Have you had big overdraft problems for a long period?

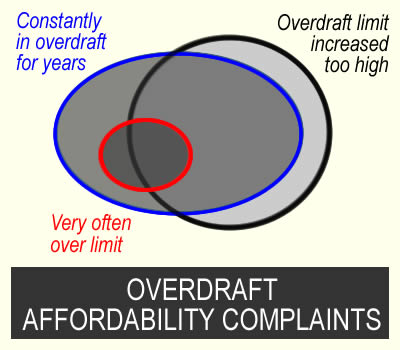

You can make an affordability complaint and ask for a refund of overdraft charges if:

- your overdraft limit was set too high at the start or increased to a level you are unable to clear; or

- your overdraft usage showed you were in long-term financial distress. For example, being in the overdraft all the time, or using an unauthorised overdraft a lot

- your overdraft was originally a student account with no charges, but now interest is being added and you are in the account all or almost all of every month.

This article shows how to make an affordability complaint to your bank, with a free template letter to use.

These complaints do not hurt your credit record. And if the bank doesn’t make a you a good offer, it is free to take your case to the Ombudsman.

Contents

Overdraft affordability complaints

Overdrafts are supposed to be for short-term borrowing

Overdrafts are intended to be used for short-term problems, not as long-term borrowing. A bank should review a customer’s repayment record and overdraft limit and if there are signs of financial difficulty, offer help.

One sign of financial difficulty is hardcore borrowing for a long period. The Lending Code defined hardcore borrowings as “the position where a customer’s current account overdraft remains persistently overdrawn for more than a month without returning to credit during that period”.

Some Ombudsman decisions

All cases are very individual. But these examples give you an indication of what the Ombudsman thinks is important.

In this NatWest decision, the Ombudsman decided:

NatWest did have an obligation to monitor Miss K’s use of her overdraft facility.

Any fair and reasonable monitoring of Miss K’s overdraft facility would have resulted in NatWest being aware Miss K was in financial difficulty … by October 2014 at the absolute latest. So NatWest ought to have exercised forbearance from this point onwards.

In this Santander case, the bank didn’t notice hardcore borrowing:

By this point, Miss C was hardcore borrowing. In other, words she hadn’t seen or maintained a credit balance for an extended period of time. Santander’s own literature suggests that overdrafts are for unforeseen emergency borrowing not prolonged day-to-day expenditure. So I think that Miss C’s overdraft usage should have prompted Santander to have realised that Miss C wasn’t using her overdraft as intended and shouldn’t have continued offering it on the same terms.

A similar decision was reached in this Lloyds case:

Mr and Mrs C’s statements leading up to the renewal shows they hadn’t really had a credit balance on their account for a prolonged period. Indeed, they’d had regular returned payments and had also exceeded their limit. In these circumstances, it ought to have been apparent Mr and Mrs C were unlikely to be able to repay what they owed within a reasonable period with overdraft interest, fees and associated charges continuously being added.

Decide which reasons apply to your overdraft complaint

You are in the overdraft all or almost of the month for a long while

This is the most common reason for winning a complaint

Overdrafts are meant to be used when you have a problem. Using the overdraft a lot for a few months is fine. Or for a few days at the end of a month before you are paid.

Banks should review your overdraft annually. This is in most overdraft terms and conditions. And even if it isn’t, the Ombudsman says this is good industry practice.

So at one of these reviews, your bank should have seen if you were in difficulty with the overdraft. For example if you are in the overdraft for all (or almost all) of the month for a prolonged period. Or if you were often exceeding your arranged overdraft limit.

I would say over a year is prolonged.

The bank set your limit too high

This may have been from the start when you were first given an overdraft. Or the initial low limit may have been fine, then the bank increased it to a level which it was impossible for you to repay.

If the bank saw signs of financial difficulty, it should not have increased your credit limit, even if you asked for it. And it should have considered offering your help instead (the regulator’s word is forbearance), for example by stopping charges.

But what is too high?

This depends on your income and expenses. An overdraft of £2,000 for someone whose income is £1,800 a month is a lot – but if you earn £5,000 a month, then a £2,000 overdraft may be reasonable.

Other points that help a complaint

You won’t win an affordability complaint by saying the charges were too high.

Instead, you say the bank should have known they were unaffordable for you because of all the financial problems it could see on your statements and your credit record.

Here is a checklist, do any apply to you?

- often having direct debits or standing orders not being paid;

- a lot of gambling showing on your statements;

- significantly increasing other debts with the same bank (you may also be able to complain about those loans or credit card);

- being recently rejected for a loan or a credit card by the bank;

- significantly increasing debts with other lenders showing on your credit record;

- a worsening credit record – maxed out credit cards, new missed payments, payment arrangements, defaults etc;

- using payday loans;

- mortgage arrears;

- a reduction in the income going into your account.

Making your complaint

What you need at the start

You don’t need to know the dates your limit was increased before complaining, my template asks for them.

If you have paper statements or you can download them from the app, that may be useful for you. But you don’t need to send these statements to the bank with your complaint – the bank already has them!

You can’t go back and see exactly what your credit score was in say 2021 when the bank increased your limit. But your current credit record shows what was happening back six years, so download your credit report now and keep it. The sooner you get the report, the further back it goes. I suggest you get your free TransUnion statutory credit report.

Send a complaint by email

I don’t recommend phoning to start off a complaint. It’s too complicated and you will be talking to someone that doesn’t specialise in these complaints.

I think email is the simplest way to make these complaints. Here is my list of bank email addresses for complaints.

An alternative is to send a long message in the app. But if this means using a chat facility, it’s not usually a good idea, as you are again talking to someone who doesn’t understand what you are saying and tries to tell you what help is available with your overdraft – when all you want is to have your complaint considered.

A template you can adapt

The section above looked at the reasons to complain and the other good points that apply to your case – you can turn those into a complaint.

In the template below, I’ve invented some examples and dates so you can see how a complaint email could read. The bits in italics should be changed or deleted to tell your story.

The bit about other points is important – what should your bank have noticed that showed you were in difficulty?

I am making an affordability complaint about the overdraft on my current account number 98765432.

Your identity details (these are needed if you complain by email, not if you use secure message):

My name is xxxxx xxxxxxxx. My date of birth is dd/mm/yy. The email address I use/used for this account was myaddress@whatever.com.

Your home address (if you know the bank has your current address, ignore this):

My current address is xxxxxxxxxxxxxxxxxxxx. Please do not send any letters to older addresses you may have on your records.

If your overdraft was originally a student overdraft with no interest include this, otherwise delete it:

My account started as a student overdraft and no fees were charged. I am complaining about the period after, when you started to charge fees.

START BY SAYING they should have noticed your financial difficulty

Overdrafts are meant for short-term borrowing but you could see I was unable to clear the balance in a sustainable way. I was using the account for long term borrowing as I could not get out of this. The fees and charges you were adding were making my position worse.

I am complaining that [every year since [20xx] OR for many years] you have failed to notice my difficulty during the annual reviews of my overdraft. You should have offered forbearance eg by stopping interest and charges being added.

By 2017 I had been in my overdraft constantly for many months, not getting back into the black even when I was paid. This “hardcore borrowing” is a clear sign of financial difficulty. My income was only £1,850 a month – after I had paid bills, there was no way I could hope to clear an overdraft of £3500 in a reasonable length of time.

OR

By 2021, although my salary took my account briefly into credit, within a few days, I was back in the overdraft.

include any other points that show you were in difficulty

You should have seen that I was in financial difficulty because you rejected my loan application in 2019.

You should have noticed that the income going into my account decreased from 2021.

From 2020-22 there was a lot of gambling showing on my account.

In 2021 you should have seen from my credit record that I had made payment arrangements with other debts.

Say if the intial limit was too high or it was later increased too high

You should never have given me an account with such a large overdraft. When I applied in 2016, you should have checked my credit record and income and seen I had recently missed payments to a credit card and had taken several payday loans.

OR

You should not have increased my overdraft limit in about 2017. When you increased the limit, you should have seen that my debts to other lenders on my credit record had increased a lot.

I do not know the exact months of the overdraft limit increases. In your reply to this complaint, please tell me when the increases were and how much the limit went up on each occasion.

END BY asking for a refund of charges and interest:

I would like you to refund all the interest and charges that were added to my account from 2016 when you increased my overdraft limit.

OR

I would like you to refund all the interest and charges that were added to my account from 2021 when you should have realised that my finances had got worse to the point that I was no longer able to clear the overdraft.

Please remove any late payment and default markers from my credit records.

Points to note

Student overdrafts

You won’t win a complaint about a student overdraft saying you were a student and it was unaffordable at that point.

But when the bank has started charging interest, it should start doing reviews and check if you are in difficulty. So from then on, you can win affordability complaints.

You can complain if the account is still being used or if it is closed

These complaints can be made in a lot of different situations. For example:

- you are still using the account or you have stopped using it and are paying it off;

- the account has been closed;

- the bank defaulted it and sold it to a debt collector (here you still complain to the bank, not the debt collector). If the debt collector has gone to court and got a CCJ, add a sentence to the template saying you want the CCJ removed as part of the settlement of your complaint.

But if you have had an IVA or bankruptcy after these problems, or if you are still in a DRO, then you shouldn’t complain – ask in the comments below for details.

Old accounts

Banks may say FOS won’t look at an old complaint, but this isn’t right. FOS will often look at a complaint if it has been open in the last six years. How far back FOS will go seems rather random, but it should be possible to go back at least 6 years.

Open and recently closed accounts aren’t a problem – the bank will still have your statements.

If your complaint is about an account that was closed more than 6 years ago, it’s going to be very hard to win.

Packaged bank accounts

These affordability complaints are not about the fees on packaged bank accounts. MSE has a page about packaged bank account charge complaints.

Personal accounts, not business accounts

The complaints covered here relate to personal accounts. For business accounts, talk to Business Debtline about your options.

The Bank replies

They want to phone me!

People are often scared if they get this message. But it may be good news! You can just ignore it or say you would like a reply in writing.

If you decide to take the call, it helps to be prepared:

- have a pen and paper handy so you can write down anything

- if they say they are partially upholding the complaint, ask them the date they are refunding the fees from, and how much. And say you would like to see this in writing before you decide whether to accept it.

- if they ask you questions that sound complicated or worrying, ask them to put the questions in writing as you find the phone difficult

- when they say they are rejecting the complaint, ask for this in writing, as you will be going to the Ombudsman.

Rejection/poor offer – go to the Ombudsman , it’s free

Banks reject many good complaints, hoping you will give up. So don’t! You know if the overdraft has caused you a lot of problems.

You can’t go straight to the Financial Ombudsman (FOS), you have to wait for the bank to reply, or for them to have not replied within 8 weeks.

Here are some things banks may say to try to put you off:

- you could have declined the increase to your overdraft limit – FOS probably won’t think that is a good reason

- you never let the bank know you were in difficulty – FOS probably won’t think that is a good reason

- your salary was enough to return you to credit each month – this is misleading if bills meant you very soon went into the overdraft;

- FOS will not look into things that happened more than 6 years ago – if your account was still open in the last 6 years FOS may well look at it.

And the bank may offer to refund fees for the last 15 months say, even though your problems have been large for many years. Think twice about accepting a low offer – you won’t put this offer at risk by going to the Ombudsman.

If you are offered a refund for the last 6 years but not any further back, have a think if this is a good enough offer. It is a bit unpredictable whether the ombudsman will be prepared to go back further than 6 years.

If you aren’t sure, post in the comments below.

To send the case to FOS, complete this online form:

- you can use what you put in your complaint to the bank;

- if the bank rejected your complaint or made a low offer, say why you think this is unfair;

- use normal English, not legal terms.

You don’t need to send your bank statements – the bank will send those to FOS. And you don’t need the policy documents for your bank account, the lender will supply those to FOS if they are needed.

Do these complaints work?

Yes! From 2024, some banks are making more offers directly.

A Guardian article featured a case where someone used the template letter here. Barclays denied it had done anything but made an £8,000 “goodwill” payment to the customer.

And if your bank rejects your case, people are winning cases at the ombudsman. FOS is a friendly service although it isn’t speedy. It isn’t faster to use a solicitor or a claims firm,

The comments below this article are from other people who have made this sort of complaint. That is a good place to ask for help if you aren’t sure what to do.

chloe says

hello, i raised a Halifax complaint on the 11th of march. i didn’t get a final response by the 8 week mark & received a text message from Halifax stating they’d extended it to the 3rd of june. so at this point i contacted FOS. (i probably should of just waited) as yesterday i’d received a phone call stating my complaint had been assigned and was being looked into & i should hear back within the next couple of days (if rejected). she said if the complaints being upheld i won’t hear from her again? is this because it’s with FOS? will they get the final response or will i get it sent to me aswell despite whatever outcome it is?

sorry if that’s a silly question!

thank you

Sara (Debt Camel) says

When a complaint is with FOS, a lender will normally send my offer to FOS and then FIS sends it to you and asks if you would like to accept it or do you want the FIS case to continue.

Sending a case to FOS doesnt slow it down!

chloe says

thank you.

the lady from Halifax called me today & said they’ve rejected my claim but are freezing interest & charges for 30 days and are going to pay £100 into my account to ‘help’ if i’m struggling.

so i guess i just need to wait for my complaint to be assigned to a case handler at FOS now.

Liberty Page says

I did mine in feb and still heard nothing, they kept sending me texts saying sorry we haven’t resolved your complaint yet and now I’ve heard nothing since April

Sara (Debt Camel) says

Feb is daftly long. I suggest you send this to FOS now

James says

Hi!

After complaining in January and then going to the FOS. They have finally got back to me today with an offer to refund all overdraft charges since 2019. £1700!

this is without the FOS investigating. Do you think accepting the offer is a good idea or should I let the FOS investigate?

This is with Lloyds the offer got sent through the FOS. It was originally a student account and I believe the interest started in 2019

Thanks

Sara (Debt Camel) says

In that case a refund form 2019 is a “full refund”.

Even if the interest started in 2018, you are getting very nearly all the interest back now. Unless you think the interest started years before, I doubt this is worth carrying on with. Good result!

Joanne says

Hi,

I have just complained to Natwest as I have been in my OD on/off since 2019 but the complaint is not being upheld.

My Complaint in bullet points:

Since 2019, the bank failed to recognise ongoing financial difficulty during annual overdraft reviews.

-Forbearance (e.g. stopping interest/charges) was not offered.

-Customer was constantly in overdraft, only able to pay minimum interest.

-In 2019, overdraft limit was increased without proper checks.

-Income was under £1,200/month; overdraft over £1,000—leading to immediate debt cycle.

-No income in 2020 due to unemployment, but this was not addressed.

-Overdraft was unaffordable and should not have been approved.

-Customer requests a refund of interest and charges from 2019 onward.

However, Natwest are not upholding the complaint. I really strongly believe that as a 20 year old (at the time) should not have been able to go into the bank and have my overdraft upped by £500 with little to no proof of income and given my financial history. They say they have emailed me etc but there hasn’t been any phone calls (real effort) made to discuss my OD with me. At least for the last year, my credit score has been poor (I know this isn’t sufficient reason) but I have had missed payment, including in 2019 and then one more recently. They even state that they have seen opportunity for the OD to be removed (likely the £80 my grandma sends me for my birthday). I don’t use this account as a main account anymore.

Sara (Debt Camel) says

I suggest you send the complaint to the ombudsman. use the link in the article above.

What other debts do you have at the moment? As you may be able to win complaints about them.

Joanne says

I have an overdraft with Monzo, which was given to me in Q3 last year – lord knows how I got a 1K OD when my credit score is low. Same goes with AMEX which I now have a repayment plan with NCO, not sure if I can do anything here and Paypal credit. Amex is the one that has caused me to go into financial difficulty now as the minimum payments were so high – how I got this credit card I do not know! I dont think I have a reason to complain about these.

Sara (Debt Camel) says

Why don’t you think you have a reason to complain about these? You say the Amex was the start of your difficulty…

Molly says

I made a complaint to several banks and have just received my biggest payout of over £7000 on overdrafts charges. I have also had lots of success with credit card and loans. Sara has been a great help and I would recommend her templates and support to everyone.

Siobhan says

I used the template exactly as it was, asking for a refund of charges back to 2017 due to it being unaffordable.

I got a refund of £2534 today straight in my bank!

Santander rang me twice and I missed it at work, then this arrived! Absolutely delighted 🤩

Emma says

Hi Siobhan,

Can I ask how long you were waiting for a response from Santander? Did you have to refer to the FOS or was this just from complaining to them?

Thanks

Jon says

Hi,

I have recently found your website via Instagram / TikTok – I have just sent a letter to Halifax, I am hoping I get a good result… I am 27 Y/O now and have been in my overdraft since I was 18… a £4,500 limit overdraft, so think I have paid well over £10,000 in fees alone… £4,500 overdraft on a £1,500 NET monthly salary (at peak, I was on £800 when I first applied/was approved for the overdraft!)

Really hoping I get a similar result to the above… I did however lie on the affordability / income/expenses thing when i was requesting for an overdraft, daft of me but will this be held against me? They obviously didn’t check because I was telling them I was earning £50,000… when it clearly showed I was being paid £1,500 a month

Sara (Debt Camel) says

A bank should have tried to verify your income if it could only see 1500 net a month – not many 18 year old earn 50k a year!

And anyway, they should have realised when they reviewed the account annually that it was unmanageably high for you

Amy says

For those of you who went to the financial ombudsman, how long did it take for a decision to be made once the case had been assigned?

I got an email from someone yesterday saying they have been assigned my case, asked me a few questions and I responded with all the relevant information. They got back to me today just to confirm they recieved all this information and said they are now awaiting information from Halifax, once they have received this they will be in touch. I’ve heard it can take months , I first went to the financial ombudsman about a month ago.

Bea says

With my case for Halifax it took over 1 year to get the information needed and a decision. Be patient as it’s worth it if your case is upheld!

Amy says

Omg a year?! Why was that? What information did they need? Glad you got it sorted eventually!

Bea says

Part of the time was waiting for the case to get assigned and then we went ages waiting for Halifax to provide information. As my case when back over 6 years I think it added to the timescale as the FOS were reviewing the way they handled the 6 years rule. Nevertheless I received approx £2k back in interest so was well worth the wait!

Jason says

Hi Sara,

Last year I commented that I had an overdraft affordability complaint with HSBC which was taken out in 2010. To keep it short, despite months and months of research and asking, HSBC continuously told me they had no data past 6 years (2017 at the time of complaint ). I luckily found old bank statements to send to FOS which were from 2014 so that was upheld in my favour however I couldn’t find anything from 2010-2014. AFTER acceptance of the outcome, it transpired that HSBC did in fact have vital information regarding my overdraft back to 2014, therefore, they most likely had it from 2010 but now complaint is settled, there’s nothing i can do about it. I made a complaint about this to adjudicator (HSBC purposely withholding and supplying information) and they’ve upheld it and HSBC have admitted to the failure. However they’re only offering £150 despite this being held from me has cost me potentially thousands in redress. Not just that but HSBC have admitted to providing ‘misleading’ and not being ‘transparent’ with me.

The adjudicator doesnt think i will be awarded any more money than this from HSBC even if it goes to FOS but seeing as they gave me £400 compensation just for not sending DSAR in time, I find this hard to believe? Also, they’ve purposely withheld evidence from me?! Could I just get your thoughts on this please? Thank you

Sara (Debt Camel) says

How was it found out that had this older information?

Jason says

HSBC haven’t given any explanation as to how it was found but during the original affordability complaint they repeatedly told me that they could only go back 6 or 7 years. This was the customer service and complaints team. I then wrote to the data protection team and and they sent a letter back saying the same thing. It was only when I went through an old phone I found bank statements from 2014 which then helped me get the complaint upheld.

The FOS dealing with the complaint even said that it’ll be hard for HSBC to determine redress as they’ve said they have no access to information from before 2017. Then, somehow, the FOS came back to me with a redress figure and I asked them how HSBC had worked that out. She then sent me a screenshot of what she had been given from HSBC and it was from a system with all the fees and interest I had paid over those years.

I’ve asked but nobody has told me where that’s come from, except HSBC have admitted that they did have that information all along.

Sara (Debt Camel) says

So this happened while your previous complaint was ongoing?

Jason says

Yes. Then the information was revealed AFTER I had agreed settlement.

Sara (Debt Camel) says

Then go back and say HSBC concealed this information, and you only accepted the low setter be use you had been told the earlier data did not exist.

Say it is unfair that HSBC should profit from this error nd that you should lose out, and that the current offer doesn’t come close to putting this situation right in a fair way.

Say you want this to go to an Ombudsman unless a much larger settlement offer is made

Angela says

I was considering making an affordability complaint about an overdraft on a bank account that was closed. I have been in a protected trust deed (Scotland) since the account was closed – can I still complain?

Sara (Debt Camel) says

You can complain, but any refund will be paid into the Trust Deed and not to you. And this won’t normally reduce your TD payments or end it earlier… unless you are Close to repaying the debts in the TD in full, which is unusual.

So this is hardly ever worth bothering with

Nicole says

Hi Sara,

I made an affordability complaint following your template for an overdraft I have with Santander on 2nd April ‘25 when my overdraft was at £1200. They acknowledged the complaint pretty quickly, since then they have emailed on the 29th April apologising that it is taking them longer than anticipated to look into and that they hope to resolve within the next 4 weeks. I sent a message within my online banking chat exactly a week ago asking for an update on my complaint as it was approaching the 8 week deadline. They replied saying that it was with a complaints investigator and that it has to be looked at thoroughly before they come back to me with an outcome. I have received an email today (27th May) apologising again that it is 8 weeks today since I made the complaint and that they are still looking into it and will come back to me as soon as possible and if I don’t want to wait I can contact FOS but it also says we hope you’ll give us the opportunity to complete our review before doing so. My question is do I give them more time and if so how long should I give before referring to FOS? I just would like to have an answer either way now, I know these things time but it’s making me feel on edge.

Sara (Debt Camel) says

You could decide to give them a few more weeks as they seem to make reasonable offers sometimes- they still refuse good claims but not all of them.

Nicole says

I’ve just called Santander today 9 weeks since making the complaint. The lady I spoke to on the phone said that my case hasn’t been allocated yet and that they have a delay in getting back to customers. I asked for an estimated timescale and she said she was unable to to say and that if you want to go to FOS to do so. Do you think I should now refer to FOS or wait a bit longer?

Sara (Debt Camel) says

I would be inclined to give them a couple more weeks but no longer

Emma says

Hi,

I’m also in the same process with Santander. I’ve been through to them a couple of times and they’ve said it’s still with a specialist team. The 8 week deadline was 4 weeks ago. Would you give them any longer Sara or look to refer to the ombudsman now?

Sara (Debt Camel) says

After an extra month I would send it to the Ombudsman, but its up to you. Santander will still look at the case if you do send it to FOS now.

Nicole says

I’m still the same. Asked for another update this week, they’re still saying it’s with a specialist team and can’t give any timeframes. It was 12 weeks yesterday since I submitted the complaint. I think I am going to refer to ombudsman at the end of the week. I just wish they’d say yes or no, starting to think I won’t get anything back because it’s dragging on so long.

C R says

Hi there,

I stumbled across your forum which led me to submit an affordability complaint for my £3000 overdraft on the 2nd of May – yet to hear anything back.

I have been in my overdraft since 2017 when I had my son – I was only clearing about £1500 a month and constantly in it. I pay between £75-85 a month in interest and have taken out multiple loans along side this to get by. My income is only around £2400 now as a single parent this has caused me a lot of stress and anxiety. I have heard nothing back from TSB – do you think they will uphold my complaint?

Sara (Debt Camel) says

It sounds a good complaint to me

But the loans you have taken, were they high cost? Who were the lenders? You may also have an excellent case to be refunded up interest on those loans

Bea says

TSB are awful I’ve had to go all the way to the Ombudsman who has ruled in my favour! Don’t get put off if they reject you, go to the FOS and be patient!

C R says

Hi Sara!

I have had multiple loans over the years, majority of them have been unsecured payday loans 118118 Money, Lendable, Mr Lender, Finio Loans to name a few.

Finally got my reply and TSB are willing to refund charges from 2021 only? Should I push back and try and get them refunded from 2017?

Thanks

Sara (Debt Camel) says

Did they say why 2021? Dud your situation get worse then?

Does the refund clear the overdraft?

Send this to the Ombudsman if they dont reply properly

re the loans – lots of cases being won against 118 and Finio

CR says

Hi Sara.

Huge thank you, I went to the ombudsman who upheld my complaint and have asked TSB to write off the overdraft and refund all fees from 2019 – what a win!

Olivia says

Hello Sara,

I finally had my response and they have close the complaint. I had a £1000 over draft that I was in throughout 2018–2023 they closed the account due to not be able to afford it anymore. That’s right.. completely closed it with all my money in and I had to go to nationwide bank to withdraw in cash.

Anyway this is what they said.. do I just accept it?

“ To reach this decision, I’ve reviewed your account and the overdraft applications. This has shown in the months leading to your overdraft applications and the increases, your account was receiving an income which on average was sufficient to support the decision to increase and your account activity weren’t indicative of a person in financial difficulty.

At the time of your requests to increase the overdraft, we also looked at the data provided by the Credit Referencing Agencies (CRA’s) which supported your eligibility and affordability to manage the overdraft. We were also able to review data from loan applications from around the time of your increases and the data input by yourself also indicate that the lending decisions were affordable.”

Thanks,

Sara (Debt Camel) says

They closed this account in 2023?

chloe says

Hi i’ve been stuck in my overdraft for around 2 years now, which has increased to £1500. i am a student and also was in maternity leave as a new mother at the time of applying for an overdraft and increases. There’s no interest charges as it is a student account so if i made a complain what would i get back if successful and if anything ?

Thanks.

Sara (Debt Camel) says

No you wouldn’t get anything back as you haven’t paid interest.

Do you have any debts you are paying interest on?

r says

hi, i have had a complaint upheld by the ombudsman, Santander have provided the refund but i feel they are short, in the final response letter it mentioned refunding all charges on the account and if in credit then 8% stat should be applied, should the charges also include the monthly bank charges for the account too? do we know if it’s common that the bank give the incorrect amount? i do have statements which tell me how much i have been charged.

Sara (Debt Camel) says

Go back to Santander and point out the FIS decision said to refund ll charges, not just interest, and that you don’t think they have done this

Tell your FOS adjudicator what has happened

MP says

Just looking for some advice really after seeing a video online.

I started an IVA in October 2016 and successfully completed in 2021. Am I right in thinking that any claim for irresponsible lending against NatWest (creditor included in the IVA) would just open a can of worms. Would and money I was entitled to just be redistributed amongst the creditors despite the Iva being closed for nearly 4 years? The main debt with NatWest was 2 loans.

Many Thanks

Sara (Debt Camel) says

So there are three problems here:

– Unless you have banks statements going back to the time those loans were taken, you have no proof of unaffordability

– the Ombudsman may well say this is too old to look at, that you should have complained earlier

– and if you do Win the complaint, any redress will first be used to clear any remaining balance on the NatWest loans

I think this is extremely unlikely to help you, it isn’t opening a can of worms, just a lot of hassle that isn’t likely to give you a good result

Kelley says

I complained in September 2024 to TSB about a £3k overdraft that had been maxed for several years. They responded quickly and agreed with the complaint and refunded charges from 2018 and also 8% interest. However, I didn’t understand they way they applied the 85 interest, so I took the case to the FOS and asked them to look at it, and also whether the charges could be refunded further back than 6 years. The case was stuck with an investigator who didn’t seem to understand it, who then left and someone else phoned me. He was really in explaining everything, but didn’t follow up with the explanation in writing as suggested, and instead just closed the case. The bit I didn’t understand was around the 3-year time bar, as he said this is applied differently on overdrafts (compared to credit cards or loans) as there is a monthly charge, which should make it clear to the consumer what they are paying for. I don’t quite understand this, as credit cards also have an monthly interest applied, but I was hoping his written explanation might help me. Is there a clearer explanation of this anywhere? Thanks.

Sara (Debt Camel) says

Ombudsman decisions seem erratic about going back further than six years, as the article above says

Laura says

Hi sara. I contacted Halifax about my overdraft in February, I have been paying fees since 2014.. they have today sent me a message saying they are paying £157 into my bank for the fees from April 2020 to may 2021…. it doesent give any information as to why only this time frame.. I have emailed them and asked them to pay the rest. What do you think? Thank you

Sara (Debt Camel) says

That is very poor communication If they don’t explain why those dates! Have you asked them why?

Send this to the Ombudsman if you think this is wrong

Laura says

Yes I have emailed them yesterday to ask them why! They didn’t even respond to me apart from sending me a message saying they were paying it in for those dates. Even though I have had the overdraft since 2014!

Sara (Debt Camel) says

is the overdraft still being used?

the credit card debt, can you stop using the cards or are the minimum payments too high?

Shadida says

I made a complaint to Barclays in regards to my Overdraft. I had 4K overdraft for over 10 years and struggled to pay back because in that time i was made redundant and started eating into this overdraft. Barclays was aware of this yet they kept upping my overdraft. Anyway only recently i managed to pay this overdraft off in full. Three weeks a go i made and affordability complaint and they have responded back saying they don’t admit fault but a goodwill gesture payment of £5,248.80 and if accept they will deposit this on. This morning this has been deposited. Thank you Sara so much for all your advice and help on Instagram. you do not know how much this has helped me. I have many more complaints I’m still waiting to hear from. I will keep you updated.

Alexandra J says

Hello, I entered into a student account with Lloyds back when I was a student in 2011 I completed my study in 2014 and I still have the overdraft now. I’m horrified how much I pay in fees and I keep trying to pay it off but I struggle. Do I have a case if this account was never my main account for wages etc?

The credit limit is around £1500 and I’m at around £900. The only other debt I have is a credit card.

Thank you.

Sara (Debt Camel) says

so this is definitely worth complaining about, although sometimes cases where you no longer use the account are harder to win.

Lloyds will likely want to see bank statements from your other account.

George says

Hi Sara!

I’m wondering whether I should make a claim on a £2000 overdraft I’ve had with Natwest since 2008. I took it out as a first year student and started to recieve charges and interest from 2013. In 2015, I called them and got a refund of interest and charges. However, I’ve called them on a few occasions to seek help with my overdraft, and have not recieved any help since – the only measure I was ever offered was a hold on missed payment charges in 2020 during COVID if I promised to make a payment in 2 weeks time from the call.

I’ve never earned above £1600 per month, have been in extensive debt with payday lenders in the past, had many missed payments on my credit file prior to 2022, and don’t recall a month where I haven’t been at the very limit of my overdraft. Since 2013, I estimate that to date, I have paid roughly 3x the value of the overdraft in fees and interest without ever coming close to clearing it. The interest fees since they went up in have been absolutely killing me, and I don’t see an end in sight.

Do you think I have grounds for a complaint?

Sara (Debt Camel) says

when did you last have payday loans?

what other debts do you have at the moment?

which lender is the credit card and when was that opened? was your limit ever increased when you were only paying the minimum?

George says

Payday loans would have been around 2015-17.

the credit card is with Capital One and it was opened in 2015. My limit was increased when I was paying the minimum – from 500 to 950.

The limit increase for the Capital One credit card was in 2022 – and I have bank statements going back as far as 2018.

Sara (Debt Camel) says

Then it’s worth complaining about that credit card limit increase.

Yes, I think you have a case for a refund of the overdraft, for at least the last 6 years.

Sara (Debt Camel) says

I was referring to the card limit increase.

But yes, I think you have a case for a refund of the overdraft, for at least the last 6 years.

Amy says

Has anybody had any success with Bank of Scotland overdraft affordability complaint?

Sara (Debt Camel) says

yes a lot of people have!

Sophie says

I have just submitted a complaint via email to Santander, using email addresses I found here https://debtcamel.co.uk/santander-overdraft-complaints/ as there don’t seem to be any of Santander’s website. However, the email has bounced.

I have tried messaging their bot to ask for an email address to send in a complaint but they are just asking me to call them during opening hours.

does anyone have a working email address that I can use to email Santander please?

Sara (Debt Camel) says

Try customerrelations@santanderconsumer.co.uk

I think they have stopped the previous one just to be difficult

https://debtcamel.co.uk/email-addresses-banks-credit-cards/

Sissi says

Hi!

I’ve taken my complaint to the Financial Ombudsman after Santander dismissed my affordability complaint about my student overdraft. I’ve been stuck in it since 2022, when it was automatically added to my account at 18. I’ve never been able to clear it, and as a vulnerable customer with a cognitive disability (diagnosed later due to NHS delays), this has caused me serious financial stress and anxiety.

Santander didn’t do any affordability checks, and in their final response, they said that since they don’t charge interest and I get a year post-graduation before fees apply, that should be enough support. I felt totally dismissed.

Most of the successful outcomes I’ve read here involve people who were charged interest or fees but I haven’t been. I’m asking for the overdraft itself to be refunded due to the harm caused.

Do you think I have a chance or am I wasting my time? Any advice appreciated!!

Sara (Debt Camel) says

I haven’t seen someone win this sort of case, unless the lender had previously been told of your mental health problems.

I do think you should be treated sympathetically. Do you have other debts? Have you looked at a debt management plan?

You may be able to ask the bank to clear the debt because of your cognitive disability. But you are asking for the write off here, not hoping for it because on unaffordability. See https://debtcamel.co.uk/debt-options/less-common/write-off/ and talk to your local Citizens Advice about this, as it may be better if they write on your behalf

Catherine says

A thank you from the bottom of my heart for the invaluable resources and advice you share here. I used your template to raise an affordability complaint on my Lloyds overdraft, which I had been pretty much living in for 15yrs+. They took a while to get back to me but today I had a call to say they’d be refunding all interest and charges dating back to 2010… almost £12k in total! A chunk of this will pay off my overdraft but there will be a sizeable amount left to pay off some other bits and have a financial reset I have so desperately needed for so long. Thank you so much!

Rebecca says

Hi Catherine

Can I ask, did you ask for charges to be refunded back as far as this. I can’t see when my overdraft started as I only have access to documents dating back to 2013, I have asked Halifax to confirm all Overdrafts throughout the history of my account though. Roughly how long did it take to get a response. I too have been living in my overdraft for probs about 15 years. Congrats on the refund amazing result 👏

Dan says

Hi Debt camel!

Thank you so much for this resource, it has been an incredible help to me on my journey to a debt free life.

I raised an overdraft complaint to Lloyds Bank back in Feb, no response so went to FO. FO emailed this week to say they have offered to refund all charges for the last 10 years, totalling around £1900, which is the majority of my £2050 overdraft.

However, the FO said they haven’t completed their investigation yet, and this is just the initial offer from Lloyds. Am I silly to accept quickly? I’m happy to accept seeing as the amount mostly clears my overdraft and I can afford to cover the rest when the close the overdraft (as part of the agreement).

Could you also advise if this will affect my credit score negatively and/or positively?

I’m slightly worried about the 12 month freeze on lending, and impact on my credit file, as my mortgage is due for renewal soon.

Thanks again!

Sara (Debt Camel) says

How long ago did your overdraft problems start?

Do you have any reason to think you have paid more than £1900 in charges in the last 10 years?

Dan says

Opened a student overdraft in approx 2013, which had no interest for 2 years, so to go back to 2015 I thought was generous from Lloyds.

I’ve responded to accept the offer pending confirmation the 12 month lending freeze doesn’t cover Lloyds group brands like MBNA/Halifax etc. because my mortgage is due for renewal soon and don’t want to impact that.

Thanks!

Sara (Debt Camel) says

Do you only want a new mortgage fix? If you do, it’s not lending more and it won’t be affected.

Nicki says

I have raised an affordability complaint with HSBC which has been rejected by them and the FOS, I have not yet escalated to an ombudsman.

I have had the overdraft for 20 + years and it has rarely been in credit for the last 20, I stopped paying my wages in about 5 years ago as I could not see a way out of the cycle. I was unaware I could make an affordability complaint about hardcore borrowing until 2024, when I saw an article about a Barclays refund. The FOS have said I am too late to complain and did not think that HSBC had acted unfairly. Do you think it’s worth escalating to the ombudsman?

I would appreciate your thoughts. Thank you

Sara (Debt Camel) says

what has happened to the abandoned overdraft? Has it defaulted? Has HSBC carried on adding charges?

what are the rest of your finances like?

Nicki says

Hi

I have been paying in small amounts, but basically it is still at the limit. I am still able to use it, the limit has never been reduced or restricted. Charges have been stopped periodically. My credit score is very low, I have several credit cards. I had a period of using payday loans which can be evidenced on my bank statements.

Sara (Debt Camel) says

how long ago were the payday loans?

are you able to pay more then the minimums to the cards and stop using them?

Nicki says

The payday loans were probably 2015-2019, before COVID.

I usually pay the minimum but then use the cards again.

The overdraft balance is £1500.

Sara (Debt Camel) says

so you can ask for an ombudsman to look at this, saying if HSBC had reviewed your account annnualy as the terms and conditions said, then they would have seen you were in diffiuclty and should have offered to help and not carried on proving the unaffordable overdraft facility.

But I think you should also talk to Stepchange about a debt management plan for all your debts, including the HSBC overdraft and the cards. this will get interest frozen and allow you to make one lower affoprdable payment a month to them. See https://www.stepchange.org/how-we-help/debt-management-plan.aspx

Nicki says

Thank you, what about the deadline? FOS said it was too late but I’m not querying the initial lending decision but the continued affordability. What is the timeline for that? . I was unaware I could make an affordability complaint about hardcore borrowing until 2024,

Jamie Lee says

I complained to Halifax about a year ago regarding affordability in my I overdraft I owe £2900 they called me yesterday and offered £2350 of overdraft charges against the £2900 and and £1350 of interest paid to me also agreed to change my default date from Feb 2024 to May 2015 when they increased my overdraft from £500 to £4500. They said that this will help my credit rating as the default will no longer appear. It still leaves a balance £550 which will show on my

credit file. How will the £550 look in my file if it shows as unsatisfied?

Sara (Debt Camel) says

“they called me yesterday and offered £2350 of overdraft charges against the £2900 and and £1350 of interest paid to me”

I don’t understand what the 1350 is here.

It still leaves a balance £550 which will show on my credit file. How will the £550 look in my file if it shows as unsatisfied?

This is hard to guess, as if they backdate the default, the record will no longer show at all on your credit file.

If they add a new record (they may not) and it shows as an unarranged overdraft, this harms your credit score but it will be better than the default that is there at the moment.

Good result!

Darren Cowan says

I emailed a compaint to Santander yesterday and this was their response … not sure what the phone call will be about any suggestions??

Dear Mr Cowan

Thank you for contacting us about your concerns.

Email isn’t a secure way of contacting us. It’s important that your personal details aren’t put at risk. Please don’t send any personal or sensitive information by email.

We want to put things right for you. We have logged your issue on this occasion, and you should expect to receive a call. In future, it is safer to contact us using one of the options below. You can also find this information on website below

Sara (Debt Camel) says

That is an automated reply.

Banks sometimes phone people who have complained – not always, it seems random.

If taking a call makes you very anxious, simply say that talking about money on the phone makes you feel anxious and you find it hard to concentrate, so ask them to put any questions in writing and you will reply

Ignore any comments that you were told what the overdraft charges were/ asked for a higher limit/didn’t reject the offered limit increase – these are irrelevant to you complaint as the Santander still had a duty to review your overdraft for affordability. But don’t get into an argument – keep it simple and ask for a response to your complaint, or any questions, in writing.

Alice says

Hello,

Thank you so much for this information! I made my complaint with Halifax on 28th February 2025 and got the outcome today: I am being refunded £1164.42p against my £1800 overdraft with a payment plan for 12 months to remove the remaining amount and any negativity removed from my credit file going all the way back to 2019!

Even though the full amount couldn’t be cleared, this has been a massive help in my financial situation and your information has helped me massively!

Thank you :)

H says

Hi, I complained to RBS regarding my overdraft (started as a student). They didn’t agree with the complaint so I moved onto Financial Ombudsman. FOS got back to me last week saying they agree and are upholding the complaint however RBS have replied to them today saying they disagree. Do you know what happens now?

Sara (Debt Camel) says

It goes into a queue to be looked at by a more senior person at FoS with the title of Ombudsman. Am Ombudsman’s decision is legally binding and the lender can’t reject it

H says

Thank you, they did end up responding. They also said the way they are dealing with complaints is currently going through the courts. From what they have said, I don’t see me getting a response for about a year. I do wonder if banks are aware they are going through court so they are pushing back because they know it’ll be months down the line but who knows!

“ Our service has received judicial review claims which challenge the way we approach complaints where section 140A is relevant law. Whilst the complaints are not identical to yours, the approach we’ve taken to complaints about unfair relationships is being challenged in the courts, and the outcome of those court proceedings may have the potential to impact the way that we consider your complaint. As a result, I’m afraid we won’t be issuing a decision on your complaint whilst the matter is being considered more widely.”

Thanks again for your help :)

L says

I have had the same! The investigator assigned to my case has upheld my decision and has gone back to NatWest with the reasons why. NatWest have disagreed twice so it’s now gone to the Ombudman. Not sure what to expect with this part!

Amy says

The case worker from the financial ombudsman got in touch with me today to let me know they believe the complaint should be upheld and included the email that they have sent to Halifax with all the reasons why they think they acted irresponsibly. Halifax now have until 26th June to get in touch with them with their decision , anyone been in this position how did this go for you?

Claire says

Hi Amy, I’m in the same position with RBS. The investigator found in my favour, and I have agreed to their findings. RBS have asked for an extension to consider the findings, they have twice requested an extension. We’re waiting patiently as it would be better than it being escalated to an ombudsman for a final review. Hopefully you hear back soon too

Fingers crossed.

H says

Hello, I was also in the same position with RBS however they have disagreed with the investigator which means it’s now being escalated to an ombudsman. I think it’s going to take a very long time to hear back now as they mentioned they are currently being challenged in court so they won’t be issuing a decision until that is over.

Hope RBS agree and you can get it sorted quickly.

Ryan says

Afternoon,

Thanks for this post! I’ve just made my complaint for a student overdraft that I had from 7 years ago. I had an overdraft of £2k and since 2018 they started charging interest on only £1,000 of it until 2019 when they changed my account back to a normal account and started charging interest on the full £2k. My income never took me over the overdraft amount so there was no way I could attempt to pay it off. I still have the overdraft to this date although I’ve managed to reduce it recently. Had other debt issues for a few years in the same period too. Hopefully NatWest refund the charges.

Ryan says

Just had a reply from my complain and NatWest are taking no responsibility for the charges etc, saying it’s the customers responsibility to inform them of any financial hardship and I fully agreed to the terms of the overdraft.

I think I’ll take my chances and go to the ombudsmen anyway

Liz says

Hi, I have two overdrafts with Barclays, both have £2k limits and both have been consistently up to there limits for over 5 years. One is a joint account one is just mine. Money goes into both each month but not enough to clear so I am constantly overdrawn. I’m paying £50 a month charges for mine and about £30 for the joint. Can I complain about both? If so do I do the complaint separately or together? Thanks

Sara (Debt Camel) says

Yes you can complain about both I assume your partner knows that you will be complaining about the joint account?

I would make them separately

Laura says

Hello,

I raised a complaint with Halifax beginning of April and just keep getting the standard “ we are sorry there has been a delay” message.

Do you know how long it’s roughly taking them to resolve cases and is it now worth referring to the FOS or just waiting? Thanks so much.

Sara (Debt Camel) says

Halifax (and Lloyds and Bank of Scotland) are being very slow. Your complaint isn’t in the “difficult” pile, literally no one has looked at it yet.

I expect they have quoted you a date in July sometime.

If you go to the Ombudsman now, Halifax will carry on looking at your complaint, if they make a decent offer you can then tell the Ombudsman you are accepting it and they will cancel the case.

it’s up to you whether you go to FOS now, or wait until that July date and go then

James says

I raised a complaint on April 2nd, 8 weeks passed and they set an extension to the 24th June. They now have 7 days left of the extended month period before 12 weeks have passed and I’m a bit lost as to what to do. Both frustrating and relieving that someone else is in the same situation – I complained to Tesco about a missed payment they put on my account and 3 days later they responded, 1 month after it was removed. Halifax are going on 3 months without as much as an automated text now.

I called them up on the day of the 8 weeks expiring, they were lovely over the phone but as Sara has said – nobody has even looked at it yet.

Cameron McKenzie says

Hello,

I emailed Bank of Scotland regarding my student overdraft on 26th May 2025. I have not had a single email saying they are investigating or looking into my complaint.

In 2024, I managed to pay off the overdraft despite being charged interest once I exceeded my interest-free limit.

Unfortunately, I am now back into my overdraft and being charged interest again. There has been no duty of care from Bank of Scotland considering they could see I was not originally using the overdraft for short term borrowing.

Should I have heard back from them by now to at least say they are looking into this?

Thanks

Sara (Debt Camel) says

If you haven’t heard after a month, phone them up and ask them to confirm that they have your complaint

Maria 2007 says

Hi Sara, thanks for your articles, they are so informative and helpful. I had an overdraft with Halifax which was increased repeatedly over short periods of time up to £2000 – which was about my take home pay each month. This went on for about 2 years til early 2020. During COVID they offered to hold payments for 3 months as I was really struggling at this point and this was followed by, in late 2020 they offered me a loan for £2000 to pay off my overdraft – which I accepted as I was never going to get out of it otherwise. I’m still paying off the overdraft now as part of a DMP which I had to set up in 2022 as my debts had completely swamped me. Do you think I have a case of unaffordable lending on the overdraft – seeing as Halifax actually took steps already to support when I couldn’t get out of my overdraft?

Sara (Debt Camel) says

yes you can try.

But what may be more useful is to complain about all the debts in your DMP, including this Halifax loan. What other debts went into it?

Maria 2007 says

Thanks Sara,

The DMP includes

The Halifax loan, a catalogue, 2 credit cards and 2 payday type/short term loans.

Sara (Debt Camel) says

Complain about them all, unless the payday loans were small when you took them out and you only had 1 ort 2 from that lender

Jan says

In what circumstances do FOS entertain a claim to refund overdraft charges beyond 6 years? I was perpetually and severely overdrawn for 12 years from 2009 to 2020. The overdraft was both excessive and unaffordable re the criteria you set out on your site.

Sara (Debt Camel) says

I wish I could give a clear answer about this. Which bank was it? how did you clear it in the end in 2020?

Catherine says

Hi Sara, I’ve been with Lloyds since 2007 throughout 2009 – 2012 I was getting charged on average £100 a month for unplanned overdraft usage. Then in may 2012 I got an overdraft as the charges were affecting me financially and have lived in it ever since.

They did write to me in march 2024 saying they’ve noticed I’ve been using it regularly for a long time and paying alot in interest they will be lowering the interest rates so the overdraft can be reduced by £20 a month. Was meant to start may 2024 but this never happend my overdraft has stayed the same. I did have a brief break from interest rates when I asked them for financial help as I have alot of debt and was finding it hard to pay bills ect. But that ended so now paying about £45 interest a month (my overdraft is currently £940 I’ve managed to pay a bit off here and there over the years it was originally 1200)

Do you think I could claim any of this back? Many thanks

Sara (Debt Camel) says

I think that sounds like a good complaint. It may not go back to the very early years, but even 6 years would be a good refund for you wouldn’t it?

Are you saying they didnt reduce the interest rate in 2024 as they said they would? If so, mention that in your complaint.

Do you have other debts as well?

Catherine says

Hi so the letter said they are starting a 6 month limit reduction plan £20 a month for 6 months interest lowered to 19.9% but they never took any payments. After the 6 months the interest has gone up to 49.9%

Quote from the letter ‘we will start reducing your arrangement overdraft limit each month from 3rd may 2024’ however they never did this.

Yes I do, I’m in rent arrears, council tax arrears and water gas and electric.

Sara (Debt Camel) says

what other consumer debts – loans, credit cards, Klarna etc?

I think you should talk to a debt adviser urgently about your arrears. An affordability complaint about your overdraft wont solve that sort of problem

Gregory says

I put my complaint in about a £2000 NatWest overdraft that started as a £500 Student overdraft in 2010 – it go upped gradually to the £2000 by 2012 and interest was applied from 2015 onwards.

I have basically lived in the overdraft for 10 years having multiple missed payments because I’d maxed it out as well as there being gambling & unhealthy spending on the account as well. I took out PayDay loans from 2011 through to 2019 and my credit has been ravaged with missed payments & Defaults.

I have earned reasonably well over the last 5 years’ so my pay does take me out of my OD but bills send me right back in. Even now after clearing all the payday loans I have about £20,000 in consumer debt spread over 4 longer term loans and about 6 credit cards.

I did try to start reducing the OD down in increments of £50 but failed the payment in month 2 and cancelled the attempt to get it down. So the OD is now sat at £1950.

NatWest called me last week saying they are denying my complaint as they acted in accordance with their lending policies at the time and their records only go back 6 years’.

I want to take it to the Ombudsman but I don’t know where to start.

Sara (Debt Camel) says

The article above has a ink to use to the Ombudsman’s online form – that is the bast way to send a case to them.

It’s hard to predict FOS decisions on going back over years but even a refund for the last 6 years would help you.

who are the longer term loans you have from?

Greg says

To be honest I was just looking for the balance of the overdraft to be forgiven! I just allowed myself to get my hopes up when I saw other people’s success! To have it flat out decline was a bit gutting! I’ve sent the complaint to the Ombudsman so i guess we wait & see!

With regards to my other loans.

I have a £1000 1 year loan from Finio Loans which the last payment will come out of next weeks’ pay

I have a £2000 2 year loan from 118 which has 9 payments remaining

I have a £6000 3 year loan from Lendable which has 2 years’ remaining

I have a £4000 Guarantor loan from ShareMyLoan which has about 4 payments remaining

I also have 6 credit cards which add up to about £5000.

Sara (Debt Camel) says

Over 6 year overdraft complaints are going slowly at the moment at the Ombudsman.

I suggest you also make complaints now against Finio, 118, Lendable, Sharemyloan. Loans taken in the last 6 years can be simpler and quicker complaints. Send these to the Ombudsman if rejected too. https://debtcamel.co.uk/refunds-large-high-cost-loans/

That is a huge amount of very high cost lending. You need to get out of this cycle.

Have you managed to stop gambling?

Greg says

Yeah, i don’t gamble at all anymore and have been sober from alcohol and drugs for nearly 4 years now which was a big trigger for my gambling!

If im completely honest with myself the borrowing over the last 4 years has been genuinely awful financial impulse control. I’ve more than tripled my income since going sober but have never really had a consistent push at getting debt free.

I’d clear a loan then clear score would tell me I’m eligible for another loan and I’d just take it.

I think im going to go through all the loans I’ve had for the last 6 years (theres been a few!) and put complaints in.

Bc says

I submitted a complaint regarding my Halifax overdraft which was given with opening the account in 2010 for £300 I have checked back to the start and for the first two years I was paying £75 to £100 per month in charges as they always took it out at the beginning of the month and then it would take me overdrawn again, this continued for a number of years, I’m now starting to get my finances in a better place but not once did they do any welfare checks and as this is my only bank I continued to be overdrawn, a few years back they changed the process of collecting fees, that I would only be charged for the amount of £50 to £300 and still they did nothing to help me reduce the use of the overdraft, earlier this year I came into a small amount of money and decided to reduce the overdraft, so I did it to £100 and they have now said that the £100 overdraft is not charged and is free to use. How amazing that they can do that now but not before, I must’ve paid thousands over the length of time I’ve had this account, my concern now is that I haven’t reviewed any notification from them that they have received the complaint it was filled out on their on line complaint form, I just had a large tick to say they’ve got it, should I wait five days and then contact them?

Sara (Debt Camel) says

I think in a week you should phone them if you haven’t heard anything

Bc says

I’ve received two text messages today advising they are looking into the complaint and will email the outcome but may call me if they need further information, so I will now wait for the 8 weeks and send to FOS if no outcome.

Bc says

Just to add further, Halifax never actually paid anything that took me overdrawn they either returned as a failed payment or didn’t pay anything that would have taken me over the £300 limit but still charged me for the privilege of rejection, I’ve been through all the statements and from Jan 2011 to December 2015 I don’t have the one’s from April 2010 to January 2012, but I’ve paid £5475 in charges, then from 2016 it was around £20 per month until January this year, so I’m hoping for this to be successful in my favour as this and the capital one credit card win would really help to clear my outstanding debt and some left over.

Really grateful for this website and the great advice provided.

James says

Hi Sara,

First of all thank you for your work and this site, you’ve helped me to resolve several issues I’ve had financially and remove painful dings on my credit report and begin pulling my finances back together.

I raised a complaint to Halifax on April 2nd about my overdraft usage, I’ve been perpetually sat at the £2000 limit for well over 8 years, putting enough money into the account each month to cover the interest charge but nothing more. I’ve calculated, since 2017, I’ve paid more than 3 times the overdraft debt in just interest and fees without reducing it at all. I was a gambling addict, and my credit profile very clearly shows it with 50+ payday loans a year, so I was unable to pay it off/back.

I got a “received” text on April 3rd, and 8 weeks later called them up on the day asking if there was any movement. They told me nobody could provide an update just yet because it was a “complex complaint” (which I heard as we’ve not assigned anyone yet) but I was able to complain to FOS. I said I’d rather hear back before doing so, and waited a further 4 weeks. Just this morning I received another update text “saying sorry they’ve not been able to resolve my complaint, we’re doing everything we can to fix this.”

At this point would it be reasonable to escalate it to FOS? I’m not sure on the validity of my complaint given I don’t use the account but I’m starting to lose faith they’ll respond at all frankly.

Sara (Debt Camel) says

They will respond, they just seem to have an overdraft backlog. Loan and credit card complaints to them seem to be going through faster.

If you go to FOS now, FOS will just wait for Halifax to consider your complaint, so it isn’t clear if this will actually speed things up.

I think if it gets to the 4 month point (start August) you should definitely go to FOS, but it isn’t unreasonable to go now.

Rachel Burns says

Hi Sara,

I logged my complaint with NatWest who rejected it (surprise, surprise!). I sent it over to FOS who have come back to me today with the following:

In response to your question, ideally, NatWest should have shared a larger window of statements. As it stands, they have only sent me the last six-years worth due to the impacts of the time limits and the jurisdiction involved when dealing with activity which is slightly more historic – as your complaint is in relation to lending decisions over six-years ago, they have raised objections.

Your complaint is also affected by relevant law, s140a to be specific. Because of this and the ongoing judicial review, if your complaint was to be upheld, there would likely be delays due to the matters being dealt with in court.

I am going to push back to NatWest and ask them, once again, to send all of their statements they have. If they can’t, then I may give you the option to seek them for yourself from the business, or carry on without them.

Do you know if I am best just saying the last 6 years and proceed with that? The overdraft has affected me since 2010, it just so happened I found my statements from mid 2010-Dec 2012 but nothing for the other years which is the issue. If I have to wait for the court decision (any info on this?) I’m guessing it will delay by a long time getting a resolution- is that right?

Thanks

Rachel

Sara (Debt Camel) says

Is this complaint just about the overdraft? Have you made any other complaints about natwest?

Would you be happy with a refund for just the last 6 years? presumably that would at least clear the overdraft?

Rachel says

Yeah it’s just about the overdraft, it was for £2000 and still at that now so not sure if the last 6 years will cover all of it or whether I’ll still owe them money. From the emails with my investigator I don’t think he is too happy with how NatWest have handled my complaint which I’m hoping is a positive sign

Grace says

Hello! I had an HSBC current account and loan for about 17 years but I closed it in Sept 2019 (just under 6 years ago!) because they charged me the entire time for going over my overdraft. The overdraft limit was only about £300 I think but I was constantly going over it and then getting £60 charges every time. Do you think I have a case?!

Sara (Debt Camel) says

Do you have your old bank statements?

Anna says

Hi. I have a Lloyds account that was originally a student account in 2004. I have a £2000 overdraft on it, which I have been in constantly for years, being charged daily interest. They even gave me a loan not that long ago even though on that account I am always in my overdraft. Is there a case here?

Sara (Debt Camel) says

yes.

Also look at a complaint about the loan!

Kate says

Lloyds rejected my overdraft complaint but the ombudsman investigator has shared his view and given them 2 weeks to reply. He’s recommended refunding all charges and fees (over £4k) since 2019 + 8%.

He’s demonstrated that on one of the anniversaries of the overdraft a review would have shown I had used 33 payday loans that year and only escaped my overdraft for one single day. I frequently went over my overdraft and had a number of direct debits bounce across the entirety of the overdraft.

Are Lloyds likely to go with it or push back?

Sara (Debt Camel) says

Well it sounds convincing to me!

Kate says

They’ve agreed to the ombudsman’s findings and agreed redress will be paid as a priority.

I’ve raised a secondary complaint as at the same time as the student overdraft, I was also issued a student credit card which has been maxed out the entire time under the exact same time period as the overdraft where they’ve admitted they should have picked up on my financial distress..etc with my overdraft.

I wonder now that they’ve awarded me full redress for the overdraft they’ll be more likely to settle the credit card complaint direct with me instead of refusing it and going back to the ombudsman with the same evidence for a very very similar issue.

Sara D says

I have sent a few affordability complaints. One has been successful already via The money platform loan but will update on here when I know more

Bea says

I have had some refunds come in from TSB after the ombudsman ruled in my favour. It doesn’t look like simple interest has yet been refunded. Do you know if they tend to do this separately?

Bea says

it’s cleared the OD and left a £1200 credit balance

Sara (Debt Camel) says

in that case they should have added 8% interest. I suggest waiting a week to see if a separate payment arrives, if not ask them when it will. And tell your FOS investigator.

Bea says

Ok I’ll do that thanks Sara. I wanted to sense check how much to expect.

I had a partial uphold from 2010 and so far the total interest rerun is about £2500 leaving the above credit. Would I get approx 8% of the 1200 for 15 years? I know we can’t calculate exactly but just trying to get an idea

Sara (Debt Camel) says

no it is usually a lot less than that. Not easy to predict

Emily says

Thank you for your help. I lodged a complaint with Santander in April and received a call today upholding my complaint. I was paying interest on my student overdraft for 6 years and the refund covered my 2k overdraft with £1000 left over. I have a good salary now so was sceptical but so glad I did.

Milly says

Hello, my Student account opened in 2016 but only been refunded from 2021-2023 due to large payments in my account for Moneybox deposits in 2023-2024. No acknowledgment of 2016-2020 – should I dispute this? They are closing my account in 60 days if I don’t repay the rest of my overdraft and adding a note to my credit file. Can I push for a refund on the 2016-2020 dates? Refund amount seems small in comparison to other comments as my overdraft hasn’t been fully cleared. Thank you

Sara (Debt Camel) says

Which bank is this?

If this started as a student account, when did they started charging interest?

What were these moneybox deposits – were you saving money?

What is your credit score like?

heather says

Hi Sara,

I raised a complaint with Bank of Scotland 7 weeks ago for an overdraft I’ve had since 2017, originally £500 as a student, that is now sitting at £2400.

I called today as I had nothing other than a text saying they have received my complaint. I was told they have a huge backlog of complaints and that others have been waiting longer than me. It hasn’t even been allocated a complaints manager yet.

Do I wait past the 8 week mark (this is from next week) or do I escalate to the FOS now?

Thank you!

Sara (Debt Camel) says

You will be lucky to hear in 6 weeks more.

you can go to the ombudsman at 8 weeks, not now. But FOS will wait for BoS to make a decision on the case. It isnt clear if this will speed up getting a decision of not

H says

Hi,

I’ve submitted my complaint to Lloyds having had an ever increasing overdraft for quite a few years, it’s currently £3400

I did have multiple credit cards so was clearly struggling – including a Lloyds card which they gave me a balance of £5500

Until last year I was only paying the minimums on that card

All my credit cards are now cleared

Is it worth complaining about the credit card as well?

Only in the last 3 years has my salary increased to a decent amount, but my credit levels with Lloyds have been this high for a number of years before that. My overdraft was over double my take home pay for a long time

Thanks,

Sara (Debt Camel) says

when did the Lloyds credit card start? did they later increase your credit limit?

H says

It started around 2010 and I’m not sure what the initial limit was, maybe £2000? Deffo increased over the years though

I remember going into the branch for something else, not long having turned 18 and being taken to a small office and being told now I’m 18 I should get a credit card etc, not had any of the interest or anything explained and just told to sign some docs

Sara (Debt Camel) says

So it doesn’t matter that you have recently cleared the card.

I think this is worth a try as lloyds probably have you bank statements for back when the card limit was increased

David Lindsay says

On live chat and the adviser said complaint been changed to a dissatisfaction? What does this even mean? No email reply

Sara (Debt Camel) says

Which bank? How long ago did you complain?

jodie says

Hi Sara,