Loans2Go offers what I have called the worst loans in Britain.

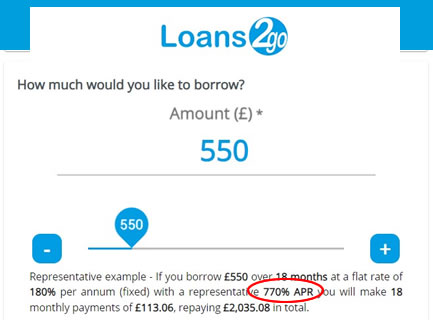

Since 2021 they have been charging 770% APR. See the representative example Loans2Go quotes on its website:

- £550 borrowed for 18 months is a monthly payment of £113

- this adds up to £2035, a bit less than four times what was borrowed.

Contents

MUCH cheaper to get a payday loan than a Loans2Go loan

Of course Loans2Go don’t point this out on their website, but check out these numbers!

With a payday loan for £550, the maximum interest that could legally be charged is £550 – the amount borrowed. So you would only have to repay £1,100 – the £550 borrowed plus the £550 interest. And the monthly repayments for a payday loan for 12 months can’t be more than £92.

So you would pay a payday lender £92 for 12 months

but Loans2Go is charging MORE PER MONTH (£113) for MUCH LONGER (18 months).

Loans2Go also used to offer logbook loans, but this article is just about their standard personal loans. If you had a logbook loan from them, use the template on this other page.

Is this legal?

The Financial Conduct Authority (FCA) calls payday loans “High Cost Short Term Credit”. Its definition of High Cost Short Term Credit is a loan over 100% in APR and of 12 months or less.

So the Loans2go loan is outside that definition because it is 18 months long. So it isn’t caught by the price cap rule.

Unfortunately, this means its loans have crept through a loophole and are legal. I think the FCA should close this loophole.

Many people are winning affordability complaints about Loans2Go loans

I think this is the worst loan in Britain.

A loan is unaffordable for you if the monthly repayments were so high you couldn’t afford to pay them without hardship, borrowing more or getting behind with important bills. This is a standard affordability complaint, used for many other sorts of loans. If you win this you will get a refund of all the interest.

Because Loans2Go loans are so expensive they are often unaffordable. Many people are winning Financial Ombudsman (FOS) complaints about these loans – here is just one example: Miss R’s personal loan provided by Loans 2 Go.

No-one who isn’t desperate would take one of these loans out, and the ombudsman says Loans2Go should make more detailed checks on affordability when it thinks the borrower may be in difficulty.

Several people have said they were not given the full details about the loan before the money was given to them. If this happened to you, say this in your complaint as well.

First complain to Loans2Go

It doesn’t matter if you have repaid the loan or you are still paying, you can still complain.

You have to complain to Loans2Go first, you can’t go directly to the Ombudsman.

Email customerservices@loans2go.co.uk and copy it to ps@loans2go.co.uk. Put AFFORDABILITY COMPLAINT as the title.

Use this template as a basis and make any changes so it reflects your case:

I am also complaining that the interest rate was grossly excessive. It is unfair to charge someone more per month over 18 months than they would have paid to a payday lender for a loan the same size over 12 months.

[only add this next sentence if the date of your loan was after the end of July 2023] This loan does not represent fair value and it is in breach of the FCA’s Consumer Duty.

[only add this if you were not told the loan terms] The loan was not adequately described to me before I was given the money. This is an unfair way to give high cost credit.

I am asking you to refund the interest and any charges I paid, plus statutory interest, and to delete any negative information from my credit record.

[delete if you have repaid the loan] I would also like an affordable repayment plan to be put in place if I still owe a balance after this refund.

I am also making a Subject Access Request (SAR) for all the personal information you hold about me including, but not limited to, my applications, all credit and other affordability checks, a statement of account for my borrowing, and a record of all phone calls.

Let me know in the comments below if you are making a complaint about a loan that started after the end of July 2023, as there are some new regulations about those.

Is an offer from L2G a good one?

If L2G has offered to wipe a small balance or take some money off what you owe, you have to decide whether this is a good enough offer to accept.

For example, they may offer 50% of the interest off “as a goodwill gesture”. Or to reduce your balance by 50%. These are often very poor offers, you could get a lot more by going to the Ombudsman.

Sometimes Loans2Go will increase an offer if you push them. Here is what one reader said:

They replied firstly with the offer to half what was left and agree a payment plan and I refused and they immediately came back and wiped the loan clean and removed it from my credit file.

It’s up to you what you think a good offer is. But you can’t change your mind later if you accept and then think you shouldn’t have.

So ask a question in the comments below if you aren’t sure.

Take a rejection or a poor offer to the Ombudsman

You can send your complaint to FOS if Loans2Go has rejected it or has made you a poor offer. This is easy, just use this simple FOS form which asks you what they need to know to set up your case.

Send your bank statements to the Ombudsman – 3 months before and 3 months after the date of the loan. These are the best evidence that the loan was unaffordable for you.

JOJO says

I got £3000 and had £9600 to pay back in total. Still paying now. I was stupid very stupid but on my road to becoming debt and high interest/PDL free thank God!

Anyone who has not broken the cycle yet do it asap these companies should be stopped or all capped.

I am in a DMP and have broken my cycle and it’s the best thing I ever done.

Jayne says

How did loans2go deal with your DMP?

Ray says

Legal fraud should be illegal thieves

Michael says

I had a loan with Loans2go for £250

Which cost me £1019.52

I did manage to save £247 paying it early but still paid out over £750

Can I get some advice as I’m planning to complain as they have 100% Exploited people in a Vulnerable position

Sara (Debt Camel) says

Hi Michael – I think exploitation is a very good way of putting it :(

You can complain to Loans2Go saying something like you feel you were charged a highly unfair interest rate, you accept that what you would pay was explained to you, but you feel the lender exploited your situation to charged an abnormally and unfairly high rate of interest. Ask for a refund of the interest you were charged.

Expect Loans2Go to reject this complaint and then send it to the Financial Ombudsman, see https://www.financial-ombudsman.org.uk/consumer/complaints.htm.

Also reading https://debtcamel.co.uk/refunds-large-high-cost-loans/ which looks at an affordability complaint for this sort of loan. If you think the repayments were unaffordable, start with the template letter there for a complaint and add on a paragraph about how high the interest rate was and how you feel you were exploited.

steve says

Hi.

I had a logbook loan with L2G my car broke down i couldnt make my payment so they took my car stating it was theirs to do what they want a scrap man came for my car and they received £300 for it when my loan was over £4500 and then they told me to pay balance remaining i only had a £1600 loan with them.

I put in an affordability complaint and they delayed a lot and i got final decision 13 weeks later after excuse after excuse and it was rejected.I sent the complaint to FOS and the guy who looked at all my loans including this one saw that the was many errors on L2G part and upheld my complaint and cleared my outstanding balance and i got just under £500 back in which i thought was disgusting as i had paid 5 times that. I lost my car for £500 really in my eyes but at least the loan was paid off and taken away from my credit file and now i can forget about it.

All i can say is if you are going to make a complaint about them be prepared to wait and wait as they play so many delay tactics

Pearlygirly says

High interest credit is a terrible thing. But some of the lower interest products out there can also end with the borrower paying many times what they borrowed. I know someone with what was originally a £15,000 loan currently at £56,000 and climbing. There is a CCJ and charging order. Blemain finance (secured loans don’t see them so much now) arent using outrageous interest to make their money but they add so many charges the debt soon spirals. Not to mention expensive but often pointless PPI, charges for not having or renewing house insurance ( they add their own to your debt and its typically 4 times the usual cost) and excessive charging for late payments, phone calls / letters chasing the debt etc. Interest is added to all these and it snowballs. Worst of all the loans are secured on property and people can’t easily get out if the mess it causes. Its worth checking all of these kinds of things before you borrow as some of the more benign looking lenders may have different traps for the unsuspecting, especially when things go wrong.

Christian white says

I borrowed a total of £700 from Loans2go. The original loan was for £500 (October last year) and I topped it up after getting texts from them in February this year. I was already in a DMP. I have borrowed to fund a gambling addiction so I have to take responsibility for something that has undermined my mental health and resulted in my home being repossessed. The loan was put into the DMP and Loans2go have come back and given my DMP company a balance of £2537 to pay off thus extending the plan further.

I have made errors before people judge me but I feel really strongly that giving a balance of £2537 is incredibly unfair. Do I have any way of making a serious complaint? Or is my own stupidity and recklessness likely to undermine any complaint I might have?

Any help or advice much appreciated. Thanks Chris.

Sara (Debt Camel) says

I am sorry you got caught by this horrible loan.

Did you have mortgage arrears at the time you applied for the loan or the top-up?

Can you say what your total debts are now, including this one and any debt from the house repossession?

Who is your DMP company and have you been making payments to them during the time your house was repossessed?

Christian white says

Hi the house was repossessed in 2011. The sale plus the 5 years I’d made repayments easily repaid the original loan + about £20000. Even so, still had interest of £45000 to repay. I’ve repaid about half but it’s been erratic. Total debts now are about £50000 (that’s the remaining interest from the repossession plus the debts in the DMP). I’m with Payplanplus. I’ve been with them since the house was repossessed. They’ve been brilliant tbh. But lots of the debt includes huge amounts of interest from high interest loans. The DMP is due to finish late 2020 because I’m making huge monthly repayments into it now.

Chris.

Sara (Debt Camel) says

Good luck with getting a lot of interest back and speeding things up!

You might also want to look at whether some of the older accounts in your DMP are still enforceable – credit cards, catalogues, old non payday loans etc – see https://debtcamel.co.uk/ask-cca-agreement-for-debt/ . This won’t tend to work with payday loans taken out online or if the debt hasn’t been sold to a debt collector.

Also have you checked for any PPI?

Sara (Debt Camel) says

re complaining about this horrible loan – use the approach on this page https://debtcamel.co.uk/refunds-large-high-cost-loans/, not the standard payday loan complaint. Also add a paragraph saying you think the interest rate was grossly unfair and taking advanatge of desperate customers. And take it to the Financial Ombudsman if the complaint is rejected.

It’s not an easy complaint but i think anyone who has been robbed this way should be complaining and saying how unfair it is.

Christian white says

Thanks Sara. Will look into the older debts and tackle Loans2go about the interest and let you know any developments. Cheers. Chris.

Chris says

L2G rejected my complaint – very quickly! I can’t be sure but I think this was before I’d actually complained! They must have taken my SAR as a cue for action. The argument was that all the costs are upfront so I knew what I was getting into. Have now sent the complaint to the FOS. Will let you know. Chris

Scott Barton says

Loans2go issued a loan to me before I’d even agreed to take it…I found credit elsewhere so just ignored their initial call…next thing I get a text and email saying that the loan had been issued and was sent an agreement I never signed saying they want over £3000 for a £750 loan. Theres 2 different repayment dates stated so that’s not clear… Then they attempted to take payment from my account before either of those dates, so far I’ve not paid anything what can I do to stop the agreement it’s over 14 days and the funds they sent were used by other loan repayments I owed before I could do anything on top of this they’ve filed 3 or 4 fraud search’s on my credit file all on the same date as if they were/are trying to stop me being able to get a loan off anyone else

Sara (Debt Camel) says

Send them a complaint listing all these problems. Say you want the interest removed so you only have to repay the 750 and you want a payment arrangement so you can pay that back at an affordable rate. If they refuse, send the complaint to The Financial Ombudsman Service (FOS)

Also say you aremaking a Subject Access Request (SAR) for all the personal information they hold about yiu including, but not limited to, applications, all credit and other affordability checks, a statement of account for the loan, and a record of all phone calls. The details from this may help with a complaint to FOS.

Sarah says

I have received my final letter from loans2go this morning saying they have done the relevant checks and that I could afford the loans i have. However on the letter it said there financial checks said I had 2547 a month coming in when I took the loan out but I have never had that much coming in. I only have ever had my wages which dont even come to a 1000 pounds a month. I have asked them to look again and have said I can provide wage slip ect to confirm that the checks they have done are wrong. What else can I do??

Sara (Debt Camel) says

Are this normal loans or logbook loans? How many did you have an do you still owe a balance? What is your job?

Sarah says

It’s a normal loan. I had one loan with them and then got a top up loan which I’m still paying. I’m just a waitress with a wage of 230 week no where near the 2547 a month there saying there checks revealed when I took the loans out.

Sara (Debt Camel) says

Not many waitresses on £2500 a month!

if they don’t make you a good offer, send the case to the Financial Ombudsman,

At the same time send them a Subject Access Request by emailing info@loans2go.co.uk and asking for a copy of all your personal information including any loan applications and credit checks they performed. If you have ever spoken to them on the phone, also ask for recordings of your phone calls. This may turn up some useful evidence for your complaint.

If you are still paying the loans, ask them for an affordable payment arrangement while the complaint goes through.

Sarah says

On the letter it says that’s there final response however I have emailed them and asked them to reconsider as the information they have gathered from there income verification tool was completely wrong and I can prove that for both loans. Is it worth waiting for them to respond again or go straight to the financial ombudsman? It’s only took them 2weeks to come back with there final response and I have a feeling they think they can fob me off with that letter and that I’ll leave it be. Do you know of anyone else who has had a similar response and then fone on to get an offer?

Sara (Debt Camel) says

As they were under the 8 weeks and you have gone back to them, I would let them have another week to reply. I don’t know anyone who has got them to change their mind, but your income is very obviously wrong I suppose they may consider it.

david says

hello,

I note this article mentions it only relates to L2Go loans and not logbook loans, but can you still make the same kind of affordability complaint regarding a logbook loan?

I had a loan from Loans2Go in 2012, shortly after also taking on an Amigo Loan, prior to that i’d had a V5 logbook loan too from 2009, of which the car was repossessed at one point – I had to borrow £1,300 from a family member just to go and pay for the auction site in leeds to release it back to me, I still had about £2k to repay which I somehow managed, all the while incurring debt elsewhere in order to afford it.

just wondered if I could look into this like I have with payday and amigo loans.

Sara (Debt Camel) says

Yes you can, use the template letters here for logbook loans: https://debtcamel.co.uk/refunds-large-high-cost-loans/

david says

thank you Sara.

i’d already performed PPI checks to ensure they didn’t add anything I wasn’t aware of (as it turns out i don’t think logbook loans can add PPI etc) but I haven’t complained about unaffordability so will look into it today.

Scott says

Ok I got a new one….according to Loans2go:

“the early settlement figure we provided is not an internal calculation and is one that has been provided by the FCA”

since when does the FCA do the calculations for companies, guessing this is a blatant lie

Sara (Debt Camel) says

The calculation is set out in legislation: http://www.legislation.gov.uk/uksi/2004/1483/pdfs/uksi_20041483_en.pdf.

It would be fair to say that in most situations where people are outraged at the settlement figure quoted, the correct calculation has been done :(

But of course Loans2Go may not have got it right…

If you have a had one of these horribly expensive loans, I suggest you complain about the interest rate as the article above says and tack on that you don’t think the settlement figure is accurate as a secondary matter.

scott says

Thank’s Sara, it was more the context they made the statement as if they have no option of reducing the amount.

I have already complained, they even tried to take the first installment of for the loan almost a week before the due date. I would have thought this was them breaching the contract.

I have even offered to repay the principle in full in one payment but they’re saying as it was taken 3 months ago I’ve missed the right to withdraw. Am I even still bound by a contract they haven’t adhered to?

Scott says

On reading previous correspondence with Loans2Go when asking them to waive interest in their response they stated,

“Unfortunately, we are unable to accept the principle amount borrowed to settle the agreement as no repayments have been made.”

Would that not be implying, they will accept just the principle amount once the arrears have been repaid? or am I stretching it… I have contacted the ombudsman but still havent heard back from them

Scott B says

My loan with these was for £750, with interest rate 207.6%. over 18 months.

When I have done the calculation I get

Total interest £1,725.56

Total to be repaid £2,475.56

In the contract, its saying interest £2335.56 and total to be repaid £3085.56…..

Am I missing something here or is their calculation wrong?

Sara (Debt Camel) says

205% is the fixed interest rate they are applying – this is not the same as the APR which is 989%… My guess is that you have used a calculator which assume you are giving it an APR, hence it has worked out the wrong amount.

Here is an article that explains the difference: https://www.moneysavingexpert.com/banking/interest-rates/ – see the Watch out for flat interest rate loans section.

Scott B says

Ergh this is so complicated I’ve repaid £685 it’s not on arrears,only 4months in and their early settlement quote is still more than the principal borrowed (not sure how that works that of £685 repaid £0 has gone towards the principal) how they still have a license is beyond me, and how the FCA is still allowing their business is a joke, wonder how much they’re paying for a blind eye …they’re a disgrace to the credit industry, ….then society wonders why people turn to crime or loan sharks…

Sara (Debt Camel) says

Totally agree. Send them a complaint and take the case to the Ombudsman!

Scott B says

Already have, FOS still haven’t got back to me though and it’s been over a month since I escalated my concerns to them…not heard a thing from them. Will give them a call Monday, thanks.

Chris says

I have just had my complaint against Loans2Go picked up by an Adjudicator so will let you know what happens. £700 loan but due to pay £2600 back even though I am in a DMP. Not sure how it will go, obviously, but fingers crossed some of that interest can be cut back.

Craig Middleton says

I applied for a loan of 700 over 12 months filled all the details in on line and was told to wait until the next working day and affordability check. I applied on a Saturday and within 3 hours they paid me 750 over 18 months at 177 a month of which I cant afford and as I’m in lots of debt no checks were truly carried out as the money was paid in to my account what can I do please

Sara (Debt Camel) says

Put in a complaint as the article above says, asking for the interest to be removed so yiu only repay what you borrowed, and send it straight to the Ombudsman if L2G reject it

scott says

I would email explaining you wasn’t given any time to read (or given at all) the contract information as well

now you have read it, its not what you applied for or want and is not affordable and would like to cancel it immediately.

The 14 day cancellation right if for cancelling without reason, because it’s not what you asked for and its less than 30 days

perhaps you can return it? Worth a shot …if nothing else it would probably help with complaint down the line

scott says

Finally in direct contact with the ombudsman, sent them everything, now I wait ….fingers crossed

Reading other comments there are more and more people saying the loan was sent before they’d agreed…exploiting people that are desperate,

payday loans were bad enough..but even the notorious Wonga at their prime , got nothing on what Loans2go are doing….the early settlement figure is around 50% more than borrowed immediately, and even after 12 months of paying on time every month it will be around the same as the amount borrowed (they don’t tell people that do they) …

You’d expect consumer exploitation to be a crime these days ….🙄

Sara (Debt Camel) says

Why not tell their regulator, the FCA, what you think of this firm? The FCA doesn’t look at individual problems, that’s what FOS is for, so it won’t help yopur case, but it could help bring about a change in the regulation. I really don’t think the FCA understands what a gruesome loan one of their regulated firms is getting away with offering.

You could try this:

Send a complaint to their regulator, the FCA, at consumer.queries@fca.org.uk.

_______________________________________________________________________________________

Say you are complaining that Loans2Go (679836) is offering loans that are massively more expensive than payday loans and you don’t understand why they are allowed to do this. Point out their 18 months loans have a HIGHER monthly repayment than borrowing a 12 month loan for the same amount from a high cost short term lender. So the longer term makes the product more dangerous not more affordable.

Add your points about the loan being sent before people agree and then it is very expensive to try to settle it straight away.

Say you are complaining to FOS and you know the FCA will not investigate your complaint but you thought as the regulator they should be away of the unfair loans that they are offering to vulnerable and desperate people. Add that not everyone will realise they can complain about affordability so thousands of people will be trapped by these loans and the regulator should ban them.

S says

Will do thanks Sara,

I informed the CCTA also as they’re apparently a member. They told me a review of L2G will be conducted asap.

Sara (Debt Camel) says

the phrase chocolate teapot comes to mind, but perhaps your complaint will prove me wrong…

Linsey says

Same situation as most here. Got a loan of 750 a few months ago. Money was in my account without me even seeing a contract let alone signing it. Phoned my bank and blocked the CPA this morning. Have emailed them today using your style letter and amended it slightly to reflect above. Will email the FCA politely letting them know what a shambles this company are. If I haven’t received anything from loans2go by the 8 weeks do I then contact FOS? Cheers

Sara (Debt Camel) says

Yes, send your complaint to the Ombudsman after 8 weeks unless you have had a good offer.

Linsey says

Thanks. Will update as and when.

Ann says

Hi can somebody help me please I have a payment plan in place with loans to go my loan was £114 per month I am paying £50 pm I have sent it to financial ombudsman around 4 weeks ago can the still default the loan if I’m making reduced payment .They want me to send an expenditure form which I’m not willing to fill in thanks

JA says

If you have broken the terms of repayment I think they’re legally allowed to put a default on your file even if you are still paying them?

I may be wrong though.

Ann says

Hi thanks I’ve not missed 1 payment of plan they are a nitemare x

Sara (Debt Camel) says

yes they are very difficult.

They can legally add a default even if youv are keeping to a payment arrangement. The good news is that if you win the complaint (and see https://debtcamel.co.uk/worst-loan-in-britain/ for why a lot of these complaints are being won) the default will be removed.

Ann says

Thanks Sara the ombudsman has my complaint so it a wating game now with them and sunny I’m not holding my Breath x

Claire says

Hi

Sorry for the long spiel but looking for some advice, I stupidly had 3 logbook loans with Loans 2 Go.. On the third loan I got into financial hardship which resulted in them repossessing my car. I put an irresponsible lending complaint into to them and the response I’ve had back is as follows, they felt they carried out the correct checks and saw the correct documentation and the loans are over 6 years old. Here is a breakdown of all the loans

8/1/09 borrowed £1000

Total payable £1420 + £700 charges

Paid £2120

29/10/09 borrowed £1070

Total payable £1511 +charges £1135

Paid £2646

12/11/10 borrowed £1709

Total payable 3367.10+charges £5093.14

Paid 4934.45

As a goodwill gesture they have agreed to wipe out the remaining balance of £3525.97.

Would you accept the offer or take it to FOS? I have till Thursday to respond, any advice would be appreciated

Sara (Debt Camel) says

When was the car repossessed and have you made any payments since then?

Do you have your bank statements for Aug 2010-repossession?

Claire says

I haven’t made any repayments as they’ve never actually been in touch with me since it happened in 2012. I do have bank statements from then as I needed them for other cases

Peter says

I have a logbook loan with loans 2go I got £400 over 18 months iv been paying them every week but fell in to arrears I agreed to pay them £25 a week instead of £18 I get txt messages and calls every day from them i asked how much to pay it off and was told £465 I got the loan in December last year. The other thing that got me confused is the car is still on finance so obviously they don’t carry out checks. The interest it more than 3 times the amount of the loan. Surely there must be someone to complain to about the way this company is conning people. Any advice in how or who to contact about them.

Sara (Debt Camel) says

you have a logbook loan with a car still on finance? have you looked at the laon agreement you were sent, are you sure this isn’t an unsecured personal loan/

Peter says

It’s definitely a log book loan it says it on the agreement its got all the details of the car on it.

Emma says

Loans 2 Go are an absolutely shocking company! I arranged a payment plan with them, then looking at my expenses, realised I couldn’t afford it so I emailed to arrange a new plan. So they sent me an income and expenditure form, I filled it out and sent it off, yet they STILL took more money on the arranged pay day. Today I then received an email from the litigation sector of their company explaining I will be handed a CCJ if I don’t pay in 7 days!! Awful, and I only borrowed £500, paying back £1560!

What is my case against them? I would really like to make a complaint about their interest.. I have read the articles on here about them but I am at a bit of a loss at what to do next. Any help greatly appreciated.

Emma

Sara (Debt Camel) says

Dreadful company

Normally you won’t get anywhere at the Ombudsman saying the interest rate was too much, but for this particular loan you can, and there is a link to an ombudsman decision there showing what the ombudsman thinks of this particular loan.

Emma says

Thank you Sara, I will do that!

Sara (Debt Camel) says

Also when you have a complaint in with them directly or at the Ombudsman they should NOT start legal action. I suggest you add a sentence to your complaints saying “As I am disputing this debt, the FCA’s CONC rules say you should not start any legal action.”

Ann says

Hi Sara can I ask a question I sent a complaint to loan to go and it now with the ombudsman reading you last response am I right saying they can’t default my account if it with the ombudsman.I have a reference number but it not been assigned yet thanks

Sara (Debt Camel) says

I said a creditor can’t start legal action. That has nothing to do with adding a late payments or a default to your credit record.

Sara (Debt Camel) says

Ok, two thoughts:

1) you may well have a good affordability complaint. See https://debtcamel.co.uk/refunds-large-high-cost-loans/ for how to stat a complaint about this loan, expect it to be rejected so send it to the Ombudsman straightaway.

2) the fact that car is still on finance means that there may be a legal problem with the Bill of Sale that the lender should have registered. See https://www.nationaldebtline.org/EW/factsheets/Pages/billofsale/logbookloans.aspx# for more about. Bills of Sale and I suggest you phone National Debtline on 0808 808 4000 to discuss this with them. If the Bill of Sale is defective, it may be that yiu just have a normal loan, not secured on your car.

Lauren sherry says

I took out a £1000 loan from loans to go to help with a situation and was not in my right mind. I have just seen that the total repayment i have to make is £4,100 ! I am really stressing out that i have to pay back 3 times the amount i have borrowed. I would never have done this if i had of known!! Is there any advice on what i can do!?

Sara (Debt Camel) says

Read the article above and send in a complaint that the loan was unaffordable and the interest rate unfairly high.

Alison says

I had a loan for £600 which I took on April 11th I phoned to pay off the loan early on August 13th realising I was being ripped of, so only had it for four months. They charged me £1054 to settle!! Over £113 a month interest!!!

Sara (Debt Camel) says

Send in a complaint and send it to the Ombudsman if it’s rejected.

Alison says

I forgot to add that I had already made three payments so in total I paid £1568.41. Interest for four months actually worked out at £941.47!!!! They have rejected my complaint! How can they charge nearly £1000 interest for four months. Companies like this should be closed down!

Emily says

I got a loan 3 weeks ago for £1100 and it was so quick to doni got it within I’d say 30mins, I didnt read anything and didnt realise I’ll be paying gover £4500 back over 18months.. I’ve applied for an IVA as I’m in alot of debt and I really cant afford to be paying £251 a month back.. I’ve tried to speak with L2Go and theyve just told me they cant lower my payments.. I’ve not paid my first repayment yet and think I’ll have to cancel the payment to them.

I know it’s my own fault for getting the loan when I’m in so much debt but its finally made me get my head out of the sand and sort it all out.

Has anyone got any advice in what I should do?

Thanks

Sara (Debt Camel) says

Let’s take this step by step. You can’t afford the next L2G repayment so yes, cancel it. Don’t make it and have to borrow more!

Next, if an IVA is the right option for you, you may as well go with it and forget how annoying this L2G loan is, there is no point in complaining about it if you are just about to enter an IVA…

BUT an IVA may not be a good option for you at all. Do you mind answering some questions about this?

– which IVA firm are you talking to? Some are a lot more likely to try to missell you an IVA when you have better options…

– how much debt do you owe in total, including this £4500 for the L2G loan?

– your other debts, how many of them are high cost credit?

– are you buying or renting?

– how much do you think the IVA payments will be per month?

Emily says

I’m going with creditfix the iva will be £85pm, I’ve spoke with an advisor and gone through all the other options and this is the best for me.. I’m in £12000 debt that includes the L2G I’ve got 2 other debts included 8n that which are high.. one is just under £3000 and the others are around £1000.

I rent I dont own anything that would be classed as leverage.

How do I cancel my payment for L2G as i think it’s a continuous payment on my card?

Thanks

Sara (Debt Camel) says

You phone up the bank to cancel the CPA to L2G. And to any of the other debts as well.

Re the IVA. First thing is is it the correct Insolvency option for you? It’s going to generate £3500 in fees for Creditfix… but do you have a better option?

I suggest you talk to National Debtline on 0808 808 4000 about whether you meet the requirements for a Debt Relief Order. In a DRO you don’t have to make any repayments and it all ends with the debts being wiped out after a year. You have less than 20k of debt and you don’t own a house, so those are both ticks for a DRO. ND will help assess how much spare income you have every month it has to be less than £50 a month for a DRO, but Creditfix’s £85 calculation could easily be too optimistic and a DRO may be right for you.

If you have too much spare income for a DRO then bankruptcy would be a better choice than an IVA. It is all over much quicker and it can’t go wrong. 30§ of IVAs fail as people can’t keep up the payments for 5 years.

Sara (Debt Camel) says

The other option is too look at affordability complaints. You can’t possibly afford that L2G loan, so if interest is removed from that after you win an affordability complaint your debts drops to 8500.

Your other high cost debts – who are the lenders? Have you used other payday lenders before, if yes, which lenders and how many loans from them?

Emily says

I have more then £50 left each month so I dont think I can qualify for a dro? The others are catalogues and phone contracts, some I’m not sure what they are anymore as they’re with lowel. I’ve got a ccj aswell.

Thank you for replying I really appreciate it.

Sara (Debt Camel) says

Please talk to National Debtline. Too many people who qualify for a DRO are being told by some IVA firms that they have too much income, when a proper DRO adviser would say they don’t. So debt advisers are seeing too many people later whose IVAs have failed who should never have had one in the first place. This is well worth the time to do it, if ND say you don’t qualify for a DRO and an IVA is right for you then that’s fine and you will know where you stand.

Sara (Debt Camel) says

Also go back to Creditfix and ask them if Loans2Go are likely to vote in favour of your IVA. The L2G loan is more than 25% of your total debt. An IVA can only be set up if 75% of creditors voting approve it… so L2G have a veto if they want to use it.

ian carr says

This company should be put into administration as they are licensed LOAN SHARKS

Andy says

I took out a £750 loan 3 weeks ago (5th October) due to having to leave my job due to disagreements with management over several reason (long story) but found another job two weeks later and needed the loan to help cover other loan payments and a few bills. Unfortunately this job, whilst giving me work, is less hours than what I was meant to be working (problems with working for a recruitment agency on zero hour) meaning that I’m earning less than was expected. After working it out with a friend I’ve realised it’s costing £3000 which is extremely higher than it should be.

When I applied for the loan there was no contract to sign as with other lenders; also have a “very poor” credit rating and it was the only one that would accept at the time. I’m currently paying £40 a week and working 2 to 3 days max (trying for more but no luck). I’ve been looking at a DMP and a DRO as possibilities, but I am currently worried about this loan because I can’t afford it (something I should have thought about or asked for the account the be nulled or something due to the cost but was just desperate to pay my bills and was expecting more work to come in but none has yet). Is there any advice you can give me about immediate/short term/long term solutions?

Thank you for your time.

Sara (Debt Camel) says

Can you say how large your other debts are, ignoring this loan?

Andy says

Totals are £2,000; £600; £400; £250; £36.28 (last payment)

I’m not sure if this is any help but here’s the monthly repayments are: £98; £36; £49; £83; £47

Sara (Debt Camel) says

I asked because if you owed £15,000 elsewhere than sorting this one debt out may not be enough to help much and it could be simpler to go straight for a DRO.

But it sounds as though if you could get the interest removed from this L2G debt, then that would make a huge improvement in your situation? If you agree I suggest you do two things:

1) put in a complaint to l2G as the article above says

2) talk to StepChange about a DMP, see https://www.stepchange.org/how-we-help/debt-management-plan.aspx. That should stabilise your finances so you are no longer under so much pressure and you can take the l2G complaint to the Ombudsman if l2G reject it.

After a few months you will know what has happened to your l2G complaint and you will also know how your hunt for more pay is going. It may be a DMP is then right to repay the debts. Or it may be clear that a DRO is a better choice. StepChange do DROs as well, so if you need to switch they can help you.

Andy says

Thank you so much you’ve been such a help, I’ll make sure to follow your advice and hopefully I can get a result and turn things around (and not stop until I get enough hours again).

Again, thank you

Umar Ashraf says

I am cuŕrently complaining to losns2go, disgusting compsny borrowed £750 and told i have to pay £3085 over 18 months, asked for an early settlement and i have already paid more than £750 since taking loan in april 2019 out of desperstion to pay other loans off, but was shocked how high the interest is absoultly vile company, how is this legal@!! Absouloutly shocking, asked for early settlemrnt and still have more thsn £800 to pay even though i have already paid more than i borrowed, im lost for words please stop thid company from ruining more lifes and getting vunerablr people in further debt Please i beg you, Loans2go cannot be Legal, instead dhould be sent to jail, this is theft

Sara (Debt Camel) says

Unless Loans2Go removes the interest from your debt, send your complaint to the Financial Ombudsman.

Have you also had payday loans? Other high cost credit?

Jonathan says

I currently have a complaint with the ombudsmen about these sharks. It has been allocated to an adjudicator so will keep you all posted as and when a decision is made.

Claire says

I’ve sent one to the FOS about these too, how long did yours take to be picked up by an adjudicator if you don’t mind me asking

Wayne says

I need some advice. I stupidly took out a loan with loans2go for £1500 to repay over 18 months and want me to pay a total of £6000. I knew the interest was high when taking the loan so I called up loans2go straight away to say I don’t want it as the rates are too high and can I transfer it back. They then transferred me to there accounts manager or someone who persuaded me and forced me to keep the loan by saying the £6000 is only there if you keep it for the full length and you can pay it sooner. As weak and vulnerable as I was decided to keep it. I was already heavily in debt and checks cannot have been done and struggling to keep my head above water. I missed my first payment due at end of October and now expecting end of November. I don’t know what to do next.

Sara (Debt Camel) says

I suggest you make an affordability complaint using the template letter here: https://debtcamel.co.uk/refunds-large-high-cost-loans/ and include two more sentences. “I also want to complain that the interest rate was exorbitant and unfairly high. And that when I called up to try to cancel the loan, you should have agreed, not persuaded me to to carry on with a loan I said was too expensive.”

Can I ask what other loans you have?

Wayne says

This is the first time I had a loan with loans2go but have other debts as well. Credit cards and drafty payday. The did not check my credit file as I have had a very low credit score and should not have been accepted. They have now put me in more debt and was at my lowest point. I will email them regarding the unaffordability.

Sara (Debt Camel) says

ok, I have just added a new template letter to the article above, so you can use that!

It’s also worth putting in a complaint to Drafty. Use the different template letter over here: https://debtcamel.co.uk/payday-loan-refunds/.

And if you are currently struggling, I think you should talk to StepChange about a debt management plan so you only make an affordable payment each month divided up between your creditors. See https://www.stepchange.org/debt-info/debt-management-plan.aspx. It can take a long while for complaints to go through as many have to go to the ombudsman. A DMP will have you in a safe finacial place while this happens.

M says

I need some advice I took out a loan last year around June from loans2go, applied and was rang by a customer service person.asked how much I would like I said 500 I was told they would have to preform a credit check and will be in touch with the results.they rang back and said they had deposited the money to my account without me first signing or agreeing to the terms.my account was in arrears and was about to go on holiday so I could not return the exact money.i took£500 and was told I had to pay back 2000 over a 18 month period,I rang and complained that this was misleading and the customer service member said this should have been explained before you signed the contract.to which was noti have 1 last payment but due to losing my job, I’m unable to make the payment. This has put a lot of stress on my life which drove me to take others loans just to balance my life.please I need some advice on to tackle this it’s affecting my well being.many thanks

Sara (Debt Camel) says

I suggest you read the article above and put in a complaint. To the template you could also add something like “I also want to complain that the money was deposited in my account before I had agreed to the loan and before I had been informed of the cost. As it was more expensive than a payday loan would have been, I could have shopped around. But as I was in a bad situation I didn’t return the money. I think this habit is taking advantage of desperate people and should not be allowed.”

Jen says

I borrowed £500

They’re now requesting £1896 off me.

I’m a single young parent, I already did have bad credit, they’re now threatening court action.

Sara (Debt Camel) says

I assume they have not started a court case – you would have received a Claim form from the Court.

And that you have not received a letter saying LetterBefore Claim or Letter Before Action, with attachments including a Reply Form.

If that is right:

Read the article above and send them the template complaint.

While you have a complaint with them – or with the Financial Ombudsman if Loans2Go says No – they can’t take you to court.

What other debts do you have? Any payday loans?

Wayne Botelho says

They dont do proper credit checks as i already know and when you call them to say you dont want the loan the talk you around into keeping it.

Lisa says

Hi,

I wonder if you can help please, I applied for a £500 loan with loans2go on 3rd Jan 2020, like some of the earlier comments I didnt sign anything, I had an email saying that the application had been provisionally accepted and that I had to click on a link to resume my application, I never followed up with the link as I needed some time to think but when I checked my bank account online they had deposited the £500 into my account? I saw how extortionate the interest would be and the fact I would be repaying £114.28 x 18 months = 2,057.04 for £500?! I decided to request to withdraw from the agreement within the 14 day time period and received an email to say it was accepted, however they still want to charge £2.85 interest per day, unfortunately when the £500 was deposited into my account several direct debits left my account meaning I will have to wait until payday at the end of January before I can payback the £500, by this point the added interest will be £79.80. I along with so many other people have several other payday loans running concurrently and payments are due at the end of the month, the £79.80 loans2go are expecting will take me over my budget and I am hoping there is some sort of way I can avoid the interest considering I am returning the £500 that I never even signed for?

Best regards and sincere thanks for this website it has helped me a great deal.

Lisa

Sara (Debt Camel) says

I suggest you put in a complaint as the article above suggests. Add to the complaint your point about the money being deposited before you had accepted the loan. Cancelthe CPA so L2G can’t take any money from your account and offer to repay the the £500 in affordable monthly payments.

Have you had other high cost borrowing?

Lisa says

That’s great, I will do that, thank you, unfortunately like so many others I have got into a predicament with payday loans over the last couple of years, I have currently 2 loans with satsuma, 1 with peachy, 1 with moneyboat and a guarantor loan with George Banco, I have submitted a complaint to the F.O for the guarantor loan as at the time I was gambling heavily in the desperate hope of winning enough to clear the debts, I have learned the hard way the house always wins in the end..

Lisa

Sara (Debt Camel) says

Also put in a complaint to Satsuma and ask peachy & Moneyboat for a payment arrangement.

Lisa says

Thank you very much for the advice, already it feels like a weight off just openly discussing my situation, no time like the present, the complaints will be going in tonight. Really happy to have found this website, thanks again.

Victoria says

Hi, I have a loan with Loans2go. I know that the interest rate is ridiculously high and have borrowed from them at a time of desperate need. I missed last month’s payment due to financial difficulties but have not missed one before, which has put me in difficulty financially in other ways. I rang them today to see if I could arrange to split the 200 missed payment over remaining payments to clear the arrears whilst maintaining future payments on time. The advisor told me they could split it over 3 months but I’d ‘probably’ be given a default and if they split them over 6 months I’d ‘very likely’ be given a default anyway and that it was out of their control, the credit reference agencies just do it automatically. Am I being very naive in thinking that companies have some sort of obligation to consider the financial difficulties of customers? I have been thinking about putting a complaint in about the level of interest charged as my original loan was for 400 and I would be paying back just over 1500. But really I just don’t know who to speak to for advice. I don’t want another default on my credit report as I’ve been working really hard to clear it after a break up where my partner left me with massive debts. Thank you for any advice you can give

Sara (Debt Camel) says

If you win a complaint – and a LOT of the complaints about these extremely expensive loans are being won – then any negative marks will be removed from your credit record.

It sounds as though they are “probably” going to add a default whatever you do as you can’t repay the whole extra amount. so that suggests you may as well make the complaint as the best chance of getting rid of the default. And of getting that horrible interest removed.

Victoria says

Thank you for your advice, the advisor on the phone was very threatening and unhelpful after I’d just told her I am pregnant and have been ill and despite me trying to resolve the missed payment :(. I think the complaint is the only was forward, very depressing to think of having a default added that will set me back 6 years again.

Sara (Debt Camel) says

that is very poor treatment, so add to your complaint that you feel you were not treated fairly as a vulnerable customer when you phoned up trying to resolve your situation and you would like compensation for this.

The template asks at the end for a copy of all your personal information including recordings of phone calls – so that should be evidence.

Victoria says

Thank you for your advice, it is really appreciated!

Stu says

An adjudicator has contacted me today with regards my complaint about Loans2go. He has basically said they did not do proportionate checks for the 2 loans they provided me and they should refund all the interest paid on both. They havent provided evidence of a credit check which they claim they did! Anybody know if they accept adjudicator decisions?

Shellie says

Hi Stu

Loans 2 Go did not accept the adjudicator’s decision in relation to my complaint, it has now been sent to the ombudsman for a review. Did this happen to you?

Shell says

I borrowed £500 back in September 2019 and I have to pay back £4000 I just can’t do it anymore I pay £60 a fortnight on benefits! Got 2 kids to feed I’m due to start work in 2 weeks and I need help. I have 2 other loans which aren’t too bad I owe about 300 on each. I also owe next 1400, I’m in a mess any advice?

Sara (Debt Camel) says

is this a normal loan or a logbook loan?

Mark says

Hi

I got a loan of £600 from loans2go back in August. The next month my partner lost her job, so I’ve been paying all of the bills. We also found out that she’s pregnant.

It’s stupid of me but I stuck my head in the sand and ignored it. Now it’s gone to pre-litigation. I have sent them a income and expenditure form and offered to pay £50 per month starting 1st Feb.

Loans2go say they will not discuss payment arrangements until I make a payment towards the account. Is this fair? Also, how likely are they to go to court to obtain a CCJ? I’d obviously rather avoid this, but cannot afford to pay more than £50 per month.

I do have a history of defaults and am trying to rectify this. So am unsure why they accepted me for a loan.

Thanks

Sara (Debt Camel) says

I suggest you send in a complaint as the above post suggests if you feel that the payments were not going to be affordable for you unless you borrowed more elsewhere OR if you feel the interest rate was unreasonable. There is a track record of these complaints being won, of course I can’t say if you will win yours.

No it isn’t fair to refuse to accept a payment arrangement unless you make a payment. You could make a complaint as described above and add in a sentence saying you feel you were unfairly treated when they refused to consider a payment arrangement.

I can’t say how likely they are to go to court.

If you have a complaint in, they should not start court action, including if they reject your complaint and you send it to the Financial Ombudsman.

Only people with a very poor credit record are desperate enough to consider taking one of their loans. But the lender still has to check the loans are affordable.

Rob says

Has anyone successfully defended against a CCJ claim in court? The reason I ask is that I have this issue and intend to include this in my claim. Can anyone help or advise? The debt has been sold to PRAC and being represented by BW Legal.

Sara (Debt Camel) says

have they started a court case?

Rob says

Yes they have.

Rob says

-Acknowledgement of service completed.

-CPR31 Request issued to BW Legal by recorded mail and received on 22/2/2019. Agreement, Default Notice and Notice of assignment.

-Section 77-79 Request sent to Prac for original credit agreement.Â*

-Have lodged an affordability claim directly with Loans2go.Â*

I have received the following back from BW Legal to date;

-Copy of Credit Agreement.

-Letter explaining that they have requested other documents from their client and the case is currently on hold. I have followed this up with a CPR15.5 request requesting agreement to the 9th March 2020. They have replied again stating that the case is on hold until the document have been received by their client and that the notice of assignment has be forwarded in todays post.

Sara (Debt Camel) says

ok, I can’t give advice on a court case in progress. it is a shame you didn’t start the affordability complaint first.

You can talk to National Debtline on 0808 808 4000 about what to do.

Ultimately if you get a CCJ and you then win your complaint against L2G they should get the CCJ removed.

Ap says

Whilst I regret ever going near Loans2go, after complaining that the 1 loan & top up they gave me were unaffordable and the interest was ridiculous, they agreed to wipe off the outstanding interest and just pay the rest of the principle back.

So from having just over £3K hanging over my head, I now have just £160 to pay back.

A sigh of relief!

Sara (Debt Camel) says

good result!

Stu says

Heard back from my adjudicator that loans2go have disagreed with there assessment and my complaint will now have to go to an ombudsman. 13 month wait and probably now another 4 months to go. Disappointing but there u go. Last complaint anyway and any win is a bonus!

Steven says

Have just logged an affordability complaint with l2g and they are asking for 2 months bank statements…how should i reply

Sara (Debt Camel) says

Your bank statements should show that the loan was unaffordable I would have thought? Send them over!

Ray says

I sent mine in last week 🤷♂️ See what happens. I had the same email

Katie says

Hello, I have made a complaint to loans 2 go about

Irresponsible lending- they have sent the below – should I send them the bank statements? I’m not sure it was necessary 2 months before I was struggling.. I had previously had a loan with them and told them of my financial difficulty, and then paid the loan off (after many months of arrears) and then desperation struck again and I took out this second loan with them

In order to investigate your concerns properly, could you please send us your 2 months’ worth of bank statements showing transactions from 2 months prior to the loan(s) being signed. Also any supporting documents (such as benefit letters, doctor’s note/medical report etc.) that you feel will help us in understanding your situation better at the time your loan application was approved by Loans 2 Go.

Sara (Debt Camel) says

I think sending banks statements does sometimes help, so it’s worth a go.

Tad says

I’m 40,000k in debt in and out of DMP’s and payday loans, including Loans 2 Go – had 2/3 loans paid part of one off and took a top up which I still owe.

I have sent the above letter as i beleive the load was for 900 but i owe £2783 – happy to pay loan off just cant afford interest…

Hopefully they see sense…

Sara (Debt Camel) says

Can I ask why you are in and out of DMPs? Are you buying or renting?

Pat says

I’ve just had a reply from L2G they don’t agree that the £700 loan was unaffordable to me but as a gesture off goodwill they will take off all interest so I just have the £700 to pay back(was over £2k with interest)

Sara (Debt Camel) says

Sounds like a good result!

Katie says

That’s great news Pat! How long did it take them to reply- the full 8 weeks? I think I’m on week 7 so hope I get a reply soon!

Pat says

Katie I complained on 21Jan, they requested bank statements a couple of days after that which I emailed them and then sent final response yesterday agreeing to waive all interest as a goodwill gesture, hope you get a response soon

Raymond Chambers says

Does this mean your future payments have come down too? How have they done it. I complained and sent bank statements and I’m now awaiting

Pat says

I assume the payment amount will come down, I’ve replied saying I accept will let yous know what happens next

Pat says

This is part of the reply:

A business isn’t obliged to review bank statements before approving loan applications.

The interest is frontloaded, which means that all the interest which will become payable over the term of a loan is added at the beginning of the loan term.

Also, as per your statutory rights, which are expressed in the loan agreement you signed, you had 14 days from when the agreement started, in which, should you have changed your mind in this timeframe, you could have exercised your right to withdraw from your loan agreement by informing us thusly and making the necessary payment of the amount borrowed, plus a small daily interest. We would have also provided an additional 30 days from the point you notified us of your intention to withdraw, for you to make the necessary payment should you have chosen to exercise this right. Thus, we did provide ample opportunity to withdraw from the agreement should you have requested.

In the circumstances and after consideration to all the evidence available to me, I am unable to uphold any aspect of your complaint.

Authorised and Regulated by the Financial Conduct Authority.

However, as a goodwill gesture we have agreed to write off all the interest on your loan agreement. This would mean you would only be liable to pay back the principle amount borrowed. This would leave a final balance of £700 as full and final settlement of your complaint.

Ray says

See that looks that they want a settlement fee… £700 up front which worries me.

Sara (Debt Camel) says

I *think* they are saying Pat now only has to repay the £700 borrowed. Not that it has to be paid immediately.

I suggest Pat goes back to L2G and says happy to accept offer if they will agree to accept £50 a month (or whatever – it really will be good to never have anything more to do with them so i wouldn’t suggest £5 unless you are totally desperate!) as a replayment plan and would like assurance that credit record will not be affected.

Pat says

They only want the Principle amount of £700 to be paid back, I’ve replied saying I accept and would like a payment plan, they’ve requested the debt back from BW Legal and will be in touch to arrange a plan in next few days, my credit report will be amended to show in a plan and £700 not £2000+.

Ray says

This is really good to know :) – so what happened to all the interest you’ve paid :( they just keep it all? Makes me feel confident about this :) I’m looking at moving out into my own place and this is one of the loans holding me back because it’s £215 a month on £900. I could pay off £900 easier.

Siobhan says

Hi

I’m not sure I can make an affordability complaint but I would like to settle my loan. I’ve been quoted the settlement figure but it’s more than I expected because of the extortionate interest. If I send a letter like this would it reduce the settlement figure?

Sara (Debt Camel) says

Complaining will only reduce the settlement if it’s a good complaint – but it may well be! For the loan to be affordable you have to be able to pay all your other debts and bills and expenses and not have to borrow any more money…

If you think it was unaffordable, send in a complaint.

If you aren’t sure, you could go to your local Citizens Advice and they could help you look at this?

Hazel says

Email from loan2go replied to say they don’t uphold complaint but will refund £272 which is all interest paid.

Has anyone had dealings with them ?

Thanks

Nick says

Yes me I accepted their offer and emailed my bank details to confirm and the money was in my account within 1 hour

Hazel says

Oh really amazing I have emailed back to accept did they reply to you to say they will process or just do it ?

Thanks x

Nick says

They didn’t email me to say it had gone in hopefully you get yours just as quick

John says

What sort of wait times are people having at the Ombudsman? It sounds like L2G are making people wait for an Ombudsman review as well. I submitted my case re. Loans2Go last August after L2G refused. I had 10 loans (half logbook, half personal, mostly 2 at a time) and repaid over 4k£ in interest (the total interest figure would have been much much higher but I paid them early). Once I called them up and they said I didn’t have enough disposable income to afford another loan, so I added 500£ on to my salary per month and they immediately accepted, no questions asked.

Carl says

Any advice on a £2k loan and they want £8k back? Took out the loan without realising how much the interest was and would have never thought they would charge £6k interest on a £2k loan over 24 months. Really do not want to pay anything over £5k back to them.

Sara (Debt Camel) says

Read the article above and look at an affordability complaint.

Salman says

Hi I took a loan out from loans to go for 250 and paid back over 750 when I had to retake a loan of 1000 to pay the rest and didn’t see the interest came to 4K plus. I have wrote to Loans2Go stating I shouldn’t have been accept d as I have Loans’s elsewhere and ccj and they replied asking for bank statements showing I was struggling to pay. Should they not have checked all that ok my credit profile before they gave it? Do I have to provide it ?

Sara (Debt Camel) says

You don’t have to, but they are more likely to uphold your complaint if you do… so it’s a good idea. If you don’t have the statements, now is the time to get them as you will need them if the case has to go to the Ombudsman as a lot of these complaints do.

Connor says

I took out a loan of £1,000 with these in august last year, I have made 8 payments of £228 (£1,824) and asked for a settlement figure. They want another instalment of £228 then….

£1,009 to settle!

I didn’t expect to have knocked much off the principal but this can’t be right, surely?

Sara (Debt Camel) says

read the article above and put in a complaint about affordability and the high interest rate. Add on your point about the unreasonable settlement figure as well, but make the other points too.

Connor says

Thank you, I’ll keep you updated.

Connor says

I sent the complaint and was asked for bank statements, sent those and received the SAR. Their i&e statement didn’t even include my mortgage! I definitely put it on!

Connor says

They’ve replied today final response they are not upholding complaint. Ombudsman it is then.

Connor says

One thing I noticed in their reply was “you should have repaid within the 14 days cooling off period”. I’d have found that difficult as they took and instalment one day after depositing the principal in my account. That’s not allowed, surely?

Sara (Debt Camel) says

Another good point to make to the Ombudsman!

Thomas says

Hi

I took out a £750 unsecured loan with Loans 2 go in June 2019. At the time I was vulnerable and desperate. After realising my total repayment would be £3085!! I now regret this, I have paid the first 10 instalments on time but the amount of interest is absolute ridiculous.

I am just wondering what’s best for me to do? If I have a leg to stand on with the complaint as I’m up to date with payments and what to expect from loans 2 go regarding a complaint?

Thanks

Sara (Debt Camel) says

Yes you can complain when you are up to date with payments, if you were desperate when you took The loan, it may not have been affordable and the interest rate is extremely high. L2G accept some complaints but many have to go to go the Ombudsman.

Thomas says

Thanks for your response. Should I keep making payments while waiting for the complaint to be dealt with?

Thanks

Sara (Debt Camel) says

are they affordable, or will making the payments mean you have to borrow more or get behind with other bills and debts?

Thomas says

Hi

Well loans 2 go have come back today and said they will not be upholding any aspect of my complaint. They said after seeing my income was £1,700 and I’d put down that my expenditure was £600 (desperate and lied). They can now see it was actually £1,450 but it still left me enough to pay to them. They have also said the interest complaint will not be upheld because I signed the agreement and they are not a payday lender so the minimum term is 18 months.

Any thoughts would be appreciated. Do I have any grounds to take it further?

Many thanks

Thomas

Sara (Debt Camel) says

I suggest you ignore what L2G said – they are trying to put you off – but instead think about your situation. Has paying this loan caused you problems, making you borrow more or get behind with other bills? If yes, then send your affordability complaint to the Ombudsman to look at.