Panorama on 17 June 2019 showed Easy Money, Tough Debt? It’s on iPlayer for 11 months if you missed it.

It covered a wide range of high cost borrowing, with stories from people who had problems with payday loans, with high-cost credit cards and catalogues, and guarantor loans, with a borrower and a guarantor being featured.

Everyday stories of high cost borrowing

For a debt adviser, these felt like typical clients we see, not extreme cases chosen to make entertaining TV.

People started borrowing with a good reason but were soon borrowing much more:

- one man’s payday loan problem started with £300 to cover a vet’s bill. He then extended that loan and when his income dropped took more loans. Soon he owed over £4,500 – as he said “it spiralled out of control very fast“;

- a single mum on benefits ended up with a £3,000 limit on catalogues which she described as her lifeline “even though you know it’s killing you“;

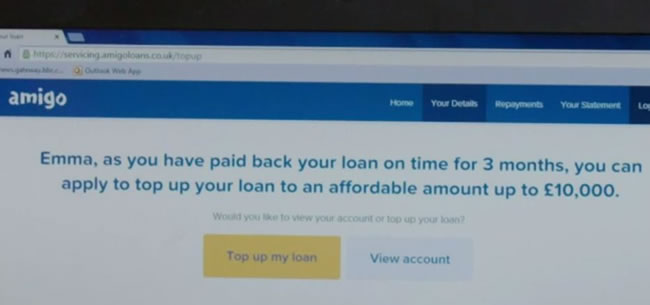

- a borrower described how she was struggling to make payments and asked Amigo for just an extra week or so, but her guarantor was contacted “my anxiety went through the roof,,, I wish I had never put my guarantor in this predicament“. So she struggled on making the repayments, and was then offered another top-up by Amigo, even though she had told Amigo she was in difficulty, as the screenshot below shows:

Are you trapped by this sort of expensive credit?

Caroline Wayman, the Chief Ombudsman at the Financial Ombudsman Service (FOS) talked about affordability complaints. These are best known for payday loans but also apply to other sorts of lending.

To be “affordable” you have to be able to repay the credit without hardship or having to borrow more money or get behind with bills.

Find out how to make an affordability complaint and how they work for different sorts of borrowing:

- payday loan refunds;

- doorstep lending refunds;

- large high-cost loans;

- guarantor loans if you are the borrower or if you are the guarantor;

- credit card and catalogues.

More regulation needed

Affordability complaints can help many people who have been harmed by high cost credit. But better regulation would stop so many people being harmed in future.

Some points that were mentioned in the program:

Stella Creasy MP said the payday loan cost cap – you can never pay more in interest than the amount you borrow – should be extended to other sorts of credit. I agree. This sort of cap should apply to credit card, catalogues and large high costs loans such as 118 Money, Avant Credit, Everyday Loans and also guarantor loans such as Amigo.

John Glen MP, a Treasury minister, said he had discussed guarantor loans with the Financial Conduct Authority (FCA) recently and the FCA is monitoring them. The FCA mentioned guarantor loans in their recent letter to high cost credit CEOs.

I think this needs to be done urgently because the guarantor loan market is getting a lot larger. Guarantor loans have some uniquely difficult characteristics for customers. They cause people a lot of stress through not wanting to harm their guarantor and Amigo is much faster to go to court than any other lender.

John Glen also mentioned the “breathing space” that is going to be introduced. Today, April 19th, the government has given more details: Individuals to be protected from ‘devastating impact’ of problem debt.

What the lenders said

FCA rules says lenders should learn from FOS decisions. QuickQuid were asked why they were not accepting so many Ombudsman decisions about affordability. QuickQuid blamed inconsistent FOS decisions.

But FOS has been making the same decisions about many aspects of QuickQuid’s poor lending practices for a long while, including:

- QQ should not refuse to consider refunds on loans over 6 years – in most cases people were unaware they could make a complaint until recently;

- QQ need to recognise the problems with long chains of loans – repeat lending for many months;

- QQ’s refusal to give refunds on post 2015 lending because they changed their checking in 2015 is wrong. Significant affordability problems have occurred with recent QuickQuid lending;

- QQ’s “balloon payment” 3 month loan product presents major affordability problems for many customers who cannot be expected to be able to save up money during the first 2 months to meet the large final payment.

Amigo said they were happy to talk to borrowers and guarantors about payment problems and never encouraged people to pay Amigo if that meant getting behind with essential bills.

That isn’t the experience of many Amigo borrowers and guarantors. The borrower on Panorama got behind with council tax, utilities, some mortgage arrears and took debt advice. When she talked to her creditors she says:

“they were all pretty helpful, everyone was, bar Amigo.“

GM says

I don’t see any changes in the near future, unless there is heavy government involvement. the problem is, the government won’t do much because their view is that regulating too much is seen as being anti-business by the business groups.

It will take time to bring any changes that could soften the burden of many households who are trapped in debt.

On the other hand, the high street lenders are also not free of guilt as they have the nasty practice of putting interest rates up on borrowers that have missed or defaulted on payments, forcing them to look out for other borrowing alternatives, like payday and guarantor loans. The payday companies know this, so they take full advantage.

Kat says

I watched this. They had similar stories to myself. Only thing was I noticed the vet’s bill guy complained in December and it’s been sorted already! I put my complaint in way longer than him, so I’m hoping to hear real soon!

Greg Sheard says

Hey,

It’s not sorted yet, I won with the adjudicator on quickquid but quickquid have declined it so all of the claims are either still in process or being passed on to the ombudsman :( still a very long way to go.

Chris says

I have a Loans2go loan over 18 months. £500 1st loan last October and then a top up to £750 in February. £159 a month for 18 months. Total repay = £2500. Just gone into a DMP but feel foolish and trapped by this one. It’s a fairly big chunk in the DMP now so will make paying the DMP last longer. I did wonder if there was any way to complain but it is only 2 loans. I wrote to them for my details to see if I could complain. They sent me the full file and then, days later, a Final Response letter even though I hadn’t actually formally complained! Their argument was that their costs are all up front and transparent and that I knew what I was getting in to.

Sara (Debt Camel) says

yes, you can make an affordability complaint. See https://debtcamel.co.uk/refunds-large-high-cost-loans/. You already have the rejection by the lender so you can send your complaint to the Financial Ombudsman.

you can see from this decision https://www.financial-ombudsman.org.uk/files/113586/DRN4441181.pdf that some people are winning complaints against Loans2Go for this sort of VERY expensive loan.

Chris says

I’ve put in a complaint today. Thank you for the advice. Will keep you updated.

MICHAEL QUICK says

these charges etc are pure fraud and time to set the old 48% cap on any lending, credit cards back to the reasonable 13/15% interest the days of breakneck rates must go and be dealt with as another Scandal with repayment to the populous. if any PM/MP got any gutts

Donna says

I have a amigo loan which I just kept topping up now it’s 9,000 which is a 375 monthly bill with just a part time job and 2 kids am struggling to pay can I get help

Sara (Debt Camel) says

Hi Donna, that is a large loan if your only income is a part-time job and benefits. Read https://debtcamel.co.uk/how-to-complain-guarantor-loan/ and send them an affordability complaint about all your loans – in the last couple of months people using the template there have been getting good results – see the comments below that page.

Sara (Debt Camel) says

Donna’s balance was reduced by over £7,000 after complaining.

David says

I think it is quite telling that many Amigo users now report that the “Top Up” option on their account is either no longer visible or it states you are not eligible; personally my online account has been offering me to loan up to £10k from an original £4k loan for about 2 years despite on at least 3 occasions making complaints against them or asking for time to make payments and advising them that I am in financial difficulties.

It is no longer an option for me (not that I would have or could have used it to be fair).

My complaint is already lodged anyway, but its certainly a key moment for complaints of this nature.

Sara (Debt Camel) says

David’s case had to go to the ombudsman but he then got £4,600 refund.

ruby2sday says

hi i have sent 3 emails to AMIGO regarding affordability starting way back in feb about 3 loans 2 being top ups, in return I got an email giving 2 weeks breathing space then asking to pay on time and contacting my gaurantor second one was not even answered ! I have now sent another email and hopefully will get some answers but because its been so long can I go straight to the ombusman?

Sara (Debt Camel) says

This depends on whether it is clear that you have made a complaint. If you just said you were having problems paying, then giving a breathing space may have been a reasonable response.

Does your recent email say clearly it is a complaint? If it doesn’t, follow it up today with one that has COMPLAINT in the subject line – there is a template over here https://debtcamel.co.uk/how-to-complain-guarantor-loan/ that you can use.

Sara (Debt Camel) says

rubys2day had all of her loans refunded by Amgo, a total refund of £11,478.

Ram says

Hi i had a 3,000 loan plus 300 brokerfee back in 2013 then a topup after 1000 paid off in 2018. Could i make a claim back of the highly interest charged many thanks

Sara (Debt Camel) says

was this from Amigo?

Ram says

Yes with Amigo an a guarantor loan

Sara (Debt Camel) says

You may have a good claim – see https://debtcamel.co.uk/how-to-complain-guarantor-loan/ which has a template letter to use. read some of the comments there – lots of people are now putting in these complaints. Many get refunded by Amigo – others go to the ombudsman if Amigo says No and many of those cases are being won.

Ram says

Ok thanks for your information i will get that sent off this week asap a kerp you an everyone updated thanks

Nicky says

Hi I had a £5000 loan back in 2014 and had to pay back just under £13K do i have a case as I’ve sent this to the ondbusman

Sara (Debt Camel) says

Is this from Amigo? And have you complained to the lender?

Angela says

Hi had a loan from amigo used a guarantor why would l need a guarantor if l was not a finical risk could not afford the loan repayment and amigo would not give me any breathing space l was in very bad health and l am a pensioner 73 they never ask for bank statements every thing was done by a telephone conversation l did pay the loan off in full because they wete giving me so much stress l needed heart surgery so a family member lent me money to settle the account l am now paying that back so you see its a no win situation for me tried to claim back unfordabily amigo said that l had missed the dead line so now l have adl the ombudsman to take up my case couple of weeks ago recive letter from amigo telling me that l was able to borrow up to 10.000 grand no thank you amigo

Greg Sheard says

3 years since I was on the show! I’m the vet bills guy. Despite winning some cases and losing others, it’s been a hard slog to pay off the debts including paying off all my defaults. I’m now 1 year away from being personally debt free and it’s going to be a huge weight off my shoulder.

These loans are poisonous and mentally put me in such a bad place, from trying to save my dogs life to then trying to keep a roof over our heads, I did what I had to do but it came at a huge cost.