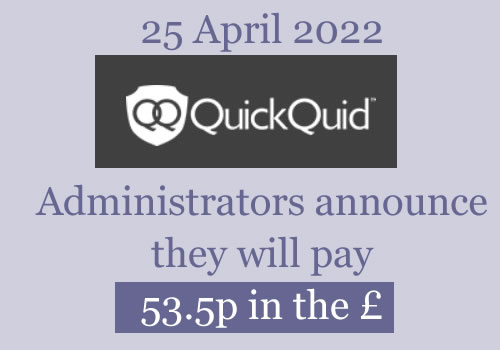

Payments – UPDATE – 25 April 2022

Administrators have started sending emails to everyone with an upheld claim telling them what they will be paid.

“The Joint Administrators are now in a position to declare a first and final dividend of 53.5p in the £”

The average claim value is c £1,700. Someone with that claim value will get a payout of about £910.

The payout details are given in the email:

- This will be paid over the next two weeks.

- If the administrators couldn’t validate your banking details, it will be sent by cheque. I don’t know how the administrators will “validate” your details.

- If you used a claims company, the money will be paid to them.

- Most people are not having any deduction for tax paid to HMRC, so there is no need to reclaim anything.

Credit records

The administrators may decide to :

– remove any negative marks on your credit record

– delete all loans that were upheld

– delete all your loans.

I don’t know what they have chosen to do – if people can check and report in the comments when they see a change, that would be great.

How much your credit score will change will depend on whether there were any negative marks. If you want to get a mortgage, you would like as many payday loans gone as possible, even if they were repaid on time and not hurting your credit score.

In a few months when the administrators no longer talk to the CRAs you can ask for any remaining loans to be “suppressed” so other lenders can’t see them. See https://debtcamel.co.uk/correct-credit-records-lender-administration/ but it is too soon to do that now.

QuickQuid went into administration in October 2019

CashEuroNet (CEU), which owns the QuickQuid, Pounds To Pocket and On Stride brands, stopped giving loans and went into administration on 25 October 2019.

I will be talking about QuickQuid (QQ) rather than CashEuroNet as it is the more familiar name. Everything here also applies to loans from Cashruronet’s other brands, Pounds To Pocket and On Stride.

Grant Thornton were appointed as Administrators. They set up a page about Redress Complaints – this is their term for people who have asked for a refund because they were given unaffordable loans.

Background to the QuickQuid Administration

QuickQuid was one of the “Big Three” payday lenders in Britain, starting out in 2007.

After Wonga and the Money Shop Group had all stopped lending and gone bust over the last fifteen months, QuickQuid was left as the largest UK payday lender.

QuickQuid had well over a million customers. When it went into administration there were c. 500,000 customers with outstanding loans.

Many of these customers had prolonged borrowing from QQ. They either rolling loans over or repaid one loan but were left so short of money that they had to borrow again.

These customers have good reasons to win an affordability complaint and get a refund of the interest they paid.

Affordability complaints started on a small scale in 2015 and increased in the next few years.

In 2018, complaints going to the Financial Ombudsman (FOS) jumped with the involvement of Claims Companies and QuickQuid became the most complained about firm to FOS, excluding PPI complaints.

For a long time QQ refused to refund interest on any loans taken more than 6 years before or where the loans were given in 2015 or afterwards. This resulted in a huge backlog of claims at the Financial Ombudsman, where QQ had made very poor offers to customers and then rejected an adjudicator decision.

In late July 2019, QQ agreed to accept several thousand FOS complaints it had previously rejected.

By accepting the FOS decisions on loans over 6 years, long chains of borrowing, and loans taken after 2015, the scale of QQ’s likely future liability for refunds will have become clear to the company.

After failing to persuade the FCA that a Scheme of Arrangement was appropriate, Enova, CEU’s large and profitable US parent, decided to close the UK business, blaming the UK regulatory environment.

How could the regulators let this happen?

This is an excellent question… Stella Creasy, MP called for an inquiry into the FCA over Wonga and QuickQuid.

What has happened in the administration

Customers with a valid claim for a refund are “unsecured creditors”. This includes:

- any refunds that were in progress after an amount was agreed or a Final Decision from a FOS Ombudsman (FOS);

- complaints that were underway at QQ or FOS when QQ went under;

- any new complaints sent to the Administrators.

All complaints at FOS legally had to stop and were been passed back to the Administrators. It isn’t possible to send any new complaints to FOS.

It is now too late to submit a Claim for unaffordable lending. The last date was 14 February 2021.

The administrators have given the following statistics about claims:

- 169,000 customers made claims for unaffordable lending;

- 78,000 claims were upheld by the administrators;

- the upheld claims had a total value of £136million, so an average of about £1,700 per claim.

Still owe a balance on a QuickQuid or On Stride loan?

More than 300,000 of the current loans were sold to Lantern in summer 2021. You should have been informed if your loan was sold.

The administrators have now stopped collecting any money from the remaining unsold loans.

This page is kept updated

The comments below this article are a good place to ask any questions. And you may be able to see where someone else has already found out the answer.

Alfie Watts says

I just updated my bank details successfully. Am I naive to expect payment sooner after the 14th? The said my claim was accepted.

Thanks alf

Lynne says

How did you update them? Was it on the website? I just got this message from Quickquid support

Thank you for contacting QuickQuid.

In regards to your query, you will need to speak with a representative today to update or confirm your banking information on file. For security purposes, we ask that you will not send your personal banking information via email or post.

The issue I have is that they can’t get into my account in the first place in order to update my bank details so it’s a vicious circle!!

Lynne says

I’ve tried calling them again. Bearing in mind this is not the claims line now this is the ‘quickquid resolution’ team. I gave her name, DOB and customer reference number – so far so good. Then she asked for my postcode. I’ve given her every postcode I’ve ever lived at in the last 15 years and she says that doesn’t match what’s on their file! How is this even possible?? I said to her you even wrote to my home address once in 2010 so how can that not be the postcode that you have on file?! This is really wearing me down now.

Karen H says

Alfie, was you able to update online or did you have to give them a call? Ive tried numerous times to do it online. So frustrating. Guess I’ll have to ring them!

Kyleigh Goodband says

I have managed to update my bank details via the portal online, it never let me before and told me I had to call to do it but tried the other day and it let me, so yay!

Gary Armstrong says

I got a reply from cash euro nett last night stating that all overpayments will be paid out at 100% and this along with all the accepted payouts will be paid out within 7 months from the 14/3 /21 so could be waiting until October!!!!! Hopefully they will pay our much earlier but don’t expect much to be paid on the accepted claims be lucky if you get 3% back , at least we will get full amount for the overpayments so that’s something

Lynne says

Did they actually tell say that? About tne 3%? I know peachy mentioned 2% on their redress email.

Lynne says

Guys Quickquid have just acknowledged my complaint – and my original email to them was underneath – dated 23rd November 2019! Anyway they’ve asked me for my bank details now so fingers crossed something may come my way.

Lynne says

They have said in a separate nesssge that my assessment was issued on 26/02/21. Is that around the time other people got notification? I’ve told them they must’ve sent it to an old email address so can they resend it to my current one as I think some people have beeen told what their redress amount would be and I’m just curious.

Louise says

I’ve done the same. Back in February they told me not to expect anything due to me before September.

Lynne says

I seem to recall Wonga sent me my redress amount in early January last year and it was end of April before I got it so yeah it could be we’re in for a long wait again.

Karen H says

Hi,

I’ve spoken to them today as site wouldn’t let me input my bank details. Tried numerous times. Might add they’d already got my bank details! She even relayed last 4 digits but even then for some reason she was unable to verify my bank account. Been with same bank for 30+years. So it seems after all the inconvenience I will be sent a cheque 😬

Sara (Debt Camel) says

do they have your correct home address?

Karen H says

Hi Sara

Yes they do thanks. Not keen on payment by cheque as it means a trip into town to pay in which I’m avoiding with covid still about. Still I’ll be happy to get payment at long last.

Thanks for this very helpful site!

Sara (Debt Camel) says

can’t you pay in a cheque through the app on your phone?

Karen H says

Unfortunately my online banking doesn’t have that facility yet. I wish it did! Thanks.

Colin Weston says

If I ever get a cheque, I write my accojnt details on the back, send a covering letter & post to my bank. Always makes it into my account

Karen H says

Forgot to mention, that she said would be anything up to 7 months before payout!

Oliver says

Spoke to them today and they have had an update from administrator. All payments including overpayments are any time up to 7 months / September. Sounds like it is a party line to prevent customers chasing

Harvey says

Hi Oliver,

Wondering if you could help! I’m desperately trying to get hold of QQ or administrator and all their lines are saying they aren’t open but they open 10-6 and we’ll, I’m calling in those times still not getting through.

Can you help at all please?

Oliver says

They are open but only Monday to Friday now. They need to update their message plus they will then put you through to complaints team.

I’m hearing that they are closing all telephone lines by the end of this month

Sophie says

Not Qq related but after I submitted my qq claim and like everyone waiting for the payout I looked at previous loans I had, the one in question was Tfs loans, thus gas now been paid in full but due to spiralling debt led me to taking pay day loans to make the payments, I submitted a complaint to them this week and they say as the loan was taken in 2013 I am out of the 6 year time frame, is this correct ? I thought the 6 years meant during or after the loan was paid.

They have said I can refer to the ombudsman but they will not look into the complaint, any advice welcome.

Sara (Debt Camel) says

Send it to FOS who is looking at loans over 6 years!

Questions about TFS are best asked on the main guarantor loan page: https://debtcamel.co.uk/how-to-complain-guarantor-loan/

Michael says

Hi, my debt was sold to a third party and in December 2020 the administrators advised me that it may take them a further 30 days to process my claim. Is anybody else in the sand situation? I’ve had no update since then.

Nichola says

Hi, I received an email on 15th December for the same reason but they said they needed 90 more days.

Jo says

Same dates and time span for me too

Laura says

Same for me also

Nichola says

Hi, the extra 90 days are up now, have any of you heard anything? Thank you.

Debbie says

Same for me. Give up chasing now. Keep giving different answers to same question.

Pete says

Nope nothing for me yet. I had to ring them to get that information rather than them email me or anything. The 90 days are up but I still haven’t heard back from them. I am going to ring by early next week if I still haven’t had an answer.

Lea says

Same here, administration advised that they needed another 90 days which would bring the date to the 16/03/21.

I wonder how this affects the appeals process if needed.

John Corcoran says

My 120 days was well and truly up in Feb so called to be told they were chasing 3rd party (debt collection) for figures on payments etc…. ive emailed and had little information given … I assume that as they are chasing down 3rd party for information this would mean that I will have a successful claim.

Jack says

Hey all,

Any idea when payments will be made?

Oliver says

I spoke to customer services today

They expect overpayment refunds to be made within the next 30 days as the portal closed yesterday for updating bank details

The actual refund amount / dividend share is anytime up to 7 months as they still have yet to sell the assets

Julie says

I emailed casheuronet today to ask when the overpayment element will be paid and they emailed back to say that don’t have any time frame

Kel says

Sounds like they are giving conflicting information again… no change there then.

It was the same when I had my loan, the advice differed from one advisor to another. It would good it was 30 days but I highly doubt it

Oliver says

Mixed messages again. The person I spoke seemed confident that it was 30 days from 14 March when portal closed as that was the last day to update banking info. What is there left to wait for as it is a full refund for overpayment. If bank details are not verified then cheques are being issued.

They said that they have also cleared the backlog of “new” claims and are just working though appeals and any that were sold to 3rd parties.

They can at least start making the overpayments In batches

stephen says

If they have agreed to your claim and provided an accepted claim value, I know that you will only get a promotion of this but do you get the full amount of the compensatory interest?

Sara (Debt Camel) says

No, you get the final payout percentage of the total value of your claim, interest refund plus the 8% statutory interest.

HJL says

Has anyone had any joy with removal of loans from credit reference agency? Although there might be a wait until casheuronet send data to CRAs, I am urgently looking to get PDLs from 2 years ago removed. The evidence is in the email they sent where they’ve accepted claims surely? Is there any rights we have here?

Adreva says

I’m one of those with an outstanding balance, received an email today from Quickquids debt collectors they’ve been told the balance as been reduced but are looking to put in place a repayment plan.

I’ve offered a low Full and final settlement and will see what happens. I’ve no intention of setting up a plan at this current time

alan says

hi, has anyone had success with a manual dispute with transunion to remove the quickquid loans that were accepted for redress? I opened manual disputes with both experian and transunion last month. Experian replied last week saying they have removed the info from my credit file, however I received my response from transunion today saying the following which is obv a load of crap

“Thank you for your recent email about your dispute.

We contacted QuickQuid and received the below response:

After careful review of Mr. x’s account ending in xxxx, our records indicate the customer’s claim is still in progress. Based on this information, no changes need to be made.

We appreciate this isn’t the reply you hoped for. However, all Information is supplied to us directly from the lender and we can’t make any amendments without their authorisation.

If you want to discuss this further, please contact QuickQuid directly. If they make any changes, these will filter through to us when they send us their next monthly update.”

if anyone has successfully had their quickquid entry(s) removed from their transunion credit history can you let me know if you had the same email as me above, cheers

Sara (Debt Camel) says

Asking for loans to be suppressed is only likely to work when the administrators aren’t replying to the CRAs.

alan says

Hello Sara,

I understand what you are saying, just seems strange to me quickquid allowed experian to remove my redress loan/default from my credit history but then tell transunion they cant!

Sara (Debt Camel) says

it may be experian never asked the administrators and you got lucky?

alan says

yeh that could be it, its really frustrating as I have lots of missed payments for this defaulted loan that appear in the transunion credit history viewed on totallymoney.com, this will have decreased my credit score wouldn’t it? as soon as they have been removed would my score increase? QuickQuid said back in December the account history would be removed and yet 3 months later it still hasnt been, taking a very long time

Dave R says

Hi Alan,

I also had this with Transunion. I replied to their email and reattached my claims outcome email and also attached the email from Experian stating that QQ had allowed Experian to remove the information. I asked TU to reopen this dispute which they did.

I then contacted CashEuroNet and asked why they had not allowed TU to remove the information when they had allowed Experian to do so. Said I had re-opened the dispute and would be grateful if they could agree to remove the information this time.

They replied and asked for my Transunion credit report which was odd – but I sent it to them. They then got in touch to say they had been in touch with the relevant team and instructed them to remove the loans. Disappeared from my report a few weeks after that.

Keep pushing it and you’ll get the response you want.

Jj says

So now no one can make a misold claim at all, after that cutoff date?

Quickquid have just popped up demanding money from years ago, convientiently just after this cut off date.

So I can’t claim against them, but they can claim against me?

Sara (Debt Camel) says

how many years ago?

Tony says

Anyone else noticed that these have now come off their credit files? Finally a bit of movement.

Hugz15 says

Hi how did you manage to get that off the report, was it by raising a simple dispute? I have missed the deadline for cleaning, but just wish the loan to be suppressed from my file. Good news is that I had a Sunny loan and Equifax and Experian are looking to remove those hopefully, they have raised an internal case for me, just waiting on Transunion now.

Oliver says

Anyone received their overpayment refund yet; wishful thinking??

Julie says

No – not yet

Kel says

I’ve emailed grant Thornton and asked them to confirm their timescales for overpayment. Tried discussing with onstride but they kept referring to the dividends so I gave up

Julie says

I also emailed grant Thornton but haven’t heard anything back. Not sure why the overpayment part is taking so long to be paid out

Janet says

Hi,

Can someone please help I stopped paying on my On Stride loan in 2019 as I couldn’t afford the payments, I called them at the time and they said they would put me on a payment holiday, I then just left it as they went into administration so was going to see if I could claim, I still had about £2000 to go on it, I have finally been able to log into my account today and the loan is showing as paid off from the 6th March? Will this be something to do with my claim does anyone know?

Thanks

Kel says

Did you submit a claim? You should have recieved an assessment email. If not, it could have been sold to a debt collector. You need to contact on stride.

Janet says

Thanks for your reply, yes I did submit a claim it was with the FOS when they went into administration. I have no received any email at all. Oh no I hadn’t thought about it being sold to a debt collector would that be more likely than it being wiped because of maybe my claim? Thanks

Kel says

I made a claim against them through the FOS but they told me they couldn’t deal with me as onstride were in administration and I had to make a claim to the administrators. If you haven’t made a claim through the administrators portal it’s more than likely gone to a debt collector. I would give onstride a call ASAP

Mel says

Hi map i have an accepted claim value and a refund value which is less, does that mean I will get the refund value amount?

Sara (Debt Camel) says

have you been making payments to a balance since the administration started?

QQdef says

I got a reply from Experian today and they have agreed to manually delete the entry

‘I’m pleased to let you know that I’m deleting this information from your credit report, This can take up to seven days to take effect.’

Hugz15 says

Had you just requested this direct to Experian? I missed the portal cut off so have not registered any claim. but just want the entry removing.

Shorif says

Apologies for the late reply and thank you again for your continued patience in this matter.

I have spoken to our technical team and they have advised they now expect your revised claim assessment to go out in the next 5 days. As you know, your account was slightly complicated which has resulted in unforeseen delays.

This has now been resolved and as previously stated, your assessment will include all your loans.

Kind Regards

Muhunthan

Rebeca says

Was this in response to an upheld appeal. I received an email on 22 February stating my appeal had been upheld but it would be a few weeks before my claim assessment would be issued because of the complexities of my separate accounts. I’ve tried chasing as it’s been over a month but heard nothing

Rebecca says

Thanks , great il copy her into an email today then

Shorif says

Yea had the same issue, cc Chris in the email on Friday got a reply on Monday and got redress claim today.

Damon says

Hi all, this maybe a really stupid question. I’ve had an accepted claim amount and mentioned in the email it states that the value I will receive will significantly less. Just wondered if anyone has previously had this with a clam and if so what percentage of the overall accepted amount was received. Thanks Damon

Ross says

4.3% based on the Wonga one. No idea whether this will be setter or worse (can’t get much worse tbf)

Peter says

Hello

I am awaiting a decision regarding mine having sent my claim on 11/10/2020. I spoke to them today and they advised that because my debt was sold in 2018, they will take an extra 90 days to speak to the DCA. I have a CCJ on that particular QQ account. If my complaint is upheld, what would happen to the CCJ on my credit file?

Thanks!

Julie says

I spoke with casheuronet today and they have said that the overpayment amount and the claim amount could be paid anytime up until September

Linda says

I am now being chased by nco collections for a quick quid loan dating back to 2011 I have not answered the phone to them as yet. I have tried to log into quick quid but it won’t let me anymore. I have applied to the scheme and recieved a reply from them stating they have got in contact with the debt agency who they handed it over to back then what do I now do I speak to them .

Sara (Debt Camel) says

recieved a reply from them stating they have got in contact with the debt agency who they handed it over to back then

I’m sorry could you explain that? if it is an email, can you copy it out?

Chantal Smith says

Legally companies are not allowed to chase anything over 7 years old as far as I am aware.

Sara (Debt Camel) says

it isn’t that simple, read https://debtcamel.co.uk/statute-barred-debt/

Linda says

I cannot find email qq sent me but when I could log into the account it said it had been handed to a debt agency. That was in 2011 I have never heard a thing from this debt agency. The email said before they can work out how much redress they will be contacting the debt collection agency and will let me know. And now the debt agency are calling

Sara (Debt Camel) says

This old loan may well be statute barred – see https://debtcamel.co.uk/statute-barred-debt/. If it is statute barred (you could talk to National Debtline on 0808 808 4000 about this) then it doesn’t matter if you talk to the debt collector now and tell them the debt is statute barred.

Or it may be simpler to wait until QQ get back to you.

Abi says

When will I receive my payment?

NATALIE says

It would be nice to know. The radio silence from them is not good.

Laura Gibson says

I received the below email from QuickQuid today (I had not contacted them but chased up Cash EuroNet Recently, not sure what it means)

Thank you for contacting us today and informing us about your status information.

This is a confirmation that we have entered into our system that you are now in ‘credit_counselling’ status.

Sara (Debt Camel) says

it means they think you are taking debt advice…

Kyleigh Goodband says

I had same email but from onstride (part of casheuronet) I am not receiving debt advice and never contacted them about anything. Not sure why I’m receiving this email?

Debbie says

I’ve had the same email go into my spam folder YET I’m not in any talks with credit counselling. For the first time in many years I am not in any debt. This is a strange email to receive.

Nichola says

Hi, I’ve just received this, I’ve not contacted anyone today. I’m just waiting for the outcome of my claim. Does anyone know what it means? Thank you.

Thank you for contacting us today and informing us about your status information.

This is a confirmation that we have entered into our system that you are now in ‘credit_counselling’ status.

Sara (Debt Camel) says

Same as Laura above…

Kyleigh Goodband says

Had this email also but just had another one telling me to disregard it, was sent in error.

Nichola says

Thank you Kyleigh.

Oliver says

I had an update direct from the administrator regarding overpayment refunds

“ Thank you for your email and your continued patience.

Unfortunately we are not in a position to inform customers of timings for over payments. However, I can confirm that this is a priority of the administration team. When we are ready to do so, you will receive an email directly.

Kind regards

Lucy

For the Joint Administrators”

June says

For an email from Quick quid tonight 26 Mar 2021 saying thankyou for contacting us to let us know yous status is now “credit counselling status” I have no idea what this means and why they are contacting me I think I got a Lon from them but this was years ago well over 7/8 years anyone had one of these weird emails?

Sara (Debt Camel) says

Several people have had these, see the other comments here. It seems to be an error.

Kyleigh Goodband says

Dear Valued Customer,

You may have recently received an email titled ‘Credit Counselling Status.’

Please disregard this email as it was sent erroneously. No changes were made to your account.

Please accept our apologies for any confusion.

Kind regards,

For and on behalf of CashEuroNet UK, LLC

The Joint Administrators

This is the email I received after the one before it like you had. Keep an eye on your email in case yours was sent in error.

Michael says

Hi everyone.

I received this email this morning from quick quid:

“Thank you for your recent payment to On Stride Financial. Your account is now considered paid in full*. You may continue to receive mailed notices from On Stride about your balance over the next several days. Please disregard these as they were sent before your final payment was received”.

The last update I had in this was in December to say they needed 90 more days to look into my classroom as it was sold to a third party. Does anyone know what this means for the status of my claim?

Michael says

Hi all,

Is anybody else in the same situation regarding their loan being sold to a third party? I really don’t know what the situation is now having received the above email. Ideally I just want this removing from my credit file!

Thanks everyone

Sara (Debt Camel) says

I think you need to ask QQ.

Michael says

Thanks Sara, would that be the administrators that I contact directly regarding this?

Sara (Debt Camel) says

no, just the customer services.

Amy H says

Hi , I made a claim in august last year on 9 loans I had with quickquid , first I sent it to the financial ombudsman and had an email from them saying they quickquid shouldn’t of lent me the last 6 loans and should repay the standard compensation, then qq when into administration so it was the usual response 90 days then another 90 days my last loan from them was sold to a third party but I paid that off in 2017 or there abouts , but qq are saying they have to get In touch with the third party , to see if it was paid off to which I asked the third party for evidence that there was no balance , which they sent in an email , to which I sent to the administrators so they have proof that the debt was repaid , the second 90 days was up on the 15th March and I have heard nothing from qq or cashnet , I was wondering what was going on ???

Ash says

I have been unable to make a claim as didnt realise this was an option until I started looking into my credit file. I have 4 QQ PDL showing on my credit files from 2016. I have contacted Transunion as I am unable to dispute the afforability with the administrators and they have said they wont suppress/remove them. Any advice on how I can email them back to get them suppressed? Many thanks

Sara (Debt Camel) says

This would have better left until later in the administration. You want to wait until the administrators are no longer replying to the CRAs.

Graham says

Oh no, that’s very valuable info. I now wish I’d waited, as I’m in a similar position with QuickQuid

Fred says

I agree, they haven’t been very flexible with me so far.

I will wait until later like I did with Sunny and Myjar

Hugz15 says

Did you have success with Sunny? I am in process of first case and they sent standard email saying contact lender! Even though administrator has passed to the CRAs .. so I have disputed the decision

Hugz15 says

Hi Sarah can I ask CRA to remove my 1 Quick Quid loan as I missed the portal claim deadline so cannot claim – but that is fine most important to me is that the loan is removed from my credit file? Thanks

Sara (Debt Camel) says

Not yet! At some point the QQ adminstrators will stop talking to the CRAs, you need to wait until after that point – if you try now the CRA will ask the administrators who will reply the debt should not be deleted.

Hugz15 says

Do you know when this is likely to be? Anybody know a phone number for Quick Quid, I could ask them to delete it, or are they not taking calls now deadline has passed, thanks!

Sara (Debt Camel) says

They aren’t going to agree to this. It is all work they don’t have to do.

Bianca says

I have misses the deadline and they are stating because I have they can’t help me. But I never knew I could make a claim. How can I take the complaint further?

Sara (Debt Camel) says

I am sorry but you can’t :(

if it’s any consolation, people will only be getting a tiny percentage of the interest they paid refunded.

Claire Briggs says

I contacted them to ask for an update and got the following I’m guessing generic email 😞

Hi Claire,

Thank you for your email and hope you are well too.

Unfortunately we are not in a position to inform customers of timings of payment. When we are ready to do so, you will receive an email directly.

Please be aware, the payment you receive will be significantly smaller than your accepted claim value. This is because it is expected that the total value of all accepted claims for customers/creditors received will significantly exceed the money available to be shared out. The money available to be shared out will not be known until all of CashEuroNet UK, LLC’s assets have been sold or realised and certain costs and deductions have been taken into account. Accordingly, it is not possible at this stage to estimate what percentage of your accepted claim value will be paid.

Nate says

Wondering if anyone can help me… When I was 21 I lived week to week on payday loans, Wonga and QuickQuid. I got into serious debt and struggled to pay my bills after getting stuck getting payday loans to pay back another payday loan.

In turn, I ended up burying my head in the sand. I ended up with a CCJ. This has been paid back in full, £2000 worth. Although the CCJ was for a number of bills, I was unable to afford them because of the payday loans, is there anything I can do about this? I honestly believe if I didn’t get into the sinkhole of the loans companies, my financial situation would have been better. I don’t want money back, I just care about the CCJ on my file.

The good side is, my CCJ is now marked as satisfied and within another 3 years it will be falling off my credit file.

Sara (Debt Camel) says

It is a shame you didn’t make claims to the Wonga and QuicjkQuid administrators, but it is now too late to do that.

You don’t have any reason to have the CCJ removed, I am afraid.

Nate says

Hey Sara, I did make a claim to Wonga and I received £117 back out of an expected few thousand. Which was nice as I didn’t expect it, also they took the references to wonga off my credit file. I’ve also placed a claim against QuickQuid, my concern is… they’ve both admitted to giving loans badly and costly, and this has affected me paying other bills etc. Surely this proves they are the reason behind me ending up with a CCJ? Would CA or a Solicitor be helpful?

Sara (Debt Camel) says

If the CCJs were from Wonga or QuickQuid debts, then you have a good case for having them removed because new evidence has come to light about those loans.

But they aren’t. Say you have a CCJ from X. It has nothing to do with X that you were mis-sold loans by a payday lender. If you go back to the time of the CCJ, if you had gone to court and said “it’s not my fault I got behind paying X, it’s the fault of those payday lenders” you would not have won your case and would still have got the CCJ. A court isn’t there to decide if you have had a rough ride in other parts of your life, they are just there to decide if you owed money to X that you have failed to pay.

Of course I can’t be 100% sure you would lose an application to have a CCJ set aside – but I have no reason to think you would win the application, and applications cost £255 (unless you are on a very low income)…

Talk to your local Citizens Advice, or phone National Debtline on 0808 808 4000, for their advice. If there is a Law Centre near you, you can get free advice there. I really don’t think it’s worth paying a solictor for this unless someone like National Debtline or Citizens Advice is more optimistic about your chances than I am.

Tom says

Hi

I got a CCJ from a QQ loan. I made a claim that was successful. Would this mean the CCJ would be removed from my credit file?

Thanks!

Andy says

Hi Sara

Thanks to all of your help I have now managed to get all of my high cost loan and pay day loan appeals accepted. The last one was with Quick Quid who initially rejected my claim back in November, but after an appeal and a lot of back and forth they have now ruled in my favour and agreed it was irresponsible lending and will remove from my credit file. They have however advised me it could take ‘a number of months’ to do this due to the volume of accounts they have to get through. I completely understand this but I’m wondering if I dispute the record with the CRA’s directly and supply the evidence from QQ, could this speed up the removal process? Basically, as soon as this is gone I will be in a position to apply for a mortgage at prime rates as this is the only thing left that is going against me. My original plan was to wait until early 2022 for the default to be 2 years old and then apply for a sub prime mortgage, but it will be amazing if I can start the process in the near future using a high street lender.

Thanks a lot again for all of your help, you have been a life saver.

Sara (Debt Camel) says

First good news on winning the QQ appeal. Quite a few people have reported this.

If you go to the CRAs now, they will just ask QQ. I don’t know what QQ will reply. Your argument to the CRAs is that QQ has agreed your credit record is incorrect so under GDPR (the data protection rules) your record should be corrected now, not in several months time.

At some point QQ will stop replying to the CRAs, then the CRAs will have to “suppress” your credit record (see https://debtcamel.co.uk/correct-credit-records-lender-administration/). But by that point there is a good chance they will have already cleared it.

Rhys Davis says

How have people managed to get in contact with them in regards to phoning them? Does anyone have a working phone number for them?

Rachel Opray says

Hi Sara, I have just had a moda entry on my credit report from 2013 shoeing as overdue. This is a fully paid debt and has appeared out if the blue. I’ve submitted an upheld claim through casheuronet and its been upheld. Is this the reason why an old debt has suddenly appeared. I’m so upset, feel like giving up. I’ve worked so hard to get my credit file in better shape

Sara (Debt Camel) says

This should not have reappeared – it is an error. You need to phone QQ and said you want this corrected immediately – not in a few months time.

Lee Jackson says

I put my clam in last year and have heard nothing I most of had 10.000 of Loans with quick quid and pounds to pocket

Please advise

Sara (Debt Camel) says

Ask customer services when you will get a decision on your claim. Don’t just wait and hope this will be all right.

Joe says

Does anyone have any idea when payments will be made for redress? Are we looking at a long time or no idea please?

Oliver says

Up to 7 months

Amy says

7 months from when? , because I started my claim back in august , and heard nothing

Oliver says

When the portal closed – 14th February

Kelly says

Hello, I have found out that it is too late to submit a claim for Quick Quid, however I was not informed in the first place that I could even make a claim. It was out of curiosity that I wanted to and when looking online I seen it. I have emailed Quick Quid support numerous times without any response. Do you have any advise? I have had a few loans in the past and initially wanted to do an affordability complaint!

Sara (Debt Camel) says

It is now too late to make a claim. Were all the loans repaid on time?

Kelly says

No all the loans wasn’t paid on time, but eventually they was paid and I no longer owe anything.

Sara (Debt Camel) says

ok, so it’s too late to get a refund – which in any case would have been small.

As important for you though may be getting your credit record cleared? You can’t do this yet, but if you wait 6-12 months, at that point the administrators will have stopped talking to the credit reference agencies and you can ask the CRAs to “suppress” the records, see https://debtcamel.co.uk/correct-credit-records-lender-administration/. But it is too soon to try to this now.

Neil says

Hi Sara,

Thanks first of all for everything you’ve done, you’ve changed many lives including my own. I am hoping you can offer me some advice. Having been through the process with multiple payday lenders over the past few years and now waiting on quickquid to be complete. Thanks to the refunds I’ve managed to clear off all the loans a couple of years now, and have been paying down the credit cards which are nearly under control. I’ve managed to gather up a 20% mortgage deposit on a very cheap house outside Belfast but obviously with my credit I can’t get a mortgage. I earn enough now, and have had a good few years at work. I’m wondering now if all the payday loan companies have removed the records of the loans where I had a complaint upheld, or now, and how I can try to sort my credit file out a bit, it seems horrendously complicated. Do I need to go through the credit files held by all three companies to see if these loans are still on my file and dispute them, or is there a company that handles that kind of thing for a fee? I keep trying to approach this to see if I can get it sorted then give up after an hour of looking into it, seems like I need to be a bit of an expert to even try to sort it out. Appreciated if you have any advice or guidance on what I should do. Thanks again.

Sara (Debt Camel) says

Do I need to go through the credit files held by all three companies to see if these loans are still on my file and dispute them, or is there a company that handles that kind of thing for a fee?

the companies that offer credit repair are usually either scams or just sending off the letters you can do yourself for free. They may send an OK letter off, but then not follow through if the lender says no.

I keep trying to approach this to see if I can get it sorted then give up after an hour of looking into it, seems like I need to be a bit of an expert to even try to sort it out.

No you don’t need to be an expert!

This isn’t difficult. It’s just a question of finding the facts then persevering. Not quick, but no one else can do it quicker.

The first thing to do is see what is actually on your credit records. See https://debtcamel.co.uk/best-way-to-check-credit-score/ and get the Statutory Credit Reports from each of the three CRAs. These are clear, simple reports that are less fancy than the ones you pay for but are much easier to use!

Then come back here and say what payday loans are showing.

Neil says

OK will do thanks Sara!

Sean says

Hi, I have some negative information on my record from old quickquid loans. I took out 6 loans within 5 months and have made affordability complaint. I know there will be no money but in what timeframe will they get back to me if they remove negative info? Been waiting over 6 months now.

sam says

Has anybody else not heard back regarding their appeal? I appealed in December and have heard nothing. I’ve chased several times and no response

Jo says

I’m the same. When you call up they are so unhelpful too

Shorif says

Yea I got a reply back from my appeal, you have to cc in the bosses to get anything done

JP says

Hi, who are the best people to copy in to emails?

I’ve been in touch multiple times over my appeal but keep getting the same generic response.

Jo says

I’d love to know the same. I haven’t even had my claim assessed yet and it’s been submitted since August last year. I see purple chasing appeals, I’m nowhere near that stage

Sam says

Thank you. Would you be able to provide the email addresses of who could be copied in? Many thanks!

Trevor says

Hi Neil,

I was in the same situation as you 12 months ago. I had just finished paying off all my payday loans thanks to some good refunds from myjar and lending stream. Myself and my girlfriend looked into getting a mortgage but the large volume of payday loans on my file was a real stumbling block. I was told that they may be able to approve me if I was 12 months clear of these loans.

Fast forward 1 year and we are reapplying. I took out a credit card that we pay off in full each month and my credit score is now really good. We had our mortgage accepted as well as an offer on a house that is beyond what I could have expected this time last year.

It may depend on your financial advisor / lender of course, but I would say a year clear of payday loans and you definitely have options for a mortgage

Good Luck!

Sara (Debt Camel) says

a lot of lenders last year were saying 2 years clear. I haven’t had many reports in 2021 as yet.

Neil McCamphill says

Awesome Trevor thanks for that! Should be near 2 years now I think. Will be more once the QQ admin is done and the 7 most recent loans are off the file…

Michael says

Great news Trevor, well done! When they said 12 months clear of the kind, do they mean 12 months since when they’ve cleared in full/the date of default?

Thanks!

Trevor says

I did not default on any of the loans so I can’t comment on that. I was just told that with 12 months of not using payday lenders that a case could be made for my mortgage approval. We have found this to be the case

Ross says

I’ve just realised I’ve had no response since their last email, in August 2020, when they said all claims would be assessed within 120 days. Bearing in mind it’s now nearly the end of April 2021, I think they may just be over that 120 day deadline!?!

As I can’t seem to access the portal anymore either, I decided to send them an email on the address provided.

Christopher Mattocks says

Hello all

can someone help me with my situation.

so back in September 2014 someone frauded my bank account and somehow got a loan out in my name so, I spoke to my bank and got all the money back so i assumed that was the end of it but then I recently downloaded Experian to check my credit score and apparently the loan is still active with them I have emailed all of the avaible emails they have and they just gave me a number to call which i have twice now left a message and they dont answer and call me back whilst im at work so i miss the calls. can anyone help please as i really need to fix my credit score.

Sara (Debt Camel) says

Have you complained to the bank? They are the ones that should correct your credit record.

Aneta says

Hi everyone.

Does any of you know what is happening with QuickQuid / Casheruonet.

Any dates for pay out? Claims updates. Claim from August 2020 – no information.

Thanks

Sabrina says

Hi, last time I emailed them which was March 2021 – they said payment by 14/9/21

Aneta says

Hi Sabrina,

Thank you for the information.

Have a nice day :)

Kamran Khan says

Hi I had a pounds to pocket loan in 2014 and changed address but my email was the same I wasnt aware I can make a claim I called today 6.04.2021 and was advised I can no longer make a claim is that the case also can I go through 3rd party companies if not direct with them will I get paid

Sara (Debt Camel) says

You have missed the deadline. No – going through a claims company or a solicitor will not make any difference. Sorry.

Rachel says

I’m awaiting a payout, it won’t be much, but anything is better than nothing. However, they said they would be sending me a cheque, and I’m going to be moving house in a few weeks due to unforeseen circumstances (it’s all happened rather quickly). How can I contact them to tell them of the change of address? Thanks.

Sara (Debt Camel) says

Customer Support Team at 0800 016 3250

Rachel says

Thank you :)

Jonnic says

Hi Sara,

Don’t know if anyone else is still waiting on their decision but have been chasing mine each month since January!!! Same story (copy below) each time. I have tried calling but all they say is that they’ll expedite my case. Is there a specific timeframe when they HAVE to give you their final say, or can it run up to September?

From casheuronet: We apologise for the delay with your decision. We were hoping to be in a position to provide the decisions by the 31st of March however, due to other logistics we are still working to make sure we have the correct information provided. We apologise for the inconvenience and we ask that you continue to monitor your email for the decision.

Sara (Debt Camel) says

There is no absolute timeframe for this.

Jonnic says

No worries, guess I should be used to the waiting now!!

Timbouk says

Just rang quick quid and they said payment will be made seven months from 14th February. So guess we need to wait until September for the payout!

Leanne Maddison says

After some advice, I have a on stride Loan, was in a hardship payment plan but the last two payments they gave have not taken, I have emailed loads no reply and tried to call the numbers but not able to get in touch with anyone. If I log into my account says there’s any error.

Any one experiencing this? Thanks