Have you had big overdraft problems for a long period?

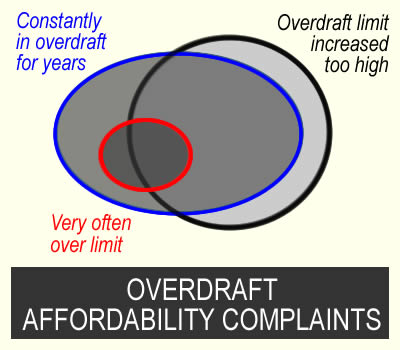

You can make an affordability complaint and ask for a refund of overdraft charges if:

- your overdraft limit was set too high at the start or increased to a level you are unable to clear; or

- your overdraft usage showed you were in long-term financial distress. For example, being in the overdraft all the time, or using an unauthorised overdraft a lot

- your overdraft was originally a student account with no charges, but now interest is being added and you are in the account all or almost all of every month.

This article shows how to make an affordability complaint to your bank, with a free template letter to use. If the bank doesn’t make a you a good offer, it is free to take your case to the Ombudsman.

These complaints do not hurt your credit record. And

Contents

Overdraft affordability complaints

Overdrafts are supposed to be for short-term borrowing

Overdrafts are intended to be used for short-term problems, not as long-term borrowing. A bank should review a customer’s repayment record and overdraft limit and if there are signs of financial difficulty, offer help.

One sign of financial difficulty is hardcore borrowing for a long period. The Lending Code defined hardcore borrowings as “the position where a customer’s current account overdraft remains persistently overdrawn for more than a month without returning to credit during that period”.

Some Ombudsman decisions

All cases are very individual. But these examples give you an indication of what the Ombudsman thinks is important.

In this NatWest decision, the Ombudsman decided:

NatWest did have an obligation to monitor Miss K’s use of her overdraft facility.

Any fair and reasonable monitoring of Miss K’s overdraft facility would have resulted in NatWest being aware Miss K was in financial difficulty … by October 2014 at the absolute latest. So NatWest ought to have exercised forbearance from this point onwards.

In this Santander case, the bank didn’t notice hardcore borrowing:

By this point, Miss C was hardcore borrowing. In other, words she hadn’t seen or maintained a credit balance for an extended period of time. Santander’s own literature suggests that overdrafts are for unforeseen emergency borrowing not prolonged day-to-day expenditure. So I think that Miss C’s overdraft usage should have prompted Santander to have realised that Miss C wasn’t using her overdraft as intended and shouldn’t have continued offering it on the same terms.

Decide which reasons apply to your overdraft complaint

In the overdraft all, or almost all, of the month for a long while

This is the most common reason for winning a complaint

Overdrafts are meant to be used when you have a short term problem. Using the overdraft a lot for a few months is fine. Or for a few days at the end of a month before you are paid.

Banks should review your overdraft annually. This is in most overdraft terms and conditions. And even if it isn’t, the Ombudsman says this is good industry practice.

So at one of these reviews, your bank should have seen if you were in difficulty with the overdraft. For example if you are in the overdraft for all (or almost all) of the month for a prolonged period. Or if you were often exceeding your arranged overdraft limit.

I would say over 18 months or 2 years is prolonged borrowing, not short term.

The bank set your limit too high

This may have been from the start when you were first given an overdraft. Or the initial low limit may have been fine, then the bank increased it to a level which it was impossible for you to repay.

If the bank saw signs of financial difficulty, it should not have increased your credit limit, even if you asked for it. And it should have considered offering your help instead (the regulator’s word is forbearance), for example by stopping charges.

But what is too high?

This depends on your income and expenses. An overdraft of £2,000 for someone whose income is £1,800 a month is a lot – but if you earn £5,000 a month, then a £2,000 overdraft may be reasonable.

Other points that help a complaint

You won’t win an affordability complaint by saying the charges were too high.

Instead, you say the bank should have known they were unaffordable for you because of all the financial problems it could see on your statements and your credit record.

Here is a checklist, do any apply to you?

- often having direct debits or standing orders not being paid;

- a lot of gambling showing on your statements;

- significantly increasing other debts with the same bank (you may also be able to complain about those loans or credit card);

- being recently rejected for a loan or a credit card by the bank;

- significantly increasing debts with other lenders showing on your credit record;

- a worsening credit record – maxed out credit cards, new missed payments, payment arrangements, defaults etc;

- using payday loans;

- mortgage arrears;

- a reduction in the income going into your account.

Free student overdrafts

You can only win a complaint about these after the bank has started charging you interest

Making your complaint

What you need at the start

You don’t need to know the dates your limit was increased before complaining, my template asks for them.

You don’t need to send statements to the bank with your complaint – the bank already has them!

You can’t go back and see exactly what your credit score was in say 2021 when the bank increased your limit. But your current credit record shows what was happening back six years, so download your credit report now and keep it. The sooner you get the report, the further back it goes. I suggest you get your free TransUnion statutory credit report.

Send a complaint by email

I don’t recommend phoning to start off a complaint. It’s too complicated and you will be talking to someone that doesn’t specialise in these complaints.

I think email is the simplest way to make these complaints. Here is my list of bank email addresses for complaints.

An alternative is to send a long message in the app. But if this means using a chat facility, it’s not usually a good idea, as you are again talking to someone who doesn’t understand what you are saying and tries to tell you what help is available with your overdraft – when all you want is to have your complaint considered.

A template you can adapt

In the template below, I’ve invented some examples and dates so you can see how a complaint email could read. The bits in italics should be changed or deleted to tell your story. Delete dates if you don’t know them. If a sentence doesn’t sound relevant, delete it.

I am making an affordability complaint about the overdraft on my current account number 98765432.

Your identity details (these are needed if you complain by email, not if you use secure message):

My name is xxxxx xxxxxxxx. My date of birth is dd/mm/yy. The email address I use/used for this account was myaddress@whatever.com.

Your home address (if you know the bank has your current address, ignore this):

My current address is xxxxxxxxxxxxxxxxxxxx. Please do not send any letters to older addresses you may have on your records.

If your overdraft was originally a student overdraft with no interest include this, otherwise delete it:

My account started as a student overdraft and no fees were charged. I am complaining about the period after, when you started to charge fees.

START BY SAYING they should have noticed your financial difficulty

Overdrafts are meant for short-term borrowing but you could see I was unable to clear the balance in a sustainable way. I was using the account for long term borrowing as I could not get out of this. The fees and charges you were adding were making my position worse.

I am complaining that [every year since [20xx] OR for many years] you have failed to notice my difficulty during the annual reviews of my overdraft. You should have offered forbearance eg by stopping interest and charges being added.

By 2017 I had been in my overdraft constantly for many months, not getting back into the black even when I was paid. This “hardcore borrowing” is a clear sign of financial difficulty. My income was only £1,850 a month – after I had paid bills, there was no way I could hope to clear an overdraft of £3500 in a reasonable length of time.

OR

By 2021, although my salary took my account briefly into credit, within a few days, I was back in the overdraft.

include any other points that show you were in difficulty

You should have seen that I was in financial difficulty because you rejected my loan application in 2021.

You should have noticed that the income going into my account decreased from 2020.

From 2020-22 there was a lot of gambling showing on my account.

In 2022 and 2023 there were a lot of rejected direct debits on my account.

… or anything else!

Say if the initial limit was too high or it was increased too high

You should never have given me an account with such a large overdraft. When I applied, you should have checked my credit record and income and seen I had recently missed payments to a credit card and had taken several payday loans.

OR

You should not have increased my overdraft limit. When you increased the limit, you should have seen that my debts to other lenders on my credit record had increased a lot

OR (for accounts that had been student accounts)

You should have seen after [2020] when you started charging interest that the limit was too high to be repayable on my income.

In your reply to this complaint, please tell me when any limit increases were and how much the limit went up.

END BY asking for a refund of charges and interest:

I would like you to refund all the interest and charges that were added to my account from 2016 when you increased my overdraft limit.

OR

I would like you to refund all the interest and charges that were added to my account from 2021 when you should have realised that my finances had got worse to the point that I was no longer able to clear the overdraft.

Please remove any late payment and default markers from my credit records.

Points to note

Student overdrafts

You won’t win a complaint about a student overdraft saying you were a student and it was unaffordable at that point.

But when the bank has started charging interest, it should start doing reviews and check if you are in difficulty. So from then on, you can win affordability complaints.

You can complain if the account is still being used or if it is closed

These complaints can be made if:

- you are still using the account or you have stopped using it and are paying it off;

- the account has been closed;

- the bank defaulted it and sold it to a debt collector (here you still complain to the bank, not the debt collector). If the debt collector has gone to court and got a CCJ, add a sentence to the template saying you want the CCJ removed as part of the settlement of your complaint.

But if you have had an IVA or bankruptcy after these problems, or if you are still in a DRO, then you shouldn’t complain – ask in the comments below for details.

Old accounts

Banks may say FOS won’t look at an old complaint, but this isn’t right. FOS will often look at a complaint if it has been open in the last six years. How far back FOS will go seems rather random, but it should be possible to go back at least 6 years.

Open and recently closed accounts aren’t a problem – the bank will still have your statements.

If your complaint is about an account that was closed more than 6 years ago, it’s going to be very hard to win.

Packaged bank accounts

These affordability complaints are not about the fees on packaged bank accounts. MSE has a page about packaged bank account charge complaints.

Personal accounts, not business accounts

The complaints covered here relate to personal accounts. For business accounts, talk to Business Debtline about your options.

The Bank replies

They want to phone me!

People are often scared if they get this message. But it may be good news! You can just ignore it or say you would like a reply in writing.

If you decide to take the call, it helps to be prepared:

- have a pen and paper handy so you can write down anything

- if they say they are partially upholding the complaint, ask them the date they are refunding the fees from, and how much. And say you would like to see this in writing before you decide whether to accept it.

- if they ask you questions that sound complicated or worrying, ask them to put the questions in writing as you find the phone difficult

- when they say they are rejecting the complaint, ask for this in writing, as you will be going to the Ombudsman.

Rejection/poor offer – go to the Ombudsman , it’s free

Banks reject many good complaints, hoping you will give up. So don’t! You know if the overdraft has caused you a lot of problems.

You can’t go straight to the Financial Ombudsman (FOS), you have to wait for the bank to reply, or for them to have not replied within 8 weeks.

Here are some things banks may say to try to put you off:

- you could have declined the increase to your overdraft limit – FOS probably won’t think that is a good reason

- you never let the bank know you were in difficulty – FOS probably won’t think that is a good reason

- your salary was enough to return you to credit each month – this is misleading if bills meant you soon went into the overdraft;

- FOS will not look into things that happened more than 6 years ago – if your account was still open in the last 6 years FOS may well look at it.

And the bank may offer to refund fees for the last 15 months say, even though your problems have been large for many years. Think twice about accepting a low offer – you won’t put this offer at risk by going to the Ombudsman.

If you are offered a refund for the last 6 years but not any further back, have a think if this is a good enough offer. It is unpredictable whether the ombudsman will be prepared to go back further than 6 years.

If you aren’t sure, post in the comments below.

To send the case to FOS, complete this online form:

- you can use what you put in your complaint to the bank;

- if the bank rejected your complaint or made a low offer, say why you think this is unfair;

- use normal English, not legal terms.

You don’t need to send your bank statements – the bank will send those to FOS. And you don’t need the policy documents for your bank account, the lender will supply those to FOS if they are needed.

Do these complaints work?

Yes! From 2024, some banks are making more offers directly.

A Guardian article featured a case where someone used the template letter here. Barclays denied it had done anything but made an £8,000 “goodwill” payment to the customer.

And if your bank rejects your case, people are winning cases at the ombudsman. FOS is a friendly service although it isn’t speedy. It isn’t faster to use a solicitor or a claims firm,

The comments below this article are from other people who have made this sort of complaint. That is a good place to ask for help if you aren’t sure what to do.

Refunds from unaffordable loans

Catherine says

Any knowledge of Santander complaints?Responses??

I tried to raise my overdraft complaint on chat but no one responding so decided to send it off to a few email addresses and got a reply back from executive communications team saying-

Good afternoon

Thank you for your email. We will arrange for a Senior Complaints Manager in the Executive Communications Team to review your concerns and they will contact you in due course.

Any one else had this??

Greg says

Part 1………

Hi Sara.

Thank you for highlighting the unfair treatment many of us have received at the hands of UK banks.

I originally opened a santander (formerly Abbey national) student account in 1997 with a modest overdraft. I’m not sure the amount of overdraft or how my account was managed up until the statements I have from 2014. Between 2014 and today, my overdraft has been at £2500 and for the wast majority of the time, overdrawn by around £2000. Sometimes 1700 or 2400 but rarely or never anywhere close to being out from the overdraft in almost 9 years. Littered throughout that time is payday loans from Wonga and sunny. There are also instances of heavy gambling, however this is masked by using PayPal as the vehicle to get an advance betting deposit when my account was empty and then the PayPal DD would debit a few days later. I eventually defaulted and they closed that PayPal account. I have letters from the DCA. One day I lost about a grand and thankfully I walked away from it. Chasing the dream rarely materialises

Greg says

On the other side, my self employed and employed yearly totals were between 5k and 10k. Maybe one p60 for probably 2016/17 might show a higher annual income.

I also highlighted the masses of interest I have paid each month with living on the edge of the overdraft. I’ve documented exceeding the overdraft, bounced direct debits and a rejected santander loan application for a minimal amount in 2015.

All of this has been in front of santander eyes, yet they have done nothing. Historically, they’ve even refused to refund bank charges eventhough they could see the state of my account.

I even took it upon myself to change my account type to limit interest to £20 instead of the 50 to 60 I was paying most months. This incurs a £10 month fee that I still pay to this day. Not once has santander look at my account and offered a shred of help. Instead they’ve been happy to prize around £4k of interest from me since 2014 (not sure about before then). 4k interest on a 2.5k short term debt that’s lasted 25 years.

I’ve sent santander the information I’ve gathered and asked them to refund all the interest I’ve paid, plus 8% interest. Refund the charges and fees I’ve paid and to wipe any adverse credit.

I expect a push back but I’ll sit it out for the 8 weeks until I escalate to the ombudsman as santander have a shocking record of responding and taking care if their obligations.

Chloe says

I got a very prompt no from them Greg. I’ve sent my complaint to FOS now. Hoping for better luck! Can you believe they even said in their response “we’re not financial advisors”. Basically put the blame on me and said “you didn’t ask for help”.

Greg says

The emphasis is on them not to exploit vulnerable and people trapped in spiraling debt. If they turn around and said….. you’ve had you overdraft for 5 years and we need to clear it. We will freeze the card, add no more interest and you still need to make the minimum payment which will reduce the balance each month! Great!

But no. They just sit there rubbing their hands at the £600 annual income they got sometimes. £600 on an average overdraft of £2k must be around 30% return. Then they pay savers 1%.

Look at the case studies at the top of the page. They aren’t worse scenarios than us. Most of them got kicked back to the customer and the fos rules in their favour. That should be a president they’ll follow. Remain optimistic.

BECKS MASH says

Finally after Barclays having my complaint for 3 months and not even bothering to look into it (despite constant reassurances it was progressing) then another 3 months with the FSO it has been allocated to a case handler! 🤞🤞

Ammi says

Hello sarah i put in a complaint with halifax regarding my overdraft i had a message after 3 week that i will get a call from them is this normal or has anyone else had a call from there bank regarding a complaint

Sara (Debt Camel) says

Some banks phone some people. It isn’t clear to me why they choose those people. So I have no idea if this is good news, bad news or they just want to ask some questions.

If they make you an offer on the phone, unless that is a refund of all your fees for the whole period, ask them to put this in writing as you need time to consider it.

If they want to go through your income & expenses now, that may mean they want to offer help going forward but it should not affect the decision about whether you should get a refund of previous charges.

If you aren’t sure why they are calling or are uncomfortable replying to any questions on the phione, ask them to oput it in an email as you find it difficult to think about numbers on the phone.

Adam says

Hi Sara,

First of all thank you so much for this website. Such a wonderful resource.

I’ve only just found out I can get overdraft fees refunded. I’ve complained to NatWest because from 2010-2020 I was almost constantly in my overdraft, usually near the max amount, which was 2K. I had a nervous breakdown in 2010 and the next decade was a struggle, I rarely had enough money for life/bills/myself. On benefits a few points, other times doing off jobs here and there and I was constantly having to top up my account just to be able to pay off the interest charge and avoid being charged for going over the limit. I spent nearly 10 years paying various fees and charges including interest. I did not gamble, nor did I get any pay day loans. I was also homeless at one point. I was pretty much living in my overdraft for those 10 years, except for a few months here and there where I’d manage to make some money working but would then be in the red very quickly. It was a nightmare. I remember there were months where I had £200 and I’d have to pay 30-50 of that towards interest charges.

In 2019 things got really bad for me and I had two credit cards, I struggled to keep up the minimum balances and had a poor credit rating. Yet I was still paying NatWest. I finally managed to clear the debt in DEC 2021 and have now been debt free since then.

I am wondering is there any chance that they will refund me from 2010-2021 etc? I managed to get all my statements from them and realised I’ve paid a fortune throughout the years.

Thank you so much for all the help you’ve given all the people above. I’ve found it really useful.

Or do you think this is a case of having to go to the Ombudsman? Also, what kind of evidence is it best to use for the Ombudsman?

Sara (Debt Camel) says

You have to start by going to NatWest.

I will be very surprised if they refund you back to 2010. But see what they offer. If it’s a refund going back 6 years (which is all a bank seems to offer), consider how much that is and whether you should accept it.

If you go to the Ombudsman, FOS may decide it can go much further back, but if you got into problems in 2010, then a refund would be from some later point where the Ombudsman decides the bank should have realised – after all an overdraft is there for an emergency. But when you have been in it all the time for a couple of years, the bank should have realised you were in difficulty.

Adam says

Hi Sara – Natwest replied to me.

I was sorry to learn from your email that you had suffered a period of ill health which affected your time as a student up to the present.

I have looked at your account history in respect of the overdraft increases on your account, ending ****, however I’m unable to investigate them for you. The reason for this is because it falls outside the time limits set by the Financial Conduct Authority for us to review complaints. These being if what you’re complaining about happened more than six years ago, and if you’re complaining more than three years after you realised, (or should have realised); that there was a problem. I have checked our records and can see that the last recorded successful overdraft increase agreed

on your account, ending ****, was done in February 2011 – this was over 11 years ago. I can see from my records that you were incurring debit interest and charges as a result of using this overdraft in 2012-2019 so you would have received a monthly interest andcharges notification – so you were aware of its existence and could have raised your concerns within a reasonable timescale i.e., within 3 years.

What can I do next? I was deeply unwell during those years and the last thing I was able to do was manage things like bank charges. They are saying I was aware of it but all I knew was that I was getting money taken out I had no idea that this could have been stopped.

“If you feel that you are struggling financially now or in the future, we want to do all that we can to

support you so I wanted to let you know we have a team who may be able to help. You can call our

Financial Difficulties Team on 0800 068 9816 and the team will be able to discuss things with you and

do what that can to help

If you’re unhappy with my decision you have the right to refer your complaint to the Financial

Ombudsman Service, free of charge. The Ombudsman might not be able to consider your complaint

if:

• the issues you’re complaining about happened more than six years ago, and

• you’re complaining more than three years after you realised (or should have realised) that

there was a problem

Sara (Debt Camel) says

Send this straight to the Ombudsman.

With overdrafts, you can almost always go back 6 years so that would be to 2016 even the “cause” of the problem was a lot longer ago as the bank should have reviewed your overdraft.

And the Ombudsman may accept your argument that you should have a refund going much further back as you were unaware that the bank should have checked the overdraft was unaffordable, you thought the bank had done nothing wrong and it was your own fault.

Catherine says

Hi Sara,

In shock,submitted Halifax complaint on 2nd of September.Received a call today upholding my complaint.

A refund of £2900,£2500 will pay the overdraft off,£400 refund plus £125 added 8% and will be paid today.

One less debt and resolved so much quicker than expected.

Advice is to include as many facts and figures in your complaint as possible,ie number of gambling transactions within a period,other debts,times you have contacted bank to ask for help etc etc

Thanks for this site once again

Mike says

Hey Sara,

Just received this from Paul Whiteing | Lead Ombudsman and Director of Casework

Assuming it’s a generic email sent to others?

Still waiting after 5 months to be assigned a case handler

Dear XXX

Your complaint about National Westminster Bank Plc

I’m getting in touch to say that I’m sorry we’ve not started to investigate your complaint yet.

We’re currently very busy, with lots of customers needing our help at the moment. That means it could still be some time before one of our case handlers gets in touch with you. I’m very sorry for this delay, but can assure you your complaint hasn’t been forgotten.

Sarah says

Hopefully this is helpful for those complaining to Barclays and cannot find an email address.

I made my complaint my using resolver end of august.

Barclays sent me a letter about a week later saying they received my complaint and would respond by the 20th of sept

Yesterday I received a text message from a Barclays complaint adviser ‘Hi. We are sorry that you have had cause to complain to Barclays. We would like to talk to you about your complaint. When is a convenient time for us to call you to discuss this? Please can you reply with a date & time that is convenient for you. If you would prefer a written response from us, reply YES to this message. Kind Regards, Barclays.’

I replied Yes as I wanted everything in writing.

They responded straight away ‘No problem. I will write out your letter this evening and it will be sent via first class post tomorrow. Kind regards – Barclays.’

I’m expecting I should receive the letter during next week. Even if they don’t accept my complaint, I can escalate to FOS.

I’ll update on here when I receive the letter.

Sarah says

Hi Sara,

Thank you for your help and this wonderful site.

I received my letter in the post from Barclays offering me 4089.16 as a good will gesture from 2015 even though I told them I made a mistake on my letter and I sent straight away I wanted it looked at from 2012.

I’ve actually had this overdraft since 2004 whist at uni but Barclays the started charging some years later possibly 2009/10.

I’m not sure what exactly I was charged from 2012 or 2015

but do I accept the offer if charges are correct + interest from 2015 or send to financial ombudsman to look at from 2012, thanks.

Sara (Debt Camel) says

is the 4089 a full refund of all interest and charges since 2015?

do you know how much you paid in charges from 2012-2015?

did something specific happen in 2012 which is why you think you should get a refund from them?

Sarah says

Thanks for the reply.

I thought you could claim from before 6 years and during that 2012 period onwards the charges were coming in regularly as I was always in my overdraft and every month getting out a payday loan.

I don’t think 4089 is correct because they do not accept they did anything wrong, the money is a good will gesture. They didn’t break down in the letter how they came to that amount.

Furthermore, I was being charged about £90.00+ a month until when the law changed on overdraft charges.

I will call Barclays and ask for a list of my charges from 2015 to be sure.

Sara (Debt Camel) says

you can claim for older than 6 years at the ombudsman. But it’s a bit random what decision the Ombudsman makes! if they have refunded ALL charges for 6 years, you may decide that is fair enough.

Do ask how much you paid in charges for 2012-3-4 too – that gives you the facts to make a decision.

AQ says

Hello, I made an affordability complaint to Lloyds for £2400 OD about a month ago. Just received a call from them upholding it. BUT they said they can only go back 6 years and last time my overdraft was renewed in July 2017 so they are willing to give back charges from that time. I told them send me a letter and I’ll think about it. He was very persuasive in me accepting the offer. When I mentioned FOS he went bonkers in telling me they will never take your complaint. Just need some help here , should I accept this offer or try ombudsman to look into it as had OD since September 2008 and always used upto the limit.

Sara (Debt Camel) says

How much are they offering to refund?

AQ says

Just checked my account , they already have put £4076 and second transfer of £152 which I think is interest

Sara (Debt Camel) says

do you know how much you paid in overdraft interest and charges for the years before 2017?

If you go to FOS, you may get more if the Ombudsman dwecides they can go back further. I think they should decide that but FOS decision on this are rather erratic at the moment so I can’t say you will definitely get it.

But you aren’t putting at risk the offer from Lloyds if you go to FOS – Lloyds have already agreed to refund you that.

Ammi says

Hi Sarah had a letter come thru the post yesterday bank paying me 7.297 in 14 days for my 3000 overdraft i had since 2016 do i need to call them to confirm or would this automatically go in my account

Sara (Debt Camel) says

I think this will happen automatically.

Are you happy with this as a resolution of your complaint?

Ammi says

I’m happy it will clear my overdraft that I couldn’t clear thankyou soo much for ur help without you this wouldn’t of happened so i wait until it come thru too my bank it did say on 28th it will stop al my interest rate on my overdraft will stop soo maybe rest arrive soon too as letter was dated from the 15th of this month

BECKS MASH says

Hi Sara

Just to let you know after Barclays ignoring my complaint for 3 months then myself passing it to the FOS in July. I have finally received a response from the FOS. They believe Barclays should refund fees and interest since March 2017. Barclays have 2 weeks to agree or disagree with the FOS.

Do you know how likely Barclays are to dispute the FOS findings or whether they seem to give in at that point?

Sara (Debt Camel) says

Barclays don’t seem to take most cases to the ombudsman levwel – fingers crossed they accept yours!

J says

Good evening, I’ve been reading through the comments. It’s encouraging to read many success stories.

I wanted to ask if anyone has had any success with RBS. Did you write to them through a claims portal or via email? From start to finish how long did your complaint take from submission to a decision from RBS or the ombudsman.

Many thanks for your help

Sara (Debt Camel) says

it doesn’t matter how you send a claim in, the result is the same. I suggest email.

Decision times are pretty random unless you are complaining about something over 6 years old, in which case you may get a rejection quickly and need to send it to the Ombudsman who can look at older complaints.

You cannot rely on getting a good decision quickly – many strong complaints are rejected and have to go to the Ombudsman.

J says

Thanks Sara. I will email them about an overdraft i had in 2015

So in this instance can go back further than 6 years? As between December 2003 and early 2009 i pretty much stayed in an overdraft between £1500-2000. i took out a loan to repay this. Or is there no chance in making a claim dating back 20 years.

Sara (Debt Camel) says

I think there is virtually no chance of a claim between 2003-9.

mark says

RBS rejected my complaint, standard template reply….I sent it to FOS, allocated to case handler after many months….A week later the case handler has written to RBS finding in my favour and asking RBS to refund all charges from December 2016. I

I did get out of my financial mess in September 2017, but i was getting charged up to £50 per month for the overdraft

was in overdraft from 2006, but sadly FOS would only look at my case from 2016 onwards.

Ben says

RBS rejected me also after a few weeks wait but they gave a good will gesture of £230…the equivalent to one months charges.

FOS ruled in my favour recently almost four months later and I was refunded £4450.

Stick with it!!

Best of luck.

Mara says

Dear Sara,

I hope you are well.

I would like to get your advice on something. I have used the email that you have mentioned for my Barclays overdraft complaint, and today I got the response from Barclays complaint handler. She has tried to call my number and alternatively wants to write a letter to my UK address. She mentioned that she doesn’t want to use email as it is not a save way for communication. The problem is that I don’t live in UK for 2 years now, moved to EU due to family circumstances. Is it reasonable for me to give my European number or better give my EU address for a letter? Will it affect my complaint in any way?

Thank you in advance

Sara (Debt Camel) says

Being abroad won’t affect your complaint.

I suggest you tell her the problem and give her your contact details abroad. But you could say that you are perfectly happy to carry on by email.

Tom says

Hi

I was wondering if anyone could help me please.

I made an affordability complaint to Halifax for my overdraft. I took out an overdraft but I was constantly in my overdraft when I was offered a higher amount.

I took out a higher amount and had that for approximately 2 years. I complained that they give me a second overdraft, I also complained that my credit score wasn’t good I didn’t have any creditors it just wasn’t good and also that I took out the loan even though I wasn’t fully aware of what I was doing because of my mental health and I provided medical evidence for this. The overdraft was £1000, they cleared £600 in interest but told me that needed to go towards paying off the overdraft so I’m left with having to pay them £400, so my balance will show minus £400 from tomorrow and my overdraft has been stopped. They also told me I could have the remainder £400 wiped off if i provided further medical evidence because the evidence i provided wouldn’t be suitable, im assuming because it was from two years ago when i first took out the overdraft. I also told them i thought a contract was void by law if a person had mental health and didn’t understand the contract but they told me no because they didn’t know about my mental health. Doe’s this all sound right? Any help/advice would be appreciated thank you.

Sara (Debt Camel) says

What is your current financial position like – what other debts do you have? do you have any arrears on bills?

Tom says

Hi Sara

Thank you for your reply!

My current situation is I’m unemployed and claiming sickness benefits, I have no other debts and no arrears on any bills. I’m not being greedy I just thought based on everything mentioned in my previous message that they would have cleared the overdraft of £1000 and paid the interest back on top of that. Thanks

Sara (Debt Camel) says

I asked about other debts, if you had a lot of them tackling them one by one may not be the best option.

I am not suggesting you are greedy, just trying to get the full picture.

If they have removed the interest they charged – that is what the Ombudsman says they should do in 95% or or more of cases.

What evidence about your mental did did you provide and what have they now asked you for?

Whether a contract is void because of mental capacity does depend on the facts of the case. It is usually simpler to give them more evidence if they are asking for that rather than argue the legal point…

Whilst this is going forward, I suggest you get a new account with a different bank and switch to that – worst case then is the overdraft isnt cleared but you just pay a £1 a month to it and ask them to freeze interest.

Tom says

Hi Sara

Thanks for the reply.

Great advice thank you!

The medical evidence I provided was from my GP report on my medical file and also some evidence from the psychiatrist.

They haven’t asked for anything specific just that if they were to wipe the remaining debt they would require further medical evidence because what i provided wouldn’t be any good. I will look into opening a new account, thank you for the advice

Sara (Debt Camel) says

I suggest you go back and ask what sort of evidence they would require.

Ceri Thomas says

I had been in conversation with Lloyds about aa unfordable overdraft given to me in late 2008.

I explained no affordability checks were made and I was on and remain on Disability Benefits.

Lloyds at one point removed my benefits for payment of my overdraft.

In 2010 I was went into a Debt Management Programme, By this time Lloyds had sold my debt to a third party..

Speaking to Lloyds they say the account is closed, I have not closed it and payments for my shares with Lloyds go into this account, so I asked where is that money, I received no reply.

I have taken my complaint to FOS, the lady I am dealing with is not really helpful.

The most recent reply state, ‘ she cannot comment as they haven’t investigated my complaint issue!.

They will only consider to investigate if there were exceptional circumstances, she says from what I have told her there is none!

Is she asking me to tell the FOS why the delay, I explained the debt was sold etc.

Is she asking was there something in y private life that caused the delay?

Such as a death etc?

She said I can disagree and have my complaint read by an Ombudsman.

I really didn’t think I had to put personal issues in my complaint, I will if needed.

I think I will ask for my complaint to be read by an Ombudsman.

Any comments/ advice would be great.

Sara (Debt Camel) says

Most banks will reject complaints about things that happened more than 6 years ago so these have to go to the Ombudsman. Send your complaint to FOS now.

When a debt is sold, the account is closed.

If you own Lloyds shares where the dividends should have been paid into that account, you should ask them to explain where the dividends have gone – it may be they have passed them on to the debt purcaher, but you are entitled to an explanation about this and a statement of account that shows what has happened.

Ceri Thomas says

Thank you for your reply.

I replied as advised to the FOS and laid my life out.

Telling her that my mum had passed away, I had lost a sister in law through medical negligence negligence , taken on a Trust and won.

Also that I had been in hospital myself and continue to have treatment for a skeletal injury.

plus that my brother passed away and two very close friends, resulting in me attending counselling.

I really didn’t want to put this to writing but I did, her reply received today, 27th October was, no there re no exceptional circumstances in my case.

Should I wish to refer the case to the Ombudsmens he will forward it on.

Needless to say, yesI do want it forwarded on.

My life was upside down emotionally and continues to be, what does this person who is ‘helping’ me class as exceptional circumstances?

Kind regards

Ceri Thomas

Sara (Debt Camel) says

I hope the Ombudsman looks at this with a fresh pair of eyes.

Ceri Thomas says

Hi Sarah

Just received a reply from the Ombudsman, which surprised me how quick the repl came through.

Ombudsman’s decision is that I left it too late even though he sympathises and acknowledges why it was left so late.

But because I had spoken to Lloyds in 2015 I could of addressed my issues with them then.

I can’t remember talking to Lloyds in 2015, I do wonder how anyone was made ware of this because the FOS said they had not read any paperwork from Lloyds during my case.

So is that the end of my complaint now, can I do no more?

Kind regards

Ceri Thomas

Sara (Debt Camel) says

did you tell FOS you have no recollection of speaking to Lloyds in 2015? And asked what evidence there is about that call?

Ceri Thomas says

Hi Sarah,

Thank you for all your help with this matter.

Sorry for the delay I have been ‘digging’ through my Lloyds paperwork.

In reply to your comment on 18th.Nov.

I have found evidence of why I contacted Lloyds Bank on the dates they say.

I was asked by the Ombudsmen to contact my Local branch about a PPI letter.

Also I had received a letter saying my debt was paid in FULL. My Debt Management Company asked me to contact Lloyds to clerify before they responded.

This was 2015, my debt was not paid off until 2018!

On all occasions no one from lloyds would speak to me about my account because the account was ‘archieved’!

Do I follow up and pass this information onto the Ombudsman?

Kind regards

Ceri Thomas

Sara (Debt Camel) says

yes, do this straight away.

Ceri Thomas says

Hi Sara

On your instructions 21st Nov.2022 I sent all the information that showed the evidence why I had contacted Lloyds on the dates they say.

The FOS has just responded to me, (1/12/2022) stating the ombudsman”s mans decision is final and cannot be changed unless there was an error.

The information I supplied does not provide the error. The Ombudsmen decision stands.

Is that me done?

Thanks for all your help and support

Kind regards

Ceri

Sara (Debt Camel) says

I am sorry it is. There isn’t anything more that can be done here.

mark says

thats the FOS got back to me….

RBS have contacted them and agreed to repay me interest and charges from March 2016 to September 2017……I cleared my overdraft at that point as i received a hefty lump sum when i took voluntary early retirement…

I will get back 700 plus 8 per cent on top of that……Really is worth sending to the FOS when banks issue their template rejection letter…

C says

My overdraft with Lloyds was taken to over £3000, when at the time I wasn’t even working. I was on the phone to them one day about another issue and I was asking for help, and I made a throwaway comment ‘you should never have given me the overdraft in the first place’. They then took this as an official complaint, investigated it and declined my complaint based on the fact that I’d had to request the overdraft increases. It had started at £500 and worked its way up over about a year.

As I didn’t realise that they’d taken it as a complaint, (I didn’t even realise I could complain about this) and therefore investigated it as such, and I didn’t know about the 6 months to send it to the ombudsman, so I didn’t.

When I mentioned this in a comment before you said that I could raise another complaint but with different wording. Their letter states that they investigated my comment that they should have never given me the overdraft in the first place. But in their write up they have referred to the increases that were made. Can I now complain and say that they should never have increased my overdraft limit after the initial £500? Because they’ve mentioned this, although they’ve stated that they investigated giving it to me in the first place.

Sara (Debt Camel) says

As I said before, you can’t make the same complaint twice. So it really matters what the first one was about.

From what you said at first it sounded as though you only complained about being given an overdraft in the first place.

But you then said their response said “Their complaint letter states that my complaint was that I was unhappy that they gave me an overdraft with no means to repay it, and the £3000 is now more than (and always has been) three times more than my monthly wage. They said that I feel the bank did not act responsibly by providing me an overdraft.”

Which suggests that they treated this as a complaint about the original overdraft and the increases.

So I said you had to go back to the ombudsman, not complain again to the bank. I think if you complain againt to the bank about the limit increases they will just say they have already responded.

If you cant get FOS to agree to look at this it isnt clear there is anything else that can be done.

C says

Thank you for finding that, I just couldn’t find it.

Their first paragraph of their complaint response stated that they were investigating, ‘you should never have given me the overdraft in the first place’.

I was hoping I could complain that they kept on increasing the overdraft, as I didn’t ask them to look into that on my initial complaint. Well I didn’t ask them to look into anything, but they did.

But in their response they referred to me opening the £500 overdraft, then said that each time they increased I clicked the button and filled in their mini form saying I understood what I was getting into. I couldn’t ever afford it, I wasn’t working when they gave it to me and increased it, my only income was universal credit and child benefit. And when I went back to work it was part time due to childcare and my wages were less than a third of the overdraft. Lloyds bank was my only bank.

So really I was wondering if I can ask them to look into the increases because even they haven’t claimed that I asked them to, even though they have mentioned them within their response. I can’t take that to the ombudsman as it’s been too long, and when I did find out that I could have done that, it was at about 9 months, I phoned the ombudsman and they said they wouldn’t accept it.

Also, if I can’t complain again, and I get taken to court for it, can I bring up irresponsible lending as a defence? The balance remaining is almost all, if not fully, just their charges now

Sara (Debt Camel) says

Have you actually sent this complaint to the Ombudsman or just talked to them on the phone and they said they would not take it?

Two optuions are:

1) to try to get FOS to take the complaint on the grounds that you never made an affordability complaint about the increases (I don’t know how likely this is to work)

2) to send Lloyds a new complaint saying that they have not treated you fairly since the 2019 complaint as it should have been clear in the annual reviews of your overdraft that it was unaffordable so you would like a refund of charges from that point. Do you know how much you have paid in charges since then?

I think realistically you would struggle to argue this as a defence in court. What is your current financail situation?

Dawny says

Hi Sara

good news, I went to the ombudsman in June 2022 and never expected to hear back until sometime in November as they have a backlog. I had an email back today to say that Santander have offered me all the interest back from 2016- March 2021. The overdraft was paid off by me in Jan 2021 but they still put charges on until March 2021. this amounts to £1532.26 and they are paying 8% on top of that which brings the total repayment to £1654. I am amazed and so thrilled I took your advice. I really appreciate your help. thanks so much :)

Sara (Debt Camel) says

Another comment saying Santander make a good offer when its sent to FOS after first rejecting it.

I am now aware of similar 5 cases since October.

Catherine says

Hi All,

Any one had a recent decision from Santander about unaffordable overdraft lending.

Not seen many about Santander.

8weeks up on 1st of November for my complaint.

Sara (Debt Camel) says

Here is one https://debtcamel.co.uk/get-refund-overdraft/comment-page-4/#comment-496428 where Santander turned down the complaint (or offered £50 goodwill payments) and so he went to the Ombudsman. Then Santander came back after a few months and offered him a full refund… so persevere if they reject yours!

Greg says

Few week back, got a letter from Santander washing their hands of the matter. I had already sent it to the Ombudsman as the 8 weeks was already well past. Got a few emails from the FOS telling me it was months of work outstanding so expect a delay. Expected movement early 2023.

Yesterday I got an email from the FOS telling me I have 7 days to accept or refuse all interest and fees plus 8% from 2016. Must be close to 4k when I tot it up.

Keep at them. Provide as much evidence to show constant overdraft usage, unaffordable interest etc.

Thanks Sarah… your a star 🌟

Sara (Debt Camel) says

I am now aware of several cases since October where Santander make a good offer before the Ombudsman even looks at the case

Saz says

Hi,

I don’t know if anyone can help me? my complaint has been with FOS since early May which has been 6 months and is still waiting of a case holder? looking at comments people have sent in after me and already had a response and case handler given. do you think there is a reason for this? is this not good sign?

Thanks

Sara (Debt Camel) says

A lot of overdraft complaints are being picked up pretty quickly at the moment. Are you complaining about anything else as well?

Saz says

No just overdraft. I ended up ringing and they said it’s just waiting for case handler said it should be any day due to being on there since may. and they have all the information they need from Halifax. Only thing I can think of is that it’s because it’s complicated case?

Sara (Debt Camel) says

I don’t think so. That suggests someone has looked at and thought about your case and put it in the “complicated” pile (which so far as I know doesn’t exist). I don’t think that happens before your case is allocated to an adjudicator.

Catherine says

I sent my case to FOS against Santander a few days ago and they said it could be a few weeks to set case up and 4 months to investigate.

Although my complaint was addressed in 2 parts and they upheld the unaffordable overdraft part and have refunded charges bar 3 months from when I first added overdraft but I had a lot of other issues that I don’t think have been resolved fairly in regards to support and account management and gambling related harm that they have not upheld or offered comp for the poor support.

I had asked for card and account to be blocked multiple times since 2021and they didn’t do anything.

My father passed away I had no support among other things.

There final response was that it’s not their fault that their blocking features don’t work very well it’s Mastercards fault.

My point is they failed to act when they were fully aware of my issues and this resulted in harm.

Don’t know what the FOS take on it will be but I’ve read lots of case studies about gambling related harm that were upheld and those were customers that hadn’t told the bank of their issues but I did,and multiple times too,so hoping FOS say they should of done more.

BECKS MASH says

What does this actually mean and how long can Barclays just go on ignoring the FOS?

Unfortunately I still haven’t received a response from Barclays. I have therefore escalated this complaint to our operational contact team. This team will liaise with Barclays management.

I appreciate your patience and understand it can be frustrating having to wait for a response. I will continue to keep an eye on this and will be in touch again once I have further updates.

Sara (Debt Camel) says

remind me what stage your complaint is at?

BECKS MASH says

It was with Barclays April to July. After the 8 weeks and no response I sent to FOS, they came back start of Oct to say they believed Barclays should refund all charges etc from March 2017. Barclays had until 17th Oct to respond. They then have them till 31st Oct. Still nothing

Sara (Debt Camel) says

At some point the adjudicator will give up and put your case in the queue for a second level “Ombudsman” decision. In 90% of cases that is the same as the adjudicators decision.

An Ombudsman decision is legally binding and Barclays can’t ignore it.

Richard says

My Iva failed, can I still complain to my bank regarding overdraft

Sara (Debt Camel) says

Was the overdraft included in your IVA?

How long ago did the IVA fail and why? What are you doing about the debts that were in the IVA?

Richard says

Hi Sara

Yes the overdraft was included.

Iva started 2019 and I terminated it this year after being missold it. I had complained.

The other debt ive contacted them to arrange repayment and also have sent unaffordable complaints in.

Sara (Debt Camel) says

Was it missold because it was unaffordable? Or because you did not need a form of insolvency?

If you win an affordability complaint when you owe a balance, the refund is first used to reduce that balance. Which is presumably your main priority.

If there is a cash refund free that it may be claimed by your IVA firm, or it may not. I don’t remember seeing a case like this recently..

Dawny says

Hi Sara thanks for your help. I received a refund from Santander with regards to an unaffordable overdraft. I received a payment of £1965.03. I thought I would get nearer to £1600 and would have been happy with £250. The letter states that they gave me 8% annual interest but deducted £108 for income tax at 20%. It states that I can claim this back if it does not exceed my personal savings allowance. does it?? I am on a low wage but pay normal income tax and have a standard tax code. I have very little in savings (£2000 this has now gone up to £3900), and receive minimal interest. so my question is how do I know if the £108 they deducted for income tax can be claimed back as I am unsure what my personal savings allowance actually is?

Sara (Debt Camel) says

Yes you can claim that back. See https://debtcamel.co.uk/ppi-payday-refund-get-back-tax/

Helena says

My husband has an overdraft with Natwest for £2,400. He is constantly in it. He has been with Natwest since he was 16 (he is now 37) he cant remember when it was increased to £2,400 but it was at some point. As he has the overdraft for a long time can we still put a complaint in?

Sara (Debt Camel) says

So he is in it every day of the month?

Helena Gray says

Hi Sara,

Thank You for coming back to me so quickly. Yes, when he gets paid it does clear him by £870 however once we pay our bills he is back in it which is straight away as he will transfer to our joint account etc. Also up until last year his overdraft was always more than his monthly wage. Its only in the last year his monthly wage is more than his overdraft.

Sara (Debt Camel) says

Ok so this definitely worth a complaint. He should hope to get back the last 6 years overdraft fees. If he goes to the Ombudsman he may get back more, but decisions for more than 6 years are erratic.

Stu says

Hi, Any examples of how easy TSB are to deal with regarding overdrafts/affordability complaints?

I essentially live in a £3000 overdraft, even when wage goes in it doesn’t clear it and each month I end up back at the max of overdraft. This has been the case for about 4 years now and before that the overdraft went up in 4 or 5 increments from £1000 and eventually £3000 despite my wage never ever been in excess of £2000 nevermind £3000.

I have debts and at the time of increasing overdraft was in desperate mindset and things spiralled. The past 3 years have seen me stabilise finances – repayment plans are in place elsewhere and steadily paying things off but overdraft monthly fee is £70 and I’m just stuck in it.

I haven’t been contacted by TSB ever regarding a review or if I’m having difficulties etc.

At the time it would have been very clear reviewing my account that there were financial difficulties and although no-one is knocking on my door now, I am still heavily repaying debt in many areas plus this £3000 overdraft – I am stretched to the limit.

Is there any case here to submit an affordability complaint with TSB?

Sara (Debt Camel) says

Definitely. Point out in your complaint that your wage is less than the overdraft so you are not able to start to reduce it and say this “hardcore borrowing” is a sign of financial difficulty they should have noticed years ago.

If TSB reject it, or make you a Poor offer, send this to the Ombudsman.

Stuart Riby says

Hi Sara. An update on this one with TSB.

After putting in the complaint at the end of November I received acknowledgment of the complaint and just before Xmas another letter stating a response would be sent within 14 days.

I have yet to receive an official response to the complaint not have I spoken to anyone from TSB but today I logged in my online banking to find the £3000 overdraft taken away and a further deposit of £570.

The transactions were listed as a series of payments all referencing ‘monthly OD usage fee’ and older charges. Plus the deposit of £570 after all the itemised fees were put in.

This is incredible and I’m over the moon, such a long time worrying about how I could ever begin to deal with it before finding this website and less than two months later I have no overdraft and a positive balance for the first time in years!

Thank you so very much, I will be spreading the word of your wonderful website.

Final question – I assume I will be receiving some communication shortly about the result of the complaint and what they have refunded me. Do you have any further advice – I haven’t formally accepted anything as I haven’t spoken to them. Once I review what they have paid back and how far they went back if I believe their refund low can I still take it further?

Sounds like I’m being greedy, more curious, I’m delighted with the outcome already.

Thanks again!

Sara (Debt Camel) says

Curious is good – wait until you get the response and then come back and say what it was and if you think it should be more.

There must be some 8% interest added in there and that will have tax deducted – you can reclaim up to £200 of tax deducted from HMRC , see https://debtcamel.co.uk/ppi-payday-refund-get-back-tax/

Neil says

Hi Stuart,

In a very similar situation to yourself (a £3000 overdraft with TSB) that I have been living in despite my wage being paid in every month. Like you also, has been the case for about 4-5 years now. I had 19 increases in total over the course of 7 months with multiple increases on the same day. I have had no contact from TSB whatsoever, I’m assuming because they’ve managed to successfully take the fees every month as it is the account I get paid into. I haven’t gone into an unarranged overdraft in 2 or 3 years however it has nonetheless still been a financial burden on me. I am currently paying back 4 unsecured loans, and ironically last month finished paying back a £500 loan from TSB. I have submitted my complaint via the app through the chat today, but have yet to receive an official acknowledgement outside of what seems to be an automated response “we’ve passed your query on to the relevant team. We’ll get you connected to an agent soon”

Just curious as to how the process went for you? Having seen your outcome, I am hoping to hear something similar back from them so I can finally see the end of this.

Stuart says

Hi Neil,

To be honest, it couldn’t have been easier or more straightforward – I couldn’t believe it

Once I had put in the initial complaint at the end of November (I used the website) I didn’t have to anything at all.

I, like you, received the immediate acknowledgement. I received something similar via letter shortly after and then towards the end of December received another letter saying I would hear about their decision/response within 14 days.

Within those 14 days all fees were paid back into my account, overdraft cleared and removed plus a bit more from the interest.

I still haven’t had any communication from them by letter, email, in-app inbox etc about the payments or how they came to the decision – just logged in one day and it was all done.

Very best of luck, I hope it goes the same way – the feeling of relief when checking my account is still with me even though it’s been a few weeks.

Kim says

I have recently had my claim agreed and accepted with virgin/clydesdale after going through the FOS and I am currently waiting to hear the final calculation of refund from the bank (anyone have any idea how long this will take?). All interest to be repaid for last 6 years and if once the refund clears my overdraft which is set at £2400 any extra that has to be repaid to me plus 8% – I am expecting the full refund to be around £3500. My question is – at present I am in my overdraft by around £1500 – would it be of any benefit to me to clear this overdraft prior to the calculation and refund issued or will it make no difference? I was thinking possibly I would be due more interest if there was no as much of the refund used to pay off the overdraft (if that makes sense). Any advice gratefully received!

Sara (Debt Camel) says

It will make virtually no difference as the 8% interest is per annum so if you have only cleared the account for say two weeks before the calculation you would only get an extra £5. Not worth the hassle as it may delay the calculation.

PS nice result!

Rachel says

Hi Sara,

Firstly as always many thanks for your help, I got thousands of pounds back from various payday loans with your templates, thought my days of refunds were over till I saw this about overdrafts, about two weeks ago I complained to NatWest about my £2500 overdraft using your template, which I have been in for years and years getting charged around £60/£70 a month interest, I was in a payday loan cycle from around 2015/2019 can’t remember exact dates but currently don’t have any just CCs and overdraft, NatWest have come back saying they haven’t done anything wrong but as a goodwill gesture given me £191 which equates to three months interest charges I have paid, is it worth sending this to the FOS? Thanks in advance

Sara (Debt Camel) says

Are you in the overdraft all month?

Your credit cards – does that include one from NatWest?

Rachel says

Thanks for the reply Sara yes I am in the overdraft the entire month even when my pay goes in, no but I have a loan from them? X

Sara (Debt Camel) says

Then definitely send this to FOS – being in your overdraft like that is “hardcore borrowing” and NatWest should have noticed you were in difficulty.

The loan – how large was it and what interest rate?

Rachel says

Okay thanks so much for the advise I’ll send it over , there are actually 2 one for 7k and one for 10k x

Sara (Debt Camel) says

what were the interest rates on the loans? because if the bank new you were in the overdraft all month, then perhaps they shouldn’t have given you such large loans?

Rachel says

They are 20% will that be a separate complaint?

Sara (Debt Camel) says

Ouch! So your bank knew you were in difficulty or it would never have charged so much interest.

You could have started this as a single complaint originally but now it’s easier to send the OD one to FOS now and start a new complaint.

In the OD conmmplaint going to FOS, mention that NatWest also gave you two expensive loans over this period and you are making a seperate complaint about this. point out that NatWest should have seen from the OD that you couldnt afford the loans and you applications for the loans should have meant they looked at your overall situation and realised your overdraft was already unmanageable.

In the loan complaint (use the template here https://debtcamel.co.uk/refunds-large-high-cost-loans/) add in a sentence saying you have already made a complaint about your overdraft which has been sent to the Ombudsman, this is in addition to that complaint and they should have seen from your ovrdraft that you were struggling anf could not afford such large loans.

Rachel says

Thanks so much Sara, I have sent the OD one to the FOS, do you think I should wait till that’s all done and dusted before I raise the complaint on the loans? How does it work tho because I still have quite a few years left to pay on the loans I have only ever had refunds back from loans I have paid off with other loans so if you still have the loans what happens if they do agree to pay back the interest but then it won’t be enough to clear the loans do you just carry on paying the interest again till the loan is done? Hope that makes sense! X

Sara (Debt Camel) says

do you think I should wait till that’s all done and dusted before I raise the complaint on the loans?

No, get on with it now.

if you still have the loans what happens if they do agree to pay back the interest but then it won’t be enough to clear the loans do you just carry on paying the interest again

What happens is that the balance is adjusted so that in total you only have to repay what you borrowed. eg you borrow £1000, have paid £700, the balance is £550. If you win the complaint the balance is adjusted to £300 which you pay off at an affordable rate. At the end you have repaid £1000, what you borrowed, no interest.

Catherine says

Hi so I had a Santander overdraft complaint upheld,the refund was used to clear some of the overdraft so still a balance left to pay and I was told to contact the financial support department to arrange a repayment plan.

I’d already stopped using the account when I put the complaint in.

They have said that either I repay the arranged overdraft left in my own time but interest and fees would continue to be added?????but it would not effect credit file.

Confused as surely if I did that I could submit another complaint that they continued to add interest on a already upheld unaffordable overdraft complaint??

Or they remove the arranged overdraft facility and put it as Unarranged and they would stop interest and account fees and I pay whatever a month to reduce it,but this would be a informal arrangement and they will record as in arrears on credit report and may default down the line??

Surely if the overdraft had been deemed irresponsible to lend I should have a affordable repayment plan with no interest on it and account should be not have negative markers on credit file??

I can’t use the account other than to add funds to be used to reduce overdraft and once paid it will be closed.

Fine with that as Santander is shocking.

Sara (Debt Camel) says

could you say what the words Santander have used are about how much they are refunding you and why.

Catherine says

Following our review, we have made the decision to refund all charges related to your usage of your arranged overdraft facility since 1 July 2018, these refunds have already begun to be processed and this action we hope to be fully completed within the next 7-10 working days. Once this has been completed, we will then arrange for the overdraft facility to be reduced by this amount and ask our Financial Support Team to contact you to discuss the next steps for setting up an arrangement for repaying the overdraft amount.

Sara (Debt Camel) says

And how large is the remaining balance?

Catherine says

£1856 left to pay

Sara (Debt Camel) says

That’s quite a lot. I was going to say if it was a couple of hundred it may be simpler to pay it off over the next few months.

I suggest you go back to Santander and say unless they allow you to pay this off without further interest being added and without this harming your credit record, you will be sending the complaint to the Ombudsman.

Catherine says

I said I would seek some advice about whether if I enter plan with interest stopped if they are even allowed to record negative markers given it was unaffordable to lend in the first place.

Like I said they said if I didn’t want it to harm my credit file then they wouldn’t put a plan in place I would just pay it down on my own but they would start to add interest and fees again.

I said that wasn’t an option as I wouldn’t be able to pay anything off it if they added interest again.

He then confirmed again if they freeze interest on remaining balance they would record negative markers and possibly add a default.

I’m not sure why it’s an informal arrangement when as part of the resolution they said to contact financial support and put a plan in place. I have,so is that not a formal agreement?

Want to make sure I’m understanding what they should/shouldn’t be doing so I know whether to make another complaint.

Sara (Debt Camel) says

I think this is all part of your current complaint, so you don’t need to start a new one. It isn’t reasonable to refund over several years and still leave you with an overdraft you will struggle to pay off if they carry on adding interest.

Tell them unless they agree to let you pay this off with no more interest being added and with no impact on your credit record, you will be sending the complaint to the Ombudsman.

The distinction here between formal and informal isn’t really relevant, I suggest not getting bogged down with it.

Catherine says

This was one of messages from financial support-

I need to be open and honest with you.

No formal arrangement has been agreed today and so your credit file will not show an arrangement flag.

***But I’ve filled in a budget planner and agreed to pay a set amount each month to pay balance

As your account will soon move into an arrears position, the arrears will show on your credit file too.

**** why would it be in arrears??

If you do not want your credit file to be impacted then there is an option not to do anything further and for you to manage the balance and any interest and account fees on your own.

***surely as the overdraft was deemed irresponsible lending then adding interest wouldn’t help

Sara (Debt Camel) says

***But I’ve filled in a budget planner and agreed to pay a set amount each month to pay balance

An agreement to pay is not a formal legal contract. There is no point in arguing with them about this.

**** why would it be in arrears??

Because you are not paying the standard charges associated with your type of account.

***surely as the overdraft was deemed irresponsible lending then adding interest wouldn’t help

Exactly. This is an unreasonable position for Santander to take after they have agreed your overdraft is unaffordable. Tell them this and say it goes to the Ombudsman if they won’t change their mind.

BECKS MASH says

Hi all. Any one have any experience with Barclays? The FOS have upheld my claim and said Barclays need to refund interest and fees from March 2017. Barclays have now agreed and the FOS have given them to Dec 5th to pay the redress. What I am asking is how likely is Barclays to meet that deadline. They have failed to meet every other deadline from initial complaint to FOS deadlines.

Ernest says

Good evening Sara .pls l need your advice for a friend about Halifax overdraft complain…£2350.

Halifax didn’t treat Ms D fairly and reasonably. I don’t think that Halifax did treat Ms D unfairly or unreasonably here though. I say this because having looked at Ms D’s statements I can’t see anything to suggest that Halifax ought to have realised she might have been experiencing financial difficulty prior to it being notified of this.

Ms D may argue her regular use of her overdraft was in itself an indication that she was struggling. But while I’m not seeking to make retrospective value judgements over Ms D expenditure, nonetheless there are significant amounts of non-committed, non-contractual and discretionary transactions – in particular regular spending on high end retail shops.

There were regular credits and cash transfers into the account and Ms D was able to bring the overdraft down and sometimes pay it off before once again going on to use her overdraft to make debit card transactions, further money transfers and cash withdrawals. I accept this doesn’t necessarily mean that Mrs I wasn’t experiencing financial difficulty. But there isn’t anything in these transactions in themselves which ought to have alerted Halifax to any potential financial difficulty. And although there were periods of time where Ms D didn’t see a credit balance Ms D kept within her limit and was often at the lower end of it.

Sara (Debt Camel) says

It sounds like a normal decision to me. Unless you disagree with any of the facts?

BECKS MASH says

8 months and Barclays have finally paid up £7750 in returned fees/charges!!! Happy dance right now

cyrilv says

Sent my complaint against Halifax end of July, they received it early August. Since then nothing except a pro-forma reply when I asked them about my claim in November. No case assessor appointed yet, nothing. Is this normal, even allowing for the fact that FOS are sure to be busy? What kind of time scales are people here getting in between sending off their complaints and the cases being picked up by the handlers?

Sara (Debt Camel) says

the comment above said 8 months from start to being paid.

Max says

Hi Sara,

Good news! It appears I’ve won my case against Halifax (detailed previously on this thread) at long, long last as Ombudsman has partially upheld my complaint in a provisional ruling after an adjudicator threw it out completely back in the summer.

I wanted them to go back to even before the 2012 OD increase from £900 to £1,600, but ruling is only the early 2013 hike to £2,000 was unaffordable.

That said, Ombudsman said at that point financial distress should have been obvious and forbearance initiated, hence decision is a refund of ALL interest, fees and charges from February 2013.

Am happy with that as worth over £4,000 plus a good few hundred pounds in simple interest. Process has been a long one given another Ombudsman first had to rule they could go back that far under the three-year rule.

Best of luck to everyone else with similar complaints.

Max

Sara (Debt Camel) says

That is good news.

Max says

Hi Sara,

Final update: Halifax accepted the Ombudsman’s provisional decision and the final decision (same as provisional) was taken a week ago.

Today, slightly more than £5,000 has hit my account via two payments and the overdraft facility withdrawn, as per the Ombudsman’s instructions.

I’ll lose some of the £1,000 simple interest to the taxman, but c’est la vie.

Whole process took about 20 months and I sent as evidence to support my case a whole load of docs, including that from a SAR to Halifax.

Between 2012 and 2021, I utilised my OD around 93% of the time (nearly 3,400 days) and often went heavily back into it just a few days after my salary was paid in, meaning there was a clear pattern.

The Ombudsman noted I ended up turning to payday loans and high-cost credit and that “the fact that Halifax continued to allow him to use his overdraft in the same way notwithstanding the annual reviews which took place and what was happening on his account, is further reason why I’m satisfied that Halifax failed to act fairly and reasonably.”

Cheers,

Max

AQ says

Hello, Lloyds upheld my complaint partially 2 months ago and paid back interest citing 6 year rule. Should I go to ombudsman and ask to go even before 2017. Thank you

Sara (Debt Camel) says

so Lloyds paid you back 6 years of interest and charges? Did they ask you to accept the offer or did they just pay it without you accepting it?

AQ says

They just paid it , I told him over the phone I don’t accept this offer and he went so you don’t want me transfer money then and the money was in my account within half an hour ,I told him I’ll go to ombudsman to which he replied I can tell you categorically ombudsman will never take up your case as they can’t go back prior the 6 years. But in the letter he did mention you can take your complaint to ombudsman.