Have you had big overdraft problems for a long period?

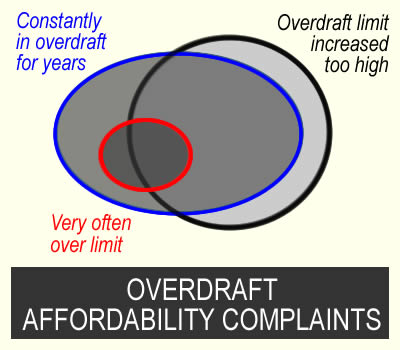

You can make an affordability complaint and ask for a refund of overdraft charges if:

- your overdraft limit was set too high at the start or increased to a level you are unable to clear; or

- your overdraft usage showed you were in long-term financial distress. For example, being in the overdraft all the time, or using an unauthorised overdraft a lot

- your overdraft was originally a student account with no charges, but now interest is being added and you are in the account all or almost all of every month.

This article shows how to make an affordability complaint to your bank, with a free template letter to use. If the bank doesn’t make a you a good offer, it is free to take your case to the Ombudsman.

These complaints do not hurt your credit record. And

Contents

Overdraft affordability complaints

Overdrafts are supposed to be for short-term borrowing

Overdrafts are intended to be used for short-term problems, not as long-term borrowing. A bank should review a customer’s repayment record and overdraft limit and if there are signs of financial difficulty, offer help.

One sign of financial difficulty is hardcore borrowing for a long period. The Lending Code defined hardcore borrowings as “the position where a customer’s current account overdraft remains persistently overdrawn for more than a month without returning to credit during that period”.

Some Ombudsman decisions

All cases are very individual. But these examples give you an indication of what the Ombudsman thinks is important.

In this NatWest decision, the Ombudsman decided:

NatWest did have an obligation to monitor Miss K’s use of her overdraft facility.

Any fair and reasonable monitoring of Miss K’s overdraft facility would have resulted in NatWest being aware Miss K was in financial difficulty … by October 2014 at the absolute latest. So NatWest ought to have exercised forbearance from this point onwards.

In this Santander case, the bank didn’t notice hardcore borrowing:

By this point, Miss C was hardcore borrowing. In other, words she hadn’t seen or maintained a credit balance for an extended period of time. Santander’s own literature suggests that overdrafts are for unforeseen emergency borrowing not prolonged day-to-day expenditure. So I think that Miss C’s overdraft usage should have prompted Santander to have realised that Miss C wasn’t using her overdraft as intended and shouldn’t have continued offering it on the same terms.

Decide which reasons apply to your overdraft complaint

In the overdraft all, or almost all, of the month for a long while

This is the most common reason for winning a complaint

Overdrafts are meant to be used when you have a short term problem. Using the overdraft a lot for a few months is fine. Or for a few days at the end of a month before you are paid.

Banks should review your overdraft annually. This is in most overdraft terms and conditions. And even if it isn’t, the Ombudsman says this is good industry practice.

So at one of these reviews, your bank should have seen if you were in difficulty with the overdraft. For example if you are in the overdraft for all (or almost all) of the month for a prolonged period. Or if you were often exceeding your arranged overdraft limit.

I would say over 18 months or 2 years is prolonged borrowing, not short term.

The bank set your limit too high

This may have been from the start when you were first given an overdraft. Or the initial low limit may have been fine, then the bank increased it to a level which it was impossible for you to repay.

If the bank saw signs of financial difficulty, it should not have increased your credit limit, even if you asked for it. And it should have considered offering your help instead (the regulator’s word is forbearance), for example by stopping charges.

But what is too high?

This depends on your income and expenses. An overdraft of £2,000 for someone whose income is £1,800 a month is a lot – but if you earn £5,000 a month, then a £2,000 overdraft may be reasonable.

Other points that help a complaint

You won’t win an affordability complaint by saying the charges were too high.

Instead, you say the bank should have known they were unaffordable for you because of all the financial problems it could see on your statements and your credit record.

Here is a checklist, do any apply to you?

- often having direct debits or standing orders not being paid;

- a lot of gambling showing on your statements;

- significantly increasing other debts with the same bank (you may also be able to complain about those loans or credit card);

- being recently rejected for a loan or a credit card by the bank;

- significantly increasing debts with other lenders showing on your credit record;

- a worsening credit record – maxed out credit cards, new missed payments, payment arrangements, defaults etc;

- using payday loans;

- mortgage arrears;

- a reduction in the income going into your account.

Free student overdrafts

You can only win a complaint about these after the bank has started charging you interest

Making your complaint

What you need at the start

You don’t need to know the dates your limit was increased before complaining, my template asks for them.

You don’t need to send statements to the bank with your complaint – the bank already has them!

You can’t go back and see exactly what your credit score was in say 2021 when the bank increased your limit. But your current credit record shows what was happening back six years, so download your credit report now and keep it. The sooner you get the report, the further back it goes. I suggest you get your free TransUnion statutory credit report.

Send a complaint by email

I don’t recommend phoning to start off a complaint. It’s too complicated and you will be talking to someone that doesn’t specialise in these complaints.

I think email is the simplest way to make these complaints. Here is my list of bank email addresses for complaints.

An alternative is to send a long message in the app. But if this means using a chat facility, it’s not usually a good idea, as you are again talking to someone who doesn’t understand what you are saying and tries to tell you what help is available with your overdraft – when all you want is to have your complaint considered.

A template you can adapt

In the template below, I’ve invented some examples and dates so you can see how a complaint email could read. The bits in italics should be changed or deleted to tell your story. Delete dates if you don’t know them. If a sentence doesn’t sound relevant, delete it.

I am making an affordability complaint about the overdraft on my current account number 98765432.

Your identity details (these are needed if you complain by email, not if you use secure message):

My name is xxxxx xxxxxxxx. My date of birth is dd/mm/yy. The email address I use/used for this account was myaddress@whatever.com.

Your home address (if you know the bank has your current address, ignore this):

My current address is xxxxxxxxxxxxxxxxxxxx. Please do not send any letters to older addresses you may have on your records.

If your overdraft was originally a student overdraft with no interest include this, otherwise delete it:

My account started as a student overdraft and no fees were charged. I am complaining about the period after, when you started to charge fees.

START BY SAYING they should have noticed your financial difficulty

Overdrafts are meant for short-term borrowing but you could see I was unable to clear the balance in a sustainable way. I was using the account for long term borrowing as I could not get out of this. The fees and charges you were adding were making my position worse.

I am complaining that [every year since [20xx] OR for many years] you have failed to notice my difficulty during the annual reviews of my overdraft. You should have offered forbearance eg by stopping interest and charges being added.

By 2017 I had been in my overdraft constantly for many months, not getting back into the black even when I was paid. This “hardcore borrowing” is a clear sign of financial difficulty. My income was only £1,850 a month – after I had paid bills, there was no way I could hope to clear an overdraft of £3500 in a reasonable length of time.

OR

By 2021, although my salary took my account briefly into credit, within a few days, I was back in the overdraft.

include any other points that show you were in difficulty

You should have seen that I was in financial difficulty because you rejected my loan application in 2021.

You should have noticed that the income going into my account decreased from 2020.

From 2020-22 there was a lot of gambling showing on my account.

In 2022 and 2023 there were a lot of rejected direct debits on my account.

… or anything else!

Say if the initial limit was too high or it was increased too high

You should never have given me an account with such a large overdraft. When I applied, you should have checked my credit record and income and seen I had recently missed payments to a credit card and had taken several payday loans.

OR

You should not have increased my overdraft limit. When you increased the limit, you should have seen that my debts to other lenders on my credit record had increased a lot

OR (for accounts that had been student accounts)

You should have seen after [2020] when you started charging interest that the limit was too high to be repayable on my income.

In your reply to this complaint, please tell me when any limit increases were and how much the limit went up.

END BY asking for a refund of charges and interest:

I would like you to refund all the interest and charges that were added to my account from 2016 when you increased my overdraft limit.

OR

I would like you to refund all the interest and charges that were added to my account from 2021 when you should have realised that my finances had got worse to the point that I was no longer able to clear the overdraft.

Please remove any late payment and default markers from my credit records.

Points to note

Student overdrafts

You won’t win a complaint about a student overdraft saying you were a student and it was unaffordable at that point.

But when the bank has started charging interest, it should start doing reviews and check if you are in difficulty. So from then on, you can win affordability complaints.

You can complain if the account is still being used or if it is closed

These complaints can be made if:

- you are still using the account or you have stopped using it and are paying it off;

- the account has been closed;

- the bank defaulted it and sold it to a debt collector (here you still complain to the bank, not the debt collector). If the debt collector has gone to court and got a CCJ, add a sentence to the template saying you want the CCJ removed as part of the settlement of your complaint.

But if you have had an IVA or bankruptcy after these problems, or if you are still in a DRO, then you shouldn’t complain – ask in the comments below for details.

Old accounts

Banks may say FOS won’t look at an old complaint, but this isn’t right. FOS will often look at a complaint if it has been open in the last six years. How far back FOS will go seems rather random, but it should be possible to go back at least 6 years.

Open and recently closed accounts aren’t a problem – the bank will still have your statements.

If your complaint is about an account that was closed more than 6 years ago, it’s going to be very hard to win.

Packaged bank accounts

These affordability complaints are not about the fees on packaged bank accounts. MSE has a page about packaged bank account charge complaints.

Personal accounts, not business accounts

The complaints covered here relate to personal accounts. For business accounts, talk to Business Debtline about your options.

The Bank replies

They want to phone me!

People are often scared if they get this message. But it may be good news! You can just ignore it or say you would like a reply in writing.

If you decide to take the call, it helps to be prepared:

- have a pen and paper handy so you can write down anything

- if they say they are partially upholding the complaint, ask them the date they are refunding the fees from, and how much. And say you would like to see this in writing before you decide whether to accept it.

- if they ask you questions that sound complicated or worrying, ask them to put the questions in writing as you find the phone difficult

- when they say they are rejecting the complaint, ask for this in writing, as you will be going to the Ombudsman.

Rejection/poor offer – go to the Ombudsman , it’s free

Banks reject many good complaints, hoping you will give up. So don’t! You know if the overdraft has caused you a lot of problems.

You can’t go straight to the Financial Ombudsman (FOS), you have to wait for the bank to reply, or for them to have not replied within 8 weeks.

Here are some things banks may say to try to put you off:

- you could have declined the increase to your overdraft limit – FOS probably won’t think that is a good reason

- you never let the bank know you were in difficulty – FOS probably won’t think that is a good reason

- your salary was enough to return you to credit each month – this is misleading if bills meant you soon went into the overdraft;

- FOS will not look into things that happened more than 6 years ago – if your account was still open in the last 6 years FOS may well look at it.

And the bank may offer to refund fees for the last 15 months say, even though your problems have been large for many years. Think twice about accepting a low offer – you won’t put this offer at risk by going to the Ombudsman.

If you are offered a refund for the last 6 years but not any further back, have a think if this is a good enough offer. It is unpredictable whether the ombudsman will be prepared to go back further than 6 years.

If you aren’t sure, post in the comments below.

To send the case to FOS, complete this online form:

- you can use what you put in your complaint to the bank;

- if the bank rejected your complaint or made a low offer, say why you think this is unfair;

- use normal English, not legal terms.

You don’t need to send your bank statements – the bank will send those to FOS. And you don’t need the policy documents for your bank account, the lender will supply those to FOS if they are needed.

Do these complaints work?

Yes! From 2024, some banks are making more offers directly.

A Guardian article featured a case where someone used the template letter here. Barclays denied it had done anything but made an £8,000 “goodwill” payment to the customer.

And if your bank rejects your case, people are winning cases at the ombudsman. FOS is a friendly service although it isn’t speedy. It isn’t faster to use a solicitor or a claims firm,

The comments below this article are from other people who have made this sort of complaint. That is a good place to ask for help if you aren’t sure what to do.

Refunds from unaffordable loans

Sam says

Hi Sara,

This is great service you provide, thank you very much.

I have put in a complaint to Barclays, basically been in my overdraft of £2500 since about the year 2000. Came out briefly during lockdown when I was actually doing two jobs!!

How long should I wait to chase up if I don’t get a reply?

Thanks

Sara (Debt Camel) says

If you don’t have the complaint acknowledged within 4 weeks, ask them to confirm they have it. If you don’t gat a response within 8 weeks the case can go to the Ombudsman then.

This sounds like a good complaint- let us know what happens!

Ashley says

Hi,

Similar situation for me, I’ve been in around £2500 overdraft with Barclays for as long as I can remember. My in app statements go back to 2009, I had earnings of £1300 a month when it went up to £2500. I have sent a complaint and had it acknowledged a couple of days later, just waiting for a response now.

Sam says

Hi,

I’ve had a letter saying they will get back to me no later than 30th May.

I know I have to take responsibility for bad spending habits but I do think the banks take advantage of this especially when they charge me fees that take me over my overdraft limit but will not allow a direct debit to go a couple of pounds over the limit!!

Fingers crossed!

Sam says

Hi,

Have you heard anything? I have just spoken to Barclays and they are refunding charges and interest for the last 6 years. The refund amount gets me out of the overdraft and a little extra but they are doing this as a gesture of goodwill apparently. Not sure how I feel about this as like previously said I have been in my overdraft since 2000/2001. They are saying that they have done nothing wrong so might push it to the ombudsman.

Hope you get sorted

Sam

Ashley says

Hi,

They still haven’t contacted me. Hopefully I get the same offer you have had. I as well would be a bit apprehensive and would think you would get more at the ombudsman but to be honest it would just be a relief to get my overdraft paid off and removed and a bit extra to pay something else.

Rosemary says

Hi Sara

I own my own property but have no savings, but since moving to this new house in April 2022 I have been in and out of work and my husband can only work part-time due to health problems.

I have taken on a couple of overdrafts through my own bank accounts since last summer with TSB £2500 and Nationwide £2000 amongst other debts.

If the overdrafts are almost less than a year old can I still send this letters? or would they have to be older debts?

I had previously paid off all my overdrafts and debts in 2019 but needed the money!

I am up to the limit on these most of the month and am finding it very depressing!

Any info would be great!

Rosie

Sara (Debt Camel) says

So these overdrafts were given to you at a time when your income had fallen or was erratic and the banks could see that from your statements?

What other debts do you now have apart from the mortgage? Have these also increased?

Mike says

Hello, what should I do, i my account with overdraft was closed by Lloyds?

I’m gonna send the complain now, because it was -£3600 for nearly 3 years. In case they decide to refund the interes, will they open my account back? If not, where they would send the monet? I still have saving account with the same sort code number.

Sara (Debt Camel) says

How long ago was the account closed?

If there is a refund, they will ask you where you want It sent or send a cheque.

CC says

I am keen to hear of anyones cases with Nationwide? I have looked through the thread and cannot find any cases.

CC says

Hi Sara,

I have an affordability claim in with Nationwide. I have suffered with my mental health quite considerably over the years and this contributed to me losing my job in 2021 which is when my finances took a huge downturn. I received a redundancy payout but this soon disappeared and I haven’t really worked consistently since. I have a letter from my doctors to my workplace regarding my mental health around this time. I am just wondering if it it worth sending a copy to Nationwide to support my case?

Sara (Debt Camel) says

Nationwide have a bad habit of rejecting complaints saying that they sent you letters in 2019 and 2020 (for example) saying you were using you overdraft a lot so you should have contacted them then.

But those letters were always generic, sent to millions, not specifically written about your account. And they do not absolve Nationwide from the responsibility of checking your overdraft is affordable. If you were using your overdraft for all or most of the month for a prolonged period, ignore this attempt to fob you off and send the complaint to the Ombudsman.

Let me know what happens!

CC says

Thank you very much Sara. I will keep you updated.

Meg says

I have raised complaint with Nationwide… they rejected it. I have since sent to FOS …the case handler agreed they have acted unfairly, however Nationwide don’t agree so going to Ombudsman…do they usually agree with case handler?

Thanks

Sara (Debt Camel) says

FOS statistics show that in 90% of cases the Ombudsman agrees with the adjudicator.

CC says

I also received my outcome from Nationwide yesterday. They have not upheld but have refunded some fees as a gesture of goodwill. I will be taking it to the Ombudsman.

Sarah says

Hi, wonder if you can shed some light, I put in an affordability complaint yesterday concerning 2 overdrafts that I was consistently up to the max from 2012 to 2018, I was in major financial trouble, my dad was ill for approximately 3 of those years so hardly had time to do anything.

Anyways to cut a long story short my bank has already tried to call me multiple times but I work shifts so I’ve missed the calls, I’ve had a message to say they will be sending me a letter. My question is do you think this is a good sign or do you think they are immediately rejecting my complaint.

Thanks for reading this.

Sara (Debt Camel) says

It’s hard to tell if this is just an automated response or not. Do you still have these accounts?

Sarah says

Thanks for replying, I do have both of them although I’m not in overdraft anymore, finally managed to get a loan to pay them off. I’ll just wait until the letter arrives.

Hopefully they will accept my affordability claim as I was missing direct debits constantly in my main account just to add over 100 per month to pay the overdraft fees, never managed to get it down.

Sara (Debt Camel) says

OK, if the bank rejects yiour complaint saying the problems were too long ago, send the complaint to the Ombudsman.

Gd says

Hi Sara,

I have made a complaint to Halifax for an overdraft of 1500 which I am in since 2017. I had a missed call today which I realised is Halifax as they followed up that they would like a call to go through their findings. I would like to have these in written format, is this normal to have a call instead and no info sent via email or letter?

Thank you!

Catherine says

I had a call from Halifax when they investigated my complaint,responded earlier than 8 weeks and simply wanted to explain their findings,in my case they upheld and explained the figures to be refunded,Had the refund in account in less than 2 hours.

Although unless it was plainly evident it was irresponsible lending,they may well be phoning to say it’s just over the 6 year limit with it been from 2017 but if they reject go to the FOS

Fingers crossed

CC says

Take it! I had a call with them a few days ago. The case handler was so nice and they upheld my complaint (partially) and I received immediate payment. So its worth speaking with them rather than waiting for the letter

Gd says

Hi all,

Thank you for the replies.

I spoke to them today and they’re partially upholding from 2018 onwards since the renewal of the overdraft. They’re only refunding half of the fees which I thought is strange but they said they will send a letter to explain in detail so I will read over that when it arrives.

Sara (Debt Camel) says

Half sounds very odd – can you put details in here when you get it?

You may be able to send this to the ombudsman and get all the fees refunded. In this sort of situation you are not “risking” what the bank has offered you.

CC says

I had a similar outcome. I am pleased but not over the moon! I am still waiting for my letter but will definitely be taking it to the ombudsman.

Gd says

The thing that is odd is that I asked what date they are upholding from and she said from July 2018 which calculating the fees would equate to more than £1000 so I found it off they are offering £600 and how they came to that number.

Gd says

I have received the letter from them now. What is says is that I initially applied for overdraft in July 2017 and what the appreciate is that they should have not renewed the overdraft automatically in July 2018. From july ‘18 to date I have paid over £1,200 in fees but they only refunding £608 from July’18 to Jan’22 because that’s when they sent me a letter to see if they could help me get out of my overdraft. What I don’t understand is why they have allowed me to increase my overdraft twice since Jan 22’ if they knew it was an issue and are not upholding from that date onwards. Do you think I should send this to the Ombudsman?

Sara (Debt Camel) says

I think that is an entirely reasonable point to make.

You probably don’t remember getting that letter in Jan 22 because – if it was like the Lloyds letters I have seen – it is just a bland letter saying that you can reduce the cost of your overdraft if you use it less (well that is what it amounted to.). It was not a tailored letter with details about your account and most people getting these letters ignored them if they read them at all.

As you say, if this was a serious warning about affordability, why did Halifax then ignore it and increase your limit? And if it wasn’t a serious warning, why have Halifax stopped paying your refund at this point?

I suggest you send this to the Ombudsman – you are not “risking” the offer that halifax has made by doing this.

Jen says

Hi Sara not been on here for a while, but have put in an overdraft complaint to Santander, have had a call after 4 weeks to say they are looking at it & will call again with findings & too discuss, I asked them to contact via email as I work in care & work shifts & can’t answer calls, they said it’s not secure & contact will be by phone, just to see if anyone has had email contact from them except to say they received complaint

Sara (Debt Camel) says

I suggest you reply by email repeating that it is very difficult for you to take phone calls and you would like a reply by email or by letter.

Mark says

I have had an overdraft with abbey national/santander since about 1994.It started on about £200 when I was on £550 a month ,it increased to the current limit of £1250 in 2008 and all overdraft requests since then have been refused.My salary has never been alot more than my overdraft.Since 2008 ranging from £1300 to £1700.As my account would show,i had a addiction to gambling since 1994 ,this was the main reason i wanted loans (of which ive had many refunds)and increases of overdraft.Its been such a long time ,i dont know how long complaints ,if mine is worthwhile,can go back.

Sara (Debt Camel) says

Because a bank has an obligation to review overdrafts every year, there is effectively a decision every year that Santander has got wrong. Going back even 6 years, which should be easy, should give you a refund large enough to clear the overdraft.

I suggest you ask for a refund from 2008, pointingg out it was irresponsible to keep allowing you to Use the overdraft with the gambling showing on the account.

Mark says

Since the start of covid in around 2020 my fees every month have been fixed at £30 but for as long as I can remember it was more than that for many years.So even going back 3 years would be enough but 2008 when the final increase was approved of £1250 even though my salary was only £1300 is what I will request.

Ben says

Hi Sara,

I finally received a response from TSB. They haven’t specified the amount they will refund but have been given a time frame for it to happen. A few things don’t quite sit right with me and so I thought I would get your opinion.

Firstly they will not be refunding any unplanned overdraft fees (caused when their monthly planned overdraft fee took me over my limit), it seems to me that if the debt was improperly sold, and so the fees rightly refunded, that the consequences of those fees should also be addressed? Secondly there has been no mention of interest applied to those fees. They have also stated they will be closing down my overdraft facility on the date of the refund and predict that I will remain in arrears. They have suggested contacting their financial services team to arrange a repayment plan.

Does this all sound correct? Should I submit a complaint to the ombudsman? I have been living in my overdraft since graduating and at no point have I earned enough to cover it, yet they increased it up to 3000. If this repayment thing still comes to less than my monthly OD usage fees (around 80) then I consider it a win. But feels like nothings changed really!

Sara (Debt Camel) says

How long ago did you graduate?

How long ago did they start charging interest on the account?

What period are they offering to refund?

How large were the unplanned overdraft fees?

Ben says

Graduated in 2018 – but I’m unsure exactly when they started charging interest.

They’re offering interest from 2020 and the fees started at around 50 a month and increased to 80 when they increased the overdraft facility

Sara (Debt Camel) says

It is possible that they did start charging interest in 2020.

Can you add up all the charges, fees, interest, whatever they call it from the point in 2020 when they are starting the refund.

Then you have a number to compare what they offer with.

Jonathan heard says

Just thought I’d give an update with the FOS. Sent complaint and received a response on 25/01/23 asking for my wife’s signature as it was a joint account. I sent this by return and was acknowledged on 3/03/23 saying they were busy with complaints and that we would hear in due course. Last friday I received another email from them stating that it was still waiting for an investigator to look at it as they were so busy. So if anyone is waiting stay patient!!

Catherine says

Hi Sara,

So Santander upheld overdraft lending complaint,but I took the poor support/other issues part to the FOS,the investigator had finished her review and an ombudsman began reviewing,during this time I received a default letter and Santander said they would record as defaulted on CRAs.

I forwarded the letters to the ombudsman after the complaints manager at Santander said they could address my further points about the default letter as part of their review.

But the ombudsman has provided her decision and made no mention of the further points I’ve made?

So does that mean I have to raise a new complaint with Santander about the default letter??it’s currently on hold Santander said until FOS provide their decision but it’s not been addressed??

I didn’t think they could default an account/threaten court action if they uphold an irresponsible lending complaint?and as part of the resolution agreed I could repay the remaining overdraft at an affordable rate??

I’m only paying a small amount to reduce the remaining as I have other priority debts and Santander’s support has been shocking so I’d rather pay other debts where they have been supportive.

They are recording account as arrangement to pay so I’m actually wondering whether to let them default as it will fall off report in 6 years from now,whereas if I’m paying a small amount for another few years,negative info will remain from 6 years from the point of settling the debt will it not??

Sara (Debt Camel) says

Go back to the Ombudsman and try to get this sorted

Catherine says

I have emailed the investigator and her manager as had a direct email for him to say that Santander agreed that FOS can resolve the default letter issue too but the ombudsman has not included anything about it.

So many of the issues I asked to be looked at and provided evidence for have been completely ignored and not referenced in the decision,therefore in my opinion not resolved but they are asking me to agree/disagree,I emailed to say I disagreed as my main reasons for asking for a review had not been addressed but by the sounds of it,the decision made is final as they didn’t issue a provisional decision first.

Completely pointless me raising all the poor support issues,didn’t even get an apology.

Such a waste of time and energy when it’s not even been investigated properly.

People get more acknowledgement for a simple account error but I had multiple examples of not been provided appropriate support when I asked for it and Santander have yet again got away with treating customers appallingly.

Sara (Debt Camel) says

You are asked if you agree or disagree because if you agree the decision is legally binding on the firm.

An Ombudsman will not normally issue a provisional decision if they are just agreeing with the investigator’s decision.

See what the investigator comes back with.

Mark says

8 weeks had past since my complaint to santander with no decision made and so as advised by santander I sent the complaint to the FOS,.I have just looked at my online banking account and I have noticed that £796 has been payed in,ref Account Adjustment but this refund appears to have been used to reduce my ovetdraft from £1250 to £450.I have had no notification that they would be paying this and I would not have accepted anyway because this about only the last 2 years of interest I have payed.

jim says

hello, I took a Lloyds overdraft in 06 for £1k it was a student overdraft. From 06 onwards I was at the end of the OD going over my overdraft and being charged. I graduated in 2010 and at this point the overdraft was increased to £1.5k and then £2k the following year with fees and interest being applied when it became a graduate account. Up until 2017 i was always at the end of the OD quite often surpassing it (hardcore borrowing). I did have a gambling issue and my statements are littered with transactions from various betting establishments. At no point was my overdraft reviewed and the max i earned during that period whilst on a zero hour contract would probably have been 1.2k a month, so at no point realistically was I able to get out of the £2k overdraft. From 2019 onwards I manage to get over my issues and out of the OD and eventually closed the account March 20 and now bank with a different bank. Do you think I am in a position to suggest i should get my interest and fees back?

Sara (Debt Camel) says

So you can certainly make a complaint. The question is how far back can it go?

The Ombudsman’s Rules allow then to always go back 6 years. But they also have a rule that let’s them go further back if you have only because aware in the last three years that you have a cause for complaint.

So if Lloyds rejects you complaint or makes a low offer, send the case to the Ombudsman.

Mark says

Sent complaint to Santander via email about overdraft charges and they have replied saying that contact can only be by telephone or online chat.Is it not possible if requested that email can be used.I have sent reply stating that so will wait and see.

Sara (Debt Camel) says

Are they saying they don’t accept this as a complaint? Or that they would like to talk to you about it?

Mark says

They are looking into the complaint and said they will attempt to call me to discuss the next step or I can use the online chat to discuss directly but in smaller text on the email it says they can also post the next action to be taken.

Sara (Debt Camel) says

ok, this is quite common – it’s up to you if you want to talk to them as the article above says

Mark says

Hi

Ive been in my NATWEST overdraft of about £7500 since 2017 briefly coming out a few times but currently maxed out and incurring monthly interest charges of around £200 per month. It was increased from about £1500 to £7500 in 2017 with I thought was mad back then as i was alway maxed out and in financial difficulty. Things are lot better these days with finances but I am still finding it very hard to escape and it is a real burden. Is this affordability complaint something I should do?

thanks in advance for your reply.

Mark

Sara (Debt Camel) says

yes I think you should. And send it to the Ombudsman if NatWest makes you a poor offer or rejects your complaint.

Mark says

Hi Sara

I sent in my complaint to the email address you provided and got a pretty swift response rejecting my complaint.

A few highlights below from the email they sent me

“My understanding of your complaint is

1. You are unhappy the bank has allowed you to have an overdraft on your current account and allowed you to increase the overdraft limit, as you believe neither facility should have been provided to you based on affordability.

I can understand the frustration this may have caused for which I would like to sincerely apologise.

In light of my investigation, while I empathise with the inconvenience this has caused you, I can confirm a bank error has not occurred.

I have reviewed your profile and I can confirm the overdraft and the limit increase have been correctly applied to your account upon you successfully completing a full application.

I can confirm during the application process for any new borrowing, we assess whether the new borrowing would be affordable. There is an extensive criterion that needs to be met and if you were accepted for an overdraft and any limit increases,

Although I hope it will not be necessary, you do have the right to refer your complaint to the Financial Ombudsman Service, free of charge – but you must do so within six months of the date of this letter”

I guess I should send this case to the ombudsman?

thanks in advance for your reply.

Mark

Claire says

Hi Mark, my husband made a complaint to NatWest and had pretty much that exact wording! Copy and paste I reckon!

Take it to the FO his overdraft was £5000 and has had over £7000 refunded today! Hope it goes as well for you.

Mark says

Hi Claire

Many thanks for your message. It has given me a little bit of hope.

I sent it off to the FO a few weeks ago so will hopefully hear something soon. Fingers crossed. Congrats on having your debt cleared!

How long did it take after you sent it off to the FO. They have replied that they have taken up the case but not heard anything since then

Mark

Peter says

Hello everybody. Received good news today. I’ll keep it short.

In January I sent a complaint to Lloyd’s about my overdraft and credit card (£800 OD (reduced from £1000 by myself) and £1250 CC), 2 weeks later Lloyd’s came back with refund of OD (around £2000 from 2017) cleared OD and used another £600 to reduce CC balance. Sent further complaint to FOS about CC because lloyds didn’t agree. 4 months later FOS comes back to me and lloyds have to refund me £1379 for my CC, so £3379 in total, OD and CC clear now. Happy days.

Thank you very much Sarah for this website and your help!

John eustace says

Hi Sara,

I cannot find the original thread to this as it only allows me to view comments from May 16th 2023. I had a complaint against HSBC in the beginning of April as they allowed me to gamble £750 over my 4900 overdraft limit but refused to let me pay for bills and food. The overdraft complaint was seemingly forgotten about and I had to remind them that I sent one 4 weeks ago.

After a month of HSBC stalling and not responding and of me having to quote laws and case studies, they offered to clear my arrears plus £100 compensation. I told them this wasn’t enough and said I would accept if they cleared my balance plus £1000 compensation. Surprisingly they have come back and accepted this and the total amount will be in my account tomorrow. They accepted my offer almost immediately so I feel that they were expecting to pay out more. Regardless I am happy this is finally been sorted.

Sara (Debt Camel) says

They have cleared your overdraft of c £5500? Good! A clean start from that one.

John eustace says

No my limit was 4900, it went into an unarranged of 5650 but they’ve cleared that arrears so is back now to 4900 but they’ve given me an extra £1000 in compensation for everything – this was for not helping me with gambling when I asked.

Overdraft affordability complaint is still on going though. I originally sent it around mid April and they said they hadn’t received it but then they realised they had so they’ve only started looking at it from today

Sara (Debt Camel) says

oh. Well off to the Ombudsman if they don’t come back with a good response

Chloe says

Hi Sara,

Santander have just called to offer me a refund on O/D charges since June 2017. The amount will clear my overdraft of £2000 and with the 8percent I’ll have another £1000 in credit.

I initially complained after reading your article and reading through the comments. I used your template above. Thank you so much for providing so many people with such useful information.

The initial complaint went in 18/2/23, so it’s been over the 8 weeks but I’m so happy to finally get rid of the O/D and have no more fees.

Santander said they’ll be changing my account to basic with no O/D but other than that I can still bank with them.

Thank you so much.

Ryan says

Hi Sara,

I had an Overdraft with NatWest from 2014. The limit was £6500. I was struggling to repay it for years. When I contacted NatWest to tell them I was struggling they didn’t even acknowledge it. Passed it all to Moorcroft and then to Wescot who pestered me with letters demanding repayment even though I continued to pay what I could directly to Natwest to get the Overdraft down.

I contacted the Financial Ombudsman in December last year detailing my case as I’d had enough. They got back to me today with the following:

Following my email dated 25 May 2023, NatWest have been in touch to make the below offer.

They’ve agreed:

A refund of overdraft interest paid of £6,308.89

A refund of overdraft charges paid of £174.00

They have also calculated 8% compensatory interest from the point you raised your complaint with them on 21st October 2022 on the refunds detailed above; which results in a further £308.34 (Gross)**

**amount paid is subject to HMRC deductions.

Total redress = £6,791.23*

This will completely clear the debt and I should have a small amount back in my pocket by my calculations. I’m guessing there’s nothing for the distress caused by aggressive debt collection letters?. I don’t want to seem greedy and I’m more than happy that this solves the debt issue I had. Just want to make absolutely sure that accepting the offer and bringing in things to a close now is the right thing to do.

Sara (Debt Camel) says

Did the offer make it clear how far back NatWest was refunding you?

Ryan says

Yes. The ombudsman said they can only go as far back as 2017. They are basically refunding all interest and charges since then which is 6 years.

I went down this route to do an affordability claim after coming across your site and following the advice. It is a fantastic result and has taken a massive weight off my shoulders. The fact that overdrafts are not meant for long term borrowing seems to be what has won it. They were happy taking over £200/month in interest when rates shot up to 40% APR on overdrafts. It was completely unsustainable but NatWest failed to recognise that

I was struggling despite being told.

Sara (Debt Camel) says

then this seems like a pretty good result to me! It’s very rare to get compensation of threatening letters. I think you have your revenge…

Ryan says

Completely agree Sara. I will be accepting the offer. Couldn’t have done it without this website, it was well worth the effort challenging. Far too many people blame themselves for debt problems and tend to forget the banks also have a reasonable duty of care.

Sam says

Hi,

I have just spoken with Barclays with regards to the affordability complaint I put in. I have basically been in my £2500 overdraft since 2000/2001. They have said that they can only go back 6 years and they are going to refund the charges and interest. They are saying that it’s not the banks fault as it states in the T&Cs so the refund is a gesture of goodwill. I’m not sure how I feel about this as like I said, it’s been a struggle since 2000. Do you think I should go to the Ombudsman? Will it affect the refund if the ombudsman agree with the bank?

Sara (Debt Camel) says

If a lender offers a small amount as a gesture of good will – £50 say – then if you go to the Ombudsman you are risking the Ombudsman saying the lender did nothing wrong and you won’t get the £50.

But banks don’t usually offer a lot of money as a gesture of goodwill unless they have done something wrong… how much are you being offered?

Sam says

The offer is £4100. £2500 to pay off the overdraft.

Ashley says

I got the same offer, I have accepted it. It pays off overdraft and a couple of other things so I’m happy enough 🙂

Sara (Debt Camel) says

So it’s your decision as to whether you think Barclays offering you this quickly is a fair solution or whether you want to go to the Ombudsman.

It does state the charges in the T&Cs … but it also states that the bank will review your overdraft every year which they don’t seem to have been doing,

It’s very very unlikely that an refund would go back before 2007.

For refunds of more than 6 years, it is the ombudsman’s decision as to whether they think you should have complained earlier. FOS can seem to make rather random decisions in this sort of situation, but some people win.

Nikki says

Hi Sara just wanted to see if you think this is worth sending off to the ombudsman. I had £700 overdraft with TSB from may 2014 (account opened 2003) but this was increased 5 times between Mar 2015 and Jan 2017, increased 3 times in Jan 2018 alone.

Between 2012-Dec 2019 I had a severe gambling addiction I am talking 260-300 transactions totally £3600-4000 every month and up to 10 pay day loans each month.

Income around £2000-£2400 per month and the OD facility was maxed out every month with multiple DD being returned each month.

TSB are saying because I had large credits (from gambling) and a loan from my friend to buy baby items, that I could have used them credits to pay the overdraft back and close it. And on that basis they have not agreed with my complaint.

Sara (Debt Camel) says

Gambling payments were showing on your account?

Nikki says

Yes sorry from the account that the overdraft was on there was hundreds of gambling transactions coming out of

Sara (Debt Camel) says

Then I suggest you send this to the Ombudsman straight away – the payday loans and the gambling show that you were in difficulty and your overdraft limit should not have been increased.

Nikki says

Thank you I will keep you updated

KTT says

Hello, I wrote a comment a couple of months back regarding Virgin Money, they rejected my claim so it’s been with the Ombudsman since March, I believe I have just been assigned a case handler.

Since having my overdraft in 2009 the bank have never monitored my balance or when I was nearing my overdraft limit, however the last few days they have text and called me and sent letters to say I’m nearing my overdraft. They are so sneaky, obviously trying to look responsible since I have raised a claim.

Can you offer any advice here? I hope I have an update and positive outcome soon. How often do people get a positive outcome when the claim is raised with FO? Thanks

Sara (Debt Camel) says

There aren’t any published figures here as the Ombudsman statistics are everything for a bank and affordability complaints are only a tiny percentage of these.

How many days a month are you in the overdraft? How long has this been going on for?

KTT says

I’m usually in my overdraft as soon as all my direct debits are taken at the start of the month, so I’m usually in my overdraft three weeks of the month and have been since 2009 really.

I feel Virgin are being really sneaky by only calling to check my financial situation since I have raised a claim, I hope the FO see through this. Thanks

Rose says

Hi Sara,

I recently lodged an affordability claim with Halifax. I had an overdraft with them since 2011, around 5k and they repeatedly increased it. I got into financial difficulties when my husband lost his job and contacted them in Jan 20 for support and asked them to reduce their overdraft fees. I wasn’t aware of the time I could make an affordability claim otherwise I would have.

I subsequently lodged a complaint about their lack of support and high fees however that was rejected in feb 20.

They then defaulted on the account.

They have offered me £3700 to settle but will only go back to 2017. Is it worth going back to them to say they should have properly considered this in 2020 and should go back to at least 2014.

Thanks

Rose

Sara (Debt Camel) says

In Feb 20 did their rejection of your complaint tell you you had the right to go to the Ombudsman? What did they say about their lack of support?

Fozia says

Hi Sara, thanks so much for the service and support. I used the template to send a complaint into Barclays who came back to me today with a ‘good will’ amount that covers six years of interest and charges. Before I accept I wanted to ask why ‘6 years’. I have been in my overdraft constantly for 12 years but before pushing back I wanted to understand why banks only go back 6 years? Thanks

Sara (Debt Camel) says

The Ombudsman will always go back 6 years. But to go back further, the Ombudsman has to decide that you have only recent found out that you can make this complaint, within the last 3 years.

So most banks will only offer refunds going back 6 years. If you want more, you will have to go to the Ombudsman.

It’s up to you if you think this offer from Barclays is acceptable. If you have been paying a lot more in overdraft charges recently, the last 6 years may give you a large proportion of what you could get in a quick and simple way.

Chris says

Thanks Sara

I’m also an ex Barclays customer and they have said they will only go back 6 years. Was an old graduate account initially given in 2005 with an overdraft that far outstripped my salary and meant I never got out of it for many years, having no choice but to pay fees etc. I closed the account in Aug 2017, so not enough time for them to even give me a goodwill gesture. Have raised to FOS saying I only found I had cause to complain after finding this site last month.

James says

Does anyone have experience with NatWest in terms of time to respond?

I complained about loans and overdraft seperately, I heard back about the loans v quickly but the overdraft complaint still hasn’t been acknowledged.

Thanks

Sara forca says

I have complaint to NatWest and it took them 2 days to acknowledge the receipt of the complaint, they have email again today after 3 weeks of waiting saying that are still investigating… that I should hear something within 5 weeks.

Nadam says

You have great articles and guides here; thank you for putting this out here.

Can I ask if this can also be used for credit cards – or overdrafts only?

What if I don’t have exact data when I’m writing my letter?

I have an overdraft facility and credit cards with Lloyds, the OD is maxed out almost constantly since 2010 (not sure when I applied for it, but I can see it in the negative from 2011), and my credit cards are £7.5k and only building the negative balance, never actually managed to pay it off.

Can I use the same template to complain about both? Can I claim from the start of OD e.g. 2009 for the refund of charges?

Sara (Debt Camel) says

See this other template for credit cards: https://debtcamel.co.uk/refunds-catalogue-credit-card/

You can make a combined complaint from the two of them if you want. But it’s often easier to send them in as separate complaints, with the complaint about the overdraft pointing out the large balance you were running on the credit card. And the complaint about the credit card saying the limit should not have been set so high as you were always in your overdraft.

Nadam says

Hi Sara,

I wanted to share an update and express my gratitude once again for this page. It appears that Lloyds has expedited my case and I have received a joint response to my two separate complaints about my overdraft and credit card.

Lloyds has reviewed the past six years and issued a refund of £3,240.92 on my overdraft. This will clear the £3,000 overdraft, and they will cancel the facility on my account. I’m not certain yet if this is a positive move.

They have also examined my credit card issue and issued a refund of £2,542.91 for interest charged since 2017, reducing my minimum payment to 1% of the total balance. They will cease charging interest and block the card, enabling me to pay off the outstanding balance.

While I don’t want to sound ungrateful as this is indeed a significant step, I am contemplating whether I should take this case to the Ombudsman. I have been struggling with these two facilities since 2009-10, a period they have not considered in their review. I have £5,000+ still outstanding on the credit card.

Thank you again.

Sara (Debt Camel) says

Lloyds has reviewed the past six years and issued a refund of £3,240.92 on my overdraft.

Is that a full refund for the whole of the last 6 years?

lloyds has the bad habit of chopping short an overdraft refund at some date, often in 2021, when they sent you a vague letter…

Nadam says

Yes, £3,240.92 was the full refund for the overdraft spanning six years, including an 8% interest. The additional contribution of £2,542.91 was applied towards my credit card.

Terri says

Hi, I submitted one complaint regarding an overdraft and a loan to RBS, it was rejected by RBS so I’ve sent it to the FOS as one complaint. Will it be for the FOS to split? Or will they address it together as I submitted it together?

Sara (Debt Camel) says

That’s up to FOS. In theory they can handle them together, but overdrafts are often dealt with by a separate team

James says

Hi,

I posted a while back re. potential complaints while in a DAS/DPP (Scotland).

My main avenue for this would be a current account held with Bank of Scotland since 1996. I would estimate I have had an overdraft of some description on this account for c.25years, at some points in excess of £2000 while on a trivial income and more recently £700 for several years.

Is it realistic to put a complaint in for the full life of the overdraft?

A contributing factor (perhaps), the bank previously reimbursed a tranche of overdraft fees as a one-off/goodwill gesture some years ago.

However, when the bank moved to a model of charging daily interest, they are effectively prolonging and expanding my debt via the overdraft and there has never been any pressure to move away from this form of borrowing.

Unfortunately due to the age of the account, I do not really have significant back statements etc.

It is also effectively dormant while I am in the DAS as the overdraft is one of the debts included.

Any advice appreciated, thanks.

Sara (Debt Camel) says

No it’s not likely you can go back before April 2007.

A contributing factor (perhaps), the bank previously reimbursed a tranche of overdraft fees as a one-off/goodwill gesture some years ago.

How long ago? why did they do this?

James says

Can I ask what is significant about the April 2007 date please?

I can’t remember exactly when they reimbursed some fees as it was a long time ago but I would estimate mid- 00’s.

I argued that the amount of the fees rather than the initial borrowing was pushing me into unauthorised o/d.

They primarily only reimbursed the fees that I could prove were ‘chicken and egg’ in moving me over my authorised o/d.

(But arguably all the fees contributed to my overall financial position.)

I made the argument that the fees were preventing me escaping my overdraft.

Pretty sure this was just at branch level.

Sara (Debt Camel) says

The April 2007 is the date the FCA (bank regulator) issued the CONC rules these complaints are based on.

I don’t know whether your old complaint will still be recorded in the bank’s system.

When did your DAS start?

James says

Think the DAS started Jan/Feb 2020.

Sara (Debt Camel) says

Then I would think there are at the least 3 years of overdraft fees you can reclaim, going back 6 years from the date of your complaint. I suggest you start the complaint now and see what happens.

James says

When we talk about overdraft fees, does this include the daily interest on the overdraft, or just punitive fees for missed payments etc. Eg. £30 for failed debits etc. Thanks.

Sara (Debt Camel) says

it includes all fees and interest charged.

Jake says

Hi,

Thankyou for this guid

Last weekI refinanced and paid off my £4000 TSB overdraft which I’ve been in and out of for four years.

I made a complaint based on the facts that:

– they extended my limit 16 times in 2 and 1/2 months to get that limit.

-Could have seen dozens of pay loans, and at least two missed payments on my credit report in the year before applying

-I had also been over limit on several cards, in the months before applying including a TSB credit card (although only ever briefly – whenever I went over limit I brought it under very quickly)

They responded within a few days – saying that they do not accept that they shouldn’t have loaned me the money but as ‘gesture of goodwill’ they will be closing the (already closed) overdraft on July 3rd and they’ll be ‘arranging to refund all charges applied from April 2019.’

It doesn’t quote a figure , but – a) do you think this is just the c. £420 of fees or the full c.3k of interest and fees they’ve charged me over the last four years?. B) if it’s only the former, do you think I should go to the ombudsman? C) Do I have to actively reject the £420, before making a claim, or can I put it towards loan repayments an then complain about the rest?

Again, I love this site – it’s helped me pay down debt and challenge these decisions. Thank you so much for all you do!

Sara (Debt Camel) says

a) do you think this is just the c. £420 of fees or the full c.3k of interest and fees they’ve charged me over the last four years?.

Not much point in me guessing, you will know soon enough.

B) if it’s only the former, do you think I should go to the ombudsman?

Yes

C) Do I have to actively reject the £420, before making a claim, or can I put it towards loan repayments an then complain about the rest?

Have they asked you to accept the offer o said how they will pay it?

Andrew says

Hi Sara

I’ve only just found your website a couple of days ago and did not know I could complain for these kinds of refunds.

Long story short, I had a gambling problem which began on 2009 and escalated with me maxing out my £2k Overdraft until 2019 only ever really escaping it when I had taken out approx 6 loans, and 3 credit cards with various providers to support my gambling (gambling very much present on my Halifax account overdraft).

After being at my lowest low (and around £30k in debt) I managed to give up gambling and have worked very hard over the past few years to only be left with 1 loan at £4.5k left now in 2023.

I have followed your instructions and issued complaints to each of my creditors over the past couple of days. However I note alot of credit I took would have been before 2017 and the 6 year general rule you have stated in your article.

I was careful to add in your paragraph to state I was not aware I could complain until now however I would assume the majority of the creditor’s will reject these outright for due to the time elapsing (bulk of credit was taken between 2014-17).

My query is when I likely have to take these to the Ombudsman, how likely are they to accept my reason for not claiming earlier and going beyond their 6 year rule?

Sara (Debt Camel) says

Yes, you should expect these complaints to be rejected by the lenders and naive to go to the Ombudsman. FOS can look back further, but I can’t guess what the chance is – all you can do is push things as far as you can.

Sarah says

Hi….. first off, this site is amazing and thank you for all your help you give.

I submitted a question on here a few weeks ago regarding 2 Halifax overdrafts I had for years, constantly in them and My fees were probably in the 1000s, over 5k I would imagine. I had a call straight away regarding one of them and it was rejected and I’ve still not had my decision letter, the other one I’ve received a call this morning but I’m at work, however I’ve just checked my accounts and had £400 pounds added across the 2 accounts including the one my claim got rejected for.

To be honest I’m annoyed as there was no option to accept this as was awaiting a decision on both accounts before I escalated it to the financial ombudsman.

Does this mean now they would think I accepted this and I can no longer escalate it and also in my mind it’s an admission that they should of seen how I was struggling beyond belief. Obviously an unexpected £400 is a big help, I’m no longer in either overdraft but it’s probably only 10% of what I gave them over the years.

Sorry for the long post but any advice is much appreciated

Thank you.

Sara (Debt Camel) says

If they didn’t ask you if you accepted this offer in settlement of your case, they there is no problem with you sending the case to the Ombudsman. When you get the decision letter, pass it on to the Ombudsman and say you want the case to continue as £400 is inadequate.

Dill says

Hi Sara, brilliant website, thank you.

I sent in a complaint to Barclays about my overdraft and credit card a few weeks ago based on the fact I have been in my overdraft almost every month since about 2007 and they have done or said nothing about it.

They contacted me today and said they want to speak to me (not going to read anything into that though). They are calling me back…

I wondered if there was any advice for arguing back with them about start dates? As I say, I am not counting my chickens but if they did say they were only going back 6 years is there ever any scope to argue/negotiate or anything useful to quote at them (I note from another comment you say you can’t go back further than 2007 because that is the date the rules came in).

Or is there no point trying that and if they say too short a period just go to the ombudsman?

Many thanks

Sara (Debt Camel) says

I would be very surprised if they go back further than 6 years, but until you know what they are going to say it hard to come up a reply.

Dill says

So, as you suggested they say they only have to go back six years.

They have offered to refund my charges (about £800) but not the interest (about £1800) as they say they have done nothing wrong. But surely multinational commercial enterprises don’t make ‘goodwill gestures’ unless they think they are in the wrong so…

The basis for saying this is they sent me letters about my overdraft usage. I did see the letters but there isn’t much I could do to reduce the overdraft when struggling with other debts. They say they only have the ability to send these generic letters and that absolves them of any wrongdoing, is that correct?

Sara (Debt Camel) says

I suggest you send this to the Ombudsman.

Jay says

Hi,

I took out a HSBC student account in August 2020, In 2021, HSBC mistakenly changed this to a graduate account, one year into the student account, even though I was on a three year course. With the account, I have had a £1000 overdraft, basically maxed out. With my account being changed mistakenly to a gradate account, HSBC never reviewed to see if it would be able to get the £2000 overdraft in year two or the £3000 in year three.

I complained to HSBC, my account being a graduate account for the last two years despite me being a student still. HSBC replied ‘They regret this is an error and appears to have been due to your UCAS letter not being recorded accurately on our system’. ‘They have the option to convert my account back to a Student Account however, as I’ve advised I am are graduating this summer, they feel this action is senseless at this juncture’. HSBC apologised for the error and have applied £50 compensation. Do you think I would likely get anymore from going to the financial ombudsman? Also, do you think they are wrong not to change my account to a student account now? With my account wrongly being a graduate account for the last two years they will no doubt try to start charging me interest on this remaining £949 overdraft balance, saying my graduate account period is now over. Even though I am graduating this summer.

Thanks

Sara (Debt Camel) says

I think you should ask them to confirm they won’t charge you interest for 2 years. Get this in writing.

Emily says

Hi Sara, I made a complaint with Lloyds and have received my final decision letter, I have since sent this to the Ombudsman as in my opinion the offer wasn’t good enough my question is however, in the banks decision letter they stated they would refund fees and remove my overdraft on 10th June (yesterday) however this hasn’t happened, would they continue with remedial action after a case is sent to the FOS or wait for their decision before doing anything, thanks

Sara (Debt Camel) says

I think you have to wait and see and what happen with your case.

Sarah’ says

Hi,

Wow thank you for this amazing website, I put an affordability complaint to the Halifax approx 4 weeks ago regarding 2 overdrafts I’ve had since 2012, never got out of them until 2021, my complaint for one of the accounts was refused within a day and was just waiting on the decision letter for both to send to the ombudsman.

I posted here a week ago as had a random 400 put across my 2 accounts and was still waiting for the letter as believed they were not responsible in giving me the overdrafts.

Fast forward I’ve received my letter today and can’t believe it but they have obviously looked into my accounts and refunded all my interest and fees from 2018, I have 3k being paid in on July 7th, they will cancel my overdrafts but I haven’t used them since 2021, I’m a different person now.

The £400 was the tax I have to pay on the interest, not quite sure how I will be asked to pay it.

Anyways sorry for the long message but a huge thank you as I just accepted it was me that messed up.

I’m still in shock, I’ll be paying a loan off for 1700 and then I’m debt free, my financial plan has been brought forward by at least a year thanks to you.

I’m forever grateful for your advice.

Sara (Debt Camel) says

Great news about the refund.

I’m not sure though what they have done about the tax. The way this should work is that the refund of interest and charges is not taxable – it’s your own money you are Getting back – but the 8% statutory interest they add on is taxed as savings. Halifax should deduct 20% tax from this before paying you.

But you may be able to get a refund of £200 (or more if you don’t pay tax) back from the taxman. See https://debtcamel.co.uk/ppi-payday-refund-get-back-tax/

Sarah says

Thanks Sara,

I’m totally confused about the tax thing, I pay tax as I work so I’m not sure what to do, I’m sure it’ll work out come April.

I have to say that 3k is amazing but I obviously had the overdraft from 2012 up until 2018 which they are not including so there must be another 6k of fees that I paid during that time and those times I was really struggling.

I suppose it’s doubtful that the ombudsman will go beyond 2018 now.

I’m still extremely happy that I’ve gained an extra 100 a month into my income after paying off the loan.

Thanks again Sara

Sara (Debt Camel) says

The tax will not “work itself out” – if you want the £200 refund from HMRC you have to make a claim for it. Halifax must send you details of the 8% added and the tax deducted – when you have those it will be pretty easy to claim the refund from HMRC if you wait until April next year – a note for your diary!

It isn’t certain the Ombudsman will go back further. But you are not putting the current offer at risk by sending your case to FOS – up to you if you want to try for a larger refund.

Siobhan says

NatWest has rejected my complaint because the overdraft was set up in 2015. I lived in my overdraft every month within a week of being paid and this continued until 2020 when I entered a DMP. I had charges every month for years for over going the overdraft limit.

Is it worth me going to FOS due to the time?

Sara (Debt Camel) says

Yes it is. FOS can always go back 6 years, which would be to 2017, and can choose to go back further if you have only recently found out about these complaints.

Make the point to FOS that although you knew your were in financial difficulty in 2020, you were unaware that NatWest should have checked the overdraft was affordable so you didn’t realise they were partly responsible for your problems and at that point had no reason to complain. Also say your DMP firm knew about your problems and they did not say you could ,are affordability complaints.

Siobhan says

Thank you.

They have said in their final response letter that they could see I was in difficulty from 2016 and that I had interest and charges monthly up until 2020 so I’ll send all this over FOS and update with what they say

Ben says

Hi there,

I recently made a complaint about a 3000 pound OD that I have been in consistently with TSB. Without waiting for me to accept an offer they have refunded 1700 in fees, which seemed great at first but they also canceled all OD facilities on the account. So I’ve gone from 2999 into a planned overdraft to 1300 into an unplanned one. This no longer feels like an improvement and could snowball quickly. I had a bad feeling so I emptied the account of what money it did have last week to make sure it wasn’t swallowed up by the OD canceling. But if I hadn’t done that I would have lost this months utility bill money .

Any advice on how I should proceed?

Thanks

Sara (Debt Camel) says

Open another bank account?

What was the offer TSB made you? A refund over what period? Did it mention removing the overdraft?

Ahmed says

Hi dear sara

I have logged a complaint to halifax for my overdraft on 9th may they bank conform the complaint and they said they will in touch if they need more information

On 9th of june they replied again saying

Dear Mr xx, we’re writing to let you know we’re still looking into your complaint. We know this has taken longer than you expected and we’re sorry about that. Your reference number is cx. If you need to speak to us, please call 0800 096 1279. If we haven’t resolved your complaint by 09 July 2023 we’ll be in touch to explain why and what we’ll do next.

Could you please tell me should I wait for their response or give them a call thanks

Sara (Debt Camel) says

Just wait. You can’t make them speed this up. If they don’t respond within 8 weeks, you can send the case to the O budsman then

ahmed says

Hi sara thank you very much i had call today from halifax they paid my £2800 overdraft and cleared it from my account plus they pid extra £640 As they said they can just go back to 2017 and they accepted they shouldn’t had increased my limit

But my question is i was using the overdraft since 2011 and i am limit was £5k

And i believe from 2011 to 2017 i have paid them nearly £4k fee which they didn’t refund me could you please advise should i go to the obdusman or what should be the next step to take the fee from 2011 to 2017 thanks

I told the case handler i would to get refund from 2011 butt he said he can just go back to 2017

Would be very kind for your reply

And thanks again for your help 🥰🥰

Sara (Debt Camel) says

The Ombudsman can decide to go further back than 6 years when you have only become aware in the last 3 years that the bank should have been checking the overdraft was affordable for you.

Did the Halifax case handler mention that 3 year rule?

ahmed says

Hi sara

No he didn’t said anything about 3 years rule he said he can check just 6 years old in his system even i said to him i would like to go back 2011

And i did calculations have paid allot of overdraft fee from 2011 to 2017

He said i will receive a letter as well explaining

And he accepted that the bank last check affordability it was in 2017

And i never knew it before the affordability claim before seen your vlog last month just then i came to know

So please could you suggest me what to do next thanks 🙏

Sara (Debt Camel) says

Probably go to the ombudsman. But wait and see what the letter says?

Sam says

Hi Sara

I have had a overdraft limit of 1200 for over 10 years but it’s never been increased but my wages was £1450 I had so much gambling on account especially over last 5years in that time i have missed bills quite often and my overdraft is at its limit within a week of being paid is this worth going to bank and asking for refund

Thank you

Sam

Sara (Debt Camel) says

Yes definitely.

Anna says

Hi Sarah. I made an affordability complaint for all accounts held with Santander for me and my husband which all gave overdrafts on we have been in every single month for years. I have my a gazillion phone calls and web chat complaints about them not getting back to me. It’s with the FOS and they responded they were giving a chance to Santander to respond. It’s now over 8 weeks. (I sent the acknowledgment letter from Santander to the FOS also. I phone against last Monday and was told I will get a decision by Friday. I had to call on Friday again and they still haven’t got a decision as they are waiting for information from other department. This is unreal. Any suggestions? I have stressed to the so many times that my husband’s mental health has suffered due to this but they obviously don’t care about it.

Sara (Debt Camel) says

when did you originally make the complaints to Santander?

Anna says

12thApril 2023

Jen says

Hi anna I put in my original complaint on 5/4/23, when I called for an update they also told me waiting on another dept, that was last week, they called on 14/4 with acc adjustment details & redress in my acc 15/4, hope this helps with timeline

Sara (Debt Camel) says

OK so it’s not much over 8 weeks and you have sent it to the Ombudsman. That is all you can do at the moment.

Santander seem to be in a bit of a mess. At first they were rejecting all complaints – well at least they have stopped doing that. They are now making some good offers eventually but it isnt speedy. See the comments below this article https://debtcamel.co.uk/santander-overdraft-complaints/

Can I ask what the rest of your finances are like? Do you also have credit cards or loans that are difficult to pay? Do you have a mortgage?

Anna says

Yes finances totally in a mess. I have a mortgage with them which we have never defaulted on but payday loans, credit cards loans, HP all which we can’t afford (I’m on a DMP also). We tried to remortgage with them to clear some down and it was rejected so they are well aware of our situation

Sara (Debt Camel) says

payday loans, credit cards, loans

are all of these in your DMP?

have you looked at affordability complaints against all of these? See https://debtcamel.co.uk/refunds-catalogue-credit-card/ for cars, https://debtcamel.co.uk/refunds-large-high-cost-loans/ for loans and https://debtcamel.co.uk/payday-loan-refunds/ for payday loans.

why are the overdrafts not in your DMP?

HP – is that car finance? How long ago was it taken out?

Jonathan heard says

Well at last the fos has picked up my complaint now. I complained about the overdraft and also the resolve loan they gave to clear the cancelled overdraft. These have different case handlers. Barclays have already raised an objection to them (fos) due to when the loan was given. Will be interesting and will keep you all updated j

Kay says

Hi, I complained to RBS regarding my overdraft and affordability. I have constantly been in my overdraft for the past 4 years and RBS have allowed me to increase on several occasions.

They replied stating they were not lending irresponsibly and that they would not refund any charges.

I have since taken my complaint to FOS. Not sure if I have a sting case. Any thoughts?

Sara (Debt Camel) says

“constantly in my overdraft” so for every day of the month?

Kay says

Yes, every month. I’ll be out of it for maybe a couple of days then I’m straight back in it once bills start to come out.

Sara (Debt Camel) says

Then that sounds like a good complaint to me

Ashley says

Wow, I’ve just sent off my claim letter to Halifax dating back to 2017. Over 8k… to say I’m disgusted in myself is an understatement but I’m hoping that they see reason. Essentially living in a 5k overdraft, persistent snowballing, daily fees incurred meaning I will never get out of the debt I owe unless there’s a miracle. No annual reviews, no identifying unaffordability, no offers of support, fee freezing, systematic reduction of overdraft amount… I can only hope,

Sara (Debt Camel) says