A reader asked: "A friend said not to pay my defaulted debts off but save money towards a deposit for a mortgage - is this a good idea?" It's often unwise to rely on friends for debt advice... They may be guessing, their situation may have been quite different from yours, or they may be assuming what happened to them years ago is still useful today. And in this case, the friend may know … [Read more...]

Budgeting & Savings

Good budgeting is the cornerstone of dealing with debts. The basics are covered in Top tips for simple & realistic budgeting that works.

Good budgeting is the cornerstone of dealing with debts. The basics are covered in Top tips for simple & realistic budgeting that works.

If your debts aren't out of control but you want to pay them off as quickly as possible, taking control of what you spend will help you get there faster.

And having some savings will make it easier to stick to a budget month after month, rather than having a crisis every time an unexpectedly large expense happens.

Buying too much online? 5 ways to cut back

A few taps on your mobile and that handbag, those kids' clothes or this kitchen gadget is on its way to you. Very convenient with busy lives and little time to go to the shops. Or when the shops are shut because of lockdown! But when money is tight or you want to save for something important, or you are just bored with being at home all the time, it can be just too easy to overspend. … [Read more...]

Have a cheap holiday at home!

Having a cheap holiday at home may not sound a lot of fun. If you are trying to blitz down your debts (is that one of your New Year resolutions?) it can be a huge gain. If your credit card is maxed out you may not have an option - but you can make a deliberate decision about what you do instead. By "at home" here, I mean in your own home! Not what the newspapers have taking to calling a … [Read more...]

How to cut your grocery bill and still eat well

Food shopping is a large part of most people's budgets and it's also one that you have a lot of control over. So if you want to cut your expenses, food should be high up on your list. It's not easy or quick to cut what you spend on rent, council tax or transport costs, but adopting a few new food habits can help you reduce your grocery bill and still eat well. Plan, plan, plan Planning is the … [Read more...]

An emergency fund – how much do you need & how to save it

A lot of personal finance advice starts out with “Everyone needs an emergency fund”. A survey showed that a third of middle-class families couldn’t pay an unexpected bill of £500 without borrowing, so the lack of savings is a very widespread problem. But what if you already have debts that you are paying off? Accumulating an emergency fund will delay clearing the debts … but having a rainy day … [Read more...]

Get a simple budget that works – don’t make excuses!

You need something that puts you in control of your spending. Your grandparents used to budget using a pencil and paper. But they didn't have contactless cards and mobile bills and overdrafts and credit cards and takeaways... Now many people find it harder to budget and feel they have lost control. For a budget to make your life easier, it has to be realistic and not time-consuming. This … [Read more...]

Has your budgeting gone off track?

If you have decided to take control of your expenditure, you may get depressed when it doesn't all go to plan. But improving your finances is a journey – one that takes time and planning. And as with all journeys, there can be stops and starts along the way. Don't let these derail your plan. Why budgets go astray Some of these reasons can be unexpected. A big bill that’s landed on your mat … [Read more...]

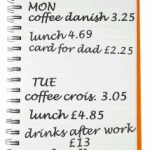

Keep a spending diary – or get an app to do it for you!

If you feel your money just vanishes or you are worried your budget isn't realistic, tracking your spending will give you the facts you need to take control. Without knowing what you actually spend, all too often plans to cut back are just good intentions that don't work in practice. Why you need a spending diary Many people have little idea about what they spend - it feels as though their … [Read more...]