Guarantor loans are coming into the regulatory spotlight.

The FCA wrote to CEOs in March 2019 saying it will be looking at affordability and whether potential guarantors have enough information to understand how likely it is that they may have to make the loan payments.

Recent work we have done in this area showed that many guarantors are making at least 1 payment and the proportion of guarantors making these payments is growing.

This article looks at the problems that customers face with these loans and why they should get additional regulatory protection to prevent many of these problems from occurring.

If you have a current problem with a guarantor loan, read one of these practical articles:

- complaints by a borrower about a guarantor loan;

- complaints by a guarantor about a guarantor loan;

- Amigo’s proposed Scheme of Arrangement.

Contents

Deception and/or pressure by the borrower

In too many cases the guarantor has not given genuine informed consent, either because they are unaware of the borrower’s true circumstances or because they have been pressured into agreeing to the loan, or both. For example:

- The simple con The borrower may disappear soon after getting the money and is never seen again. They may only have known the guarantor for a short time. The guarantor may have been easily persuadable because they are young, anxious to please or have mild learning difficulties.

- A position of trust eg people have been asked to guarantee loans for their boss at work, for the manager of their sheltered housing, for someone who is a full-time carer for their mother. These are relationships where the guarantor may feel they can’t risk annoying the borrower by saying No.

- Domestic violence or financial abuse This is usually from partners or ex-partners: “he threatened to take my son, beat up family members and also threaten to kill himself“. The guarantor may not only be pressured into agreeing to be guarantor but also into lying about their income: “he told me exactly what to fill out, exactly what to say“.

- Financial pressure Often the guarantor loan is not the first financial link between the borrower and the guarantor. Most couples’ affairs are linked to some extent, even if they have separated, for example “he told me he needed the loan for his business, otherwise he wouldn’t be able to make the payments on a bank loan I had taken out for him before we split up and wouldn’t be able to support our son.”

This also often happens with top-up loans: the borrower says they can’t manage the repayments on the existing loan, so if the guarantor doesn’t agree to the top-up, the guarantor will have to start repaying the original loan. - Emotional pressure There doesn’t have to be any dramatic threats – if you know your partner or child is desperate and thinks this loan will solve their problems, it can be hard to say No.

- Concealing extent of financial problems or addictions Often parents don’t realise their child has a gambling problem, they just think they have been unlucky in losing their job. In extreme cases: “I had no idea she had gone bankrupt a couple of years before“, “I found out later that his business had already collapsed before he took the loan he told me was for the business“.

The deception here is not always deliberate. Often the borrower is indulging in self-deception – although their history shows that every high-cost loan they have had made their situation worse, somehow they have convinced themselves that this time will be different. So although the borrower may not be completely open about the extent of their problems, they are not setting out to deceive the guarantor.

Information asymmetry

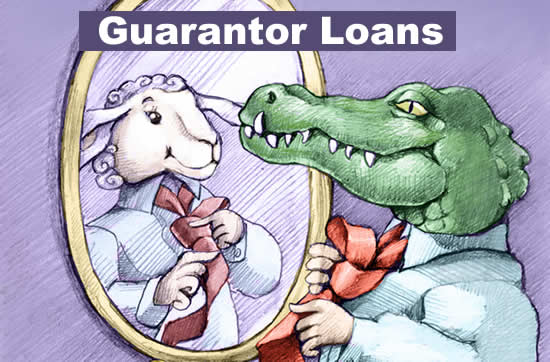

The idea behind guarantor loans is that the guarantor knows the borrower and that they can be trusted to repay, providing the lender with valuable reassurance.

In practice, there is a large information asymmetry, but it is in the opposite direction. The lender often knows more about the borrower’s true financial situation than the guarantor does:

- the lender can see the payday loans, missed payments, defaults, CCjs etc on the borrower’s credit record;

- the guarantor only knows what they have been told by the borrower.

This feels fundamentally unfair to me. The guarantor derives no financial benefit from this loan. The lender, who may have much better information, gets all the advantage of someone with a decent credit record and often a house with equity backing a loan at c.50% APR on the basis of false or incomplete information.

A guarantor loan also puts the borrower in a vulnerable position

I started by highlighting all the ways guarantors can be pressured into agreeing to a guarantor loan, but once the loan is taken out it is the borrower who is under emotional pressure to carry on making the payments to prevent their guarantor being called on.

They can’t include the guarantor loan in a Debt Management Plan or enter insolvency. Even though legally a guarantor loan is not a priority debt, that is how most borrowers see it and they may choose to default on all their other debts instead. Many turn to other forms of high-cost borrowing to provide funds to pay the guarantor loan.

This effective deprivation of access to debt solutions is unique to guarantor loans.

Because of it, borrowers need better information about the implications of a guarantor loan and their other options before they take one. Consolidating high-cost short term debt into a guarantor loan is very often a very poor choice – the borrower swaps the protection of the payday loan price cap and loans that can be included in a DMP for a product with no cap and where they are emotionally unable to enter a payment arrangement.

This also means that simply looking at default rates by the borrower underestimates the number of guarantor loans that turn out to be unaffordable.

Poor behaviour by lenders

So guarantor loans are a product where both the guarantors and the borrowers can be vulnerable and under a lot of pressure. These problems can be reduced or made worse depending on the lender’s checks and procedures. And too often at the moment they are made worse.

The FCA’s CONC rules do not specify in detail what affordability checks a lender must make on the borrower or the guarantor. But because of the extra pressure on borrowers to pay and the additional security from the guarantor, a lender has little financial incentive to verify reported incomes and expenses.

Borrowers and guarantors often report pretty sketchy affordability checks, sometimes with implausibly low amounts being accepted by the lender or even suggested. Guarantors have reported having a phone call to discuss their I&E while they are at work (“I was unable to give my full financial statement but they just kept saying roughly what do you think you spend so some was just a guess off the top of my head.“) or even in hospital.

Too often the lender doesn’t prompt for expenditure lines that may be missing: people with petrol costs and car insurance are not asked about road tax, MOT or servicing costs; people in receipt of disability benefits are not asked about the additional costs of their disability etc.

Lenders don’t always ask if there are any financial links between the borrower and the guarantor, or whether a guarantor’s finances would be affected if the borrower lost their job or died.

There are widespread reports from debt advisers that guarantor lenders are very fast to go to court. It is unusual for commercial lenders to take people to court for consumer debts quickly – most lenders prefer to accept arrangements to pay and ultimately sell the debt. Sometimes a court case has to be stayed to allow complaints to be taken through the Financial Ombudsman – this is not an issue that comes up with other forms of lending.

Public information supplied by the Registry Trust supports this. In Northern Ireland in 2018, Amigo obtained 275 CCJs with a total value of just over £1.9million. This was the highest total value of any claimant in Northern Ireland in 2018 – only one other claimant had CCJs totalling over £1million. This claimant data is not available for England and Wales.

Guarantor has less legal protection than the borrower

The unfair relationship provisions of the Consumer Credit Act do not apply to guarantors because the lender has not provided any credit to the guarantor (see Clydesdale Bank plc v Gough & Gough 2017).

The 14 day cooling-off period that should allow someone to change their mind about a loan is largely ineffective for guarantor loans. The guarantor will usually have been asked by the borrower to transfer the money to them immediately they receive it from the lender. The situation where a cooling-off period would be most useful is where the guarantor has been under some form of pressure but now wants to back-out – but here the borrower is not likely to return the money.

How regulations can be changed to provide extra protection

Currently borrowers and guarantors can complain to the lender and then take their case to the Financial Ombudsman, for example if they feel they were given a loan or approved as a guarantor when the loan was unaffordable for them. But although this can work in some cases, it is unsatisfactory:

- it only provides redress after the event and to customers who become aware of it as an option. Many of the most vulnerable customers are not likely to complain;

- it places large demands on the debt advice process, with many clients needing considerable amounts of support, which is undesirable for a product which is being increasingly sold;

- there is no clear redress for the guarantor who was not aware of the borrower’s situation who wants to complain that the lender failed to adequately check that the borrower could afford the loan.

I think additional checks should be mandated by the FCA that together would prevent a very large proportion of the problem loans being made.

Thorough affordability checks

The lender should verify borrowers’ and guarantors’ income and expenses using Open Banking or asking for bank statements for at least the last three months. For the self-employed or where income varies, there may need to be further checks.

The I&E that is drawn up needs to take account of reasonably foreseeable changes to income and expenses as CONC 5.2A already provides. It should be further verified by a phone conversation with the respective borrower or guarantor, scheduled for a convenient time for a detailed discussion.

If there are any financial links between the borrower and the guarantor, a second I&E for the guarantor needs to be drawn up that would reflect the likely position of the guarantor if the borrower stopped making any contributions to the guarantor’s finances.

For relending, if the borrower’s debt position has got worse since the first loan, there should be a presumption that no top-up should be offered and the borrower should be signposted to free debt advice.

Any evidence of significant gambling should result in an application being declined.

Warning against debt consolidation

The lender’s website should have a prominent section saying that guarantor loans may not be a suitable way to consolidate high-cost debt, spelling out that a guarantor loan makes it is harder for a borrower to make a payment arrangement or enter insolvency as the guarantor would be called on to make payments, and providing links to free debt advice.

If the borrower states that the loan is needed for debt consolidation they should be warned by the lender that they may have better alternatives and signposted to free debt advice.

Disclosure to the guarantor of the borrower’s situation

I think the provision of general statistical information such as “Of the outstanding loans provided by lender X, 5% have resulted in CCJs, 8% are currently being repaid by the guarantor and an additional 6% had at least one payment made by the guarantor in the last year” would be helpful but not sufficient.

An optimistic or deceived guarantor is likely to dismiss it as not being relevant to them. Instead the guarantor needs to see the full details of the borrower’s situation.

The borrower needs to consent to the lender showing the guarantor the borrower’s credit record, bank statements and the borrower’s verified income & expenditure.

The guarantor will be relying on this in information deciding whether to proceed with the application and if later the borrower’s I&E proves to have been significantly inaccurate the guarantor should be released from their obligations.

This is not an invasion of privacy, it is a necessary protection for the guarantor who is being asked to back this loan and not derive any benefit from doing this.

The guarantor should have sufficient time to consider this information before being asked to confirm that they want to go ahead as guarantor.

Prevention is better than cure

I think it’s likely that introducing these extra checks would prevent many of the least desirable loan applications being made. They would provide the basis for the guarantor to give genuine informed consent to the risk they are taking on.

Cathy says

Thank you for Sara for very well written and easy to read report on the pitfalls of guarantor loans. Lets hope stronger regulations are put in force to protect the vulnerable in society. I currently have a case with the ombudsman on behalf of my son who was taken advantage of by a so called friend, who had defaulted on a £10,000. Moved away from the area and has not made any payments since November 18.

Gail Jackson says

Excellent article, thanks for all the advice. Working with a family where the husband has an Amigo Loan and his wife is guarantor (she has the same finances as her husband and can only speak English at a very basic level). He has defaulted as lost his job and now on ESA but the debt is still in the family. Is there any advantage to her challenging using your email template when if successful the debt would just return to her husband? Ot, is there a way to challenge that an unemployed spouse shouldn’t be accepted as guarantor? Thanks

Sara (Debt Camel) says

If her English is very limited, this should have been obvious during the phone call with Amigo. It may well be grounds to say she did not understand what she was being asked to agree to and Amigo should not have accepted her as a guarantor with additional checks.

Ask for a copy of all her personal infomration including a copy of call recordings and credit checks.

Whether this is a good way forward comes down to the specific circumstances. If they are buying not renting, it is usually best to get her removed as guarantor to protect her share of the equity. If she has no or little other debt, then it is definitely worth getting her removed as guarantor to protect her credit rating and he can then look at debt solutions which are likely to include insolvency options if his health isn’t going to improve.

Should he have passed an affordability test at the start? If no, then she should apply to be removed as guarantor and he can put in an affordability complaint – if its won interest would be removed from the debt. But if that would remain at a high level and if he has other problem debt as well, insolvency may be a simpler option if they are renting.

But if she has stacks of other debt, then insolvency for both of them may be faster and less stressful.

Chris Bone says

Guarantor loans are the cancer of the debt world. The lenders are making so much money they should provide a network of solicitors to provide free independent legal advice to any guarantor so they know full implications of what they are entering into, including questions on coercion and undue influence etc. It may extend the drawdown period but it has to be better going forward. What do we have now…an extremely aggressive collection process, default, a CCJ against borrower and lender followed by enforcement where possible particularly charging orders which is so unjust, often against elderly people.

Sara (Debt Camel) says

I agree about the extremely aggressive collection practices. I was horrified at the Northern Ireland Amigo CCJ statistics – they are so fast to go to court that vulnerable people may not get debt advice in time, and it would have placed a significant burden of debt advice services in Northern Ireland if half of those CCJ cases had sought advice and had needed to be supported through FOS claims.

The FCA has to find a way that will prevent the large majority of inappropriate loans at the start. I think this has to be a combination of extra checks – your suggestion would be another good safeguard. As would not paying the money out to the guarantor for 14 days after loan approval to provide a genuine cooling off period.

Christopher says

The emotional blackmail I had from Amigo when entering an IVA was an absolute disgrace, they were also the only company to vote down my IVA. At the time I’d been signed off due to mental health and had just had an in patient treatment stay so I was not in the best way. They also contacted my mum, who was fully aware of my situation, with a similar tone instead of it being a factual thing. The way they acted was manipulative and underhand yet the FOS refused to look at the wording of the letters which was particularly frustrating.

Sara (Debt Camel) says

Perhaps their staff would benefit from some proper vulnerability training. I have heard Insolvency Practioners say that guarantor lenders routinely vote against IVAs.

Christian white says

I’ve not had a guarantor loan but did once ask a colleague and friend if he would be willing to act as guarantor for me. Fortunately he said no! He kindly lent me a few hundred pounds to give me a breathing space which I was able to repay within a couple of months. I’ve not looked at them since. These loans benefit the lender twice over. Interest rates are high and, often, because the amounts you can borrow are high, the total additional costs run into thousands. Then, the loan company has a second line of security with the guarantor. In normal high cost lending, the high interest rates are justified because there is high risk and no security. Guarantor loans want to charge high rates AND have security. The marketing by one of these companies in particular completely disguises the real risks of the loans to both guarantor and borrower. There might be some circumstances where such a loan can work but I would imagine that these are rare.

Sara (Debt Camel) says

Well done your friend!

C says

Hi so I am the borrower and I have not missed any payments or been late. My mum just can’t have this attached to her. She was never in the right financial state to take on the loan when it came to affordability. Its with UK credit. She wants to be taken off so its one thing she doesn’t have to be concerned about.So my mum had a record of financial difficulties on her credit score when the loan was taken out and she is in a job were the hours are not guaranteed every week and her and my father entered some sort of agreement were they could not take any further credit. And she was in debt at the time too. She has sent the complaint as of today with the template and appropriate bits added on.

Sara (Debt Camel) says

I hope she gets a good result – she needs to expect that UK Credit will reject her complaint – this doesn’t mean it’s weak, she should send it to the Financial Ombudsman.

If you would like to follow what is happening to other complaints by guarantors, this https://debtcamel.co.uk/amigo-complaints-by-guarantor/ is the best page. And the comments on https://debtcamel.co.uk/how-to-complain-guarantor-loan/ may also be interesting.

Eloise says

Hi there, please I need help..

I am currently a guarantor for someone through amigo loans.

This has been going on since mid last year. Since then the borrower has gone through an Iva in hope it would clear me from the guarantor loan, however it breached amigos contract terms, therefore I am now responsible for this loan.

I was seriously coerced into agreeing to be a guarantor by the borrower, as he was at the time my manager at our work, and felt like if I said no my job would be at risk.

It is also having a huge strain on my mental health as this person was very financially abusive towards me during our “friendship”.

Please can you advice if there is any way of me getting out of this loan? Is there a way to find a new guarantor for this loan?

Sara (Debt Camel) says

no-one would be prepared to be the guarantor for a loan where the borrower had already gone for an IVA.

But read https://debtcamel.co.uk/amigo-complaints-by-guarantor/ and look at sending Amigo a complaint asking to be removed as guarantor.

You can say this because you felt pressured into becoming the guarantor for your manager.

You may also be able to argue that when the loan was taken out you could not have afforded to make all the loan repayments and still pay your own debts, bills and normal expenses. This is an “affordability complaint”. If you can combine this with also arguing that you were pressured into taking the loan that gives you two ways to win your complaint.

Elizabeth says

good morning i was wondering if yu could help i went guarantor for my daughter a bit pressure as she said she dident have christmas presants for her children and then she wanted it topped up she made a cuple of payment and ive been payong the rest as she keeps giving her job in now she has a decent job in the royal mint she still isent paying she keeps moving the date and ive ask amego loans not to do this now im finding the preasure is getting to much for me ive got a disabled husband and i dont need the stress its making me ill i dont want to be a guarantor any more and i dont no what to do please help

Sara (Debt Camel) says

So two thoughts.

First was the loan actually affordable for you at the time of the last top up? By affordable, I mean you could have made all the payments and still paid your own bills and debts and living expenses? If it wasn’t, you can complain and ask to be removed as guarantor. See https://debtcamel.co.uk/amigo-complaints-by-guarantor/ which has a template letter you can use.

You can’t ask to be removed just because you don’t want to be the guarantor, but if it wasn’t affordable for you at the start, that is a good reason.

Second it doesn’t sound as though the loan was affordable for your daughter! Send her a link to https://debtcamel.co.uk/how-to-complain-guarantor-loan/ and suggest she makes a complaint as if she wins that the interest will be removed from the loan and she can arrange to pay the rest in more affordable amounts. If you win your complaint she will have to pay the loan herself and so it will be good if she can complain now so that this will be easier for her.

John says

Great Article.

I am currently a borrower in Guarantor Loan with UK Credit. I fell behind with my payments, due to my struggles with employment. However i did make smaller payments to the company. They have still defaulted my loan and sent out a formal demand to my guarantor, who is in a worser position than i am.

I have asked UK Credit that i will make payments and complete the my loan before the end date. But i do wish my guarantor to be bothered regarding this. They are still insisting on pursing my guarantor but expect payment from me aswell to the schedule i have outlined.

is there any advice regarding this situation?

Many Thanks

Sara (Debt Camel) says

When you took this loan, was it affordable for you? A loan is only affordable if you can repay it and still pay all your other loans, bills and living expenses – if paying UK Credit means you were getting deeper into debt, then the loan was not affordable.

Also when the loan was taken out could your guarantor have afforded to make all the payments out of their income? And still paid their own debts, bills and living expenses?

John says

Hi Sara,

Thank you for getting back to me

At the time of taking the loan out, both me and my guarantor were able to afford to pay the loan, however circumstances have changed for both of us, we both lost our job due to the pandemic. But I am in a better position to make smaller payments and my employment has been secured to started next month.

My guarantor situation is not good at the moment. I have contacted UK credit about me making the payments, sent them an affordable payment schedule and also look on track of completing all my payments before the loan end.

They are still insisting on my guarantor to be liable for payments even thought I have stated that I am in a much better position now.

Sara (Debt Camel) says

Legally they are right, your guarantor is still liable.

Is your guarantor still out of work? Do they have other problem debts? Are they renting or do they own a house?

John says

Yes they are out of work and currently on universal credit. They do rent currenly also.

If I pay off my arrears by the due date they have stated will the guarantor still be liable?

Sara (Debt Camel) says

If the arrears are paid off, there is nothing for them to be liable for.

But do they have other debts?

John says

Yes they do have do currently have outstanding debts with other lenders

Sara (Debt Camel) says

Have they talked to a debt adviser? because if they have been out of work for a while then it may be that something like a debt releief order is a good idea for them? Their liability as guarantor can be included in this if you have defaulted so they have been asked to pay.

Sean Cook says

Dear Debt Camel,

My loan was sold to Lantern! My guarantor has had a full refund and released from my loan. Yes the loan is still outstanding(I would still be in need of a guarantor)to take any loan now. I am disabled and in a vulnerable state of mind and body, have been under mental health for nearly 3 years. I appealed the decision with Amigo loans, when they rejected my first appeal after my guarantor was refunded in full and then some more! But I was left with a £6300 debt that could not afford to repay from 2017. I told them last year they should not have sold my loan as anyone in a vulnerable position were not to be sold under their own agreement, but as they were in administration the administration themselves sold the loan to lantern anyway, as the outstanding needs to be resolved. Lantern would have then bought the loan for Pennies and now will force me into bankruptcy as I am on disability benefits which includes my housing costs I cannot afford to give what I don’t have.

With Kind Regards

SJ

Sara (Debt Camel) says

Can I ask if you have any other debts as well? Is your tenancy social or private?