Contents

Misleading DMP advice

Mrs B was advised to go into a Debt Management Plan (DMP) by an IVA firm. They referred her to a firm that charges fees for running a DMP.

I suggested that she should talk to StepChange or another provider that doesn’t charge any fees for a DMP.

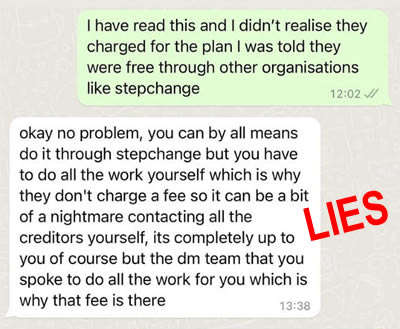

Mrs B went back and queried the advice with the IVA firm. This is the WhatsApp conversation:

I explained to Mrs B that this was nonsense. StepChange do all the work when they set up a DMP. They work out pro-rata payments from the amount Mrs B can afford, notify the creditors and make the payments each month. If a debt is sold by a lender to a debt collector, StepChange switches to paying the debt collector.

And the same applies to other fee-free DMPs such as Payplan or Christians Against Poverty.

The only difference with a fee-charging DMP firm is that they deduct their fees first from the monthly DMP payment, so the creditors get less. As a result, a fee-charging DMP goes on for months or years longer than a free one does.

Mrs B now has a DMP set up by StepChange and is happy. But she was pretty cross at being given such misleading information by the IVA firm. The IPA, who regulates the Insolvency Practitioner at the IVA firm, has Mrs B’s complaint with all the details.

I am not naming the IVA firm, or the fee-charging DMP firm they tried to get her to sign up with, here. It’s up to the IPA to investigate the complaint and I am interested in the general subject, not this individual case.

Regulatory whack-a-mole

The background to this is the changing shape of FCA and Insolvency Service regulation.

The FCA became responsible for regulating debt management firms in 2014. It published a review on the Quality of debt management advice in 2015. This started by saying:

Individuals trying to deal with problem debt … can be prey to firms that do not have customers’ best interests at heart and do not treat them fairly.

And concluded with:

Our findings were very disappointing and have reaffirmed our view that poor debt management firms pose a high risk to consumers (particularly those in vulnerable circumstances).

By March 2016 no firms had yet been fully authorised and the FCA said:

- more than a hundred firms had exited the market;

- there were about 400,000 clients on fee-charging DMPs.

More firms dropped out after that or were refused authorisation. Few fee-charging DMP firms were eventually authorised in 2017.

Some firms exiting the fee-charging DMP business in 2015-16 may have turned into IVA lead generators, using the PERG 2.9.25-27 exemption to avoid FCA regulation. But when the Insolvency Service started to try to crack down on unregulated lead generators, it may have become convenient for some lead generation to be run through FCA-authorised entities for debt advice.

The FCA then faced the problem of very poor “advice” being given by firms whose only significant revenue came from IVA referrals. It proposed a ban on referral fees for “debt packagers” in 2021, which came into force in 2023.

Since then, anecdotally, creditors are seeing increasing numbers of payments being made to fee-charging DMP firms.

So could some “debt packagers” be getting round the FCA ban by also referring clients to fee-charging DMP firms, not just IVA firms? Or by setting up their own fee-charging DMP operations?

“First Advice” is crucial

The FCA’s 2015 Review identified that:

Information about the availability of free advice was either not provided, was not sufficiently prominent or was biased against, or derogatory about, the free sector.

And it seems this is still carrying on in 2024.

It may be that the fee-charging DMP firm Mrs B was referred to would have given good advice about the availability of free DMPs. But the damage has already been done by then. If the FCA-authorised fee-charging firm said “there are free DMPs if you want”, someone who has been told they are a “nightmare” isn’t likely to go and investigate them.

We have been through the same situation with IVA referrals. An IVA lead generator can give a misleading optimistic impression of how an IVA works, tell the client they aren’t eligible for other debt solutions, reassure the client that naturally they don’t want to go bankrupt… After that the IVA firm may give detailed information, but the client is already sold on an IVA being the best thing ever and isn’t really listening.

Insolvency Practitioner Association (IPA) rules

The IPA’s Ethics Code

The IPA ethics code says:

R330.11 A3 When communicating information about any referral or agency arrangements the insolvency practitioner should provide the following information:

• the advantages and disadvantages of the service or product being provided;

• that similar services or products could be available from other providers at a different cost,

• any direct or indirect benefit that the insolvency practitioner or the firm might receive if a service or product is taken up;

• that seeking independent advice should be considered.

None of that happened with Mrs B when she was first referred. And when she queried the referral she was given highly misleading information.

More generally, the Code also says:

R330.9 An insolvency practitioner shall not make a referral to a third party, even with a disclaimer, if they know of a better alternative.

R330.10 The insolvency practitioner shall document the reasons for establishing an agency with another supplier or recommending a particular provider.

It would be interesting to see how an IVA firm can justify the referral to a fee-charging debt management plan. How is it in the interest of a client to end up in a DMP that takes much longer?

But is this enforced?

So we have a situation where the IPA rules look OK but may be being ignored. With falling IVA numbers it is possible that some IVA firms are now seeing fees for referrals to fee-charging DMPs as a good source of income, so this is becoming more important.

It would be useful if the IPA started asking routine questions about DMP referrals:

- how many referrals are currently made to fee-charging DMPs by IVA forms? Has this increased over the last 2 years?

- how have you decided who to refer to and is a referral to a fee-charging firm in the best interest of your clients?

- what information do you give clients about fee-free DMPs?

FCA rules

The referral and the misleading information came from an IVA firm that was not FCA-authorised and did not need to be because of the PERG exemption. But if Mrs B had followed the referral and spoken to the FCA-authorised firm that charges for DMPs, the FCA’s CONC 8 rules would have applied.

Informing clients about fee-free DMPs

CONC 8.2.4 says:

A debt management firm must prominently include:

(1) in its first written or oral communication with the customer a statement that free debt counselling, debt adjusting and providing of credit information services is available to customers and that the customer can find out more by contacting MoneyHelper.

When a referral comes from a third party such as an IVA firm, this can hardly be described as a good consumer journey.

If Mrs B had talked to the fee-charging DMP firm, she would already have been on her third different contact (lead generator – IVA firm – fee-charging DMP firm). So even if she hadn’t been lied to about StepChange, would she be likely to go off and explore the Money Helper website to find links to other DMP firms?

If she did, she would find that the Money Helper website doesn’t even say which of the firms it provides links to will run DMPs. Most people seeking debt help are stressed and may be vulnerable. A better way has to be found to get them the advice they need with as few steps as possible.

In the best interest of the client?

Fee-charging DMP firms should comply with CONC 8.3.2 which says:

A firm must ensure that:

(1) all advice given and action taken by the firm or its agent or its appointed representative:

(a) has regard to the best interests of the customer;

But how is it ever in the interest of a client to be in a DMP which will take much longer?

And do fee-charging DMP firms explain to their clients the reason why they consider a fee-free DMP is unsuitable (CONC 8.3.2 (3))?

What level of fees are acceptable?

The Consumer Duty has brought a sharper focus to the issue of value for money for clients:

PRIN 2A.4.2 A manufacturer must: (1) ensure that its products provide fair value to retail customers in the target markets for those products

CONC 8.7 says DMP fees should be less than half of the payments a customer is making each month. The details vary a lot between firms, with different charging structures and different setup and ongoing fees.

Anecdotally there are reports from creditors that many fee-charging DMPs seem to be close to the 50% cap on fees. So a DMP that could end in four years with a free DMP would take nearly 8 years with a fee charger.

What extra value is a fee-charging firm is adding to justify such a substantially longer debt-free journey? In its review of CONC 8, the FCA should seriously consider a major reduction in the permitted fees.

DMP firms’ fees are frequently buried away on their website – they need to be much more prominent. There is nowhere independent that lists all the firms that provide DMPs and what they charge. So there is no simple way for any consumer to make a comparison.

The FCA, which is reviewing CONC 8, should consider setting up such a page or asking Money Helper to set it up. It should then be a condition of being authorised to run DMPs that a firm provides details about all its fees to go on this comparison site and links to that comparison site prominently on its home page.

Paying DMP fees? Change to a free plan!

If you have a DMP with a fee-charging firm, talk to StepChange about changing to them!

You don’t need to worry this will harm your DMP, or that your creditors won’t like the change. Creditors will like being paid more quickly in a StepChange DMP as no fees are paid and all your monthly payment is divided between your creditors. So for the same monthly payment, your DMP will end sooner.

Malcolm Hurlston says

It’s still necessary to ensure that a practitioner is named. Either these people are professionals or not. They shouldn’t cower behind the names of firms

Sara (Debt Camel) says

I agree. But this topic is much bigger than one particular firm and its IP.

Nicki says

Always go the CAB. Never go the IVA route. I speak from family experience. Always go for a DRO if you can and never let anyone pressure you into an IVA!

Sara (Debt Camel) says

Always go for a DRO if you can is great advice!

No one should ever feel pressured to make a decision on a debt solution. Any firm that is pressing you to decide or contacting you every day is probably thinking of their own finances, not yours…

Mr Stephen Mosses says

The CAB are different to Stepchange/ Payplan/ CAP. The latter will handle the payments for you for the life of the DMP. A CAB does incredible work reviewing finances, agreeing, and setting up any repayment plan, but the customer still has to make the payments to the creditors.

Sara (Debt Camel) says

indeed – but it’s good to get impartial advice from CAB who are not going to make any money from whatever debt solution is best for you. If they recommend a DRO or DMP or an IVA you can be sure it’s because it is in your best interest.

Dean Russell says

Stay away from most if not all DMP firms. I have had clients with Stepchange who were put into DMP for 10 years paying £70 per month. Both a DRO and Bankruptcy were better options, and cheaper.

John says

Dro and bunkrupcy is legal agreement. On DMP you can pay 70£ even you income is 3000£. You can play with expenses. On dro and bunkruptcy will be checked and asked where you spend,why so much and where you must reduce spending. It is a huge difference. And your 70£ will be increased to 370 after proper spending.Stepchenge service is free and for them is pointless to offer DMP if other options is better.

ffionpearl says

As a DRO Intermediary, I feel bound to correct that and explain that we don’t say people “must reduce spending”. Any good debt adviser will tell you where you can save money, but its the client’s choice whether they take the advice. A DRO “budget” is the client’s representation of their income and expenses backed up with (but not based on) bank statements.

Soph says

There could have been an array of reasons why a DMP was advised over insolvency. Housing status, employment status, certain expenses on a budget, family or friend debts, loan shark debts. It would have been offered on the best interest of the client. A payment of £70 a month to a DMP is flexible and may be increased depending on affordability, therefore reducing the duration of the DMP.

Tracy says

I had a similar experience years ago with Gregory Pennington. The initial phone call was with a lovely lady who took all my details and helped me set up a DMP. I was then passed on to another advisor, who was downright rude to the core. To cut a long story short, one of my creditors (Provident) came to my home to show me that 6 months into my DMP, they had only received one payment. After much ado with GP, I took it on board myself to contact my creditors and work out a payment plan for each one. I understand not everyone can do it themselves and that’s why these Debt management companies are set up – to help – not to benefit financially from someone else’s misery.

Sara (Debt Camel) says

A fee-free DMP from StepChange is in effect the same as a series of payment arrangements – all your money goes to the creditors each month.

AJC says

I am in an IVA with Creditfix since 2021. I am paying every month, even during a short time when I was unemployed. Currently I am thinking of ending my IVA. Had enough, plus it’s had a negative impact on my health. I had a heart procedure in March. I found out today, Creditfix are not regulated by the FCA. So what rights do their customers have?

Sara (Debt Camel) says

Sorry to hear about your health problems – are you back at work? How much are you paying a month to the IVA? Is it for 5 years?

Dom says

Hi Sara, my debts have spiralled out of control (largely due to having a gambling problem for the last 16 years) and I will probably end up on a debt management plan, at some point this year.

I was hoping to get some clarity as I’ve been a little apprehensive and keep going back and fourth.

I’ve heard that with a DMP there is potential to have a destroyed credit rating for more than 6 years, depending on when certain creditors will apply a default. As i understand it, it can vary from lender to lender?

How could minimise the impact of this?

Various posts I have read online suggest that I could stop paying my cards (I have 5)

Which means that a default would be added from the get go.

I have significant debts (around 50k) but I also have a good job so I believe I could pay this within 6 -8 years or so.

My debts consist of 5 credit cards, 2 personal loans (the consolidation trap) and some small miscellaneous debts.

I also own a house that has 52k in equity currently, which I want to protect at all costs because ultimately, it will go to my kids in future. (Current deal 2.74%, until August 2025) owing 325k

I am 46 and will have 27 years to run on my mortgage (as of August 2025)

My basic salary is around 68k but for the last 10 years I have been making more on top of that with unrestricted overtime.

Sara (Debt Camel) says

Can I ask who your mortgage lender is?

And are all your debts credit cards – any loans, overdrafts, car finance?

And have you now stopped gambling?

Dom says

Thank you for your response.

Mortgage is with Nationwide ( my only account with them)

Credit cards

Virgin money 9k

Halifax 10k

MBNA 8k

Barclaycard £1800

NatWest gold £1600

Tesco bank £1700

NatWest personal loans

9k @3.9apr and 14k @13.9apr (both consolidation loans with 3 years and 7 years to run respectively)

I have stopped gambling at the moment and I am looking into the Moses exclusion scene as we speak.

Thanks

Dom

Dom says

Hi Sara, I have spoken to you previously and received some good advice.

I am close to finishing a DMP budget having stopped paying my debts and having agreed temporary breathing space with my individual creditors, meaning I have to take some long term action soon.

I have 2 years of back pay coming next month which will probably be around 7k after tax.

I was hoping to use some of this money to pay back my ex partner who helped me with 4k worth of vets bills, when my cat was run over in June.

I promised to pay her back when I received my back pay.

On my recent call to StepChange, I was told that this money is an asset and if I pay back my ex, it would be favoring another creditor and therefore could cause me problems setting up a DMP.

I thought that until the budget is finished, I could pay back things as I see fit.

This new information has completely demoralised me.

Any advice would be appreciated

Sara (Debt Camel) says

Well this is a very recent arrangement and presumably your ex would not have given you the money unless they new they would get it back very soon.

it would have been simpler not to tell StepChange about repaying your partner. It isn’t clear how your creditors would know about this?

How large are the debts that will be going into your DMP? How much will you be able to pay a month to the DMP?

Dom says

Thank you for your reply.

My debts are around 55k with 13 creditors. I will probably be able to pay around 5-£600pm.

I get paid 4 weekly so at various times of the year, I get a free month on large monthly payments (mortgage/child maintenance etc) as well as an annual leave premium at Xmas, which I can pay into the DMP so probably around 4-5k a year.

I also have potential to earn extra in overtime going forward but that is not guaranteed.

Protecting my house is my priority, but he painted a bleak picture (which is very different from the last few calls I had with SC)

I am looking at renting a room out and also making affordability complaints due to gambling (which I have now stopped), so I think I will be able to clear a DMP in a good amount of time.

I understand that once in a DMP then creditors must be treated fairly. But I’m not there yet. I am in arrears now with most of my creditors and have a 30 day hold on my CCs, and forbearance on my two loans.

The way the SC representative made it sound is that the back pay would become an asset and if I didn’t distribute it fairly, it could cause me problems and my creditors could put charging orders against my house.

My ex, loaned me that money in good faith and that phone call has made me feel, that she will have to go into the DMP also, and will not see her money for a long time.

Sara (Debt Camel) says

It isn’t at all clear to me how you creditors would know that you have settled this urgent debt with your ex.

I think you have 3 possible options, after you have paid off your ex:

– go back to StepChange afterwards and ask for a DMP

– go to another free DMP provider such as PayPlan and CAP and ask for a DMP

– go for a DIY DMP, see https://debtcamel.co.uk/how-much-work-dmp/ for how to do this. This can work well.

Dom says

Well I assumed that when setting up a DMP, they would ask for payslips and bank statements which would show the back pay, so maybe that’s the reason they would know.

The reason I even mentioned it, was because one of my larger debts (9k) is with Virgin money who have recently become part of the nationwide group (my mortgage provider) so naturally I am worried about my mortgage renewal, in August 2025. I thought that I might be able to clear that card completely, to avoid having a debt with my mortgage provider which wasn’t the case until the recent merger.

The SC representative told me that if I didn’t manage things fairly, there is a possibility that some my creditors won’t play ball and potentially put a charging order on my house? They also mentioned that they could take payment directly from my wages (like tax) and I would have less control. Obviously I want to avoid this at all costs.

I am currently on antidepressants because of this situation and I have worked so hard for my house so losing it is unthinkable.

Sara (Debt Camel) says

when setting up a DMP, they would ask for payslips and bank statements which would show the back pay, so maybe that’s the reason they would know.

The lenders? No, they don’t normally ask for anything like that

Owing a credit car£ debt to you4 mortgage lender will not affect the mortgage if the card debt goes into a DMP.

Seriously you are worrying too much. Ditch StepChange and either talk to Payplan for a DMP or opt for a DIY option. These can work very well.

I do understand that this feels scary. Why not post on the MSE debt help forum and see what people there say? https://forums.moneysavingexpert.com/categories/debt-free-wannabe

Dom says

Thank you and you’re right, I’m worrying too much. Sorry, you have been very helpful and I’m grateful.

I will look into PayPlan and also the possibility of a self managed DMP.

I will call some of my creditors to see what I can put in place individually.

Am I right in saying that if I go down the DIY DMP route, I should insist on defaults in the first 6 months, to avoid having a more detrimental AP marker placed on my credit file?

Thank you again, for your help

Sara (Debt Camel) says

I wouldn’t try to deal with them all individually – too stressful. Especially when you are also making affordability complaints at the same time. A DIY DMP can be offers to them all at one.

I think your credit record is not high on your problems at the moment. Many lenders will add a default quickly anyway and a DMP gets the interest stopped, rather then have another 3-6 months interest added on until a default on a card.

Connor says

Hello.

I need some advise about debts that have been passed to 3rd party collectors like ACI, Lantern and CRS.

I have 5 debts passed to these equaling about £27,000

I can afford to pay around £700 a month.

They have all defaulted now. Is it better to use StepChange to manage this for me? Or make an arrangement with the creditors themselves? What would be better for my credit rating in the long run?

Sara (Debt Camel) says

What sort of debts were these and how long ago are the default dates on your credit record? Are these your only debts, are you making any payments to them at the moment?