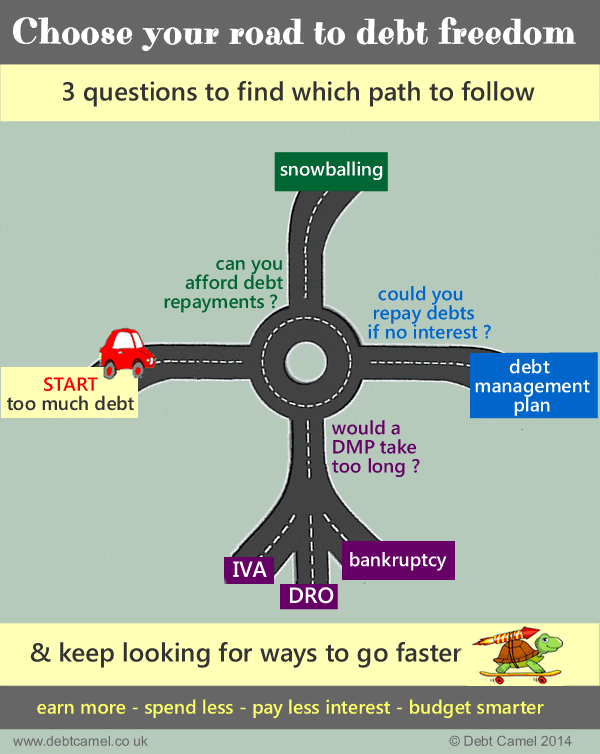

Go round the roundabout…

The picture at the top of this page is a good at-a-glance guide to handling problems with consumer debts such as loans, credit cards and catalogues.

Go round the roundabout and turn off at the first road that will work for you!

If you have priority debts including such as mortgage, rent, council tax or car finance arrears, these need to be handled differently, see Priority and non-priority debts.

The common debt solutions

The five main debt options are:

- Snowball your debts! Usually the best solution if you can make at least the minimum payments on your debts each month and your debts are falling, not increasing. As you snowball, your credit rating will get better and better, unlike all the other debt solutions that will damage your credit rating.

- Debt Management Plan (DMP) where you pay less than the normal payments each month and your creditors freeze interest – they almost always do.

This can just be a temporary measure if needed eg until you find another job.

The payment can be as little as £1 a month – these token payments aren’t a debt solution, just a holding measure. - Debt Relief Order (DRO) is often the perfect option if you owe less than £50,000, can pay less than £75 a month to your debts and don’t own a house.

- Individual Voluntary Arrangement (IVA) can work well if you have a reliable income and assets to protect such as a house with equity. Avoid if you have no assets to protect because a lot of IVAs fail and bankruptcy would also be cheaper.

- Bankruptcy which sounds scary but for many people it is the fastest and simplest way to be able to start again. Find out the facts rather than dismissing this because of myths and rumours that may not be correct for you.

The last three – DROs, IVAs and bankruptcy – are all types of insolvency. They are formal legal arrangements that aim to resolve a debt problem completely and are not suitable as a temporary measure. Most types of debt are included, but check this page for details.

There are three less common debt solutions:

- Full & Final Settlements These can be very useful if you have been on a DMP or haven’t been able to make any payments at all for a while and you may be able to get a lump sum.

- Write-off Debts, Creditors won’t usually consider these unless there are unusual circumstances, and

- Administration Order These are now extremely rare, you have to owe less than £5,000 and have a CCJ. If you think you would qualify, talk to a good debt adviser.

Affordability complaints

If you have been given unaffordable credit, look at asking for refunds:

- loan repayments may have been so large that you were left short and had to borrow more

- a credit limit increased on a credit card or catalogue when you had only been making minimum payments for a long while, or had been making a lot of cash withdrawals

- overdraft limit increased stupidly high when the bank should have seen you were already in big difficulties? You can complain about a student overdraft after the bank has started charging interest on it.

These may sound great! But it can be hard for you tell how good a case you have. Lenders reject many good complaints so they have to go to the Financial Ombudsman, which can take a long while.

So if you are in immediate difficulty, then often a good combination is a debt management plan, to get you into a safe financial space and affordability complaints, which will speed up the DMP if you win any.

Other ways to improve your situation

There are other ways to improve your finances , such as selling assets, paying less interest, reducing your expenses and increasing your income. If you can make a big enough change to your situation, then you may be able to snowball and not need a DMP or insolvency at all!

If you don’t have enough money for your expenses if you pay nothing to your debts, then this needs to be tackled before trying to resolve your debts, even if your debts feel urgent. Talk to a debt adviser as soon as possible.

Making the right choice

Choosing the best debt solution is vital. If you have read through how some of your possible options work, you will hopefully have ruled some of them out, but many people will feel unsure which of two options to choose.

Have a look at the Hard Choices page. That provides a direct comparison of many of the options, such as “IVA or bankruptcy”, and also looks at difficult decisions such as “How far should I cut back my expenditure?”

Good places to get debt help

Good, reliable and free debt help and advice is available.

- Make sure you talk to one of the good guys, for example a national charity such as National Debtline or your local Citizens Advice.

- The adverts you see offering “free advice” usually turn out to be anything but free… and never trust anyone that cold-calls you offering debt advice.

It’s important to take your time and research your options.

Don’t let worries about defaults or bailiffs panic you into making a fast decision that you will later regret. Good debt advisors want you to be comfortable with the route you choose and will be happy to answer questions about all the alternatives and how they work.