Guarantor loans are coming into the regulatory spotlight. The FCA wrote to CEOs in March 2019 saying it will be looking at affordability and whether potential guarantors have enough information to understand how likely it is that they may have to make the loan payments. In a speech, Jonathan Davis said: Recent work we have done in this area showed that many guarantors are making at least 1 … [Read more...]

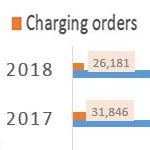

Are you worried about a charging order?

Can your house really be at risk if you get into difficulties repaying something like a credit card bill? You might think the answer is "no", but there are some very rare situations where this can happen. It helps to know the facts, so you can make good decisions about how to deal with your debts. To be able to sell your house a creditor has to: start by getting a County Court Judgment … [Read more...]

Which is better a DRO or an IVA? There is a very simple answer!

Everyone has heard of bankruptcy, but Debt Relief Orders (DROs) and Individual Voluntary Arrangements (IVAs) are less well known. Here is a comparison of IVAs and DROs, so you can see would be better for you. DROs and IVAs were the two most common types of personal insolvency in England and Wales in 2023. Some choices between debt solutions are genuinely hard. When I wrote about comparing … [Read more...]

“Debt collector can’t prove it’s my debt but wants payment”

A reader, Ms J, asked: I sent a Prove It! letter to a debt collector as I have no recollection of debt they say I owe. They replied saying that they cannot “provide specific details to your dispute” and we have marked your account as unenforceable meaning we will not pursue legal action and have informed our client to remove any reporting on your credit file. However the above account remains … [Read more...]

What happens in an IVA if I am made redundant?

Losing your job can be a big problem for your IVA unless you can get a new job quickly. Having redundancy pay can help through this period - but some of your redundancy pay may have to be paid into your IVA. Here I'll describe what the 2016 IVA protocol Individual Voluntary Arrangement says. Most IVAs have similar provisions for redundancy. It's a good idea to check your own IVA paperwork and, … [Read more...]

Recent payday loans make it hard to get a mortgage

Having a recent payday loan on your credit history can make it much harder for you to get a mortgage at a good rate - or even at all! If you have used payday loans, the rule of thumb for a mortgage application is to wait until at least 2 years have passed after your last payday loan was settled. Before coronavirus, the usual advice was to wait one year. But from 2020 many mortgage lenders … [Read more...]

“What will happen at my IVA annual review?”

A reader asked: I’m worried about my first IVA annual review. How much detail will they go into? I've found the year tough with a few car problems. I switched gas and electric to try to save money but it hasn't helped much. This is one of the many IVA issues where I have to start by saying that there is no definitive answer for everyone. It depends on the terms of your IVA, your IVA firm, your … [Read more...]

Is it a lot of work to run your own DMP ?

Most people use a firm to run their Debt Management Plan (DMP). In this case you make one monthly payment to the firm, who then divides it between your creditors. This is free if you go to StepChange, Payplan or CAP - other firms do exactly the same but charge you a fee each month. But you can do all this yourself, not using a DMP firm. The advantages of this are: you are in control; … [Read more...]

Complaining to the Financial Ombudsman – what happens

When you have a complaint about a loan, credit card, mortgage, pension or insurance and you can't get it settled with the company, send the complaint to the Financial Ombudsman Service (FOS). FOS describes what happens: Your complaint will be investigated by one of our case handlers, who will try to understand what happened and if the business did anything wrong. Your case handler will let you … [Read more...]

Can a debt collector or a lender call you at work?

A reader asked: I work in a Finance Department and I am worried I will be called by a debt collector about a credit card. Can I say I don't want them to call me at work? This is a common worry. Whatever your job, you don't want your manager or your colleagues to know you have money problems. It could be a lender or a debt collector, it could be an overdue bill or a debt. Creditors should … [Read more...]

What happens after an IVA fails? What can you do?

Your IVA seemed like the perfect solution when it began, but now it may be failing. Will you be back to square one and have difficult creditors to deal with? Or could you even be made bankrupt? First, there may be ways to rescue your IVA An IVA failing may not be a disaster, for some people there are better options! That's what the rest of this article looks at. But don't assume nothing … [Read more...]

2018 – Ombudsman decides it can look at payday loans over 6 years old

The Financial Ombudsman (FOS) has published in September 2018 two Decisions involving payday loans over six years old: Mr H has complained about fifty-four payday loans Lender C lent to him between March 2010 and September 2014. Mrs W’s complaint is about nine short-term loans from Lender D between November 2009 and July 2012. In both cases FOS has decided that its rules do allow it to … [Read more...]

Adding Liability Orders to credit records – a bad idea!

County Court Judgments (CCJs) are added to people's credit records, so why shouldn't the same be done for Liability Orders (LOs) for council tax arrears? This is a really bad idea, involving major problems and costs for local authorities and magistrates courts. These would massively outweigh the potential benefits. Magistrates Court Liability Order processes are not comparable to County Court … [Read more...]

Getting a clean start after gambling debts

A reader, let's call him Mr C, asked: I have been in bad mental health and have in periods of illness suffered big losses due to online gambling. I used to earn £32,000, I now only work part-time, getting c £700 a month, and have moved back to my parents. I have debts of £27,000 with £1,000 a month repayments. Some debts are very new eg a £8,000 loan three months ago. I am very unlikely to … [Read more...]

Lending Stream – poor and slow complaints handling

Lending Stream, a mid-sized payday lender in Britain, is noticeably bad at handling payday loan affordability complaints. This article looks at what often happens in a Lending Stream affordability complaint so you are prepared. By taking your complaint to the Ombudsman you may get a much better award. In the first half of 2018, the Financial Ombudsman was agreeing with the customer in more than … [Read more...]

- « Previous Page

- 1

- …

- 9

- 10

- 11

- 12

- 13

- 14

- Next Page »