Individual Voluntary Arrangements are complicated long-term legal agreements. A lot can change in your life during the 5,6 or 7 year term your IVA lasts.

Individual Voluntary Arrangements are complicated long-term legal agreements. A lot can change in your life during the 5,6 or 7 year term your IVA lasts.

Sometimes your IVA firm isn’t as helpful or sympathetic as you think it should be. You should always be treated politely and have things explained to you.

If there is something really wrong with the way your IVA is being handled, then you can and should make a formal written complaint.

Complaining has a bad image these days: it’s seen as weak, better to have a positive attitude and “get on with your life”. But in some situations making a complaint is absolutely your best option.

I need to point out the obvious – I don’t know what your problem is and I don’t know the terms of your IVA. I am also not a lawyer!

Some of this article may not be relevant for you and there may be other avenues that you can explore. You may sensibly decide you need help to lodge a complaint – see the bottom of this article.

Let’s look at a couple of common reasons people give for not wanting to complain.

“Complaining won’t make a difference”

Lots of people go into an IVA because they are scared about their debts, CCJs, bailiffs etc. Perhaps you feel your IVA firm are the experts, you know nothing and have to put up with whatever you are told.

But you aren’t powerless:

- an IVA is a legal contract where the exact terms matter;

- your Insolvency Practitioner (IP) is personally liable if you decide to go to court (NB this is very rare and I am not suggesting that you should!);

- your IP can potentially lose their licence, which means losing their job. Again this is very rare, but the point is that an IP has to act professionally. They can’t just tell you what to do if it’s not in accordance with the terms of your IVA;

- handling complaints can also be a difficult and time-consuming problem for the IP and the firm to deal with. They will want them sorted out as soon as possible.

“My IP will make me bankrupt if I complain”

Your IP may feel that answering your complaint is a nuisance, but this is not a valid reason to make you bankrupt.

The Insolvency Act 1986 says the court will only approve an IP’s petition to make someone bankrupt if they haven’t complied with their obligations in the IVA, they have supplied misleading information (this doesn’t mean a minor error or omission) or they haven’t complied with a reasonable request by the IP.

If at any point someone from your IVA firm says they will make you bankrupt if you don’t do X, you should ask them to explain in writing the clauses of your IVA you will be in breach of by not doing X.

It is incredibly rare for an IVA firm to make someone bankrupt except in extreme circumstances eg where you have inheirte4d money and are refusing to put it into your IVA.

Contents

Step one – get a reality check

You need to know that your complaint is actually reasonable. Things go wrong with IVAs and if something large has changed in your life it may be there is no chance of the IVA being completed.

This is especially likely if it has happened early in the IVA. Later when you have made a lot of payments already, there are usually more options. Read my article on What happens if you can’t afford the IVA payments, and see if that suggests potential ways to solve your problem.

But if your problems are the result of the cost of living crisis, or your mortgage or rent going up a lot, then there are new options, brought in in 2022. For example you can ask your IVA to have your IVA completed “on the basis of funds paid to date” so that it just finishes and doesn’t fail. See Help with IVAs if you can’t pay because of the cost of living for details.

I suggest you post on one of the IVA forums,e.g. theivaforum.co.uk or MoneySavingExpert. That will give you some feedback on whether you do have good grounds for complaining. You may also find that in replying to you, people write phrases that you can use in your complaint and give useful links.

Posting can be done anonymously but do name the IVA firm, because people may say if other posters have had similar problems with your firm.

On the forums you may get asked questions such as “is there a minimum dividend clause in your IVA?” or “what does it say about taking a payment break?” Look at your IVA paperwork:

- the IVA document and any annexes are the key items. If any of these are missing, ask your IP to send you a copy;

- any correspondence between you and the IP before the IP was proposed or during it.

It may seem confusing at first, but persevere and ask questions on the forum. The more you understand about your IVA, the better your complaint is going to be.

Step two – simply ask why

Before you lodge a formal complaint (step four below) it is a good idea to write to your IP stating your concern. Even the best firm sometimes makes administration errors or there may have been a misunderstanding.

You can find the email address for your IP from the IP directory.

Keep it short and use plain English rather than legal wording:

- don’t use the word “complaint” at this stage

- ask the firm to explain why you are being asked to do X, you don’t think you should have to because of Y

- if you would like a payment break or to propose a full and final settlement but your IP says you can’t, ask them to explain why

- say if you would like to speak directly to your IP.

Step three – background research

Whilst you are waiting for the reply, do some research on your IP and the company as this may help you with the next step:

- look up who authorises your IP;

- read SIP 3.1 – this is a Statement of Insolvency Practice for IVAs. This link is to the one issued by the ICEAW; the other bodies that authorise IPs have identical ones;

- read the Code of Ethics that your IP’s regulator publishes; here is ICEAW’s, where Section A and D are most likely to be of interest;

- find out who regulates your IVA firm. If they do other debt management work apart from IVAs, they should be FCA regulated and their website should say this;

- if you would like to know some factual information that could affect your complaint, consider putting in a Subject Access Request to your IVA firm. Do this as a separate email to the Step Two query and add a sentence on the end making it clear that this SAR is in addition to the query you sent them on dd/mm/yy.

This is all background information, you can read quickly, looking for things that seem relevant to your situation.

Step four – make a formal complaint to the IP

Your IVA firm’s website should have the details for how to make this formal complaint.

Don’t by-pass this step even if you know you have a serious problem (one exception that is actually very rare – if your IP informs you he is about to petition for your bankruptcy, you need professional help right away, see below).

Going through a formal internal complaint has the following advantages:

- if it works it will be quicker;

- it provides a way to reach a settlement without attacking your IP’s professional competence. If you complain to the IP’s regulator, it is less easy for them to back down because they may feel they have to defend their actions

- it may give you more useful information if you do need to take your complaint further.

Try to separate out the major issue from any subsidiary ones.

For example, if your main complaint was that your IP is telling you your IVA is going to fail when you think it could reasonably be marked as completed, you may have other complaints such as that you were initially misled about what an IVA involved and staff don’t return phone messages – list these other points after explaining the most important problem so that you don’t confuse it.

If you know what you want to happen, ask for this clearly, for example, “I would like you to confirm that I do not need to do X as it is not mentioned in my IVA terms.” Or “I would like my creditors to be asked to vote on whether my IVA should be completed on the basis of funds paid to date”.

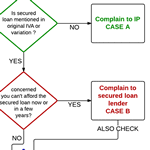

Step five – make an external complaint

Just because this seems complicated doesn’t mean that your complaint is going to fail!

Your options depend on your specific case, so I’m just going to outline them briefly. Think about getting professional help to choose between these and to take them forward, see below.

(5A) complain through the Insolvency Service

You are not complaining about your IVA firm, you are complaining about your IP.

Complaints about an IP have to go to their authorising body, but the Insolvency Service has provided Insolvency Practitioner Complaint Form for you to use.

The Insolvency Service says:

The authorising bodies are not able to intervene directly in any insolvency case, nor to overturn the decision of an insolvency practitioner, nor that of any Court. They will consider any referral within the context of whether the actions or behaviour of the insolvency practitioner may result in the insolvency practitioner being liable to disciplinary action.

That may mean that you can’t see the point of making this complaint!

However there may be conciliation mechanisms that will help to resolve your dispute, even if the regulator lacks the legal power to force an IP to change a decision. This is worth doing even if you are skeptical.

(5B) court action

To overturn an IP’s decision you can go to court. If you are being told to do something that seems to be against the terms of your IVA agreement, or which is not mentioned in your IVA agreement, then this may be an option for you.

You need a lawyer to discuss how to pursue this. This would be a civil matter usually dealt with by a County Court, so the police will not be involved.

(5C) Complain to the Financial Ombudsman about mis-selling

The Financial Ombudsman (FOS) has no jurisdiction over the operation of IVAs.

But FOS can look at complaints about the advice to enter an IVA if the advice came from an FCA authorised firm:

- this could be your IVA firm – although many IVA firms are not FCA members;

- it could also be the firm you originally spoke to about an IVA that passed your details to your IVA firm. This would be separate and in addition to any complaint to your IVA firm.

There is also the problem that if your IVA is continuing, then any compensation ordered by the FO may even fall into your IVA under the windfall clause, although this may make it easier to get it agreed that your IVA has been completed.

Get help

If you think you need help with all this, contact your local Citizens Advice. A local Citizens Advice has access to the national specialist debt team, so don’t worry that the advisor you see hasn’t dealt with an IVA complaint before – it might be a good idea to show them this page! They will want to see your IVA documents and they will be very pleased if you can give them the ‘background research’ from step three above.

You may need a lawyer. Some CAB’s have lawyers, others will be able to refer you to a local Law Centre or other places for pro bono (i.e. free) legal help.

In 2022 there are legal firms saying they can win IVA mis-selling cases. It isn’t clear how successful they are though… and many want you to pay several hundred pounds for them to write a report, but it isn’t clear how much this report will help.

t curtis says

Made my last iva payment march 2014 have yet to have my completion certificate who/what can i do or contact about this?

Sara (Debt Camel) says

Hi T, I have written an article about delays in getting your IVA completion certificate that you may find useful: https://debtcamel.co.uk/iva-completion-certificate/. As it has been over 9 months, this is time to complain!

marlow says

Hi I made my final iva payment last may 14. My debts were £23000. With all my payments and 3 ppi I have paid back about £21500. I have been enquiring about my completion certificate and have just had a letter yesterday asking for 12 more payments of 260 per month. Can they do this 10mths after my final payment. Also barclays sent me a letter saying they were giving me back £3500 in interest that shouldn’t have been taken and they sent a letter to dfd about this. No matter how many times I ask how much I owe no one will tell me. They also wont give me any information on the barclays interest.

Sara (Debt Camel) says

Hi Marlow, you could ask DFD in writing about the Barclays interest issue and whether this affects the maximum amount you might have to pay into your IVA. re the 10 months delay, that is very poor, you may well have made financial commitments if DFD told you that your IVA wouldn’t be extended. Again a written complaint (as described in this post) would be a good first step and I would suggest talking to your local Citizens Advice Bureau if you would like help with this.

Harry says

Hi Sara we spoke a month or so ago , still not got my certificate, I rang today they told me that they r waiting for 1 bank that did not replay to them so is outstanding, Santander, if they don’t get in touch soon the money will divided between the over creditors or come back to me to pay Santander ,, or is not right

Sara (Debt Camel) says

Hi Harry, you need to ask your IVA firm what will happen if Santander don’t reply. But you are not going to be left with your IVA finished and still owing money to Santander if that’s what you are worried about. Your IVA finished in December. If you haven’t got your completion certificate by the end of the month, put in a formal complaint to you IVA firm and the Insolvency Service’s gateway for complaints.

keith says

Took out iva in 2009. First two annual reviews, payments were adjusted to cover, no problems. Original firm taken over by Money Plus. Next three annual reviews went in heard nothing. I could see myself that any extra earnings had balance out to my out going. Even on a tight budget I had nothing left each month. Final payment in Aug 2014. Heard nothing, so I thought it was over. Great. Then March 2015 got annual review pack. So I filled in sent off. Now they say I owe several 1000’s (waiting on final figures). Panicking now and don’t know what to do. Have they mishandled my iva? Or am I at fault for not chasing them?

Sara (Debt Camel) says

Hi Keith, if you completed the annual reviews and thought there wouldn’t be a change in payments because your expenses had also gone up, I can’t see why it was your job to chase the IVA firm if you didn’t hear anything! If I was you I wouldn’t wait to hear “the final figures”, I would email them saying why you don’t think your payments should have increased (detail your increased expenses). Add you will be putting in a formal complaint to them and also to the Insolvency Service Gateway if your completion certificate doesn’t arrive within the next month.

Collette thomas says

Hi not a negative comment I’m actually in shock and EXTREMLY pleased . We made our final payment to our iva on the 1/12/15 then received query regarding equity in our property which we dealt with quickly and today 12/1/16 we received our certificate of completion issued on the 6/1/16 !!!! Very happy as was worried as I had read lots regarding people waiting silly lengths of time to receive there completion certificate . Our iva was originally with grant Thornton then changed to aperture .

Sara (Debt Camel) says

Good to hear this!

jim says

Hi I was with Grant Thornton now named as Aperture, i made my last payment last month and they have now told me it will take up too 8 months to complete, which im shocked with, i suppose ill have to wait and see.

Mark says

Hi,

I’m 2 years into my IVA and was hoping to pay off any debt still owed, dependant on inheritance I may receive. I’m inquisitive on how I go about this as I don’t seem to be able to get an easy and straightforward answer.

Any advice or help would be much appreciated

Sara (Debt Camel) says

Hi Mark,

you may find this article useful: https://debtcamel.co.uk/iva-settlement/.

Your IVA firm won’t be able to give you an exact amount needed to settle the IVA until it’s know when you will be able to pay this because a) until that point you will be making more monthly payments b) if your IVA has the “statutory interest” clause that amount goes up as time goes on and c) other windfalls (typically PPI) may reduce the amount you have to pay to settle.

However if you ask for a rough estimate of what the amount would be likely to be if you paid in in, say, 6 months then they should be able to give you a figure and explain how the calculation works. If you don’t seem to be getting anywhere with your case handler, out in a formal written complaint to the firm and emphasise that you are only asking for an estimate and an explanation of the calculation.

David Lane says

Funnily enough I’ve just made a complaint to my IP, completed my IVA early in June 2013 after finding their staff rude and mistake made on several occasions with regards to overtime and income/expenditure sheets reverting to previous levels.

Fast forward to now and once again an issue has arose, once again their member of staff was rude and once again it seemed like everything was too much trouble for them. As I am in the process of remortgaging it transpires that despite having over three years to do so they have never removed the restriction on my property. They weren’t apologetic, and advised me to put any complaint in writing. They have promised to submit a form to remove this interest but this is the final straw for me with them, having experienced issues on a couple of previous occasions. they have apologised and seem to feel that a mere apology is acceptable in the circumstances. From their emails its clear that their original form to remove their interest wasn’t sent by recorded delivery, to me it seems that this is incompetence which could have a massive effect on my life

Lee says

Does anybody know wots happening with this Green v Wright case

Sara (Debt Camel) says

Postponed, lack of judges (!), no date set.

Edited – decision and discussion about it is here: https://debtcamel.co.uk/ppi-iva-green-wright/

james burgess says

hi i have just made my last payment after 6 years 8 months to IVA company now they are telling me it may take up too 8 months to close as they have to asses my last years earning which will take 8 weeks then a further 6 months to close down, is there a time limit they have to do this.

Sara (Debt Camel) says

There is no time limit, but by the point it gets to 4 months I suggest emailing the firm with a formal complaint, then if you still don’t have the certificate by 6 months put in a complaint to the Insolvency Service gateway, see https://debtcamel.co.uk/iva-completion-certificate/ for more details.

MS says

My iva isn’t registered on my credit file or the insolvency register and I’ve been on it over 18 months now. I’ve got a copy of chairmans report, creditors meeting etc

Is this right ?

Sara (Debt Camel) says

No it’s not right. But it’s not to your advantage to have an IVA showing on the register or your credit record so I’m not sure I would bother to complain about it! I suggest keeping an eye on your credit record and if you see the IVA appear, make sure it has the right start date.

Michael Kelly says

Hello

I am some 10 Payments away from completing my 60 Month IVA – I have no assets or Mortage so I should get to the 60 Month and not be approached for an Extension – which I believe is correct. I have however just been offered to take an unsecured loan in order to end my IVA early – This I find so Hypocritical it is unbelievable – that an IVA company encourage you to get into Debt in order to pay off the IVA early and they Charge a £200 referral Fee in the process – Is this legal and can they actually do this?

Sara (Debt Camel) says

Hi Michael, I have written an article about this Creditfix / Perinta loan: https://debtcamel.co.uk/perinta-loans-end-iva-early/

Lee Brown says

You should not even be applying for a loan if still in a iva

Sara (Debt Camel) says

In this case the loan is being suggested by the IVA firm in order to make a full & final settlement offer to the IVA. I don’t think this is a good idea (for the reasons given in the link to my other article) but it’s not illegal.

John says

Hi. I am 54 months into my Iva and at the equity release stage. I received a letter yesterday saying that there is over 5k equity and I am unable to remortgage,thus I have to continue for extended 12 months. So I rang my IP and asked for them to explain there findings.

Firstly I feel they have overpriced my property and they said that I am welcome to get my own valuation done by (pretending) to sell my home to a local estate agent. Which I thought was very unprofessional.

Secondly when I was given the findings their stated that there was 8k of equity in the property,so I asked if that was 8k each for me and my wife as we are in a interlocking iva. The response I got was that I’m in a joint iva and there only needs to be 1 x over 5k to remortgage.

I’ve done some research and dissected my Iva proposal and I believe that due to the wording of my proposal that we would need 5k each of equity.

Can I challenge this second point with my IP.

Thanks

Sara (Debt Camel) says

First get that valuation. Bother unprofessional, this could be a simple way to resolve your situation. You need to ask the estate agent for a realistic but not fire-sale price, say you want the house sold within a few months.

You could look back at the documents you got when your IVA was set up. They may have contained some worked examples which will clarify the point. For most joint IVAs the de minimis 5k applies for each of you but it will depend on the wording of yours.

You can definitely challenge this – put in a formal written complaint to your IVA explaining why you consider they are wrong. You may want to get some help to draft this – your local Citizens Advice or a Law Centre could help.

John says

Thanks Sarah. I’ve got a estate agent coming to do a valuation on Wednesday. so hopefully could have this resolved soon.

I’ve looked at similar properties in the area and they seem to be in better condition than mine and cheaper than their valuation And I’m sure that my house won’t match there valuation.

Thanks again

Louise says

Hi, I’m coming to the end of my 54 month. I have been advised my equity release is £9000, I cannot get a remortgage as it is shared ownership social housing. I requested how much was left to pay as I’ve paid 2 lots of ppi totalling £14000 on the original debt £31,000. They could not give me a breakdown but said I owe £9000 which included fees and interest. I get regular credit reports and the figures don’t stack up – my understanding is that they are not to make a profit – can I challenge this as they have i need to make 12 extra payments.

Sara (Debt Camel) says

First, do you agree with their calculations on how much equity there is in your property? You should be left with at least 15% equity. See https://debtcamel.co.uk/iva-equity-release/

Two lots of PPI totally 14k sounds like a lot, but the claims company they used will have been expensive and their fees have to be deducted. So it may not make as much impact on how much has been paid in as you think. But you are entitled to ask for breakdown showing how much has been paid in to date and what the fees have been.

Gina says

Hi

My experience is goal post changes all the time and fees need to be checked as to what you are paying for ask for a break down of what your paying and also ask for a list of if creditors and go back to them and ask for balances and proof letter from them and I know it’s hard but try work out what you have paid and include ppi and original variation and if it don’t add up go to them with a complaint and your proof and ask for investigation. And don’t give up! Until you get the answers chances are balances are a lot less than what you think if they are old debts some might of even been written off you are entitled to know what you are paying for as you employed them good luck

anthony oliver says

i completed my iva in june 2017 with debt free direct and i havnt received any feedback as when i will receice my completion certificate in fact dfd wont even answer the phones

Sara (Debt Camel) says

DFD’s parent company has gone into administration. The DFD subsidiary is being sold to Aperture. I suggest you start sending emails rather than phoning.

Wendy says

Hi get an email address write one email and overload them everyday until they respond also you can go through fairpoint as they own DFD with a complaint about completion I just bombarded them all day everyday until they listened to me ! Goodluck I can’t see how they are going into administration as there turnover last year was somthing like 5.2 million check out fairpoint and I’m sure you will see your insolvency practitioner on there website as a director or manager there

Lee says

There’s a shock Aperture taking over more Ppi money for them

Sanjeev sharma says

I completed my iva in May 2017 I waited 5 months for the final closure document to come threw but it eventually did,, previously in October 2016 I got a letter from bank saying I had ppi to come back to me so I informed the iva company about this and left it at that. Then in March I got another letter from bank saying you haven’t yet claimed your ppi so again I phoned the iva up and the said the have collected all my ppi’s so again I left it at that because I was coming to the end of my iva. I then was given the option of remortgaging to further pay my debt which I took out so then in May I stopped paying my iva and started paying into a different repayment scheme. When I did get my final enclosure document I started applying for ppi as I hadn’t previously in many years. Then I got a response from the same ppi that sent me a letter in 2016 that my iva company had not contacted them and the money was still with them. So I sent them the final document and behold the iva company who i finished with in May took all the money. Is this right can they do this even if I am out of the iva and paying a different company for the existing debt that the creditors agreed on

Sara (Debt Camel) says

I’m sorry but it probably is right. See https://debtcamel.co.uk/ppi-iva-green-wright/

Sarah says

I would just like to add that IVA is the worst government financial scene ever! I have all written documentation and proof – I owed £25,800 and in all I paid back £40,989!!!!!! This is the biggest con ever – if people read this my advice is go bankrupt and don’t pay anything back!!!

No one will help you, no one cares and banks and financial people do not give a shit about anything or anyone accept how much they can get out of you.

Waiting for the day when soneone takes these IVA companies to court and they are told they must pay back the money they stole from people!!!!

Sara (Debt Camel) says

The large majority of people don’t have to make any payments if they go bankrupt. However in your case you probably would have been one of the those who have to make monthly payments for 3 years in bankruptcy, and you would not have been able to keep any PPI refunds for example. So although you probably would have paid less than in an IVA, and it would all have been over a lot more quickly – you would not have paid nothing in bankruptcy.

Sarah says

Thank you – I knew I had been mis-sold it but there is nothing to do about it – I had no one to talk to for help regarding it. I messed up and it has subsequently messed my life up also. No home, no where to live, no job either, no savings, nothing. People should be warned off these companies who promise the world and deliver hell. There is no way I can get anything back now either. I have tried with banks concerning PPI and they say they have no information on me? When it comes to money and life in general I am the unlucky one!!!

Strawjaw says

I took out an Iva when I was made redundant in 2008 and none of my creditors would agree to smaller payments. I made my last payment in July 2013 – but have never received a completion certificate. Debt free direct wouldn’t send it until I signed a form entitling then to claim my ppi – then it was made legal for them to just get it anyway, they were sent a payment of over £6000 which along with all my payments should have repaid my creditors in its entirety. Still no certificate of completion – now I’ve just been given another ppi refund – which has gone directly to a firm called Aperture – is there anything i can do? I feel like DFD have been very sly and surely something must be illegal – no certificate of completion when it’s paid up for nearly 5 years – and now being able to make a claim on my other refunds – how is this fair??!!

Sara (Debt Camel) says

I am sorry but DFD were perfectly within their rights to refuse to give you a completion certificate until you agreed to them collecting PPI afterwards.

When you agreed to your IVA, assets that you had (apart from excluded ones) became the property of your creditors. These assets included the right to make PPI claims.

It is a pity you didn’t take advice at the time and just sign and get your completion certificate. I am sure Aperture will send you it now if you sign.

Alicia says

I have iva for just over a year. My circumstance changed and I am earning less. I have infirmed them and received no response. All chasing. Considering to stop payment and go bancrupt.

Sara (Debt Camel) says

Hi Alicia,

that may be the right way forward for you but it is a big decision. Do you have a house with equity? Any assets? How large are the debts in your IVA? do you think your earnings may improve?

Sarah Coyne says

My response is after being talked into an IVA by the now defunct Debt Free Direct, is go bankrupt. You’ve only wasted 1 year with them – don’t waste another 5 paying it off – go bankrupt and do t pay anyone – your still young – no stigma with bankruptcy the best people have done it. Forget IVAs they are the biggest government rip off and money making scam since PPI

Lisa says

I took out a joint Iva almost 6 year a go my ex has paid nothing towards it for 5 year or our mortgage , I am now married and trying to put my husband on my mortgage and take my ex off I rand my Iva and they agreed and sent my a letter through email confirming this my mortgage company asked for a letter not the email so Iv rang back and are now saying my ex can’t be took off till the Iva is complete and I’ll need to remortgage with my ex to release the equity in my house! They just be mad if they think I’m going to do that surly that’s wrong I don’t mind remortgaging if my husband is on as we live in the property but why would I remortgage with my ex who doesn’t pay towards nothing and also the fact they have sent me the wrong information in the first place it’s shocking Iv gone through 3 months of stress trying to add my husband finally get it sorted for them to say aww sorry you when told the wrong information!

Sara (Debt Camel) says

First of all, there is no such thing as a “joint IVA”. There are two separate IVAs. Have you been paying your ex’s IVA all these years without knowing this?

Second how long was your IVA for – if it was for the usual 5 years, you should already have passed the “remortgage or pay an extra year” point?

Who is your IVA firm?

Andy h says

Are these iva’s a con i think there worse then ppi i got back 15000 and it went in into the iva so i will be paying the same that i owe

Sara (Debt Camel) says

How large were the debts that went into your IVA? how large are your monthly payments?

kevin waterman says

My iva has failed i was paying £262 a month and i called them to say i cant afford that much but they wouldnt drop it so it failed ,i payed in £4730 and out of that only £700 went to my debts and the rest my iva (unity) took ,lm still in debt and ballifs knock the door any suggestions ?

Sara (Debt Camel) says

Sorry for all the questions:

When did your IVA fail?

What did you want it reduced to? Was this put to a vote of your creditors?

How much are your current debts?

Are you renting or do you have a house with equity?

Charlie says

My IVA company have gone into insolvency, if this is the right term for it. Im just absolutely shocked. I have also been told that the ways we were asked to send our information I.e. via whats app was not secure! A new company has taken over and have sent me forms to sign but I I don’t know them. I have lost all trust in what I thought was a highly regulated debt solution. I have also read that if I leave this IVA because of this that all the payments I have made ( because they are under 100) will be lost on fees!

How can a company that is supposed to be looking after mine and others debts, get into debt themselves????

Sara (Debt Camel) says

Good questions!

Which Iva Company is this and who have you been transferred to?

How long until your IVA finishes?

Can you say how large the debts were, if you are buying or renting and what your monthly payment is?

Charlie says

It was pareto, they have been taken over by creditfix I owe 4474.

I think I’m paying over 5-7 years ??

No car finance, started about a year ago ?

I rent. I pay between 70 and 90 a month.

Thankyou

Joy says

Hi due to a family bereavement I contacted my insolvency practitioner to notify them I would be receiving a sum of money and asked for how much I would have to pay. I was given a figure which I noted. A month later I received a letter informing me of a new figure which was an increase of 7k on the figure given to me over the phone.

I emailed them for an explanation which I deemed unsatisfactory and asked for the case to be escalated to a senior manager. I eventually received another email telling me that the initial figure given to me was incorrect and that I have to pay the higher figure. The manner in which this has been handled is unacceptable and I have serious concerns over the way my IVA is being handled.

Sara (Debt Camel) says

Have you asked for a breakdown of the new amount?

Joy says

Yes and I have received it. Along with a response to all the points I raised which refer back to the original agreement.

Dawn says

I owed £13.5K to creditors. I have been paying off the IVA at £100pcm for 4 years and it runs for 5 years in total. I might have a lump sum of money coming in, and the IVA firm are asking £16K to close the arrangement! I was never told I could end up owing more than the original debt, I feel the IVA was missold to me. (I have bipolar disorder, so debt has been a lifelong problem)

I was actually told prior to signing up for the IVA that reducing the total debt payable (ie £100 pcm for 5 years totalling £6K) was the lenders’ way of taking responsibility for loaning stupid amounts of money to someone who clearly couldn’t pay it off (I banked with Barclays, they lent me most of it, and they knew they were giving me debt which was more than I earn in a year)

I now feel totally scammed to end up owing more than I originally did, despite having paid for 4 years. Is there any recourse open to me?

Sara (Debt Camel) says

who is your IVA firm?

how much of this extra 16k will be IVA fees and are they also adding in something that may be described as “statutory interest” or “8% interest”?

Dawn says

Hi Sara, thank you so much for responding to my enquiry.

The IVA firm is Creditfix, I was put in touch with them by a firm called Corbrooks who pressured me to go ahead and sign all the documents quickly.

The additional fees are for a whole host of things including Nominee Fee, Supervisor Fee, Successful PPI Claim fee, PayDay loan investigation (I’ve never had a payday loan!) Partnerlink Technologies fee, PPI external consultancy, Vision Blue Case management and montly support fee…. the list goes on and on and most of them are things I’ve never heard of and certainly wasn’t told I could ever be expected to pay for. If I’m looking at the document correctly, all the fees total £4,350. I find that a shocking proportion to add to the original debt, it is obscene.

I can’t see any mention of interest, I guess I should be thankful for that. I was told that all interest was cancelled by taking out an IVA.

Sara (Debt Camel) says

if you owed 13.5k to creditors and an extra 4.5k is added in fees that comes to 18k. But you have already paid about 5k haven’t you? So why are you now being asked to pay 16k more to close the IVA?

If you are finding it difficult to work through all the numbers, can I suggest you get in touch with your local Citizens Advice who can help you look at this and help with a complaint to Creditfix if necessary?

Dawn says

Thanks Sara, yes it is all very confusing. I will go to my Citizens Advice with the paperwork and see what they make of it.

Ian says

Hi

I started in an IVA in 2007, and reading these comments I see that bankruptcy was never offered to me as am option. All was going ok from late 2007 to Feb 2012, when the IVA was terminated. I was behind on one payment I think and no good explanation was provided. Later I moved onto a DMP, through their advice and I stayed there untill August 2019, when a second IVA was started.

I have some records from my first IVA and it’s number and monthly payment amount, but the company has deleted all their records as it’s over 6 years old: despit me still being one of their clients. I have a rough figure of how much I have paid into the first IVA, but now have no proof and no proof of the original debt total! I do have detailed information from the DMP and exact figures for that.

The creditors I’m now paying have A/Cnumbers I dont recognise and figures I dispute. Am I entitled to know what I’m actually paying for? What debts each creditor has bought up, from who and how much? And should my debt advisory company not have all the records of their clients untill 6 years after they stop being a client? It’s been going on for 13 years now, with 5 to go in this current IVA, as naturally they insisted it had to be a 6 year IVA not 5! A life sentence that is now effecting my health.

Sara (Debt Camel) says

That is very poor. Some possible options to think about:

One option for you is to send your IVA firm a complaint saying your IVA was mis-sold as they never explained to you the alternative of bankruptcy. Say they to resolve this you would like them to propose to your creditors that your IVA is completed now on the basis of the fund paid to date. Point out you have been paying your creditors through them since 2007 and that you now have health problems.

Say if your creditors refuse, you would like the IVA failed and for your IVA firm to refund you fees that have charged in the IVA so far and you will deal with your debts yourself.

Another option is to not bother with the complaint but simply tell your IVA firm you are stopping paying the IVA and will deal with the debts yourself. You can then contact all the creditors (your IVA firm will have to give you a list) and if they are loans or credit cards, ask them to produce the CCA agreement for the debt. See https://debtcamel.co.uk/ask-cca-agreement-for-debt/. If they can’t (and since 2007 it is good bet quite of few of them can’t) then the debt is unenforceable and you can ignore it. If you are unlucky and a lot of the creditors produce the CCA then you can look at bankruptcy.

Deciding to fail an IVA is a big move – it would be a good idea for you to talk to an independent debt advisor about this about your full situation before deciding, for example you could phone National Debtline on 0808 808 4000.

Or of course you can carry on with the IVA.

Ian says

Hi Sara,

I thought I would give an update as to the situation with my IVA complaint. After waiting for 8 weeks for the IVA company (PayPlan) to give me their response, it arrived today; they see that they have done nothing wrong!

Interestingly they did not say that it was their final decision, but to contact them in the first instance if I did not agree with their response! And so it continues!

Sara (Debt Camel) says

Have you talked to National Debtline? If not, I encourage you to do this so you have a full view of your situation from an independent source.

Ian says

Thank you. I have drafted a letter in the first instance suggesting the IVA is completed.

Mr G says

Hi I set up IVA about a year ago and I was and still am on benefits , via company didn’t tell me that pip payment isn’t included for consideration of payment , was I miss sold iva

Sara (Debt Camel) says

Is paying the IVA proving difficult?

Mr G says

A little yes , I have been trying to call iva compamy and phone is permanently engaged , have been trying for last 3 hrs and nothing , pretty anxious

Smahan says

Hi Sara I’m currently in my 2nd year on my IVA , I recently recieved an affordability refund from Amigo , I’ve informed my Iva , I’ve asked for a settlement figure of what I owe etc , but they keep saying I have to hand to money over first , I feel like that’s all there interested in and feel uncomfortable doing this without any figures in writing , any advice on what I need to do

Thanks Mrs kelly

Sara (Debt Camel) says

I am afraid the Amigo refund should go to your IVA firm. It can’t be used to settle your IVA early, unless it means all your debts and your IVA fees have been paid in full, you will have to carry on with your IVA payments.

C Pye says

I finished my IVA in 2013 gir my certificate in 2017 due ti them messing me about. They confirmed they had collected all PPI. 2 years ago I was told I had 12,000 PPI yn collected. Varden Nuttall took the lot. Today they have offered me 3599 as a good well gesture is this right or is it to shut me up.

Sara (Debt Camel) says

See https://debtcamel.co.uk/ppi-iva-green-wright/.

It may be they have offered you the “8% statutory interest” on the claim. Some IVA firms do that.

Miss T says

Hi,

I took out an IVA last year and was told at that the time that I could pay it off quicker or pay more off each month to close it early. I upped the payments by £20 a month and then was offered the cash by a family member to close the remaining balance. When I tried to do this I was told off for paying extra and also told that I could afford more so that they were doubling the amount owed which means I now can’t afford to close it but also the debt is not that much less than the original amount, which was £11,000. I have paid £2000 and they now want £8000.

I have some savings in a separate account which would be enough for a 10% deposit on a house but now stuck renting paying double because I won’t be able to get a mortgage. I just want out of the iva So I can make steps towards buying my own home, even if it means paying the debt myself. Is there any way to do this or will I have to use my deposit?

Sara (Debt Camel) says

“and was told at that the time that I could pay it off quicker or pay more off each month to close it early.”

Who told you this?

With an IVA on your credit record fir6 years you will not be able to get a mortgage even if you can end it early.

Adrian says

Hi. We are coming to the end of our IVA but have recently realised that a restriction on our property is included in our IVA arrangement. We are being told that this is because the restriction is in my wife’s name as she is the deed holder on our property and it has been accepted in the IVA arrangement under my name as it is my debt also. Can this be done? Is it legal? We have made a complaint to the relevant bank and have been told that they are not to blame as our IP should have explained this. Does this mean I have been mean mis-sold my IVA as it will mean that even when the IVA is complete, the restriction will still be on the property and we won’t be debt free?

Sara (Debt Camel) says

Did your wife complete an RX1 form when your IVA was set up?

Adrian says

Hi Sara. What is an RX1 form? As far as I know she didn’t

Sara (Debt Camel) says

It allows a “restriction” to be added to your property.

Is your IVA 5 or 6 years? Did your IVA firm not discuss equity release with you before the IVA?

Adrian says

Our iva is 5 years but we will be paying an extra 12 months of contributions instead of remortgaging. The restriction was placed on the property a while before we took out the Iva and the bank are insistent that it takes priority over the iva even though they have accepted iva payments since it was set up.

kevin says

I was on an iva with unity they kept putting up monthly costs until they wanted £252 per month i said i cant afford this amount but with no joy ,they wiuldnt budge,so i cancelled it.i payed in £4700 but they took £4000 for them and paid my debters £700 which i think this is wrong can yiu help ?

Sara (Debt Camel) says

When did your IVA fail? How many months payments had you made?

Do you have a house with equity?

Haw large were the debts going into your IVA?

Kevin says

Failed in 2018 paid for 2.5 years no house as we rent and debts were around £20,000 +. Im now going into another iva with a much better company

Sara (Debt Camel) says

ah.

How much contact have you had with your creditors since the IVA ended?

You do know your new IVA company will charge the same sort of fees as the old one did?

What makes you think they are any better? More thana third of IVAs fail…

Is there a reason you aren’t looking at bankruptcy instead? It can’t go wrong.

Kevin says

Bankruptcy cost to much its not just me its my partner also if we could afford it we would

Sara (Debt Camel) says

what will the IVA payments be?

How large are your partner’s debts? how large are yours? do you have any joint ones?

how much hassle are you getting from the creditors?

Kevin says

Payments will be around £120 per month,our debts are 60/40 and some are joint we are getting some from bailiffs hence why were trying to get sorted again.

Sara (Debt Camel) says

Talk to National Debtline in 0808 808 4000 urgently – before you sign up to this IVA.

It may be that both of you could qualify for a Debt Relief Order now. See https://debtcamel.co.uk/debt-options/dro/. That costs £90 and all your debts are qwiped out after a year with NO monthly payments.

Or it may be that only one of you would qualify.

BUT the DRO rules may be changing in May so that you can have larger debts and more disposable income. It may well be that if you don’t both qualify now, you would in May.

Do not commit to a 5 year IVA until you know you can’t get DROs. A DRO is always better, it costs massively less and doesn’t go wrong.

Bailiffs – what sort of debts are you being chased for?

Kevin says

Baliffsare after council tax debt we are all ready paying £150 every 4 weeks on top of paying current c tax.but now there after another debt and refuse to put the two togethet yet both are for council tax

Sara (Debt Camel) says

ok, well council tax bailiffs have NO right of entry. Just refuse to open the door to them and they will eventually send the debt back to the council. This doesn’t get rid of the debt but the DROs (or bankruptcy or IVA) will do this.

Do not let yourselves be bounced into choosing an IVA when it sounds like a dreadful idea.

please talk to National Debtline tomorrow.

Kelly says

These IVA need looking at , I think I’ve been mis old one , their only intrested in the deed they con you into , wish I had more knowledge about them before I entered intro one just con people !

Dean Russell says

Hi..hopefully someone can answer my question.

We have a complaint with the FOS in regards to a mis selling of a IVA. The business concerned has responded that when our client first took out the IVA it was with a company which went bust. Gregory Pennington, then took over the IVA, client made some payments to them before having a DRO. So is Gregory Pennington correct in saying they should not be responsible for the miss selling of the IVA because they never set it up?

Or if they take over the book they are responsible?

Sara (Debt Camel) says

I suspect you will not get anywhere with this.

what compensation are you asking for?

Dean Russell says

The refunds of all fees paid into the IVA. or see what fees the client paid to Gregory P and reclaim them

I am thinking you may be correct,

client blatantly miss sold the IVA

Sara (Debt Camel) says

have you checked if the IP changed? Sometimes the IP moves with the IVAs…

L williams says

I was persuaded that an IVA was the best solution for me but I heavily queried that I had just entered into a vehicle finance agreement and did not think this was an option, I was assured that having a vehicle on finance was not a problem as it was classed as a “need”. Six months into my IVA I have just received a letter from my vehicle finance company to say that they will be terminating my agreement and repossessing the vehicle with the balance still owed by me as I had entered into an IVA. Surely I must have grounds to bring a strong miss-selling complaint with the IVA company? This isn’t the IP’s mistake/fault so can I complain without bringing them into it?

Sara (Debt Camel) says

There will be a term in your car finance contract that allows them to repossess if you become insolvent. You should have been warned by your IP that this was a possibility.

If your IP told you this could not happen this is 100% your IP/IVA firms fault, see https://debtcamel.co.uk/car-finance-iva/.

How much are you paying in your IVA and how large were your debts? Are you buying or renting? Was protecting the car the only reason to choose an IVA?

Do you know the IP? Why do you think it is the IVA firms fault and not the IPs?

Karl says

Hi,

I took out an iva 2 years ago. For debt of £6000. I was paying £100 a month back for the past 2 years. So i had £3600 left to pay this year. I was gifted the remainder of the money to pay off early. Which i went ahead and asked my IP to this. They then have worked out i am earning more a month and stated you need to off £8400 for your creditors to consider (which was more than my original debt before i joined the iva). Which i find mad, do i have chance of making a complaint? Is there anyway i can get out of this situation?

Sara (Debt Camel) says

Was there an annual review after the first year?

has your income gone up a lot?

Issy says

Hi Sara any advice about this please . Recently terminated Iva with financial support systems, basically the dividends they have put down as paid to creditors, creditors are saying to me they haven’t received or part received making it really difficult to gather how much each balance it , numerals calls and emails to financial support systems are getting ignored or when I do soeak to them on tge phone telling me they are dealing with it but when I speak to creditors they have not heard from them , I’m trying to sort my debts out but it’s really difficult if they are not giving creditors information they are being asked for , how can I deal with this as this has been going on for 5 weeks and nothing is moving along and it’s causing me stress and anxiety I just want to pay my creditors and move on

Sara (Debt Camel) says

You are going for a DRO I think?

Issy says

No paying the debt myself now , surely they need to make sure the paperwork is correct on the correct dividends paid or if any was paid as creditors are querying this , just want to know what I need to do to get it resolved Sara

Sara (Debt Camel) says

do you not qualify for a DRO? Sorry, but not many people who would qualify will sensibly be able to repay the debts

Issy says

As I paid quite a lot into the Iva , I only owe around £1600 to a few creditors, so a family member is kindly going to pay this , but obviously I’m not going to pay creditors if according to financial support systems they have been paid or some of tge debt has been paid , that’s why I’m not entering a DRO

Sara (Debt Camel) says

are you getting hassled by creditors? if not, I suggest you sit back and wait for the IVA firm to sort things out. And i wouldn’t pay any until it is all done, the IVA firm doesn’t sound well organised.

Issy says

Hi yes they are contacting me , but are saying they are putting account on 30 day hold till they hear from Iva , but yes think that’s what I’ll do just let them sort it out between themselves , thanks Sara for the advice , just wasn’t sure how resolve it all

richard may says

yes creditfix r bully people with leaning disabity glascoe head office it sick want hav been reading about iva this just after cash line on pocter

Dean Russell says

Hi

Where do i make the complaint. IP or FOS

I am not making a complaint about the IP.

I wish to make a complaint to the FOS on the grounds of miss selling and unsuitability of the IVA over bankruptcy

Although the FOS has no jurisdiction over the operation of IVAs it can look at complaints about the advice to enter an IVA if the advice came from an FCA authorised firm, Stepchange is authorised by the FCA.

• The complaint is around the mis selling of the IVA.

• Stepchange failure to deliver a standard of care to its clients.

Client has no assets, debts of £35K.

Lives in council property with wive and 4 children.

He will pay £11k into the IVA over 5 years.

Although working i do not believe he would have been subject to a Income Payments Order, paying full rent CT and bills etc.

Where does the complaint go

Stepchange hacve directed me to the insolvency service, i believe it is the FOS

Sara (Debt Camel) says

How long ago did the IVA start? What are they paying a month and is it affordable at the moment?

Dean Russell says

Hi Sara

Sorry did not include, the client is currently in prison expecting a 1-3 year sentence. He has been in custody since May 2022. So the IVA is now no longer affordable.

At the time of the IVA which started Nov 2021 he was in full time employment. He has made 5 monthly payments of £185, total £925. IVA is about to fail, no payments made since Mayz.

According to SC Comparison form SC advised the cost of the IVA will be £11,100 compared to £12,403 bankruptcy costs, this includes paying £185 per month over 3 years into a IPO. These figures are miss leading and is not an accurate cost of clients’ bankruptcy. SC cannot forecast with any accuracy IPO monthly payments over 3 years. Although working at the time is highly unlikely client would have been subject to an IPO. Client paying full rent Council Tax and bills food clothing etc

£680 fee will be paid by the RBL

Sara (Debt Camel) says

So the IVA is failing and you will be helping your client apply for bankruptcy.

The answer to your question is that the complaint should go to StepChange. Go back to them and say it appears their advice to have an IVA was inbreach of CONC 8.3.2 and PRIN 6.

They should respond to this complaint and if they are rejecting it, say your client has the fight to go to FOS.

BUT what are you hoping to achieve by doing this? If your client goes bankrupt, any refunds are likely to have to go to the OR not to your client. This is the fundamanetal problem with IVA complaints where the client has no option but to go bankrupt.

Dean Russell says

Hi Sara

I get that any refunds may go to the OR. However, as i am seeing more and more of clients being offered IVAs and DMP that are completely unsuitable for the client it is good training to go down the complaint route. If the client was doing a DRO they would have been allowed to keep the money, however i am more disappointed in Stepchange in this matter, they should know better. Same day SC put another client into a DMP for 20 years….The client will pay £135 per month. Again no assets so bankruptcy is a far better option than a DMP.

Dean Russell says

Hi Sara

Just a thought, lets say the FOS cannot look into the miss-selling of IVA and any IP complaint goes nowhere.

Hypothetical question, if the client any client prove a IVA was an unsuitable option, i.e. failed within 12 months, could the client take the company through the small claims court to recover their payments.

It may make companies such as SC to toughen up their advice and options and advise the client to obtain a 2nd opinion through CAB or other similar organisations

Sara (Debt Camel) says

I don’t think so – I think you would have to take the IP to court for breach of the Insolvency Act and that would be the High Court.

Dean Russell says

Hi Sara

I remember when a person took a bank to the small claims court to recover his overdraft charges. so its possible

Sara (Debt Camel) says

Yes but that was not an insolvency case.

If you client wants, take the case back to StepChange and say what FCA regs you think have been broken. Then try to take it to FOS. See how this goes.

Issy kelly says

I really think it’s time for this mis selling of some of these awful IVAs to be outed it’s clear some Iva’s we’re not suitable fir a vast nunber of people why isn’t anyone doing anything about it there are a scam why if you are in debt already would you possibly have to pay these ridiculous fees for nothing it’s time for this to be brought in a a huge mis selling !

Kelly says

Please help. I was due to end my IVA next month but now the company (Freeman jones/financial wellness group/Pennington – they trade under so many names) are insisting I owe another £4000. I pay £90 a month for debt under 10k. They are insisting I owe it because they think I have received tax credits when I haven’t. I have sent every bank statement. All screenshot of hmrc records etc but they won’t budge. They still insist I am to pay it. The cost of living has put me on my knees, I have not used heating for the last two years, no gym, hairdressers clothes etc. This company I am dealing with are evil. They do not contact people, they do nothing just take your money and I had no idea how much they would take. Please what can I do to stop these people because I have not received the money they accuse me of and I can’t afford this anymore

Sara (Debt Camel) says

Do you know who your IP is, their name should be on your IVA paperwork. It will be either catherine.mcneill@freemanjones.com or Michael.bellingham@freemanjones.com

I suggest you email them with Complaint as the title and explain your problem. Let me know what happens.

Piotr says

This is a scam, Iva isn’t helping you, Bardfield is just killing you. Me and my wife signed up for this system and the rate was £155. First 6 months £420 and then £155. My wife lost her job and didn’t work for 6 months and she increased my rate to £360 a month. I appealed and they reduced it to £320. our income is lower and the rate is higher, that’s how Iva works. It’s a stab in the back.

Sara (Debt Camel) says

Which IVA firm is this? Why were the first few months higher?

Dean Russell says

Unless you have a asset to protect such as a house then IVA or DMP should be treated like the plague, stay away, they are of no benefit and i would say in 9 out of 10 cases are not in ones best interest

Sara (Debt Camel) says

I would agree with you about an IVA.

But what’s wrong with a DMP if you have a temporary problem or a decent amount of disposable income? Insolvency is best avoided if you don’t need it.

Dean Russell says

Seen clients who were put into long term DMP,s i.e. 5-10 years, clients not correctly advised on DRO, we have complaints with the FOS on this issue, one of the companies should know better.

Sara (Debt Camel) says

Oh sure. But there are plenty of people who do have disposable inland don’t qualify for a DRO where a DMP is a good option

Mags Moores says

My term for the IVA was 60 months on my documents.

The term that Ebangate have is 72 months!

I am waiting fir a reply.

Will the term Ebenegate have be altered on their system?

Sara (Debt Camel) says

Is it possible that your IVA was drafted at 5 years but when it came to the creditors meeting they said they would only approve it if it was increased to 6 years? You should have been informed about this at the time and asked if you would like to proceed…

Mags Moores says

Hi.

I do not remember having a conversation about a 6year term. What can I do

Sara (Debt Camel) says

I suggest you go back to Ebenegate and complain, saying that your IVA paper work says 60 months not 72,.

Lynne Laurent says

Hi My daughter got into an IVA back in 2022 without telling anyone. Due to getting into debt with her ex boyfriend. She had already made 60 payments totaling £1133 + £164.50 = total £1297.50. The IVA was for the amount of £6180

In 2023 she told us the situation and I contacted his father to discuss the debt as it was made by both of them. He agreed to pay his sons share of the IVA. He paid it directly to the debt movement as we presumed this would be the best option. Error No.1. The amount of £3182.50 was paid to the IVA & debt movement. He also supplied them with all his details, email, telephone etc. This was in February 2023. A further £1700 was paid as a windfall. Total sum £6180. Since March 2023 my daughter has been contacting them to come to a final conclusion for the IVA. They have never given final details and had not even informed the creditors of these payments. Today my daughter received a new statement – 14/15 months AFTER paying the money with added on fees of £3021!!! This is outrageous – who should we complain to? FOS or other. or get lawyers this is NOT being paid. They have completely ignored all contact for over 14 months and held that money on file. They should not be allowed to trade. What are her options

Sara (Debt Camel) says

The IVA was for the amount of £6180

do you mean that was the total of her debts that went into the IVA?

or that was the total of payments she was told at the start she would have to make?

Kerry says

Hi Sara,

I took an Iva out in September 2023, I now realise this was a huge mistake but one of my children became unwell and required a lot of my time. To lessen my stress my parents took a loan out and cleared the Iva in May, before paying the company I spoke to them and asked if I would be quicker to contact and pay my creditors direct as I wanted this dealt with quickly. I was advised against this so paid the company the full and final settlement. This was six weeks ago and not one of my creditors has yet been paid. I have been hounded by one of my creditors (daily calls, daily email with my credit card statements) so I called them. They had no idea that I even had an Iva and haven’t received one payment. The company keep fobbing me off so today I sent an email making a complaint. Can I take this further as to me they haven’t done what is basically agreed – contacting my creditors in the beginning regarding me having an Iva!!

Sara (Debt Camel) says

How large were the debts that went into your IVA?

How large was the settlement that has been paid?

Does the IVA show on your credit record?

Kerry says

My debts were £10,762.

I have paid credit fix £10,020 not including the £1260 I paid them monthly for 7 months. So £11,280 in total and yes the Iva is now on my credit report

Sara (Debt Camel) says

and Creditfix put this to a vote of your creditors? Because you have paid less in total than the debts plus the IVA fees.

It takes more than 6 weeks to settle an IVA. Creditfix are not being unusually slow. Is there a specific reason you want this doen very quickly?

You were informed I hope that the IVA will remain on your credit record for the rest of the 6 years and that settling it will not improve your credit score?

Kerry says

I wanted it done quickly as I was dealing with a lot of stress at home involving one of my children and I just wanted this finished so I could concentrate on that and not worry about debt. I do understand that this will sit on my credit report for six years and wish I’d used a different path.

When I spoke to credit fix they advised it can take 3-6 months to pay my creditors but one of them doesn’t even know I have an iva?

Yes the board agreed the full and final settlement and I paid it all straight away

Sara (Debt Camel) says

So there is nothing you need to do. If it hasnt made progress in 6 months, come back here. It isnt your job to talk to the creditors – if they contact you, refer them to creditfix

Mike says

Hi Sara

I am in a protected trust deed, so the Scottish equiv of an IVA. I had debts of 8700 on an income of 35,000. I was not explained just how much would be going to fees, which increased total debt to ~£15k. I didn’t realise how bad that was.

The company is barely contactable (carrington dean/creditfix) and take weeks to reply to stuff. I was wondering if it would be worth going through complaints procedure to discharge and go into other debt methods?

I now have an income of 47,000 – so it is a small debt and could be paid off relatively quickly provided I don’t get saddled with the fees etc on top of my debt.

I have paid £2,100 so far, but that probably just covered interest if anything.

Sara (Debt Camel) says

That is a madly small amount to have a Trust Deed/IVA for.

how much are you paying a month?

MIke says

122at the moment, but with payrise it will be 270, after saved for my wifes visa it will be about 370/m

Sara (Debt Camel) says

When did it start and how long does it last? when will it be going up to 370?

Mike says

August 2023, lasting to August 2027.

It will be going to 370 in Juneish. As of today its 270

Sara (Debt Camel) says

So you will only be paying the higher rate for a couple of years. Isnt this the simple option? There is no way so far as I know that you can get a TD cancelled as the advice was poor. Talk to a Scottish Advisor though who would know more about that

Brian says

I was put in touch with an iva firm Forestking Insolvency by Faith Financial Services who have since gone bust. Took iva out February 2021. I stopped paying Forestking Insolvency in September 2023 as I had paid £2500 and nothing had been paid to my creditors. I also watched a Panorama programme on iva’s and Forestking Insolvency was featured on there and done exactly the same thing to a disabled person as they did to me.

Sara (Debt Camel) says

what are you doing about the debts that were in the IVA?

Brian says

Hi. The IVA was still live after nearly 18 months of not paying them. The guy on the phone said I had been lucky that I had 18 years breathing space from my creditors. I was a bit upset as I wanted to know how much I still owed. He told me that out of the £2500 I had paid them £975.00 set up fee. £750.00 a year running the account. So not lot had been paid to my creditors. Apparently after my phone call I was told that within a week the iva would fail. Up until now it is still active.

Brian says

I only received the termination letter today. On the phone call three weeks ago I was told that out of the £2500 I had paid Forestking Insolvency £950.00 was the set up fee. 750.00 per year to run the account. So the guy told me that very little if any had been paid to my creditors.

Sara (Debt Camel) says

So how large are your debts and how do you propose to deal with them?

Brian says

Total outstanding is £9000. I’m just waiting for the Iva failure letter then wait for the creditors to contact me. At least I’ll know how much is still owing. The Iva was totally missold to me. The sweetener was ALL phone calls. Emails and Letters would stop. Looking back on things the £2500 I paid Forestking Insolvency i could have paid to my creditors.

Ken says

Good morning, I’m looking for a little advice.

My wife and I entered into an IVA in Feb 2021,

I had minimal debt, roughly around £11K which £8K was Amigo (how we love those guys).

The rest was 3 credit cards totalling just over £3K.

My wife’s on the other hand was quite substantial.

While talking to the insolvency group they were of course helpful and eager for our business.

I listed the Amigo loan and nothing was said, upon receiving our IVA summary amigo was listed.

I was contacted by Amigo and asked for payment, it was at this point I was told I was still to pay them via my guarantor. Had I been told my dad was still liable for payment I would have opted out of the IVA as Amigo was the main reason to enter into it.

I called the IVA company and they advised me to pay the monies to my dad’s account as he was not in the position to pay (missold Amigo loan).

Had I just paid amigo and used the fee for my insolvency I would of paid off my debt with in 20 months as amigo went under and as I paid the principal I no longer was liable for payments.

This is just one instance of the miss handling of my account. For 18 months I was paying someone else’s debt even after a yearly review they did not flag this and it was myself who brought it to their attention and they still tried to say it was my debt.

I complained about a multitude of issues but was left with just a partial resolve.

The IP investigator has looked into this and I feel it is sadly not just.

The fees alone were not fully disclosed.

I went from owing £11K to paying out over £16K.

I paid off the debt 100% in full 3 years early.

What are my options with complaints etc

Sara (Debt Camel) says

who is the IVA firm?