Have you had big overdraft problems for a long period?

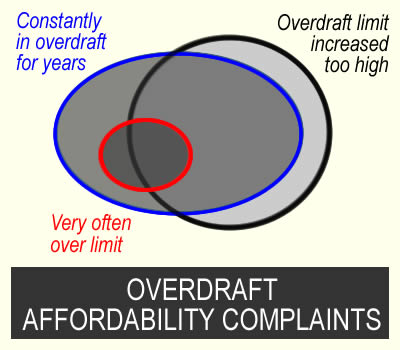

You can make an affordability complaint and ask for a refund of overdraft charges if:

- your overdraft limit was set too high at the start or increased to a level you are unable to clear; or

- your overdraft usage showed you were in long-term financial distress. For example, being in the overdraft all the time, or using an unauthorised overdraft a lot

- your overdraft was originally a student account with no charges, but now interest is being added and you are in the account all or almost all of every month.

This article shows how to make an affordability complaint to your bank, with a free template letter to use. If the bank doesn’t make a you a good offer, it is free to take your case to the Ombudsman.

These complaints do not hurt your credit record. And

Contents

Overdraft affordability complaints

Overdrafts are supposed to be for short-term borrowing

Overdrafts are intended to be used for short-term problems, not as long-term borrowing. A bank should review a customer’s repayment record and overdraft limit and if there are signs of financial difficulty, offer help.

One sign of financial difficulty is hardcore borrowing for a long period. The Lending Code defined hardcore borrowings as “the position where a customer’s current account overdraft remains persistently overdrawn for more than a month without returning to credit during that period”.

Some Ombudsman decisions

All cases are very individual. But these examples give you an indication of what the Ombudsman thinks is important.

In this NatWest decision, the Ombudsman decided:

NatWest did have an obligation to monitor Miss K’s use of her overdraft facility.

Any fair and reasonable monitoring of Miss K’s overdraft facility would have resulted in NatWest being aware Miss K was in financial difficulty … by October 2014 at the absolute latest. So NatWest ought to have exercised forbearance from this point onwards.

In this Santander case, the bank didn’t notice hardcore borrowing:

By this point, Miss C was hardcore borrowing. In other, words she hadn’t seen or maintained a credit balance for an extended period of time. Santander’s own literature suggests that overdrafts are for unforeseen emergency borrowing not prolonged day-to-day expenditure. So I think that Miss C’s overdraft usage should have prompted Santander to have realised that Miss C wasn’t using her overdraft as intended and shouldn’t have continued offering it on the same terms.

Decide which reasons apply to your overdraft complaint

In the overdraft all, or almost all, of the month for a long while

This is the most common reason for winning a complaint

Overdrafts are meant to be used when you have a short term problem. Using the overdraft a lot for a few months is fine. Or for a few days at the end of a month before you are paid.

Banks should review your overdraft annually. This is in most overdraft terms and conditions. And even if it isn’t, the Ombudsman says this is good industry practice.

So at one of these reviews, your bank should have seen if you were in difficulty with the overdraft. For example if you are in the overdraft for all (or almost all) of the month for a prolonged period. Or if you were often exceeding your arranged overdraft limit.

I would say over 18 months or 2 years is prolonged borrowing, not short term.

The bank set your limit too high

This may have been from the start when you were first given an overdraft. Or the initial low limit may have been fine, then the bank increased it to a level which it was impossible for you to repay.

If the bank saw signs of financial difficulty, it should not have increased your credit limit, even if you asked for it. And it should have considered offering your help instead (the regulator’s word is forbearance), for example by stopping charges.

But what is too high?

This depends on your income and expenses. An overdraft of £2,000 for someone whose income is £1,800 a month is a lot – but if you earn £5,000 a month, then a £2,000 overdraft may be reasonable.

Other points that help a complaint

You won’t win an affordability complaint by saying the charges were too high.

Instead, you say the bank should have known they were unaffordable for you because of all the financial problems it could see on your statements and your credit record.

Here is a checklist, do any apply to you?

- often having direct debits or standing orders not being paid;

- a lot of gambling showing on your statements;

- significantly increasing other debts with the same bank (you may also be able to complain about those loans or credit card);

- being recently rejected for a loan or a credit card by the bank;

- significantly increasing debts with other lenders showing on your credit record;

- a worsening credit record – maxed out credit cards, new missed payments, payment arrangements, defaults etc;

- using payday loans;

- mortgage arrears;

- a reduction in the income going into your account.

Free student overdrafts

You can only win a complaint about these after the bank has started charging you interest

Making your complaint

What you need at the start

You don’t need to know the dates your limit was increased before complaining, my template asks for them.

You don’t need to send statements to the bank with your complaint – the bank already has them!

You can’t go back and see exactly what your credit score was in say 2021 when the bank increased your limit. But your current credit record shows what was happening back six years, so download your credit report now and keep it. The sooner you get the report, the further back it goes. I suggest you get your free TransUnion statutory credit report.

Send a complaint by email

I don’t recommend phoning to start off a complaint. It’s too complicated and you will be talking to someone that doesn’t specialise in these complaints.

I think email is the simplest way to make these complaints. Here is my list of bank email addresses for complaints.

An alternative is to send a long message in the app. But if this means using a chat facility, it’s not usually a good idea, as you are again talking to someone who doesn’t understand what you are saying and tries to tell you what help is available with your overdraft – when all you want is to have your complaint considered.

A template you can adapt

In the template below, I’ve invented some examples and dates so you can see how a complaint email could read. The bits in italics should be changed or deleted to tell your story. Delete dates if you don’t know them. If a sentence doesn’t sound relevant, delete it.

I am making an affordability complaint about the overdraft on my current account number 98765432.

Your identity details (these are needed if you complain by email, not if you use secure message):

My name is xxxxx xxxxxxxx. My date of birth is dd/mm/yy. The email address I use/used for this account was myaddress@whatever.com.

Your home address (if you know the bank has your current address, ignore this):

My current address is xxxxxxxxxxxxxxxxxxxx. Please do not send any letters to older addresses you may have on your records.

If your overdraft was originally a student overdraft with no interest include this, otherwise delete it:

My account started as a student overdraft and no fees were charged. I am complaining about the period after, when you started to charge fees.

START BY SAYING they should have noticed your financial difficulty

Overdrafts are meant for short-term borrowing but you could see I was unable to clear the balance in a sustainable way. I was using the account for long term borrowing as I could not get out of this. The fees and charges you were adding were making my position worse.

I am complaining that [every year since [20xx] OR for many years] you have failed to notice my difficulty during the annual reviews of my overdraft. You should have offered forbearance eg by stopping interest and charges being added.

By 2017 I had been in my overdraft constantly for many months, not getting back into the black even when I was paid. This “hardcore borrowing” is a clear sign of financial difficulty. My income was only £1,850 a month – after I had paid bills, there was no way I could hope to clear an overdraft of £3500 in a reasonable length of time.

OR

By 2021, although my salary took my account briefly into credit, within a few days, I was back in the overdraft.

include any other points that show you were in difficulty

You should have seen that I was in financial difficulty because you rejected my loan application in 2021.

You should have noticed that the income going into my account decreased from 2020.

From 2020-22 there was a lot of gambling showing on my account.

In 2022 and 2023 there were a lot of rejected direct debits on my account.

… or anything else!

Say if the initial limit was too high or it was increased too high

You should never have given me an account with such a large overdraft. When I applied, you should have checked my credit record and income and seen I had recently missed payments to a credit card and had taken several payday loans.

OR

You should not have increased my overdraft limit. When you increased the limit, you should have seen that my debts to other lenders on my credit record had increased a lot

OR (for accounts that had been student accounts)

You should have seen after [2020] when you started charging interest that the limit was too high to be repayable on my income.

In your reply to this complaint, please tell me when any limit increases were and how much the limit went up.

END BY asking for a refund of charges and interest:

I would like you to refund all the interest and charges that were added to my account from 2016 when you increased my overdraft limit.

OR

I would like you to refund all the interest and charges that were added to my account from 2021 when you should have realised that my finances had got worse to the point that I was no longer able to clear the overdraft.

Please remove any late payment and default markers from my credit records.

Points to note

Student overdrafts

You won’t win a complaint about a student overdraft saying you were a student and it was unaffordable at that point.

But when the bank has started charging interest, it should start doing reviews and check if you are in difficulty. So from then on, you can win affordability complaints.

You can complain if the account is still being used or if it is closed

These complaints can be made if:

- you are still using the account or you have stopped using it and are paying it off;

- the account has been closed;

- the bank defaulted it and sold it to a debt collector (here you still complain to the bank, not the debt collector). If the debt collector has gone to court and got a CCJ, add a sentence to the template saying you want the CCJ removed as part of the settlement of your complaint.

But if you have had an IVA or bankruptcy after these problems, or if you are still in a DRO, then you shouldn’t complain – ask in the comments below for details.

Old accounts

Banks may say FOS won’t look at an old complaint, but this isn’t right. FOS will often look at a complaint if it has been open in the last six years. How far back FOS will go seems rather random, but it should be possible to go back at least 6 years.

Open and recently closed accounts aren’t a problem – the bank will still have your statements.

If your complaint is about an account that was closed more than 6 years ago, it’s going to be very hard to win.

Packaged bank accounts

These affordability complaints are not about the fees on packaged bank accounts. MSE has a page about packaged bank account charge complaints.

Personal accounts, not business accounts

The complaints covered here relate to personal accounts. For business accounts, talk to Business Debtline about your options.

The Bank replies

They want to phone me!

People are often scared if they get this message. But it may be good news! You can just ignore it or say you would like a reply in writing.

If you decide to take the call, it helps to be prepared:

- have a pen and paper handy so you can write down anything

- if they say they are partially upholding the complaint, ask them the date they are refunding the fees from, and how much. And say you would like to see this in writing before you decide whether to accept it.

- if they ask you questions that sound complicated or worrying, ask them to put the questions in writing as you find the phone difficult

- when they say they are rejecting the complaint, ask for this in writing, as you will be going to the Ombudsman.

Rejection/poor offer – go to the Ombudsman , it’s free

Banks reject many good complaints, hoping you will give up. So don’t! You know if the overdraft has caused you a lot of problems.

You can’t go straight to the Financial Ombudsman (FOS), you have to wait for the bank to reply, or for them to have not replied within 8 weeks.

Here are some things banks may say to try to put you off:

- you could have declined the increase to your overdraft limit – FOS probably won’t think that is a good reason

- you never let the bank know you were in difficulty – FOS probably won’t think that is a good reason

- your salary was enough to return you to credit each month – this is misleading if bills meant you soon went into the overdraft;

- FOS will not look into things that happened more than 6 years ago – if your account was still open in the last 6 years FOS may well look at it.

And the bank may offer to refund fees for the last 15 months say, even though your problems have been large for many years. Think twice about accepting a low offer – you won’t put this offer at risk by going to the Ombudsman.

If you are offered a refund for the last 6 years but not any further back, have a think if this is a good enough offer. It is unpredictable whether the ombudsman will be prepared to go back further than 6 years.

If you aren’t sure, post in the comments below.

To send the case to FOS, complete this online form:

- you can use what you put in your complaint to the bank;

- if the bank rejected your complaint or made a low offer, say why you think this is unfair;

- use normal English, not legal terms.

You don’t need to send your bank statements – the bank will send those to FOS. And you don’t need the policy documents for your bank account, the lender will supply those to FOS if they are needed.

Do these complaints work?

Yes! From 2024, some banks are making more offers directly.

A Guardian article featured a case where someone used the template letter here. Barclays denied it had done anything but made an £8,000 “goodwill” payment to the customer.

And if your bank rejects your case, people are winning cases at the ombudsman. FOS is a friendly service although it isn’t speedy. It isn’t faster to use a solicitor or a claims firm,

The comments below this article are from other people who have made this sort of complaint. That is a good place to ask for help if you aren’t sure what to do.

Refunds from unaffordable loans

Em says

A massive thank you to Debt Camel for this template! It has helped me receive over a £900 refund from HSBC which was applied to my account on Christmas Eve. This now means that I will be out of my overdraft within a couple of months!! Thanks again!

EP says

Dear Sara

As the year is coming to a close I just wanted to give you a massive thank you. Using your templates and advice I have received refunds totalling almost 20,000. A complete life changer for me and has me out of debt for the first time in mad long as I can remember! Wishing you a fantastic new year!

Claire says

Hi Sara, I have an ongoing complaint with the ombudsman, they seem to be accepting to look at my complaint going back further than 6 years today I received an email looking for the following information. I’m not sure how to respond, any advice would be helpful.

I can see from your bank statements that around 2014 you were regularly using your overdraft. Please could you let me know:

Did you contact RBS at that time to discuss concerns about managing your financial situation

If so how was this completed with the bank

And if you did what measures or proposals were discussed with the bank

If not can you recall when you first became aware that RBS may have done something wrong.

Sara (Debt Camel) says

FOS is asking a lot of people these sorts of questions.

Did you ever talk to RBS at that time or the next few years?

The answer may simply be that you didn’t because you thought it was your problem for spending too much on the account, and as you didn’t realise RBS should have checked for affordability, it didn’t occur to you that there was anything to complain about.

But if you did contact them, in a branch, or on the phone or by message, what did they say and what happened?

When did you become aware RBS didn’t make proper checks – was this when you heard about affordability complaints?

Claire says

Thankyou for responding so quickly, I’ll reply to the FOS with a response.

Ross says

Hi Sara, I have recently put in a complaint to Lloyds due to being constantly in my overdraft, I had previously had contact with them back in 2018 that they should not be offering me an overdraft due to me being a compulsive gambler, I am in recovery and have been seen 2019. Do you think I have a case here? They have gone against my word and in my eyes been irresponsible with their lending. Thanks

Sara (Debt Camel) says

what happened in 2018, did they agree not to offer you an overdraft?

how long have you recently been in your overdraft constantly? this is very day of the month?

Ross Gunn says

Yes they agreed but since then I have been on various dmp yet they’ve still given me an overdraft. I am awaiting a call from them today to talk about my claim so fingers crossed they uphold my complaint

Lauren says

I just wanted to say a big thank you and share my success story for my overdraft complaint. I was refunded a total of £2322 for 2 of my accounts with an overdraft (one £500 and another £750) with Halifax acknowledging that they let me extend my overdraft irresponsibly and far too easily! With this money I have been able to pay off and close both overdrafts and still have an amazing amount of money leftover for savings. They are also writing off the unarranged overdraft impact on my credit record. I’m so pleased with this outcome and was beyond anything I ever expected! Without your advice and template for the form I never would have thought to do this, so thank you so much 😊

Ellie says

Hello, I’m with Halifax also and have used the template to make a complaint, out of interest how long did it take for you to hear back? I received a text message 24 hours after my email was sent with them acknowledging they’d received my complaint but just wondered how long it took for you?

Sara (Debt Camel) says

they will often take all 8 weeks to reply.

Linda says

Hi,

Just wanted to share my affordability complaint success story with Halifax. I had an overdraft of £1600 and for the past 4.5 years I was constantly overdrawn and it wasn’t affordable at all. I just couldn’t get out of it. So I followed Sara’s advice and sent a complaint to Halifax. They did delay the final decision till the very last day and called me to ask for some questions regarding my financial situation and some of my cash withdrawals but they did came back with the answer the next day and were happy to refund me the full amount of the interest I paid and extra £75 compensation. I am truly happy and very thankful for this page and information available. I now have a hope that I will be debt free next year!

Thank you Sara!

Holly says

Hi,

I have two loans with Halifax (my main bank account) and an overdraft with this same account.

My overdraft is £3500.

Loan 1 was a total of £13,500.

Loan 2 was a total of £25,000.

For loan 1, I pay £647.98 per month and loan 2, I pay £599.54 per month as well as having a regular mortgage payment leave my current account of £546 per month.

This is totally unaffordable for me.

I earn around £1900 per month.

I am still currently paying back both loans and loan 2 feels impossible to pay back as the interest is almost as high as the amount I pay.

Would I be in a good position to make an affordability complaint and ask that interest is repaid for both the over draft and loans and any further interest is for the loans is cancelled and therefore only pay back what I have borrowed?

Thank you in advance. I have ready through your pages but just wanted to clarify if this will be a sensible thing for me to do!

Sara (Debt Camel) says

That sounds very difficult for you.

The overdraft – how many days of the month are you in it on average? And how long has it been like this?

What dates were the two loans taken?

was either of them for consolidation?

Do you have any other debts at the moment?

Are you struggling to make the payments at the moment, how are you getting through the months?

Holly says

Thank you for your response.

I am always in my overdraft as I don’t earn enough money to cover it – so 31 days. This is interest if over £90 per month. I have had an over draft of at least £1500 for many years, however, increased it to £3500 help me manage in 2024. This increase was done after I had the loans I believe.

Loan 1 – July 2023 – £2845 remaining.

Loan 2 – April 2024 – £24,488.39 remaining – high interest.

I cannot remember the exact reasons that I put on the loan applications, however, each time I did try to pay off my overdraft with some of this money.

I have smaller debts such as a very account (£1500), next account (£600) and a few little bits on Klarna.

I always make the payments on the loans as I am very conscious that if I do not then this will negatively impact me in the long term however, this is of course a huge struggle. I have borrowed money from family members ect but this of course is not a long term fix.

Each month is very stressful and I worry about this almost all of the time. I work hard in my job but my salary can only stretch as far as it can stretch.

What are your thoughts?

Thank you for your time!

Sara (Debt Camel) says

can i ask if you are renting or buying? If buying, who is your mortgage lender?

Holly says

Buying – mortgage with Barclays.

Sara (Debt Camel) says

I think you should look at a debt management plan with StepChange – this will freeze new interest and let you make a lower affordable payment so the stress goes. This harms your credit score, but you will still be able to get a new fix from Barclays when the current fix ends (assuming you don’t have mortgage arrears) as they have signed the Mortgage Charter. .

Affordability complaints are then a great way to speed up the DMP as winning any of them reduces the balance being repaid in a DMP. These complaints may take a long while to go through as they often have to go to the Ombudsman, so a DMP gets you into a safe space.

Holly says

Thank you so much for your advice.

Mandy says

Hi I’ve just received this text from the Halifax regarding my complaint about an unaffordable overdraft. I just wanted to ask if if should go to the ombudsman now or wait like they suggest?

Cheers

Mand

Dear Mrs xxxxxxxxx, we’re still looking into your complaint. We know it’s taken us longer than it should have to resolve this and we’re sorry for the delay. Because it’s been eight weeks since you told us about your issue, you can refer your case to the Financial Ombudsman Service. You don’t need to do this now as you’ll still have time after you receive our final response. You can find more details at https://www.financial-ombudsman.org.uk/businesses/resolving-complaint/ordering-leaflet/leaflet. Your reference number is xxxxxx. If you need to speak to us, please call 0800 096 1279. We’ll be back in touch by 12 February 2025 if we still haven’t resolved your complaint.

Sara (Debt Camel) says

I would send this to FOS now. it takes time to get things sorted at FOS so get yourself in the queue now.

(Although at least Halifax isn’t going to go bust. If you aren’t in any financial difficulty and want to wait, that’s up to you.)

Mandy says

Hi update. I decided to wait and give them a little more time. So today I’ve got a missed call and then an email saying it was them saying can I call them as they need further information regarding my complaint. I know this seems like a simple and reasonable request but I think I have already provided them with all relevant details already so just wondering what kind of thing they might want to ask so I can be prepared. I’m also worried that they may try and trick me into saying the wrong thing. Anyone else had this or be provide me with advice.

Thanks

Mandy

Sara (Debt Camel) says

you don’t have to take the call if you don’t want. But people who have taken it haven’t said they felt they were being tricked.

Mandy says

Hi sorry me again.

An update and a request for some advice.

So I’ve received my letter from Halifax and they are going to refund £1625 which they say is the interest from 1st January 2022 and I need to contact them to pay off the rest of my £2000 overdraft. They admitted they shouldn’t have set it so high but say they’re not looking further back than that because they reckon they haven’t made an error but no other explanation. I had requested that they refund the interest from jun/July 2018 when they upped my overdraft to 2000 (which incidentally is almost double my monthly income).

Do you think it’s worth taking this to the ombudsman and if so is all I need to do is send my original letter of complaint and their reply? If not what do I need to do. Also do I need to contact Halifax and tell them that I’m taking it to the ombudsman. I’m also worried that if I do this I might lose the money they say they’re going to refund?

Sorry this is so long but any help is so appreciated as I’m really nervous dealing with all this!

Sara (Debt Camel) says

did your situation get worse in late 2021?

If you think back to jan 202, were you in the overdraft all or almost all of the month at that point?

Same question for 2020?

Mandy says

No my finances have been consistently poor since as long as I can remember around about a period of unemployment in 2009/2010.I have also been on a debt management plan since around 2010. The overdraft has been maxed out since was raised as it was before it was raised to £2000. I only asked for the refund since the limit was raised to 2000 in 2018, it was probably too high beforehand as well, but the £2000 seemed a good point to ask from. I also asked them for a list of charges from that point but they said they were unable to do so.

Sara (Debt Camel) says

Well if you are unhappy with the decision, then yes, send it to the Ombudsman. The article above has the link to the Ombudsman’s online form which you should use.

It is very unlikely you would lose the money already offered.

Mandy says

Thank you for the info. I probably will go down the ombudsman route. Can I just ask you one final question? Should I let the Halifax know that I’m taking it to the ombudsman?

Sara (Debt Camel) says

No, the Ombudsman will tell them

mandy says

Hi there, i just wanted to thank you for all you help and advice. After going through the ombudsman who agreed with my complaint i recently received just short of £3000 on top of them closing my overdraft . Which was nice. Thanks again.

Amy says

This is very helpful thank you. I have a question regarding Vanquis.

I started a £1000 credit card with them August 2023. Since then, I was able to pay this off twice, working additional freelance jobs. My employment situation has since changed and I am now unemployed and this account has been maxed out since October 2024, with charges/interest. Do I have any leverage in seeking refund on these interest/charges?

Appreciate the help!

Sara (Debt Camel) says

Not an affordability complaint, but I suggest you immediately contact them and say you are out of work, offer a token £1 a month and ask them to freeze interest and charges, see https://debtcamel.co.uk/token-payment-debt/. And do the same with other debts you can’t afford until you are back in work. Talk to National debtline on 0808 808 4000 about this if you need advice on your situation.

JD says

Hi Sara,

Have you any more information or heard that the ombudsman is doing another review? I received the following correspondence about my complaint which is asking to go back to 2012 and was submitted to the ombudsman in June 2023.

‘Your complaint is awaiting the ombudsman’s final decision. There is a judicial review going on for s140 impacted uphold cases so it may be a while before a final decisions can be issued on your cases, but once final decisions can be sent your case will be prioritised due to the length of time they’ve been with us.’

Very disheartening for there to be another delay after already being delayed for a year.

Sara (Debt Camel) says

The Ombudsman completed its review, this is a lender challenging the FOS decision in court.

JD says

Would you have an estimate as to how long this may potentially delay a decision?

Sara (Debt Camel) says

I don’t know

But it shows the Ombudsman shift in approach is good news for borrowers as the lenders hate it!

Shanice says

Hi, I’ve just followed this article in regards to a £500 overdraft I was allowed to open with only £800 p/m income. Would this be sufficient that it was unaffordable?

I also could never reduce my overdraft when I could pay it off bit by bit, causing me to stay at max limit. Santander would say it was an issue on their end that I could not reduce my overdraft.

I was also offered to switch to an account with lower fees, I did so, but the fees were practically the same.

Is it likely that this’ll succeed?

Sara (Debt Camel) says

Being unable to clear an overdraft so you are in it all the time for a long period is a good reason to complain

Laura harvey says

Hi, I’ve had my overdraft with Santander for at least 10 years, my overdraft is 1200 and I get paid £2080, once I’ve paid my half of the bills I’m straight back in my overdraft. Usually within 2-3 days. Is this enough to make a complaint?

Sara (Debt Camel) says

That sounds good to me.

Melissa says

I’ve had an overdraft with Santander since 2019 when I started university. I believe it was a very small amount at the beginning and this increased every year automatically and in my finally year it was upped to £2000 and I maxed it out. I have in the last year started paying interest and fees, my account states I’ve paid nearly £200 in fees. I get paid £1,700 a month. But I do not use the Santander account for anything other than to pay off my overdraft. I have 1,800 left to pay. Do you think I have a chance at a complaint?

Sara (Debt Camel) says

So you are using a different bank account as your real account? Does that have n overdraft too? Do you have credit cards or other debts?

James says

Hi,

I’ve had a £1500 overdraft for around 4 and a half years now and every pay day I’m straight back into overdraft via direct debit bills, I also applied for a credit card with a limit of £1000 which has been maxed out for around 2 years I try to pay into it but with no money in current account I can’t help dipping back into the credit card! I’ve called multiple times for help or consolidation loans to make it easier to pay off but was declined. Just the option to freeze interest for a month. Is it worth doing an overdraft complaint?

Sara (Debt Camel) says

Is the credit card from the same bank?

Hayley says

Hi ! I was looking at putting in a complaint to my bank. I got my overdraft about 7 years ago with Natwest. I can’t remember the 1st overdraft but it was upped to £2500 and I get paid £1815 a month. I’m never out of the overdraft. I’ve been told to get a new bank account for my wage before I make the complaint is this correct?

Sara (Debt Camel) says

Earning less than your overdraft means you can never get out of it, so you have to do something!

Switching to a different bank account can be a good approach – if in the end winning your complaint doesn’t clear the overdraft you can just chip away at the remining amount a but each month.

And although it’s rare for a bank to close an account, you may feel more comfortable if you have already got another bank account open.

But is your overdraft your only problem? Do you also have loans or credit cards that are making your life difficult? Look at affordability complaints about them too – those lenders should have notice from your credit record that you were overdrawn a lot and so unlikely to be able to afford a lot of new credit

Chloe says

Hello,

I have a £2000 overdraft with NatWest, I originally got this as a student 6 years ago. They give me 1500 and then increased to 2000 within the year. I have been unable to get out of this since and have now been getting charged interest rates as I am not a student anymore. I earn £1700 a month which is not enough for bills etc and to pay to get out of it. Do you know if I have any base for a complaint please and any advice?

Sara (Debt Camel) says

yes this sounds like a good complaint. You can never get out of an overdraft when your wages are less than it and NatWest should have noticed this after they started charging interest.

Also see my response to Hayley above.

THW says

After doing a bit of research digging, I found Debt Camel and thankfully I did. I put in an affordability complaint and Halifax offered £3300 refund which has cleared my £800 overdraft. Thank you Debt Camel. 🐪 Regrettably, NatWest, whom I banked with longer – since 1999, have been less accommodating, and as such, I have referred my matter to the financial ombudsman. Lets hope for a favourable result.

Thanks again for providing valuable information on this site.

Amy says

Hi, hope you don’t mind me commenting but how long did Halifax take to get back to you? I know it says allow up to 8 weeks , I only submitted a complaint a couple of days ago. Glad you got some

Back!

Sam says

Morning Sara!

I have had my current account with Barclays for many years, I have always had a large over draft, it’s currently £1000 ( I’m not sure when it was increased) but I am in this every month for a few years, they have recently emailed me to say they have noticed this and want to lower it but won’t because they don’t want to put me in more of a financial problem , can i still send a complaint email to them?

Thank you!

Sara (Debt Camel) says

This sounds like a very good time to make a complaint!

Do you also have a Barclaycard or a loan from them?

Sam says

Yeah I have a Barclay card with them too, this has always had something on it and if it’s been paid off it’s been due to another card that I’ve transferred over too for consolidating ( I’ve complained to these already )

HS says

Hi,

HSBC offered me a £300 overdraft in October 2024 but within a month let me increase this to £3,300.

My take home pay is only £1,700 a month- even though this is relatively recent would I have a leg to stand on? It is worth noting since I’ve had the overdraft I’ve not been positive once.

I also had another £1,000 overdraft with Lloyds at the time of application which had been maxed out for months.

Many thanks

Sara (Debt Camel) says

Had your income very recently fallen?

What other debts do you have at the moment?

HS says

Hi,

My income has not fallen it is the same as when they first offered me the overdraft -may be worth noting I’m only 21.

I have no other debts currently.

Emily says

Hi Sara have sent and affordability complaint email via the email you supplied for TSB, but I haven’t had any response to acknowledge the email is this normal?

Sara (Debt Camel) says

how long ago did you send it?

Emily says

On Wednesday morning

Sara (Debt Camel) says

oh thats not long. If you haven’t had any form of acknowledgement in a few weeks, phone them up and ask. Don’t just send another email.

lo says

will this work for paypal credit ?

Sara (Debt Camel) says

That is more like a credit card than an overdraft, see https://debtcamel.co.uk/refunds-catalogue-credit-card/. It may work if the account was opened, or the limit increase you are complaining about, was post Brexit in January 2021

TW says

If anyone is thinking about making a complaint on overdraft affordability, I’d deffo recommend. I’d been in an arranged maxed out overdraft of 2K with Santander for 5+ years after uni, paying interest each month. I had recently paid the overdraft off but came across this account in December and used the overdraft template to complain about the years I’d been overdrawn by max balance, paying interest I couldn’t afford each month when it was clear I could not repay. Santander have now refunded all interest charges in the period my overdraft was active, which is just over 2K! Great page, really useful.

Carly says

Hi,

I have an overdraft with Barclays which I have been in maxed at £1000 for over 4 years, I haven’t ever been able to get out of it, however I am worried that if I email an affordability complaint they will cancel my other account which is now my main account with all of my direct debits etc with my husband.

Will it also affect my credit rating and if I ever need future credit will it be impacted?

Thanks

Sara (Debt Camel) says

what are the fees each month on this?

do you have an overdraft on your joint account? do you have other debts as well? what is your credit score like at the moment?

Meggie says

Hi Sara & fellow debt camels!

Thanks to Sara and her amazing template I popped my email over to Lloyds on Sunday night, I got a text Tuesday morning to say that ‘Dear Miss X , we’ve received your complaint and we’ll be in touch soon. To resolve this for you, we’ll look at the information we have and ask for more details if we need them. If we need to contact you, we’ll do so by telephone. We’ll then give you our final response, which we may send by email. Please check your junk folders in case it ends up there. If you prefer that we do not send our response by email, please let us know. If you don’t accept our final response, you can ask the Financial Ombudsman Service to look at your concerns’ I haven’t had a phone call from them yet or an email, and I was just wondering whether anyone else got the same text, and roughly how long it then took them to reach out to you? I took out the overdraft in 2010 and they didn’t start charging interest till 2012- 2013, so I have asked them to look at refunding me starting 2013 (wishful thinking I know) would love to hear anyone else’s story who have had a complaint with Lloyds and will keep you updated on mine :)

Lee says

Hello Sara,

Thank you for hosting such a fantastic resource—it’s greatly appreciated.

I have reviewed the article but couldn’t find specific information on refund periods. Could you clarify the timeframes in which we can request refunds? For instance, are claims limited to the past six years, or is it possible to go beyond this period?

In 2020, I raised an affordability claim with TSB regarding both an overdraft and a credit card. I was in and over my overdraft for many many years.

Unfortunately, both claims were declined. At the time, I was already working with the Ombudsman on multiple affordability claims related to payday loans and short-term loans (all won thanks to this website). With the added challenges of the COVID-19 pandemic and some personal matters, I simply didn’t have the energy to pursue TSB further.

Could you advise whether it would still be possible to raise a new affordability claim, or would it be better to approach the Ombudsman regarding my 2020 claims?

Thank you in advance for your guidance.

Sara (Debt Camel) says

You can’t take a 2020 rejection to FOS now, that is a long way outside the 6 month window you had.

And you cannot make the same complaint twice. It would simply be rejected as already answered before and the ombudsman would not take this.

How much have you used your overdraft since 2020? How many days of the month are you in it on average?

Have TSB increased your credit card limit since the 2020 complaint?

LR says

How long would you say they usually take to respond? I submitted my Lloyds complaint on 22/12. Contacted them for an update 2 weeks ago and was told it’s been assigned but no response on there yet. Contacted them for another update yesterday and was told the same.

Sara (Debt Camel) says

You often won’t get a reply before 8 weeks.

Are you in financial difficulty at the moment as you cannot reply on these complaints providing a quick solution, many have to go to the Ombudsman after a rejection or a poor offer.

LR says

Yes and no, I can manage. They are upping my OD fees to 49.9% APR on 31/01, so I would’ve liked a response prior to that. As if this gets rejected I plan to utilise a 0% money transfer I have on one of my cards.

From the following do you think it’s likely I have a case? Took out OD in 2021 when I was a student but had a lot of money coming in (sfe, part time work, money from parents). Upped the limit myself from 500-2500 a few months after taking it out. Instantly was overdrawn roughly -1800 every month for the next 3 years. Take home has ranged from 2.3-2.6 per month so only just getting out of it for a few days/a week before paying bills. Only issue I think they may have is I pay my rent via PayPal on my Amex to collect points via my partner. So quite big payments to them every month.

I have had creditors interfere prior when irresponsibly using credit (reducing limit etc) and it doesn’t feel like Lloyds followed those protocols at all. Especially now they are raising the APR.

Sara (Debt Camel) says

You can explain the large & regular Amex payments as being your rent. Are you being charged interest by Amex?

Leah says

No interest on Amex as I pay it off in full then use the PayPal f&f option to transfer (I only use it to pay rent)

Jamie says

Hi Sara

I am going to write a letter of complaint to the BOS about unmanageable overdrafts. I also have a credit card with the same bank which I have been struggling to pay back also. Should I write a letter of complaint for the credit card also. And should this be a separate complaint or part of the same email.

Sara (Debt Camel) says

How many days a month are you in the overdraft and how long has it been like this?

How long ago was your credit card opened and has the limit been increased? Have you mainly paid the minimum?

Jamie says

In the overdraft most of the month and often go into un arranged. It’s been like this for a number of years. The credit card was about 2019 which has been up and down but for about 2 years now been only paying the minimum and paying lots of interest.

Sara (Debt Camel) says

It’s best to send these as two separate complaints. You can cross refer “I have also complained about my overdraft in a separate complaint”

WR says

Hi Sara,

I have a £2000 overdraft & a £1000 credit card both with RBS that have been maxed since I got them whilst at university (6 years ago). I pay off £100 a month on the CC but always end up having to use it & with the overdraft, I’m paying around £60 a month in charges.

I am also paying off an old Barclays CC to PRA group which has around £600 left on the balance.

I am currently unemployed so my financial position doesn’t look to change any time soon unfortunately, would I be in a good position to make an affordability complaint & if so, does this impact my credit score? Am I also at risk of them closing my accounts if I complain?

Thank you!

Sara (Debt Camel) says

If you are currently unemployed I suggest you should ask to reduce your payments to PRA and the RBS card to £1 a month and ask RBS to halt charges on the overdraft until you get a job. This hurts your credit score but it stops you getting deeper into debt each month. This harms your credit score but it must already be poor with a default and a maxed out card on it. Talk to National Debtline on 0808 808 4000 about this and any other options.

You can’t rely on affordability complaints resolving this sort of problem as you may not win them and many are slow, having to go to the ombudsman.

If you are constantly in your overdraft, your best option may be to get a new bank account with someone else now and move over your benefits and essential direct debits.

Samantha says

Hi Sara,

I have been in a 2k overdraft since I was at university roughly 2018. I have lived in that overdraft ever since and rarely have ever been able to get out. I miss direct debits every month and always have. Do you think I have a claim? I pay £30 a month for my overdraft like today where they’ve left me over my overdraft by taking the £30.

Sara (Debt Camel) says

How long ago did they start charging interest?

Do you have other debt problems?

Is your income enough to cover the bills and living expenses if there was no overdraft?

Liberty says

Hi Sara, I’ve been in a 2350 overdraft for about 5 years I applied in Covid when I lived on my own and panicked to cover the bills. Since that time I’ve been constantly in my overdraft I earned about £1400 at the time of getting the overdraft. They have sent me a letter about discussing my overdraft fees as I paid £864 in interest last year. I am going to call to discuss my options Monday however would this still give me grounds to make a complaint.

Thank you ☺️

Sara (Debt Camel) says

which bank is this?

do you have other debts as well?

you can still make a complaint whatever they say on Monday – come back and chat when you know?

Owlbird says

Dear Sara,

My husband put in an affordability complaint as we are always maxed out on our overdraft and have been for 5 years. They rejected it! We were shocked and annoyed. We didn’t take to the Ombudsman as husband thought we would lose. My question is as its a joint account can I complain in my name and then if they reject it take it to the ombudsman? Wondered if the complaint is per person not per account. We have tried to talk to them about how much we need to get out of it but they don’t care.

Thank you

Sara (Debt Camel) says

How long ago was the rejection?

Tell me about your other debts

Owlbird says

It was around 8 months ago the complaint. Have other credit cards to. Our mortgage is due to renew this year and I’m feeling very overwhelmed.

Sara (Debt Camel) says

It is a shame you didnt take this is to the Ombudsman.

I haven’t see anyone try again with the other person of the joint account. i would expect the bank to reject this and I don’t know what the ombudsman would say.

What are your and his other debts?

Who is your mortgage with?

Owlbird says

I know I’m so annoyed now. I found the letter and it was dated the 22nd May and we only had 6 months to go to the ombudsman.

We have a fair few debts with credit cards. Mortgage is with Pepper Money.

I mean is it worth going to the ombudsman any way or is it a total waste of time?

Sara (Debt Camel) says

Not unless there was some big factor that meant you couldnt go before.

Look at affordability complaints against the cards

Lucy B says

Hi Sara

I took an overdraft in 2022 while I was a student in university and my only income was student finance. I was approved an over draft of £1500 and since then I haven’t been out of it. I’m now working full time but every month results being back in overdraft. Would this be a worthy complaint?

I’m charged interest every month of around £50

Thanks

Sara (Debt Camel) says

So this wasn’t a “student overdraft” with no charges. In that case, you will get a refund if you win an affordability complaint

how many days of the month are you in the overdraft?

Lucy B says

From approx june 2022

Roughly about middle of every month I would go into my overdraft

Sara (Debt Camel) says

That seems a lot of interest to be charge on a 1500 overdraft for just two weeks a month? When you get paid, you are back into credit again and don’t need the overdraft for two weeks?

do you have other debts as well?

Lucy B says

It would be every month really. Yes I’ve around £100 left to pay on next catalogue. It is not worrying me however the overdraft is

Sara (Debt Camel) says

OK, I am still not clear on your situation but it’s obviously causing you difficulty, so make a complaint and come back here with what the response is?

JS says

Hi Sara,

I complained to Lloyds about my overdraft in end of November, explaining how they kept increasing my limit without checking affordability. My overdraft use spiraled from £100 in 2018 to a £1,500 limit in 2022, which I maxed out immediately. Despite clear financial difficulties—including other debts like a Nationwide overdraft and PayPal credit—they didn’t offer meaningful support, only short-term interest holidays I had to apply for myself.

It’s now been 8 weeks, and they still haven’t assigned my complaint to a complaints manager. When I called, they discouraged me from going to the Ombudsman, saying it would ‘delay things.’ and that they have a ‘very high level of complaints’ they are dealing with at the moment, but ‘hope it will be picked up soon’ due to the age of the complaint.

Has anyone else experienced this? Should I escalate?

Sara (Debt Camel) says

I would be inclined to say it goes to the Ombudsman if you haven’t received a suitable offer within two weeks

JS says

Hi Sara

Great news! Just had my complaint reviewed, and they upheld it from October 2017 my overdraft actually began in 2017. They admitted they should have stepped in sooner and refunded me £2,534.12.

For anyone still waiting—stay persistent! It took time, but it was worth it in the end. Thank you Sara, without coming across this I would have been none the wiser!!

Charlotte says

Dear Sara,

I would like to inquire about the eligibility of my situation for an affordability claim. I applied for an overdraft of £2000 with Halifax thirteen years ago while in college. Now, in my mid-thirties, I remain consistently overdrawn each month. Last year, Halifax expressed concern about the limit, and we met; however, no resolution was reached, and I continue to pay interest without reducing the overdraft. I received another call later in the year to consider a loan, but I explained that it would further increase my debt. Unfortunately, they seemed unconcerned. Do you believe this claim is eligible? Thank you for your time.

Sara (Debt Camel) says

sorry i wasn’t clear. I was asking on average how many days of the month are you in the overdraft – very soon after you are paid? half way through the month, the last week?

Charlotte says

No worries, I’m overdrawn every single day.

Sara (Debt Camel) says

then that sounds like good claim. If Halifax reject it, send it to the Ombudsman

J says

Hi! I was wondering on my eligibility – 2017 I had a student overdraft opened (£1500). Stopped being a student in 2020. Since 2021/2022 I have been unemployed, receiving benefits and in the bottom end of my overdraft. I have been paying interest of about £40 a month – it says it is an “arranged overdraft interest” but I am not a student any longer.

I believe them to be irresponsible with charges so I will ask them to stop. Can I ask for a refund of said charges? I’ve been paying for years. Thank you

Sara (Debt Camel) says

so you are in this overdraft the whole of the month?

do you have heath problems or is there some reason you can’t get a job (knowing this may help with a complaint)?

do you have any other debts, as overdrafts are often the symptom of a bigger debt problem?

J says

Yes I am. I haven’t been out of it for years. I have mental health problems- the benefits are LCRWA (£800 a month). I have no other debts other than PayPal Credit I am paying off and a klarna debt. Thank you

Sara (Debt Camel) says

This sounds like a good complaint. Send it to the Ombudsman if the bank rejects it. Don’t be fobbed off!

thistle says

Hi, my husband and I have been fully in an £2,200 overdraft every month since about 2004 when our income decreased. They put it up to £2,400 at some point after that. The account is with RBS, we now come about £200-£400 into the black after getting paid but use the whole thing every month still. Should I say that this has been going on 20+ years in the letter and say we want the fees etc back for the past 20 years? Or should I just ask for the past 5 or 6 years? Anything back that would help us finally clear this would help. I am in Scotland. Thank you for your help.

Sara (Debt Camel) says

So you are using the overdraft very soon after payday each month?

I suggest you ask for a full refund. In practice they may not have bank statements going back that far, so unless yours have kept yours, there will be a limit. But just make the complaint now and see what they say. Come back and discuss?

thistle says

Yes we get paid on the 28th and are in credit by a few hundred but only until bills come out on the 1st. Then we use up the overdraft and are at or near the limit the rest of the month.

I will try to write to them using your template. Thank you!

Georgia says

Hi, I recently started a debt allocation order with a company to help me get back on track. Is this the same as an IVA? Can I still apply to get the charges back from my bank and store cards? My debt is not being written off, I am paying it all back over 3.5 years at a more manageable monthly amount.

It hasn’t been finalised, it is still in the process of going through.

Thank you

Sara (Debt Camel) says

Can you tell me more about this – which company is this? what sort of debts are going into the order and how large are they? is interest going to be frozen on the debts?

G says

3 x credit cards plus 3 x store cards = £13k. It is a company called J3 solutions that has sorted it for me.

Sara (Debt Camel) says

They are an insolvency practitioner. They don’t list “a debt allocation order” as a possible debt solution… Have they explained how this will be recorded on your credit record? Are the monthly payments flexible if your situation changes? What fees are they chargingm- if they say “non” they what fees are they taking out of the payments you make so the creditors get less?

For so little debt I strongly suggest you talk to StepChange immediately about a debt management plan – and then cancel the arrangement with J3 are planning. That is fee free and flexible and will not show as insolvency on your credit record. And you will be able to make affordability complaints in a DMP which will speed it up and help to clean up your credit record a bit.

Sara (Debt Camel) says

Are you in Scotland?

Connor says

Hi Sara,

Im thinking of making a complaint. I have been in my overdraft for many years now with Santander and although I receive emails mentioning that overdrafts are for short term borrowing they have never actively reached out to put a stop to charges or anything. I did change my account type to one where there are no unwarranted overdraft fees and a set monthly overdraft fee but still haven’t been able to get out of my overdraft. I pay money in from my other account (not Santander) then end up pulling money out before charges hit and am back to square one.

Do I have a case to complain? Super embarrassed by this which has caused me so much mental health issues that even reaching out is causing me anxiety.

Sara (Debt Camel) says

So santander isnt your main bank account?

Connor says

Santander was my main account (i have had it open for probably 20 years in total) however I have a Barclays account where I get paid into and use for bills and a Revolut account which I use for day to day spending

Sara (Debt Camel) says

I think this is well worth a complaint

Connor says

Thank you Sara,

I have finally gotten over the anxiety to contact yourself and have sent off an email to Santander to complain. I will let you knwo every step of the way what they respond with.

Thank you so much for your help, I hope i can finally pout this behind me.

Connor O'Brien says

Hi Sara,

Just wanted to let you know that Santander did email me last month to say it was taking a little longer than expected and they would be in touch.

Today, after them trying to call me for the last 3 days due to me not paying anything into my Santander and it going over my arranged overdraft limit, I have just received an email saying they are changing my overdraft and after looking on my app they have given me an account adjustment of £2,800 with a new message in my in app inbox saying they are taking away my overdraft leaving me with £800 in my account for the first time in probably 10 years.

Not sure if that means my complaint was successful or what as they haven’t responded to that yet but thank you so much!

Sara (Debt Camel) says

sounds promising!

Kevin says

Hi Sara, I’ve been with Halifax since I was 18 (24 now) and have been essentially living in my now £1800 overdraft since I was about 19/20, I earn £1900 a month after tax so get out of my overdraft on payday but usually go straight back in as soon as I start paying bills. Do you think I have a good case? They not long ago let me go up from £1550 to £1900 despite me always living in my overdraft.

Also, if I do complain will they just cancel the overdraft and pay back the fees and then I’d be left with nothing to spend?

Sara (Debt Camel) says

This sounds like a good complaint to me. It sounds like they should have offered you help not an increased overdraft limit.

Legally a bank can withdraw an overdraft or indeed close an account whenever they want. I don’t recall this being a problem with Lloyds/Halifax who usually given notice of any changes, but you may feel happier if you have already opened a new bank account to switch to, so it’s their in the unlikely case that you need it.

Richard says

Hi Sara. You asked me to let you know out come on my long standing Ombudsman case against royal bank of Scotland. (Halifax). They have finally replied and got bank to ombudsman. The investigator herself wasn’t fulling ne with confidence regarding the years prior to the last 6 years. I was paid out nearly 2 years ago for 2017-2023 totalling £8.5k

The Halifax have finally agreed that the overdraft should never been raised. And now paying out from 2008 to 2017 another £7k plus 8%.

So people should not give in or give up hope.

I’m happy to copy and paste the response in here redacted of personal information if course. If you think it will give others hope.

Thanks for all your previous advice.

Richard

Sara (Debt Camel) says

I would love to see the decision. You may have to post it in bits, and can miss out the boring stuff!

Richard says

We have re-reviewed the complaint and assessed all the overdraft applications and completed a review of the statements from the initial overdraft limit provided of £50 in October 2002. This later increased to £100 in August 2005 and increased further to £300 on 28 August 2008.

We’ve concluded the overdraft limit provided up until 28 August 2008 was affordable for Mr …. However, we shouldn’t have allowed Mr … £300 overdraft limit to be provided on 28 August 2008. This is because it was evident the account was being used for gambling. The gambling transactions increased further into 2008 following the increase of Mr …. overdraft limit on 28 August 2008.

To put things right we’ll refund all overdraft interest and charges applied since 28 August 2008 up until 12 March 2018 minus any previous refunds Mr … may have already had during this period. This totals £6953.88. All overdraft interest and charges since 12 March 2018 onwards have already previously been refunded as part of the original decision to Mr …. complaint.

We’ll also look to make an 8% compensatory interest payment if required. Both the refund amount and the 8% compensatory interest payment, if this is required will be paid into account ending 2790 once we receive acceptance from your service and Mr … that this resolves this complaint in full.

PL says

Thanks Richard,

This fills me with a bit of confidence. I was assigned an investigator on the 2nd of December. I followed up a month later because I hadn’t received an update, the said they’ll start looking at my case in greater detail the next week, so far it’s been just over 2 weeks, so hopefully I get a decision soon.

It was the same case for me, I had a load of gambling transactions on my account. My overdraft was raised from 2k to 15k within the one application.

It’s worth noting that I have been paying 3-400 a month for 6 years. I’ve consistently been in my overdraft since December 2018, except for 2 periods in May and June 2019 where it was cleared, but I was back in it within days.

Richard says

I first started my claim around 18 months ago. It was dealt with pretty quickly by the Halifax and paid out the last 6 years straight away. I know now though they have stopped doing this in most cases and now just rejecting. So the ombudsman will be clearly busier now.

I wasn’t happy with only the six years. So I asked the ombudsman to assist. This as took 1 year 4 months. Now I know there was a court case which as been good for us that are claiming. I’m sure Sara will as as quoted it.

I assume you have claimed through bank and sent it do ombudsman because of rejection.

My advice would be to keep at it. If the investigator doesn’t agree with you. Send it to ombudsman. Just keep at them and don’t let it go. But I would expect it to all take 9-12 months.

PL says

I complained to my bank at the beginning of October, 8 weeks later the bank rejected my complaint, so I raised it with the FOS shortly after. I was assigned an investigator within a couple of months. Probably due to the complexity of the case, who knows.

In total I’ve paid over 20k in interest! Which makes me feel sick, but hopefully I get the result I’m hoping for via the FOS investigator and the bank accepts it, otherwise it’ll mean a longer wait via the Ombudsman.

Congratulations on getting such a large refund back, seems like it was worth the wait.

Richard says

Feels like our situation is very similar so hopefully that gives you some reassurance. Wish you luck

JAY says

Hey Richard,

Great result with your complaint!!

Can I ask, did the ombudsman mention anything about a judicial review? Can I ask when the ombudsman at the final stage issued a decision? I have a very similar aged case that has been going on since June 2023 detailing a complaint back to 2012. FOS paused it while they were reviewing their approach, confirmed that this internal review was now complete but then in the middle of January have said that they are pausing decisions on these complaints due to judicial review and they didn’t know how long this would last.

Richard says

No they didn’t mate. I’m just waiting on Halifax now paying out. Maybe sara can help you more with what this might be.

Jo says

Hi,

I want to complain regarding my £1700 Santander overdraft as after a few days of being paid and bills coming out, I’m in it again and have been since 2014.

I have a Santander mortgage too but I am worried that if I make a complaint, they will withdraw my overdraft altogether and leave me in a worse

position – has this ever happened?

Sara (Debt Camel) says

Nothing that happens to this overdraft will affect your mortgage. When you need a new mortgage fix, Santander won’t check your affordability or credit record.

What is your current credit score like? Do you have a lot of other debts as well?

A bank can withdraw the overdraft – that just leaves you with an unarranged overdraft. You can obviously send the complaint to the Ombudsman who will always be able to go back at least 6 years and can decide to go back further. If you win the case at the ombudsman, Santander would normally have to remove negative marks on your credit record. So you have had some temporary damage to your credit score that is then corrected.

if you don’t complain, what other way out of this trap do you have?

Evan says

Hi Sarah. I have had a £2000 student overdraft which I was increasing by £100 pretty much every day with NatWest and I ended up leaving university and when I started working and my account changed to a graduate account, my overdraft was always more than my monthly pay and when I had a graduate account I was really struggling as I was constantly getting further credit and gambling to try and get rid of my debts. Would I have a case with NatWest? There has never been a time when I wasn’t in my full overdraft

Sara (Debt Camel) says

How long has interest been charged on this?

Have you managed to stop gambling?

Do you have other problem debts as well?

Evan says

The interest has been charged for at least 2 years and I still have my problems with gambling it’s something that I’ve struggled for years. I do have other problem debts and I’ve resorted to going on a debt management plan because of it. I was constantly trying to place bets to reduce my debts. Usually putting me in more of a debt

The DMP is with money wellness and they have taken into account my NatWest overdraft

Sara (Debt Camel) says

OK so you need help to stop gambling. If you don’t then getting any refunds isnt really going to help you as you will probably just gamble away the money :(

If your gambling is online, sign up to Gamban. It is effective. Gamstop is too easy to get around.

But yes you can complain about this overdraft. And also about most of the other debts in your DMP probably! Can you list them?

Evan says

Hi Sara. Thank you for your response about this. I want to mention that although I wasn’t a problem gambler at the time I got my £2000, overdraft.. do you think I still have grounds to complain? Like I said I’ve never had a wage bigger than my overdraft amount so if that holds weight I’ll certainly look at complaining.. I definitely was at the time it changed to a graduate account and I was being charged interest. I’ll try gamban but GamStop unfortunately doesn’t ban every single betting site.

I have intrum, aqua,lowell, and a few others. But yes with alot of them I was given credit while I was a problem gambler.

Sara (Debt Camel) says

Like I said I’ve never had a wage bigger than my overdraft amount so if that holds weight I’ll certainly look at complaining..

That is the main reason to complain. The gambling makes their decision to carry on giving you an overdraft worst

I’ll try gamban but GamStop unfortunately doesn’t ban every single betting site.

Gamban has a reputation for being much more effective. If online gambling is your weakness, it’s worth the money

intrum, aqua,lowell, and a few others

go back and find out who the original lenders were – they are who you should be complaining to, not intrum, lowell. even if they couldn’t see the gambling, they should have seen your heavy overdraft usage which should have suggested you couldn’t afford the repayments

Evan says

Hi Sara,

Thank you for your response. The original lenders are places like very and studio. I’ll have a look through them tonight. I just want to mention that when I kept getting allowed to increase my overdraft I was still a student and during that time I was not gambling at all. when it became a graduate account is when I really had an issue with gambling. Thank you so much for your help with this Sara

Evan says

Hi Sara, I have now sent a complaint over to NatWest. I wanted to ask if my complaint still holds weight. I basically said while I was working full time (2018 onwards) I wasn’t being paid any more than my overdraft limit which started gaining interest maybe in 2019 or 2020. They sent me one or 2 emails about the interest I’m paying but no major effort in terms of at least giving a call. Thank you

Sara (Debt Camel) says

this sounds good to me. If it has to go to the Ombudsman, and Natwest reject many complaints, start by saying you are only making a complaint from 2019/20 when Natest started adding interest

Anthony Brown says

Hi Sara,

I have a overdraft with HSBC of £750 which was originally at £250, then £500… these increases we’re granted whilst my overdraft was maxed out and taking loans, paying off credit card debt and only having an income at the time of £1500 a month. The overdraft facility does not charge me any interest; however I have been reliant on my overdraft for over 7 years now and struggle to pay it off alongside the other debts i’m paying off (I have taken a look at your other links to support these). I have been in my overdraft so long now It is effectively considered my spending money as I cannot afford £750 to be immediately wiped off my monthly wage. Is there any grounds for Irresponsible lending here? Is it worth my time contacting them as the template requests a refund of interest as well as charges, which my account is not affected by?

Sara (Debt Camel) says

There isn’t any interest to be refunded, is there? Do you often get charges?

What other debts do you have at the moment?

l J says

I just wanted to leave a comment firstly thanking you Sara for your help, it is truly invaluable.

Secondly, to acknowledge a successful affordability complaint against HSBC for my overdraft. I started with a student overdraft in 2015 and since then have continually been in it for most of the month (minus a few occasions when it was paid off and cleared, but then subsequently increased).

I complained to HSBC that I was continually at my overdraft limit, only coming into credit when I was paid but then quickly back into the overdraft. They allowed me to increase it, even with additional lending on my credit file, CC’s, loan, mortgage etc., as well as exceeding my overdraft limits on occasions.

The current limit is £2000. HSBC rejected my complaint and said that it was affordable as I was able to bring it back into credit each month – Sara helped me in suggesting I escalate to the Ombudsman and highlighted why HSBC’s response was inadequate. 2 weeks later the ombudsman have informed me that HSBC have offered over £1800 in returned interest and charges going back to 2019, they are also going to close my overdraft. I am so happy with the outcome. I strongly advise that even if your bank rejects your complaint, it is worth escalating to the ombudsman.

Thanks again so much Sara. If I agreed with the idea of an MBE, you would certainly deserve one for the wonderful work that you do!!

Kirsty Bradley says

I had had a problem overdraft with Satander since around 2018, that had been sitting at around the £2k mark for a long time. It was left over from an interest-free student account that since turning into a graduate account I had been just about paying off the fees monthly. I’d reached out to Santander about 2 years ago about support, but I was given very little back by way of clearing it, so I just stuck with it hoping for a miracle. I submitted an affordability complaint with Sara’s help in September 2024, and received back acceptance from Santander that they should have provided support and I was being granted a refund of around £100 with the note that they couldn’t refund more as I had stopped using that account as my main- a switch I had made so that I could try to start budgeting properly without just living in my overdraft. I then handed this over the the Financial Ombudsman, who said that whether that was my main account or not was irrelevant, and Santander were ordered to pay back all fees plus interest, resulting in a £2.4k refund- clearing my overdraft and leaving me with a little bit extra!

Sara, thankyou so so so much for all your help through this process and I can’t tell you enough how this has changed my situation. I would never have known about this, or how easy it is to do without your support and endless resources.

Thankyou!

Sara (Debt Camel) says

Very pleased to hear this good result!

John says

I have an overdraft of £3400 with NatWest that I haven’t been able to get out of since 2019-20, I have contacted them to set up a overdraft reduction each month, but I keep getting refused. I also have a credit card with a limit of £8500 with them that was frozen (interest still being added) around 2021 and I have paid around £3000. I also have credit card debt with PayPal and Newday of around £5000 each that I have payment plans set up with debt collection agencies £2000 payed off on each. My finances haven’t changed since around 2012 as I am disabled and have full time care. When I was given the overdraft I had direct payments from the council which I paid towards, which was sent to the care agency, I think that NatWest counted that as income when they decided to give the overdraft and credit card. Should I make a claim for both NatWest in the same complaint or claim separately? Thanks You for your help.

Sara (Debt Camel) says

That sounds very difficult for you.

Can I ask if you are renting or if you own the house?

When were the Payplan and Newday limits set that high?

Amy says

I sent an affordability complaint to Halifax on 14/01/25 to Halifax , I know we have to give them 8 weeks. I got a text from Halifax today apologising for the delay it’s taking longer than expected and advising if they haven’t made a decision by 13/03/25 then they will call me and tell

Me why , has anyone had this?

Sara (Debt Camel) says

You are the third person this week that has mentioned this “Sorry, delay”, email from Lloyds/Halifax.

If your finances are now pretty safe eg your life has turned around or you are in a DMP, you may be happy to wait.

But going to the ombudsman now gets you into the queue so your case may be picked up sooner. Lloyds/Halifax will still respond to your complaint if you go to FOS, and if the offer is suitable you can just tell FOS this.

Laura says

Hi Sara,

My investigator has got back to me RE my NatWest complaint.

They have said NatWest should have been reviewing my account from Feb 2015 and would have been able to see that the overdraft was unaffordable. However they say they should only have to refund me from March 2018 (6 years from when I complained) as I should have known I could have complained earlier. Even though I explained I had no idea I could complain about this.

“If it’s clear that a relationship is unfair, and Ms X was aware of that, I think it’s reasonable to have expected her to have brought that to NatWest’s attention to give it the chance to put things right. I’ve seen no evidence that Ms X did that, and I’ve not seen that there was anything that would have prevented her from doing so.

Even if Ms X wasn’t aware of the specific reasons that I’ve upheld this complaint she would’ve known the facts relevant to her claim because it was clear she had financially struggled and should’ve known the financial position she found herself in was aided by NatWest’s continuance of the overdraft. I can’t see Ms X did anything further until she complained in 2024. This was eight years after I think she was aware of the relevant facts to make this complaint.”

I know that I can, and will, ask for an Ombudsman to look at this but is there anything else I should say? Thank you!

Sara (Debt Camel) says

Did you tell the ombudsman that in 2016 you thought natwest has set the overdraft too high?

did Natwest’s rejection of your complaint list any specific reasons why they think you should have complained before?

did you take any actions such as consolidation loans or 0% balance transfers to try improve your situation at any point before or after 2016?

Laura says

Hi Sara,

Thanks so much for responding.

Did you tell the ombudsman that in 2016 you thought natwest has set the overdraft too high?

I didn’t – the overdraft was at £2,000 from 2010 as it was a graduate acount back then and that was the highest available OD amount you could have. I didn’t think of it as being too high, I just thought it was normal.

did Natwest’s rejection of your complaint list any specific reasons why they think you should have complained before?

No – they gave me a flat-out rejection of my entire complaint arguing that I hadn’t made them aware I was in any financial difficulty.

did you take any actions such as consolidation loans or 0% balance transfers to try improve your situation at any point before or after 2016?

No – at first I maxed out credit cards (for day-to-day living), then when I couldn’t get any more I turned to payday loans and large high-interest loans – I wasn’t eligible for any mainstream loans or 0% balance transfers then.

Sara (Debt Camel) says