Have you had big overdraft problems for a long period?

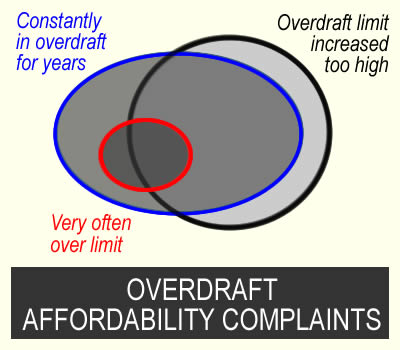

You can make an affordability complaint and ask for a refund of overdraft charges if:

- your overdraft limit was set too high at the start or increased to a level you are unable to clear; or

- your overdraft usage showed you were in long-term financial distress. For example, being in the overdraft all the time, or using an unauthorised overdraft a lot

- your overdraft was originally a student account with no charges, but now interest is being added and you are in the account all or almost all of every month.

This article shows how to make an affordability complaint to your bank, with a free template letter to use.

These complaints do not hurt your credit record. And if the bank doesn’t make a you a good offer, it is free to take your case to the Ombudsman.

Contents

Overdraft affordability complaints

Overdrafts are supposed to be for short-term borrowing

Overdrafts are intended to be used for short-term problems, not as long-term borrowing. A bank should review a customer’s repayment record and overdraft limit and if there are signs of financial difficulty, offer help.

One sign of financial difficulty is hardcore borrowing for a long period. The Lending Code defined hardcore borrowings as “the position where a customer’s current account overdraft remains persistently overdrawn for more than a month without returning to credit during that period”.

Some Ombudsman decisions

All cases are very individual. But these examples give you an indication of what the Ombudsman thinks is important.

In this NatWest decision, the Ombudsman decided:

NatWest did have an obligation to monitor Miss K’s use of her overdraft facility.

Any fair and reasonable monitoring of Miss K’s overdraft facility would have resulted in NatWest being aware Miss K was in financial difficulty … by October 2014 at the absolute latest. So NatWest ought to have exercised forbearance from this point onwards.

In this Santander case, the bank didn’t notice hardcore borrowing:

By this point, Miss C was hardcore borrowing. In other, words she hadn’t seen or maintained a credit balance for an extended period of time. Santander’s own literature suggests that overdrafts are for unforeseen emergency borrowing not prolonged day-to-day expenditure. So I think that Miss C’s overdraft usage should have prompted Santander to have realised that Miss C wasn’t using her overdraft as intended and shouldn’t have continued offering it on the same terms.

A similar decision was reached in this Lloyds case:

Mr and Mrs C’s statements leading up to the renewal shows they hadn’t really had a credit balance on their account for a prolonged period. Indeed, they’d had regular returned payments and had also exceeded their limit. In these circumstances, it ought to have been apparent Mr and Mrs C were unlikely to be able to repay what they owed within a reasonable period with overdraft interest, fees and associated charges continuously being added.

Decide which reasons apply to your overdraft complaint

You are in the overdraft all or almost of the month for a long while

This is the most common reason for winning a complaint

Overdrafts are meant to be used when you have a problem. Using the overdraft a lot for a few months is fine. Or for a few days at the end of a month before you are paid.

Banks should review your overdraft annually. This is in most overdraft terms and conditions. And even if it isn’t, the Ombudsman says this is good industry practice.

So at one of these reviews, your bank should have seen if you were in difficulty with the overdraft. For example if you are in the overdraft for all (or almost all) of the month for a prolonged period. Or if you were often exceeding your arranged overdraft limit.

I would say over a year is prolonged.

The bank set your limit too high

This may have been from the start when you were first given an overdraft. Or the initial low limit may have been fine, then the bank increased it to a level which it was impossible for you to repay.

If the bank saw signs of financial difficulty, it should not have increased your credit limit, even if you asked for it. And it should have considered offering your help instead (the regulator’s word is forbearance), for example by stopping charges.

But what is too high?

This depends on your income and expenses. An overdraft of £2,000 for someone whose income is £1,800 a month is a lot – but if you earn £5,000 a month, then a £2,000 overdraft may be reasonable.

Other points that help a complaint

You won’t win an affordability complaint by saying the charges were too high.

Instead, you say the bank should have known they were unaffordable for you because of all the financial problems it could see on your statements and your credit record.

Here is a checklist, do any apply to you?

- often having direct debits or standing orders not being paid;

- a lot of gambling showing on your statements;

- significantly increasing other debts with the same bank (you may also be able to complain about those loans or credit card);

- being recently rejected for a loan or a credit card by the bank;

- significantly increasing debts with other lenders showing on your credit record;

- a worsening credit record – maxed out credit cards, new missed payments, payment arrangements, defaults etc;

- using payday loans;

- mortgage arrears;

- a reduction in the income going into your account.

Making your complaint

What you need at the start

You don’t need to know the dates your limit was increased before complaining, my template asks for them.

If you have paper statements or you can download them from the app, that may be useful for you. But you don’t need to send these statements to the bank with your complaint – the bank already has them!

You can’t go back and see exactly what your credit score was in say 2021 when the bank increased your limit. But your current credit record shows what was happening back six years, so download your credit report now and keep it. The sooner you get the report, the further back it goes. I suggest you get your free TransUnion statutory credit report.

Send a complaint by email

I don’t recommend phoning to start off a complaint. It’s too complicated and you will be talking to someone that doesn’t specialise in these complaints.

I think email is the simplest way to make these complaints. Here is my list of bank email addresses for complaints.

An alternative is to send a long message in the app. But if this means using a chat facility, it’s not usually a good idea, as you are again talking to someone who doesn’t understand what you are saying and tries to tell you what help is available with your overdraft – when all you want is to have your complaint considered.

A template you can adapt

The section above looked at the reasons to complain and the other good points that apply to your case – you can turn those into a complaint.

In the template below, I’ve invented some examples and dates so you can see how a complaint email could read. The bits in italics should be changed or deleted to tell your story.

The bit about other points is important – what should your bank have noticed that showed you were in difficulty?

I am making an affordability complaint about the overdraft on my current account number 98765432.

Your identity details (these are needed if you complain by email, not if you use secure message):

My name is xxxxx xxxxxxxx. My date of birth is dd/mm/yy. The email address I use/used for this account was myaddress@whatever.com.

Your home address (if you know the bank has your current address, ignore this):

My current address is xxxxxxxxxxxxxxxxxxxx. Please do not send any letters to older addresses you may have on your records.

If your overdraft was originally a student overdraft with no interest include this, otherwise delete it:

My account started as a student overdraft and no fees were charged. I am complaining about the period after, when you started to charge fees.

START BY SAYING they should have noticed your financial difficulty

Overdrafts are meant for short-term borrowing but you could see I was unable to clear the balance in a sustainable way. I was using the account for long term borrowing as I could not get out of this. The fees and charges you were adding were making my position worse.

I am complaining that [every year since [20xx] OR for many years] you have failed to notice my difficulty during the annual reviews of my overdraft. You should have offered forbearance eg by stopping interest and charges being added.

By 2017 I had been in my overdraft constantly for many months, not getting back into the black even when I was paid. This “hardcore borrowing” is a clear sign of financial difficulty. My income was only £1,850 a month – after I had paid bills, there was no way I could hope to clear an overdraft of £3500 in a reasonable length of time.

OR

By 2021, although my salary took my account briefly into credit, within a few days, I was back in the overdraft.

include any other points that show you were in difficulty

You should have seen that I was in financial difficulty because you rejected my loan application in 2019.

You should have noticed that the income going into my account decreased from 2021.

From 2020-22 there was a lot of gambling showing on my account.

In 2021 you should have seen from my credit record that I had made payment arrangements with other debts.

Say if the intial limit was too high or it was later increased too high

You should never have given me an account with such a large overdraft. When I applied in 2016, you should have checked my credit record and income and seen I had recently missed payments to a credit card and had taken several payday loans.

OR

You should not have increased my overdraft limit in about 2017. When you increased the limit, you should have seen that my debts to other lenders on my credit record had increased a lot.

I do not know the exact months of the overdraft limit increases. In your reply to this complaint, please tell me when the increases were and how much the limit went up on each occasion.

END BY asking for a refund of charges and interest:

I would like you to refund all the interest and charges that were added to my account from 2016 when you increased my overdraft limit.

OR

I would like you to refund all the interest and charges that were added to my account from 2021 when you should have realised that my finances had got worse to the point that I was no longer able to clear the overdraft.

Please remove any late payment and default markers from my credit records.

Points to note

Student overdrafts

You won’t win a complaint about a student overdraft saying you were a student and it was unaffordable at that point.

But when the bank has started charging interest, it should start doing reviews and check if you are in difficulty. So from then on, you can win affordability complaints.

You can complain if the account is still being used or if it is closed

These complaints can be made in a lot of different situations. For example:

- you are still using the account or you have stopped using it and are paying it off;

- the account has been closed;

- the bank defaulted it and sold it to a debt collector (here you still complain to the bank, not the debt collector). If the debt collector has gone to court and got a CCJ, add a sentence to the template saying you want the CCJ removed as part of the settlement of your complaint.

But if you have had an IVA or bankruptcy after these problems, or if you are still in a DRO, then you shouldn’t complain – ask in the comments below for details.

Old accounts

Banks may say FOS won’t look at an old complaint, but this isn’t right. FOS will often look at a complaint if it has been open in the last six years. How far back FOS will go seems rather random, but it should be possible to go back at least 6 years.

Open and recently closed accounts aren’t a problem – the bank will still have your statements.

If your complaint is about an account that was closed more than 6 years ago, it’s going to be very hard to win.

Packaged bank accounts

These affordability complaints are not about the fees on packaged bank accounts. MSE has a page about packaged bank account charge complaints.

Personal accounts, not business accounts

The complaints covered here relate to personal accounts. For business accounts, talk to Business Debtline about your options.

The Bank replies

They want to phone me!

People are often scared if they get this message. But it may be good news! You can just ignore it or say you would like a reply in writing.

If you decide to take the call, it helps to be prepared:

- have a pen and paper handy so you can write down anything

- if they say they are partially upholding the complaint, ask them the date they are refunding the fees from, and how much. And say you would like to see this in writing before you decide whether to accept it.

- if they ask you questions that sound complicated or worrying, ask them to put the questions in writing as you find the phone difficult

- when they say they are rejecting the complaint, ask for this in writing, as you will be going to the Ombudsman.

Rejection/poor offer – go to the Ombudsman , it’s free

Banks reject many good complaints, hoping you will give up. So don’t! You know if the overdraft has caused you a lot of problems.

You can’t go straight to the Financial Ombudsman (FOS), you have to wait for the bank to reply, or for them to have not replied within 8 weeks.

Here are some things banks may say to try to put you off:

- you could have declined the increase to your overdraft limit – FOS probably won’t think that is a good reason

- you never let the bank know you were in difficulty – FOS probably won’t think that is a good reason

- your salary was enough to return you to credit each month – this is misleading if bills meant you very soon went into the overdraft;

- FOS will not look into things that happened more than 6 years ago – if your account was still open in the last 6 years FOS may well look at it.

And the bank may offer to refund fees for the last 15 months say, even though your problems have been large for many years. Think twice about accepting a low offer – you won’t put this offer at risk by going to the Ombudsman.

If you are offered a refund for the last 6 years but not any further back, have a think if this is a good enough offer. It is a bit unpredictable whether the ombudsman will be prepared to go back further than 6 years.

If you aren’t sure, post in the comments below.

To send the case to FOS, complete this online form:

- you can use what you put in your complaint to the bank;

- if the bank rejected your complaint or made a low offer, say why you think this is unfair;

- use normal English, not legal terms.

You don’t need to send your bank statements – the bank will send those to FOS. And you don’t need the policy documents for your bank account, the lender will supply those to FOS if they are needed.

Do these complaints work?

Yes! From 2024, some banks are making more offers directly.

A Guardian article featured a case where someone used the template letter here. Barclays denied it had done anything but made an £8,000 “goodwill” payment to the customer.

And if your bank rejects your case, people are winning cases at the ombudsman. FOS is a friendly service although it isn’t speedy. It isn’t faster to use a solicitor or a claims firm,

The comments below this article are from other people who have made this sort of complaint. That is a good place to ask for help if you aren’t sure what to do.

Stephen says

Hi Sara, just a quick message to say thankyou. I have been living in my overdraft for over 6 years now and really struggling to make any dent in paying it back. Using your template, i was paid £3500 last week which has cleared my overdraft completely (i no longer have the option for one now too, thankfully) and left me with some change to get even closer to being debt free. Your service is amazing and you change peoples lives with your advice, thankyou again.

Sara (Debt Camel) says

Excellent. Do you mind saying which bank it is?

Ben says

How long did it tak for FOS take to get back ti you. I’m still waiting since early may for it to be given to a handler.

Mr T says

Hi Sara,

Brilliant what a brilliant platform you provide for everyone, thanks for your ongoing support!

Using Natwest’s online banking i have found that i’ve paid £6,796 in interest and charges on my £5,000 overdraft during the last 5 years. The total figure will be much higher than that. I was issued the overdraft as a student and it was increased several years back, whilst i am now paid well (to a separate account) at the time i was not on a good salary or there was no income entering the account. I have struggled with a gambling addiction throughout, which i am now in recovery. I’ve complained to natwest who have dismissed it citing “The charges and interest were correctly taken in line with our T&C’s. A refund would only be made to yourr account when the bank has made an error.”

Is it worth bothering with

Sara (Debt Camel) says

If they increased your credit limit while there were a significant number of recent gambling transactions on the account, this is definitely worth taking to FOS.

Mr T says

Thanks Sarah. I forgot to mention i had an awful credit rating, multiple payday loans (at the same time) and was in the overdraft 99% of the time. I’ll take it up with the FOS and let you know how i get on. Thanks again for your help

Mr T says

Hi Sara

Hope you are well. I heard back from the adjudicator today

I’m happy to inform you that NatWest have agreed to my view of your complaint. They said the following

NatWest’s redress includes the following:

Overdraft charges £670.75

Overdraft interest £5522.53

Accrued overdraft interest to waive £236.86

Total refund due to account ending XXXX: £6193.28

An 8% interest will be added to the refund; however subject to HMRC deductions.

Do you think 8% Will be added to the £6193? or is that included? Do you think they will automatically cancel the overdraft. I have asked them these questions but no response.

Thanks to you and debtcamel for making this happen

Sara (Debt Camel) says

how large is your balance at the moment?

Mr T says

Hi Sara

My balance is currently £5,450 overdrawn

Sara (Debt Camel) says

ok then the 8% interest is not likely to be much, as it is only paid from the point when the account would have been in credit.

My guess is they will cancel the overdraft or reduce it to a very small amount.

Ernest says

I have the same problem… adjudicator did not uphold my complaint and told him to send yo Ombudsman and Ombudsman upheld my complaint and told them to refund all my interest back from 2015 till date.

Jayne says

I am currently living in a £1500 over draft with Santander. As soon as my wages go I’m on the overdraft again. I also have a credit card with Santander which is at £3500 limit and I have barely managed the minimum payments. I’ve not been great with money over last few years caught ins cycle of payday loans etc. The overdraft kept allowing me to increase it from initially £250 to £1500 over a two year period. I’m constantly going over this authorised overdraft and keep getting larger charges added onto my account by Santander this is now 2022 and I’m still in this position since 2016. I sent them the complaint template and they torture straight away saying they have done nothing wrong and will not withhold my complaint. I’m currently in a payment plan to pay back my credit card for a few months and I also have missed a loan payment to Santander twice now. They would be well aware from my account that the last few years I’ve been struggling massively financially. Yet they are still putting charges on my account and not helping at all with this overdraft any advice should I refer complaint now to regulatory bodies? Or is it not worth it?

Sara (Debt Camel) says

The overdraft kept allowing me to increase it from initially £250 to £1500 over a two year period.

during this time you had payday loans?

Are your wages less than £1500?

You mention the overdraft and a credit card – you also had a lon from them?

And did they increase the limit on your credit card?

This sounds like a good complaint, I am asking all these questions to focus on what to say.

Jayne says

Yes I she payday loans during this time. My wages vary every month but would be between 1600 and 1800. The loan was for £12000 which I pay monthly at £288 and is now almost paid off. My credit card limit originally set at £3400 and was given to me by Santander around the time of increases on overdraft and when I was deciding numerous notifications of unpaid debits form account. The credit card limit has been reduced by Santander at some point. But since then I’ve been struggling massively. I’m now off work on long term sick with view to I’ll health retirement and on half pay so struggling now with the fees they keep charging me but they won’t stop. I’m surprised they were able to respond to my complaint so quickly also with a definitely no as most other people I’ve complained too have taken 8 x weeks or so. On a brighter note I have just received a refund offer from 118 after an affordability complaint was sent to them following advice on your page . Should I reply to Santander or just now refer to Fos?

Sara (Debt Camel) says

Good you have received a refund offer from 118.

yes i think this should go to FOS. You can point out that as your pay varied between 1600 and 1800 each month, you had a Santander loan where the repayments are £288 a month and a Santader credit card, then the overdraft limit of 1500 has been unaffordable for years – as soon as your wages go in, you are soon back in the overdraft. the overdraft fees make it impossible to escape from this.

Jayne says

Thank you so much for taking time to reply to me and all of your advice.

Ernest says

Good afternoon Sara… thanks so much for your help on this site .. pls what is the interest on this offer.

Refund all the interest charged in relation to your overdraft since November 2015. The amount will be £2,197.44

On the date the above settlement is made, the bank will remove the £500 overdraft facility from your account and if the account is overdrawn on that date, the bank will use the relevant amount of the above funds to repay any outstanding debt.

If the bank is required to use any of the above funds to settle the overdraft, then whatever amount is left will only receive the 8% simple interest from the date the interest was incurred until the date of settlement. However, if you are in credit on that date of settlement, you will receive 8% simple interest on the full amount of £2,197.44 quoted above.

Sara (Debt Camel) says

what is the current balance on the account?

Which bank is this?

Ernest says

current balance is £500 overdraft and Halifax bank

Sara (Debt Camel) says

ok so the refund of £2197 of interst will first be used to clear the £500 current balance. Then the remainder – £1697 – will attrcat 8% interest, from the the date the interest was added. – I can’t guess what those dates will be,

Margo says

Hi Sara, I got my respond from Adjudicator. He thinks they can’t look into my complaint. That it is more then 6 years now, and that I should realise that when charges were applied to my account that this was not correct n hard to deal with it. So that 3 years doesn’t apply to it neither. And I just complained much to late. I want my case to go to an Ombudsman to see ann understand the case. Really don’t know how or what to write to him.

Sara (Debt Camel) says

I suggest you reply saying that you would like the decision to go to an Ombudsman and say (putting into your own words and changing as necessary):

I have read the 2 key Ombudsman decisions about payday loans https://www.financial-ombudsman.org.uk/files/17783/payday-loans_time-limts_final-decision-lender-C.pdf and https://www.financial-ombudsman.org.uk/files/17784/payday-loans_time-limits_final-decision-lender-D.pdf. It seems to me that the approach used there is directly applicable to my situation.

One says “Mr H would also have been aware, or ought reasonably to have been aware, that he was paying an increasing amount of interest the more loans he took out. So I think that Mr H also ought reasonably to have been aware that he may have suffered a loss, or that he was suffering a loss as he was taking out these loans. But I wasn’t persuaded that Mr H realised that Lender C might’ve been responsible for his repayment problems – nor did I think that Mr H ought reasonably to have made that connection either. In my view, Mr H would, quite reasonably, have seen Lender C’s offer of further loan as a solution to his problem, rather than a cause of it.”

The other said:

“Mrs W appears to be an intelligent and articulate individual who is capable of using the internet to access information. But I do not think it necessarily follows that a reasonable person in those circumstances, who became aware of affordability problems with her loan and who understood that she had suffered loss as a result, would also become aware that her difficulties could be due to failings on the part of the lender. In my view, a reasonable person in Mrs W’s circumstances would be more likely to take personal responsibility for the difficulties she faced.

I am satisfied that a reasonable person in Mrs W’s position could not reasonably be expected to have understood from her contract with LENDER D that the lender had an obligation to check that her loan was affordable before agreeing to provide it to her.”

Like Mr H and Mrs W, I realised that I was paying a lot in overdraft charges and that this was a big problem for me. But I thought this was my fault for not managing money well I didn’t realise lloyds [was it?} should have reviewed whether my overdraft limit was affordable. Until I found out what affordability complaints aout an overdraft were this year [or whenever you did], I did not realise I had a cause to complain.

Margo says

Thank you Sara! You are our help always! I’m about to send him the email with the informations. I will keep you updated if he will change his mind or will send it to Ombudsman to deal with it.

Can you explain me what is the 6years rule n additional 3years one.

Thank you.

Sara (Debt Camel) says

The Ombudsman can look at any problems which have happened in the last 6 years. that is their main rule.

but they can also look at any problems where someone has found out they had a “cause to complain” within the last 3 years.

Natalie Palmer says

Hi Sara, I have recently put in an overdraft complaint to my bank about a £5k limit I had when I was earning £11k a year but it was back between 2003 and 2016. I used your templates etc and sent it to the bank and then the ombudsman. Both have come back to say it was too long ago and I should have realised and complained in 2013 when I took a loan to pay off the o/d. I have replied to say it was only in March 2022 when reading your posts that I realised I could complain and just how irresponsible it was in the first place and was the catalyst to my years of debt problems. I accept I took the OD etc but as a normal consumer I never realised that I could complain.Is there anything else I can do?

Sara (Debt Camel) says

That is a very long time ago. You can ask for the case to go to an ombudsman for a decision – but one of the problems is that the bank may have kept very little information about the account as the overdraft was cleared in 2011.

Ernest says

Thanks so much Sara …

Steve says

Hi, I made a complaint to Lloyds TSB about the constant increases to my overdraft between Jan 2019-Oct 2019, despite clearly being in financial difficulties, and they have agreed with my complaint and acknowledged that these increases shouldn’t have happened. My overdraft debt started at £400 but due to the increases ended up being £2800. This debt was later sold to PRA GROUP and I am still paying this off today at an affordable rate based on my budget.

Lloyds have informed me that they are sorry they didn’t support me sooner and that they are going to pay me £40. In additional to this, they will reduce my outstanding balance from the debt which was sold to PRA GROUP by £739.73 which is made up of the daily arranged overdraft interest charged since my overdraft limit was first increased. They have informed me that they failed to see the signs of financial hardship and apologised for not addressing this sooner.

I would obviously like to accept this but before I do I just wanted to make sure that this seems a fair and generous resolution. I’m a bit confused about the offer of £40. Thanks. Steve.

Sara (Debt Camel) says

I assume you think the charges may well add up to £793?

They seem to have added the £40 as a gesture of goodwill.

Has PRA been adding any charges?

You can also ask them to remove the default on the Lloyds and PRA records.

Gaz says

Hi Sara

I have a claim in with Provident and Just seen this about overdrafts, credit cards, loans etc.

Do you know if there is any claim for a mis sold mortgage. In 2006 we applied for a 100% mortgage with Northern rock. when the advisor went through our income (which included overtime) and expenditure the amount offered wasn’t enough to buy a house so applied for a loan with Northern rock on the side. over the next few years we struggled. missed some mortgage payments along with payments for other bills we also had an overdraft of £3500. in 2010 I was offered voluntary redundancy. I saw this as my only choice as if I stayed the company were cutting down to 4 days work and all overtime stopped. which I couldn’t afford. I struggled to find work and lost the house. all this left me £80,000 in debt. I set up am IVA supposed to pay £18000 over 6 years, took 8 years to pay. a very hard 14 years that I feel is all due to that mortgage. do you feel I have a claim against them.

Sara (Debt Camel) says

no sorry, mortgages come under a different regulatory area.

it is a shame you did not go bankrupt rather than into that IVA.

Cj says

We used out overdraft for over 20 years went to 4750 I complained years ago to them as if were less than a pound over limit we would be charged £37 for bouncing item then £37 for going over limit . Spent a lot of money on interest and charges …was told couldn’t claim anythin* back

Sara (Debt Camel) says

That was a complaint about the level of charges.

The complaints discussed in the article above are about whether the overdraft is affordable or not.

Do you still have the overdraft?

Cj says

No was lucky enough to pay in full from compensation paid from payday loans last year

Sara (Debt Camel) says

ok so the account has only recently been closed so the bank (who is it?) should still have all the records. – that is good.

I suggest you use the template letter in the article above to send in an affordabiltiy complaint now. That template does not say that the charges were too high – it says that the overdraft limit was unaffordable for you.

The bank will almost certainly reject it either because you have already complained before or because it says you are complaining about something that happened more than 6 years ago. In either case, send your complint straight to the Ombudsman.

LF says

Hi Sara,

I just want to thank you for this site. This site is what made me aware of payday loan redress. I started looking around at other information on here and came across this post on reclaiming bank charges/overdrafts. Then seen the paragraph on packaged accounts wasn’t sure what it was but clicked on the link to take me to MSE and realised that this was what I had with RBS. I used the template letter on MSE & sent of the complaint to RBS 4 weeks ago.

Last week they rejected my complaint but I emailed them with additional information on Friday and after a quick call with them this morning (they called me) I have just been refunded £1,680 straight into my bank account! Beyond delighted!

Lee says

Hi, Has anyone had a refund from nationwide and how long did it take to be credited to your back to your account. I’ve had this complaint with Nationwide for a year. Finally they accepted the adjudicator findings from April. They are telling me they have 4 weeks from 24th May. 3 weeks already gone. Even had the complaints team call me twice to tell me money hasn’t gone in yet. Maybe they need to chase it up. 4 weeks is 21st June.

The delay tactics make me think of changing bank after all this.

Dawny says

Hi after reading about getting a refund on overdraft fees, I decided to try and see if my bank would help me. I had lived on an overdraft from 2014 until 2021. I actually paid off my overdraft during lockdown probably due to not putting petrol in my car, not going out and various other reasons. Also during lockdown the fees went down on my overdraft so instead of paying a £1 for each day I was overdrawn – it was changed to a percent rate which help as instead of paying a £1 daily which amounted to £30 a month I was paying about £13 a month instead and during the lockdown the first £500 was not charged. However about 6 years on an overdraft was a lot in fees which is why I wrote to my bank to ask for my fees back as previously I had contacted them 3 times for help. I literally sent the letter on Monday 13th June and they have not replied as yet but they have put £50 in my account as ‘adjustment of fees’. Is this right – it hardly covers the amount I have paid over the years especially when I had told them 3 times that I was struggling. Should I accept the £50 or contact them again? thanks for your help

Sara (Debt Camel) says

I suggest you get back to them and ask when you will be getting a response to your complaint.

£50 is clearly unsatisfactory! they may be hoping you just give up. Which bank is this?

Dawny says

its with Santander. It’s just the silence really. No letter back from them and I have checked my on line messages – nothing. why pop £50 in my account but not follow this up with an explanation.

it was also so quick for them to put the money in my account after I sent the letter – I am glad you say it is unacceptable. I will get back to them to see what they say.

thanks for your help

Dawny

Dawny says

Hi Sara

I have not yet gone back to Santander as I have been poorly with Covid!!

I received a letter from Santander on Friday which says why they put the £50 into my account. They say there was an error on Santander that they received my letter about the overdraft and they never replied in September 2020. This is why they gave me £50. However regarding the overdraft – the letter states they can only see from 2020 and the overdraft was £1350 in July 2020 but it was reduced to £500 in September 2020.

the reason the overdraft reduced is because I was paying it off and had to keep ringing them to reduce the overdraft whilst I was paying it off – this was so that I was not tempted to touch the overdraft whilst paying it off. it was not because they had reduced it.

they also say they believe their fees are fair and reflect the management of of my account and are withing the terms and conditions agreed.

Can I now go to the ombudsman and how do I address this?

thanks

Dawny

Sara (Debt Camel) says

So did you complain last year and never got a reply?

Dawny says

Hi Sara

I complained in 2020 – almost two years ago and never received a reply. They have acknowledged that they did not reply and sent me the £50 as an apology. The letter states that they can only see from 2020 but I can see their replies on the banking messaging system from 2015 and 2016. It would have been cheaper for me if they had offered me a loan instead. I was paying £30/£31 a month in charges from 2014 and it was 2020 when the charges changed and the first £500 overdraft was interest free which really helped. They say they reduced my overdraft at this time – but I rang to reduce my overdraft during lockdown so that what I was paying off was not available for me to spend again. Do you think I am able to go to the ombudsman?

Sara (Debt Camel) says

I think you should send this to the Ombudsman now. If the bank says it’s too late to go, point out they never responded to your complaint.

Dawny says

Hi Sara I complained in 2020 – two years ago and never received a reply

Sara (Debt Camel) says

Yes, send it to the Ombudsman now

Ernest says

Good morning Sara .. just want to say thank so much … l got over £2500 overdraft charges + 8% interest from Halifax on Friday thank you again ..

Sara (Debt Camel) says

excellent!

Chris says

Hi

Well done on your refund. Can I ask how long it took for your complaint to be dealt with ? I also have a complaint in with the Fos about a Halifax overdraft it’s been with them since February ?

Thanks

Ernest says

I think is December but Adjudicator did not upheld my complaint but Ombudsman did upheld my complaint between 2 weeks submit to them. And l got paid one week after by Halifax

Sara (Debt Camel) says

the time in an Ombudsman queue for overdrafts seems very short at the moment.

JL says

Hi

Im a bit confused as to how my upheld complaint is going to be worked out.

My overdraft has been £4150 for he last 15 plus years, but the FOS have mentioned the six year rule – so only applicable from March 2017. They have ruled that the bank should rework the current overdraft balance so that all interest, fees and charges

applied to it from March 2017 onwards are removed. Then if there is a balance should work out a repayment plan and if not any excess refunded plus the 8% statutory interest.

My question is, is this a case of adding up all charges and taking it away from my balance – I don’t understand the reworking bit !

TIA

Sara (Debt Camel) says

I think (but you would have to ask your adjudicator to confirm) that “reworking” let’s the bank see when you would have been in credit and so how much 8% interest should be paid.

JL says

Thanks for this Sara, the charges were roughly £55 per month, for approx 6 years.

Would I ever have been in credit from it ?

Sara (Debt Camel) says

probably not then, but it should clear almost all of your balance.

Josh says

Hi Sara

A quick question.. I use HSBC to bank with and I’ve never had an official overdraft but 10 years or thereabouts I used to gamble heavily and back then my bank account would allow up £500 overdraft but would charge £25 every time I made a transaction whilst in the overdraft.. my guess would be that I paid way over £1000, maybe even closer £2000 over the years. Then one day it just came to a stop and I could no longer go overdrawn. Would this be worth a go or has it been too long to try my luck and claim?

Thanks

Josh

Sara (Debt Camel) says

roughly when did this stop?

Josh says

This is a very rough estimate but I’d guess around 6-7 years ago maybe 8. I’m guessing this is too long ago to pursue a claim?

Thanks

Sara (Debt Camel) says

Well it’s not too long in theory, although claims over 6 years are harder.

But if this only happened for a couple of years, the Ombudsman may decide that HSBC did the right thing in stopping you from going overdrawn and they were not unreasonably slow about this. If it happened for 4 years, well that is a longer period and you may be more likely to win.

SB says

Hello Sara, Just looking for a little bit of advice for my Mum. She has been in her overdraft for as long as she can remember. It’s an arranged overdraft of £2500. Her and my Dads wages don’t even clear this each month so she is in it all the time with fees of around £70 a month these use to be higher until it got changed. I’m unable to go further back than 2015 on her online bank statements to see when the increases were made but it has been at unsustainable level for years. She has been in financial difficulty for a while and there is evidence on her bank statement of making arrangements with other providers to set up repayments. Would she be able to put a claim in for a refund of overdraft fees or does it have to be particular circumstances to be able to do this. Thank you for any advice you can offer.

Sara (Debt Camel) says

I think this sounds like a good claim. If you could help her complete the template letter in the article above? If you don’t know when the overdraft limit was last increased, add a sentence to the complaint asking this. Also say you would like to know for how many years she has been continuously in the overdraft.

Timbo says

Nationwide have just come back to me not upholding the complaint I made regarding increasing my overdraft from £600 to £3000 over a number of months in 2015. They are saying that at the time they followed the correct checks however these are likely to be different now. They called in the overdraft in 2016 and I had to pay it back in a payment arrangement over a number of years. Do you think it is worth sending to ombudsman?

Sara (Debt Camel) says

Yes it is.

cyrilv says

Well, Halifax have just come back to me with an offer, and it’s a lousy one. Just short of £300, which is well shy of the £1200 or I was looking for. Worst of all, it says that they’ll take the overdraft facility away when it’s paid. Not good; my £500 overdraft I have now is not something I need to go into but it’s crucial that that facility is there (I don’t need any more, but I’d be in bigger trouble without one). Also, the date they quoted was wrong. I’m going to talk to them tomorrow about a counter-offer that doesn’t get rid of the overdraft facility. What I’m getting right now is not so much goodwill but cold as charity. How long do I give them once I’ve contacted them before I go to the Ombudsman?

Sara (Debt Camel) says

why do you have to have the overdraft?

cyrilv says

In case of emergencies, for example if the rent’s due and I need to transfer money across before close of banking business. This buffer is very useful. I would not, however, want any more than my current limit, though things could get a little dicey without that safety net.

cyrilv says

Well, I talked to Halifax this morning, and they say the payment of £287 (and the removal of the overdraft) will go ahead as normal on the 22nd of July. Thing is though, they are referring to a period between June and August 2018 immediately before the dates i quoted in my complain, when the OD was increased from £400 to £500, and for some reason they think the subsequent increases were affordable. Which sounds nonsensical. They have also said that I can keep the £287 even if I go to the Ombudsman afterwards; so shall I go to the Ombudsman once this £287 hits my account? I will still have five months to do so after then.

Sara (Debt Camel) says

I suggest you go the Ombudsman straight away. If they are arguing that later increases were affordable, then that doesn’t sound sensible.

If say you can get £500 back, why can’t you keep that in a savings account and use that as a pot instead of an overdraft?

Rodney says

Hi Sarah

Thanks very much I used your template to contact Barclays. They say their charges are correct but as a gesture of goodwill they are going to refund charges from 2016 totalling £3,985.10 as a gesture of goodwill with no interest. My overdraft issues have been longer than this but I am just going to accept. It pays my £2k overdraft off and saves me about £70-80 per month in charges.

Than you so much

Becks Mash says

Hi Rodney. How long did it take Barclays to get back to you? Im 12 weeks, stil waiting

Sara (Debt Camel) says

Have they said it will be longer or just not replied to you?

Becks Mash says

Every 4 weeks keep getting a letter saying we need more time. According the Barclays track it app it hasnt even been started yet!

Sara (Debt Camel) says

You could send it to the Finacial Ombudsman now. 12 weeks is not reasonable. If you want to wait a bit longer, set 16 weeks as the deadline?

Rodney says

I sent the complaint by online message on 14th june

Becks Mash says

Wow that is fast!

Becks Mash says

Oh I have Sara! Just hoping Barclays would sort this out before the FSO investigation really started

Ernest says

Good evening sara.. pls quick advice on this offer from NatWest overdraft complain amount of overdraft is 3200.

I received this offer today. Hope is good offer pls? Any advice pls? I don’t want any plan to will affect my credit record. And not pay anymore interest go forward .

In response to my assessment of your complaint, NatWest have made the following offer:

Given the circumstance, we would like to offer Mr E gesture of goodwill. We would like to offer to refund all charges and interest applied to Mr E account from May 2021 to date. We have deducted any previous refunds provided over this period which I believe its fair. See offer below –

Charges = £0.00.

Interest = £87.93.

Total offer = £87.93

Mr E will retain an overdrawn balance therefore no net interest will be provided. Furthermore, as Mr E will still hold an outstanding balance, we recommend he contacts out financial difficulty team on 0800 068 9816 to discuss a suitable plan going forward. This department are the experts in this area and will be able to go through and income and expenditure review and then discuss the options available to Mr E. Charges and Interest will continue to be applied to the account until a plan is put in place with this department.

We are not requesting a final decision however we believe the above is a fair and reasonable outcome to this complaint.

Sara (Debt Camel) says

Can you say something about how long you had an overdraft on this account? did they increase your overdraft limit? Was there anything special about May 21?

how large is the current balance and how much can you pay to it each month to clear it?

Ernest says

I have the overdraft from 2005 or 2006… am sure if they increases it ..am sure they reduce it .. when l make irresponsible lending complaint last yr ..they give me 6month to go to Ombudsman but l did not go … but l make another complain to them 2month ago … and they told me is over 6month ..and then l took it to financial Ombudsman and Adjudicator said the same thing is over 6month and then l told Adjudicator to send to Ombudsman… and Ombudsman said they will only look it to it from May 2021… which am very happy with that because l never pay any interest on the overdraft from 2007 till 2021 because the bank made a mistake by not charging me interest… the remaining balance now is £3200.. l can pay £30 every month .

Sara (Debt Camel) says

then I suggest you phone up the financial difficulty team as they have suggested and say that you would like a payment arrangement and for this not to harm your credit record. Explain the situation. You will probably need to prove that you in financial difficulty.

Ernest says

Good morning..l financial difficulty team to make payment arrangements for the outstanding balance.. but the option that they have that will not harm my credit is too high £187 a month but can’t avoid the monthly and another one is to default my account . This is what Adjudicator told them to do.

In this case, I think NatWest should now settle Mr Earnest’s complaint as follows:• Re-work Mr Earnest’s current overdraft balance so that all interest, fees and charges applied to it from May 2021 onwards are removed.AND• If an outstanding balance remains on the overdraft once these adjustments have been made NatWest should contact Mr Earnest to arrange a suitable repayment plan for this. If it considers it appropriate to record negative information on Mr Earnest’s credit file, it should backdate this to May 2021.OR• If the effect of removing all interest, fees and charges results in there no longer being an outstanding balance, then any extra should be treated as overpayments and returned to Mr Earnest, along with 8% simple interest on the overpayments from the date they were made (if they were) until the date of settlement. If no outstanding balance remains after all adjustments have been made, then NatWest should remove any adverse information from Mr Earnest’s credit file

Sara (Debt Camel) says

Then they are complying with what the Ombudsman said. Realistically £30 a month will not clear that overdraft for a VERY long time. If that is all you can afford, then a payment arrangement will be recorded.

I am afraid you have to accept that this is a most unusual case, what with the bank forgetting to charge interest for many years, you making a complaint but not sending it to the Ombudsman, then making a second complaint about a subsequent very short period.

Sarah says

Thanks to your site I’ve managed to get refunds from my previous payday loans, and yesterday Halifax paid me over £5000 for overdraft charges over the last 6 years!! Thank you so much! Just waiting on piggybank now (whenever that may be?) finally in a good place mentally after breaking the gambling and payday loan cycle and help through this site!

Catherine says

Hi Sarah not sure if you’ll see this but did Halifax respond within the 8 weeks with a direct upheld decision or did it go to FOS

I’ve just submitted a Halifax overdraft complaint today.

Daniel says

Hi,

Firstly, thank you for all the information you’re providing on this website.

Loan with Lloyd, 11/2015 – £7,500

Loan with Lloyds 06/2017 – £12,7750

Lloyds Overdraft

Jan 2016 – £1300

Sept 2016 – £2500

October 2017 – £4000

April 2019 – £4420

Credit Card 04/2015

£6000 – £7000 Limit (was increased over time)

Was always using it but using most of my limit throughout 2017 onwards

I was earning between £27-33k takehome.

I ended up with around £45k of unsecured debt which is more than I ever earned in a year before deductions.

I want to tackle Lloyds first as it’s the biggest debt with about £19.5k remaining which was sold to PRA. I’m going to complain to Lloyds first, can I bundle all those together or do I have to do separate complains re charges / irresponsible lending. Then whatever the outcome from that is I will go back to PRA and as for if they can provide the CCA Agreement, they took on 3 accounts from Lloyds, MBNA and Barclaycard totaling around £31.5k outstanding.

I’m just overwhelmed with where to start, which order and if they should be separate complaints or not.

Would appreciate any help on this, thank you!

Sara (Debt Camel) says

do you think you may also have affordability complaints against MBNA and Barclaycard – did they increase your credit limit while you were onlt making minimum payments and your credit record was showing you were acquiring a lot more debt?

Can I ask why you started taking the loans and overdrafts – was there a sudden problem with your finances, a gambling issue, or what?

Are you buying or renting?

Daniel says

I will be making affordability complaints against MBNA and Barclaycard yes. Barclaycard gave me a credit card with a £9200 limit while being in around £23k of debt already and having multiple credit cards, loans and always in my overdraft.

I was struggling to manage money and my earnings were decreasing. Poor management really, no gambling or addiction problems. I was transferring debts between cards and using more credit to pay for credit thinking I would be able to get on top of it but that never happened I just used more credit eventually to a point I couldn’t manage anymore when I changed jobs.

I rent, I have no assets of value (I was thinking about bankruptcy) but I want to see if I can do something again first before doing that.

Thanks Sara

Dan says

Hi Sara,

Received a final response from Barclaycard.

They rejected my claim saying that when they gave me a credit card I was given a 0% balance transfer which I benefited from by transferring £7700 (of £9200 limit) and additional spending on the card caused my balance to increase, which Barclaycard cannot be held responsible for. I did transfer a balance from another credit card which just enabled more spending on another credit card on top of the extra credit I had with them. I was in £23/24k of debt at the time and I earned around £33/34k before tax in 2017-18 and £30k in 2018-19.

I’m not sure how they can say it wasn’t irresponsible, I had 3 credit cards, 2 loans and an overdraft I was constantly increasing along with the credit card limits prior to Barclaycard.

I’m moving this forward to FOS now. So frustrating, I think it’s just standard procedure to make you think you won’t get anywhere with a complaint.

Sara (Debt Camel) says

balance transfer cards are always trickier as the extra credit wouldn’t be increasing your debt if you had closed the other card. But you do seem to have a hd a lot of debt so you can reasonably argue there is no way you could repay the amount transferred within the 0% period.

Sara (Debt Camel) says

ok, well I think in that case you need to everything at once, as you don’t know what is going to work.

So all the affordability claims to the original lenders and ask for all the CCAs from the current creditors (CCAs don’t apply to overdraft debts).

Otherwise you could spend 12-18 months feeling quite stressed and may not cut your debts by enough to avoid having to go bankrupt anyway… These are all large complaints. realistically if one offers you a good will gesture of a couple of thosuand, you are going to have to reject it and go to the Ombudsman as it isn’t going to be enough to make much difference to your situation,.

re Lloyds, I suggest you put all the complaints together into one as the timescales for the different sorts of credit overlap.

Dan says

Hi Sara,

None of the lenders have got back to me / acknowledged my emails at all. I’ve sent reminders. Is there a timeframe in which I should wait before escalating and would escalation be taking it to FOS?

Thanks

Dan

Sara (Debt Camel) says

They have 8 weeks to reply. After that point you can send it to the Ombudsman if they haven’t replied.

but after a couple of weeks you may want to phone up and check they have received it as you have not had any confirmation?

Elle says

Hi Sara,

I’ve received the final decision from the Ombudsman for my Barclays overdraft complaint, they’ve said that Barclays need to refund all interest and charges from June 2015,..so that’s good. However,..typically at present I have no letter from Barclays on how they’ve calculated anything but they have just put £2175 into my bank account.

I’ve worked out that Barclays should refund me for 60 months of interest/charges in total from those last 6 years (June 2015 – June 2021). The last year (2020-2021), I didn’t have any interest added as I’d cleared my overdraft with your help, thanks…so it’s 5 years (60 months) redress.

When I first complained to Barclays they gave me a ‘goodwill gesture’ of £3073 (stated to cover 26 months only) but what I don’t quite understand is the 8% part…they never added 8% to that earlier amount but when faced with the FOS they then offered an additional £652.82 as a settlement saying it was 8% on that earlier figure/calculations…I refused this, and sent the complaint to the Ombudsman.

The Barclays new refund should now include a further 33 months by my reckoning + 8% on the whole final amount…i.e.on the first 26 months & 33 months.

Does that sound correct in principle? How do you work out 8% on redress on Overdrafts?

I also think their original ‘goodwill gesture’ was higher than the interest I’d paid for 26 months, but I feel I’ll need a way to check they’ve calculated and added 8% correctly.

Sara (Debt Camel) says

Yes that sounds right.

It should be relatively simple to work out the interest and charges to be refunded.

The 8% part is not so simple. Do you know which were the 26 months the original goodwill gesture was covering?

Elle says

Hi Sara,

Yes the original 26 months were from 26th June 2015 -26th Aug 2015 (= 2 months)…plus from the 27th June 2017 – 25th June 2019 (= 24 months).

My interest charges are shown on my bank statements and were roughly the same most months at between £75 – £95 per month.

Sara (Debt Camel) says

so to work out the 8% interest, the bank has to effectively rework your account and find out at what point it would have been in credit if the interest and charges had not been applied.

I suggest you just wait and see what is offered and if it sounds reasonable.

Elle says

Thanks Sara,

It does sound like quite a complicated task they have… I will await Barclays letter and see if I can fathom what they have done…

I may be back. :) Thanks again.

Becks Mash says

Hi can i ask how long it took from start to finish. I complained to Barclays 12 weeks ago now and just keep getting letters saying they need more time. Sent to FOS 4 weeks ago

Elle says

Hi, I sent my complaint to Barclays back in June 2021, I had loads of hassle even getting Barclays to recognise the type of complaint to start with… then eventually 2 – 3 weeks later (after arguing with them on the phone) I had a reply saying they didn’t uphold my complaint, they could only look back 6 years but gave me a goodwill gesture straight into my account as they could see there had been problems… I wanted them to look back further, they refused so I sent to FOS,.. sadly I’ve then had a very young, inexperienced adjudicator,.. who has kept making mistakes, and then he agreed with Barclays!.. I requested it go to an Ombudsman who then upheld my complaint but again for only 6 years back,.. but it’s a win either way.

To be honest it’s the adjudicator and his mistakes that I’ve had to chase him up on and get corrected that has pre-longed things for me, but there is now finally some light at the end of the tunnel…

All told it’s taken just over a year… that may sound like a long time, but I’ve had other cases for catalogues that took 2 years and others I’m still waiting on the FOS to pick up…I don’t think there’s any set timescale but from what I’ve read here the bank complaints are being dealt with a bit faster than catalogue credit complaints, if it helps. :)

Tim says

Has anyone put any overdraft complaint to the ombudsman lately? Just wondered how long took as just put one in today regarding a Nationwide overdraft.

Thanks

Sara (Debt Camel) says

They seem to be picked up more quickly. And the queue for the Ombudsman if the adjudicator can get this sorted is positively speedy!

Dan says

Thanks Sara,

I’ve put one in for Barclaycard already via Resolver using a template. I’ll write up one for Lloyds now for irresponsible lending. Thank you

Becks Mash says

Wow! So I lodged an overdraft interest fees complaint with Barclays on 12th April. Every month since I get a letter saying they need for time. Last month said I should hear by July 4th. This dates comes and goes. Colleagues on live chat keep telling me that it is definitely being investigated and progressing countless times. So today I phone the complaints line to ask why I have been waiting 12 weeks. The lady says “Im so sorry this hasnt been allocated to a complaints handler, i will email the team and see if it can get allocated but I cant guarantee it will be looked at” OMG!

Please note you can contact the FOS. Are they for real?? Are Barclays just ignoring complaints now so they dont have to get involved until the FOS say so?

Sara (Debt Camel) says

*!%*!*

I suggest you send it straight to the Ombudsman!

Becks Mash says

I sent it 4 weeks ago when the 8 weeks was up! I just had the positive attitude that maybe Barclays could come to a conclusion before it went to months of waiting with the FOS. More fool me! I also emailed the CEO with my …… thoughts 😂

K Drury says

I put an overdraft affordability and irresponsible lending complaint in through the message facility with my bank.

I got this response “We do review eligibility monthly based on your credit score, and we do allow an increase in overdraft as long as you are eligible for one, but the decision to apply is still yours. We can certainly logged this as formal complaint but just set your expectation we will not uphold this as there are no bank error how would you like us to proceed?”

How can they tell me within 8 hours of my complaint being submitted that they will not uphold?

Sara (Debt Camel) says

which is the bank?

I suggest you reply that your complaint goes to the Ombudsman if it is not upheld.

K Drury says

It’s Bank Of Scotland

Becks Mash says

Hi Sara looking for some further advice please on a good comeback to Barclays

So after 12 weeks and me emailing the CEO they have sent me a final response (within 1 day of it being allocated) They have rejected my complaint stating it was my responsibility to speak to them about my overdraft not up to them. They then offered me £100 compensation.

Back story is

.

I have had an overdraft for over 15 years of £2520 which has been 100% utilised every month. For 10 years plus there has been no salary going into that account. Around 2013 it was cleared due to a packaged account missell refund by themselves. Since then it has been at the full overdraft every month. Only payments going in to cover interest/fees.

It is with the FOS but I would like to go back to the executive complaints team to see if they will change their decision before the FOS get too involved.

Any suggestions?

P.s I have always had around £15000 debt throughout the 10 years , loans/credit card/payday loans

Sara (Debt Camel) says

Not really. I think you will just be wasting your time. Just leave it up to the ombudsman.

Jax says

I had a good experience with Barclays. Made a complaint last year that they rejected. Then just before Christmas they contacted me again saying they had relooked at my complaint and offered me a goodwill gesture of nearly £4k to settle. It was about £40 less than I had calculated so I accepted. Cleared my overdraft and reduced the facility to £500.

Becks Mash says

Thanks for that! Was it an overdraft irresponsible lending complaint?

Jax says

Hi Becks, yes it was.

Rose says

Hello

I have a £950 overdraft that I am paying via a DMP, around £10 a month with Barclays. I was in my overdraft for years and my earnings were only a few hundred £ more.

I currently have a default on this as the repayment is so low :(

Do you have any suggestions if I should write to Barclays?

Any help is so appreciated

Sara (Debt Camel) says

This sounds well worth a try. I think Barclays is rejecting all complaints at the moment so as soon as this gets to 8 weeks, send it to the Ombudsman, don’t delay hoping for a good result from Barclays as that is unlikely.

What other debts do you have in your DMP?

Rose says

Hi Sara

Thank you so much for your quick reply

I have also a credit card, loan, and 2 x catalogues in the dmp..

Sara (Debt Camel) says

Then it may also be worth looking at affordabilty complaints about those:

– credit cards & catalogues https://debtcamel.co.uk/refunds-catalogue-credit-card/

– loans https://debtcamel.co.uk/refunds-large-high-cost-loans/

Brad says

Hi Sara, I have just received the below from an adjudicator regarding an overdraft limit increase in 2014 (i complained in 2021) which sounds incorrect to me…

‘In regards to the overdraft limit increases, these happened more than six years ago and we can only look as far back as six years on any overdraft complaint as those are the rules. You are confusing this with the jurisdiction rule. Your complaint is in jurisdiction, however we cannot look at events that happened more than six years ago as those are the rules surrounding overdraft complaints.’

I thought the 6 + 3 year rule applies for overdrafts? therefore they can look into?

I knew i could complain less than 3 years ago but they have not even asked me about that….

Sara (Debt Camel) says

I suggest you reply asking the adjudicator to review that and say that you would like the decision to go to an Ombudsman if they do not change their mins. Say (putting into your own words and changing as necessary):

I have read the 2 key Ombudsman decisions about payday loans https://www.financial-ombudsman.org.uk/files/17783/payday-loans_time-limts_final-decision-lender-C.pdf and https://www.financial-ombudsman.org.uk/files/17784/payday-loans_time-limits_final-decision-lender-D.pdf. It seems to me that the approach used there is directly applicable to my situation.

One says “Mr H would also have been aware, or ought reasonably to have been aware, that he was paying an increasing amount of interest the more loans he took out. So I think that Mr H also ought reasonably to have been aware that he may have suffered a loss, or that he was suffering a loss as he was taking out these loans. But I wasn’t persuaded that Mr H realised that Lender C might’ve been responsible for his repayment problems – nor did I think that Mr H ought reasonably to have made that connection either. In my view, Mr H would, quite reasonably, have seen Lender C’s offer of further loan as a solution to his problem, rather than a cause of it.”

The other said:

“Mrs W appears to be an intelligent and articulate individual who is capable of using the internet to access information. But I do not think it necessarily follows that a reasonable person in those circumstances, who became aware of affordability problems with her loan and who understood that she had suffered loss as a result, would also become aware that her difficulties could be due to failings on the part of the lender. In my view, a reasonable person in Mrs W’s circumstances would be more likely to take personal responsibility for the difficulties she faced.

I am satisfied that a reasonable person in Mrs W’s position could not reasonably be expected to have understood from her contract with LENDER D that the lender had an obligation to check that her loan was affordable before agreeing to provide it to her.”

Like Mr H and Mrs W, I realised that I was paying a lot in overdraft charges and that this was a big problem for me. But I thought this was my fault for having a gambling problem and not managing money well I didn’t realise x [which bank is it?] should have reviewed whether my overdraft limit was affordable. Until I found out what affordability complaints about an overdraft were this year [or whenever you did], I did not realise I had a cause to complain.

Also As I understnd it, banks have a duty to review overdrafts every year. So even if it is not possible to go back more than 6 years, I think it is reasonable to allow me to complain about each of the reviews within that time limit that failed to notice my major financial difficulty.

Brad says

Thank you, the adjudicator essentially said the other cases were not relevant and dismissed the other comments. Looks like i will have to go to the Ombudsman.

Is there much of a wait for one?

Sara (Debt Camel) says

Overdraft complaints seem to be going through pretty quickly.

Colin Brown says

Hi Sarah

If I can’t find tax certificates from a couple of years ago and they went bust would HMRC be able to give me this if I ring them so I can claim back?

They would know under my name?

Sara (Debt Camel) says

No. Do you have the email saying what you were being paid and the tax deduction?

Ernest says

Good afternoon Sara pls quick advice… is that any complain l can make to NatWest bank about my overdraft.. l have the overdraft from 2006 of £4000 later reduce to £3300 in 2017 but they stopped charging me interest on the overdraft till 2021 January by financial difficulty team . they wrote to me in that time 2021 that they made mistake of not charging me interest … computer errors.. and that time l wrote to them by making complain to them they should not charge me any more.. but they regent my complaint and give me £100 compensation … what can l do pls? Type of complain

Sara (Debt Camel) says

When did you complain to them?

Ernest says

Last year February or January about my stopping interest on my overdraft . but l submit another irresponsible lending complain 2 months ago but fos said they will only look at my complaint from last January and they refund me £89

Sara (Debt Camel) says

Ok I remember the case – as I said before:

They are complying with what the Ombudsman said.

Realistically £30 a month will not clear that overdraft for a VERY long time. If that is all you can afford, then a payment arrangement will be recorded.

I am afraid you have to accept that this is a most unusual case, what with the bank forgetting to charge interest for many years, you making a complaint but not sending it to the Ombudsman, then making a second complaint about a subsequent very short period.

George says

Firstly, some great work that you do, Sara. Hi!

I found the template online and wrote to make a complaint which Lloyds subsequently rejected. From here I went straight to the FOS where an adjudicator responded to say they agree with my complaint and the bank have until 8th July to respond.

Last week this date passed and perhaps I am being a little hasty but I was just wondering whether you had any experience in the length of time it takes from here, as I am unsure whether the bank have replied to the adjudicator, or just ignored it and what the next steps to take would be if they had done either of the above?

Thanks

George

Sara (Debt Camel) says

You need to ask your adjudicator – if Lloyds haven’t replied the adjudicator will usually give them another few weeks.

George says

Thanks Sara. Thought I’d try giving the FOS a call and the person I spoke to was very helpful once I provided my details and case reference. After checking the notes he stated that Lloyds have accepted all that the adjudicator had said and a response including breakdown would be sent to me within 48 hours. I will keep updated.

George says

Received offer of 6k today. Safe to say wouldn’t have been possible to comprehend this process without coming across this site and the guidance it provides. Thank you Sara

Sara (Debt Camel) says

Excellent!

Becks Mash says

Hi all. Does anyone know how long Overdraft complaints with the FOS are taking at the minute?

George says

Mine was extremely quick. Heard from FOS within 2 weeks of complaint form being submitted. They then gave the bank 2 weeks to respond from their decision and today I have received the offer. All within less than 2 months from start to finish. Cannot say the it’ll be the same in all cases but from what I’ve seen they overdraft complaints through FOS are much quicker than payday loans etc. Hope it is a speedy process for you.

Max says

Hi Sara,

I’m pleased to say an adjudicator at the FOS has now been given the green light by an Ombudsman to look at my overdraft complaint involving Halifax after an Ombudsman rubber-stamped the former’s initial decision.

Halifax cited the six/three-year rule in rejecting my complaint, which relates to increases dating all the way back to the start of the last decade.

While the adjudicator will now actually look into whether I have a cause to complain, the fact the Ombudsman has agreed they can look back more than 10 years is welcome news.

My argument on the three-year rule was based on me never having been aware of irresponsible lending/affordability complaints until the administrators of Wonga emailed me back in 2019.

That email got me looking into such redress avenues and with the help of your website/forum and other portals, I fired off around two dozen complaints to credit providers that same year.

That flood of complaints and email evidence from Wonga has now helped me win this first round of the battle, but there’s still a long way to go.

I just wanted to share with readers you need to gather as much evidence as possible to support your case as the Ombudsman made it very clear in his ruling that each case is unique and decided on its own merits.

I’ll update this thread once the adjudicator decides whether to uphold my complaint.

Max

Max says

Hi Sara,

Unbelievably, the adjudicator has thrown out my case, saying Halifax did nothing wrong with five sets of increases a decade ago – even though I’d only entered a DMP 18-24 months earlier with £40,000 of defaulted credit cards and overdrafts, and had a recent CCJ against me for a four-figure sum.

In addition, they’ve not even looked at part two of my complaint, which was that I’d been in my overdraft for three weeks out of every four for almost a decade, as well as tens of thousands of pounds of payday loans and gambling transactions in more recent years that should have triggered some sort of review of the facility.

I’m livid none of this appears to have been taken into consideration and that Halifax never once offered help and/or forbearance and instead treated me as a cash cow year after year.

Of all my irresponsible lending complaints (all successful) this was the one I was most confident about given the huge weight of evidence that included 400+ pages of statements and an awful credit report from many years ago clearly showing shocking data they would have had access to.

The FOS website has dozens of upheld overdraft complaints at Ombudsman level far weaker – in my view – than mine so I’m going to fight tooth and nail for a different decision at a higher level.

Will keep you posted.

Max

Paul says

Hi Max, I had similar case to yours thrown out against Halifax back in May . I left UK to work abroad Jan 2010 due to all my debts, (defaults/CCJ’s) (mainly due to gambling & big loss on a property). Late 2010,though not in England, not on electoral roll, no wages in bank I was able to get payday loans paid into Hfax. It soon got out of control. In Nov 2011 Hfax amazingly accepted me £600 o/draft. 4hrs later they let me increase by £600 &so on till £3600. I just paid the interest each month. In 2013 it got difficult so rang them. They put me being accepted down to a bug & agreed for me to pay £10 interest per month. In 2014 the £10 stopped & the account was left owing £3600 for 6yrs with no contact at all from Hfax till 2020. By then I had come to learn I had grounds to complain so did. 16 wks they took to reply to say over 6 yrs so nothing they could do. Went straight FO with tons of evidence. The adjudicator sided with Hfax so submitted more evidence to show why I was only complaining now (in 3 years) & it went to Ombudsman who rejected also saying I should have complained before Nov 2017 knowing I had no way of paying it back. I felt so dejected that Hfax hadn’t even been asked to answer when I’d put so much time & effort into my case. I cleared the £3600 o/draft last month (used 0% cred card) after the Hfax Collection team said, now complaint answered, interest would be charged. So I wish you lots of luck Max in taking it further & keep us posted.

Sara (Debt Camel) says

I think yours was a rather odd case Paul as Halifax had reduced your interest a lot and then had not actually charged interest over much of the period.

Max says

Thanks, Paul. Sorry to hear your problems with them over such a long period caused so much stress.

I crunched some numbers over the weekend to support my case at Ombudsman level. I hadn’t gone into such forensic detail as assumed my case was so strong it would be a waste of time.

My adjudicator failed to even look at my OD use and even told me it wasn’t excessive by any means.

Yet for a decade I was in my four figure OD for 93% of the time, including years where that ratio was 98%!!!

Over £90,000 of payday loans entered and left the account too. And over £200,000 of betting transactions! Yet, not a word from Halifax.

Will keep you posted as I’ve quoted CONC and old OFT regulations extensively in my latest correspondence.

Max

Antony says

Just like to thank you Sara, paid all my debts off through a PayPal dmp a year ago, I had an overdraft with Lloyds, was constantly in my overdraft, sent them an email 8 weeks ago complaining, received a cheque for £2500 today, thanks for all the advice on here, most of the stuff is as simple as sending an email

James says

Hi Sara, can I have some advice on whether to accept this first offer?

Although no bank error has occurred, as a gesture of goodwill, I agree to refund the interest and charges applied since June 2016. This amounts to a refund of interest amounting to £9,539.91 and a charges refund amounting to £1,409.33.

I will then be reducing the overdraft facility by the amount of the refund, so the overdraft facility will reduce to £1,051.

Once the refund has been paid, the balance on the account will be £1,728.23 overdrawn against an agreed overdraft facility of £1,051.

What do you think?

Sara (Debt Camel) says

Can you say some more about your account? When did you get into difficulty with it?