper to get a payday loan than a Loans2Go loan Of course Loans2Go don't … [Read more...]

Payday lenders – email addresses for complaints

If you want to get a refund for "unaffordable" payday loans, the first step is to complain to the lender. Often it's simple as the lender has a Complaints section on their website, but some have been taken over or the website isn't there anymore, so here is a list of their email addresses. For all these emails put AFFORDABILITY COMPLAINT as the subject of the email. If you haven't already … [Read more...]

“Lender says I lied – what should I do?”

Some lenders responding to affordability complaints by saying your application wasn't accurate about your income or expenses when you took out the loans. They are doing this to try to put you off taking your case to the Financial Ombudsman. That may save them a lot of money! Let's see why applications may have been inaccurate and whether this is a problem for your complaint. Most of the … [Read more...]

Recent payday loans make it hard to get a mortgage

Having a recent payday loan on your credit history can make it much harder for you to get a mortgage at a good rate - or even at all! If you have used payday loans, the rule of thumb for a mortgage application is to wait until at least 2 years have passed after your last payday loan was settled. Before coronavirus, the usual advice was to wait one year. But from 2020 many mortgage lenders … [Read more...]

2018 – Ombudsman decides it can look at payday loans over 6 years old

The Financial Ombudsman (FOS) has published in September 2018 two Decisions involving payday loans over six years old: Mr H has complained about fifty-four payday loans Lender C lent to him between March 2010 and September 2014. Mrs W’s complaint is about nine short-term loans from Lender D between November 2009 and July 2012. In both cases FOS has decided that its rules do allow it to … [Read more...]

Lending Stream – poor and slow complaints handling

Lending Stream, a mid-sized payday lender in Britain, is noticeably bad at handling payday loan affordability complaints. This article looks at what often happens in a Lending Stream affordability complaint so you are prepared. By taking your complaint to the Ombudsman you may get a much better award. In the first half of 2018, the Financial Ombudsman was agreeing with the customer in more than … [Read more...]

Do you need help to escape from unaffordable debt?

My articles on How to ask for refunds looks at how to make affordability complaints about different sorts of debt - overdafts, loans, credit cards, catalogues, even car finance. It also applies if you have repaid the credit already or if you are still repaying a balance. But what do you do about this month's repayments if you can't manage them? You can't put in a complaint and then carry on … [Read more...]

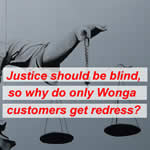

Do a million need payday loan compensation?

On 2nd October 2014 the Financial Conduct Authority (FCA) announced that Wonga had agreed to compensate an estimated 375,000 customers where Wonga's "affordability" checks are likely to have been inadequate. The common reactions were first that Wonga was being made an example of to warn other payday lenders and second that this was a huge number of refunds... But should many more people get … [Read more...]