Loans2Go offers what I have called the worst loans in Britain.

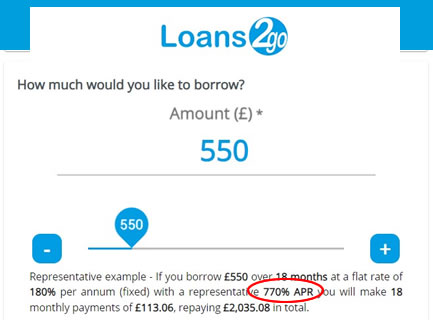

Since 2021 they have been charging 770% APR. See the representative example Loans2Go quotes on its website:

- £550 borrowed for 18 months is a monthly payment of £113

- this adds up to £2035, a bit less than four times what was borrowed.

Contents

MUCH cheaper to get a payday loan than a Loans2Go loan

Of course Loans2Go don’t point this out on their website, but check out these numbers!

With a payday loan for £550, the maximum interest that could legally be charged is £550 – the amount borrowed. So you would only have to repay £1,100 – the £550 borrowed plus the £550 interest. And the monthly repayments for a payday loan for 12 months can’t be more than £92.

So you would pay a payday lender £92 for 12 months

but Loans2Go is charging MORE PER MONTH (£113) for MUCH LONGER (18 months).

Loans2Go also used to offer logbook loans, but this article is just about their standard personal loans. If you had a logbook loan from them, use the template on this other page.

Is this legal?

The Financial Conduct Authority (FCA) calls payday loans “High Cost Short Term Credit”. Its definition of High Cost Short Term Credit is a loan over 100% in APR and of 12 months or less.

So the Loans2go loan is outside that definition because it is 18 months long. So it isn’t caught by the price cap rule.

Unfortunately, this means its loans have crept through a loophole and are legal. I think the FCA should close this loophole.

Many people are winning affordability complaints about Loans2Go loans

I think this is the worst loan in Britain.

A loan is unaffordable for you if the monthly repayments were so high you couldn’t afford to pay them without hardship, borrowing more or getting behind with important bills. This is a standard affordability complaint, used for many other sorts of loans. If you win this you will get a refund of all the interest.

Because Loans2Go loans are so expensive they are often unaffordable. Many people are winning Financial Ombudsman (FOS) complaints about these loans – here is just one example: Miss R’s personal loan provided by Loans 2 Go.

No-one who isn’t desperate would take one of these loans out, and the ombudsman says Loans2Go should make more detailed checks on affordability when it thinks the borrower may be in difficulty.

Several people have said they were not given the full details about the loan before the money was given to them. If this happened to you, say this in your complaint as well.

First complain to Loans2Go

It doesn’t matter if you have repaid the loan or you are still paying, you can still complain.

You have to complain to Loans2Go first, you can’t go directly to the Ombudsman.

Email customerservices@loans2go.co.uk and copy it to ps@loans2go.co.uk. Put AFFORDABILITY COMPLAINT as the title.

Use this template as a basis and make any changes so it reflects your case:

I am also complaining that the interest rate was grossly excessive. It is unfair to charge someone more per month over 18 months than they would have paid to a payday lender for a loan the same size over 12 months.

[only add this next sentence if the date of your loan was after the end of July 2023] This loan does not represent fair value and it is in breach of the FCA’s Consumer Duty.

[only add this if you were not told the loan terms] The loan was not adequately described to me before I was given the money. This is an unfair way to give high cost credit.

I am asking you to refund the interest and any charges I paid, plus statutory interest, and to delete any negative information from my credit record.

[delete if you have repaid the loan] I would also like an affordable repayment plan to be put in place if I still owe a balance after this refund.

I am also making a Subject Access Request (SAR) for all the personal information you hold about me including, but not limited to, my applications, all credit and other affordability checks, a statement of account for my borrowing, and a record of all phone calls.

Let me know in the comments below if you are making a complaint about a loan that started after the end of July 2023, as there are some new regulations about those.

Is an offer from L2G a good one?

If L2G has offered to wipe a small balance or take some money off what you owe, you have to decide whether this is a good enough offer to accept.

For example, they may offer 50% of the interest off “as a goodwill gesture”. Or to reduce your balance by 50%. These are often very poor offers, you could get a lot more by going to the Ombudsman.

Sometimes Loans2Go will increase an offer if you push them. Here is what one reader said:

They replied firstly with the offer to half what was left and agree a payment plan and I refused and they immediately came back and wiped the loan clean and removed it from my credit file.

It’s up to you what you think a good offer is. But you can’t change your mind later if you accept and then think you shouldn’t have.

So ask a question in the comments below if you aren’t sure.

Take a rejection or a poor offer to the Ombudsman

You can send your complaint to FOS if Loans2Go has rejected it or has made you a poor offer. This is easy, just use this simple FOS form which asks you what they need to know to set up your case.

Send your bank statements to the Ombudsman – 3 months before and 3 months after the date of the loan. These are the best evidence that the loan was unaffordable for you.

Angela says

Hi, I’ve had an adjudicator uphold my complaint with Loans 2 Go. I know they can still dispute this so just wondering if anyone has experience of them refusing to accept a decision at that level which means it then needs to wait for an ombudsman to look at it?

T says

Hi Sara

You may remember I have asked previously about loans 2 go and I followed your advise and referred to fos for affordability complaint. I also have a cancer diagnosis and am on active treatment all of which I made l2go aware of at the beginning and this is also within my complaint. I did ask fos if they could look at it sooner due to this but have only received the generic response, I don’t want to jump the que and am happy to wait but yesterday received a final demand from l2go for the outstanding amount. I replied back immediately advising I would forward to fos, I felt they were really threatening, one paragraph said they could look at contacting my employer to get an attachment of earnings order. Do you think that they are just trying to get me to pay by using threatening tactics or could they actually go to my employer. I have been completely transparent with them about my diagnosis, treatment and the impact this had financially but they really don’t care!! It’s currently costing me £70 A week to fill my car to get to and from daily radiotherapy sessions so I just don’t have the money to pay them.

Sara (Debt Camel) says

I am sorry but this sort of case is EXACTLY why FOS gives some cases priority. Please phone FOS up. You are not “jumping the queue”.

They can’t get an attachment of earnings order without going to court for a CCJ first. That will take many months. They should not be making these baseless threats to a vulnerable client. Tell FOS about this too.

T says

Thank you, I will ring them but do find it really difficult sometimes actually speaking to anyone really. But thank you again.

Lynne says

God this sickens me. All the best to you 🤞🏻

T says

Thank you, they really have been so unpleasant and unhelpful.. It’s just not the sort of stress that anyone needs.

Adam says

Wish i had access to this info earlier, i’m at either paying £900 for a loan i didn’t need (£300) or paying it off.

despite me complaining to loans 2 go years go about the loan being unaffordable and i made the application in error they just passed it off to a collection agency, it’s not that i didn’t want to pay it back, i was struggling at the time, needed money for christmas presents for nieces and nephews and took out a £300 loan, i then got a bonus from work so let loans2go that i could return the £300, they refused, this was back mid december 2020.

now i’m stuck paying over £900 because i couldn’t afford to pay it regularly after losing my job.

Talia says

Hi Sara

I used your template on the 30th June (thank you) I struggled to pay back the loans to L2G they have not responded as yet, how long does the initial acknowledgement take?

Florian says

Hello Sara,

I’ve sent an complaint of my behalf using your template,my statements 3 months before taking the loan are showing ,hasn’t been an affordable loan (pay it back one 1000tobthem),U paid back the principal amount ,I borrowed)Donyou think they can send the debt collectors or issue an CCJ ,I told them ,my next step will be a complaint to FOS ,how do you think.

I have received confirmation about complaint.

Thanks

Sara (Debt Camel) says

As I have said before, there is nothing you can do now except wait until Loans2Go reply, which will probably be 8 weeks after the complaint.

You said you were going to speak to StepChange – have you done this?

Florian says

Dear Sara,

Thank you.

Yes ,I will wait of course.

But yesterday I red a comment of person here who made complaint and shared ,that Loans2go gave him on collection agency ,even on the complaint time

I will speak to Step change tommòrow when I am off, but worried to speak as now for 2 months my income is higher over 3000abd I manage to pay some arrears and also dud pay up to date the 3 of loans ,overdraft is ok as well.So my concern was if they say “You are on higher income(3000£) ,but for 2 months you can’t fix a year spent in surgeries ,hospitals, being unemployed ,I,want to make sure they will objective on my situation.Thank you.

Sara (Debt Camel) says

if you aren’t paying the Loans2Go debt then it’s likely they will send it to a debt collector.

StepChange will look at your current debts and income and what you can afford to repay now. Explain if you think the income is seasonal and when it is likely to reduce.

Florian says

Actually I paid off the principal amount and have one other loan paid to them as the most people here ,and some people during complaint haven’t paid anything and he stood firm to his point ,so why should they do stupid things to go to debt collector if you bring them to ombudsman, yes 6 months or more ,but once there us a complaint they will be charged 650£ fir complaint and there is a big possibility the ombudsman to judge a full refund,yes no logics in greedy people.(Ombudsman can huhe and the debt collection to stop and e.t c).

I am really confused but they landed unaffordable, with any credit check and nothing.

So let us continue to make legal “regulated” theirs rich yeah.

Have a lovely afternoon!

Sara (Debt Camel) says

There is no point in worrying about this. Talk to StepChange to get into a safe financial space and wait for L2G to reply.

Florian says

Dear Sara,

Thank you for everything you do for people.

Ok ,I will talk to StepChange .

Richard says

Hi. Firstly just want to say thank you for the advice and help this page as gave me. It’s worked wonders. Had to go to ombudsman. But they are upheld my complaint and now I’m just waiting for payout from loan 2 go. Secondly just wondered how long others waiting from this point to get there refund. Literally Loans to go have now closed my outstanding balance and I can no longer log in. And the information as been sent to the finance team from them to pay me. How long did people wait from this point. Are they quick or do they drag it out.

Thanks again

Angela says

Hi, have you heard from L2Go yet since ombudsman decision? I received an email on 14th July from adjudicator saying L2Go had accepted her findings and would be in touch re redress. Her email states they have 8 weeks to get in touch with me but hoping it’s a lot quicker than that.

Lynne says

Just got this from the Ombudsman

Loans 2 Go has responded to our assessment of your complaint – and has said it agrees with the recommendations we set out in our letter.

what happens next

If you’d like to discuss my recommendation, please let me know as soon as possible.

Otherwise, you don’t need to do anything. If we haven’t heard from you by 22 July 2022, we’ll assume you’re happy with how we think your complaint should be sorted out – and we’ll tell Loans 2 Go to contact you to arrange settlement.

Lynne says

Apparently they now have a further 4 weeks to write to me with how they’re going to solve the case. All this waiting around yet they were quick enough to debit our accounts with their extortion!

Shirley says

Hi Sara,

Do you have any experience with credit spring?

They have refused my claim stating it was affordable. I can not access my reports showing it wasn’t. I also had a CCj in which they said they checked and it wasn’t there. It is, I have a screenshot of it on my account from 2018. Should I respond back to them or go to the FOS?

Sara (Debt Camel) says

I can not access my reports showing it wasn’t.

what reports can’t you access?

Also how long have you been borrowing from CS?

Shirley says

I can not access my historic credit reports on Experian or Equifax.

It has been since March 2021

Sara (Debt Camel) says

Realistically a CCJ in 2018 would not have been a bar to a bad credit lender giving a small loan in 2021.

Can you get your current credit reports?

Shirley says

Ah ok.

Yes I can access the last month- I’m not sure if this is because I’ve only recently joined Experian/equifax.

Sara (Debt Camel) says

That is all you need for an affordability complaint. It should show your credit history going back 6 years which is ample for a complaint about something that happened last year.

I haven’t seen many mentions of CS and I don’t remember anyone winning a case against them. But if you think the loan was clearly unaffordable then make the case.

Angela says

Hi, can anyone help out with timescales? Loans 2 go have accepted adjudicator decision upholding my complaint. Just wondering how long approximately L2Go take to advise of redress and payout? Thanks

Florian says

Dear Sara,

I have received a response, final from Loans2go

,of course they ignore the fact ,that the loan hasn’t been affordable, according to their “online tools for check of incomes”.My statements are showing I am on minus overdraft, minus other debt that time September 2021,and I have payed off them one debt at full(1000£),also I paid them the principal amount I borrowed 950£

And they are offering me to write off 50% like gesture of goodwill-they want me to pay them back 1129£ afforyour contractual instalments. Had there been any cause for balance, rather than having to factor the accrual of any , we are offering to reduce the interest on the active Loan Agreement by 50%. Current Balance: £2,412.04 Proposed Write Off Amount: £1,282.52 (50% of Total Interest) Proposed New Balance: £1,129.52 Please advise us if you are satisfied with the resolution provided and accept this as full and final settlement of the complaint within 14 days of this letter to ps@loans2go.co.uk s

Sorry for long write and post ,

What will be your advice to me in this situation(I sorted my other loans ,scheduled and no need of StepChange-after all is up to date now)

What to do with these loan mafia?

Thank you so much!

Sara (Debt Camel) says

The first loan – you borrowed 1000 and repaid how much? Then was there a gap before the second loan, or did the second loan settle the rest of the first loan?

You borrowed 950 for the second loan? How much have you paid to the second loan so far?

Florian says

Hello Sara,

First loan was 1000£ and paid off in 1 month -June 2021,the second one of 950£ was taken September 2021 ,and repaid 1103£(principal amount 950)

They are saying in their “final responce”

According to them the loan has been”

affordable”

How affordable one account with Bank statement of minus, -1500£ can be and other loans, yes I had them up to date (paid minimal paymenys”,but minus is a minus.

Sara (Debt Camel) says

ok so you can’t have paid much interest on the first loan. If you can reach a satisfactory agreement of the second loan, you probably don’t care about not getting a refund on the first loan. But if your case has to go to the Ombudsman, ask for a refund on both of them!

The second loan you borrowed 950 and have so far paid 1103 (correct? say if this is wrong)

If this loan was upheld as unaffordable by the Ombudsman the balance would be cleared and you would get a refund of £53.

Instead they are proposing that your balance should be reduced to £1129 (correct? say if this is wrong). Their offer seems very poor to me.

Loans2Go are sometimes prepared to negotiate on an offer. In a negotiation you won’t get everything you could get by going to the Ombudsman. What do you think would be a satisfactor offer:

– do you want the balance cleared?

– would you be happy if it was reduced to £250? £500?

Florian says

Good morning Sara,

I apologize for duplicates,just didmnt get info it was posted.

You are right 1129 £ is really poor offer,

I’d like to ask if I answer to them ,that I want a balance closed and ,that I will go to the ombudsman will they take any stupid CCJ actions.

What is your advice?

Thank you very much.

Sara (Debt Camel) says

They shouldn’t take you to court while you have an open complaint with the Ombudsman. They may make threatening noises but this hasn’t been a problem in practice, as you can just enter a defence saying you dispute the debt and would like the case stayed (legal jargon for put on hold) pending a decision on your FOS case.

CCJs take an average of 11 months to get to court anyway, and it would be several months before L2G could even start the process.

Florian says

Sara your advices are priceless for people fallen in this horrible situation.

I thank you so much.

So I am agree ,with your opinion 1129£ is a really poor offer.

So as some people here did ,should I tell them ,that I am not accepting their offer and ask them to close my account or I am moving the case to FOS ?

If I agree with amount of 200£ or 500£ isn’t that a wackiness from my side?

Thank you very much!

Sara (Debt Camel) says

So as some people here did ,should I tell them ,that I am not accepting their offer and ask them to close my account or I am moving the case to FOS ?

If you don’t want to take their offer AND you don’t want to make a counter offer as a compromise, then you can tell them if you want or just send the case to FOS.

The phrase “close your account” has no meaning here – you have an open balance until either you repay it or it is cleared with a refund.

If you decide to stop paying them, then you should tell them this but they will carry on asking for payment. You could also offer to pay at a lower more affordable rate.

Stopping paying or paying less will harm your credit record – if that is bad already you may not care. If you win the case at FOS any negative marks on your credit record will be removed.

If you cannot afford the repayments without getting behind with other debts or bills or borrowing more, then you should stop paying them or offer a lower payment. Talk to StepChange if you are not sure what you can afford to offer.

If I agree with amount of 200£ or 500£ isn’t that a wackiness from my side?

You don’t have to do this, you may be happy to send your case to FOS and hope to get a full refund on both loans. I am just saying that L2G are sometimes prepared to negotiate, but if you want the balance cleared and would not be happy with a much lower balance, tell L2G that. This is your choice and I cannot recommend what you should do.

Florian says

Dear Sara,

Thank you very much!

I will answer to their 1129£ offer, that is not acceptable and sorry if I didn’t expressed myself correct (not my native language)

As you say they can negotiate sometimes ,

I think 2 or 3 people here with identical situation have informed LG2 ,that they will take case to FOS and they had their accounts closed and sorted.

They even haven’t paid as much as me ,the one ,so I will not putty head down for such greedy ,unfair “lenders”.

I will inform them ,that I will take case to the FOS.

Thank you very much!For your time, sincere help ,your knowledge and everything.

Without your help would be able to even gave 50% offer.

As Edmond Birk said”Is enough the good people do not do anything ,for evil to triumph.

Florian says

Dear Sara,

Hello ,hope you are well.

Just to inform, that 4 days ago I have sent response to Loans to go ,that I ask them to clear interest and close account, after the principal amount paid1103 for loan of 1103,I rejected their offer of 1129 (a 50%,”good will gesture).So far no indication ,that they opened email ,or received.I wrote them ,that will move to FOS if they reject my request.

Sara (Debt Camel) says

did you give them a time limit? If not I would send it to FOS in a week.

Florian says

I would like to thank Sara and all people here ,who shared their experience

Loans2go first offered me 50 % ,I rejected and stated how I will proceed, asked them to close my account and clear the “outstanding “debt.

It is finished.

Sara I have no words to express my gratitude.

Thank you !

Don’t gave up to fight against robbers and criminals dressed in “regulated” lending.

Sara (Debt Camel) says

excellent

N Khan says

Hi Sara

Any guidance would be appreciated. I took a loan with loans2go in a desperate time for £2,000. I have paid back £1900 to date and still have 16 months of repayments at £241.33 a month (bringing the total to over £5000).

I was in hardship when I took the loan, I have 2 large overdrafts (totalling £5,500) with both my banks and had another loan (£2500) at the time. The company should never have approved me for a loan. I want to complain on the basis of affordability but not sure what I should ask for as an outcome. A reduction in interest or the whole loan wiped out?

Sara (Debt Camel) says

if the loan was unaffordable, you should ask for interest to be removed so you only repay what you borrowed. As you have paid £1900 that would reduce the balance to £100.

Those overdrafts – how much with which bank? And what is your income each month? If may be possible to win an affordability complaint about them too and get a refund… see https://debtcamel.co.uk/get-refund-overdraft/

And the other loan – was that high cost, anything over 15%? It may have been unaffordable whioch is why you had to get the L2G loan… so look at complaining about that too, see https://debtcamel.co.uk/refunds-large-high-cost-loans/.

When someone has payday loans and loans like L2G, thay normally had other unaffordable borrowing as well. So although L2G is the worst, also make the other complaints and see if you can get your finances back into a position where you don’t this sort of expensive credit again.

N Khan says

My overdrafts were affordable to me at the time I took them out. So I have no complaints against the banks. A change in personal circumstances meant my outgoings increased, which got me into significant overdraft and credit card debt. I took out the loans2go loan after this debt had accrued.

My complaint is only against loans2go as they should never have borrowed to me, as I clearly could not afford to pay them and have been struggling ever since. I have actually calculated that I have paid loans2go £3503 in total. I have complained to them today and asked for anything I have paid above £2000 to be refunded and any outstanding debt waived.

Sara (Debt Camel) says

The rules about bank overdrafts are not quite the same as for other sorts of credit. Banks should review overdrafts annually. So if these overdrafts were OK when you first had them but have been too large not for a couple of years, you can make a complaint about the overdrafts.

N Khan says

Thanks for the advice, I have submitted a complaints to Barclays about my overdraft. I checked the terms and it states they will

Review it annually. I have been in a constant state of being overdrawn for 3 years so I have complained about their ongoing charges despite seeing that i am in constant debt. Will let you know how they respond.

I have sent my complaint to loans2go last week. They responded today with an acknowledgement. Can anyone confirm how long it takes loans2go to give an outcome.

Steve says

Hello Sara.

I sent L2G your template in an email a week ago, and of course as yet have had no response, except to say that they are extremely busy and will reply when they can. In the mean time I am getting texts and an email asking for a missing payment from August. I am also expecting that they will attempt to take a payment on the 13th by debit card. As the loan is in dispute now am I entitled to withhold any outstanding payments ( which I can’t afford anyway) and prevent further payments being taken ( which involves moving money out of my current account at some unearthly hour in the morning)?

I did once have 2 payments taken by a payday loan company in the past and couldn’t get a refund from my bank as it was accepted that the lender was entitled to take overdue amounts too. I hope L2G don’t attempt this too, if they are allowed.

The other issue I have is that the stress I was under when I took out the loan has led me to return into a gambling addiction. Will this affect their decision to cancel the loan which was for £1000, and I have paid £820 so far?

Sara (Debt Camel) says

At the moment you still owe the money so L2G are entitled to take it.

If you can’t afford it, you need to stop this happening – is the money taken by a direct Debit or a Continuous Payment Authority?

Steve says

By CPA, so it normally gets paid around 3am and in order to stop it I have to transfer money into another account, then transfer it back the next day.

Sara (Debt Camel) says

ok so you can cancel a CPA – you need to phone your bank and tell them you want this cancelled.

Not paying will harm your credit score, but if you can’t pay, then you don’t really have an option. If you win the complaint, any negative marks will be removed frok this loan by L2G

“The other issue I have is that the stress I was under when I took out the loan has led me to return into a gambling addiction. Will this affect their decision to cancel the loan which was for £1000, and I have paid £820 so far?”

Events that happen after a loan is given don’t usually affect the decision on affordability. It’s likely that if you win this complaint you would still have to pay the remaining £180 of what you borrowed.

What is the rest of your financial situation like? Are you getting help to stop gambling? It would be a good idea for you to talk to a debt adviser about the complete picture, I suggest you call National Debtline on 0808 808 4000.

You should also be looking at affordability complaints against the other high cost lenders you used before L2G. L2G may be the worst, but the others may also have given you unaffordable credit.

Steve says

Thanks for the reply. I did start to gamble again a couple of months prior to the loan. They didn’t ask me if I used my income to gamble, and I presume if they had asked for a bank statement it would have been obvious that I was.

I stopped gambling for 3 years just by using self help guidance I learned in the past so I will return to that again.

Luckily I have no other high interest loans and previous payday loans have been addressed for refunds, for those companies that have been put into administration, but many have now disappeared without any chance for redress. Minicredit is the only one left that owes me a redress, but is likely that there will be no funds available to pay anyone other than the administrators.

I will contact my bank today, thanks. I have had debt help in the past from my local Citizens Advice Bureau, who were magnificent, but hopefully I don’t need any further assistance once the L2G loan has been sorted.

Florian says

Hello dear Sara,

I’ve been wondering if I can make complaint to Loyds bank when I have overdraft from 2019 ,and its 1500£ ,and I dud pay and did pay percent ,every month at least 60 £so it is paid ,how you will advice me to act?

Thank you!

Sara (Debt Camel) says

This article https://debtcamel.co.uk/get-refund-overdraft/ looks at complaints about overdrafts with a template letter.

Florian says

Thank you very much!

Its on overdraft from 2019 ,1500£ and I am paying and paying all those years 60£ every month.

I don’t see anyone won against Loyds,but worth trying.

Thank you, Sara!

Sara (Debt Camel) says

oh plenty of wins against Lloyds. But they often reject good cases so you have to go to the Ombudsman, eg this one: https://debtcamel.co.uk/get-refund-overdraft/comment-page-3/#comment-490616

Here are some offers directly from Lloyds:

– https://debtcamel.co.uk/get-refund-overdraft/comment-page-3/#comment-487735

– https://debtcamel.co.uk/get-refund-overdraft/comment-page-2/#comment-484759

– https://debtcamel.co.uk/get-refund-overdraft/comment-page-1/#comment-470838

N Khan says

Hi Sara I have heard back from Loans2go today. They have rejected my complaint and state that I had no adverse CCj or defaults showing on my credit file and therefore their lending to me was appropriate. They also state they had no obligation to review my statements and even if they did they don’t see any gambling etc on my statements which makes their lending irresponsible.

My point to them was that I was significant debt – totalling over £10,000 including my overdrafts. So although I was keeping up with my payments, I was doing so and leaving myself with pennies for the rest of the month.

They have offered me a reduction of 50% of the balance, which leaves me with £1800 to pay still (I have already paid them more than £3000 for a 2000 loan.)

Do you consider that I have reasonable prospects of succeeding at FOS. Or should I try to negotiate with L2g further?

Sara (Debt Camel) says

I think 2000 is a large loan and they should have made careful checks.

They will sometimes be prepared to negotiate, so you could go back and suggest a compromise? eg that you will be happy if they just write the balance off? Or reduce it to £500? It’s up to you what you feel is acceptable. If you want the full refund you need to send this to FOS.

N Khan says

I have heard back from Loans2go today and they have agreed to wipe off the full balance of my loan (£3500). They did reject my complaint but state my statements show that my expenditure significantly increased during the lifetime of my loan, and they are giving a gesture of goodwill. I will accept this outcome.

Your help has saved me more than £300 expenditure per month, through the writing off of this loan and my overdraft and cleared a total of over £6000 debt. Thank you for the advice, a huge weight has been lifted off my shoulders.

Steve says

Hi Sara.

I have had a ‘final response’ letter from Loans2go concerning my affordability complaint.

Here is a part of that letter:-” Following an extensive review of your application and your credit file, we calculated your monthly expenses to be around £573.28. Therefore, the contractual loan repayment of £205.56 per month would have still been

affordable…..We considered all the available information whilst calculating the loan’s affordability taken out with us, and it was determined that you had enough disposable income to afford your contractual

instalments.”.

They have in a gesture of goodwill reduced my outstanding balance by 45% which now leaves : £1,868.36 to pay, which they will accept in smaller monthly payments than originally contracted, So payments of £133.45 instead of £205.

There was no mention of any gambling issues which would have been obvious from the bank statements I sent in. I have 14 days to reply/accept their “generous” offer.

They have said I can take it further but as far as they are concerned I can still afford this loan, plus I didn’t consider the interest rates and outstanding balance when I took out the loan. Plus I had 14 days to cancel and return the money( which was spent within 2 days). So they are making it obvious they are not at fault and I can continue to pay them.

Sara (Debt Camel) says

So you have three options.

1. accept this “generous” offer

2. send it straight to the Ombudsman

3. go back to them and argue some more. Ask for the balance to be reduced to say £500 as a compromise or you will go to the Ombudsman. This often works with L2g. See these two examples: https://debtcamel.co.uk/payday-loan-refunds/comment-page-223/#comment-494565 and https://debtcamel.co.uk/worst-loan-in-britain/comment-page-6/#comment-492685

Steve says

Hello Sara.

I offered a compromise to Loans2go and they have accepted a £500 settlement! I am gobsmacked to say the least. Thank you so much for your advice and assistance. I was very happy that after their ‘final response’ they still considered the offer. I can sleep easier and plan better for the other issues with the cost of living etc. You have been brilliant thanks again. I must admit that their responses have been professionals and courteous and no nasty remarks. Keep up the good work.

Steve says

Just to let you know I paid the £500 by 5 installments and am now clear of Loans2go. They sent me an email thanking me for the payments and custom and were quite reasonable about the whole thing. I think they are inundated with complaints but will accept a decent offer if pushed.

Jon smith says

Impossible to get hold of. By definition waiting up to an hour and then they’ll dosconnect the line when your close to an operator.

Sara (Debt Camel) says

why are you trying to phone them?

Annoyed says

I have repeatedly asked for a settlement amount and the company have not once provided this. I borrowed £250 initially and have been paying circa £50 each month for around 6 months and they are stating my account is still £200. Avoid these people like the plague. They clearly do not want you to early settle and to this day I am still awaiting a reasonable close amount

Sara (Debt Camel) says

When did you first ask for this?

Marcus says

I have recently taken out a loan of £600 with this company. Tonight I logged onto their website to try and pay the loan off early. Clicked their link about early repayment and they say it will be processed overnight. About 20mins later I log on again and click the link and find it stating if I pay £626.65 by Sunday the 27th it will be settled. So I pay the amount immediately but it’s still saying I owe them. I’m guessing they are going to state that because I paid on the 27th not before I’ve breached contract but how the hell can I if they haven’t sent the offer before the stated date! Any help in this issue will be greatly appreciated

Sara (Debt Camel) says

I think you need to phone them up to find out what has happened. Then complain if it is unfair.

Marcus says

Thank you for your swift reply. I think I just got scared, especially reading everyone’s bad experiences. I sent them an email last night and my account is settled and everything is sorted. They for sure need to sort their website out but I have to say my experience with them has been nothing but professional. Cheers anyway Marcus

Steve says

Just email customerservices@loans2go.co.uk and they will respond quicker.

Frankie1 says

Hello,

Firstly thank you very much for your very helpful article and template.

I wrote a complaint to loans2go for my partner. He has a gambling problem. He borrowed £1k, and has to date repaid £1.6k. There is still £3,400 outstanding. Early settlement fee is £1.2k.

There was a default on his Experian report the month the loan was taken out. We also mentioned in the complaint his multiple gambling transactions.

Following our complaint to loans2go, they have not responded to our affordability complaint. They have just sent us the DSAR documents. Has anyone else had this?

The DSAR documents do not show the default account, it may be that the search missed this by a few days given it was the same month?

Should I just respond requesting they respond to the affordability complaint, as he has already paid back what he borrowed plus more?

Thank you

Sara (Debt Camel) says

A lender will often reply to the DSAR first and then reply to the complaint. How long has it been since you made the complaint?

Vicky says

Hi Frankie, I made a complaint to loans2go on 11th November. I too have a gambling problem. I took out a £500 loan in December 2021, and only made 1 repayment, after a few missed payments, it was sold to a debt collector. They reviewed my loan and offered me a 50% discount on the interest. I replied on Friday and said I was unhappy, I sent 3 bank statements leading up to when they leant to me. I also took out 3 payday loans within the month before they leant to me, so I also said that in my email. I said that their irresponsible lending only fuelled my gambling addiction. They came back today and said they are wiping off all interest, so the balance of my loan has gone from £1700 to £300. And it only took 2 emails. I hope you succeed too. Thank you to this website. I finally feel like I’m getting a life back again after 6 years of not living and being on the edge.

Frankie1 says

Okay thank you. It has been two weeks today.

Sara (Debt Camel) says

Then they have 6 long weeks to reply in. Good luck.

Frankie says

Thanks so much. They came back and offered a 40% reduction on the remaining balance (all interest). I rejected it and asked them to write off all interest otherwise I would go to the financial ombudsman. They responded the next day agreeing to write off the outstanding balance. This will be a huge weight off his shoulders. Thank you

Reuben says

Hello,

I have complained to loans2go, first they offered 50% reduction and then 75%. I argued that I had a lot of debt outstanding and overdue and they said they would require proof. Upon providing them the proof of all loans etc they ignored the email for 6 weeks and only replied after chasing them. They said their position remains the same

. Does them offering 75% come across as an admission of guilt almost to the ombudsman? I’ve already sent the complaint there and have further asked loans2go for an explanation of their decision as they refuse to explain.

Sara (Debt Camel) says

It suggests they didn’t want the case to go to the Ombudsman. Whether they felt they would lose or they wanted to avoid the FOS fee I can’t guess.

Tobi says

Hi Sara

First I would like to say thank you for the service you provide. Not enough people in the world like yourself.

Secondly, I took out £250 with this lender and ended up paying over £1000 back! Do you believe I have a reasonable claim as the repayment terms were not clearly explained at the time

Sara (Debt Camel) says

That depends on what you can say about how unclear the terms were.

John says

Hello Sara,

I have recently entered into a dispute with L2G over an unaffordable loan. I had a loan of £400 and after a year have paid back over £1000. My current early settlement is £390 which they then “generously” offered to reduce to £280 as they believe it was an affordable loan. I rejected it and stated that I’d like them to write off the remaining amount or I would proceed with the FOS. They have replied stating that they will reduce it further to £180 as they still believe it was affordable. They say the affordability was verified but I originally suggested I recieved an income greater than my acutal income (I have not mentioned this to L2G). How would this be viewed by the FOS? Would it still be worth proceeding with them? I can afford to pay the £180 but do still have several thousand pounds worth of debt and would rather not make any additional payments to L2G. Thanks.

Sara (Debt Camel) says

The question is whether this loan is large enough that FOS will say the lender should have checked closely. 400 is about on the edge – what would your credit record have shown at the time you applied for it?

John says

My credit score was actually over 600 (according to clearscore, using experian) at the time as between October and November 2022 it had risen by over 300 (I assume due to the administration of a couple of PDLs and the closing of a 24 mnth loan I had taken out 2 years prior). I guess it’s probably best to pay off the £180 as I don’t want to risk refusal from the FOS and the added anxiety of continued time doesn’t help my mental health. Would you agree? Thanks

Sara (Debt Camel) says

This is a pretty personal decision.

Ilie says

Hi ,i have the same problem with this company loans2go i borrrow 2000 and then i realize that i have to pay tham back way to much every month …and they over stress me with payment for 2000£ i have to pay back 104paymets of 62.30£ every week with a total of =6,479 to pay back ..is to much and i will never afford to give them this money back :(( so i fall in to gambling to try to make this money back and pay them but there is no succes to do so and now all the bills on top of this is make the situation more worst i wonder if i can get any help and what i can do to be less than that to pay back ..if anyone know what i need to do and how i must procedd please just tell me ,thank you verry much and sorry for my writting is not my native language

Sara (Debt Camel) says

Can you say what other debts you have? Were you already in a difficult situation when you applied to Loans2Go?

Ilie says

Hi Sara , and thanks for qick answer .

Yes i was already in didficult situation when i applied to this company i barely manage to survive whit the imcome that i have day by day ..im afraid i will be behind with payment to the car that im on finance ,236£ a mont for 5years i have an overdraft on the bank 300£ wich is not paid back and another loan that i will have to pay it but that one i think i will manage to pay it i take that one to be able to pay this company wich is 100£ every month for 12 months 1month bihind with rent to the person where i live now at the moment and im in the areas payment with loans to go 700 £or so i pay till now 1400 , also an credit card to the limit 500 £ no other debts at the moment but im afraid that this one will distroy me ..i can not sleep because of stress to pay them and other things that need to survive . And yes even now my situation is dificult day by day if this company will not be over my sholder every day

Sara (Debt Camel) says

Your priorities are rent, car finance, food and other essentials. Not this loan or any of your other unsecured debts such as the credit card and overdraft.

How much have you paid to L2G so far?

Ilie says

Hi sara i write a reply to this but i still do see it ,maybe it wasnt going thru , so i write again ,sory for that ..

I have pay till now 1.400£back but now my account is i areas for about 700-800£ .i will be happy to pay them back what i borrow (2000£)and something extra maybe but not that huge amont of 6.600 and i dont know what and how i have to do this ? Do i need to call them or make a complain to them ,to reduce all this interes or write them an email ?thanks and sorry for my writting mistake im not so good to write in english i still learn to do that ,thanks

Ilie says

Hi ,Sara. I made a complain to loans to go about few moths ago and they didnt say anything and i dont get any reply from them i use the above template but nothing happen ,what i can do more ? I still own to them they said 5000£ thanls

Sara (Debt Camel) says

Send your complaint to the Financial Ombudsman and say L2G have’t replied

Sara (Debt Camel) says

You can send Loans2Go a complaint as the article above these comments says.

BUT if you have rent arrears and arrears on car finance for a car that you need, those are your priorities not these other debts. I suggest you phone National Debtline on 0808 808 4000 for advice. If you don’t want to use the phone, go to your local Citizens Advice.

Emma says

Today I heard back from the financial ombudsman about my affordability complaint that Loans 2 Go agreed with their findings that my two loans with them were unaffordable. Loans 2 Go are now required to pay back the interest + 8% on the two loans.

One loan was for £840.09 with just over £3,400 paid to that loan. The other loan was for a similar amount with £3,014 paid.

Very pleased with the outcome, now just waiting for contact from Loans 2 Go with regard to how I will be getting my money back!

Dean says

I have been told I have a claim against Loans2Go for a mis-sold loan.

However this is showing on my credit file as settled even thou i never made any payments as I simply could not afford to, and I have never had any correspondance from them since July 2020.

If I pursue this would there be a chance the loan would be put on my file and I would have to pay up?

Sara (Debt Camel) says

It seems very unlikely that L2G has written this off without telling you. They may have sold the debt to a debt collector, who may wait a year or so and then pop up and demand to be paid. In this case if you claim against L2G and win, they will have to sort the debt out with the debt collector.

Who told you you have a potential claim – a claims company? You can make this claim yourself and avoid their high fees.

What is the rest of your finacial situation like? Di you have a lot of debt defaulted in the ast few years?

Dean says

Morning Sarah,

I have a look again and the L2G debt although saying settled is listed as a default debt , I also have 4 other defaults (capital one ; Vanquis ; Hoist and EE (I took a contract for my sister and she stopped paying after 12 months)

All the above debts are incorporated in a DMP with stepchange along with some other debts totalling £42,000 and I pay £88 a month.

As for the L2G , do you think it would be worth claiming it as a mis-sold loan or would I just be chasing my tail?

Sara (Debt Camel) says

are you buying or renting?

what are the other large debts in the DMP?

Dean says

Hi Sarah ,

I’m renting , and the other large debts are loans and credit cards from HSBC.

Sara (Debt Camel) says

Then I think you should take debt advice about insolvency. Even if you make and win affordability claims about all of the debts in your DMP you are realistically unlikely to get more than half of them cleared which will still leave a balance that is simply impossible to repay.

You can talk to StepChange about this or phone National Debtline on 0808 808 4000.

Luke says

Hello, I was always in my overdraft with Lloyds (deep into it) and eventually had to default on the account due to covid and not working for months – this wasn’t actually explained to me (in my opinion) the extent as to how detrimental a default could be, or else I’d have considered options. Before I took any loans out, I asked lots for one but I used to gamble a lot and refused. This led to a few loans and eventually having to default on overdraft and enter a DMP.

I no longer gamble (3 months and counting) and only have a few months left on DMP which is £500 a month, so I have any scope to complain to Lloyds about unaffordable overdraft, and/or not making the affects of a default clear enough? Let me know if you see me to post on the website instead. You do amazing work, really is appreciated- thank you

Sara (Debt Camel) says

when did your overdraft problems with lloyds start?

How large was the overdraft and what were you earning at that time?

“Before I took any loans out, I asked lots for one but I used to gamble a lot and refused. This led to a few loans and eventually having to default on overdraft and enter a DMP”

Sorry I am not clear, were these loans from llyds? Other lenders? what date were these loans?

Luke says

No was refused a loan with Lloyds so ended up taking payday loans (one of which loans to go in fact) – first payday loan was 2019. Had been in overdraft constantly for years before that.

I took had to resort to a DMP and between stepchange (which is overall has been a life saver) and Lloyds, I don’t believe the implications of a default were made clear enough to me. Lloyds acknowledged my gambling when I was refused initially and said that was reason for decline, but I only started gambling because I was struggling financially- was offered no help or advice from Lloyds which led to more gambling and bad loans. Of course, I accept a lot of responsibility here

Sara (Debt Camel) says

In that case send lloyds an overdraft complaint ( see https://debtcamel.co.uk/get-refund-overdraft/) and also complain to the other lenders.

Luke says

Thank you very much, is there a generic email address to complain to Lloyd that you’re aware of? Thanks again

Sara (Debt Camel) says

see the link on the Overdraft page.

geri says

So, I can’t remember when I took a loan out with this company, quite some time ago, but I do remember it was for £300 and now they think I am due them £1083.39 from the last text message I received. I have told them I will pay the £300, I have made repayments in the past, but it got excessive, and I couldn’t keep up, but as of now I point blank refuse to pay them anymore, it is daylight robbery and I have no idea as to how this company keeps operating. My next step is to contact my local MSP or whatever member of parliament governs this to get this bunch of cowboys shut down, especially in the current financial climate, they are and have been preying on the vulnerable for years and it’s about time we stood up to this company and got them shut down.

Sara (Debt Camel) says

Have you made a complabout unaffordable lending?

Campaigning to have them closed so no one else falls into their clutches could take a very long while so you also need to take practical steps to get yourself safe.

Sinead says

Hey Sara I took out a loan with loans 2 go and it was for £1000 they said I would have to pay back £3494.52. I sent your template and they offered me £2414.49 as an offer I shouldn’t have been giving the offer in the first place as I’ve so much debt already.

How do I go about refusing the offer to pay back the money I owe I’ve paid £200 of the £1000 so far PLEASE HELP!! Thank you!

Sara (Debt Camel) says

Can you tell me about the rest of your current financial situation? What other problem debts do you have? Are you in arrears with any important bills?

Jack says

Hi there,

I stupidly got a loan off these guys. I was in a desperate situation. At the time of applying with Loans2go I was heavily in debt with other pay day loan companies. I was getting denied everywhere. I couldn’t even get a £12 phone contract. I was behind on my utilities bills and rent. I was also unemployed and had no income. I filled out the form for Loans2go and said I was self employed. They offered me a £1000 loan with over 1000% apr so would need to give them over 4000£ back. As I said I was desperate for money at the time and stupidly accepted it. I was surprised I was even offered it as my credit rating was very poor and was in so much debt. I’ve wrote to Loans2go and they said all checks was done and was affordable to me and case is closed. I’ve spoken to my credit file and they said I was maxed out of credit and in heavily debt and there was no way I would have been accepted for anything. Again I was also unemployed with no income coming in.

Sara (Debt Camel) says

Have you repaid this loan? If not, how much do you still owe?

What is the rest of your financial situation like at the moment?

Jack says

Thanks for getting back to me and I haven’t repaid the loan. And it’s still bad. I’ve spoken to this company who said I’ll be able to get a IVA but if I can get the Loans2go sorted, which they agree is also ridiculous and shouldn’t of been given to me, I can set up affordable payments plans for my other debts instead of having a IVA. As the £4000 from Loans2go is the highest by far out of my other debts.

Sara (Debt Camel) says

How much do you owe in total? are you buying or renting? do you have a car worth over £2000/

Jack says

I don’t have a car. I’ve just got out of private renting as I fell behind on payments and now back living with parents. My total debt including Loans2go is between £8000-£10,000. Without Loans2go it would be £4000-£5000. I was in more debt but thankfully to family help I got rid of about £5000. When I took the loan with Loans2go I was about £7000 in debt and had three defaults and a CCJ on my file when they accepted me.

Sara (Debt Camel) says

ok so send them a complaint as the article above says. With the complaint sent a copy of your credit record and your bank statements for 3 months before the loan.

They will sometimes make a poor offer but can be persuaded to improve it, so come back here if you aren’t sure?

I suggest you set up a debt management plan with StepChange – there is no reason to set up individual payment plans, that is a lot more stress for you and they are harder to change if things go well and you can pay more or they go badly and you have to cut what you pay. You can still make affordability complaints about debts in a DMP, in fact its a great way to speed a DMP up.

Also look at making claims to your closed debts including those that went to CCJs! the more money you can get back, the soomer you carn pay off the current debt.

Jack says

Hi there,

I sent them the email but they said this investigation is closed and sent me 4 screens shots of what the looked at. The screen shots are literally what I filled out on the loan form when I applied. They haven’t sent me any proof of checks being done. They said they can’t assist anymore and the debt has been sold. I’ve asked 4/5 times now for all the checks that was done and all the information they had on me and just keep getting the same robotic response. Is there any way I can attach the screens shots they’ve sent to me to you so you can have a look as I’m confident they haven’t done any checks on me. I’ve sent them 3 months worth of bank statements before I took the loan which shows no income from employment and also sent them my credit file but they just keep saying the same.

This is their response.

We have provided you with all the information we have available from the time of sale already and are unable to provide you with any further information.

The information you have provided should have been provided to us prior to us investigating your complaint as was requested of you in the acknowledgment of the complaint or short time after and we are unable to change our final decision now.

Sara (Debt Camel) says

You need to send this complaint to the Financial Ombudsman.

this may take quite a while to go through so setting up a debt management plan with StepChange including this debt would be a good idea.

Gettingbackontrack says

Hi Sara. Thanks so much for your website – it has been an enormous help.

I was contacted by a debt collection agency several months back with a letter of claim via email, stating I owed their client several thousand pounds. I had no recollection of the debt, however, I had a serious psychological breakdown a few years back and therefore went back through records. I did take out a payday loan for £1k with a first instalment 30 days after the payment into my account. However, I received a “notice of missed” payment email from the lender 9 days after the deposit of the loan, which of course bounced.

Partly due to panic and partly circumstance, I ignored the email and others for the next 2 months – after which I received a Notice of Final demand. The lender was clearly in breach of the agreement and I wish I had fought it at the time, but such is life.

I have contested and complained about the debt with the agency using your site’s help (prove it etc) over the last few months and several times told them I do not believe I am liable. I have asked that they evidence the deposit of the loan but so far they have only produced a Pre Contract Credit Information document with my name and address. They have now said they believe they have evidenced it based on that and are resuming collections. The total amount is four times the principle amount – it makes me sick to think about.

Your kind advice on where to go next would be appreciated beyond words.

Sara (Debt Camel) says

How long ago was this? And who was the lender?

Gettingbackontrack says

The original loan was beginning 2020. The letter of claim, October 2022.

The lender was Loans2Go. I was going through a very unsteady time and only found the emails when I went back and searched for history on the matter. Morally I would be happy to pay back the principle sum but am hesitant to admit liability for it considering the circumstances and the total sum is now four times

Sara (Debt Camel) says

then you must be able to get bank statements from that time which show the loan money was never paid to you?

Gettingbackontrack says

Please allow me to clarify: the money was indeed paid to me. The loan agreement date was 23/04/2020 and stipulated a first payment date of 22/05/2020. The issue came in when I received a Notice of Missed Payment 01/05/2020 – implying the lender had attempted to take payment before the date of first payment in the agreement.

Sara (Debt Camel) says

sorry, I misunderstood what you wrote. So you did take out the loan, you aren’t disputing this?

Who was the lender?

Sara (Debt Camel) says

ok then I suggest if you think the repayments would have been unaffordable and that L2G should have noticed this and not given you the loan, that you make an affordability complaint.

See https://debtcamel.co.uk/worst-loan-in-britain/ which has a template to use for Loans2Go horrible loans.

Gettingbackontrack says

Thanks Sara. Being that I have not yet acknowledged the debt in any way with the collection agency and considering Loans2Go were in breach of contract by attempting to collect the first repayment several weeks early – is it wise to raise a complaint with Loans2Go and therefore acknowledge the debt? Also, if it is currently being handled by a collection agency, what happens when I raise a complaint with L2G? Does this suspend collection with the 3rd party agency?

Sara (Debt Camel) says

Acknowledging the debt only matters inthe context of a debt becoming statute barred, which takes 6 years of no acknowledgment… you are a very very long way from that and I suggest it isn’t relevant. You ar likely to be taken to an out for a CCJ long before the 6 years is up.

If you complain to L2G this doesn’t stop collection by the debt collector. But you haven’t yet repaid what you borrowed so I suggest you said up an affordable repayment amount.

If you can’t afford anything, or you have other problem debts, or you are in arrears on any bills, I suggest you talk to National Debtline on 0808 808 4000 about your options.

Gettingbackontrack says

Thank you wholeheartedly for your quick replies and ongoing advice. I look forward to updating you of a (hopefully) positive outcome.

natalie says

Hi I have had a reply off loans2go offering me a reduced amount of £1561.56 as a gesture of goodwill, do you have a sample letter I can send asking them to refund the interest and close my account as stated in the above comments please.

Thank you.

Sara (Debt Camel) says

It depends very much on your situation.

How much did you borrow and when? how much have you paid them so far? What is your current balance without this 1561 offered reduction?

natalie says

Hi Sara, I borrowed £1650 over 24 months with a repayment of £222.20 a month I have paid £2666.40 with an outstanding balance of £2666.40, I received a letter of Good will gesture of a new balance of £1561.56

Thanks

Natalie

Sara (Debt Camel) says

So I am assuming the repayments have been difficult for you? And that your credit record at the start wasn’t good with a lot of other debt?

If you win at the Ombudsman you would get a refund of about £1000. If you want that, you have to send the case to the Ombudsman.

There is no point in going back to L2G unless you are prepared to offer a compromise offer, Less than you would get from the ombudsman. eg for the to clear the balance. It’s up to you if you think that would be acceptable.

natalie crane says

Hi Sara, If I go to the ombudsman how do i go about it? Is there are sample letter I can send to them.

also do I contact loan2go and tell them what im doing.

kind regards

Natalie

Sara (Debt Camel) says

You just use the FOS online form linked to in the article above. You can use bits from your L2G complaint – there is no sample letter for this.

You don’t have to tell L2G but why not? Just a one line saying you are sending the case to the ombudsman.

natalie crane says

Hi Sara, I sent the first complaint on 29th December, L2G sent a response on 13th January offering me a reduced balance of £1561.56, I told them this was not acceptable and I wanted the balance clearing, now they are asking for copy bank statements between Oct-Dec when I took out he loan to see if it was affordable.

kind regards

Natalie

Sara (Debt Camel) says

well if you want L2G to reconsider their offer, you should send them the statements. Tell them the case goes to the ombudsman in 10 days if they haven’t agreed to clear your balance.

Ryan says

So having discovered their disgusting practise of front-loading interest. I have asked for an early resettlement figure.

What they have quoted me is £100 more than the initial loan amount, even tho I have already paid 80% of the original loan amount.

Do you think I can do anything about it?

Thanks in advance

Sara (Debt Camel) says

Front loading is how all loans work.

Are the repayments affordable? That means can you afford to pay them and still be able pay your other debts, bills and living expenses?

Thomas says

Hi Sara,

Last week I used your template to put in an affordability complaint against loans2go for 5+ loans over the last 4-5 years as well as top up loans. These accounts are all closed and paid off but I still have defaults from them on my credit file. I sent them in depth bank statements and proof of other defaults on my credit file before they lent to me.

They even gave me a new loan 12 days after I had just received a default from them!!

They have come back straight away and said that they won’t upheld my claim and believe everything they did was affordable lending even though I’ve proven how much debt I was in with multiple other lenders at the time.

Even though they haven’t accepted and accounts are closed and paid off they have offered me a “goodwill gesture” of £500 to help with my finances which seems ridiculous and like they are just palming me off. How can they offer a sum of money yet not upheld my claim?

I’m not bothered about the money as financially I’m ok now, I just want the adverse events/defaults removed from my credit file as it’s affecting me getting a mortgage.

Would you recommend rejecting this and telling them I will be taking case to the FOS? I thought I had a really strong case and they’ve just shot me down instantly!

Thanks

Thomas

Sara (Debt Camel) says

have you added up how much interest you have paid them over the years?

Thomas says

Hi Sara

Yes, interest paid totalling over £5000.

They concluded that the credit checks done for giving me a loan 12 days after a default with them was ok and affordable. Irresponsible surely if I’d already had lots of past troubles with repayments with them.

Sent them bank statements showing masses of gambling transactions which is clearly what I was taking the loans out for and to try and pay off other loans I had out for that reason but apart from the odd question asking what expenses were they didn’t want to check any bank statements etc. Multiple defaults on file and still no issues on their end lending to me

Regards

Angela Smith says

Definitely reject and take to ombudsman. Sounds very like the situation I was in with them (although didnt offer me any goodwill gesture). They rejected, I submitted to ombudsman and they upheld and I was refunded over 2k.

Sara (Debt Camel) says

So your options are:

1) take what has been offered and give up

2) send the case straight to the Ombudsman

3) go back with a compromise offer – somewhere between their pretty pathetic offer and what you could get from the Ombudsman. L2G will sometimes accept these offers. So you could say you would be prepared to accept £2000 if they also agree to remove the negatrive marks in the interest of a speedy settlement

Thomas says

Hi Sara, gone back to L2go and they’ve come back with the same rubbish as their first response that they still think it’s responsible lending etc etc and they aren’t willing to accept my counter offer but they would still offer me the £500.

Do I just let them know I’m taking to the FOS?

Sara (Debt Camel) says

yes.

Jack says

The ombudsman got back to me today and said there looking into my case for me but can take up to 4 months as there extremely busy at the moment so fingers crossed they can get a good outcome for me. Loans2go need to be shut down. They’re affecting too many peoples lives and honestly don’t care. Don’t know how they’ve been getting away from it for so many years

Mr H says

Hi, 3 Loans with loans2go all for 1k. 1 in oct 2017 paid off early in Nov. 2nd in Jan. Paid off early. 3 rd in Feb paid off early in May. Loans2go rejected complaint saying expenditure form showed I had it along with credit check but this was not a clear picture of my financials as I was in fact struggling with debts defaults and gambling at the time. Adjudicator agreed with loans to go and asked me if i would close or to pass to ombudsman to decide, I emplored for her to pass to ombudsman as I clarified my struggles and back to back nature of loans 2-3. Ombudsman looked at it and has given me preliminary agreement saying that when they checked expenditure form inconsistencies along with 2 defaults in history should have prompted further checks. They would then have seen my struggles and thus plans to uphold. Take it all the way to the end and fight your position as in the end the truth comes to light amongst the smoke and mirrors of the expenditure forms and credit checks these rogue companies rely on to cover irresponsible lending. Thank you Sarah, I should get approx 1500 returned and adverse history cleared thanks to this site.

Mr H.

Jamie says

I have a question i probably know the answer to but i’ll give it a shot anyway.

Back in 2020 i made an affordability complaint to Loans2go regarding a loan i was provided by them. I borrowed £400 and paid back an insane £1645.56. At the time of being given a loan i was already paying back 3 other payday loans with numerous gambling deposits visible on the docs i provided them so in hindsight it probably should not have been given to me. Loans2go rejected my complaint out of hand.

I didn’t follow up with the Ombudsman at the time like i should have. I know there is a 6 month window to do these things following a rejection but would i be able to put in another complaint to Loans2go and try the process again?

Sara (Debt Camel) says

No, sorry they would just say they have already replied to that complaint.

Jamie says

Thank you Sara. As suspected.

Eva Marie says

Hi Sarah,

Thank you so much for this blog, the advice is a godsend and I’m realising my situation is not unique.

I took out a £2k loan with L2G in December 2022. This month I took out another loan with MoneyBoat (£800). I also took out 2 credit cards worth £700 in December 2022. In September 2022 I took out 2 loans with Admrial and MyCommunityFinance worth ~ £7k. I have credit cards maxed out at ~£7. I had a Santander overdraft from 2013 which I defaulted on in 2019 but have since settled. I have 2 commsave loans outstanding with £1.5k left to pay off.

I have tried forex trading monthly out of desperation to try and make some money back to pay off debt.

In all, I’m in a huge financial mess and my credit score is poor. What is your best advice for me please?

Eva

Sara (Debt Camel) says

Can you say some more about your situation – are you single? do you have children? do you have a mortgage or are you renting? are you in work?

Eva says

I am in full time work earning ~ £39k. I am single with no children and living with parents.

Sara (Debt Camel) says

Can I ask what has gone wrong? Do you have a gambling or other addiction problem?

Eva says

I don’t know if Forex trading is considered a gambling problem but I have unfortunately tried and tried to make it there and lost. In desperation I have attempted to recover losses over years and gotten into a cycle I’m struggling to get out of. I was also out of work for a while (this is when I defaulted on my Santander overdraft during lockdown).

I realise that this is all my fault but would really appreciate any advice please.

Sara (Debt Camel) says

ok so first you absolutely have to stop borrowing. Every loan at a daft interest rate is making your situation worse.

I suggest you immediately talk to StepChange about a debt management plan for all of your debts. That will get you into a safe financial position where you make one affordable payment to StepChange each month and have enough money left to live on. The debts will start dropping.

A DMP isnt good for your credit score but yours is already poor so that doesnt matter.

You can then look at making affordability complaints against all of your debts. It’s hard to guess how many you will win as your income looks good but the lenders should have seen from your credit reports that you were in a bad mess. It;s likely most of these complaints will have to go to the ombudsman and may take a long while. That is why its essential you are in a DMP and can sit this out.

Any complaints you win will help you speed up the DMP.

Eva says

Hi Sara,

Thank you for responding so quickly and without judgement.

Just to clarify, will the basis of my affordability complains be that they should seen my extensive borrowing and not borrowed me money/given me credit cards? I want to ensure I write everything necessary in my complaints.

Thanks again.

Sara (Debt Camel) says

The argument here is that although from your income it may have looked as though you have a lot of surplus income, your credit record shows increasing borrowing and debt problems. So something doesn’t add up – the lenders should have tried to verify your income and expenses or just rejected your application.

Eva says

Thanks Sara,

For added context, I started this 39k role last Feb. Before that I worked in a 29k role for 10 months and prior to that I was unemployed for over a year. I’m not sure if that makes any difference to my claim?

I saw something on your site re asking Payday lenders to remove their account from your credit file – is this feasible in my case with L2G? I have paid ~£600 of the £2k not counting the ~£4.5k interest. If I am successful in getting them to remove the interest and allow me pay the 2k, is it realistic to ask them to remove record of themselves from my credit file? Same re MoneyBoat.

Thank you for the advice re DMP, is that my only option here? Will go ahead if so but I fear that the repercussions from a DMP will last a very long time on my record. What alternatives do I have please?

Sara (Debt Camel) says

it would significantly help any claims about any credit given while you were unemployed.

“is it realistic to ask them to remove record of themselves from my credit file? Same re MoneyBoat.”

That is unlikely. Certainly until the remaining debt has been cleared. But why do you want this – you cannot be hoping to borrow more money…

Can you afford to consistently make all the normal payments to your current debts and still have anough money for living – food, transport, whatever you pay your parents etc ? Right through until the debts are cleared if you do not win any claims?

Eva says

Sorry for the many questions Sara, just want to be sure I’m understanding it all correctly.

If I attempt to clear the original debt (i.e. loan before interest) before filing the claim, will this increase the likelihood? Is it actually possible for a lender to remove their record from your credit file? I didn’t know this was an option and may have misunderstood what I read.

The reason I ask is because I’m thinking of options long term re getting a mortgage next year with a high earning partner. I’m aware that payday loans will make that impossible (I have no intention of any further borrowing! I just want to pay it all off and finally be free).

Sara (Debt Camel) says

If I attempt to clear the original debt (i.e. loan before interest) before filing the claim, will this increase the likelihood?

Of winning the claim? No, it may even make it a bit harder with some of the more difficult lenders as that would mean they have to pay you a cash refund, not just reduce the balance.

Is it actually possible for a lender to remove their record from your credit file?

Yes but it breaches the lenders code of conduct unless there is a reason to do this. So they will often say they can’t.

Moneyboat will show as a payday loan but L2G won’t.

Sharon says

Thank you for this I took a loan of £1700 in September this will be repaid within 3 more payments and I will still have around £4000 left to pay.

I’ve sent the above email and they now want me to complete an income and expenditure form which I’m happy to do but my biggest concern is the interest being charged, do I need to complete the income and expenditure form surely this is too little too late shouldn’t they have requested this before giving me a loan?

Sara (Debt Camel) says

You are just trying to get this settled. If you don’t like what they offer then the Ombudsman carries on looking at it.

TT says

Hi All,

Complaint with the use of the template (thank you Sara and this website!), L2G denied initially then I sent it to the Ombudsman. Long wait to be appointed but then super quick service and adjudicator sided with me and the complaint was upheld! L2G have now accepted and now need to refund me. Anyone any idea how long that takes, or has experience with L2G refunding? I need to go back to ombudsman if i don’t hear anything within 8 weeks…

Sara (Debt Camel) says

Very please you have the right result.

TT says

Thank you very much Sara!

Have you heard of L2G processing this refund rapidly or will it take long more like 8 weeks?

Sara (Debt Camel) says

I haven’t heard people grumble about this. It will tend to be slower if you defaulted and the loan has been sold to a debt collector.

TT says

No did not defaulted! will wait and see!

Angela Smith says

Hi

I was in the same position as you and L2G were quick to respond and refund, within a week or two at most.

TT says

Thank you Angela, hope it is as quick!

James Hannah says

FOS upheld my claim against loans2go – full refund and interest. Many thanks Sara! Loans 2 Go are a rotten company and terrible that they’re allowed to operate in this country.

They had until tomorrow to respond to the adjudicator but have ignored them. Is this common for them to let it roll over to an ombudsman? Are they just being awkward for awkwards sake?

Lew says

Hello,

Took out a Loans 2 go loan on 7/7/2019

Credit report shows a default of £1240. Original loan was only £350 with payments of £79.99 a month for 18 months – total repayable £1439.

Paid £228 to L2G then debt was sold and have since paid £717 to debt company. The account not shows as closed with a balance of £0.

I have emailed them based on irresponsible lending as my credit account shows defaulted account in 2017, arrangement to pay in 18 x2, late payments and 5 months in arrears accounts in 2018.

Loans to go have offered to write off the remaining debt despite credit report saying balance is £0, they suggest the remaining debt is £492.

In their findings they say that I declared my income as 1250 a month and that they used an income tool to prove my wage was £919 a month so clearly I had lied when declaring my wages. They state – Following an extensive review of your application, in addition to your credit file, we calculated your monthly expenses to be around £714.83. Therefore, the contractual loan repayment of £79.99 per month would have still been affordable. However my credit file clearly shows other defaults and missed payments for loans that I was struggling to pay.

Is it worth replying and agreeing to debt being cleared even though credit report says £0 and the account being closed?