It is normally a good idea to tell your creditors if you are in financial difficulties, not ignore them.

So should you tell people you are planning on going bankrupt?

And who do you have to tell afterwards?

Contents

Before bankruptcy – you won’t gain from telling your creditors

Few creditors will feel sorry for you and stop pestering you if you tell them you are going bankrupt. So you aren’t likely to gain anything.

Most will ignore it. They have heard lots of people say they are going bankrupt and some of them don’t intend to do it, they are just hoping a creditor will write off a debt.

A few debt collectors, especially bailiffs, may even decide to hassle you more as this is their last chance of getting any money from you.

Almost all debts are wiped out when you bankrupt.

But if you have already let a bailiff into your house and he has a list of things he will take if you don’t make agreed payments (called a controlled goods agreement), this isn’t wiped out. So before you go bankrupt you need to keep a bailiff out of your house if possible, see Bailiffs – do you have to let them in?

Be very careful if you have a house

And if you have a house then you need to be more careful.

Bankruptcy doesn’t always mean losing your house if it is in negative equity or there is someone who could “buy” your equity from the Official Receiver, see the information on bankruptcy for more details.

If you tell an unsecured creditor that you intend to go bankrupt, there is a risk that they may rush to try to get a charge over your house. If they can do this, then their debt will not be wiped out by your bankruptcy.

This isn’t usually a very large risk as it will take some time for the creditor to first get a CCJ and then apply for a charge – most creditors simply won’t bother unless they already have a CCJ. But court cases are a hassle that you just don’t need at all, so avoid this by not mentioning bankruptcy to your creditors.

The problem of unsecured creditors going for CCJs and then charges won’t matter if you are going to hand back the keys and have the house repossessed. But you want to be able to stay in control, so that you leave the house when you want – when you have found somewhere to rent – rather than have thebhouse repossessed by the mortgage lender.

Even if you expect to be renting in a few weeks from now it is still better to say nothing – something may go wrong with your plans. The page about the process of going bankrupt talks about the “race” for you to find somewhere to rent before you are evicted. So make sure you have a head start in this race by not telling your mortgage lender that you are going to go bankrupt.

So what should you say?

Anything really, just don’t mention the B-word.

Offer them a token payment of £1 a month, tell them you expect to be able to pay more in a few months time or simply say you are going to be taking debt advice and leave it at that.

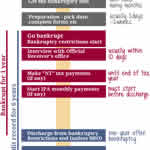

Of course if you have the bankruptcy fees ready, then it doesn’t really matter who you tell. The process of applying to become bankrupt and having your bankruptcy approved is very quick.

But if it is going to take quite a few months to save up the bankruptcy fees then your life is going to be easier if you don’t tell your creditors.

After bankruptcy – it can make your life easier if you tell some creditors

You don’t have to tell anyone!

All the debts listed on your bankruptcy application will be informed by the Official Receiver (OR) that you are now bankrupt.

But this takes a few weeks, so there are some situations where it’s good to tell a creditor yourself because it will make your life easier.

Debts you have been paying

As soon as you have gone bankrupt, you should stop making any payments to unsecured creditors.

This includes credit cards, loans, payday loans, catalogue debts, utility arrears, council tax and other tax debts.

If you are paying by Direct Debits or Standing Order, cancel all these. Don’t have to ask the creditor if you can do this, the bankruptcy rules say you have to.

You don’t need to write or phone the creditor to explain why. The OR will inform them about your bankruptcy.

Pre-payment meters

If you have a pre-payment meter for electricity or gas which has arrears loaded on to it, contact the utility company as soon as possible and tell them your bankruptcy details. They should remove the arrears from your meter, so all the money you add will be available to spend.

Telling them sooner is good as the deductions from your payments will stop sooner.

Deductions from benefits

Most benefit overpayments are included in bankruptcy but this can be complicated. If you took advice on going bankrupt from a debt advisor, you will hopefully be clear on whether your overpayments are wiped out.

Where a benefit overpayment is included in your bankruptcy, then you should tell the DWP, your local council or HMRC and ask them to stop deducting money from your Universal Credit or other benefits.

If they refuse to stop deducting money, go to your local Citizens Advice and ask for help to get this resolved. This doesn’t often happen.

What if creditors contact you after bankruptcy?

If you are phoned or a door-step collector comes round, just give them your bankruptcy details: “I went bankrupt on dd/mm/yy and my bankruptcy number is 999999.”

Letter from a lender or a debt collector soon after your bankruptcy can usually be ignored – either the OR may not yet have told the creditor or the creditor’s systems haven’t yet been fully updated yet.

One exception is if you get a Letter before Claim/Action, this is a special letter that has to be sent before a court case is started. It’s easier to reply giving your bankruptcy details now than have to stop the court case.

If a creditor continues to call or write, then write or email them with your bankruptcy details and ask them not to contact you again.

If a creditor keeps contacting you after you have told them you are bankrupt, pass the details to your OR. This is very rare – not something to worry about.

Debts where court proceedings are underway

Bankruptcy gets rid of almost all of your debts, so no court proceedings should continue, including:

- Liability Orders for council tax arrears

- Claims in a county court that would lead to a county court judgment (CCJ); and

- Charging order cases in a county court.

If a court case has already started, tell the creditor and enter a defence to these proceedings: state that your bankruptcy application was approved on dd/mm/yyyy, and give your bankruptcy number, this is on the Bankruptcy Order you were sent.

National Debtline is a great source of advice for all matters court-related. They have a good library of information, but if you are in any doubt, phone them up or use their webchat.

If you don’t do this and you get a CCJ after you are bankrupt, you can get this “set aside” – the legal term for cancelled – but it is just simpler to enter a defence and stop the CCJ being made in the first place.

Debts with a bailiff

If you get a letter from a bailiff, you need to know what debt it relates to:

- if it is a CCJ, council tax arrears or a parking ticket then tell the bailiff that you have gone bankrupt.

- magistrates court fines are not wiped out by bankruptcy.

If you aren’t sure, contact National Debtline on 0808 808 4000 urgently to see if you do still have to pay this debt and, if you do, how to deal with the bailiffs.

Where you have already let a bailiff in and they have made a controlled goods agreement – this is a list of your things that the bailiffs will take and sell if you don’t make the agreed payments – then you need urgent advice. Call National Debtline as soon as possible.

Chris says

I forgot to put some old utility debts on my bankruptcy petition, will I still have to pay them ?

Sara (Debt Camel) says

Hi Chris, no you don’t have to pay them – debts that were not on your form are still wiped out in bankruptcy. Tell the creditors you are bankrupt and Contact your Official Receiver’s office to say what has happened.

STEPHEN says

Hi there. I was declared bankrupt in 2007, however, i am STILL paying arrears to a gas company via my pre payment meter (£4 towards the debt per ever £10 credit). Is it too late to contact them? should i be refunded this money since my bankruptvy was finalised?

Sara (Debt Camel) says

Hi Stephen, it’s not too late. Contact them and give them the details of your bankruptcy (date, court, bankruptcy number). And yes, you should get a refund for the money they have incorrectly collected for this debt which no longer exists.

paul simpson says

hello i have gone bankrupt a week a go after speaking to cab it was my only choice could you tell me please the council tax is in joint names the council will start chasing my wife for half of it she does not work she is blind with other health issues no income only dla what should i do about it i already know what i was paying them monthy will have to go in the ipa and i wont have much left over to offer them thank you p.simpson

Sara (Debt Camel) says

Hi Paul, it would be best to talk to CAB about this and what the options for you and your wife are. If she has debts a DRO for her may be best? Are you sure you will be paying an IPA – less than 1 in 8 who go bankrupt do. If your wife’s on,y income is DLA then I would expect this years council tax can be included in your expenses for IPA calculations.

paul simpson says

cab told me that i most likely have to pay that in to ipa will have to wait and see what they say in a couple of months will talk to local cab thank you for your help

Suzi says

Hello

I am undischarged bankrupt as of July 2016 all going ok so far had letters from creditors acknowledging this however have returned from work today to a county court letterwith a Notice of Issue of Warrant of Control advising me i owe £1k plus which i presume is to a debti forgot to list on my bankruptcy application. They are threatening to come Monday next week unless i pay £1014.33.

Can they do this even though i am undischarged bankrupt? I am so worried sick.

Sara (Debt Camel) says

Hi Suzi,

you don’t say what sort of debt this is. Almost all debts are included in your bankruptcy even if you didn’t list them on the application, see https://debtcamel.co.uk/forgot-debt-bankruptcy/ for details.

I suggest you call your Official Receiver’s office tomorrow and discuss it with them.

Jean says

Hi there,

Could you please advise how long it usually takes for the OR to inform all my creditors of my bankruptcy?

Sara (Debt Camel) says

I think the letters go out within a week or so. It isn’t uncommon for a creditor to deny receiving one – this is more likely to be an admin problem than the creditor deliberately being awkward.

Are you asking out of curiosity or do you have a problem?

Andrew says

Hi Sarah

I have a huge issue of the back of bankruptcy. My employer have given me an application form for an additional card holder, for their business account.

I don’t need to sign anything but it does ask for all my personal details. As the bank was included in my bankruptcy, will they decline me as an additional card holder and inform my employee why?

I can see in the small print that their right to information, that includes the card holder, can be used for credit scoring and fraud checks.

Advice is much appreciated.

Sara (Debt Camel) says

I would be surprised if anyone is declined as an additional cardholder because they have been bankrupt, in a DRO or an IVA assuming there are no fraud markers on your account.

Michelle says

I’m in the process of making myself bankrupt via the MAP route. It’s not finalised yet, I have a had a loan company from my old bank ask me to call them should I just ignore it? I don’t think it will be too long before everything is finalised.

Sara (Debt Camel) says

Hi Michelle, I will ask a Scottish adviser to reply to you.

Alan McIntosh says

Hi Michelle

If you are quite far down the process, there should be no harm if you call them. You can tell them you are going bankrupt, who is advising you and their contact details and that they need to contact them.

Alternatively, my advice is just wait to they call you back then tell them. There is nothing they can do to stop your application and once they know the route you are taking they will probably just mark up your file to say that and put it on hold.

I hope this helps.

Alan

Stuart says

I am at the starting block of declaring bankruptcy. I have been advised by stepchange that this is my only option.

I did inform my creditors of my situation and both agreed a temporary relief. So both Dd were cancelled. One creditor relief period is now up and waiting a call for update. Do i speak to them or do i set up a SO to pay £1 until i can pay bankruptcy fees. I have read sooo much info im confused and unsure.

Please advise

Sara (Debt Camel) says

There are just two creditors? How long will it take you to get the bankrupcty fees together – have you read https://debtcamel.co.uk/help-with-bankruptcy-fees/? Do you own a house?

stuart says

Yes just two creditors. I privately rent but that is in my partners name. I have no assets available and have sold my car a good few months ago. Yes I have read the link you sent, but do not qualify for charitable and turns2 support. I have a 2nd bank account that i opened last month as a precaution, so i am unsure if i should start to use the new account. or if i should continue using the original account and set up Standing orders of £1 to creditors so i then can get the money together to pay bankruptcy fees.

Patrick says

If an IVA fails will the IP make you bankrupt and cover the fees or will the fees have to be covered individually?

At the same time if you know the IVA will fail can you ask the IP to make you bankrupt?

Claire says

That’s a really good question Patrick. My IVA is a disaster. And I’m wondering if I could apply for bankruptcy also. Or can I get the IVA to apply ?

Sara (Debt Camel) says

It is VERY rare for an IVA firm to make you bankrupt. See https://debtcamel.co.uk/when-iva-fails/.

How close is your IVA to ending? How large are your total debts in the IVA? Are you buying or renting?

Gemma says

Hi can somebody help me i am currently doing my bankruptcy application but today united utilities have sent a letter (well marstons)for £1000 debt i rang and offered them a monthly payment (to keep them away) they refused and said enforcement officers will be round on the 21st of oct.I explained the situation and she said that it dosnt matter as my bankruptcy wont b done in time.Any advice? Once paid for and applied can they still come?? X

Sara (Debt Camel) says

There is normally only a couple of days between applying for bankruptcy and it being granted. On what day do you expect to apply?

If bailiffs turn up, don’t open the door. If you own a car, make sure it is not parked outside. They have no right of entry.

Have you taken advice about going bankrupt? If not I suggest you talk to National Debtline on 0808 808 4000 – even if you are sure bankruptcy is the best option for you, it is always good to talk to an expert about this. And they will also be able to confirm what I have said about the biliffs.

Gemma says

Thankyou so much i did my bankruptcy and it was the biggest relief.Stepchange were amazing.United utilities have also been great xx

James says

Hi

Once I apply for bankruptcy, do I need to inform anyone?

I have multiple letters and debt collectors coming.

Also, what is the time frame of me submitting an bankruptcy application and actually becoming bankrupt?

Thank you

Sara (Debt Camel) says

The article above looks at who you should tell AFTER you have gone bankrupt.

This other article https://debtcamel.co.uk/tell-creditors-bankrupt/ looks at who you should tell BEFORE you go bankrupt.

The time from submitting a bankruptcy application to having it approved is usually only a couple of days.

Gem says

I did my bankruptcy application in oct within 2 days the official reciever rang me and 2 days after that all my debters were contacted,it was really quick.Im still having the odd letter but i just email them my bankruptcy order.Any debt before that date for me has been wiped.Massive weight of my shoulders.

Good luck xx

Paul says

I am going bankrupt but one of my loans is a gaurantor loan. Do I add this to my bankruptcy claim

Sara (Debt Camel) says

If you go bankrupt, your guarantor loan will be included in your bankruptcy and ypu should list it on your application form.

BUT if you do this, the lender will go after your guarantor. If you don’t want that to happen, read https://debtcamel.co.uk/guarantor-loans-in-dro-iva-bankruptcy/ and what it says about getting your guarantor removed from the loan.

ALSO have you taken advice on bankruptcy? If not, I suggest you talk to National Debtline on 0808 808 4000 about the details and whether it is your best option.

Lynda Jayne Peterson says

Hi myself and my husband both recieved email today telling us that our bankruptcy application was approved and we should receive a letter in the next 2 weeks telling us all that we need to know, will this letter also confirm when we will receive our phone call from the o/r

Thanx

Lynda

Sara (Debt Camel) says

I don’t know, it may depend on your OR’s office.

Amy says

Hi, I was a discharged bankrupt in March 2018 but previous to this In April 2017 I was taken to court for overpayment of housing benefit and fined by the court £250 which i paid. The reason I went bankrupt is because the council issued me with a bill ofr £7500 of overpayment which I just could not pay , so along with this and other debts I was advised to go bankrupt. The bankruptcy was discharged in March 2018 and since then the council have pursued me for the £7500 taking nearly £200 a month from my salary as an attachment of earnings. I am so confused – surely this debt which was an invoice and on the original bankruptcy should have been discharged? i am struggling so much to pay this amount although it is now done to £4000. Does anyone know if I should continue with this or if it should have been written off ?

Sara (Debt Camel) says

Was there any suggestion that the HB overpayment arose through fraud?

Amy says

Hi, the offence i was charged with was failing to notify change of circumstances affecting entitlement to any benefit payment under the social security administration act. The disposal was £200 Fine and costs of £85.00. I received nothing in writing to say I would have to pay the money back and was just issued with another invoice in March 2018 after the bankruptcy was discharged to pay back the overpayment.

Sara (Debt Camel) says

I suggest you talk to National Debtline on 0808 808 4000 about this. If the HB overpayment is viewed as the result of fraud, then they can still collect it. I don’t know who advised you to go bankruptc without checking up on this.

Zaf says

Hi I Applied for a bankruptcy on the 12th November 2020 and it was approved on the 13th November 2020. I am now waiting for an interview with the Official Receiver. However I also received a letter in the post from the county court for a CCJ asking for my attachment of earnings for a county court claim that was still ongoing….. What shall I do now? do I contact the court that the CCJ was issued? I have 8 days to do so…

Sara (Debt Camel) says

Have you been sent an N56 form – see https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/722820/n56-eng.pdf for what this looks like?

Lewis says

Hi,

I have received an N56 form for a CCJ totalling £1017. I have additional debt which adds up to £10,000. Receiving this form has brought my head out of the sand and i have reached out to nation debt line for advice. I think that bankruptcy will be my best option but unsure if I should fill in the N56 and then file for bankruptcy or not.

Sara (Debt Camel) says

I don’t want to alarm you as you are obviously taking this seriously, but it is a criminal offence not to fill the N56 form in or to give false information on it. This means you could go to prison. It is one of very tiny number of situation where it is possible to be sent to prison for a debt in this country.

Talking to National Debtline is absolutely the right thing to do. They can advise how to complete this form AND what your debt solutions are.

(Can I just check you are talking to the real National Debtline? 0808 808 4000? https://www.nationaldebtline.org/ ? because there are commercial firms that deliberately have very similar names to try to con you…)

Bankruptcy may be your best option. Or a Debt Relief Order, see https://debtcamel.co.uk/debt-options/dro/. National Debtline can help you look at all your possible options and the pros and cons.

Lewis says

Hi Sara,

Yes, I am speaking with the correct nationdebtline.

Currently waiting on my statutory report from Experian to move the process forward.

They made me fully aware of the penalties for not filling in the N56 and I am 100% taking the seriously. Sorry if it sounded like I wasn’t. I guess my question to you is if I file for bankruptcy and then fill the form or fill in the form making an offer of payment and then file as would this not be the same as what you mentioned here I would be offering to pay the ccj with full intention of not paying it by going bankrupt.

Sara (Debt Camel) says

if you have already had your application for bankruptcy approved, then you can return the form to the court with a letter giving the date and number of your bankruptcy.

But the timescale for returning this form is very tight. I suggest you talk to National Debtline about returning the form and asking for the order to be suspended.

Charlie says

Needing some advise.

If I were to declare myself bankrupt today, and a potential client takes me to court tomorrow – will it happen or will it be resolved?

Weatherman says

Hi Charlie

Do you mean declaring yourself personally bankrupt, or declaring a business as bankrupt?

The important date for personal bankruptcy is when (and if!) the bankruptcy order is made – not when you apply for the bankruptcy. It also depends what the court hearing is about. If a creditor gets a CCJ against you in between, it will still be included in the bankruptcy. But if a creditor ‘secures’ the loan against your property – e.g. gets a Charging Order – it won’t be written off. You might be able to challenge the Charging Order on the basis that it would be unfair to your other unsecured creditors, as if you go bankrupt, the creditor with a Charging Order would be the only one able to chase you.

It’s never a good idea to go bankrupt without advice, so speak to National Debtline first! 0808 808 4000

If it’s a business you mean, it’s possibly the same situation, but speak to Business Debtline: https://www.businessdebtline.org/

Duncan says

My wife was officially declared bankrupt on 17/10/2019 and was discharged on 17/10/2020.

The Bankruptcy appears on her credit file showing both the start date and the discharge date and has a status of discharged.

She however also has a CCJ on her file granted on the 18/10/2019 despite the fact that the company knew she was filing for bankruptcy, i suspect that they were trying to get the CCJ granted before she went bankrupt.

There are also still entries on her report that were part of her bankruptcy that are still marked as defaulted, but are being updated monthly by the 3rd party firms with the debt that was owed at the time of the bankruptcy.

I have asked the CRA to have these records ammended however they advise that they only take the information from the 3rd party, the issue here is that the 3rd party is now a Debt Recovery firm and not the original debtor so i have no contact details.

As far as the CCJ goes, am i able to get this set aside, as from my understanding the CCJ should not have been granted if i was already declared bankrupt? However i can see that the court might not have known this, and hence the CCJ was awarded.

How do i go about removing this, or is it even worthwhile trying, and would it be removed based on the above?

Sara (Debt Camel) says

i suspect that they were trying to get the CCJ granted before she went bankrupt.

There is no advantage in a creditor doing this. A debt before bankruptcy is wiped out in bankruptcy whether there is a CCJ or not.

(A CCJ only helps the creditor if after getting the CCJ they also manage to get a charge over your house before bankruptcy. This is not a quick procedure – if a creditor thinks you are about to go bankrupt they would be unlikely to do this, as it is more likely they would not get the charge through in time and would have thrown away the fees for getting a CCJ…)

Yes, you can apply to have a CCJ granted after the bankruptcy set aside. Talk to National Debtline on 0808 808 4000 about how to do this. And about the fees – if your wife is on a low income she may be able to get the fee reduced or waived.

In this case however you may decide that getting the CCJ set aside isn’t worth bothering with if there is a fee because it is only 1 day after the bankruptcy. Bankruptcy will disappear from her credit record after 6 years and so will the CCJ. So the CCJ will only be harming her record when it is clean from bankruptcy for 1 day…

She will find it very hard to get credit for the rest of the 6 years bankruptcy is only her record. realistically having a CCJ on there as well is unlikely to make this any worse.

If the creditor tries to enforce the CCJ, point out that she is bankrupt, the debt has been wiped out when she was discharged.

BUT

There are also still entries on her report that were part of her bankruptcy that are still marked as defaulted, but are being updated monthly by the 3rd party firms with the debt that was owed at the time of the bankruptcy.

Read https://debtcamel.co.uk/credit-file-after-bankruptcy/ and ask the creditors to correct these. They should have a default date on or before the bankruptcy date. And they should shop as satisfied or partially satisfied in some way (or settled) on the discharge date, with a balance owing of zero.

Dan says

Hi, I received a “notice of issue of warrant of control” letter from the county court money claims centre as I hadn’t made payment under the judgement of a CCJ. I’ve now been sent this above warrant of control letter that has a 7 day period. I have the money to apply to go bankrupt as I’ve been thinking this over for some time now. Will the bankruptcy wipe out the weren’t of control? Or what’s the process when it comes to this if I apply to go bankrupt, before bailiffs are enforced to take goods? Thank you for your help.

Sara (Debt Camel) says

2 things:

– read https://debtcamel.co.uk/bailiffs-dont-open-door/. For bailiffs trying to collect a CCJ, do not open the door and park your car a long way away.

– living in fear of bailiffs is not good. If you have been thinking about bankruptcy, this may be the right time to get on with it. BUT you need proper debt advice on this.

So ring National Debtline on 0808 808 4000 and talk about all your debts and this bailiff letter. They can explain your options. If you have the money for the fees, this can be very quick.

Dan says

I’ll contact debtline today but should i go bankrupt if my debt is nearly statute barred (6 months out between September to November) one debt which I’ve mentioned applied a ccj and now a notice of warrant. I’m self employed full time, so I’m unsure how it works if I go bankrupt and if I’d have to pay some debt off as it mentioned about 3 years depending on my salary. Is there a certain amount I’m allowed to live on or would it be possible to go for a dro with my debts nearly hitting the 6 year mark? I’m guessing the one debt which has court action on it will no longer be near the 6 year mark. I really appreciate your help.

Sara (Debt Camel) says

As you are self-employed, phone Business Debtline 0800 197 6026 – National Debtline’s sister service that deals with personal and business debt problems for the self-employed and owners of small limited companies.

If your debts are under 30k and you do not own a property, a DRO may be a better option for you than bankruptcy – BD can explain how a DRO works when you are self-employed and set one up if one is right for you.

If a DRO is not right, they can explain about bankruptcy. 5 out of 6 people in bankruptcy do not have to make monthly payments for 3 years.

Statute barring – it can be harder than you think to be sure a debt is statute barred, see https://debtcamel.co.uk/statute-barred-debt/. Also you may well find you are chased for these debts when there is only a few months to go…

If there is a CCJ, it never becomes statute barred. If a court case is started, the 6 year ststute barring clock stops at that point.

Terry says

Hello I have a car on finance and have it to put in to for bankruptcy but can I leave my bank and car finance off the bankruptcy or will I lose them as well thank s

Sara (Debt Camel) says

You MUST list your bank account on your application. Some banks will close your account. Some will downgrade to a basic bank account (really the only thing you lose is an overdraft and a cheque book). See https://debtcamel.co.uk/bank-accounts-after-bankruptcy/ for more about getting a new bank account if you have to.

You also have to list your car finance. Depending on how much the car is worth and how necessary it is, you may be allowed the cost of paying the car finance in bankruptcy. Or not. And annoyingly some car finance companies will take back the car even if you can carry on paying as there is a clause in the finance documentation that allows them to do this if you become insolvent.

Have you had advice on bankruptcy? It may be the right choice for you, I have no idea, but however sure you feel, it is still worth an hour of your time to discuss this with an expert. I suggest you phone national Debtline on 0808 808 400 if you haven’t taken advice – and they can also give you more information on these questions.

James says

Hi

I’m about to start a new job and enter into pre screening prior to employment. Should I tell them about my discharged bankruptcy?

thanks

Sara (Debt Camel) says

Were you asked if you have ever been insolvent? Are they checking your credit record?

Tracy Stevens says

Hi there I applied and paid for bankruptcy this Monday. I have had a bailiff this morning at 605am I told him to go away and wouldn’t give my name but now I’m panicking was this ok?

Sara (Debt Camel) says

Is this the first call from a bailiff? Do you own a car?

Tracy Stevens says

No I don’t own a car and yes it’s the first time. I’ve now got my bankruptcy approved so I sent him it via text

Sara (Debt Camel) says

That should be fine unless the debt is for something that cannot be included in bankruptcy, which would be unusual. Did you take debt advice before going bankrupt?

Tracy Stevens says

Yes I did from many sources and citizens advice. I did have an iva that added £3000 to my debt. It’s been an absolute nightmare. I didn’t see another way out. And I don’t own anything so it seemed the better option.

Sara (Debt Camel) says

That’s good.