Some lenders responding to affordability complaints by saying your application wasn't accurate about your income or expenses when you took out the loans. They are doing this to try to put you off taking your case to the Financial Ombudsman. That may save them a lot of money! Let's see why applications may have been inaccurate and whether this is a problem for your complaint. Most of the … [Read more...]

Getting out of debt

Practical articles about the different debt options, which might work for you and different ways of dealing with creditors

Why the Ombudsman released a guarantor from a loan

The Financial Ombudsman (FOS) has recently published two important decisions about guarantor loans, one where a borrower complained and one where the guarantor complained. I have covered the borrower case here: Ombudsman – Amigo did not check properly that a borrower could afford the loan. This article looks at the FOS decision about the guarantor for a loan. I have selected points from the … [Read more...]

Ombudsman – Amigo did not check properly that a borrower could afford the loan

The Financial Ombudsman (FOS) has recently published its decision on Miss G's complaint against Amigo. This FOS decision criticised Amigo's inadequate assessment of Miss G's income and expenses. It said her poor credit record meant Amigo should have verified the figures, for example by looking at bank statements. So FOS ordered Amigo to refund all the interest and charges she paid, plus 8% … [Read more...]

Letters from Reunite or Prime Location Services – be careful

This article covers letters from Reunite (website: reunitemenow.com) and Prime Location Services (website: primelocationservices.co.uk). Both firms send "tracing letters", trying to find someone, without saying anything about why they are trying to contact you. Both have links with Global Debt Recovery, who are a debt collector. Reunite A typical letter from Reunite says: We require your … [Read more...]

“What if I forgot to put a debt on my bankruptcy application?”

A reader asked: I am thinking of filing for bankruptcy. Some of my debts go back quite few years. I tried a DMP and an IVA that failed. I’m behind on my household Bills too. I’m single mum and find hard to cope with all this stress. I finally plucked the courage to do the form. I have at least 13 creditors, some of these details I took off my IVA creditors list but some have passed the debts … [Read more...]

“What happens to a DRO if I move in with a new partner?”

A reader asked: I’m a single parent and have had about 10k of debts in a debt management plan for several years. I’m on low income and it looks like it will never end plus I have got some further debts. Now I’m considering a Debt Relief Order (DRO). But I met someone and I’m thinking about starting to live together. I don’t want to tell him about my debts and really want to sort this out … [Read more...]

Going bankrupt in England and Wales – a checklist

Most people find going bankrupt is stressful. Although afterwards it is usually much easier than you have expected, at the time there seems to be so much to get right. Here is a checklist, covering everything you need to do before submit your bankruptcy application. The good news is that this is now all much simpler than it used to be. A few years ago you had to go to court with three copies … [Read more...]

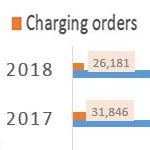

Are you worried about a charging order?

Can your house really be at risk if you get into difficulties repaying something like a credit card bill? You might think the answer is "no", but there are some very rare situations where this can happen. It helps to know the facts, so you can make good decisions about how to deal with your debts. To be able to sell your house a creditor has to: start by getting a County Court Judgment … [Read more...]

Which is better a DRO or an IVA? There is a very simple answer!

Everyone has heard of bankruptcy, but Debt Relief Orders (DROs) and Individual Voluntary Arrangements (IVAs) are less well known. Here is a comparison of IVAs and DROs, so you can see would be better for you. DROs and IVAs were the two most common types of personal insolvency in England and Wales in 2023. Some choices between debt solutions are genuinely hard. When I wrote about comparing … [Read more...]

“Debt collector can’t prove it’s my debt but wants payment”

A reader, Ms J, asked: I sent a Prove It! letter to a debt collector as I have no recollection of debt they say I owe. They replied saying that they cannot “provide specific details to your dispute” and we have marked your account as unenforceable meaning we will not pursue legal action and have informed our client to remove any reporting on your credit file. However the above account remains … [Read more...]

- « Previous Page

- 1

- …

- 10

- 11

- 12

- 13

- 14

- …

- 16

- Next Page »