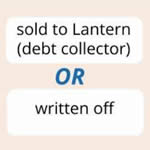

Morses Club went into administration in November 2023. Morses Club was the largest doorstep lender in the UK after Provident stopped lending in 2021. See Morses Club goes under for details about why it failed. In March 2024, the administrators have sold or written off all outstanding loans. It is now expected that people who were promised refunds of hundreds or thousands of pounds in the … [Read more...]

Debt news and policy

Debt Camel articles on what's changing - and what ought to change - in the world of personal debt in Britain.

If you are interested in a specific area, look at: High cost credit news & policy and Insolvency news & policy.

Amigo’s Scheme – June – my summary of the current situation

UPDATES Mid August 2024 And the deadlines have slipped yet again. There are just under 4,000 people still waiting for a decision, or a revised decision after winning an appeal, or a recalculation. There are also now (21 August), about 8,000 people where Amigo has wrong or missing bank details: this includes £1.7m of redress to be paid "in full", and £2.4m of Initial … [Read more...]

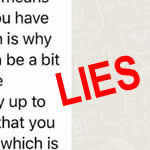

Are people being told the truth about DMP fees and no-fee DMPs?

Misleading DMP advice Mrs B was advised to go into a Debt Management Plan (DMP) by an IVA firm. They referred her to a firm that charges fees for running a DMP. I suggested that she should talk to StepChange or another provider that doesn't charge any fees for a DMP. Mrs B went back and queried the advice with the IVA firm. This is the WhatsApp conversation: I explained to Mrs B that … [Read more...]

Lloyds and Halifax to charge up to 49.9% interest on overdrafts

The Lloyds Banking Group - Lloyds, Halifax and Bank of Scotland - are changing overdraft charges for customers from August. Some are increasing, some are reducing. The new 19.9% and 29.9% charges are lower than most major banks. But the new 49.9% charge will be the highest overdraft rate charged by a high street bank. The current charges This is the first change since 2020. Before that Lloyds … [Read more...]

SafetyNet & Tappily loans are written off

The administrators of Indigo Michael Limited have announced that all current SafetyNet Credit and Tappliy balances are being written off. And that any affordability complaints have to be made within the next few weeks. My previous article SafetyNet Credit goes into administration gives details about why the lender failed. And also why, unusually, it was allowed to carry on lending to existing … [Read more...]

DROs – major improvements introduced in 2024 Spring Budget

In a Spring Budget that was short on surprises, the Chancellor pulled a large rabbit out of the hat for debt advisers and some of their clients - big changes to the rules for Debt Relief Orders (DROs). DROs are a form of insolvency for people who have little or no spare income to be able to make any payments to their debts and who only have low assets. Introduced 15 years ago, they were … [Read more...]

The new DRO hubs – what happened in 2023

In January the Insolvency Service published data showing how the volumes of Debt Relief Orders (DROs) done by advice agencies changed in 2023, see Monthly IS statistics Jan-Dec 23, Table 3.2. In February 2023, the two new MaPS-funded DRO hubs began operating. These are run by Citizens Advice and Money Wellness (called Benesse Advice in the IS statistics, also known to debt advisers as Gregory … [Read more...]

NSF’s scheme for Everyday Loans, George Banco & Trust Two – waiting for decisions

Non-Standard Finance group (NSF) proposed a Scheme of Arrangement in March 2023. This Scheme was approved in June 23. NSF had three brands: Everyday Loans (lending from high street shops) and George Banco and Trust Two (two guarantor lenders). All customers with loans that started before 31 March 2021 had to make a claim to the Scheme before 31 December 2023. That date has now passed and no … [Read more...]

Loans2Go – the worst loans in Britain – ask for a refund

Loans2Go offers what I have called the worst loans in Britain. Since 2021 they have been charging 770% APR. See the representative example Loans2Go quotes on its website: £550 borrowed for 18 months is a monthly payment of £113 this adds up to £2035, a bit less than four times what was borrowed. MUCH cheaper to get a payday loan than a Loans2Go loan Of course Loans2Go don't … [Read more...]

Bad news – MSE Credit Club switches from Experian to TransUnion

In November 2023, MSE announced that its Credit Club report would soon switch to cover TransUnion data, not Experian data. MSE has told subscribers: The need-to-know change: Experian is stopping giving us access to its full credit report. So ... we’re moving to one of the other three big credit reference agencies, TransUnion. MSE has tried to dress this up - the first paragraph was headed The … [Read more...]

- 1

- 2

- 3

- …

- 21

- Next Page »