A reader, Ms J, asked:

I sent a Prove It! letter to a debt collector as I have no recollection of debt they say I owe.

They replied saying that they cannot “provide specific details to your dispute” and we have marked your account as unenforceable meaning we will not pursue legal action and have informed our client to remove any reporting on your credit file. However the above account remains outstanding.

I have now received another letter asking me to get in touch to arrange a payment plan. What should I do?

The simple answer is that Ms J should not be paying anything until the debt collector produces some evidence that the debt is hers!

A consumer credit creditor has to prove who the borrower is

Consumer credit includes loans, credit cards, catalogues, car finance and overdrafts.

Ms J has told the debt collector she does not recognise the debt by sending a Prove It! letter.

The rules for disputed consumer credit debts are in section 7.14 of the FCA’s CONC handbook. These include:

Where there is a dispute as to the identity of the borrower or hirer or as to the amount of the debt, it is for the firm (and not the customer) to establish, as the case may be, that the customer is the correct person in relation to the debt.

So Ms J does not have to prove that the debt isn’t hers – proving a negative is extremely difficult!

Instead the debt collector has to show the reasons why it thinks she was the borrower. For example, a copy of the CCA agreement for the debt would have had the name and address of the borrower.

The debt collector’s response gave the date that the debt collector acquired the debt and said what the balance is. But it said nothing about who the borrower was. The debt collector said it was unable to provide these details, so it said the debt was unenforceable.

The letter saying the debt was unenforceable is misleading. It refers to “your debt owed to us” and says the balance of the account is outstanding. But neither of these things has been proved.

If Ms J was the borrower, her debt would be unenforceable if the CCA cannot be produced. In that case the debt collector could still ask her to repay the debt even though it was unenforceable.

But here the debt collector hasn’t proved that Ms J took out this loan. So it has no right to ask Ms J to make any payment.

The last letter is also misleading

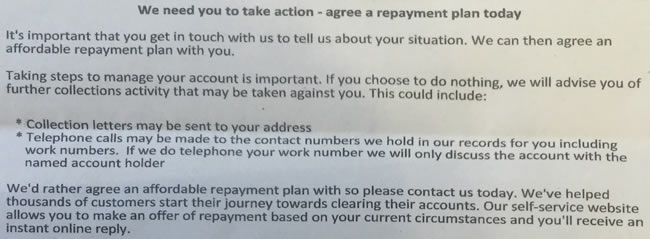

Here is a part of the most recent letter Ms J received:

This letter does not mention that the debt is unenforceable.

CONC 13.1.6 (4) says that when someone has made a request for a copy of their CCA agreement and it cannot be found, all future requests for payment from a creditor should make it clear that the debt is unenforceable.

Ms J technically didn’t ask for a copy of the CCA agreement. However as the debt collector has accepted the debt is unenforceable, I think it should follow 13.1.6 (4) and have said in this letter that the debt is unenforceable.

The letter made references to “further collections activity …. which could include… “. That is misleading and threatening as it suggests there are other sorts of collection activity that may happen. But with an unenforceable debt there aren’t!

Ms J should complain about this

If Ms J ignores this letter or replies refusing to pay, there is nothing the debt collector can do apart from repeat the requests for a payment arrangement.

But I don’t see why Ms J should have to put up with this. I think she should complain.

Most debt collectors will have an email address people can send complaints to. If she sends a letter, she should send it recorded delivery.

A complaint could look like this:

As I said then, I have no memory of having had a debt to [the original lender] dating from that time.

You said in your letter dated dd/mm/yy that you could not produce any further details about this debt. But you have not shown me any information supporting your allegation that I am the borrower.

Your letter refers to “your debt owed to us” and says the balance of the account is outstanding. I consider that is misleading and in breach of the rules in CONC 7.14.

I consider the letter you sent dated dd/mm/yy was misleading and threatening. It did not mention that the debt was unenforceable. And the references to “other collections activities” seem designed to alarm.

I would like you to confirm that you have been unable to verify that I am the borrower and that you will not ask me again for any payments towards this debt.

If you do not do this, I shall be taking my complaint to the Financial Ombudsman.

Taking a complaint to the Finaincial Ombudsman

I hope this won’t be needed!

You have to give a firm 8 weeks to reply to a complaint. During this time, make sure you keep a record of any further letters, emails or phone calls from the debt collector.

If your complaint is rejected, it is simple to send your complaint to the Financial Ombudsman.

The Ombudsman Complain Online form asks you for all the information that is needed. The complaint itself can be a copy of what you sent the debt collector. And you can attach information, such as the letters between you and the debt collector.

Debts that aren’t Consumer Credit debts can’t be taken to the Financial Ombudsman, but other Ombudsman organisations may be relevant.

Mr Y says

I have 5 year old default, that has NOT been showing on my credit file since 2016 but has just re-appeared last month just as I was applying to get a mortgage and completely ruined my plans.

I sent them several letters back and fourth when I first noticed the default starting in 2015 as I didn’t the recognise the debt at the time, which lead to them attempting to go to the court for a default judgement. They did a no show and the court struck it out. After this point the default was removed from my credit file, and has not showed since. The debt collectors have now added the original default back to my file again showing it as ‘satisfied’ with a zero balance stating it was paid off this month.

What is my best course of action to get the default removed from my file?

Sara (Debt Camel) says

To be clear, you disputed you owed the debt and they didn’t produce any evidence to show that you did? What date did the alleged debt date from?

Mr Y says

Thanks for your response!

Yes that’s correct, the alledged debt date is April 2014

Sara (Debt Camel) says

I suggest you put in a complaint to the debt collector, attach the past history showing they lost the court case on dd/mm/yy, tell them to remove the incorrect record and default that has just appeared within 2 weeks or you will be asking the Financial Ombudsman for compensation as you have just lost a mortgage offer because of their error.

I would also go back to the mortgage lender and show them the evidence that this debt was nothing to do with you and ask them to reconsider.

Mr Y says

Hi Sara,

Just a quick update that the debt collector did remove the default from my file, sent an apology letter and also £50!

This shows me that they clearly knew what they where doing was extremely under hand, I also noticed there was a search on my file by them labelled: ‘’collections strategy’. I wonder why they did this??

Anyway thank you so much for your assistance! Your helping so many people it’s great!!

Sara (Debt Camel) says

excellent!

Derek Ramsay says

I been sent a letter from a debt agency for a supposed debt dating back 20 years, I did not respond to there letters as they got my address from the local council list. I don’t recall this debt and I never applied for it but since they have my national insurance number and my old address and every time I move they send out the letter. I contacted them and asked for a copy of the agreement with my signature and supporting evidence. This debt does not appear on my credit file nor any court CCJ has been issued against me but there threatening to send a debt collected to my address. This debt has been forwarded from the original company to a debt collecting agency when I make contact I been told to communicate in writing with the original company that I suppose to owe this money to but I feel as they are chasing me for this non existent debt they should send me prove that I actually owe this debt all they have sent is computer generated paper work that gives me dates and much the loan was for. My recent letter states that they will send a attachment of earnings to my employer piling pressure on me to pay a large amount that I do not owe and don’t recall ever taking a loan out with them. Repeatedly I have asked for a copy of my signature and nothing is forth coming but they want to set up a payment plan for money that they claim I owe.

Sara (Debt Camel) says

What sort of debt are they saying this was? Who was the original company?

Derek Ramsay says

Social Fund loan that I don’t recall ever taking out correct address but from the computer paper work it’s looks like either someone is moving and is for someone who is singe. I lived here for some time this loan was taken out after I lived here for a couple of years and as we both were working I never applied for it.

Sara (Debt Camel) says

I suggest you go to your local Citizens Advice and ask for their help with this. You have two reasons to challenge this debt – you don’t think you ever took it out and it may well be “time barred” as it is so old.

Indie5018 says

Thanks for advice it much appreciated and I will contact them and make an appointment. I tried to explain why I disagree that I owe this alleged amount and have repeatedly asked for both of them to confirm via a letter a copy of the signature and paperwork to support there claim but it’s not forth coming the only readdress can can convince both of them that I have never taken out that loan for the said amount is by taken out legally action against them both to clear my name.

When I respond to the Debt Agency letters I am referred back to the social fund and vice a versa. The said debt is 1993 so there must be paperwork that I allegedly completed but nothing is forth coming from both of them. The Social fund has never taken me to court for the alleged debt nothing on my credit file. No CCJ has ever been issued or attachment of earnings order requested in fact I never had any correspondence with the Social fund relating to this alleged amount.

Sara (Debt Camel) says

I would be interested to know what happens?

Gemma says

What is the stance on asking for a copy of the CCA does it have to be the original?? and can the DCA issue a DN in their own right if the OC has already done so

Sara (Debt Camel) says

It has to be a true copy.

DN – are you concerned with your credit record or a DN under the CCA act?

Gemma says

True copy do you mean original paper copy. DN under the CCA act as OC issued one I believe in 2009 however req copy of CCA etc four years ago and DCA have been silent until this week. Seemingly they are starting the whole process off again asking for me to contact them. Just want to be clear as prev advised only one DN can be issued

If CCA request relates to pre April 2007 can a reconstituted CCA be offered as an alternative…if not it would suggest the arrangement to be unenforceable

Sara (Debt Camel) says

If you asked the DCA for a copy of the CCA agreement 4 years ago using the correct terminology (eg the letter in here https://www.nationaldebtline.org/EW/factsheets/Pages/getting-information/credit-agreement-advice.aspx) enclosed £1 and have proof ofpostage, then I suggest you just ask the DCA why they have not responded to it. If you didn’t use the right words or didn’t supply £1, I suggest you start again from scratch and send them a new request, recorded delivery.

A reconstituted agreement can be supplied. This post https://paulatwatsonssolicitors.wordpress.com/2013/05/30/a-point-of-interest-that-arose-today/ mentions several court cases if you want to read about this. The Legal Beagles forum is a better place to discuss this though.

In the meanwhile, I suggest you don’t worry about what a true copy looks like as you don’t seem to have one at all. And I don’t know why you care if you get another DN?

Gemma says

I care as another DN may result in a CCJ or court proceedings

I have also just been sent a Notice of Sums in Arrears so I guess their next step is to issue a DN to initiate court

I will proceed with requesting the information again however I did sent a ‘prove it’ letter and they sent an illegible copy with no T&Cs and have requested more time from the original creditor

Any thoughts

Sara (Debt Camel) says

NOSIA letters are churned out automatically by systems, they are not something to worry about. Just send a proper CCA request now with £1.

Debbie says

I’m in a similar situation where I have sent prove it letters for a debt I did not take out which is claiming a substantial sum.

I sent a SAR and Prove it letter to the credit card company back in 2013 when I found myself being chased for a debt I did not have, they claimed it was unenforceable but were going to continue to chase it. This was passed onto a DCA 2 years ago and I also sent the prove it letter to them. The DCA, Robinson Way, could not send proof and continued to request payments without proof but went quiet late last year after their solicitors threatened to take me to court and I contacted them to say they had not proved it.

Today they sent me a letter claiming they now have proof and the proof provided to me is 3 sheets of personal information that have been created in a spreadsheet format, there is no signature, no disclaimers or any other legalese. The 3 sheets are all on plain paper, not headed note paper, I could have created it on my laptop. I don’t think this is proof of the debt but as I am unsure of what constitues proof of a debt I hope someone will be able to help me understand what is happening and how to proceed please?

Sara (Debt Camel) says

I suggest you take the template letter to ask for a CCA agreement in that previous link, add a sentence to say their solicitors are persisting in contacting you about this debt why you deny is yours, and send it to the debt collector with £1.

Then reply to the solicitors that you never had a credit card with that company [assuming that is correct], say you have asked the debt collector to produce the CCA agreement for the alleged debt and also say that nothing seems to have been paid to it for more than 6 years so it is statute barred anyway.

Debbie says

Thanks Sara,

I suppose what I’m saying is that it’s not my debt so I’m not entitled to ask for information pertaining to someone else which a credit agreement for this particular debt would. I didn’t send the letters until late 2013 but as I wasn’t paying it anyway and as they have been focussing on me I presume no one else has been paying I guess it would be statue barred by now. I have to contact them by the end of the month so I will mention that in my reply.

I get the distinct feeling they are never going to accept it wasn’t my debt, I can’t prove I didn’t do something. I also know even statute barred debt won’t stop them from chasing, it’s very worrying to keep receiving these threats.

Thanks for your help I appreciate it.

Sara (Debt Camel) says

“they are never going to accept it wasn’t my debt, I can’t prove I didn’t do something” I agree – and so does the regulator. The FCA’s rules say:

“Where there is a dispute as to the identity of the borrower or hirer or as to the amount of the debt, it is for the firm (and not the customer) to establish, as the case may be, that the customer is the correct person in relation to the debt or that the amount is the correct amount owed under the agreement.”

Just persist with this. Ask for the CCA.

Adam says

Hi Sara,

Arvato financial solutions (who Google tell me are a debt collector) have left two automated voicemails and an email asking me to get in touch regarding my account. No information regarding any debt has been described. The voicemail also claims they have sent me a letter which I have not received. I have an idea on who they may be acting on behalf of and it is for a web hosting company who I have a dispute with over approximately £25. I suspect the company does not have my correct address details and I am also in the process of moving within a month. I am nervous that if I do not contact them that I may discover a CCJ on my name at a later date especially as I am moving house. At the same time I am nervous of contacting them as they haven’t said who they are or what they want from me. Should I contact them over the phone as they have requested, or write to them, or ignore them as they have given me no information about their intentions so far? Any advice would be much appreciated.

Thanks,

Adam

Sara (Debt Camel) says

Honestly if the only debt you can think of is £25, just phone them up and ask them what the debt is. If it the web hosting one, tell them it is in dispute with the company (is it? or have you just let this drop?). Anything else ask them to send proof the debt is your as you have no memory of it. And give them your new address when you move!

Adam says

Hi Sara,

Thank you for you advice. I called them and ended up having to call the web host who the debt was with and they agreed to remove the charges.

Many thanks,

Adam

Beth says

Hi, I sent the cca letter to wescot who have been collecting monthly payments from me for a credit card debt (RBS) that is older than six years and has now dropped off my credit file. They responded by saying that they would look into it and have put my account on hold while they do this. Today I received a letter from RBS saying that due to me ‘not being able to agree a payment plan with Wescot’ (untrue), they have now passed the debt onto another collection agency, Robinson Way. What do I do now? It seems that I’m back to square one.

Sara (Debt Camel) says

When RW contact you reply that you asked the previous debt collector to produce the CCA and they never did so you will not make a payment arrangement until you are sent it.

John says

Hi .2 years ago Barclays contact me and ask me if i want a loan of 20k i will be approved straight in 5 min.because i had some bad times with my job i took that 20k loan .evrything was ok ,i paid the first 2 months . I want to menționa that my fiance advice me to take the loan ,she said we will pay it back together. We furnish the house been to a nice holiday., and then she took all the money left in my account and finish with me .she put me out of the house , lost my job i lost evrything .i explain to the bank the situation .they said that they give me some time to recover.i been to my mom for almost e months and how i come back . When i come back i call the bank straight a way.but the bank told me that my loan been passed to Moorcroft Recovery.i received letter from them ,few of them..

I dont know what to do .im so scaried .

Can you give me some advice please .

Sara (Debt Camel) says

Can I ask some questions?

Do you have other debts as well as this?

Your house – were you renting or buying?

Are you back at work now? Do you have any money spare to pay to your debts? It’s ok if the anser is No, a lottle or a lot, but it’s going help to know which it is.

Indie5018 says

Quick up date from an alleged debt from 1993. So far I had no response either from the Social fund or the debt collector after I asked for prove that I owe this debt. In fact it gets quite interesting as the social fund has told me I don’t owe anything. They hid behind the data protection act and only offer a computerised print out with alleged amounts but no name or national insurance number. I sent 3 letters to each requesting that both provide me with a copy of the signature and the agreement. To date I have never received any acknowledgment of my letters the next step and don’t know if I will get another letter as there is no closure. After 26 years of threatening letters threatening me with CCJ, attachment to my earning and sending bailiffs to my house. I fully intend to take both of them to court as I want them to prove to a judge that following me for 26 years for a debt I never had and I want closure now and in the future.

Sara (Debt Camel) says

Challenging the DWP about this sort of old debt can be hard. I suggest you go to your local Citizens Advice and ask for their help. It’s also worth talking to your MP< when you have one after the election.

Indie5018 says

I don’t really get it, one part of the DWP alleges I owe it but when I phone them they have not any knowledge of this alleged debt. I am not sure if they know who they are talking to, I will go to the Citizens Advice but I feel that my readdress is via a court they can put there evidence before a judge for him to decide. Debt collectors think they have a right to threaten you with CCJ and Bailiffs or court and you don’t have any readdress but I kept all correspondence from different debt agencies who have been tasked by the DWP. I asked them both on numerous occasions to take me to court but to date no one wants to take me to court, they hide behind the laws and the data protection so I feel I don’t have anyway of resolving this and don’t want to be chased for another 26 years so I feel that my only readdress is to take them both to court..

Sara (Debt Camel) says

I think you need help from an expert – it isn’t simple to sue the government.

Xavier Bonneville says

Why is the recommendation that the person receiving the legally false and incorrect letters containing threats should “complain”?

This is an obvious case of harassment and attempted fraud by the individual and entity sending the letters.

The individual receiving these letters should build a case and sue for harassment.

“Complaining” would only give power to the fraudulent entity, they will do nothing. The behaviour will only stop when such actions are held to account. You should be ashamed that you give such weak “advice”.

Sara (Debt Camel) says

Because the vast majority of people would prefer to avoid going to court. That is why the Financial Ombudsman was set up, as a simple alternative to court action.

Good luck if you want to go to court, but there is no reason why anyone taking the alternative of a complaint and going to the ombudsman instead should feel ashamed for doing the sensible thing.

Jennie says

Hi, I have a query I’m hoping someone can help with.

I have been paying a monthly payment to DCA for 7 years, as was advised this was thing thing to do.

Is it too late to request a CCA?

thanks in advance

Sara (Debt Camel) says

not too late! how much do you still owe, what sort of debt was this originally? has it been sold to the DCA or are they just collecting on behalf of the original lender. is the debt still showing on your credit record?

Jennie says

thanks for the reply.

I don’t know if they brought the debt.

It was originally credit cards now with an outstanding amount approx 6k. It no longer shows on my credit file.

Thank you

Sara (Debt Camel) says

ok, well the odds are the debt has been sold. Read https://debtcamel.co.uk/ask-cca-agreement-for-debt/ which looks at how to ask for the CCA.

Jennie says

Ok that’s great, so definitely worth requesting a CCA? Eve after all this time of paying?

Sara (Debt Camel) says

Well it may not work, the DCA may be able to get the CCA. But after so long they often can’t! There is much more chance of this working for old debts rather than newer ones.

Colin says

I have a question. On feb 26 out of the blue I received a notification of court action from bw legal on behalf of prac ltd stating I owed them £200 for a sky debt that they claimed I had a signed agreement in 2014 which I have no kno Of so I disputed it and sent a prove it letter and after various letters and emails they claimed to have bought it from fresh start in Oct 2019 who in turn had bought it from sky in 2017 ! I’ve never received any letters from fresh start have no idea What this was about and was told that they my request was frustrating there attempts and found my request unreasonable! Finally they sent a letter stating that they could not provide the signed contract as it was an unregulated telecommunication agreement and also refused to send me the deed of assignment as they weren’t obligated to! But said I should still pay ! Or they may take me to court and to seek legal advice.

It’s my understanding that they have no physical proof and this alleged debt is unenforceable , it’s also my opinion that heresay (which is what they claim is there proof ) is inadmissible in court and I fully intend to defend against the claim and I do not know anything about this debt.should I send them a cease and desist letter as they don’t seem to be backing down even though they’ve admitted to not being able to provide proof I’m reasonable for any thing with the exception of a claim of hearsay from 6 years ago .

Frank says

B&W did the second to me regarding a alleged debt from talk talk who didn’t even give me my set top box B&W say they don’t have to prove this debt as they bought it in good faith. they can’t provide the original contract. the are B&W bulls hiring me. the cos it is now going to a hearing. they are rude and ruthless!

Sara (Debt Camel) says

Anyone with a court case in progress should talk to national Debtline on 0808 808 4000 and/or post on the Legal Beagles forum for help: https://legalbeagles.info/forums/forum/legal-forums/court-claims-and-issues

Kimberley says

Good evening Sara, after reading your excellent advice throughout I thought I’d drop you a line to see if you can help me at all. I’ll try to summarise. I paid off my debts years ago through an IVA. Shortly after paying off all my debts in 2017, I received a new Barclaycard, with a new Bigger limit. I had just found out I was pregnant and was about to lose my salary on statutory maternity pay so I thought it was a miracle from God and I bought what I needed for my baby and everything leading up to it. I did not request for this new card or new limit. Now after 2 years of not paying anything back, as I was living on £400 a month with a newborn, I returned to work and it took me nearly a year to get out of the financial mess I made with friends and family who supported me throughout.

I am now being harassed by Robinson Way for the largest debt, £12K. Do I have any legal standing here? I received a letter before action last year, so I asked for them to prove it’s my debt, they just sent me statements, a letter Barclaycard say they sent to me when the debt was sold (I don’t recall receiving) the letter from Robinson way and the terms and conditions which are not signed or dated?! 1/2

Kimberley says

Anorther screen dump of the account number and my name (could’ve created all of these docs myself except the letters) I have no idea what happened here but I cannot pay £12K back. I am not in a position to pay anything back. I finally have a better paid job but now at a time when I need to move home to accomodate me and my growing son who’s nearly 2, we are in a studio flat under the keyworker scheme so I have no rights for a swap or transfer. I am trapped here. I also have to now put my son into nursery from September which will take any left over money I do currently have.

Can I fight them in any other ways here, like through no consent or power of attorney deed as nothing is signed/dated by me?

I received this “information” today. But the letter is dated the 6th July 2020. I have 30 days to respond even though it’s taken them almost 10 months to respond to me when I gave them 60 days to supply this information, before the covid19 pandemic and any unforeseen circumstances.

Thank you.

2/2

Sara (Debt Camel) says

Have they sent you a copy of the Consumer Credit Act agreement for the debt?

Matt says

Hello! Link financial has been chasing me for a debt I don’t recognise. They sent me a letter saying they were unable to prove the debt is mine. However they keep on asking me I pay this debt. I told them I’m not going to pay for some imaginary debt I don’t recall having, that does not appear on my credit file and they can’t prove. But they keep on calling, emailing and writing to me. How can I get them to stop? Thank you!

Sara (Debt Camel) says

what sort of debt was this?

Margo says

Hi Sara. DCA has sent me a letter demanding to pay them a lot of money claiming that I signed guarantor agreement for business loan. I asked them to send

me a copy of the agreement and there is my name on it, my company number but completely different company name. It’s all signed online ( no real signatures). It looks like fraud, as I never took any business loan. What shall I do?

Sara (Debt Camel) says

Talk to Business Debtline https://www.businessdebtline.org/. I hope this should be easy to prove but get some help with this.

Paul says

I have a letter that has been asking me about 3 mobile phone contracts I supposedly have taken out. Two were in 2016 at one address and one was for another address in 2018. I have no recollection of opening these accounts and asked them to prove I did. I have had a response telling me when they were taken out, the default dates and on the later one said a credit card payment was made to the account (I do not remember paying it)

The thing is I have no proof I do not owe these as the only possible bank accounts that would have been used are now closed. Also one is for Vodafone and the DCA said because it is a low amount owed (about £75) they can’t get a statement but it is on hold for 30 days. But they have asked Three and BT to send statements and have put those accounts on hold.

Obviously at the moment I can’t go to CAB and it’s a bit tricky explaining it on the phone as someone would need to see the letters really. What do you suggest I do?

Sara (Debt Camel) says

You can get bank statements and credit card statements from accounts that have been closed?

Paul says

Sadly no, one of the accounts was actually closed by the bank for some reason (can’t remember what might have been lack of use) To be honest I can’t even remember the account details. I know I’ve had a Lloyds and NatWest account but now I’m with Metro since March 2019.

Sara (Debt Camel) says

You can still get the statements. It is your right. With your name, address, birthday you will be able to prove your id to the old bank.

if you think they will help you prove your case, then I suggest you do this.

Mathew Armstrong says

I have recently been made aware of a CCJ on my credit file. I have contacted the court who have informed me that the CCJ is relating back to one of my old addresses, 2 years after I had moved out. They informed me that the CCJ has something to do with items sold online, that the buyer did not receive (items purchased off facebook marketplace). I do not sell items on facebook and never have. I also do not recognise the name of the person who started this court case.

I have been told by the court that if I think that this is a fraudulent case then to put a claim in to action fraud to look into it. I do not know what information I would be able to provide to them other than my old address and my name.

The court has informed me that they have passed the case back to a high court Judge to review the case. Its been a few weeks now and I have not heard anything back but this random CCJ is still staring me in the face. Are there any other routes I can go down with regards to this? Anything I can provide to the court? They have dodged a question I asked them which was “If they believe the case was for me, why did they not chase me at my actual address? I’m on the electoral roll.

Is it that easy for someone to make a claim like that against someone simply by knowing their name and address, despite it not being their actual address and just an old one?

Thanks

Sara (Debt Camel) says

I suggest you talk to National Debtline on 0808 808 4000.

Isabell says

This month (February) a mobile debt I had defaulted on was removed from my credit report. Around the same time I started getting messages and letters from Lowell saying I needed to pay this debt. This debt was with the original provider. I told them I wasn’t going to pay for something not in my credit file. I have since received information that in March a debt will be added to my report from lowell. Is this legal? How do I move forward? It is about 3 years old and I hadn’t heard anything from the mobile company in the last 3 years. Your advice is greatly appreciated.

Sara (Debt Camel) says

Why was the debt removed from your credit record? Did you dispute that it was accurate?

Isabell says

I’m not sure, they didn’t say anything about the debt for years (mobile company) then it was removed with no notice or warning. The guy I spoke with from the debt collection agency to inform them that since the debt was not in my credit file I would not be acknowledging it or paying tried to bully me into accepting it and I also told them to stop contacting me as they had done so more than 5 times in the last few weeks. He tried to say this didn’t constitute harassment, but I stuck to what I’d said about them harassing me over something not in my file. I didn’t acknowledge anything to them and I’m now confused as to why they are putting this on when it has been removed by the original company. I hope this makes sense.

Sara (Debt Camel) says

Unless the debt record was deleted because it was incorrect in some way, its removal doesn’t mean anything.

A debt collector is entitled to ask you to pay a debt that is yours. You need to have a valid reason to dispute the debt, the fact it isn’t on your credit record doesn’t mean it is not enforceable in court.

Isabell says

Alright, I understand. I have spoken with the mobile company and they have no record of the debt anymore or any records of the account. They have said that they will clear this with the debt collection agency. I really appreciate your help with this. I’ll give an update once I receive more information. Thank you for your advice.

Mathew says

I’d be very cautious with Lowell. The have “updated” debts I had from 2012 and are now showing again on my credit score. I contacted them about this and their response was “although we cannot legally chase you for the debt, the debt is still outstanding and therefore has been updated to show this”. Which from what I believe is totally illegal.

Sara (Debt Camel) says

Are you saying there was previously a default date on the record and it dropped off? Then a later default date has been added?

Mathew says

Yes 100%! Theyve done this with 2 of my old debts (mobile phone contracts). They actually updated one in January 2019 from 2012. So right as it was about to disappear. Its now showing as defaulted January 2019. I’ve questioned it, I’ve even sent a request off to equifax. But it’s still showing.

Sara (Debt Camel) says

“although we cannot legally chase you for the debt”

is this because they have agreed the debt is statute barred? if not, what is the reason they are saying this?

Ash says

Hi

I have following debts and all of their debt collection agencies are chasing me including HMRC old self assessment tax going back to 2014-15 ( appx period) and charging me interest too daily , I would like to know / help what should I do next ? Need really your advise on this –

1) TSB credit card – 1950.00 TSB Ssend me letter they sold all my debts rights to ARROW Capquest isince 21/3/20

2) Halifax Over draft – 2438.00 Halifax sent me letter they said they transferred this account to debt collector credit security to arrange collection of the o/s amount on 15/9/20

3) Capital one – 2034.00 when I asked debt collector Lowell Solicitors Credit agreement copy they filed CCJ against me .( appx date of debt -2017-18

4) Barclays Cr Card – 8900.00 firstly Robinson way was chasing and recently Hoist Finance guess these debt collectors bought from Robinsonway ( debt date since 2012-13)

6) HMRC Self assessment tax liability – £13127.24 ( this might be late payment penalty and interest they keep charging me hence I am unable to clear this balance and they sent me threatening letter and keep asking me if I have any assets on my name which I don’t have but my wife own house and we share all expenses so can they do something to house to recover money legally or not ?) need advise (debt date since 2012/13/14/15)

Please advise me how can I deal with these creditors debt collection agencies and HMRC

Your help will be much appreciated

Regards

Ash

Matt says

I thought it was just me! When I sent a prove it letter to them. I then received a CCJ under Lowell. It seems to me that they don’t like any sort of emails asking for proof of information.

Weatherman says

Hi Ash

With this many debts I would honestly advise you get some free debt advice – National Debtline can give you much more information about your options than I could on here, and look at your entire financial situation. You can call them on: 0808 808 4000

The most important thing, from what you’ve said here, is to not ignore ‘the letter before claim’ or the court form for the CCJ when it comes. If the court form has already come and you didn’t respond within 14 days the court will order that you should pay the entire amount in one go. You can still apply to repay it in instalments if they do that – but you’ll need to work out what you can afford, and be able to show that this is a reasonable (and sustainable) amount for you to pay. Again, National Debtline can help with that!

There’s more information about the CCJ claim form and your options here: https://debtcamel.co.uk/court-claim-form/

Ash says

Thank you so much and how National Debtline will help me ?by write off debts or reducing debt or completely bad debts ? Please guide me how they can help me please .

Regards

Sara (Debt Camel) says

There a lot of possible debt solutions for you. Weatherman is saying that with so many debts, you need to talk through your full situation with a debt adviser who can suggest the best options for you and their pros and cons.

Andrew Smith says

Hi,

In 2019 we had renovation work done on our home.

As part of this a plumber was asked fir a quote which he provided(verbal only,nothing documented or signed from either him or us).

He started the work and was paid for his first invoice for first fix.

In short, he failed to complete further work and the work that he did “complete” was of such a poor standard it has had to be redone.

There have been many more problems in relation to him and his company.

He subsequently sent an invoice that amounts to over double his origin quote.

We have refused to pay and asked him how he justifies this huge increase.

He has failed to do so and now we are being contacted(harassed) by a debt collection agency that quite openly boasts that they are not regulated by the FCA.

We have replied stating how we wish them to contact us and to prove the debt.

We are obviously the right people, at the right address that the alleged debt refers.

However we dispute the amount.

We’re we right to insist that they prove the debt and, as they are not regulated by the FCA are they committing any offences?

Do we need to engage with them at all?

Thanks in advance.

Sara (Debt Camel) says

Who is the debt collector?

What sort of things is he saying?

Andrew Smith says

Hi Sara,

The debt collector is Cobra financial solutions.

We’ve asked them to prove the debt and told them it is disputed.

We told them contact only via email.

They responded by sending debt collectors to the door who, whilst on private property took photos and possibly videos of our cars.

The visitors were only spoken to via ring door bell.

We emailed Cobra and told them they’d overstepped the threshold re the harassment act.

They responded by saying the visitors had only come “to serve papers”

Our last email to them(yesterday 17 th May) stated we dispute the debt and we believe the best way to deal with it is through civil court.

They responded this morning by saying they have proved the debt,” have you not seen the invoices we sent you?”

They also state that their client now wants to enter our property and remove items not paid for(boiler etc.)

We have already paid a portion of the bill which we believe covers the boiler and other items.

We are aware that they have no right to remove items and this will be viewed as further harassment.

Thanks,

Andy

Sara (Debt Camel) says

Have you explained to them why you think the amount is wrong and why you have repaid the true amount?

You can carry on asking them to “prove” the debt, but actually there is no dispute that you did owe some money – the dispute is over whether you have made an adequate payment.

“See you in court” is a reasonable response.

How large is the alleged debt?

A Smith says

Thanks for your reply Sara,

We have asked,on numerous occasions for a breakdown of the bill so that we can take off what we’ve had to have done(which he was contracted to do and didn’t do) and what has had to be done again because of his poor workmanship.

He’s refused.

He’s also not explained how the final bill came to be twice his original quote.

He alleges we owe £10,590.

We have tried to resolve it with him,but can’t because he won’t give a breakdown.

Sally says

Hi Sara,

A debt collection company is chasing for a debt that is not ours and in the name of our now dissolved company. The address was wrong, the duration of the bill was after we moved from the local area and we’ve never had any dealings with the water company. We have provided proof of addresses in the form of old invoices but they keep coming back asking for more and more proofs! We have also NOT seen the actual bill. They have caused us distressed with their bullyish behaviour which we now consider harrasment. What can we do? Thanks

Sara (Debt Camel) says

I suggest you talk to Business Debtline https://www.businessdebtline.org/ about your options.

Gail says

Hi – I received a letter from Barclaycard and PRA Group advising that the Barclaycard debt has been assigned to PRA Group on Barclays letter and purchased by PRA group on their letter. There’s no details of breakdown etc just it’s a whopping 8000, in the envelope was the data protection policy for PRA Group and how to pay. I have emailed them ‘prove it’ letter but they are wanting me to tell them my personal details. I’m not wanting to give them these details as I know this debt is not mine. It’s on my credit report which I have disputed apparently it started March 2020. I was made redundant then and honestly the last thing I was thinking about was taking out debt I might not be able to afford because it was uncertain I would have a job during lockdown.

I have a few questions if you can help me do the letters need to be sent by post recorded obviously? Do I need to provide them with any personal details? What if they can prove the debts mine? Should I send the cca now? Any help you can give me would be amazing!

Sara (Debt Camel) says

Does it show on your credit record as a Barclaycard debt, a PRA debt, or both?

Matt says

Hi Gail

When I had arguments with PRA Group, I made them go back to Barclaycard for the information.

If Barclaycard sold it, they are obliged to give all the details they have for this specific debt.

Just ask them to go back to Barclaycard for the information required, it’s their error that they bought something with missing parts.

It worked for me. Good luck.

Tracey says

Hello Sara,

I received a letter from link financial in 2020 saying I defaulted on an account in 2019 and it was put on to my credit score. I have been disputing this ever since. I didn’t recognise the debt and sent a prove it letter. They replied to say it was an account with Lloyds and had been making payments to it up to this point(2019)I told them I did not recognise this account and had not defaulted any accounts in 2019 and asked for a CCA. They said they could not provide this but the original company said I had made payments to it up to this point(2019) so it was still enforceable and not statute barred. I replied to say I did not recognise this debt and would not be paying anything to them. They have continued to send me letters which I have ignored saying I owe them this money and I received a letter today from a solicitor saying they may start court proceedings if I don’t respond. In 2012 I defaulted on bank loans and bank account following a drastic change in circumstances. I have been paying back my creditors under an informal agreement ever since. This debt link financial are referring to may date back to then but then and was not dealt with by the bank at the time but I am only summising this. I rang step change today and they advised me to make an official complaint. I am concerned about responding to this letter but worry they will apply for a CCJ if I don’t. Any advice would be gratefully received.

Sara (Debt Camel) says

can I be clear:

Are you saying you never had this account with Lloyds?

Or that you had an account with lloyds which you are still repaying? Does this account show on your credit record as Lloyds?

Tracey says

Hi Sara,

I am unsure if this was my account. I had a number of accounts I closed or stopped using in 2012. I am repaying Lloyds for an overdraft and a loan which was defaulted in 2012. I am unaware of any creditor not setting up a repayment plan with me at this time. When I ask Link to show me what it is all they said is it was with Lloyds and it defaulted in 2019. I did not default any account in 2019, only 2012. The account shows as link on my credit score.

Thanks

Tracey

Sara (Debt Camel) says

who is the solicitor?

Tracey johnstone says

its Kearns solicitor. Their address is Brecon House, 3 Caerphilly business park, Caerphilly,CF83 3GQ

Sara (Debt Camel) says

Is the letter you have received a Letter Beforre Claim/Action? It may have some other titles, but this is a very specific letter with several attachements, eg one headed Reply Form. See https://debtcamel.co.uk/letter-before-claim-ccj/ for what this letter looks like.

If it is that letter, you need to reply using the Reply Form as that article suggests. Talk to National Debtline on 0808 808 4000 if you arent sure what to do. Don’t just send a complint, use that reply form.

If it isn’t…

I suggest you send an email headed COMPLAINT to complaints@linkfinancial.co.uk and copy it to info@kearns.co.uk.

Put any ref numbers you have from Link & Kearns on the email.

Say that you have previously told Link you are disputing the debt and they have not yet produced any proof that it is your debt. Say you have had debts with Lloyds but you do not recognise this one as you did not default on any in 2019. Ask them for the type of debt (overdraft, credit card, loan) and details of the account and a statement of account showing the current balance.

Ask them to stop sending you threatening letters and respond to this dispute about the debt.

ALSO

think about all your Lloyds accounts and whether you can make affordability complaints about any of them. This is in addition to challenging this debt. See https://debtcamel.co.uk/tag/refunds/ which has articles about the different types of debt.

tracey says

The letter is headed letter of claim along with a reply form. I’ll contact national debtline as I’m unsure as to whether I am disputing or are unsure of the debt. Thank you for your advice, you have been really helpful.

Tracey

Jason Coe says

I received a letter form Lantern back in March for £500, which from reading your comments i asked Lantern for Proof giving them 28 days, i didn’t receive a response so i left it, then in October when i tried to transfer a debt from one credit card to another I couldn’t, after speaking with Transunion i found out Lantern had marked it on my credit history, however the debt they recorded on the credit history dint have my date of birth so this prompted me to sent a letter again, from which i asked for proof giving them 28 days ( I also sent copies to Transunion and FCA) all three by recorded delivery. After the second 28 days I sent an other letter referencing both letters ( all three and recorded delivery) basically saying ‘ you haven’t provided proof … the debt isn’t mine…. remove it…’ after this i received a letter from Lantern with proof however the proof has my name but the email address and phone number are not mine, and there is no signed contract etc. With this and the evidence on the credit history ( which incidentally doesn’t list the credit check for the bank the debt is with ( KLARNA) ) surely the debt isn’t mine? how do I provide it if my name is on it? what should be my next step?

Sara (Debt Camel) says

what sort of Klarna debt is this – one of their BNPL where you pay for something in a couple of months or a longer term debt involving interest?

Debbie says

Hi can you help: I have. Good credit history no defaults missed payments or CCJs. I have been married for 7 years and moved house 6 years ago.My son has randomly received a letter addressed to me today at his home address but addressed c/o to me in my maiden name.

He rang me to tell me bout this letter so I asked him to open it and it was from a company called Global Debt Recovery saying they

would appreciate my assistance and can I give them a call……..

I had minimal debts over 15 years ago….. to my knowledge all paid off. So it seems this company have made some effort to trace me and randomly sent a letter to my sons address which is alarming as I have never lived there. What advise can you give me please.

Sara (Debt Camel) says

oh them. They buy up very old debts. See https://debtcamel.co.uk/prime-location-services-debt/

If the letter had come to your house or to a house you had lived at, I would suggest replaying to them and asking them to prove there is a debt. If they can show that money is owed, it may well be statute barred (see https://debtcamel.co.uk/statute-barred-debt/) or if it is a loan, credit card or catalogue they may be unable to produce the CCA agreement for the debt (see https://debtcamel.co.uk/ask-cca-agreement-for-debt/)

But as they don’t have your correct address, it’s up to you if you want to start what may be a stressful process of getting them to go away. I

if you decide not to, tell your son that you want to know about any more letters, specifically anything that says what the debt actually is.

Mary says

Hi Sara,

I have recieved a letter from a debt collection agency. It was accrued 4/5 years ago from electricity charges.

We had an account with our power who collapsed, then switched to a company who refused to tell us how much they were now charging us. So we changed to another company. A few years later a debt collection agency got in touch via an old email. I cooperated said I knew there was money owed however no one had been in touch and i needed bills as proof. Very nice agency, Debt sent back to utilita. They were unable to provide all bills for this period so I raised a complaint and eventually when to the ombudsman. Suddenly they were able to find these bills. The ombudsman said there was enough to prove accurate debt however I double checked bills before paying full amount and noticed on the owr power bill at the top it said £240 previously owed. I was not happy, all other debt had been itemised and proven so I disagreed with ombudsman decision and appealled. Their appeal decided that there was still enough proof for full debt however I was to be given £75 for bad customer service.

Not happy with ombudsman decision I waited to see what utilita would do. 2 years later debt passed to new debt collection agency. Asking for full amount again. What this gone so my questions are?

Should they have to provide itemised bill for the £240?

What should I do?

Should I get in touch and offer to pay full amount, minus £75 and £240?

Thank you for your time

Sara (Debt Camel) says

I think you should talk to National Debtline on 0808 808 4000 about this and what options you have.

Mary says

Thank you. Tried debt advice, said they couldn’t help.

Sara (Debt Camel) says

Who did you talk to and what did they say?

AM says

I am being stalked by http://www.controlaccount.com, who I thought was a fraudster posing as a debt collector, because they claim I owe amounts to Fedex while I’ve never shipped anything with Fedex. They’ve completely turned silent to provide proof with tracking and sender details to prove that I have used Fedex, but they continue harassment and even called A FRIEND to demand to talk about “my” Fedex payments due.

I want to take them to small claims court and demand £2,500 compensation plus £185 per hour for my fee for processing the claim, and whatever the court fees are. Has anyone taken a debt collector to small claims?

Sara (Debt Camel) says

I suggest you contact your local Citizens Advice for help with this.

Simon says

Hi, Hoping if anyone would be able to help me. The vet bill was meant to pay by the insurance but the insurance had not accepted the claim. Regardless well the vets have then sent my bill to debt recovery whom have added another £600 on top of a £1500 vet bill. The question is that the vets have not written to me or contacted me to state that you need to pay this bill as the insurers and not going to pay. They sent my bill to the debt collectors/recovery. I just think this is not fair and unethical. I would like some help in what I can do regarding this.

Sara (Debt Camel) says

Did your insurance company tell you?

Simon says

Yes, my insurance company told me after I had been taken to the debt collectors. I will have to look still look at the dates on correspondence. All I know that the vets sent me no letter or communication “final warning please pay your bill or we will take it to debt recovery or pay we are otherwise going to give this bill to the debt collectors or we have given the bill to the debt collectors.”

My insurance company had not mentioned any debt collectors all they had said that it’s they were unable to pay but as I recall that a depute with pet plan was in place regarding the insurance and bill. This was told to the vets as well.

Sara (Debt Camel) says

Your insurance company should have told you promptly if they were declining the claim.

Are you disputing the decline?

The problem here is that even though the vet hasn’t behaved very helpfully, they are not regulated, so it may be hard to get them to call back the debt and remove the charges.

Simon says

No insurance company we were having a dispute until we resolve the issue that they come back and say you don’t have to pay then I was going to pay the bill. Truthfully I paid the debt recovery asap in full as I didn’t want Ccj or court action and more charges put on. The true fact here is that there was a dispute in place with pet plan but petplan had said nothing about sending it to debt collectors and neither did the vets. I did inform the vets “look we need to find out with pet plan who’s responsible for this bill since I have been paying my insurance, so I spoke to petplan and started a dispute and a week or so later I find the debt collectors letter where the vets have sent it to them. Did vets inform me pay up or we will take it to debt collectors? no, did they send me anything or inform me that this will be going to the debt collectors? No, did petplan mention anything? No !!! Do I take this matter to FOS Sara? All I can see is I would have had paid the bill if either informed me that debt collection will take this debt on but did anyone inform me to pay? Yes, they did but I started a dispute, so until the dispute was resolved then after that they should of taken action. The vets seemed like it was going into liquidation at the time as they ceo had gone and it was no ceo for the vets which is a limited company. This was in the mist of the pandemic. Personally from anyone’s point of view who takes your bill to the debt collectors without notifying you?

Sara (Debt Camel) says

I don’t know of a practical way to take forward a complaint about the vet if they have rejected it. You cannot take a complaint about the vet to FOS.

You can take a complaint about the insurance company. But Petplan would have no knowledge of the vet sending the bills to debt collectors. It is a shame you didn’t ask the vet to put a hold on the bill until you had resolved your dispute with the insurance company.

Simon says

Hi Sara, yes, do you have any ideas of whom I would be able to take this matter too?

Sara (Debt Camel) says

Have you made a complaint to the insurance company and had it rejected? If so, how long ago?

Simon says

I complained to the vets but due to the limited company going into liquidation they didn’t contact me back. I think they had also said that have to deal with the debt collectors.

Sara (Debt Camel) says

As ai said, I can’t see a complaint against the vets getting your anywhere. I have no idea if you can win a complaint against the insurance company, it isnt clear to me what they did wrong but this is not something I know anything about.

Simon says

Yes, It’s bit of a grey area. I will see what can be done

Thanks

Simon

Tania says

Hi I have received a letter to say a claim has being made to the County Court and I will receive forms shortly.

I have already told the solicitor’s that the debts are not in my name. They have sent what they say are the credit agreements but one has no date on and no amount of credit given.

The other has no address on and they can’t send a copy of the default notice issued.

These are not my debts and I am not sure what to do. Please can you advise.

Sara (Debt Camel) says

Talk to National Debtline on 0808 808 4000

Tania says

Thank you. They are closed until the 2nd Jan.

What do I do if I receive any court papers before then?

How can they take me to court for debts in a different name and for debts I have no knowlege of?

I have identification to prove I am not the debtor.

Can I let the court know I am not the person they are looking for?

Thank you.

Sara (Debt Camel) says

What do I do if I receive any court papers before then?

Have you received anything? A court claim form (N1) is described in here: https://debtcamel.co.uk/court-claim-form/

Have you previously been sent a Letter Before Claim/Action? It is a letter with several forms attached, it is described in here: https://debtcamel.co.uk/letter-before-claim-ccj/

Can I let the court know I am not the person they are looking for?

No, you enter a defence if you are sent a claim by the court. National Debtline can help with this.

BeBop says

Hi, I have been chased by Link for a debt I do not recognise. I asked them to provide proof/CCA. They replied saying that they could not. They stated that the debt was therefore unenforceable, but still collectable which I don’t really understand. They have now begun adding hard “debt collection” searches to my TransUnion credit file (so far, not appeared on either Equifax or Experian). It looks as though the first was about 6 months ago and another one now This feels punitive as they have already confirmed in writing that the debt is unenforceable if that is the case why are they now carrying out hard searches on my file and is there anything I can do? Thanks for your help.

Sara (Debt Camel) says

Are you sure they are hard searches? That is unusual. I suggest you double check and send them a complaint if they are hard searches.

BeBop says

Thanks Sara,

They are both definitely hard searches, but only on TransUnion. Not appearing elsewhere. Can I complain – are there grounds to get them removed or corrected in some way?

Sara (Debt Camel) says

you can send them a complaint and ask why there are two hard searches.

BeBop says

Thanks Sara.

Would it be fair of me to question the legitimacy of their actions based on having no evidence of a credit agreement with me? My understanding is that normally a hard search requires the consent of the individual being searched – such as for a credit application. Presumably Link Financial have no such permission because they have no evidence of an agreement – so my permission couldn’t have been transferred with the assignment of this debt to them? Is that a fair claim to make or does legitimate interest still stand?

I will definitely send a complaint letter, just trying to establish something to go back at them with. If a legitimate interest argument trumps any need for permission, do I actually have grounds to complain? Even with the searches being hard searches?

Thanks for your comments.

Sara (Debt Camel) says

I am sorry, I was concentrating on the fact that Link have said the debt was unenforceable – I think you should go back to them and say that you dispute this debt, they have failed to produce any evidence that the debt was yours and they should stop registering hard searches on your credit record.

I wouldn’t get tangled up in your not having provided consent to a hard search at the moment – just make a simple complaint.

BeBop says

Thanks for your advice Sara. I’ll do that.

Aimee peters says

With respect non if this information is applicable if the debt collection agency refuses to comply . Also I contacted the FCA and could not report the threats I’ve had because debt collection agencies are not required to have an operating licence because they are not a business and are not regulated by the FCA . Debt collection agencies are unregulated as the FCA advised me . I could not complain to the financial ombudsman because debt collection agencies do not provide financial services like a bank or insurance agency so they told me I cannot raise a complaint with them . Cab told me they don’t have the expertise to help wiith debt advice and various advice lines have told me the same . I have been able to get no advice it help . Meanwhike this alleged debt remains unproven and the collection agency has refused to respond to a prove it letter or any complaints and have only said ” see you in court “. The advice on here cannot be in reality followed unless a collection agency acts legally and they do not .!

Sara (Debt Camel) says

the article did say it covered consumer credit act debts – I have now made that clearer by mentioning it in several places.

I assume your debt wasn’t. If it was a utility or mobile bill, there are other Ombudsman organistions you could go to.

Lee says

Hi im seeking advice if possible way way back in 2008 HSBC merged my credit card debt with my loan account i had with them. Then i became ill and could not repay the require amounts. I entered into an agreement to pay the debt minus the interest over many years it would take me into the 2040s to pay back.. i was paying this debt at the required rate for about 5 years and then it was transfered to marlin dca and now cabot. I was continuing to pay the same amount up u til 2 years ago when i stopped due to ill health and working reduced hrs. At first cabot were good and out my accound on hold. However this tome they wont and have only said they would give me breathing space for 30 days. My famly member offered a payment as fill and final settelment but they refused saying i could pay token £1 payments instead.

My question is would it be worth asking for a copy of the

consumer credit act (CCA) agreement? Even though ive previously paid towards this debt. Its 16 years old and causing me lots or stress im never going go be in a position to pay it in full.

Sara (Debt Camel) says

It is definitely worth asking Cabot for the CCA. The fact you have being paying the debt isn’t relevant, that matters for statute barring but it has nothing to do with asking the creditor to produce the CCA.

See https://debtcamel.co.uk/ask-cca-agreement-for-debt/ which has a link to use.

Are your health problems likely to improve?

Lee says

Thanks for your quick reply so if they are not able to produce the CCA will that mean they cannot enforce it and i will not get harassed about this debt every few months. I have several health conditions that all prevent me from working long days or hrs, i frequently need time off and require hospital treatment. They know all this but cabot are not being as supportive as previously.

Sara (Debt Camel) says

Well they are allowed to contact you occasionally but they have to say each time that the debt is unenforceable.

If there are too many contacts complain because of your health problems and ask them to stop

Adel says

Hi Sara,

I have recieved a letter from a debt collection agency. It was accrued 4/5 years ago from electricity charges.

We had an account with our power who collapsed, then switched to a company who refused to tell us how much they were now charging us. So we changed to another company. A few years later a debt collection agency got in touch via an old email. I cooperated said I knew there was money owed however no one had been in touch and i needed bills as proof. Very nice agency, Debt sent back to utilita. They were unable to provide all bills for this period so I raised a complaint and eventually when to the ombudsman. Suddenly they were able to find these bills. The ombudsman said there was enough to prove accurate debt however I double checked bills before paying full amount and noticed on the owr power bill at the top it said £240 previously owed. I was not happy, all other debt had been itemised and proven so I disagreed with ombudsman decision and appealled. Their appeal decided that there was still enough proof for full debt however I was to be given £75 for bad customer service.

Not happy with ombudsman decision I waited to see what utilita would do. 2 years later debt passed to new debt collection agency. Asking for full amount again. What this gone so my questions are?

Should they have to provide itemised bill for the £240?

What should I do?

Should I get in touch and offer to pay full amount, minus £75 and £240?

Thank you for your time

Sara (Debt Camel) says

this is tricky as you have already lost this argument at the Ombudsman, havent you?

Has this debt been sold to the debt collector or who are they collecting on behalf of?

Adele says

Hi Sara

I received a letter from a debt collector (DC) that I owed over £5,000 to Abbey Bank.I have no knowledge about this debt.I was provided just the ONE option to contact them via phone.Instead I posted a royal mail recorded delivery letter requesting to know if the account is Statute Barred and provide CCA docs such as the Deed & Notice of assignment etc.

I received a (not dated) letter from the DC accusing me of making no contact or repaid the debt, hence, the account will be passed to a firm who would pay me a Home visit.I checked the royal mail website and the letter was signed and received by DC the previous week.I made an official complaint via email.The DC confirmed via email that the account was Statute Barred and would close the account.Next day,I rec’d their letter in response to my own recorded letter that the account was Statute Barred but they still believed I was responsible for the debt which they admit is unenforceable. They offered 50% discount.The DC still did not provide any document that I requested for under CCA.I still proceeded with my complaint that I would be requesting for compensation for the attempted Trespass, intimidation, stress and alarm they had caused me. Finally,I received a Final response to my complaint with an apology with no compensation offer.

My question,can I take this to a civil court to make a bigger claim or go to Financial Ombudsman within 6 months?

Regards

Sara (Debt Camel) says

When you originally wrote to them, did you say you would not be making a payment as the debt is statute barred?

Adele says

Correct. After they confirmed that the account was Statute Barred and unenforceable, I told the DC that I will not make payment and also because they had failed to prove beyond unreasonable doubt tha it was my account due to their failure to provide any of the CCA docs I requested such as the Notice & Deed of assignment. Shortly after, I received a Final response apologising especially the threat to come to my Home.

Sara (Debt Camel) says

ok so the timescale for these communications is pretty tight.

“The DC confirmed via email that the account was Statute Barred and would close the account.Next day,I rec’d their letter in response to my own recorded letter that the account was Statute Barred but they still believed I was responsible for the debt which they admit is unenforceable. “

That letter you got the next day would probably have been written before your email.

I doubt you would get anything by going to court at this stage.

The Final Response to your complaint acknowledged that the account was closed and you wouldn’t be contacted again about it? If it did, I suggest you treat this matter as closed.

Of course if they send you more chasing letter or “bargain offers” that would be very different!

Adele says

Thank you for your response Sara.

Because of you and what you have done for the public, what if I did not know about Statute Barred and the CCA docs. Especially the threat to attend my home , accusing me of not making payment despite the fact upon my request that they had no provided any CCA document to prove beyond unreasonable doubt that I may have been liable for the debt., accusing me for not contacting them which was false. Surely, something must be used as a deterrent to stop them abusing their position. What if I was elderly, sick or vulnerable.

Nevertheless, Much Appreciated Sara.

Natalie says

This is really useful I have been being chase by a debt collector for a debt that I do not recognise and the name on the account is slightly different to mine but the debt has been placed on my credit file. I have sent a prove it letter which I know they will not be able to prove as I started this process previously they also said they couldn’t speak to me as the debt isn’t in my name when I asked why they are reporting it on my credit file they sent a letter saying we are not sure why please contact the credit file companies and ask them to remove on doing this they have rejected my request. This has been going on for a couple of years now. So today I’ve resent the prove it letter I think on receipt of their reply I will send the above I am happy to pay debts that I owe and actually apart from the default they have placed on my credit file my credit history is really good but the default has caused me so many issues when trying to obtain any form of finance. Thank you for your help.

Sara (Debt Camel) says

If you don’t get a clear answer agreeing to remove the debt from your credit record, then make a complaint and then send it to the Financial Ombudsman if it isn’t sorted.

Natalie says

Thank you I will do as soon as I get a final response this has been such a pain it previously went to the ombudsman who said they couldn’t help as it’s not in my name but I’m going to push to get this resolved this time we’d love to purchase a house but this can’t happen whilst this is on going

DM says

Hi Sarah,

I ran into some financial difficulty over 10 years ago and set up a DMP to deal with several credit card debts. Your advice regarding asking for CCA’s was very helpful in bringing the DMP to an end.

I agreed settlements on all the enforceable debts, however one account which was sold on to Link Financial confirmed to me in writing in 2021 that the CCA was illegible and therefore unenforceable. As a result, I stopped making any payments to that account. Since then, I’ve continued to receive an annual statement from Link accompanied by a request to make contact in order to set up a payment plan. I did make an offer of a small token settlement amount 2 or 3 years ago but this was refused. I’ve made no further payment and have ignored any letters since then.

In the last few months ,Link have suddenly escalated contact by letter, phone calls and text messages and I have ignored all of these. I am now being contacted several times each week. None of these communications have mentioned that the debt is unenforceable.

Today I received a letter threatening that if i don’t make contact within 14 days the matter will be passed to the ‘Reconnections Team’ to be considered for a Home Visit.

What advice can you offer on how I should respond to this?

Many thanks!

Sara (Debt Camel) says

I suggest you carry on ignoring this UNTIL you get sent a formal Letter before Action/Claim – see https://debtcamel.co.uk/letter-before-claim-ccj/ for what one of those letters looks like, they can have various headings but they always have to include a Reply Form in a fixed format which that article describes.

You may never get one of those letters, Link may just be bluffing.

If someone turns up at your house (which isn’t very likely) they have no right of entry at all. Open the door and tell them politely that the debt is unenforceable and you will not be talking to them about it.