Have you had big overdraft problems for a long period?

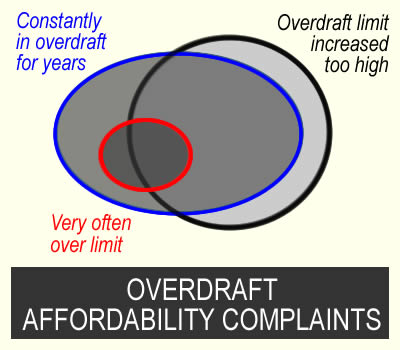

You can make an affordability complaint and ask for a refund of overdraft charges if:

- your overdraft limit was set too high at the start or increased to a level you are unable to clear; or

- your overdraft usage showed you were in long-term financial distress. For example, being in the overdraft all the time, or using an unauthorised overdraft a lot

- your overdraft was originally a student account with no charges, but now interest is being added and you are in the account all or almost all of every month.

This article shows how to make an affordability complaint to your bank, with a free template letter to use.

These complaints do not hurt your credit record. And if the bank doesn’t make a you a good offer, it is free to take your case to the Ombudsman.

Contents

Overdraft affordability complaints

Overdrafts are supposed to be for short-term borrowing

Overdrafts are intended to be used for short-term problems, not as long-term borrowing. A bank should review a customer’s repayment record and overdraft limit and if there are signs of financial difficulty, offer help.

One sign of financial difficulty is hardcore borrowing for a long period. The Lending Code defined hardcore borrowings as “the position where a customer’s current account overdraft remains persistently overdrawn for more than a month without returning to credit during that period”.

Some Ombudsman decisions

All cases are very individual. But these examples give you an indication of what the Ombudsman thinks is important.

In this NatWest decision, the Ombudsman decided:

NatWest did have an obligation to monitor Miss K’s use of her overdraft facility.

Any fair and reasonable monitoring of Miss K’s overdraft facility would have resulted in NatWest being aware Miss K was in financial difficulty … by October 2014 at the absolute latest. So NatWest ought to have exercised forbearance from this point onwards.

In this Santander case, the bank didn’t notice hardcore borrowing:

By this point, Miss C was hardcore borrowing. In other, words she hadn’t seen or maintained a credit balance for an extended period of time. Santander’s own literature suggests that overdrafts are for unforeseen emergency borrowing not prolonged day-to-day expenditure. So I think that Miss C’s overdraft usage should have prompted Santander to have realised that Miss C wasn’t using her overdraft as intended and shouldn’t have continued offering it on the same terms.

A similar decision was reached in this Lloyds case:

Mr and Mrs C’s statements leading up to the renewal shows they hadn’t really had a credit balance on their account for a prolonged period. Indeed, they’d had regular returned payments and had also exceeded their limit. In these circumstances, it ought to have been apparent Mr and Mrs C were unlikely to be able to repay what they owed within a reasonable period with overdraft interest, fees and associated charges continuously being added.

Decide which reasons apply to your overdraft complaint

You are in the overdraft all or almost of the month for a long while

This is the most common reason for winning a complaint

Overdrafts are meant to be used when you have a problem. Using the overdraft a lot for a few months is fine. Or for a few days at the end of a month before you are paid.

Banks should review your overdraft annually. This is in most overdraft terms and conditions. And even if it isn’t, the Ombudsman says this is good industry practice.

So at one of these reviews, your bank should have seen if you were in difficulty with the overdraft. For example if you are in the overdraft for all (or almost all) of the month for a prolonged period. Or if you were often exceeding your arranged overdraft limit.

I would say over a year is prolonged.

The bank set your limit too high

This may have been from the start when you were first given an overdraft. Or the initial low limit may have been fine, then the bank increased it to a level which it was impossible for you to repay.

If the bank saw signs of financial difficulty, it should not have increased your credit limit, even if you asked for it. And it should have considered offering your help instead (the regulator’s word is forbearance), for example by stopping charges.

But what is too high?

This depends on your income and expenses. An overdraft of £2,000 for someone whose income is £1,800 a month is a lot – but if you earn £5,000 a month, then a £2,000 overdraft may be reasonable.

Other points that help a complaint

You won’t win an affordability complaint by saying the charges were too high.

Instead, you say the bank should have known they were unaffordable for you because of all the financial problems it could see on your statements and your credit record.

Here is a checklist, do any apply to you?

- often having direct debits or standing orders not being paid;

- a lot of gambling showing on your statements;

- significantly increasing other debts with the same bank (you may also be able to complain about those loans or credit card);

- being recently rejected for a loan or a credit card by the bank;

- significantly increasing debts with other lenders showing on your credit record;

- a worsening credit record – maxed out credit cards, new missed payments, payment arrangements, defaults etc;

- using payday loans;

- mortgage arrears;

- a reduction in the income going into your account.

Making your complaint

What you need at the start

You don’t need to know the dates your limit was increased before complaining, my template asks for them.

If you have paper statements or you can download them from the app, that may be useful for you. But you don’t need to send these statements to the bank with your complaint – the bank already has them!

You can’t go back and see exactly what your credit score was in say 2021 when the bank increased your limit. But your current credit record shows what was happening back six years, so download your credit report now and keep it. The sooner you get the report, the further back it goes. I suggest you get your free TransUnion statutory credit report.

Send a complaint by email

I don’t recommend phoning to start off a complaint. It’s too complicated and you will be talking to someone that doesn’t specialise in these complaints.

I think email is the simplest way to make these complaints. Here is my list of bank email addresses for complaints.

An alternative is to send a long message in the app. But if this means using a chat facility, it’s not usually a good idea, as you are again talking to someone who doesn’t understand what you are saying and tries to tell you what help is available with your overdraft – when all you want is to have your complaint considered.

A template you can adapt

The section above looked at the reasons to complain and the other good points that apply to your case – you can turn those into a complaint.

In the template below, I’ve invented some examples and dates so you can see how a complaint email could read. The bits in italics should be changed or deleted to tell your story.

The bit about other points is important – what should your bank have noticed that showed you were in difficulty?

I am making an affordability complaint about the overdraft on my current account number 98765432.

Your identity details (these are needed if you complain by email, not if you use secure message):

My name is xxxxx xxxxxxxx. My date of birth is dd/mm/yy. The email address I use/used for this account was myaddress@whatever.com.

Your home address (if you know the bank has your current address, ignore this):

My current address is xxxxxxxxxxxxxxxxxxxx. Please do not send any letters to older addresses you may have on your records.

If your overdraft was originally a student overdraft with no interest include this, otherwise delete it:

My account started as a student overdraft and no fees were charged. I am complaining about the period after, when you started to charge fees.

START BY SAYING they should have noticed your financial difficulty

Overdrafts are meant for short-term borrowing but you could see I was unable to clear the balance in a sustainable way. I was using the account for long term borrowing as I could not get out of this. The fees and charges you were adding were making my position worse.

I am complaining that [every year since [20xx] OR for many years] you have failed to notice my difficulty during the annual reviews of my overdraft. You should have offered forbearance eg by stopping interest and charges being added.

By 2017 I had been in my overdraft constantly for many months, not getting back into the black even when I was paid. This “hardcore borrowing” is a clear sign of financial difficulty. My income was only £1,850 a month – after I had paid bills, there was no way I could hope to clear an overdraft of £3500 in a reasonable length of time.

OR

By 2021, although my salary took my account briefly into credit, within a few days, I was back in the overdraft.

include any other points that show you were in difficulty

You should have seen that I was in financial difficulty because you rejected my loan application in 2019.

You should have noticed that the income going into my account decreased from 2021.

From 2020-22 there was a lot of gambling showing on my account.

In 2021 you should have seen from my credit record that I had made payment arrangements with other debts.

Say if the intial limit was too high or it was later increased too high

You should never have given me an account with such a large overdraft. When I applied in 2016, you should have checked my credit record and income and seen I had recently missed payments to a credit card and had taken several payday loans.

OR

You should not have increased my overdraft limit in about 2017. When you increased the limit, you should have seen that my debts to other lenders on my credit record had increased a lot.

I do not know the exact months of the overdraft limit increases. In your reply to this complaint, please tell me when the increases were and how much the limit went up on each occasion.

END BY asking for a refund of charges and interest:

I would like you to refund all the interest and charges that were added to my account from 2016 when you increased my overdraft limit.

OR

I would like you to refund all the interest and charges that were added to my account from 2021 when you should have realised that my finances had got worse to the point that I was no longer able to clear the overdraft.

Please remove any late payment and default markers from my credit records.

Points to note

Student overdrafts

You won’t win a complaint about a student overdraft saying you were a student and it was unaffordable at that point.

But when the bank has started charging interest, it should start doing reviews and check if you are in difficulty. So from then on, you can win affordability complaints.

You can complain if the account is still being used or if it is closed

These complaints can be made in a lot of different situations. For example:

- you are still using the account or you have stopped using it and are paying it off;

- the account has been closed;

- the bank defaulted it and sold it to a debt collector (here you still complain to the bank, not the debt collector). If the debt collector has gone to court and got a CCJ, add a sentence to the template saying you want the CCJ removed as part of the settlement of your complaint.

But if you have had an IVA or bankruptcy after these problems, or if you are still in a DRO, then you shouldn’t complain – ask in the comments below for details.

Old accounts

Banks may say FOS won’t look at an old complaint, but this isn’t right. FOS will often look at a complaint if it has been open in the last six years. How far back FOS will go seems rather random, but it should be possible to go back at least 6 years.

Open and recently closed accounts aren’t a problem – the bank will still have your statements.

If your complaint is about an account that was closed more than 6 years ago, it’s going to be very hard to win.

Packaged bank accounts

These affordability complaints are not about the fees on packaged bank accounts. MSE has a page about packaged bank account charge complaints.

Personal accounts, not business accounts

The complaints covered here relate to personal accounts. For business accounts, talk to Business Debtline about your options.

The Bank replies

They want to phone me!

People are often scared if they get this message. But it may be good news! You can just ignore it or say you would like a reply in writing.

If you decide to take the call, it helps to be prepared:

- have a pen and paper handy so you can write down anything

- if they say they are partially upholding the complaint, ask them the date they are refunding the fees from, and how much. And say you would like to see this in writing before you decide whether to accept it.

- if they ask you questions that sound complicated or worrying, ask them to put the questions in writing as you find the phone difficult

- when they say they are rejecting the complaint, ask for this in writing, as you will be going to the Ombudsman.

Rejection/poor offer – go to the Ombudsman , it’s free

Banks reject many good complaints, hoping you will give up. So don’t! You know if the overdraft has caused you a lot of problems.

You can’t go straight to the Financial Ombudsman (FOS), you have to wait for the bank to reply, or for them to have not replied within 8 weeks.

Here are some things banks may say to try to put you off:

- you could have declined the increase to your overdraft limit – FOS probably won’t think that is a good reason

- you never let the bank know you were in difficulty – FOS probably won’t think that is a good reason

- your salary was enough to return you to credit each month – this is misleading if bills meant you very soon went into the overdraft;

- FOS will not look into things that happened more than 6 years ago – if your account was still open in the last 6 years FOS may well look at it.

And the bank may offer to refund fees for the last 15 months say, even though your problems have been large for many years. Think twice about accepting a low offer – you won’t put this offer at risk by going to the Ombudsman.

If you are offered a refund for the last 6 years but not any further back, have a think if this is a good enough offer. It is a bit unpredictable whether the ombudsman will be prepared to go back further than 6 years.

If you aren’t sure, post in the comments below.

To send the case to FOS, complete this online form:

- you can use what you put in your complaint to the bank;

- if the bank rejected your complaint or made a low offer, say why you think this is unfair;

- use normal English, not legal terms.

You don’t need to send your bank statements – the bank will send those to FOS. And you don’t need the policy documents for your bank account, the lender will supply those to FOS if they are needed.

Do these complaints work?

Yes! From 2024, some banks are making more offers directly.

A Guardian article featured a case where someone used the template letter here. Barclays denied it had done anything but made an £8,000 “goodwill” payment to the customer.

And if your bank rejects your case, people are winning cases at the ombudsman. FOS is a friendly service although it isn’t speedy. It isn’t faster to use a solicitor or a claims firm,

The comments below this article are from other people who have made this sort of complaint. That is a good place to ask for help if you aren’t sure what to do.

MARK says

just been sent my rbs reply to my complaint…Very sloppy, first line says, i understand you are complaining about personal loans…

When, its the overdraft….

ive now complained to FOS…

Cocodog411 says

HI Sara,

Just after some advice please. I have 2 current accounts with RBS. One has a small overdraft facility (£250) and one has none. Between 2016 and 2018 I was really struggling financially. Over this period RBS charged me over £2,000 in charges over both accounts. I submitted a refund claim to them last week, using your template and they have come back to me basically rejected the claim. They state this is because I applied for the overdraft in 2016 and stating the overdraft is automatically agreed and no one actually looks at the application and going on to say ” the onus is on the customer when agreeing to an overdraft that the lending as affordable”. They also say if I was struggling financially I should have contacted them to remove the overdraft but I contacted them loads when they were charging me £90 at a time to tell them they were making matters worse and they even took money from my savings account without my knowledge to cover the amount I was over my overdraft limit following the charges. They also say the will not uphold my complaint as I fully utilised the overdraft!! I am today still always at the top of the overdraft as they will not reduce as it is such a low amount I only have the option to pay it off and then remove it.

Can this go to FOS?

many thanks

Sara (Debt Camel) says

How much money was in your savings account? was it there for a particular reason?

Cocodog411 says

I can’t remember exactly but probably about £50 as I remember it was all I had . I move my money into my savings account all the time as I don’t like leaving it in current account. It’s just habit.

Sara (Debt Camel) says

ok that is fine – if you had had a couple of thousand sitting there, then RBS could reasonably have expected you to use that money to clear your overdraft.

I think this sounds alike a good complaint. Send it to FOS and point out that you had told RBS you were stuggling and they ignored you.

Cocodog411 says

Thank you Sara. I have not sent anything to FOS before. Do you have contact details and do I send my original complaint letter and RBS’ reply with my complaint?

Sara (Debt Camel) says

the article above these comments has a section on sending a claim to the Ombudsman

Calum says

Sorry to be a massive pain Sara, I know you go above and beyond, but what is the best email address to send to RBS?

Thanks

Sara (Debt Camel) says

If you have an open account, the best option is to use the secure messaging in the app.

If you don’t, try customer.relations@natwest.com with COMPLAINT as the subject

expect them to reject thew complaint and send it to the Ombudsman, don’t be fobbed off.

Mark says

i used the app in my complaint to RBS..

Looks like they respond to complaints via a template rejection letter as the reply

mentioned me complaining about loans, when i complained solely about my overdraft at the time.

I have already passed on to FOS and i fully expect to win.

Lee says

Hi Sara, I am currently constructing a letter to Santander based on your template above relating to Overdraft fees. I have been living in my overdraft effectively for over 7 years, and have paid over £1,500 in fees in this time. Literally as soon as im paid, im back in the red by a substantial amount once the mortgage payments, bills etc come out. Across the years, I have been unfortunately had a bad gambling addiction and although i have limited recently it still sits in the statements to this day. So will utilise the template, regarding the annual reviews. A couple of questions regarding the template if you dont mind me asking…… You mention a specifc date to when they increase the limit, however i want them to review the last 7 years in total (as the limit fluctuated by my request between the 7 years), therefore is that possible to articulate in the letter, further more i have calculated through the statement the exact amount i have paid since 2015 , therefore would you advise to put this in the letter and ask for a refund alongside the 8 ….. sorry if these are silly questions

Sara (Debt Camel) says

I would just change the template to say that although your limit has changed over the last 7 years it has never been affordable so you would like a refund of all the charges from the last 7 years. You don’t need to quote the amount. Point out they could see your gambling problem from your account.

Expect them to reject this as the problem started over 6 years ago – ignore this and send it to the ombudsman.

Lee says

Thank you so much for your prompt response. I will send off tomorrow and hope for the best. Will keep you updated with any progress (Good or bad)

Adele says

Hello,

I raised my complaint with Ombudsman on 1st July last year (9 months ago) regarding overdraft charges.

Every time I call them they tell me it is waiting allocation.

I’ve raised complaints since and all been dealt with and resolved.

I’m running out of patience now with this. 9 months is an awfully long time for me to be waiting.

Is there anything I can do to get this looked into quicker. I don’t mean to sound like I’m moaning so apologies if I do.

Thanks

Gareth says

Hi Sara

I first want to thank you for advice on affordability on your website. After getting my self in mountains of debt (I am now almost clear after a couple of hard years) i took your advice and complained to loan companies, credit card companies and also payday loan companies and have since had numerous payouts as they accepted responsibility. Unfortunately several companies went bust before the pay out.

This leads me to the above article and a request for more help. As a student I opened the Natwest account in 2004 and got the £2000 overdraft, through all of uni I never came out of that overdraft. In 2011 I opened a new account with another bank. Since then no money was paid in to the Natwest account on a regular basis, the overdraft stayed at £2000 and i only ever paid in enough to cover the interest to keep the wolves at bay. This was all while I was managing crippling debt from payday loans, bank loans and credit card debt. Natwest in the 11 years since ( i cleared the overdraft in december with a lump sum payment) have never once contacted me to say they can see im struggling or offered help. They have only carried on charging interest and fees when the account went over the agreed overdraft limit.

Have I got a case to claim and unaffordable overdraft and if so how do I go about it. As ive tried to contact Natwest and its impossible.

Thanks in advance

Sara (Debt Camel) says

Its pretty normal to be in a stident overdraft all the time, you can’t complaint about that period.

But from 2011 I think it should have been clear to NatWest that there was a problem with the account as no money was being paid in on a regular basis. And if they had looked at your credit record they would have seen all the other problems.

You could ask for a refund of all charges from 2011.

expect NatWest to reject this, they may say it is too old. if they do, send the case straight to the Ombudsman who can look at cases where someone has complained within 3 years of finding they had a reason to complain. Yoou can point out you knew the charges were causing you problems but you did not know that a bank should have reviewed overdrafts to check they were affordable, so it was only when you came across hhis page this year that you realised you had a cause to complain.

Ernest says

Good afternoon Sara… any advice for this pls… about irresponsible lending for my overdraft and loans… l just received this email from adjudicator by regent my complaint.

understand that you applied for your overdraft and limit increases online. There wasn’t anything in the information you provided or your account history with the business which suggested you wouldn’t be able to repay the overdraft within a reasonable period of time, without undue difficulty. Your salary and other incomings into the account were high and the account was in general well maintained. I appreciate you’ve said that you had a gambling addiction at the time of applying for the overdraft and subsequent increases, however whilst there were a lot of outgoings related to gambling, there were also a lot of incomings from gambling winnings. At the time the overdraft was approved and subsequent increases, I can’t see that the gambling on the account was causing you financial difficulties. As such, I don’t think it was wrong for Halifax to have approved the applications.

Sara (Debt Camel) says

do you think that is a fair summary?

Ernest says

No because some cash came to my account which l borrow from my friends and family that is not my income from work .. and they count as my income…

Sara (Debt Camel) says

so give some rough numbers. On a typical month (take a few months and average the numbers) what was your income? How much did you spend on gambling? how much did you win? how much extra income was coming in from other borrowing eg from friends and family. what was the overdraft at the start of the moneth? and at the end?

E says

My monthly income between £1500 t £1600.. gambling in a month between £400 and £600 monthly .. my house bill with mortgage credit cards overdraft payday loans car finance about £1600 monthly.. borrowing from friends and family about £500 monthly.. also l received pay out for my car accident of £9210.69

Because my car was written off. They count that as my Income because l have transferred the money from savings and current account.. which l used the money to buy another car to drive to work…. insurance payout for your car that is written off is that an income pls???

Sara (Debt Camel) says

and how large was your overdraft?

E says

The overdraft is £2000 from £500 increases to £2000 and aslo £1500 personal loan to clear proportion of my overdraft to £500 am still pay the loan and still still paying the interest on the overdraft.

Halifax offered you a personal loan for £1,500 to clear the proportion of your overdraft on which you were paying 49.9% interest and the interest rate on the personal loan would be 19.9%. Halifax also offered to reduce your overdraft limit to £500, as the first £500 was interest free. I can see that you took this personal loan on 21 September 2020.

Sara (Debt Camel) says

Then I suggest you reply that your income was £1500-£1600, your mortgage and other bills came to about £1600 , you were gambling £600 or so a mo0nth and you were only being kept afloat by money from family and friends. And that you had a large car insurance pay out which was spend on another car. [assuming all that is correct????]

This is worth a try but you have to accept that this doesn’t sound like a simple case and that you may not win it.

Vince says

Hi Sara

Today I have received a reply from Halifax saying ‘We agree with your complaint’ and offered only £281, they state, ”As your last overdraft was in 2012, you needed to let us know about your concerns by 2018. Because you didn’t get in touch with us by this date, we’re not taking this part of your complaint further,’ is this correct?. They have accepted liability, so surely it should go all the way back, to 2012?.

This is there final decision they state by the way.

The account was opened in 2008 and was struggling as soon as an overdraft was used, I believe the account had already got the overdraft it was not asked for.

Sara (Debt Camel) says

the account was closed in 2012?

Vince says

Apologies, no the accounts were alive up until the beginning of this week. I put the complaint approximately 1 month ago, they have closed them due to the complaint. They stated on letters received this week about the closures that I asked them to do this, but I never did. The accounts have been open since 2008 as stated before. As mentioned they stated on the letter today in bold writing ‘ We agree with your complaint’.

I forgot to also mention that Halifax made changes to the way they were charging customers and it doubled in price, they went from a standard fixed amount to a daily charge. I could not afford it and even though my credit was incredibly poor and the state of the Halifax accounts , they allowed (or forced my hand) me to get a loan out from them to pay off the overdraft.

Sara (Debt Camel) says

Then I suggest you send this straight to the Ombudsman. The Ombudsman can look at complaints about things over 6 years old where someone has only found out recentley they “had a cause to complain”. now you knew the overdraft was giving you problems but you probably didn’t think you could do anything about it and it was your fault for being bad with money. you only found out in the last year that a bank should have reviewed your overdraft to see if it was still manageable, and until you knew that you didn’t realise you had a reason to make a complaint.

Vince Le Whadher says

Thank you Sara,

I wanted to also tell you in that letter received they wrote: I am unable to offer you 8% interest payment as the refund of charges wouldn’t have taken your account balance into credit. Not sure what that meant, but the accounts were closed with no debt, I cleared the account with a different loan and did not bother using the account again. Also I thought the 8% was an interest payment for the money they are giving back, in return for having it for so long?.

Sara (Debt Camel) says

ignore the 8%, that doesn’t matter, what does matter is getting the basic refund sorted.

H says

Hello,

Just after some advice please, I had account with Bank of Scotland from around 2007/2008 which I was continuously increasing the overdraft due to debt, payday loans etc. I entered into an IVA around 2013 and this account was on it, IVA failed after a couple of years, and I have never paid any more towards overdraft etc.

would it be possible to open complaint regarding spiralling overdraft after it’s been in an IVA even though the IVA failed? Thank you

Sara (Debt Camel) says

They carried on adding charges to an overdraft after a failed IVA? What is the current balance?

H says

No, sorry, I didn’t explain very well. The account from Bank Of Scotland was included in my IVA, roughly £5000 overdraft balance was on it at time of IVA approval… I applied and got IVA around 2013… the IVA failed around 2016… not paid anything further towards Bank Of Scotland debt… never actually been requested to pay any further towards it since IVA failed I don’t think. All of the £5000 owed was in spiralling / progressive overdraft and fees etc. Didn’t know if possible or worry sending complaint to Bank Of Scotland or not? Thank you for your time.

Sara (Debt Camel) says

It is very likely that this old overdraft debt is now statute barred – too old to be enforced in court. If you want this confirmed, phone National Debtline on 0808 808 4000.

But if you make a complaint about it and win, your refund will first be used to clear this old debt.

Also it’s going to be very hard to win a complaint here about what happened in 2007/8 that has been closed for 9 years. There may be no information about it.

I’m not sure this is worth bothering with. The debt has effectively been written off.

Aaron says

Where do you stand with possible refunds on charges refunds on unarranged overdrafts, HSBC literally charged my month after month pushing my account further into an unarranged overdraft that I didn’t have. No overdraft was given to me prior to this there fore I was being charged for an overdraft they were putting me into further with charges

Sara (Debt Camel) says

how long did this go on for? How large were the charges each month?

Timbo says

Hi just sent off an email about an overdraft I had with Nationwide. With three months they upped it from £500 to £3000 ( I was earning about £1900 a month) with a lot of payday loans on my credit history and my nationwide credit card maxed out at its £3500 limit . It meant for the next three years I never came out of my overdraft and only did when they withdrew it with in 30 days and I agreed to pay back £100 a month until it was cleared. Has anyone had experience of claims with nationwide?

Sarah Wood says

Hi Sara

I wondered if you might be able to advise me on a Barclays overdraft, a few years ago I was consistently using the full amount of my overdraft – I was never in debit. They decided to almost triple it, way above the amounts going into my account and of course I was further in debt. I raised the issue via telephone once i managed to clear the debt as I thought it very odd and it happened to be around the same time the overdraft fees shot up but they brushed me off and said they didn’t know anything about the increased fees???

I have avoided making a formal complaint as I seem to recall around 17 years ago I made a complaint about overdraft fees – it was around the start of the whole PPI thing and they made me sign a document saying I would not raise the issue again – Im not sure if Ive imagined taht part???

Sara (Debt Camel) says

I don’t know what you signed. But if you are complaining about something that happened more than 17 years ago you aren’t likely to win anyway.

Sarah says

No sorry I think that was misleading, 17 years ago I claimed for what is essential a refund on my overdraft charges as they were upping my overdraft etc. in 2016 they did the same thing again upped it to more than triple my wages even though I was never out of my over draft – I know I was foolish to get in to the same mess again. Can I claim for the last few years or would I not be able to?

Thank you

Sara (Debt Camel) says

what refund or help did you get in 2016?

Sarah says

No refund in 2016, in 2016 I was constantly in my overdraft by at least £500 then they increased it from £1200 to £4900. My income was around £900. I’ve only just got out of that cycle in the last year.

In 2006 I made a complaint that my account was £600 overdrawn even though I had no overdraft agreement and I was paying massive fees, I seem to recall that as a goodwill gesture they refunded some fees but I had to agree not to make any such claims in the future – I was 19 at the time.

Sara (Debt Camel) says

Then I think this sounds like a good complaint. I don’t think something you signed more than ten years before should prevent you from complaining about a bank trebling you overdraft 10 years later.

send this straight to the Ombudsman if Barclays dont at least offer to refund charges from 2016.

Sarah says

Thank you – I shall use your templates and see what comes of it!! I have heard of some banks closing customers accounts when they make complaints – is this likely??

Thank you again for your help

Sara (Debt Camel) says

It’s unlikely they will close the account or remove the overdraft but in any case it might be a good idea for you to move to a new bank with no overdraft and start afresh, just seeing the overdraft as an old debt to be paid off. Monzo and Starling are good current accounts with apps that help you budget.

Anno says

Hi I’m after some advice please I have an overdraft of £600 with NatWest I have been in this overdraft for over 10 years, I was in financial difficulties with pay day loans my wages went in paid the OVerdraft and payday loads I then have to take them straight out and basically use the overdraft to get through the month went on for years until I opened a new bank account and got my wages paid in to there and stopped the pay day loans I still have the overdraft which I just pay the interest charge each month could I complain on this?

Sara (Debt Camel) says

what is the rest of your current financial position like?

Anno says

I have many defaults on pay day loans credit cards etc rent arrears moved back in with my parents due to the financial difficulties I’m on monthly payment plans for them all now

Sara (Debt Camel) says

I suggest you talk to StepChange and set up a debt management plan. And include this overdraft in the plan.

You can also complain about the overdraft, but really you need the charges stopped right now. A complaint that goes to the Ombudsman – as many of these do – can talk a long while to go through.

Tom says

Hi Sara.

I have a current account with Barclays that was initially set up when I went to University back in 2002 and was granted an overdraft facility. Essentially since then I have always been in the overdraft and never spent more than a few months in the black at any one time.

I have looked at the Barclays online banking facility and the oldest statement on there is from December 2009 at which point my overdraft was £3,000 and my monthly salary was £1,080. I had significant gambling transactions on my account at the time, which in time lead me to take out payday loans. I was almost every month being charged guaranteed transaction fees of £8 for every time i made a transaction above my overdraft limit.

I still currently have the overdraft which is down to £1,500 but I am still living within the overdraft and never being out of it. Fortunately I have a refund on the way from Quick Quid (£2,600), thanks to your advice, which will allow me to finally clear the overdraft.

Basically i have never been out of the overdraft for 20 years so am looking to make a complaint to Barclays.

Firstly do you think I have a basis for a complaint?

Secondly if I can only see statements from December 2009 on the app will this be as far back as a complaint could go?

Thank you for all of your help.

Sara (Debt Camel) says

I think this sounds like a good complaint. Make the points that the overdraft was much higher than your salary, so you were 2hardcore borrowing” as it could never be cleared. And point out that Barclays should have seen the gambling transactions and that you had payday loans – all signs of major financial trouble.

Even if it only goes back to 2009 it should be a good refund!

Expect Barclays to reject it because of its age and then send this to the Ombudsman.

qq says

Is the Camelot (Lotto, Euromillions) once or twice a month considered gambling? (£10 – £20)

Sara (Debt Camel) says

Probably not at that sort of low level

qq says

I’m surprised there are no FOS decisions in regards to overdrafts at HSBC (Last 15 months). Are they so good and uphold all complaints at the point of the first moan?

Sara (Debt Camel) says

It may just mean they accept all adjudicator decisions. Only Ombudsman decisions are published.

Dave jones says

Hi Sarah, not sure I have a case. I am with Barclays and have been since I was 11. As a student 17 years ago I got a university overdraft for up to £1k. This increased to £2k by the time I graduated. 14 years later when my salary is paid i am still in this overdraft. I’ve paid various account fees over the years and now pay monthly for being in the overdraft. Plus I was given the £150 reserve which is often used by the end of the month. I have won various affordability’s complaints from pay day loans including 1.2k from the most recent cash Euronet ones. I am living within my means now but am paying 60-85 per month in fees and not clearing anything. Apart from being a complete idiot for being still in this situation do I have a complaint and should I open a new bank account with or without the switch guarantee before making a complaint?

Sara (Debt Camel) says

How much of the month are you in your overdraft?

Dave jone says

All of the month i think I have been out of it maybe 6 times in the time ive had it

Sara (Debt Camel) says

Then this sounds like a good complaint,

Expect Barclays to reject it because of its age and send it to the ombudsman.

Dave jone says

Thanks Sarah, should I be opening a new bank account before making the complaint? I dont want to get stuck if Barclays canel the overdraft.

Sara (Debt Camel) says

They don’t normally. On the other hand why not move to a bank such as Monzo or Starling? nice apps with great budgeting facilities.

Dave jones says

Ok thank you very much. You’re a real life loving angel

Sim says

I had made an unaffordability compliant with Natwest for overdraft. My overdraft was £4000 and I was in overdraft for more than two years and had been paying only for the interest. Natwest final response said that they had done their check and did not uphold my complaint so I sent it to FOS. FOS just informed me that Natwest informed them that they made a settlement offer to me which they did not. Can they make such lie to FOS anyway I responded that they did not made any offer nor did not received any letter nor email for any settlement. Also I am on DMP and Natwest continue to charge me for interest for my overdraft and loans can I make a complaint about why they are still charging me for interest

Sara (Debt Camel) says

the overdraft was listed in your DMP?

Sim says

Hello Sara

Yes it is listed on my DMP

Sara (Debt Camel) says

Then they should have stopped the changes. I suggest you also tell your adjudicator this.

If your adjudicator says that is a seperate matter, not part iof this complaint, then let this complaint get resolved and if you don’t get a refund for that period, put in a new complaint about that specifically.

Sim says

Its not only the overdraft that they are still charging interest. They charge interest as well in the three loans I have with them. And this three loan is also part of my DMP. I called them and asked why they are still adding interest they just transferred me to Moorcroft and said that they are dealing with my accounts but it was natwest sending me the statements so I am confused. So my balance with them really has not changed much.

Ruth says

Hi Sara,

I’ve been with RBS since I graduated and started building debt when I became single mother 10 years ago. Long story short, I started with o/d and cc usage, then took loan to refinance both and then would go back to using o/d and credit card and refinance everything every 2 years or so and never repaid a single loan off with my loans becoming bigger and bigger with worse interest rates. There was also a period of a few years when I was in £4k o/d and utilising credit card limit of £1k slowly going up plus taking wonga and qq loans. My debt with them is managable now (kind of as long as nothing bad happens with earned income), but I am fully utilising almost £3k credit card and I still have overdraft, but will reduce it to 0 due to qq payment today.

During the period of o/d use during those 10 years they only contacted me once to offer refinancing into second loan and actually refunded charges of around £100 for a short period. However, looking at my statements at the last 7 years (they only show last 7 years online) , I paid so much more in interest and unarranged o/d and unpaid item fees, especially during that dark period when I was taking qq and wonga loans.

Do you think I could make a successful claim considering there were short periods o/d and cc went to 0 due to refinancing and would it be just for o/d, or is there anything else I could argue was irresponsible lending? And if yes, would I have to submit one or separate claims?

Sara (Debt Camel) says

I think you should make a single complaint about the overdraft, loans and credit card usage. Say the bank has not treated you fairly by keeping offering loans to refinance overdrafts and then allowing you to borrow more, when they could see you were struggling and taking payday loans.

Bozza says

Hi, I composed my letter to bank regarding the £500 overdraft I lived in for years which was increased to 17 times that to £8500. I had a bad gambling habit and earning only £3000 a month which wouldn’t allow me out of my overdraft of £500 after bills.

They let me increase my overdraft consecutive days up and up until I reached £8500.

I’ve paid on average £230 a month interest for 2years now.

I received my reply today saying they don’t agree with my argument but as a token gesture they have credited my account this months interest of £200 or so into account.

I thought I had a good case as within the last three years after living in £500 overdraft with lots of gambling transactions for years previously they allowed my limit to go up so high were I wouldn’t have a chance of paying it off.

Really disappointed and the worries continue.

Do you think it’s worth replying or should I be thankful of the £200 back for this month and look at some kind of debt company who may be able to help.

Sara (Debt Camel) says

I think you should send this complaint to the Ombudsman straight away.

What is the rest of your financial situation like? What other problem debts do you have? Are you behind with any important bills?

Have you managed to stop gambling?

Bozza says

Hi Sara thanks for your quick reply.

I have the £8500 overdraft which is lived in.

I have a large loan £7000 left to pay.

I manage to survive paying all bills maybe the odd one is later from time to time but as I earn a decent wage I make it work. I’ve managed to cut the gambling down dramatically in the last year or so maybe £25 a week with the thought I may win and my troubles will be over. Silly I know.

Ok I will take your advice and forward my letter to bank and also their reply. Do you think I have any chance of getting anything more then the £200 they credited my account with?

Thanks for your help.

Sara (Debt Camel) says

I hope so! Send it to the Ombudsman if they don’t make you a decent offer – if you aren’t sure, come back here to discuss it.

Andy says

Anyone had any success with TSB?

Had a £3k overdraft for around 5 years which i am always in

Only recently my wage has reflected this amount, back when they gave it to me my wage was around £1,500.00

They are 4 weeks in to my complaint sent and have sent me a letter today to say they are still investigating my complaint

Kim says

Has Anyone had a successful claim with Clydesdale Bank/virgin money recently? If so how long did it take?

Sara (Debt Camel) says

I don’t remember one recently. Expect them to reject this and send the complaint to the Ombudsman.

Laura says

Hi can anyone help/advise pls? Had a hsbc overdraft refund complaint held up last week by fos which hsbc agreed to. Can anyone advise how they contact you to sort the refund, how long it takes etc. I’m expecting a rather large refund and it could really really help but I don’t know how long it will take

Laura says

Anyone? They agreed on 24/04 and yet to hear from them and I’m financially struggling this month 🥹

Sara (Debt Camel) says

They have 28 days in which to sort this out. I suggest you don’t expect it until then of that period…

what are the rest of your finances like at the moment?

Laura says

Okay thank you. Normally finances are stable (after a long long time of struggle) but this month I’ve been caught out by having to pay more tax and bills going up. I will have to try and borrow some money from family. I was hoping they might come back to me quicker but it looks like they will string it out to the last minute.

Laura says

So still waiting for hsbc to contact me, I don’t even know what I should be getting back apart from it should be fairly large, 6 years worth with at least 4 of those years being 60-80 in charges alone each month. FOS have been really good and asked that hsbc pay me early but looks like they will be simply ignoring them too. Never ever will I us hsbc again they have been the only worst to deal with out of all my complaints!

Saz says

Had my response from Halifax

Is it worth sending to the FOS.. had a overdraft for 2500 for years got it down over the years now I only owe 1100 I was in bad circle of payday loans etc.

Thanks for getting in touch about your overdraft and your financial situation. We haven’t been able to talk about this, but I’ve looked into this for you and based on what we know, we’re declining your complaint.

I’m sorry for any upset or inconvenience caused by this. I appreciate this may not be what you expected, so I’d like to explain our decision and what you can do next.

We’ve paid you £100.00

I’m sorry to hear about the impact arranged overdraft fees are having on your finances. I’ve paid £100.00 to cover some of the charges that debited your account in the last 12 months.

We’ve taken steps to temporarily stop further arranged overdraft fees

A 30 day freeze on arranged overdraft fees was added to your account on 5 April 2022. We’ve paused fees on your account as we want to give you the time to get in touch with us so that we can discuss how best we can help you.

Sara (Debt Camel) says

That is all they said? They are declining it without giving any reasons?

can you say some more about the overdraft?

did they increase your limit? to what? how long agao?

what was your salary at that time?

do you know how much you have paid in overdraft charges in the last year?

Saz says

Yes that’s it. They just mention FOS. It was from 2016 from when I was browsing from Peter to pay Paul upping my overdraft to pay other payday loans etc debts. I was on around 1500 a month at the time maybe even less and trying to get myself out of it ever since. Overdraft fees between 30-40 a month. I am now in better financial position and slowly getting rid of it but I was really bad at the time.. young and stupid!

over space over a month or two I upped my overs after from a few hundred to 2500 there was even times I’d reduced it for a few week hoping I wouldn’t do it but then would up it again!

Sara (Debt Camel) says

Then I suggest you send the complaint to the Ombudsman straight away. £100 doesn’t cover much of the last years charges, does it, let alone any previous ones.

The overdraft was a lot more than your wages – how were you supposed to clear it? It was unaffordable.

Saz says

Thank you Sara,

I will do it straight away funnily I’ve had to chase them 3 times to email me the letter as they said they posted it of 5th April only got the email today. I’ll keep you posted.

Jade says

So ive followed the advice youve given and complained about a 2500 over draft from lloyds bank, they have responded by saying they will wipe 2210 off it. There is a part of the letter i dont understand which says i dont qualify for the 8% back as the account is in debit and its definately not its minus 2500. They have also stated i have to pay the rest or my bank account faces closure. Do i take this as a win or esculate to the FOS? Thank you

Sara (Debt Camel) says

How long have you had an overdraft problem – can you say some more about it as otherwise I can’t guess if this is a good offer or a poor one.

What is the rest of your financial situation like at the moment?

When they say your account is in debit, they mean you are using your overdraft. If your account was in credit, then you would have money in the bank, no overdraft.

Mh says

Hi,

Interesting question for you. Whilst a student in the last 6 years, I was able to open 4 student bank accounts with the overdrafts (£5500 total) that they come with without any issues and used these to try and pay off other debts. As far as I am aware your only supposed to be allowed 1 student bank account however there seemed to be no check in place to see if I had another which allowed me to get into these debts. Surely they could have seen that I was in overdraft debt in other accounts and not let me have the account. I as a result now have defaults etc on my report with these accounts. Whilst I never paid anything back and entered into a trustdeed, I wonder if there is any grounds for the defaults etc to be taken off my credit file?

Sara (Debt Camel) says

With a trustdeed on your credit record, removing a few defaults isn’t likely to make any difference I would have thought. But ask a Scottish expert by posting in the comments on this page: https://www.advicescotland.com/home/protected-trust-deed/.

Lewis says

Hello Sara,

Could you help me please.

I had an account with NatWest.

Standard / Basic account – No overdraft/No credit cards.

My credit history was awful so just had an account for my wages.

I was gambling online and noticed a day later that my account was £1100 overdrawn.

My account was immediately closed by the bank.

I set up a payment plan with Stepchange and now pay them monthly to clear it.

I raised a complaint with NatWest as they shouldn’t of even let me go overdrawn.

My account didn’t have this facility.

They didn’t uphold my complaint and said that it was in relation to pending transactions as to why it happened.

I raised it with Ombudsman.

They called me today and are now saying that they will look into the ‘pending transactions’.

The lady didn’t sound very confident with my case.

I just find it really weird how it happened.

Even if something is pending in my bank then it still comes off my available balance.

Am I wasting my time?

If the Ombudsman don’t uphold my case then is there anything else that I can do?

I know I am partly to fault as I should’ve been on top of what was going in/out but the transactions were accepted so I just assumed I had the funds.

Thanks

Lewis

Sara (Debt Camel) says

I haven’t seen an Ombudsman decision on one of these cases.

If your case is rejected at FOS by an adjudicator, then you can ask for it to be looked at by an Ombudsman.

If it is rejected by an Ombudsman, your only option is to sue the bank. I think you should take professional advice from a solicitor if you want to do that.

Lewis says

Thank you.

I will wait and see what they come back and say.

Lewis

Rob says

Hi Sara,

Great work you do here and its much appreciated. Can you advise if there is an email address for overdraft complaints for Santander? I have scoured their site yet cannot find one, apologies if this has been asked before. I have tried looking on this site yet cannot find anything in comments or replies regarding Santander email address.

Thanks in advance, Rob

Sara (Debt Camel) says

Banks normally want you to phone them or send them a complete via secure messaging. Or write a letter.

You can try emailing customerservices@santander.co.uk with COMPLAINT as a title. I don’t know if that will work.

Rob says

Thx Sara, will givebit a go. I have today spoke to them as i no longer have access tobthe account. Im still paying off the overdraft via a DMP. The email you suggest is the same i was given by the advisor who assures me they will take onboard the complaint via that channel

Thx again.

Chris says

Hi

Has anybody won a case against the Halifax for giving unaffordable overdraft ?

Thanks

Sara (Debt Camel) says

A lot of wins against Lloyds.

Vince Le Whadher says

Yes, I did but they ringed fenced the amount of years claimed, I have subsequently sent to FOS to inspect on Sara’s advice. Personally they actually agreed to my complaint, so they have accepted they had failed me, so it makes no sense that they ring fenced, when the accounts were on trouble for many years before.

Chris says

Hi

Thanks for reply so how many years did Halifax go back too ?

Thanks

Vince Le Whadher says

To 2017, they have poor reasons for do this, saying there was no issues before. There were actually 2 current accounts with overdraughts on both in negative. My wages were put into one, which put it into positive, which soon became negative when bills came out, they were taking overdraught payments out of negative balanced accounts, this went on for years before 2017.

Lee says

Santander?

Sara (Debt Camel) says

These complaints are too new for me to be able to guess a success rate. And the Ombudsman decisions website doesn’t help as they bundle together all complaints about a bank, not just affordability.

But this really doesn’t matter to you. If the success rate is 80% or 20% what matters is what will happen in your case, and they are all quite individual. Can you say something about your situation?

Lee says

Had my response today from santander . Rejected due to below reasons in general :

They complete affordability checks as per FCA regs , and upon reviewing their records are happy the lending facility has been provided correctly

Advised that it’s a self managed and its customers responsibility to regularly monitor their accounts as well as notify santander of any financial hardship that they are experiencing .

Advised fees charged correctly and no unarranged charges have been applied recently…

I will take to FOS but is there anything further to add after this response from santander on my appeal

Sara (Debt Camel) says

Have they said when your limits were changed?

Lee says

Good Morning Sara, Apologies for late response. No they have not, the statements above are really in as much detail as the letter goes to . No dates , no figures etc. on their response to me. I will look to draft out the appeal today via FOS, however is there anything further you would add to the form?

Sara (Debt Camel) says

I would say that you had hoped to provide some more detail, but Santander haven’t answered your questions about the dates they increased your overdraft limit.

Also send Santander a formal Subject Access Request, see https://www.santander.co.uk/personal/support/industry-updates/your-personal-data-rights. Ask for details of the dates and amounts your overdraft limit was increased. And for the total amount per month you have paid in overdraft charges and interest since the account was opened.

Lee says

Thanks Sara, so submit the appeal with FOS alongside the DSAR at same time with Santander?

Sara (Debt Camel) says

yes, no reason to delay,

adele says

Hi Sara,

I have an overdraft debt that is currently with Moorcroft. I pay them an affordable amount each month, however it will take forever.

The debt is £2600.

I have £2000 that I have managed to save.

What is the likelihood of them accepting this if I was to offer them and pay it all in one payment?

Would it be put down as part paid on my credit file?

Cheers, Adele x

Sara (Debt Camel) says

do you have other debts? because I assume no interest is being added to this, do it would be better to use the money to clear any credit cards or cataloges that are charging interest.

Adele says

You’re right, no interest is being added. I have two other debts which are both for just over £300. They are just payday loans so no interest or changes are being added. They are with Stepchange who I pay monthly.

Jeff says

Hi Sara,

I’ve just had a redress payment from Lloyds regarding a claim i made about two different overdraft accounts i had with them.

But they have said they cannot look back further than 6 years…should i send this to the FOS?

For back ground about 4 years ago i agreed a refinance loan with LLOYDS for the overdrafts and the credit card i had with them. So the redress is only for that 2 year period before they were refinanced. The overdrafts were in place for about 10 years before i took the refinance load with them. Any info would be amazing? xxx

Sara (Debt Camel) says

Send this straight to the Ombudsman. Who usually will look at older cases – come back here if they say they won’t.

Lewis says

Hi Sara,

I’m not happy with this response from FOS. What do you advise I do? Cheers x

The complaint

You had a basic account without an overdraft. You were gambling and this account was to avoid debt. Despite this you went overdrawn by £1,100. The balance showed you was in credit. It caused you anxiety and has left you in financial difficulty.

My findings

I’ve reviewed the T&Cs of the account you held. The terms and conditions state:

“We’ll continue to accept the following payment instructions even if you’re registered for Overdraft Control. Payments made using your debit card where the retailer doesn’t check with us before accepting payment, that you have sufficient funds available in your account; and any fees or overdraft interest due from your account”.

You stated that you were not aware that the account could be overdrawn but this information was provided to you in the T&Cs. You believed your account was in credit. The bank said the transactions didn’t go through immediately. This could be due to a merchant not notifying them of the transaction immediately. On occasions transactions may not show as pending if they were made ‘offline’ which means the merchant was unable to contact them. This meant that the transactions didn’t debit until 1-4 days after due to card validation and fund availability checks.

I’m not satisfied that the delay was due to errors by the bank. You would have noticed there were delays. So, there was a risk of spending more.

Sara (Debt Camel) says

So you could reply:

– That you don’t think when an account is advertised as not having an overdraft it is satisfactory for such an important point to be in the small print of the T&Cs.

– And that the bank would have known from the Merchant Category Code that these were gambling transactions. It isn’t reasonable to accept those without checking if they would take you into an overdraft that you have said you don’t want by choosing a bank account that specifically did not allow for an overdraft. So you don’t think the bank has treated you fairly.

Lewis says

Thank you so much x

Sara (Debt Camel) says

I do have to say that is is not a “standard” overdraft refund complaint. I haven’t seen one like this. But this is worth pushing on as I feel you have been badly treated.

Laura says

Well finally hsbc have contacted me to sort Payment! Hurrah! In just 5 years I had interest and charges of over 5,000 on a 1750 overdraft! Keep going people and don’t give up!

Sally says

Hi Laura,

I’ve submitted a similar complaint to them for similar charges and interest on a £1700 overdraft. How long did it take for them to resolve?

Thanks

Laura says

My original complaint was submitted to hsbc in early September: they took 7 weeks to reject and I immediately sent to ombudsman which was picked up early April, they agreed with my complaint almost immediately but hsbc have taken from 14th April till today when they have finally paid up.

Micheal says

Anyone help? I’m not sure how to end the email, I’m not very good at wording.

I have a RBS overdraft of 800- its constantly used since about 2015. I wasn’t working when I applied for it or when I upped it a few times to the 800. I wasn’t working when I opened the acc in 2013ish right up until 2019 and I didn’t have any benefits going into it either. In 2014/15 I was also gambling an awful lot and there are lots of transactions on my statements (no longer a problem). This account is not my main account as I opened a new one a couple of years ago with a different bank.

Sara (Debt Camel) says

one important point to make is whether they increased your limit at the time when you had gambling problems?

Micheal says

Hi, yes I’ve been looking over old statements. I cant figure out exactly when the ODs were upped but going by the -balances yes the gambling was the same time.

When I started working I applied for a loan with RBS so I could pay the overdraft off but was refused it, not sure if that makes a difference.

Sara (Debt Camel) says

It is worth mentioning that they wouldn’t give you a cheaper loan

Ernest says

Good afternoon Sara .. pls l need your advice.. thanks for the other days about the advice you gave me l wrote the same thing to Ombudsman after the adjudicator not uphold my complaint… but Ombudsman did .. Halifax will refund me all interest for my overdraft from 2015 till date.. am still bankin with them at the moment am received my wages in to my Halifax bank account and aslo all my direct debit and mortgage go out from there… is that OK if am still banking with them ? Or change to another bank.. I have another nationwide bank account. Also they will refund me interest on my Halifax credit card aswell… at the moment l still have £500 overdraft.

Sara (Debt Camel) says

So the Ombudsman upheld your Halifax complaint? that’s good – as I said it sounded a bit complicated.

Also they will refund me interest on my Halifax credit card aswell

excellent

It’s up to you if you want to change banks.

Ernest says

Yes Ombudsman upheld it thanks so so much Sara.

Sarah says

Hi Sara,

Just after some advice please,would i still be able to put a complaint in even though the account has been closed for years (not sure when it was actually closed) I think the overdraft was for like £2000 and was always in it, I did contact HSBC about it but they wouldn’t help me i asked if ever time I made a payment towards it would they reduce it but they wouldn’t,in the end the account was closed and it was sent to a debt collector.

Sara (Debt Camel) says

roughly how many years?

Sim says

Hello Sarah

I just want an advise

I receive this from FOS adjudicator should I agree with what he says

Your complaint about National Westminster Bank Plc

I’m writing to let you know that NatWest have made the following offer to settle your complaint:

“ xxxxx was approved a £4,000 overdraft on 05 February 2018.

As a gesture of goodwill, I would like to offer to refund charges and interest applied to xxxx account from February 2018 to date. See below offer details –

Interest = £1,598.16.

Charges = £163.50.

Total offer = £1,761.66.

On xxxxxx’ acceptance of the above gesture of goodwill offer, I will credit this amount to his account ending *723. As this will leave a debtor balance, I will not provide any interest. At this point, I recommend xxxxx contacts the relevant department on 0800 068 9816 to discuss a suitable payment plan going forward.Having done so, I’ve been in touch with NatWest about what’s happened – and they’ve made an offer to resolve your complaint.”

What they’ve offered to do

I can confirm that the above offer is what we would’ve recommended NatWest to do had we assessed your complaint and upheld your complaint. Therefore, I think NatWest’s offer is fair to settle this complaint.

Please let me know if you accept the above offer as full and final settlement of this complaint by 25 May 2022.

Please get in touch if you have any questions.

Sara (Debt Camel) says

was that when the overdraft started? or was it increased at that date?

what are the rest of your finances like at the moment?

Sim says

Its was increased February 2018 from £100 to £4000 i am on DMP with step change at the moment.

Sara (Debt Camel) says

ok so it is the big increase that was the problem. (If it had been increased from 3000, that would probably have been unaffordable before.)

Is the overdraft in your DMP?

Sim says

Yes it is in my DMP

Sara (Debt Camel) says

so the bank has stopped charging interest I assume? And you now have a different account to use as your main one?

Andy says

TSB have sent me a holding letter saying they need a little more than 8 weeks to resolve my complaint

Shall I give them a bit more time or go straight to the ombudsman?

Sara (Debt Camel) says

You could say it will go to the Ombudsman in 2 weeks? No idea if that will work.

Sam says

Hi Sarah

I have had a overdraft since 2015 and it’s always up to limit by the 2nd week of month every month since 2015 but I have not increased the limit can I still claim ?

Sara (Debt Camel) says

How large is the limit? How large is your salary going in?

Sam says

Hi Sara

To put in a complaint do your overdraft amount need to be increased since you started it because I have not increased mine since it started in 2012 ,but since 2013 my overdraft has always been up or over the limit by the 2nd week of every month due to gambling and struggling with loan debts and seeing I get paid last day of every month just wondering if I can make any claim .

Sara (Debt Camel) says

how large is your limit? and how large is your salary going in each month?

Sam says

The limit is £1200 and my salary was £1500

Sara (Debt Camel) says

Then you can argue that as the limit was such a large proportion of your monthly income and you had used the whole limit early in each month, you have no realistic prospect of ever repaying this and it is made worse by the overdraft charges being added.

Add a sentence saying this into the template complaint.

Lorraine says

Hi Sara

Do you have a e mail address for santander plz the one I sent a complaint to only deals with car finance and I couldn’t find another

Sara (Debt Camel) says

Do you still have the account? Sending a secure message is the easiest way.

Lorraine says

No I don’t sara

Sara (Debt Camel) says

Then you need to write to them Complaints, Santander UK plc, PO Box 1125, Bradford, BD1 9PG

Lorraine says

Thanks Sara

Becks Mash says

Hi

I have a Barclays overdraft of £2520 which I have had for years and years. I am always in my overdraft 100% and dont have any salary going into that account and havent for at least 10 yearsm Basically i transfer enough to cover the interest and then withdraw back up to the full amount, every month. Do I have a case. If they send me an account review they just say they are keeping it as it is?

Sara (Debt Camel) says

What has happened to the rest of your finances during this time? What would your credit record show?

Becks says

Lots of credit cards, overdrafts, payday loans!

Sara (Debt Camel) says

Have your other debts bee getting larger?

Becks Mash says

Yes they have really

Sara (Debt Camel) says

Then I suggest you make a complaint about the overdraft, saying that Barclays should have noticed how your other debt situation was getting worse, with larger debts no payday loans, and how you never repaid my of the overdraft. So it wasn’t responsible of them to continue to offer this overdraft and charge you a lot of interest for it when they spcould see you were In prolonged financial difficulty..

Laura says

Hi Sara,

I raised a complaint with FOS. The investigator said they would not uphold my complaint. I responded back and requested for this to be looked at by an Ombudsman.

The investigator has emailed me today apologising that I’m not happy with the outcome and saying she would like to speak to me and has requested a time that is best for her to call.

I don’t really feel comfortable talking again as I’ve already explained everything, both on the phone and via email. Can I refuse and say that I still want it looked at by an Ombudsman?

Thanks

Laura

Sara (Debt Camel) says

It’s usually better to talk – why was the complaint rejected? Whatever she says, you are entitled to have this looked at by an Ombudsman.

Claire says

Hi, I sent an irresponsible lending complaint to Halifax on the 10th April, on nearly at the end of the 8 week mark, and I got a letter from Lloyds (assuming they deal with the Halifax complaints) stating they need another 4 weeks. I received this yesterday. Is it normal for them to extend?

And do you have any idea why they’d extend?

Thanks :)

Sara (Debt Camel) says

My guess is no one has yet looked at it…

You can send this to the Financial Ombudsman now if you want. Or you could reply saying it goes to the Ombudsman if you haven’t had a reply in 2 more weeks?

Anita says

Hi Sara. I did not accept the compansation offer and sent it to Ombudsman. The adjudicator said that it was a fair offer. Can I come back to the company and accept it even if their offer expired in April?

Thank you in advance

Sara (Debt Camel) says

You need to ask the adjudicator. You can also ask for the case to be looked at by an Ombudsman.

H says

Hi Sara,

Just wanted to say Thank you for all the information you have provided. Whilst waiting for the the quick quid claim to finish i saw one of your comments about overdrafts, so gave it a go as I had nothing to lose. I was rejected by my bank straight away so took it to FOS, after 2 months my case was picked up and a day later I received the Adjudicator decision. He has agreed that my overdraft was unaffordable and have told NatWest to refund me all charges and fee’s since the beginning of my overdraft. This is somewhere in the region of £5k + 8% simple int (I’m very happy right now)

Just a few quick questions,

Do bank’s usually disagree with an Adjudicator decision?

Could you also remind me how to work out 8% simple interest? (so I can get a more accurate final figure)

Many Thanks for all your help with everything.

Sara (Debt Camel) says

Sorry I can’t guess at the odds of them accepting. Ombudsman cases about overdrafts seem to be going through quite fast if this does have to happen.

Do you have a current overdraft balance?

ZC says

Keeping things brief, my wife opened an account with Barclays that was held in joint names. She defaulted on the overdraft in 2003, after which the debt was sold to PRA (sometime in 2004) and token payments were made. My wife died in 2020 and I asked PRA for proof of my liability since I no longer had the original agreement and had no assignment letter from Barclays. One year later, they have sent neither but have forwarded statements from 2003. It is clear from these that an attempt was made to clear the overdraft prior to it defaulting, but it built up again after she used it to pay her credit cards bills. Two questions: does the statement on its own prove my liability (my name is on it) and is there any chance of making an affordability complaint after such a long time? I suspect the answers are Yes and No, but just wanted to check before I reply to PRA. Technically, they have not proved that THEY own the debt now have they?

Sara (Debt Camel) says

I suggest you talk To National Debtline on 0808 808 4000 about the liability issue.

I don’t think you have any chance of winning an affordability complaint about this.

Elle says

Hi Sara,

Final reply from the Ombudsmen about my Barclays overdraft. Sadly, they’ll not look back further than 6 years, I’d added everything you’d suggested but basically they say that everyone (the general public) are/were aware that they can/could complain to their banks.

They’d said they would investigate from 2015-2021 and have provisionally set out what they think should happen in regards to putting things right. They’ve noted that Barclays stated in their final response that my overdraft was “unaffordable and unsustainable” but they didn’t act on this back in 2015….and whilst I occasionally paid chunks off my overdraft this was down to further borrowing from a mortgage reserve account (also w/Barclays) which in turn has had it’s own interest added monthly.

Now, this may sound like a silly question, but where they state that Barclays will need to repay all interest and charges from 2015 to put my account in a position it would have been in had Barclays not acted irresponsibly, can they be asked to refund any interest from the further borrowing too? i.e. had the issues not arisen w/my overdraft, (at the fault of Barclays) I’d not then have borrowed further from another account.

Thanks again.

Sara (Debt Camel) says

I don’t think so.

Paul says

Hi Sara,

I’m with Stepchange. I’m paying back NatWest for an overdraft I had. All interest etc now stopped and account closed. I owe them £2553 and pay £26 per month via Stepchange.

Are banks usually any good with accepting an offer?

I have been offered some help from a family member because I just want this gone.

It’s causing anxiety and I just want to be debt free. What would be a reasonable amount to offer the bank?

Thanks.

Paul

Sara (Debt Camel) says

is this the only debt in your DMP now? how long has the DMP been running?

also can you say something about this overdraft – had it been large for a long while? was it larger than you wages at the time, so you had no ope of paying it off as you were always in in it even when paid?

Paul says

I have a few others too but they are small payday loans. Gone through the whole ombudsman process but sadly didn’t get anything. It’s always been around this mark. I’ve been in a plan about 18 months. I can’t remember if it was larger than my wages. Are they funny about accepting offers? Am I better off just sticking to the plan?

Sara (Debt Camel) says

banks don’t often accept low offers.

Dave says

Just been rejected by natwest having been in a 4800 overdraft constantly between 2008 and 2020,ironically natwest claim biggest overdraft was 3200, just sent statements off to ombudsman showing monthly interest payments for the 4800 overdraft they appear to have forgotten I had, laughable really

DR1991 says

Hi Sara.

I have made a complaint to Halifax about giving me overdrafts on two accounts back in Nov 2019. They have come back and said they totally agree that it was unfair lending and are paying back all overdraft charges back, this isn’t enough to cover the two debts that I still have. If I send to the Ombudsman is there I chance I may get the debts wiped?

Thank you