What do you need to do if you want your house to be repossessed after you go bankrupt in England, Wales or Northern Ireland? Perhaps the house is unaffordable, has negative equity, or it’s the wrong size for you. For whatever reason, you want to move out, are happy for the mortgage lender to repossess and may want to “hand back the keys” as fast as possible to get it all over with.

The mortgage debt forms part of your bankruptcy

Some of the information you may read on the Internet about mortgages and bankruptcy can be confusing. To understand what happens, think of the mortgage as a being a combination of two different things:

- the mortgage debt, the money you borrowed from the lender; and

- the mortgage security, your house.

The debt is wiped out by bankruptcy. You will have listed the mortgage and any other secured loans on your bankruptcy application. You don’t have to do anything special for these debts – they will be wiped out by your bankruptcy when you are discharged in the same way that unsecured debts such as credit cards are.

But the lender still has your house as security. Even though the “debt” part of the mortgage no longer exists, if you don’t carry on making the agreed debt and interest repayments the lender will at some point repossess your house and sell it. Because of this, if you want to stay in the house you need to carry on with the repayments, but I’m not considering this case in this article, which only looks at the situation where you do NOT want to stay in the house.

How to get the house repossessed

You need to do two things:

- stop paying the mortgage. You may already have stopped paying the mortgage before you went bankrupt as it’s a good way to get the deposit for somewhere to rent and your bankruptcy fees.

- move out

- inform your mortgage lender by letter that you have moved out, give them your new address, and say they should repossess the house. Hand back the keys if this is easy.

That’s all!

You do not have to attend any meetings the mortgage lender invites you to or any court hearings. Handing over the keys is just a symbolic gesture – if your lender doesn’t make it easy for you to do this, don’t worry about it.

You do not have to sign any documents the lender sends you, see below.

The lender will organise the repossession. This may take longer than you think is reasonable but it really doesn’t make a difference for you. Just reply to any contact from the lender that you have gone bankrupt, you have left the property and you do not intend to start repaying the mortgage.

If you later hear the house is on sale for what you think is too low an amount, just shrug, it’s not your problem. If the sale price isn’t enough to repay the mortgage, it doesn’t matter how large the shortfall is, it will all be wiped out by your bankruptcy.

Do not sign a Deed of Acknowledgement

The one thing you have to be careful about is that you must not sign a Deed of Acknowledgement. The Insolvency Service has said this:

“Sometimes, after the date of the bankruptcy order a lender might ask you sign a document in which you agree to be responsible for the debt and any shortfall arising on the sale of the property. This is known as a deed of acknowledgement of a debt. If you sign it, the lender will be able to ask you to pay the debt after you have been discharged from your bankruptcy [my bold]. If you are asked to sign a deed of acknowledgement you may wish to take legal advice before doing so.”

So bankruptcy wipes out your mortgage debt but if you sign this afterwards, you are back owing the money.

If you want the house to be repossessed you should refuse to sign this. If the lender suggests that you can’t hand back the keys unless you do, just refuse. Your local Citizens Advice will confirm that you do not have to sign this.

You might wonder why anyone would ever want to sign this. If you want to keep the house then there may be some circumstances in which it is a good idea, in this case you DO need a lawyer. But I can’t think of any reason why someone who is moving out should ever sign it.

“Help, I’ve already signed one”

If you signed the deed of acknowledgement before you went bankrupt, it doesn’t matter. The mortgage shortfall when the house is sold will be wiped out by your bankruptcy. If you are unsure about this, ask your Official Receiver’s office.

If it was after your bankruptcy, then you need to take advice, especially if you feel you were misled into signing it. Go to your local Citizens Advice Bureau.

Mark B says

In laymans terms , absolutely f*ckin brilliant , wish i’d found this page couple of months ago .Go bankrupt like I did ,dont respond to the stigma of peer pressure of losing your (the banks)home ,you tried your best and you have a right to a good life do not live in servitude to the lenders !

Kim D says

Is the above 100% correct as I have been informed that even if I refuse to sign a deed of assignment the secured lender or lenders can do so in my absence.

Tia for any advice or help xx

Sara (Debt Camel) says

Hi Kim, I assume you mean “deed of acknowledgement” not “deed of assignment”. You have to sign this. It is pretty unlikely your lender would forge your signature!

Mike Thomas says

Sara, good article.

I cannot find a case where a lender has enforced the DoA.

My understanding is that if the borrower has inadvertently signed the DoA then it is most unlikely NOT to be enforced by the mortgage lender as the borrower will claim they were mis-lead into signing, a point you mention.

Catherine says

I’m just going through this. I told them as soon as I went bankrupt to repossess the house as I wasn’t living there as now disabled. All they’ve done since is keep adding in interest and sending letters and threatening people to come round to discuss financial terms. They waited until exactly a week after my discharge for it to be heard in court which I didn’t go to and they put the order in place, they’ve just rung me still trying to get me to pay something even though they have everything on file, he even read it out to me. So I’m trying not to stress about it, I named the mortgage and loan secured on it in the petition so any letters they send I will just follow advice and send them back. I won’t be signing anything as they are trying to tell me I’m liable for the shortfall but my Offical Receiver confirmed what you have said already.

Mike Thomas says

Catherine, well done for researching your position, you are now a lot more knowledgeable which should stand you in good stead.

If you either one, mortgage company or secured lender, keeps saying you are still liable and you feel harassed or threatened then lodge a complaint with the perpetrator and say that you will go to the Financial Ombudsman Service (FOS) if this continues.

I recently helped a chap on our forum who got £250 compensation, ordered by the FOS, to be paid by a debt collector for a similar issues as yours.

Keep strong and start making detailed notes of any future communications you have with lenders re the house.

Catherine says

Thanks mike I’m a recently retired police detective hence why I had to go bankrupt it was on medical grounds so I like to research. I know they have everything on record as he read it out today that I’d been in touch told them of the order told them I don’t live there and yet all they’ve done is keep badgering and adding on interest. They keep telling me they fall outside the bankruptcy rules as they are a secured debt I told them they are not exempt from harrasing and calling me, it was constant. I told him I’m not stupid to be signing any forms he says I would need to for the keys I just said tough. So any letters will just wing their way back. But I will definitely bear this in mind as I feel they will keep trying it on.

Catherine says

Well not only did I get that phone call iv received a letter from the mortgage company this morning GE kindly informing me of the court decision and that I can still challenge the order and stop the bailiffes but that they would still like to come to,an arrangement!

So despite me telling them last year and it’s in record that I wasn’t living their and to re losses the property depsite me sending there letters back confirming the bankrupcy and to repossess and also the long call I had last week where the guy confirms he had all that and that I wouldn’t be paying anything they are still trying to get me to agree to payments. It’s starting to get me down now, I. Discharged now and I want to live on with my life they know I not working as I’m now disabled and trying to look after my family. They know I know the law and have threatens the, a few times but they seem to think they can just keep writing and calling. I keep sending the letters back and I block very number they use but they just call from other numbers. The order comes in on 14th of sept so I’m not sure what they are hoping to achieve.

Mike Thomas says

Hello Catherine.

Time to call the Financial Ombudsman Service (FOS) on 0300 123 9 123 as I mentioned above, do it today to put your mind at rest.

Best wishes, Mike

Craig says

Hi, I went BR in November 2009 and am just approaching the 6 year mark now. In the process I had my home repossessed – the bank Halifax were insisting I had to sign this DoA but my insolvency advisor was insisting that I did not. I did not have the funds to seek legal advice so when I went to surrender the keys (Feb/March 2010) the bank gave me the form to sign when I handed over the keys but I crossed out the bit saying I acknowledge that I am liable for the shortfall and initialled it. Luckily the woman who I saw in the branch had never had someone surrender the keys before so she did not query the fact that I crossed out the relevant bit and initialled it before signing the form and surrendering the keys. Halifax never contacted me again in any way and a friend subsequently saw the flat for sale on an auction site at approx 30% less than the value of the mortgage.

Tbh it was the most stressful period of my life and I have tried not to dwell on it since. As I am now a postgraduate student I wanted to apply for a student account with Barclays. In the last week they have upgraded my account from one of those non credit check accounts to one with an overdraft facility (altho that facility is set to null and when I called them a minute ago the guy said the system wouldn’t give me a discretionary limit).

Since I am reluctant to apply for credit for fear of it being refused and adversely affecting my credit record, should I wait for 6 years from:

A) The date of the BR or

B) 6 years from when I had the house repossed

I will of course be applying to the credit agencies in the new year to see whether the BR is on there, but I saw this website and wondered if maybe you would have any thoughts or suggestions.

Sara (Debt Camel) says

Hi Craig, well done for crossing out that bit on the form!

Re your credit record What matters is the date of default that is showing on the mortgage. This SHOULD be the date you went bankrupt but it can be a bit of a struggle to get a secured lender to get this right – so I suggest you start now, don’t wait until next year! The process for trying to get a default date corrected after bankruptcy is described here: https://debtcamel.co.uk/credit-file-after-bankruptcy/.

My other thought is that you should immediately apply for a “bad credit card” and start getting some positive ticks on your credit file. Repay the balance in full, on time every month to avoid paying their horrible interest rates!

Darren says

Hi

I went br in March 2010 and I’m just getting ready to apply for a mortgage again.

I was repossessed and the shortfall was written off by the main lender but I checked my credit file recently and the 2nd charge creditor has marked my account as still active and defaulted for the last 5 years.

How can I rectify this?

Sara (Debt Camel) says

Hi Darren, this post https://debtcamel.co.uk/credit-file-after-bankruptcy/ says what your credit file should show and how to get it corrected.

George says

Hi, so I handed the keys to my (the banks) property over 3 years ago. The mortgage was with NRAM. In just under 3 years, they sold it for way under what was owed. I had a mortgage on it and part loan. About 111000 on mortgage and 15000 on loan. They sold it for 50k and I did see a letter about a year back saying I still owed 70k (they didn’t call it a shortfall).

I have never communicated with them since I sent the keys back and when I did I explained the reason for leaving was that living at a regeneration house on a very bad council estate was having a serious psychology affect on my family.

I have recently checked my credit file and found that experian show both the mortgage and attached loan as settled at the time the house was sold. I can see no sign of any other debt related to this. I called experian and they said as far as they were concerned the debt was settled…although they advised that what they say is not to be considered guidance.

Does anyone know how I can confirm what’s happened here without talking to NRAM or does anyone know the answer through previous experience. It seems to good to be true to say that the debt is wiped but it would be very good if it was.

Sara (Debt Camel) says

Hi George, you can’t take your credit records as an accurate picture of the legal situation, There could simply have been an error updating them. If you want to know what has happened, you have to ask NRAM I am afraid.

If the debt still exists – which is likely – you need to take some debt advice, looking at your full situation, including any other debts and your ability to repay. I think you talk to a debt adviser now, rather than wait and get a letter from NRAM threatening court action in another couple of years. Given the huge size of this debt, the options include bankruptcy, a full and final settlement and asking for the debt to be written off.

George says

Thanks for the thoughts, but I am still confused as to why NRAM would tell Experian that the debts are settled. Anyone else doing a credit check on me would also see that I had settled those debts and therefore, in theory, could give me credit on the basis that this debt is settled and no further credit related to this does not exist. My Credit file looks relatively healthy, all things considered as I only appear to have a few grand showing owed.

Do the banking and finance agencies not have a legal requirement to provide the correct information to the credit reference agencies…especially one that was until very recently, government/publicly owned.

Sara (Debt Camel) says

Yes they do, and if you contact them to ask them to correct the error I am sure they will do so … which is not what you want. Basically the fact they have made an error isn’t going to wipe out a £70,000 debt.

George says

So I’ve been doing a little more research on this and this appears to be very common that NRAM debts show as “settled” on credit files. Forum’s don’t appear to show what this means and why it is there. Some have suggested that it means that the debt has been sold on, although it doesn’t indicate who has the debt. Many are choosing to assume that it means the debt has gone away and therefore ignore it until it drops off the credit file. At the end of the day, no-one seems to have a clear idea of what the term “settled” means on a credit file with respect to NRAM.

According to definition, “Settled” on a credit file means: “A settled account means that you have come to a negotiated settlement with the lender that is less than the original repayment terms of the loan. Once the settlement has been reached, the lender will update your credit file with the words ‘account settled.”

Personally I take that as the account being settled. No more debt. I’ve checked the other credit agencies and have found the same term used for NRAM on my file. Therefore, NRAM has gone to the effort to make what Sara suggests could be a mistake, with every UK credit agency.

Based on the frequency that I have found NRAM doing this for many people and the fact that I see no other company has taken ownership of the debt, I feel reasonably confident that they have just chosen to right the debt off after the sold the house.

For NRAM, it kind of makes sense as their goal was to clean up their balance sheets of bad debt, which this does.

Does anyone have any further thoughts on this or can actually confirm what is happening here. Based on what I have read, there are a lot of other people in the same confusing situation, scared to investigate further but assuming similar to what I think.

Sara (Debt Camel) says

Well it is up to you. but as I said before, i suggest you should not take anything on a credit file as an indicator about the legal status of the debt.

Say you are right and that NRAM have wiped this debt out – then if you contact them they will confirm this and you can proceed with your life with no worry about what could happen. But if you are wrong, there has just been some sort of error, then it is better to find out now and decide what your options are.

SC says

Hi Sara,

Huge thanks for your invaluable advice re the deed of acknowledgement; I have a feeling that may be imperative in the not too distant future. My mortgage company is probably going to start repossession proceedings in the next couple of months, and I have also reached a decision that bankruptcy is probably my only option. Firstly, should I wait for the repossession process to begin before declaring bankruptcy, or am I best to do it the other way around? Or doesn’t it make much difference?

Also, there seems to be a lot of expenses related to my house being repossessed – will these be wiped out by my bankruptcy?

Many thanks!

Sara (Debt Camel) says

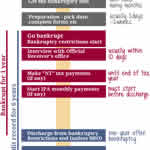

Hi SC,

my usual suggestion is that people should sort out where they want to live next as their top priority and go bankrupt after they have moved and handed back the keys. This puts you in control of what happens and when. Second if you have to rent, this is all sorted prior to bankruptcy – it’s not impossible afterwards but it’s one less thing to worry about. See https://debtcamel.co.uk/debt-options/bankruptcy2/ for more about this.

But there may be other priorities for you – you should talk to a debt advisor about bankruptcy and whether you have any other sensible options and discuss the timing issue with them.

The expenses relating to your house repossession are all effectively added charges onto your mortgage debt, which will be wiped out by bankruptcy.

SC says

Hi Sara,

Thank you so much for your speedy and very useful reply!! Your website is easily the most informative resource available when it comes to bankruptcy, and the reality of what actually happens, advice of what to do/what not to do etc. It has answered pretty much everything I needed to know and much more. Sending you huge appreciation for providing this and for being so very helpful in difficult times!!!!

SC

Jenny says

Hi Sara me and my husband went bankrupt last April then moved out our home we did not sign anything and our house was repossessed. I’ve now had a letter from nram saying we are responsible for any shortfall! This has started to worry me I just want this nightmare over! What should I do?

Thanks

Jenny

Sara (Debt Camel) says

Hi Jenny, write them a letter saying that you went bankrupt in xxxx court on dd/mm/yy and quote your bankruptcy reference number. Say the mortgage debt was included in your bankruptcy and you are not responsible for any shortfall. Add that you will complain to the Financial Ombudsman if they continue to suggest that you are responsible.

If you would like confirmation about this, talk to your Official Receiver’s office – they will confirm it.

Jenny says

Hi Sara

Thank you for your reply. I will do that and hopefully they will leave us alone

Thank you!

Ben says

Hi

I went bankrupt in 2011 and discharged in 2012 my estranged wife refused to sell the property and the official receiver returned my interest back to me in 2014, during the past years my ex has continually not paid the Morgage and now the bank are moving to repossession, the bank have been informed repeatedly of my bankrupcy.

Please can you adise what liability I will have for the unsecured debt following sale from the repossession, my understanding is that the debt forms part of my bankrupcy and providing I have not signed any new documentation since being bankrupt the debt is still covered within this.

Any advice would be helpful the only answer I can get will cost me 800 from a specialised lawyer which is money I do not have.

Sara (Debt Camel) says

Hi Ben, I suggest you talk to the Official Receiver’s office that handled your case – they should be able to confirm that the mortgage debt was included in your bankruptcy and that you have no liability for the resulting shortfall.

Nicole says

Hi

After reading all the previous posts I’m wondering if u may be able to help me with my situation. My ex husband currently lives in the matrimonial home to which I’m a joint owner of. I moved out in 2009 following a break up. I took him to court in 2013 to force a sale on the property as he was running in arrears anything from 2-4 months worth currently 3. There is a secured loan over the property which he has accrued £51,778 worth of arrears since I moved out. He has a minimal payment plan is place of £148 a month to a £900+ request so therefore the shortfall plus interest is being added to the balance each month. This has now made the property in negative equity by approx £40000 at present time. The forced sale was declined as the judge couldn’t over rule the secured loan lenders decision to allow him to pay pennies!!! I’m liable for both and the situation is worsening every month I have tried everything I can think of but can’t free myself from the burden is bankruptcy an option? As i was told by my solicitor it’s not until the shortfall becomes unsecured following a sale or repossession , both of which aren’t gonna happen anytime soon. Thanks in advance

Sara (Debt Camel) says

I don’t think your solicitor knows much about bankruptcy :( Yes, bankruptcy would get rid of your liability for this debt. That doesn’t mean that bankruptcy is necessarily a good option for you, you need to talk to good debt adviser about your options: https://debtcamel.co.uk/more-information/

Nicole says

Thanks for your reply. Would u mind explaining why u think bankruptcy might not necessarily be the right thing please? As if it’s an option I can see it being possibly the only option as after 5 yrs of fighting this I can see no light at the end of the tunnel. I saw citizens advice only yesterday and they were unsure if there I have any options. Thanks

Sara (Debt Camel) says

Because I know nothing about your circumstances! You could have a house with equity or other problems… If you have talked to CAB and they don’t think you have any other options and bankruptcy doesn’t present any particular problems for you, then it may well be sensible.

Nicole says

Ok thankyou. The house in question is in neg equity and I rent privately I do not have any assetts but have a few small debts to the value of approx £5000 as well as the debt over the property. Can I go bankrupt as a joint owner of the property if my ex still lives in it? Sorry for all the questions and thanks again

Sara (Debt Camel) says

Yes you can.

Mike Thomas says

That would be possible Nicole, any outstanding debt would then pass on to any other named person on the agreements. Like Sara I do not know enough about your circumstances to confirm if this is the right option for you. That said if you have disposable income (DI) after making your necessary reasonable monthly expenditure payments (in line with industry set guidelines) then in a bankruptcy you may be subject to an Income Payment Agreement (IPA). An IPA is for three years and the money goes towards the administrative cost of running your bankruptcy, any money left after this would go to the creditors in your insolvency. Before jumping into bankruptcy look at getting that right advice from a couple of respected and trusted sources and then make an informed decision. You do not have to wait until the house is repossessed to go bankrupt. Provided the mortgage and any other creditors you have are included in the insolvency then you will be covered. Trust this helps.

Sara (Debt Camel) says

Mike, she has been to CAB, she has no assets, a secured debt can’t be included in an IVA, what else would you suggest? Also few people have to pay an IPA :)

Catherine says

My situation slightly different an iva was out of the question bankruptcy the only option and I know we don’t like to use that word but I found it the biggest release ever and I was a police detective. I had a house in negative equity and a second Morgage of 30k plus unsecured debts I became disabled so I paid my money and it was the best thing I ever did. It lasted 12 months finished last August and I’ve never looked back. I couldn’t get any credit anyway so why was I holding onto it paying peanuts to an every rising debt and chasing letters. Bankruptcy isn’t as bad anymore

Nicole says

Thankyou I’m thinking the same I’d rather be free now than stuck for upto another 14 years which is what’s left in the mortgage. I can’t obtain credit now so I’m wondering wat difference it would really make to me to go bankrupt. I just want to make sure I take this drastic action all my liability to the house will definitely go and that will be the end of it.

Nicole says

Thanks for your responses. Just to shed a little light on my circumstances. I’m a mum of 4 kids eldest being 15 youngest being 4, I do not work. My partner works and we receive ctc. I have no personal assets and ask don’t work no disposable income as such. Or would it be based on household income? Therefore inc my partners wage? I haven’t paid anything to either the mortgage or secured loan since I moved out on 2009 and my ex pays the 1st mortgage but it’s currently running 3 months in arrears and the secured loan he is on a payment plan of £148 a month to a nearly £900 request. This loan is in arrears of £51778 and the original loan started at £60000 so it’s nearly doubled. The house is worth approx £210000 so is in quite heavy neg equity. He obviously wants to keep the house which he clearly can’t afford but I want to be free of it to prevention putting me in any further debt. Hope this info helps thanks

Also I have looked into transfer of equity to my ex, the loan to value of the first mortgage needs to 85% or less which it is if you disregard the secured loan which the mortgage company said they would but it must be arrears free for 12 months and the Payment plan he is to clear the 3 months arrears will take another 4 and half years to clear then a further 1 yr before I can apply that’s even if it stays arrears free for that period of time. Do u know if I did get released this way dies the second lender have to remove me following the first? Or can I still be liable for the ever increasing loan? Thanks again in advance.

Sara (Debt Camel) says

An IPA is based on your income so you won’t get one. It sounds as though you have looked into this in detail and bankruptcy is the best options for you. It will completely remove your liability for the mortgage and the secured loan.

Catherine says

Bankruptcy is 100% the best option o could have lost my job because of it, it’s not such a massive deal now as bad as that sounds since the recession people haven’t had a choice you fill the paperwork in I did it on my own and put every last penny down name every single and joint debt then make an appointment at the courts you go into a small booth a little man looks over your documents takes your money I had to talk to a judge in chambers because if my job to check I was happy and that was it. Paper stamped. The receivers called me after to discuss the forms they don’t take your possessions and if your in rented it doesn’t effect it. We even got our gas and electric bills written off which was amazing. Do not sign any forms to do with the house at all after bankrupcy no matter what they say, but you may need some advice on it but I didn’t sign a thing it got sold lost money that debt got written off the loan on the house got written off I’m clear. I was only in this mess because of an ex. You cannot trust him to meet payments there will come a time where action is forced and the debt is higher. You can’t get credit now… My advice… Get out now!

Nicole says

I think it’s my only sensible option thankyou all got your advice and support. I now have made my mind up and bankruptcy it is.

Darren says

Hi Nicole

All I can add to this is if you do decide to bankrupt then you need to plan it properly.

I went BR 6 years ago and only this week I am applying for a mortgage again. I made a few mistakes on the way because I didn’t have access to the free information available on this website back then.

Make a plan and follow Sara’s tips here and you will be free in 6 years.

Make sure you include both mortgages on your BR.

Your Official Receiver will write to the lenders but also you should let them know too.

Don’t make any more payments to any debt after the BR.

Get a Mobile phone contract and keep it… It will help you to build credit in 6 years time.

During the 6 years don’t miss any payments. After a couple of years get a vanquis credit card and pay off every month.

The only things you will miss are Internet banking (we used my wife’s account for that), contactless payments (same again) and buying stuff on credit which is not a bad thing!

It’s all on Sara’s excellent website. Good luck Nicole.. there is light at the end of the tunnel and there are lots of good people on here to help you to that light!

Catherine says

Just to add to above I got a phone on contract before as well don’t do anymore spending on credit as some people decide to go bankrupt and max everything out they will question this and could extend from 12 months to 2 years so try not to spend anymore.

You don’t have to tell anyone you don’t have to write to anyone I didn’t. If I received letters after I either wrote in return to sender or put a note in with my bankrupcy number and date never signed it told them to stop writing and sent it back. Good luck but it’s easier then you think Hun x

Sara (Debt Camel) says

Hi Nicole,

good advice from Darren and Catherine. They also put what would have been really useful info about changing your bank account – except this has now got a whole lot easier since January 2016! You can now have a basic bank account with 9 different banks and many have interent access and even contactless cards :) See https://debtcamel.co.uk/bank-accounts-after-bankruptcy/ for details.

Sarah says

I had to move out of the house due to domestic abuse and needing to be as far away from my ex as possible. I told the mortgage company I was no longer living in the house and that my ex husband was. The house was finally repossessed in april 2013 – despite me telling the mortgage company in august 2010 that they should repossess the house as my ex was not paying the mortgage and I had moved out in april 2010.

It took me 3 yrs to save up the money to declare myself bankrupt being a single parent raising 2 kids. I declared myself bankrupt in march 2012 and have been discharged March 2013.

Last week I received a letter from some debt company saying I owed my ex mortgage company £70k I phoned them and told them I had declared myself bankrupt and the mortgage was listed on my bankruptcy order. I have never received any communication from the mortgage company since declaring myself bankrupt. I did not leave them any contact telephone numbers and forwarded the letter to my Official receiver – I have no idea how this company even got my address as I recently moved in with my new partner.

Today I have received a letter saying they refer to my phone call from me stating I was declared bankrupt on 9 march 2012. At the time I was declared bankrupt I was still the owner of the property this debt balance relates to. Repossession of the property took place on 26th of april 2013 and the subsequent sale being july 2013. Therefore their client was a secured creditor and would not have been included in the bankruptcy. As such I remain liable for the balance due to our client!

Obviously you can imagine that I now feel sick with worry and this is bringing up all the trauma of the break up of my marriage. I lost my job and everything as a result of me walking away from a violent marriage. Please can you give me some advice on whether I am actually going to be made to pay for this. I have not signed any acknowledgements of anything via the mortgage company this is the first form of communication I have received. I have been working hard to try and rebuild my life and live a frugal existence and never have plans to borrow money ever again. I thought that my bankruptcy had all been dealt with and I feel ill now after receiving these letters and wonder when they will end.

Sara (Debt Camel) says

Hi Sarah, this debt would have been wiped out by your bankruptcy, the fact the house hadn’t been repossessed at that point is irrelevant. You should be able to get confirmation if this from your Official Receivers office.

Once you are feeling reassured, you need to tell the debt collector again that this debt was included in your bankruptcy and that you will be complaining to the Financial Ombudsman if they continue to contact you about it.

Sarah says

Thank you for such a quick response my OR is out of office till tuesday I have emailed him a copy of this letter and the previous letter. I just want to get on with my life, the mortgage was a joint mortgage I have no idea what my ex husband may or may not have done but I just need to have the reassurance that I can put this part of my life in the past now and move on.

I think it is awful that despite me telling this company I have been declared bankrupt and the mortgage was listed on my bankruptcy that they are trying to tell me that the mortgage company is a secured creditor and I am liable to pay this! the distress this is causing me is unreal.

liz says

Question here…me ex husband went bankcrupt in November 2014 leaving me to pay the mortgage which I have but not sufficienty for the bank and they now have put a suspended repossession on it as I took an offer on it yesterday. There is going to be a shortfall am I liable solely for this amount? Please advise.

Sara (Debt Camel) says

After your ex went bankrupt, it is as though the mortgage is only in your name, so if the house is sold and there is a shortfall, you would be solely liable. I’m not sure from what you said if you have just accepted an offer to sell the house? I think you need to talk to an advisor about what your housing and debt options are from here on – your local Citizens Advice would be a good place to go.

Teressa says

Hi, I’m hoping you can help me please.

I split up with an ex partner who i have a joint mortgage with (a flat/apartment)back in 2009, he moved out and stopped paying the mortgage which put me in financial disaster. The apartment in in negative equity.

I ran up credit cards and had to obtain loans to keep on top of it as my ex refused to let me sell or rent the property. I became a prisoner in my own home. Solicitors wrote to him but he failed to ever respond.

I have since met a new partner and now have children and desperately need a house. I have had to give up work due to ill health and can no longer afford to pay the debts and need a house asap.

I have looked into bankruptsy and have a meeting with CAB next week but it appears to be the best option. Am i best to rent a property before applying for bankruptcy and handing the keys back?

I’m extremely worried and would appreciate any help or guidance as my ex is clearly not prepared to sort the housing situation in any way and i cannot afford to finance the sale and sort the negative equity in the property.

Thanks in advance T*

Sara (Debt Camel) says

I am glad you have an appointment booked with CAB to talk about bankruptcy. It may well be your best option, but having someone to talk through the details with is really important in case you have realistic alternatives and if you don’t, it will give you the reassurance that this is the right thing for you and your family.

If bankruptcy is your chosen way forward, then it is usually more important to resolve your housing situation first. If you are in poor health and with children, talk to CAB about your housing options and benefit entitlements. Move – hand back keys – go bankrupt is the order that often works well, but CAB will help you look at this.

Teressa says

Thank you Sara for your advice.

You’ve provided more info in the thread than I ever got from a Solicitor. Not once did they suggest bankruptcy or DRO.

I’m going to try and sort somewhere to live asap and will then do what you’ve said, hand back the keys and go bankrupt.

Thanks again for your insight.

Thomas says

Hi Sara,

Please can you advice whether I should apply for bankruptcy before or after handing the keys back?

My mortgage company are due to take legal action at the end of the month so I’m unsure if I have to wait for the house to be sold and be made aware of the shortfall before applying for either bankruptcy/DRO etc.

Many thanks,

Tom

Sara (Debt Camel) says

You can apply for bankruptcy either before or after handing the keys back. Many people find getting their next house sorted and moving in are the most important things, then deal with bankruptcy afterwards but I suggest talking to a debt adviser (your local Citizens Advice or National Debtline on 0808 808 4000) about your situation to discuss what points are the most relevant for you.

If you think you may qualify for a DRO (talk tot the debt adviser about this too!) then you will have to wait until the house has been sold by the mortgage company, not just repossessed. This may not be quick.

Thomas says

Thank you for such a quick response.

I’ve found a property to rent and have that sorted to move into next month.

I had been led to believe that I needed to wait for the house to be sold before I could apply for bankruptcy. If I hand the keys back now then, will any shortfall be included in my bankruptcy application? I am aware that it is currently in negative equity and it is a joint mortgage with an ex who has no interest in the property. Will the shortfall fall to her if I go bankrupt?

If I was to wait until the property is sold, could I go bankrupt then or does it need to be done beforehand? I’m not sure on the amount of debt the sale will incite so have been told I may be able to go down the DRO route and it may not affect me as badly.

Sorry, I’m just really confused/anxious that I get this right as I dont have the money to seek legal advice.

Thanks again! Tom

Sara (Debt Camel) says

“If I hand the keys back now then, will any shortfall be included in my bankruptcy application?” Yes

“Will the shortfall fall to her if I go bankrupt?” You are both jointly liable for the shortfall. If you go bankrupt, she becomes solely liable for it.

“If I was to wait until the property is sold, could I go bankrupt then or does it need to be done beforehand” You can go bankrupt at any stage, before you hand back the keys, after you hand back the key but before it is sold, or after it is sold. In any of these situations the shortfall will be included in your bankruptcy. The only think to look out for is that you do not sign a Deed of Acknowledgement, as the article above discusses.

BUT I think you should speak to a debt advisor to talk through your situation. You do not need to pay for legal advice – both Citizens Advice and National Debtline are free services. They will be able to talk to you about the timing of going bankrupt, the impact on your ex, whether you may qualify for a DRO instead and any other questions or options that you may have. This is a big decision and it’s worth being really confident about it.

Josh Solent says

Hi Sara, hoping you might have some advice for my situation.

I purchased an apartment for £143,000 back in 2005. I have an interest-only mortgage and the purchase price included 25% shared equity (actually a secured loan) as part of Barratt Homes ‘Dreamstart’ scheme (otherwise known as ‘Nightmare-Start …).

The loan is now due – Barratts are willing to extend the due date year on year but are adding 4% over the base rate each year. The apartment is in significant negative equity – it is now worth around £115,000. I currently rent it out and am living abroad. The rent is barely enough to cover my mortgage payments and the service fees on the property.

I am considering bankruptcy as an option – can the secured loan from Barratts be included? If the apartment was repossessed and sold on the open market it should fetch enough to pay off the mortgage from my first lender (I believe they have priority).

Any advice much appreciated.

Josh

Sara (Debt Camel) says

Yes the secured loan – and indeed the mortgage – will be included in bankruptcy.

I am just answering your question there – I don’t know whether you have other debts, whether you intend to return to the UK at any point, whether you have any assets, in the UK or outside, or anything else – I strongly suggest taking some advice about whether bankruptcy is a good idea for you or if you have any other practical options.

You also don’t say where you are living – if it is in the EU it may not be simple to go bankrupt, see https://nationaldebtline.org/get-information/guides/bankruptcy-and-foreign-issues-ew/

Josh S says

Thanks Sara – I live outside the EU and don’t plan on returning to the UK for the foreseeable future. I’ll be sure to take advice.

Josh

Alice p says

Hi Josh

I am in exactly the same position as you with a shared equity from a builder on my apartment. They found out the apartment was rented and are now demanding full repayment of the 25% which I don’t have. I am scared though as have read that secured loans may not be included. Would be interested to hear how you got on.

Sara (Debt Camel) says

Secured loans are included in bankruptcy. I suggest you talk to a debt adviser https://debtcamel.co.uk/more-information/ about your situation to see if bankruptcy is a suitable option for you.

Rachel says

Hi Sara,

i was hoping to get some advice on our mortgage situation :/

Me and my partner signed a mortgage for £250K (thereabouts) on a 40 year mortgage in 2006, we have been paying off over £1,000 every month in repayment yet hardly anything has come off our mortgage, it’s pretty much all interest. We are a growing family desperate to move, and the house has become a stress in our lives, a noise around our neck, we never imagined being stuck here!

We are based in Northern Ireland so hit massively by negative equity. We would be lucky to get £120k for this house now. So we are considering bankruptcy. Any advice on what your thoughts are would be much appreciated, do u think this is our only solution to move on. We are pretty sure it is, but as we have always paid our debts, never bought on credit, it just feels awful to have to go bankrupt at the end of it all.

All advice welcome

Many tks Rachel

Sara (Debt Camel) says

That is a huge amount of negative equity. I think you should go to your local Citizens Advice and talk through bankruptcy and what your other debt options may be. You need to look at factors such as what it would cost you to rent somewhere suitable for your family.

Rachel says

Thanks Sara, rent would be less for a house that would suit our needs and enable us to move on with our lives without this debt. I am planning on seeing citizens advice asap, to see what they advise us to do.

Margaret Taylor says

Hello, My husband and I were made bankrupt in Jan 2011. We had a buy to let property on an interest only mortgage with NRAM. We included this in the bankruptcy and refused to sign the deed of acknowledgement, thanks to you.

NRAM then appointed an LPA and they have dealt with the tenant since then. in all that time the mortgage has been on our credit reports. NRAM say they will not put the house up for sale until the end of the mortgage tern in 2022.

I worry that if there is a void in the tenancy and the mortgage goes into arrears that this will show on our credit reports (which are looking very healthy now).

Can we force NRAM to sell?

Sara (Debt Camel) says

One thing you could consider is putting in a complaint to NRAM asking them to add a default date of the date of your bankruptcy to your credit record and to set the balance owing to zero. See https://debtcamel.co.uk/credit-file-after-bankruptcy/.

Margaret Taylor says

I wrote to NRAM and got a phone call. They said up until 2015 they never took it off the credit file but since then, if requested, they will do so. They have – it is no longer on our credit report. Thanks for your help

Steve says

Hi Sara,

Please can you help. I had a mortgage from 2004 but in 2010 was made bankrupt. I carried on making mortgage payments for 8 months after my bankruptcy order but got to a point where I just couldnt carry on making the payments, so the house was voluntary repossessed in 2011 and Lender sold in 2012. As it was secured debt at time of bankruptcy and wasnt included in the Bankruptcy, at the time of the Bankruptcy, does the shortfall when the property was sold still fall into the Bankrurptcy? Is there anyway a Lender can argue that as the debt wasnt unsecured at time of Bankruptcy, so it cant be included and still chase you for the money? Heard different views on this and wanted to check…

thanks for any help

Sara (Debt Camel) says

The debt was included in your bankruptcy – it isn’t possible to leave a debt out. If you had carried on making payments the lender would not have rpossessed, so it may have “felt” as though it wasn’t included, but it was.

Provided you didn’t sign a Deed of Acknowledgement, then you shouldn’t have a problem with this. has the lender contacted you about the shortfall?

Have you looked at your credit record – you need to find out what is recorded there. See https://debtcamel.co.uk/best-way-to-check-credit-score/ for how to check your credit score. It should have a default date of your bankruptcy date and a zero balance owing – has it?

Steve says

Hi Sara,

Thanks for your reply. Yes, the default is showing as partially satisfied but only when the house was sold after repossession (which was nearly 18months after the bankruptcy…..and I have been told, this is because the property (secured debt) wasnt included in the bankruptcy estate, at the time of the bankruptcy, even tho the secured debt was in place, at the time of the bankruptcy. I always thought all your debts, secured and unsecured automatically formed part of your bankruptcy estate and being told this has got me worried I wasnt protected by the bankruptcy and Lender could decide to chase me for the shortfall. Is there something you need to do, so that all debt (secured and unsecured) form part of the bankruptcy estate when you go bankrupt or should it be automatic? I included the mortgage account in the bankruptcy petition but have nothing else to confirm whether it was or wasnt included…Is there any legal guidelines to confirm all debt at time of bankruptcy forms part of your bankruptcy estate? appreciate any help

Sara (Debt Camel) says

OK, if the debt is showing as partially satisfied, that is all right – it means the lender accepts that the balance on the debt is zero and you shouldn’t have any problem with being asked to repay the shortfall.

Having said that, the default date really should be the date you were made bankrupt. See https://debtcamel.co.uk/credit-file-after-bankruptcy/ for more details – that post has a template letter to write to the lender to ask for this to be corrected. If the lender refuses, you should take this complaint to the Financial Ombudsman, not the ICO.

Steve says

Hi Sara,

Thanks again, appreciate your help…the problem I have is that I have been told I need to show evidence that the secured loan was included in the bankruptcy estate at the time of the bankruptcy, unless I do, the Lender will not backdate to the bankruptcy…having spoken with the FO, I have been told, it isnt automatic that secure debt gets included in the bankruptcy estate and I need to show something to confirm it was part of the bankruptcy estate before the default can be moved. Does “all” debt form part of your bankruptcy estate? I always felt it was automatically included? Can a property form part of the bankruptcy estate but not the debt(account) secured on it? Many thanks again for your time, it really is appreciated!

Steve says

Hi Sara,

Just found section 382 (Insolvency act) Would this be the legislation I need to use to confirm the secured debt is automatically included in Bankruptcy? thank you again for your help.

“Bankruptcy Debt”

(a) Any debt or liability to which he is subject at the commencement of the bankruptcy,

(b)any debt or liability to which he may become subject after the commencement of the bankruptcy (including after his discharge from bankruptcy) by reason of any obligation incurred before the commencement of the bankruptcy,

Sara (Debt Camel) says

There should however be no need for you to be quoting legislation at all. I suggest you put in a formal complaint to the creditor and take the complaint to the Financial Ombudsman if the creditor refuses to backdate the default date. If you want help with taking the complaint to the Ombudsman, your local citizens Advice will be able to help you.

Steve says

Thanks Sara…

Just a little update! Lender has now agreed that under section 382 of the Insolvency Act, the default needed to be in line with the bankruptcy order date and is going to amend the details on my credit report.

Many thanks for all your help….appreciate all your time and very helpful advice.

Kind regards

Steve says

Hi Sara,

Hope its ok to just check something with you.

I’ve now checked all my credit reports, since my last message above and all record of the default has been removed. When a debt is “bankruptcy debt” and a default marker has been set in line with the bankruptcy order, does the Lender also have to correct the settlement date in line with the discharge?

The account is still showing on my credit report as a full “settlement date” with no default, repossession or missed payments showing BUT…the closed account(settlement) date is still showing when house was sold 8 months after discharge.

Can it harm your credit file to show an old (up-to-date) fully settled account or should I get them to backdate the “settlement date” in line with discharge?

Thank you again for all your help.

Steve says

Hi Sara,

Not been on here for a while but just wanted to drop you a quick final update on how everything went….After help from he FOS, the lender finally agreed to remove default and shortly after, was able to get a mortgage offer for a property After spending the last 6 years having to rent…we have just completed and moved in to our own home. I had 6 years of struggle and months of fighting a very difficult high st bank to get this final default removed but with a little help from yourself and the FOS, I won!! Thank you again and best wishes.

Sara (Debt Camel) says

Well done for persevering!

Beth says

Hi Sara,

I was wondering if you could clear a point up for me.

My husband went bankrupt and according to ICO guidelines, the mortgage company should ‘default’ his mortgage account from that date (they didn’t and having just realised this, they were asked to about two days ago). The property has been given to an LPA receiver rather than repossessed by the mortgage company. The LPA receiver (who do not currently have a tenant for the property) are stating they are not liable for the council tax. In this situation, who should be liable for the council tax? As my husband has gone bankrupt (about 5 and a half years ago) and hasn’t paid the mortgage since 2008, when does his liability for CT end or should it have done so already?

There were several of these BTL’s with the mortgage lender. They stuck them all with LPA Receivers almost straight away (nine years ago, when the mortgages stopped being paid). We didn’t know any better and thought that when a mortgage stopped being paid, a lender repossessed. They have done that on all but 3. One of those three is now the problem with the Council Tax. Should I take it that we should have requested voluntary repossession? If we do that now, are they obliged to agree?

Sara (Debt Camel) says

I think you need to take some legal advice on this.

patrick says

Me and my wife separated in 2013 she moved out and rented a place of her own and i stayed in the property we joint own. We also have two secured loans i have been paying all the bills but i had to cease trading as a down turn in work and trying to manage household bills was getting harder. I have also got a £20000 tax bill from hmrc iam looking at bankruptcy .i have spoken to my lender about handing the keys back but as me and the wife have had no contact since mid 2014 they will not start the process till they are able to make contact and for her to agree to this. Is this right and where does this leave me.

Many thanks patrick

Sara (Debt Camel) says

If you are going to go bankrupt, then none of this really matters – find yourself somewhere to rent, move out, stop paying the nmortgage and secured loans and go bankrupt – what the lender does is their problem.

BUT have you taken advice on bankruptcy? A good place in your sort of situation is Business Debtline, see https://www.businessdebtline.org/.

Patrick says

Hi thanks for the advice. Because of my finanical situation my only option is to rent a room from my sister. How does this go down with the bankruptcy and the or.

Thanks patrick

Sara (Debt Camel) says

Renting from a relative shouldn’t prove a problem.

NB As always with bankruptcy, if you think you have found a clever trick it may not work, eg saying you are paying your sister £1,500 a month to rent a room so that you won’t have any spare income left for an IPA – expect this to be queried!

Ciaran says

Hi Sara – i went bankrupt in Dec 2010. I included my property (joint mortgage with ex partner) in the bankruptcy. In Jan 2011 I posted the key back to the lender and informed them of my bankruptcy and I’d no further interest in the property. The property was finally repossessed in Jan 2012. Im hoping to get back on the property ladder – I’ve read it is very difficult to obtain a mortgage after being bankrupt and having a property repossessed – would this be correct ? Thank you.

Sara (Debt Camel) says

Getting mortgage after any form of insolvency (DRO, IVA, Bankruptcy) is always harder. And some lenders also ask if you have ever had a property repossessed.

Has the mortgage disappeared from your credit record? It should have – if it hasn’t, you need to ask for a default date to be added which is the same as your bankruptcy date, see https://debtcamel.co.uk/debt-default-date/ for how to do this.

You need to go to a broker, not direct to a lender when you apply for a mortgage.

Ciaran says

Hi Sara – thanks for reply. All my credit reports (3 of them) are currently excellent. I did have an issue with the the mortgage default date but when I provided Discharge details from the OR the bank changed the date of default to the date of bankruptcy. I had 6 years plus of no negativity on my credit reports, I’ve had mobile contracts all paid on time, 2 credit cards all paid on time.

Ciaran says

One of the lenders I was going to apply through ask if i had ever been declared bankrupt in the past 6 years – I am assuming I would answer no, as I was declared bankrupt 6 years and 8 months ago.

Sara (Debt Camel) says

That is a correct answer. I still recommend going through a broker though.

Josh S says

Hi Sara,

I’m considering bankruptcy from abroad (living in a non-EU country and <3 years since I have been here). This would involve repossession of my apartment which is in significant negative equity and the builders are demanding their 25% shared equity back. I know I can file myself online from abroad now but wondered what you thought about third parties that do it for you ?

Cheers

Josh

Sara (Debt Camel) says

I don’t know anything about companies that provide this service, they must be finding life harder now you can apply online from anywhere in the world.

If you have assets, either in England or where you now live, you need debt advice on what will happen to them. Most people (7 out of 8) don’t get an IPO, but that will depend on how large your income is compared to your expenses. In general the more complicated your affairs are the more professional help may be needed.

Josh S says

Thanks Sara. Interestingly the company are claiming that most people will have a 3-year IPO imposed if they have excess income. I guess this is how they get people overseas to sign up to their service!

Sara (Debt Camel) says

Few people actually pay an IPA/IPO.

It all depends on the calculation of excess income!

Steve says

Advice needed.

Bankruptcy in 2015

Discharged 12 month later.

House not dealt with until now March 2018.

I have refused the offer to purchase the beneficial interest to the receiver as the house if on the open market will only just clear the mortgage outstanding.

I have stayed in the property while waiting of the OR decision as to what happens and paid interest only to the mortgage company.

I have told the bank I have no interest and I’m looking at voluntary repossession.

Will the short fall be included in the bankruptcy? I have not signed or been asked to sign and documents yet. Which of course I will not and I will refer any correspondence to the OR.

What would you advise next stage please.

Sara (Debt Camel) says

I’m sorry but I think you need to discuss your situation in detail with a debt adviser, perhaps call National Debtline. I can’t tell if the offer to purchase your beneficial interest was priced too high, if you don’t want to at any price, what it would cost to rent a suitable property in your area, or if you simply want to move, if so immediately or is there any reason to postpone it? etc.

Steve says

I want out of the house full stop now. Regardless of the amount being asked for by the OR.

The OR has got a meeting planned for next Friday and they are considering lifting the restriction as the value has dropped in the area meaning they would be less than £1000 equity.

So my original question is where would I stand on returning the keys moving out.

I am only concerned that any shortfall would still be included in the bankruptcy as the mortgage debt is already in the bankruptcy as the OR has restrictions on the property.

Thanks.

Mandy says

Hi Sara,

Where exactly do repossessions appear on credit reports? I know that there used to be a CML section which was stopped in 2010. So how have repossessions subsequently been reported? I initially thought it was done within the account information by status code but I looked at Experian’s document “Understanding your Experian Credit Report and Credit Score” and there was no sign of a status code for repossessions. I couldn’t find a similar document for Equifax and have not looked for one for Call Credit yet. There is obviously no separate section on any of the reports as there is for CCJs, bankruptcies and insolvencies.

Thanks.

Sara (Debt Camel) says

I don’t think they do.

Rob says

Hi .. all

really need help here please….

I was made BR in 2015 did exactly what advised on here.s top paying mortage and moved out at the start of my BR…its now 2.5 years on and found out that birmingham midshires have still not repossessed property and i now find myself in debt with council tax????….after speaking to them they said they have no set procedure to repossess…. surly not having ANY contact with me for 2.5 years and sending people round to vacant house they would have repossessed???….The reason i had no idea of this is that the insolvency released their interest on the property while i was still actually bankrupt?????? this was after they told me at meeting at the start of BR that if they hadnt sold it after 3 years i could have it back….so shouldnt expect it back for another 6 months???…… Can Birmingham midshires claim any shortfall now??? ….

Sara (Debt Camel) says

No BM can’t claim any shortfall. Did you tell them you were leaving the property and they could repossess it?

Rob says

No I didn’t unfortunately I took what the insolvency people told me which was if we hadn’t deposed of property after 3 years it would be handed back. They also told me I couldn’t go back to property. Apparently they sent a letter to all concerned while I was still actually bankrupt releasing their interest in property which I may add I never received which is another story… If I had received this letter I would have informed Birmingham midshires….

Lynne Todd says

Hi Sara

I was declared bankrupt January 2010 for a lease on business premises, my husband was declared bankrupt in April 2011 for the same debt, we had a Birmingham midshires mortgage on our home. We had no contact from the lender and continued to pay the mortgage and live in the house. My husband passed away in October 2013 and the insolvency service had surrendered our life insurance so I wasn’t able to pay off the mortgage. I have been ill this last 2 years and unable to work, so I’ve struggled on to keep the house. In June this year i sent the keys back to the lender and asked them to repossess the property. I expect my bankruptcy is so long ago, that it has no effect on the repossession now?

Mark E says

Hi need some advice. I have a flat in massive negative equity. I want to hand the key in voluntary repossession and plan to go bankrupt. Do I have to pay council tax and service charges until it is repossessed or do I stop paying that as it would be included in the bankruptcy? Any help would be very helpful.

Sara (Debt Camel) says

Who is your mortgage lender? Do you currently have mortgage arrears? CT arrears? Service charge arrears?

Do you have other accommodation lined up? Do you have other debts as well?

Mark Elliott says

Hi Sara

Sorry for not checking the reply, its been a tough year. If you can still offer advise, I would be grateful. Mortgage lender is Bank of Scotland/Birmingham and Midshire. As of today yes I have mortgage arrears. No CT arrears and no service charge arrears. I live with my wife in her house and I have other debts on credit cards.

Lyndsey Longden says

Hi everyone

Just after a little advice please. Folowing on from some dodgy financial advice we are in a situation where our IVA has failed just after we did a voluntary repossession on our shared ownership home (we are now in rented accomodation).

All the advice I have got so far (step change) is that the pending mortgage shortfall cannot be added in to say bankruptcy until it actually materialises.. so I guess my question is what should we do in the meantime with the debts which we are now not in the protection of an IVA (about £20k) until the mortgage shortfall comes along (approx £10k-the property hasn’t sold yet).

Thanks

Sara (Debt Camel) says

I am sorry to say this, because you must be feeling very fed up with getting poor or conflicting advice, but StepChange are wrong about this. If you go bankrupt now, your mortgage debt goes into the bankruptcy. If you phone National Debtline on 0808 808 4000 they will confirm this.

Lyndsey says

Thanks for the fast reply Sara. So, even though the shortfall isnt here yet it would he included in the BR if we did it now? (Even if the shortfall came from the housing association who owned the other part of the house, as I think that would be the case with a shared ownership property, the mortgage provider takes all they need to claw back from the sale of the house)?

But the predicted shortfall couldn’t be added in to an IVA if we wanted to avoid BR I’m guessing? Thanks

Sara (Debt Camel) says

Your mortgage debt is included in your bankruptcy – that will be reduced from the whole mortgage size to the mortgage shortfall when the property is sold.

“Even if the shortfall came from the housing association who owned the other part of the house, as I think that would be the case with a shared ownership property” so far as I am aware, you took out the mortgage and that was secured on the part of the property you were buying. You don’t owe the HA anything apart from possibly rent arrears for the other part? And rent arrears would also be included up to the point you go bankrupt. I don’t know if an HA can charge you rent after you have left the property and gone bankrupt.

I said talk to National Debtline before – an alternative would be Shelter https://england.shelter.org.uk/get_help who may have come across more HA shared ownership cases.

Sarah says

Hello

I am about to file for bankruptcy. My husband and I jointly own the house. The house is worth around £95k and we have an outstanding mortgage of £72k. I want out of this house ASAP. If I initiate a repossession will my husband lose his half of the equity?

I am terrified the sale will be slow or held up for 12 months or more. I desperately want out of this house but I don’t want my husband to lose his share of the equity.

Any advice would be greatly appreciated.

Kind regards,

Sarah

Sara (Debt Camel) says

Are you still with your husband or are you splitting up? Who is paying the mortgage? Does your husband also want the house sold?

Sarah says

My husband and I are still together, and he is happy for the house to go too. He is not filing for bankruptcy. My husband is currently paying the mortgage and car, and I pay the household bills including council tax.

However, I am currently ill and losing my job as a result (this is why I must file for bankruptcy). I will be applying for benefits whilst I recover. Then I will no longer be able to afford to pay the bills and my husband doesn’t earn enough to cover the mortgage, essential bills, council tax and his car for work.

I am worried about being trapped in our house. I would like to get things over with ASAP so I can concentrate on my recovery.

Many thanks

Sarah

Sara (Debt Camel) says

Sorry to hear about your health problems – it’s understandable that you don’t want money problems on top of that.

Is your house up for sale? Because if you just leave and hand back the keys, not only can it take many months for it to be sold, but it may fetch a lot less than you think it is worth. So your husband will end up with a lot less money.

Do you mind saying how large your debts are? Are these loans, credit cards, catalogues or is there anything more unusual in there?

Sarah says

Thank you. The house is not currently for sale.

My debts are around 32k, a loan and credit cards. I have long term mental health problems going back 20 years. This means I am not good at managing money. Additionally, a large portion on my debt is from private prescriptions. I was addicted to prescription painkillers for over 10 years following an operation. I am now receiving treatment for this and my mental health. I am looking at around 2 years to complete treatment.

My husband has been through enough and if possible, I want to ensure he gets his share of the equity. We’re together at the moment but I can’t say what the future holds for us.

I am filing for bankruptcy next week with the help of a financial support worker. I am lucky to have this support through the NHS.

What would happen if my husband put the house up for sale? With my consent of course? Would this be a better option?

Many thanks

Sarah

Sara (Debt Camel) says

Selling the house yourself is normally a much better option than handing back the keys if there is equity and only one of the joint owners is going bankrupt. As you have a financial support worker, you need to talk through your options with them.

Are you currently up to date with your large debts? Or have they been defaulted already? possibly even sold to a debt collector?

Will it be cheaper for you two to rent than pay the mortgage?

Sarah says

I was on a DMP for all my debts, however I am no longer employed or in receipt of CDP so I can no longer afford those payments. I haven’t paid them for 6 weeks and I will be filing for bankruptcy in the next two weeks.

I sought independent financial advice and I am satisfied bankruptcy is my best option. Renting will cost us at least £200 a month more than our current mortgage of £400 pm, so it’s out of the question. My husband will be staying with a friend once we have to leave our house. I will be officially homeless and housed in temporary accommodation by my local council. We have no option but to live separately for a time once this house is gone. I was the main earner previously and my husbands wage doesn’t cover the basics.

I am concerned the house will drag things out and all I want to do is get this sorted so I can concerntrate on my treatment. Part of my treatment has been suspended until the bankruptcy/housing situation is sorted because i am under too much stress to successfully complete it. This has been a huge blow, and I feel like I’m stuck in limbo, hence my desperation as far as the house is concerned.

When I read the Trustee could delay the sale by up to 3 years I entered a blind panic as I don’t want to be kept in this awful situation for another 3 years.

Many thanks

Sarah

Sara (Debt Camel) says

The Trustee should be very happy for you to sell the house as soon as you can. If your husband was going bankrupt or there was no equity, you could just walk away, stop paying the mortgage and the house would be sold. But you can probably get a better price if you sell it – and that matters for your husband’s half of the equity. You don’t have to delay going bankrupt until the house is sold. I am glad you are getting support through what must be a very difficult time.

Sandra says

I went into bankruptcy in 2011 discharged 2012- property listed in bankruptcy (sole owner) – dealt with by trustee and returned within 3 years (negative equity). NRAM tried to repossess in 2012 but adjourned as I came to payment arrangement for the arrears – I have managed to keep up the contractual payments and have 6k arrears (generated pre bankruptcy) which I have an arrangement to pay each month – going forward, I am not going to be able to continue paying the mortgage due to severe financial difficulties, the property is still in negative equity and I need to cut my losses and do a voluntary repossession – Will this mortgage debt still form part of the original bankruptcy (still on same mortgage deal from pre-bankruptcy) also, if I stop paying the mortgage, do all the missed payments go into the shortfall pot? I can’t find any info on actual monthly mortgage payments, how they are regarded debt wise, and if they would be included in the shortfall. Just worried I would be building up new debt.

I realise its quite a few years since my bankruptcy and I’ve stayed in the house but I have read that it does not have a time scale once the debts have fallen in the bankruptcy.

You mention in your write up – if you stay in the house for many years, repaying the mortgage, and later get into financial difficulties then you may get into a bit of a grey area and will need legal advice. Just wondering does this alter the bankruptcy protection or the debt position?

Thanks

Sara (Debt Camel) says

What a pity you didn’t walk away from the house in 2011. I suggest you talk to National Debtline on 0808 808 4000 about the mortgage debt, the arrears and your other financial problems, I am sorry but all these cases are very individual, you want specific infomration here, not generalities.

Sandra says

Thank you for your speedy reply – aside of my case,

What is the position regarding missed mortgage payments, in terms of how they are regarded debt wise obviously until the property is sold they would show as arrears but once the property is repossessed and sold would they form part of the shortfall?

Thanks

Sara (Debt Camel) says

Sorry, I am going to repeat my suggestion to talk to National Debtline.

Mark Elliott says

I have a property that is being repossessed . I have not filed for bankruptcy as yet. Is it to late to file for bankruptcy and to include the mortgage in the bankruptcy? or should I have handed back the keys first to enable the mortgage to be included in the bankruptcy?

Sara (Debt Camel) says

If you go bankrupt after the repossession the mortgage – or any shortfall if the house is sold before your bankruptcy – will be included in the bankruptcy. Take some debt advice about your options!

Mark Elliott says

Thanks for the speedy reply

Sorry to be a pain, so to break this down, I can apply for BR and inculde the mortgage and the short fall when the house is sold will be included, is that what you are saying?

Regards

Mark

Sara (Debt Camel) says

If the house hasn’t yet been sold, list the mortgage on your bankruptcy application and it will be included in your bankruptcy. So when eventually there is a shortfall you will not be liable.

If the house has already been sold, you can list the shortfall on your bankruptcy application.

NB take some debt advice, bankruptcy may be much your best option but it is always worth an hour of your time to talk everything through with an expert. Phone National Debtline on 0808 808 4000.

Mark Elliott says

Thank you for your reply but I have one last question..Does it matter that I have not voluntarily given possession? also Im living in my wifes house, is there any come back on her?

Any advise would be appreciated

Mark

Mark Elliott says

I think you answered the bit about the voluntary repossession.

Sara (Debt Camel) says

“also Im living in my wifes house, is there any come back on her?” not unless you have been helping her pay the mortgage for a while or paid for a new kitchen, that sort of thing. It is possible to have a “beneficial interest” in a property you don’t own, but not just becayse you are married, you have to have been contributing in some way.

Mark Elliott says

Thank you for your reply, thats very helpful

Mark

Mark Elliott says

Reall sorry just need to know what is meant by beneficial interest. Does ithat mean any financial interest, as I dont have that in my wifes home. Im not sure how I prove that if I had to?

Sara (Debt Camel) says

You asked if your wife’s house could be at risk. The answer is not unless you have some “beneficial interest” in the house. That would be unusual. But it’s possible if as I said, you had paid for some improvements or been paying some of the mortgage. I suggest you talk to National Debtline on 0808 808 4000 who can talk to you about whether you should go bankrupt and about your wife’s house if you are concerned about that.

Marie says

Im hoping you can adI’m currently living in a house that I hate which is mortgaged in both mine and my abusive exes name. I’ve been paying into a DMP for 4 years. I’m up to date with my payments on the Dmp and the mortgage. However, I’ve had no heating or hot water (bar an electric shower) for 2 years, the windows are falling out and I’ve been taken Ill numerous times this year due to respiratory infections probably caused by damp. I’m a single parent. I can’t get credit (and don’t want it) to fix the house up. I currently owe £67000 on the mortgage. A house a couple of doors down with central heating and double glazing sold for £67000 so it’s fair to say I’m in negative equity. I’ve had one set of awful neighbours after the other and my ex made sure that we were far away from my family so I’m isolated.

I didn’t opt for bankruptcy initially due to the fact that I’m a professional on a decent income and was advised by the cab and a financial advisor that my bankruptcy could potentially be indefinite (although another woman at the cab said I should do it). My current income before tax is £43000. Would I have to pay back forever? This house is the bane of my life and it just reminds me of him. The thought of bankruptcy absolutely terrifies me but I can’t live like this. I’ve got £26000 left to pay on my Dmp (debts he ran up). I just don’t know what to do.

Sara (Debt Camel) says

The maximum period you may have to make payments in bankruptcy is 3 years. This cannot be extended further. Bankruptcy remains on your credit record for 6 years.

How much are you paying to your DMP each month? How much is the mortgage and what do you think it would cost to rent somewhere close to your family?

Marie says

The mortgage is £445. The minimum I’d pay rent is £550 but that’s for a house similar to this in a horrible area. It’d be about £700 for a half decent one.

I’m currently paying £368 a month into the Dmp.

rihat says

Dear Sarah,

Pls advise with my debt problem.

I had 16 BTL houses with MortgageExpress(ME) and BirmMidshires(BM) back in 2007.