For many years Gregory Pennington (GP), part of the Financial Wellness Group (FWG), has charged its clients monthly fees for running Debt Management Plans (DMPs) But MaPS awarded Gregory Pennington a contract that began on 1 February 2023. And it can't charge fees for DMPs under this contract. StepChange, Payplan and CAP have always provided "fee-free" DMPs, where all a client's payments go … [Read more...]

Getting out of debt

Practical articles about the different debt options, which might work for you and different ways of dealing with creditors

IVA mis-selling must stop – FCA finally acts to ban debt packagers

Many people have been mis-sold IVAs when they had a better (cheaper, quicker, less risky) debt option available. These other options were ignored or not properly described by some firms that should have given proper debt advice. IVAs are the only debt solution in England, Wales and Northern Ireland that generates large fees for the firms setting them up. These fees can distort debt advice given … [Read more...]

How to repair your credit record after bankruptcy

Bankruptcy badly affects your credit record for six years. This article looks at what should show on your credit record after you are discharged from bankruptcy. For almost everyone, discharge happens after a year. But if lenders don't record bankruptcy and your discharge correctly, they will continue to damage your credit record for longer than they should. Even if you … [Read more...]

Affordability complaints for two credit cards from a lender

My article on credit card affordability explains when you should make a complaint and has a free template letter to use. Some people have two credit cards from the same lender. Or two catalogue accounts from the same lender. The most common lenders this affects are: Newday - brand names include Aqua, Marbles and Fluid; Capital One - some people have been given two Capital One cards. … [Read more...]

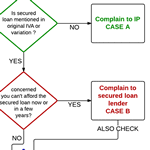

IVAs and secured loans – how to complain

The IVA protocol, which applies to most new IVAs that started before July 2025, says that in the last year of your IVA, if you have a house with equity, you may have to release equity by either remortgaging or getting a secured loan. Most IVAs that started after July 2025 will use the "Protocol 2025" that does not require equity release, so this article is not relevant. Some of the proposed … [Read more...]

Has your debt with Hoist been sold to Lowell?

In September 2022, the debt collector Lowell bought Hoist's UK business, with over 2 million defaulted accounts. Most of these debts were loans, credit cards or overdrafts from lenders such as Barclays, Egg, HSBC, Newday and Santander. Lowell is moving over the Hoist accounts to its system. With so many accounts to be transferred, this is being done in batches. When yours is switched … [Read more...]

I have a letter from a debt collector – what can they do?

If you get a letter saying that a debt has been sold to a debt collector you may be very worried. This article answers common questions about what has happened and how it will affect you: will the debt collection agency (DCA) be horrible to deal with? is it legal to do this? do you still have to pay the money? what about your credit record? what if you don't owe the money? I … [Read more...]

What happens after discharge from bankruptcy?

This article looks in detail at what happens when you are discharged from bankruptcy: the practicalities, the implications for savings and gifts and the restrictions that end after discharge. Discharge is almost always after 12 months Almost everyone is discharged from bankruptcy automatically 12 months after the date they went bankrupt. During these 12 months when you are bankrupt, you have … [Read more...]

The debt collector wants to review my monthly payment

Mr A asks: I have had an arrangement with a debt collector for a number of years, paying £10 a month. They have sent a letter asking for a review. Do I have to do this? Can they do anything if I just continue with my current payments? You don't have to give these numbers but... It is a good idea to give revised details Everyone was happy when the arrangement was set up. Mr A was relieved … [Read more...]

Correct credit records by “suppressing” them if the lender has disappeared

If you feel that your credit report is wrong, the usual first step is to ask the lender to put this right. But when the lender is in administration, the administrators may not respond to requests from you to correct your credit files. And if the lender has been liquidated, there is no-one for you to contact. Here the Credit Reference Agencies (CRAs) should help if you ask them to. Incorrect … [Read more...]

- « Previous Page

- 1

- …

- 4

- 5

- 6

- 7

- 8

- …

- 16

- Next Page »