UPDATE: FCA fines TFS £880,000. On 10 June 2022, the FCA announced: TFS Loans Ltd (in administration) has been fined £811,900 by the Financial Conduct Authority (FCA) in relation to deficient affordability checks on 3,150 guarantors in its consumer credit business. The FCA has also imposed a requirement on TFS to redress the guarantors that were harmed by the firm not conducting appropriate … [Read more...]

Complaints about guarantor loans

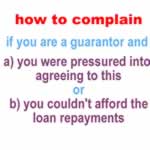

These articles look at what can go wrong with guarantor loans and how to complain about them, if you are the borrower or if you are the guarantor. It is simple to complain and 90% of these complaints are being won at the Ombudsman.

They apply to all guarantor loan lenders. They do not apply to guarantor mortgages, or if you are the guarantor for a business loan or someone's tenancy.

Amigo is much the biggest so many of the examples are about Amigo but the same rules apply to all lenders.

For articles that look at Amigo's own finances, see Amigo Company Archives.

How the borrower of a guarantor loan can complain

UPDATES: Do not use the template on this page for Amigo, Buddy, George Banco, Trust Two, Glo. It is now too late to complain about them. For TFS see TFS Loans goes into administration. Guarantor loans are very expensive. Often the lender didn’t check properly that you could manage the loan repayments without having to borrow more. It doesn't matter how well off your guarantor was, you … [Read more...]

How to complain when you are the guarantor for a loan

UPDATE: Do not use the template on this page for Amigo, Buddy, George Banco, Trust Two, Glo. It is now too late to complain about them. For TFS see TFS Loans goes into administration. If you are a guarantor for a loan you can ask to be removed as the guarantor: if you couldn't afford to repay the loan without difficulty; or you were pressured into becoming the guarantor; or … [Read more...]

Guarantor loans – why guarantors & borrowers need extra protection

Guarantor loans are coming into the regulatory spotlight. The FCA wrote to CEOs in March 2019 saying it will be looking at affordability and whether potential guarantors have enough information to understand how likely it is that they may have to make the loan payments. In a speech, Jonathan Davis said: Recent work we have done in this area showed that many guarantors are making at least 1 … [Read more...]

Bad credit loans to avoid

Logbook loans, guarantor loans, "pay weekly" shops such as BrightHouse - these may sound attractive if you are short on cash but have a poor credit rating or have been refused a payday loan. But this sort of debt can end in disaster if you have money problems. This article looks at bad credit loans, how they create a lot more problems than they solve and what alternatives might work better for … [Read more...]