UPDATE March 2025 - final scheme payment announced Amigo has announced the last percentage payment will be 6.01%. Together with the first percentage payment, this takes the total up to 18.51%. The amount you will receive will be a bit less than half the previous percentage payment you received. (If you have received 2 payments, the one from Amigo Loans was an "in full" refund … [Read more...]

Debt news and policy

Debt Camel articles on what's changing - and what ought to change - in the world of personal debt in Britain.

If you are interested in a specific area, look at: High cost credit news & policy and Insolvency news & policy.

NSF’s scheme for Everyday Loans, George Banco & Trust Two – now completed

If you had an Everyday Loan or Evlo loan (their rebrand) that started after 31 March 2021, you can make an affordability complaint about this. This isn't through the Scheme discussed on this page, so you may get a larger refund. Use my "large loan template ". If your complaint is rejected, send it to the Financial Ombudsman (FOS) straight away, as that article explains. FOS will be able to … [Read more...]

Morses administration – more delays to the tiny distributions

Morses Club went into administration in November 2023. Morses Club was the largest doorstep lender in the UK after Provident stopped lending in 2021. See Morses Club goes under for details about why it failed. In March 2024, the administrators have sold or written off all outstanding loans. It is now expected that people who were promised refunds of hundreds or thousands of pounds in the … [Read more...]

Are people being told the truth about DMP fees and no-fee DMPs?

Misleading DMP advice Mrs B was advised to go into a Debt Management Plan (DMP) by an IVA firm. They referred her to a firm that charges fees for running a DMP. I suggested that she should talk to StepChange or another provider that doesn't charge any fees for a DMP. Mrs B went back and queried the advice with the IVA firm. This is the WhatsApp conversation: I explained to Mrs B that … [Read more...]

Lloyds and Halifax to charge up to 49.9% interest on overdrafts

The Lloyds Banking Group - Lloyds, Halifax and Bank of Scotland - are changing overdraft charges for customers from August. Some are increasing, some are reducing. The new 19.9% and 29.9% charges are lower than most major banks. But the new 49.9% charge will be the highest overdraft rate charged by a high street bank. The current charges This is the first change since 2020. Before that Lloyds … [Read more...]

SafetyNet & Tappily loans are written off

The administrators of Indigo Michael Limited have announced that all current SafetyNet Credit and Tappliy balances are being written off. And that any affordability complaints have to be made within the next few weeks. My previous article SafetyNet Credit goes into administration gives details about why the lender failed. And also why, unusually, it was allowed to carry on lending to existing … [Read more...]

DROs – major improvements introduced in 2024 Spring Budget

In a Spring Budget that was short on surprises, the Chancellor pulled a large rabbit out of the hat for debt advisers and some of their clients - big changes to the rules for Debt Relief Orders (DROs). DROs are a form of insolvency for people who have little or no spare income to be able to make any payments to their debts and who only have low assets. Introduced 15 years ago, they were … [Read more...]

The new DRO hubs – what happened in 2023

In January the Insolvency Service published data showing how the volumes of Debt Relief Orders (DROs) done by advice agencies changed in 2023, see Monthly IS statistics Jan-Dec 23, Table 3.2. In February 2023, the two new MaPS-funded DRO hubs began operating. These are run by Citizens Advice and Money Wellness (called Benesse Advice in the IS statistics, also known to debt advisers as Gregory … [Read more...]

Loans2Go – the worst loans in Britain – ask for a refund

Loans2Go offers what I have called the worst loans in Britain. Since 2021 they have been charging 770% APR. See the representative example Loans2Go quotes on its website: £550 borrowed for 18 months is a monthly payment of £113 this adds up to £2035, a bit less than four times what was borrowed. MUCH cheaper to get a payday loan than a Loans2Go loan Of course Loans2Go don't … [Read more...]

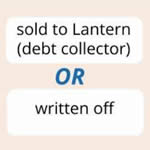

Morses Club goes under – in administration – Scheme fails

UPDATE - March 2024 - the administrators have sold some loans to Lantern and written off all the others. See Morses administration – what is happening to loans. That article is now the current Morses article and if you have any questions, please ask them in the comments there. Morses Club went into administration on 17 November 2023. Morses Club was the largest doorstep lender in the UK … [Read more...]

- 1

- 2

- 3

- …

- 12

- Next Page »