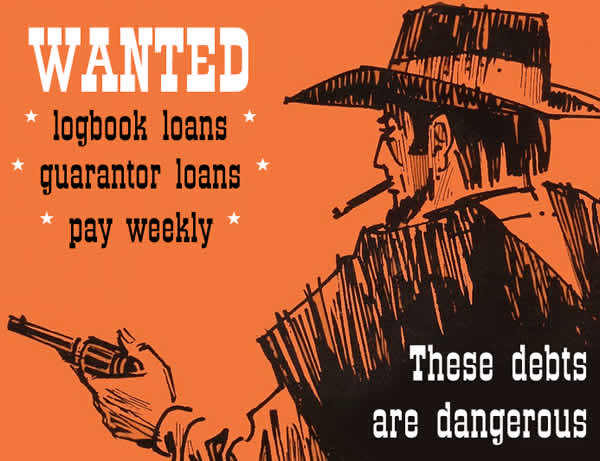

Logbook loans, guarantor loans, “pay weekly” shops such as BrightHouse – these may sound attractive if you are short on cash but have a poor credit rating or have been refused a payday loan. But this sort of debt can end in disaster if you have money problems.

This article looks at bad credit loans, how they create a lot more problems than they solve and what alternatives might work better for you.

And it has links to help you complain if you already have some of these loans and are feeling stuck. If your lender didn’t check you could afford one of these loans, you may be able to get a refund of the interest on it, which would be a big help.

Logbook loans

If you have a car, logbook loans may seem like an easy way to borrow money quickly, with no credit checks at all.

But borrowing from Varooma, Carcashpoint, Mobile Money, Logbook Loans, Auto-Money, Loans2Go and other loans secured on your car can prove extremely expensive in practice.

The interest rates are high and there can be a long list of extra charges which aren’t clear when you borrow the money. Citizens Advice has seen people who were charged £12 for making a payment on time!

Logbook loans aren’t normal bank loans at all – legally they are “Bills of Sale” – when you take one out you are actually selling your car to the lender.

If you miss a payment, the lender can take your car without even going to court first. If you depend on your car to get to work or if you are disabled, this means you are in a very vulnerable position.

You can’t get help to set up an affordable monthly payment if things go wrong – with logbook loans you are trapped into the high payments or you will lose your car.

As a result, when someone can’t afford the high repayments they often feel they have no alternative but to borrow more from the logbook lender. These lenders helpfully deluge you with offers to extend your loan after you have repaid a few months. That then makes the problem worse – people can get trapped in this cycle for years.

One reader has said:

I currently have a logbook loan with about 18 months left to pay off. I am up to date with the payments at present. I have rolled this over 4 times now and paid about £2500 in interest so far on a £1000 loan.

Practical help – if you have a logbook loan or have repaid one with difficulty, look at this page Refunds for large bad credit loans. if you have repaid the loan, you may be able to get all the interest refunded. If you still have the loan, you may be able to get the interest removed so you only repay what you borrowed.

These affordability complaints work! Here is a Financial Ombudsman decision against Mobile Money and another against Varooma.

2023 – many fewer logbook loans

Many lenders have stopped or reduced the number of loans. Varooma went into administration. Some other lenders are still in business but no longer offer logbook loans.

Guarantor loans

Guarantor loans are expanding rapidly as it becomes harder to get payday loans. Amigo is a major provider of guarantor loans in Britain, with extensive advertising on daytime TV aimed at people with poor credit ratings. Other lenders include UK Credit, TFS, George Blanco, Buddy Loans and Bamboo.

These guarantor lenders love to say how much lower their interest rates are than payday loans. But as Money Saving Expert Martin Lewis points out, “comparing yourself with the market’s dirtiest, doesn’t make you clean.”

If you borrow £3,000 at 49.9% for 5 years, you will be repaying an eye-watering £8,000.

The cap on payday loans, so you can never pay more interest than you have borrowed, doesn’t apply to guarantor loans as they are over a year long.

Many guarantors don’t understand what they are getting into and would struggle themselves with the repayments on these loans. Your parents may own a house, but their actual pension income may be low and they would struggle to make the loan repayments.

And often a guarantor doesn’t know just how bad the borrower’s situation is, so they don’t have enough information to make a properly informed decision.

I hope the FCA, who regulates these lenders, will change the regulations for guarantor loans to give guarantors extra information before they commit to such a big risk. But until that happens – if you are asked to be a guarantor, say No. If you really want to help a relative, you give them a loan yourself.

If you have bad credit and need a loan, don’t get a friend or family member involved in your financial mess. Talk to a debt adviser instead. Because guarantor loans turn into a nightmare if you lose your job or have your hours cut or see your rent hiked.

Guarantor loan lenders sometimes market themselves as a good way to rebuild a poor credit score – they aren’t – they are expensive, dangerous for your credit rating and for your guarantor.

Practical help – if you have borrowed using a guarantor loan, read How borrowers can ask for a refund for a guarantor loan. If you are the guarantor there are several reasons why you can ask to be removed as the guarantor.

In the summer of 2019, Financial Ombudsman statistics showed that the Financial Ombudsman was agreeing with the customer in a massive 83% of guarantor loan complaints.

2023 – all the major lenders have given up

Amigo and NSF(George Banco and Trust Two) are no longer giving guarantor loans. Buddy Loans and TSF have gone into administration.

“Pay weekly” shops

Companies such as BrightHouse and Perfect Home advertised “affordable weekly payments” and no deposit as a simple way to buy household goods such as TVs, laptops or furniture. You may not think of these shops as selling expensive loans at all, but that is exactly what “pay weekly”, also called “rent to own” or “rent to buy” are – and they are used by over 400,000 people in Britain in 2016.

The shops emphasise the weekly payments which can sound small, not the total cost you end up paying:

- their price often includes delivery, installation, and very expensive insurance, whether you need them or not;

- interest rates between 65 and 95% are usually charged on top;

- the cheapest washing machine at some of these shops could cost over £1,000 if someone paid weekly over three years. But a similar machine with similar service cover only costs £350 in a normal shop.

In April 2019, the regulator brought in new rules that will mean that these shops can’t charge as much for some good as they have been doing.

2023 – the big lenders have gone

BrightHouse, the largest pay weekly retailer, went under in 2020. Perfect Home in 2022.

If you want to buy white goods or furniture look at Fair For You – a pay weekly online shop with a lot of major brand goods but they work on a not-for-profit basis and their total costs are often less than half what you would have paid at BrightHouse.

The worst part – these loans stop you getting help with your debts

If you have unsecured debts such as credit cards, bank loans or even payday loans, there are a lot of options for dealing with money problems.

- you could get a payment arrangement with a lender.

- or you could get a Debt Management Plan set up where the interest is frozen and you only make one payment a month.

- if just freezing interest isn’t enough, there are insolvency options such as a Debt Relief Order.

But none of the poor credit loans discussed here can easily be included in a payment arrangement, a DMP or in insolvency because the lender will simply repossess your car or furniture or go after your guarantor.

So you are trapped by these expensive debts. Which is of course what the lenders want…

These loans are being sold to people who have little spare money, often reliant on benefits, but those are exactly the sort of people who find it hard to afford the high-interest charges. The quoted weekly or monthly payment may sound manageable to someone who is desperate, but it becomes a huge burden when it continues over a long period.

So these three sorts of loans make money difficulties both more likely and harder to resolve – a vicious circle.

Last updated 2023

tim says

Hi. My son was persuaded to act as guarantor on a amigo loan of 4000 pounds by one of his best friends. She isnt making the payments so he’s stuck with it. Can i sell this debt in anyway. Or s there anyway i can get my son removed as guarantor.

Cheers

Tim

Sara (Debt Camel) says

Hi Tim,

the person that can “sell” a debt is the creditor, as they have rights (to get the debt repaid) which are worth something so someone else may want to buy it. As your son is the debtor, he has nothing of any value to “sell”.

If you meant “settle”, then the lender will be more than happy if you want to pay the debt… and if your son is struggling and can produce an income & expenditure statement showing that he can’t afford to repay it, the lender may accept a “Full & Final settlement offer” from you – more information about these here: https://debtcamel.co.uk/debt-options/less-common/full-final/

Guarantor loans are a nightmare – worse in many ways than a payday loan as “innocent” people like your son get caught up in them.

EDIT in 2019 a lot of people are now winning affordability complaints against Amigo. A guarantor lender should have checked that loan could be afforded without hardship by both the guarantor and the borrower. That means you son would have to be able to make all his normal monthly commitments, pay all his bills, normal living expenses, current debt repayments, and still be able to pay the guarantor loan.

See https://debtcamel.co.uk/amigo-complaints-by-guarantor/ for how he could complain and ask for a refund of any payments he made.

Jay N says

Can you make a complaint and request a refund, on grounds of affordability from Amigo loans?

I had a £5000 loan over 5 years and took a bank loan to repay this loan. The bank loan is in my partners name. But this loan went over 12 months and I paid over £2000 back.

Sara (Debt Camel) says

Hi Jay, yes you complain on grounds of affordability. This would be similar to the complaints that are being put in about payday loans (see https://debtcamel.co.uk/payday-loan-refunds/). It is an easier argument to make for payday loans because the repayment amount is so huge, but the “affordability” priniciple is general and applies to all lenders. The argument is basically the same – a loan is “unaffordable” if you can’t meet the monthly repayments and still pay your other commitments, rent, bills, food, transport and other debts. It helps the argument if your credit record would have told Amigo that you were already in debt trouble, with defaults or missed payments.

Chelsea says

Amigo Loan –

I currently have an amigo loan backed by a guarantor. I lost my job pretty much the next month after getting this loan. I had money issues before taking this loan and was using payday companies, borrowing from friend and family to juggle my finances. I have been reading the comments about affordability and have now written to some pay day companies asking what affordability checks were done.

I told Amigo I had difficulties paying this loan and they never froze any interest and only gave me a month to get my act back in order or they will go to the guarantor for payment.

My question is that I still have this Amigo loan and I do not want the guarantor to be impacted by my mistakes. Can I write to Amigo using the same affordability argument as pay day. Will they go after the guarantor? I am worried that any action I take against Amigo or stop any payments (which I am still making using family support) and they will go after the guarantor.

Sara (Debt Camel) says

I too would be worried that Amigo would go after the guarantor if you try this.

If you get any money back from payday loans perhaps you could use this to repay the Amigo loan?

Chelsea says

Thanks for replying Sara. If I do get this loan repaid, could I then ask to claim any int and charges back based on the unaffordability argument. Also should they not have frozen the interest when I told them I was having payment difficulties?

Sara (Debt Camel) says

You could certainly put in an unaffordable complaint – at that point there is nothing to lose!

They aren’t obliged to freeze interest just because you say you have difficulties I am afraid. guarantor loans are VERY difficult to deal with.

Debbie says

Can anyone give me advice on Amigo loans? I want to know if a loan with them would be subject to the same or similar regulations as PDL’s. I’m having a really battle with them at the moment they are the only creditor who refuses to suspend interest and charges and I actually pay them more than I pay on my mortgage arrears.

Sara (Debt Camel) says

Yes the affordability rules are the same for guarantor loans. The problem about making a complaint is whether, if you won, Amigo would simply go after the guarantor instead. I would argue that they shouldn’t, but I’m not aware of past cases supporting this.

If your guarantor could also put in an affordability complaint at the same time, this could be one way around this?

Debbie says

Hi Sara,

My guarantor was my husband who when I took out the loan had a good credit rating although I didn’t, when we were short of cash it was me took the pay day loans so we kept his rating up. However the problems started when he was made redundant and I had to try and meet all of the household costs. I had an original loan of £2000 and then took a new loan of £5000 to pay off the old one and consolidate others. They would have checked us both out and should have been able to see the overall picture. They agreed to a reduced payment which ~I have maintained but have continued to add interest so that I now owe way more than I did. I have made contact with them regarding an affordability complaint and the email back was frightening. They are now threatening to go for an attachment of earnings, CCJ and a charge over our property. I really don’t know what to do.

Sara (Debt Camel) says

So it sounds as though your husband may not win an affordability complaint – his credit rating was fine, he was in work. You have a case that the loan was unaffordable for you when you were given it. And that given both your circumstances they should be freezing interest now.

How large are your other debts? How much are you paying to them? If you get any money back from payday loan complaints this can be used to pay off some of the guarantor loan.

I think it would be a good idea for you to talk to a debt adviser about your full situation and this letter you have been sent. It may just be listing all the things they could do. If they get an attachment for earnings, for example, they can’t usually go for a charge over your property. A debt adviser could look at whether interest would be frozen after a CCJ.

Gypsy says

Hi Sara

Just after some advice. I took out an Amigo Loan in 2011 and in 2012 repaid the old one and took out another £5,000. Looking back through my bank statements I was already using payday loans and was always in my overdraft. Unfortunately in 2014 having struggled to pay them back they took us to court. My brother was my guarantor and as you can imagine this has caused a real rift in the family and I now know how stupid I was but I am a widow with two children and was trying to make ends meet. Anyway there was no leeway with Amigo and they took us to court and my brother and I both received a CCJ. I am now in a DMP and paying them back a small amount each month and they have suspended the interest. Working it out over the two loans I paid interest of £3502 plus court charges of £923. They are a very nasty bunch of people to deal with. My question is can I pursue getting the interest back and the rest of the loan written off?

Sara (Debt Camel) says

EDIT

In 2019 lots more people are winning complaints against Amigo and other guarantor lenders. See

– for borrowers: https://debtcamel.co.uk/how-to-complain-guarantor-loan/

– for guarantors: https://debtcamel.co.uk/amigo-complaints-by-guarantor/

And it is possible you can still take a case to the Ombudsman when you have a CCJ. See: https://debtcamel.co.uk/amigo-ccj-can-still-complain/

Chloe says

Hi Sara, my partner currently has a loan with UK Credit a guarantor loan company (his cousin is the guarantor) I think the original amount was 4500 and then topped up to 6000. The total amount he has to pay back is £9479. At the moment he still owes £3628 (not sure how much of this is interest) but so far he has paid £2752 in interest. When he got the loan out his credit rating was horrendous what with all the late payments defaults etc from payday loans. Would we stand any chance in getting anything back or having the rest written off? Also wondering if anybody has had any dealings with this company in the past?

Sara (Debt Camel) says

It’s worth a try with guarantor loans – especially as it was topped up. It will depend if they asked properly about affordability and his expenses before taking out the loan.

Also can his cousin argue it wasn’t affordable for him either?

It’s not one of the big guarantor firms – I don’t remember seeing them mentioned here.

Chloe says

Well they did ask him questions over the phone but as you can imagine desperate times! Wasn’t entirely truthful about how much we paid out, I don’t know how this will effect it? The guarantor at the time more than likely wouldn’t have been able to make the payments. But my partner actually has no contact with him anymore so would be tricky. It was more to the point that I can’t imagine his cousins credit rating was very good and I know my partners definitely wasn’t at the time of getting the loan out

Sara (Debt Camel) says

If he lied during the affordability check, then unless he was saying something completely implausible, the lender can probably have assumed it was true. Unless what he said on the phone didn’t match what they could have seen from his credit report – that should have been a warning signal.

Guarantor loans are meant for people with poor credit ratings. He has to be able to show the lender should have realised he can’t afford the loan…

Andrew says

Update on my affordability complaint with amigo loans.

Adjudicator emailed last week agreeing with amigo the loans I’ve had were affordable and asking if I had anymore information.

I sent more details of my outgoings and he got back to me today agreeing loan 3 was unaffordable and amigo should have done more checks. Asking to refund interest and the 8%.

It won’t clear my outstanding balance but should take my outstanding loans to under £1000 from the current £4500 so still a good result if amigo agree. Fingers crossed.

lucy says

Great news for you.

My adjudicator agreed with Amigo on my complaint :(

Andrew says

Shame. They do seem a hard company. Adjudicator agree that amigo tried to lead my answers over the phone so that helped.

debbie says

Did you ask Amigo for copies of the transcripts for the phone calls? I’m just wondering as I have had 3 loans with amigo and feel they were responsible when I kept coming back and saying I was using the loans to consolidate but had clearly not paid them off with the first loan.

Andrew says

I didn’t get copies but the adjudicator did. I mentioned in my complaint I felt I was being led with my answers which he agreed with.

Sal says

Hi Sara,

I would like lodge a complaint about 2 LOGBOOK loan companies in Mobile money and Loans 2 go.

I believe they lent irresponsibly knowing they had my car as collateral.

Have you got a standard letter for these type of complaints to these “logbook” companies and their email addresses?

thanks

Sara (Debt Camel) says

There is no standard letter – you have to make out a very specific argument related to your exact application and credit record. EDIT : you can now adapt the new latter for large bad credit loans, see https://debtcamel.co.uk/refunds-large-high-cost-loans/

You need to be able to show that the lender should have known at the beginning of the loan that it was unaffordable for you. What was on your credit record at that time, recent defaults? You were presumably asked about your expenditure when you took the loan, did you say anything which would not have matched with what your credit record would have shown – this may help your case. But if your income and expenses were incorrect on your application, that will harm your case.

Both firms have email addresses for complaints on their website.

Sal says

Thank you.

I strongly believe that my credit was very poor at the time and had many ongoing loans at once. Yes, they should have realized that I was going to be in difficulty! BUT yet they offered me the loan!

Brad says

Hello. I have had several Log Book Loans with Varooma. I have cleared my balance with them. The interest has been redicoulius. Its only been noticable since i requested my statement of accounts from them for all my loans.

Do i have a case for unreasonable lending?! If so, shall i go about this the same way i would with a normal Payday Loan Lender?!

Sara (Debt Camel) says

The fact the interest rate was high is irrelevant. What matters is if you could afford to make the repayments and whether they did proper checks.

Your case may be easier because you had several loans, especially if you didn’t finish one but refinanced it with another.

Nwc says

Hi Sara

Just thought I would add what happened with my loans2go complaint it was upheld by ombudsman with full interest plus 8% to be returned, they did the calculation and sent to FOS and me which was half what it should be, they had almost just made up a figure, asked me to confirm it and they would pay, luckily thanks to you and this site I knew to check the calculation against my loans and spotted it quite easily, easy on 2 loans only though, I could quite easily have agreed it and not known any better.

When I spoke to the adjudicator he said another case had the same issue as well yesterday and they had escalated the issue to some higher powers!

Thanks for all the great advice as usual.

Nwc

T says

Hi Nwc,

Glad you got a refund.

I am trying to get this back for my sister who paid a fortune and it was easily unaffordable.

Did it take a long time to get the money back?

loans2go have sent my sister a statement but I couldn’t work it out what shes actually paid in interest.

Thanks

T

Rose says

Question regarding Amigo loans…my mum was guarantor for ex husband who fled the country leaving £5k in 2013…I’ve since consolidated and paid this off in full in 2016, but the repayments were never affordable on her wage if I hadn’t of paid it. Would she have a case to go to amigo and say my ex should never have been granted the loan based on what she could (not) of ever repaid?!

Sara (Debt Camel) says

Yes she may have a case. A guarantor lender is supposed to check that the loan was affordable for both the borrower and the guarantor.She should ask for a refund of the interest paid.

Rose says

I didn’t let the loan lapse and go under her name for repayments as would of caused too much stress for her so it shows as though ex has paid it in full under her name, could she still try and claim?

Sara (Debt Camel) says

Probably not – she hasn’t paid any money so she hasn’t lost anything.

Sal says

Dear Sara,

I raised a COMPLAINT about unaffordable lending to Mobile Money. The ombudsman sent me this.

The latest loan was taken on 18 July 2011 and this meant you’d have until 18 July 2017 to complain to Mobile Money based on the 6 year time frame. Because you complained to Mobile Money on 28 July 2017 it means you’ve raised your complaint out of time.

They said in exceptional case they can help.

What can I say to them?

Sara (Debt Camel) says

I suggest you reply saying (a) you have only just become aware of what an affordability complaint is so you are within the three years from the point when you released. And (b) the logbook loan contuned for [however long it was] and it didn’t become clear to you how impossible the repayment amounts were for some time, so that was within the 6 years.

But this isn’t going to be easy. I’m not aware of any success with logbook loans taken out over 6 years ago.

Matt S says

Has there ever been any success with affordability complaints against Amigo Loans? I’ve looked at the Ombudsman decisions pages and not seen any cases that were upheld against them. I took out a £5000 loan with them in December 2013 with my mum as guarantor, have kept payments up to date with them and have so far paid approx £8500 and still have a balance of over £4000. They also advised that as my first payment was 45 days after the loan was paid out and because I have moved the date forward twice over the course of the loan (25 days additional interest in total) that this has added to the interest and I will now have a further 6 payments of £197.62 a month on top of the scheduled 60 payments. I’ll have paid in total over £8000 in interest by time this loan has cleared and almost £1200 additional interest because of the 25 days that were added on in the early days of the loan. This seems well excessive!!

I realise they will say I agreed to the terms and conditions and that they’ll have a recorded call with me saying I could afford it. But this was at the height of my payday lending / gambling issues when I was desperate for money any way I could get it and they never asked to see any bank statements or anything.

Sara (Debt Camel) says

Yes there have been a couple of wins, not many but not many people have made affordability complaints against them. From memory the wins were mostly either where someone had taken more than 1 loan from them or where it could be shown that they should have realised that your application was not accurate or complete because something didn’t cross check against your credit report.But you have a lot of experience with affordability claims – if you think your case is good, then go for it!

Matt S says

Hi Sara,

Thanks for the reply. It has been almost 4 years since I took out the loan so cant recall the conversation that was had with them, but with the situation I was in at the time I believe I may have exaggerated a little with regards to my income and expenditure when I spoke to them on the phone. Should they have crossed checked this with credit reports / bank statements or is it fair and accepted that they would take my word for this?

Sara (Debt Camel) says

They should certainly have checked that what you said was plausible and in line with what your credit report said. If it wasn’t, they should have asked more detailed questions.

Linda says

Hi Sarah I follow all your site with interest as I am trying to sort my fiances out a bit, I find something interesting on all your pages and find your debt news interesting. After a stressful financial time I now feel I have a lot more control with everything Ive read. I read the above and wondered if you could help at all. I currently have appliances (x 3) from Perfect Home, the interest is disgustingly high and looking at my statement tonight I was appalled at how much balance is still remaining and how long I have left of my term, its the first time I’ve took note of the interest payments, not good. I noticed in this forum a recommendation about a company called Fair You You. I had a look at their pages and I could save money and have a shorter term for the same appliances. However my question is can I return the goods back to Perfect Home and go elsewhere or am I stuck now, also do Fair For You consider poor credit history applicants as I dont want return goods and be declined. I’d call and ask Perfect Home but since they’ve gone online their customer service inst good. I regret going with this company but I was in a mess at the time with my credit report, history and I was in a DMP so felt I had no choice, stupid really I should have brought second hand. Any help would be appreciated

Sara (Debt Camel) says

Perfect Home contracts are HP contracts. This means that if you have made half the payments on an item you can return it and not owe anymore or have your credit record harmed. If you look at the agreement, this should be specified in one of the terms and it may give more details on the date this halfway point will be reached.

Fair For You don’t demand a perfect credit history but they won’t lend if you have a current DMP in place or you can’t repay your current debts. See https://www.fairforyou.co.uk/loan-eligibility/.

Linda says

Thanks, pity about Fair For You as they seem a better company but as I say I’m on a DMP. I was when I took out my Perfect Home items do surprise they accepted me. Think I’ll wait until I’ve paid half and return. A lot of money wasted but way cheaper in the long run.

Ian says

Hello, I want to ask some questions around Varooma. I have taken loans out with them constantly for about 2 or three years now and the interest you pay is absurd. However its one of the only places that will let you lend easily. I don’t feel they do checks thoroughly and that salesperson that you sit with just kinda say sign there really. has anyone had any success in making claims against them? And if so on what grounds. Ive asked for a statement of account and dread seeing what that will say when it comes through,

Thanks

Ian

Sara (Debt Camel) says

Yes people have won affordability complaints where they have had several logbook loans from the same company. It is well worth complaining, ask for a refund of the interest you have paid. Expect Varooma to reject your case, don’t be put off, send it to the Ombudsman.

Ian says

Yes I feel I have a valid case. 9 Loans from Varooma in just over 2 and a half years says something. Just done the maths. I have borrowed £5600 and paid back just over £8k. Ill send the email and keep people updated.

Thanks

Gail says

Do you have a separate suggested template to complain to a logbook loan company for unaffordable lending

Sara (Debt Camel) says

no – use and adapt the template for large unsecured loans: https://debtcamel.co.uk/refunds-large-high-cost-loans/

Andy says

Hi Sara, just to update you about Mobile Money Log book Loans, the adjudicator has upheld my complaint for a full refund of interest & fees for loans 4 & 5 out of 5 loans I had between 2010 & 2013, stating that loans 1 & 2 were over 6 years old and that I ought reasonably to have been aware for cause to complain when I experienced detriment as a result of a lack of affordability checks in 2010 & 2011. Loan 3 was deemed affordable as inc. & ex. was completed whereas there is no proof of inc. & ex. for loans 4 & 5. It has also been ruled that an extra £50 compensation be paid for incorrect settlement dates on my credit report which have now been removed. I am happy with this it has been a lot of effort & time to get this result and I was hoping all 5 loans would be repaid. Mobile money have 1 week to accept.

Thanks for all your help and advice

Sara (Debt Camel) says

fingers crossed they accept decision!

Andy says

Yeah I hope so, I am really confused by the within 3 years of being ought reasonably to be aware rule as the adjudicator will not back down on their opinion that I should have complained or become aware in 2011 when I missed several payments. I have stressed that I only discovered this site on 6th April 2017 but can’t get him to change his opinion, which is a shame as Loans 1 & 2 had nearly £2k of interest and fees. I know I could ask for this to be escalated to the next level, but tbh I am just happy to have got a result on loans 4 & 5.

Andy says

Mobile Money have accepted adjudicators findings within 24 hours and are now calculating refund with 8% interest for 5 years and £50 compensation on top. I am really happy with this as it has taken 6 months to get a positive result and I have been speaking with the adjudicator at least twice a week since mid December.

linda says

Hi my loans with mobile money are over 6yrs old and i had at least 10 over the years final loan paid off in 2012 or 2013 my dad paid this i had paydsy loans too at the time , is it worth me trying who or where did you complain too , thankyou for any advice

Andy says

Hi I sent a complaint 4 weeks ago to varooma. I have heard nothing not even acknowledgement that they have received complaint and are dealing with it. I sent a further email 2 weeks after the first asking if they could acknowledge my complaint, still with no reply. Could anyone tell me if this is normal with them? Thank Andy

Sara (Debt Camel) says

I haven’t seen enough varooma cases to comment on them, but in general the logbook lenders try to ignore things for as long as possible. Expect a rejection and to have to go to the Ombudsman however strong your case is!

linda says

Hi , does this site include log book loans with mobile momey i had around 6 may be more , my dad paid my final payment around 2012, i also at the time had payday loans , i have had some success and no success with these thankyou for any advice

Sara (Debt Camel) says

Yes it also covers logbook loans. There are a lot fewer of these loans so a lot fewer cases mentioned. BUT you are unlikely to win a complaint for loans over 6 years old I am afraid.

Stephen Turner says

Hi

Mobile money rejected the adjudicators decision (twice!)so it is now with the ombudsman pending his decision.

MM are still persuing payments but i cannot pay at present due to financial circumstances but they are not interested.

Can they persue debt whilst it is being looked at or do they have to wait for his decision?

They are threatening legal action

kind regards

Sara (Debt Camel) says

I suggest you contact the Ombudsman and say you are being threatened and ask if they can speed up getting an Ombudsman to look at it. Enclose any emails you have had from MM.

Stephen Turner says

Thanks Sara

I spoke to adjudicator but he said they cannot do anything to help but it will be looked at asap.

Surely they cannot take legal action knowing that the likelihood is that the FOS will award against them?

Kat says

Hi I have had a logbook loan on my old vehicle and rolled the loan over / renewed loan and additional borrowing about 5 times my car then had to be scrapped so I had to transfer the debt to a personal loan with loans 2 go

I couldn’t afford the payments and had to borrow additional money to cover shortfall can I claim for unaffordable lending ?

Sara (Debt Camel) says

Yes you can, both for the logbook loans and the last unsecured loan.

steve says

Kat fight them i have just won against them and they will play every delay tactic they have also lose information and also they even tried to hide bank statements from them for me but i had already send all bank statements and info to ombudsman so it didnt work.I knwo they aint very good to try and complain directly too i would just go straight to ombudsman it worked for me.

Kat says

Hi Steve glad to hear you won against loans 2 go I submitted complaint 8 weeks ago and just had response that they are not upholding complaint said they carried out affordability checks

I had 4 loans with them rolling each one over and then had to transfer to personal loan due to car been scrapped and now unable to make full payments due to been on maternity

How long did it take after replying to obuduaman donyou think I should ?

steve says

I had 5 loans from loan2go in approx 6 month and i missed a few payments so got a few admin charge.My car broke down and they decided they were going to scrap my car in which they did.I went to ombudsman with a complaint and loans2go delayed and delayed asking for more time but the adjudicator had enough of the delay tactics and exculated to ombudsman and it took them 10 days to come to comclusion and now my complaint has been upheald and they have to pay back all interested on all 5 loans and the default fees.They said that they would not have to pay the 8% interest though due to me not filling expenses out correctly.I have a major gambling problem and they should of picked this up in which they didnt.The marked my credit file and sold the debt to motormile(lantern) and they have to remove information from credit file and buy back the debt so all in all a great result.

Ian Bland says

I sent over 3 maybe 4 emails about a complaint to Varooma (Greenlight credit) and they were all ignored. however I did get the email address for their compliance officer who replied in 28 minutes declining my complaint and said go to the FOS. So I took it to the FOS who I get a letter off a couple of days ago siding with me on the complaint to the tune of about £2500. however Varooma have rejected this so now it will go to an ombudsman. Its a long drawn out process and I don’t know how long a it will take for an Ombudsman to look at it, but its looking positive so far. I don’t know how many get overturned from the adjudicator’s but I cant expect it to be high otherwise it devalues the use of the adjudicator I would presume. Keep plugging away its worth it

Sara (Debt Camel) says

90% of decisions are unchanged by an ombudsman – do let us know how yours goes!

big D says

Hi, I took a logbook loan out to cover some payments I had missed on some pay day loans! I borrowed 500 on the Wednesday and by Friday had borrowed another 500. I ended up paying over 3k back so I would certainly avoid that. I have claimed lots back from my pay day lenders in terms of interest and charges but wondered if I could do this with the logbook company? I only borrow twice but in a very close period of time,

any advice would be welcomed, has anyone achieved anything by complaining so far??

Sara (Debt Camel) says

How lonmg ago were these logbook loans?

big d says

2014 to end of 2015

Sara (Debt Camel) says

OK, I just wanted to check they weren’t over 6 years old. In that case you can make an affordability complaint – use the approach on this page https://debtcamel.co.uk/refunds-large-high-cost-loans/ as that works best where the loans are larger and you don’t have a lot of them.

These complaints aren’t as easy to win as payday loan complaints, but be persistent and take your case to FOS as the lender will definitely reject it!

big dee says

thanks sara, I only had this one but I still had a few pay day loans on my credit file. I also struggled part way through the term when I took a pay cut and I informed them my circumstances changed but they still continued to charge me £12 per text message telling my payment was late

Sara (Debt Camel) says

Ask for a refund of those charges as well!

S says

Just wanted to return a little help/information if that’s ok Sara, mainly for anyone struggling with an unsecured loan from Loans2go.

L2G is now telling me that as the contract is for 12+month they are a long term loan provider so the HCSTC cost cap does not apply to them. However, looking through some past FOS decisions, I found a recent one in which the Ombudsman states the definition is broad but it probably is an HCSTC they then go on to explain that the interest rate is so outrageous they think a court may well have found it grossly exorbitant and that the agreement grossly contravened ordinary principles of fair dealing. https://www.financial-ombudsman.org.uk/files/113586/DRN4441181.pdf

One question for you Sara if I may this case referenced above is almost identical to my situation, isn’t there some rule or something that a lender shouldn’t drag their feet when coming to agreements when they know a similar complain has previously been upheld by the ombudsman?

Sara (Debt Camel) says

There are provisions in the FCAs DISP (ie Dispute) rules that says a firm has to learn from previous FOS decisions. But this isn’t going to greatly help you here until there are a lot of FOS decisions making the same point.

But that decision should encourage you to take your case to FOS if Loans2Go have rejected it. Are you also arguing that the loan was unaffordable?

S says

Ah ok, it was more a little reassuring for me about taking the case to FOS.

I am arguing unaffordability and thinking about pushing for some kind of compensation undue stress/harassment along with them using my details improperly etc.

I’ve received their final response with the inc/ex figures they’ve plucked out of the air and refusing all aspects of my complaint, I just have to wait now before I can escalate.

Sara (Debt Camel) says

You can send to FOS now if you have a final response

s says

oh ok cool thought I had to wait until the deadline thing on resolver

Ovi says

Has anyone got any dealings and success stories with Bamboo and UK credit?I put a complaint for both on affordability grounds and they have both been rejected

Sara (Debt Camel) says

These were guarantor loans? The best place to ask is the guarantor loan page: https://debtcamel.co.uk/how-to-complain-guarantor-loan/.

But if you know that the repayments on these loans caused you problems, having to get into more debt elsewhere perhaps, then send the complaints staright to the Ombudsman. The guarantor loan article explains how to do this. There is a very hhigh uphold rate at the Ombudsman for guarantor loan complaints, more than 80%… so the lenders aren’t getting these decisions right!