Have you had big overdraft problems for a long period?

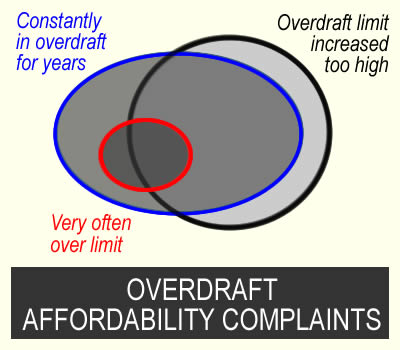

You can make an affordability complaint and ask for a refund of overdraft charges if:

- your overdraft limit was set too high at the start or increased to a level you are unable to clear; or

- your overdraft usage showed you were in long-term financial distress. For example, being in the overdraft all the time, or using an unauthorised overdraft a lot

- your overdraft was originally a student account with no charges, but now interest is being added and you are in the account all or almost all of every month.

This article shows how to make an affordability complaint to your bank, with a free template letter to use.

These complaints do not hurt your credit record. And if the bank doesn’t make a you a good offer, it is free to take your case to the Ombudsman.

Contents

Overdraft affordability complaints

Overdrafts are supposed to be for short-term borrowing

Overdrafts are intended to be used for short-term problems, not as long-term borrowing. A bank should review a customer’s repayment record and overdraft limit and if there are signs of financial difficulty, offer help.

One sign of financial difficulty is hardcore borrowing for a long period. The Lending Code defined hardcore borrowings as “the position where a customer’s current account overdraft remains persistently overdrawn for more than a month without returning to credit during that period”.

Some Ombudsman decisions

All cases are very individual. But these examples give you an indication of what the Ombudsman thinks is important.

In this NatWest decision, the Ombudsman decided:

NatWest did have an obligation to monitor Miss K’s use of her overdraft facility.

Any fair and reasonable monitoring of Miss K’s overdraft facility would have resulted in NatWest being aware Miss K was in financial difficulty … by October 2014 at the absolute latest. So NatWest ought to have exercised forbearance from this point onwards.

In this Santander case, the bank didn’t notice hardcore borrowing:

By this point, Miss C was hardcore borrowing. In other, words she hadn’t seen or maintained a credit balance for an extended period of time. Santander’s own literature suggests that overdrafts are for unforeseen emergency borrowing not prolonged day-to-day expenditure. So I think that Miss C’s overdraft usage should have prompted Santander to have realised that Miss C wasn’t using her overdraft as intended and shouldn’t have continued offering it on the same terms.

A similar decision was reached in this Lloyds case:

Mr and Mrs C’s statements leading up to the renewal shows they hadn’t really had a credit balance on their account for a prolonged period. Indeed, they’d had regular returned payments and had also exceeded their limit. In these circumstances, it ought to have been apparent Mr and Mrs C were unlikely to be able to repay what they owed within a reasonable period with overdraft interest, fees and associated charges continuously being added.

Decide which reasons apply to your overdraft complaint

You are in the overdraft all or almost of the month for a long while

This is the most common reason for winning a complaint

Overdrafts are meant to be used when you have a problem. Using the overdraft a lot for a few months is fine. Or for a few days at the end of a month before you are paid.

Banks should review your overdraft annually. This is in most overdraft terms and conditions. And even if it isn’t, the Ombudsman says this is good industry practice.

So at one of these reviews, your bank should have seen if you were in difficulty with the overdraft. For example if you are in the overdraft for all (or almost all) of the month for a prolonged period. Or if you were often exceeding your arranged overdraft limit.

I would say over a year is prolonged.

The bank set your limit too high

This may have been from the start when you were first given an overdraft. Or the initial low limit may have been fine, then the bank increased it to a level which it was impossible for you to repay.

If the bank saw signs of financial difficulty, it should not have increased your credit limit, even if you asked for it. And it should have considered offering your help instead (the regulator’s word is forbearance), for example by stopping charges.

But what is too high?

This depends on your income and expenses. An overdraft of £2,000 for someone whose income is £1,800 a month is a lot – but if you earn £5,000 a month, then a £2,000 overdraft may be reasonable.

Other points that help a complaint

You won’t win an affordability complaint by saying the charges were too high.

Instead, you say the bank should have known they were unaffordable for you because of all the financial problems it could see on your statements and your credit record.

Here is a checklist, do any apply to you?

- often having direct debits or standing orders not being paid;

- a lot of gambling showing on your statements;

- significantly increasing other debts with the same bank (you may also be able to complain about those loans or credit card);

- being recently rejected for a loan or a credit card by the bank;

- significantly increasing debts with other lenders showing on your credit record;

- a worsening credit record – maxed out credit cards, new missed payments, payment arrangements, defaults etc;

- using payday loans;

- mortgage arrears;

- a reduction in the income going into your account.

Making your complaint

What you need at the start

You don’t need to know the dates your limit was increased before complaining, my template asks for them.

If you have paper statements or you can download them from the app, that may be useful for you. But you don’t need to send these statements to the bank with your complaint – the bank already has them!

You can’t go back and see exactly what your credit score was in say 2021 when the bank increased your limit. But your current credit record shows what was happening back six years, so download your credit report now and keep it. The sooner you get the report, the further back it goes. I suggest you get your free TransUnion statutory credit report.

Send a complaint by email

I don’t recommend phoning to start off a complaint. It’s too complicated and you will be talking to someone that doesn’t specialise in these complaints.

I think email is the simplest way to make these complaints. Here is my list of bank email addresses for complaints.

An alternative is to send a long message in the app. But if this means using a chat facility, it’s not usually a good idea, as you are again talking to someone who doesn’t understand what you are saying and tries to tell you what help is available with your overdraft – when all you want is to have your complaint considered.

A template you can adapt

The section above looked at the reasons to complain and the other good points that apply to your case – you can turn those into a complaint.

In the template below, I’ve invented some examples and dates so you can see how a complaint email could read. The bits in italics should be changed or deleted to tell your story.

The bit about other points is important – what should your bank have noticed that showed you were in difficulty?

I am making an affordability complaint about the overdraft on my current account number 98765432.

Your identity details (these are needed if you complain by email, not if you use secure message):

My name is xxxxx xxxxxxxx. My date of birth is dd/mm/yy. The email address I use/used for this account was myaddress@whatever.com.

Your home address (if you know the bank has your current address, ignore this):

My current address is xxxxxxxxxxxxxxxxxxxx. Please do not send any letters to older addresses you may have on your records.

If your overdraft was originally a student overdraft with no interest include this, otherwise delete it:

My account started as a student overdraft and no fees were charged. I am complaining about the period after, when you started to charge fees.

START BY SAYING they should have noticed your financial difficulty

Overdrafts are meant for short-term borrowing but you could see I was unable to clear the balance in a sustainable way. I was using the account for long term borrowing as I could not get out of this. The fees and charges you were adding were making my position worse.

I am complaining that [every year since [20xx] OR for many years] you have failed to notice my difficulty during the annual reviews of my overdraft. You should have offered forbearance eg by stopping interest and charges being added.

By 2017 I had been in my overdraft constantly for many months, not getting back into the black even when I was paid. This “hardcore borrowing” is a clear sign of financial difficulty. My income was only £1,850 a month – after I had paid bills, there was no way I could hope to clear an overdraft of £3500 in a reasonable length of time.

OR

By 2021, although my salary took my account briefly into credit, within a few days, I was back in the overdraft.

include any other points that show you were in difficulty

You should have seen that I was in financial difficulty because you rejected my loan application in 2019.

You should have noticed that the income going into my account decreased from 2021.

From 2020-22 there was a lot of gambling showing on my account.

In 2021 you should have seen from my credit record that I had made payment arrangements with other debts.

Say if the intial limit was too high or it was later increased too high

You should never have given me an account with such a large overdraft. When I applied in 2016, you should have checked my credit record and income and seen I had recently missed payments to a credit card and had taken several payday loans.

OR

You should not have increased my overdraft limit in about 2017. When you increased the limit, you should have seen that my debts to other lenders on my credit record had increased a lot.

I do not know the exact months of the overdraft limit increases. In your reply to this complaint, please tell me when the increases were and how much the limit went up on each occasion.

END BY asking for a refund of charges and interest:

I would like you to refund all the interest and charges that were added to my account from 2016 when you increased my overdraft limit.

OR

I would like you to refund all the interest and charges that were added to my account from 2021 when you should have realised that my finances had got worse to the point that I was no longer able to clear the overdraft.

Please remove any late payment and default markers from my credit records.

Points to note

Student overdrafts

You won’t win a complaint about a student overdraft saying you were a student and it was unaffordable at that point.

But when the bank has started charging interest, it should start doing reviews and check if you are in difficulty. So from then on, you can win affordability complaints.

You can complain if the account is still being used or if it is closed

These complaints can be made in a lot of different situations. For example:

- you are still using the account or you have stopped using it and are paying it off;

- the account has been closed;

- the bank defaulted it and sold it to a debt collector (here you still complain to the bank, not the debt collector). If the debt collector has gone to court and got a CCJ, add a sentence to the template saying you want the CCJ removed as part of the settlement of your complaint.

But if you have had an IVA or bankruptcy after these problems, or if you are still in a DRO, then you shouldn’t complain – ask in the comments below for details.

Old accounts

Banks may say FOS won’t look at an old complaint, but this isn’t right. FOS will often look at a complaint if it has been open in the last six years. How far back FOS will go seems rather random, but it should be possible to go back at least 6 years.

Open and recently closed accounts aren’t a problem – the bank will still have your statements.

If your complaint is about an account that was closed more than 6 years ago, it’s going to be very hard to win.

Packaged bank accounts

These affordability complaints are not about the fees on packaged bank accounts. MSE has a page about packaged bank account charge complaints.

Personal accounts, not business accounts

The complaints covered here relate to personal accounts. For business accounts, talk to Business Debtline about your options.

The Bank replies

They want to phone me!

People are often scared if they get this message. But it may be good news! You can just ignore it or say you would like a reply in writing.

If you decide to take the call, it helps to be prepared:

- have a pen and paper handy so you can write down anything

- if they say they are partially upholding the complaint, ask them the date they are refunding the fees from, and how much. And say you would like to see this in writing before you decide whether to accept it.

- if they ask you questions that sound complicated or worrying, ask them to put the questions in writing as you find the phone difficult

- when they say they are rejecting the complaint, ask for this in writing, as you will be going to the Ombudsman.

Rejection/poor offer – go to the Ombudsman , it’s free

Banks reject many good complaints, hoping you will give up. So don’t! You know if the overdraft has caused you a lot of problems.

You can’t go straight to the Financial Ombudsman (FOS), you have to wait for the bank to reply, or for them to have not replied within 8 weeks.

Here are some things banks may say to try to put you off:

- you could have declined the increase to your overdraft limit – FOS probably won’t think that is a good reason

- you never let the bank know you were in difficulty – FOS probably won’t think that is a good reason

- your salary was enough to return you to credit each month – this is misleading if bills meant you very soon went into the overdraft;

- FOS will not look into things that happened more than 6 years ago – if your account was still open in the last 6 years FOS may well look at it.

And the bank may offer to refund fees for the last 15 months say, even though your problems have been large for many years. Think twice about accepting a low offer – you won’t put this offer at risk by going to the Ombudsman.

If you are offered a refund for the last 6 years but not any further back, have a think if this is a good enough offer. It is a bit unpredictable whether the ombudsman will be prepared to go back further than 6 years.

If you aren’t sure, post in the comments below.

To send the case to FOS, complete this online form:

- you can use what you put in your complaint to the bank;

- if the bank rejected your complaint or made a low offer, say why you think this is unfair;

- use normal English, not legal terms.

You don’t need to send your bank statements – the bank will send those to FOS. And you don’t need the policy documents for your bank account, the lender will supply those to FOS if they are needed.

Do these complaints work?

Yes! From 2024, some banks are making more offers directly.

A Guardian article featured a case where someone used the template letter here. Barclays denied it had done anything but made an £8,000 “goodwill” payment to the customer.

And if your bank rejects your case, people are winning cases at the ombudsman. FOS is a friendly service although it isn’t speedy. It isn’t faster to use a solicitor or a claims firm,

The comments below this article are from other people who have made this sort of complaint. That is a good place to ask for help if you aren’t sure what to do.

Kye says

I have very recently (a couple of weeks ago) been made redundant. I have had a £1,800 overdraft that I’ve been increasing in line 1/200 increments over the last couple of years, this started at around £500 three years ago. It started as a student account which my mum helped me get out of, and I only started it again because I kept being promoted by the app that it was a good financial decision and a safety net. It’s obviously been more like quick sand, and my credit score has recently decreased significantly, I also in the last year opened an overdraft with Monzo to the sum of £350. I also opened a credit card with them to get my credit score back on track and find this a much more manageable approach to spending. My pay before redundancy was only £1800, I do have £1700 that it’s taken me years to save in a cash ISA at £50 per month. I’ll also say that my career was stunted due to Covid and some issues that I raised as a grievance, and as a result my pay increases never matched inflation and I was overlooked for promotion. In 5 years my pay went from £1450 I think to £1850. Lloyds is my main bank account that my pay goes in to. I also recently started using tools like Klarna and I would be right at the end of my overdraft limit during the middle of the month, right through to being paid. Now that I’m about to be unemployed I won’t be able to come back out, at least until my settlement amount comes through.

Sara (Debt Camel) says

Your problems sound very recent so any refund would be likely to be very small. And it may be hard to win an affordabilty complaint where you have been making regular savings into an ISA.

i think you should be concentrating on finding another job.

Kerrin says

Hi,

I started uni in 2006 and within less than 6months Halifax had continually increased my student overdraft until it was £3750. It was fine for the four years I was at uni and it was interest free but I was unable to pay it off until around 2015 when my husband inherited some money and gifted me the balance to get rid of this never ending debt (I was only paying the interest off every month). Is it too late to request a refund of some sort of action?

Thanks

Sara (Debt Camel) says

Halifax will reject this complaint as being too old.

in theory the ombudsman can decide to go back further, but Halifax may no longer have any records/ So you have old statements?

Megan says

Hi Sara

I recently used your website for an affordability complaint with NatWest. In short, I began an orange overdraft of Nov 2020 at £250, I upgraded this another 4 times, the last being an overdraft of £3000 by May 2021. Since then, I have continued to stay in my overdraft, and have been charged £2,601.84 in interest fees. In 2020, my annual income was £2,622.. 2021 – £9,484.. 2022 – £3722.. 2023 – £3610.

Unfortunately the response wasn’t great from NatWest.. I had unintentionally lied on the overdraft application, putting mine and my partners income combined rather than just mine. Something they say was validated by the system average credit turnover (as my partner sends me money for household bills, payments etc). They also state because I’ve stayed within my arranged overdraft and not gone over I’ve been able to ‘run with the agreed overdraft facility’. They also contacted me 2/3 via email times a year to book discussions with a staff member regarding my overdraft. But my disability and anxiety caused me to ignore these, as the thought of discussing my situation with a stranger, either on the phone or face to face was horrifying. For those reasons they are unable to agree with me and have given me details for FOS. I now feel like the above reasons will go against me and I’m now uncertain whether my anxiety can cope with the idea of FOS and what comes with it.

Is there any real chance that I have a case?

Sara (Debt Camel) says

whatever you said on your original application, for the subsequent overdraft limit increases, NatWest could see how the account was being used. I think you should send this to the Ombudsman.

Holly Yates says

I’ve recently had Zopa come back rejecting my complaint but have taken it further with the ombudsman. Santander contacted me today via phone at work so I haven’t had chance to speak to them, does anyone have experience with them and if they are kind or not on the phone when dealing with these things I have severe anxiety to talking on the phone is a big fear for me. But I have been in my overdraft with them since 2014 till now where o have just got out of it due to some money I was given.

Sara (Debt Camel) says

If you find it stressful or confusing on the phone, tell them this at the start. And if they are asking you questions, or make you an offer, ask them to put these in writing so you can think about them.

let us know what they say!

Han says

Hi. I have a £1200 overdraft with Natwest that has been at that amount for over 20 years! I am always in my overdraft and feel it is impossible for me to clear it. Before payday I am extremely close to the limit. Within that time I have been on mat leave, been a student, and now work as a nurse and get universal credit top up. In more recent times, when the bank have contacted me for a review, I have declined as didn’t want to be offered a loan and effectively take on more debt. At the point I was given the overdraft, there was no way it was affordable…and still isn’t. I rarely go over my overdraft to avoid extra charges but my lending with other companies has increased. Is it worth me applying with it being such a longterm issue?

Sara (Debt Camel) says

so you are in this every day or almost every day of the month?

Katie T says

I am looking at my TSB account which holds my main bank account, with £1000 overdraft and my credit card.

In Feb 2022 my credit card had a £3275 limit and I hardly used it.

By January 2023 it was almost at max due to maternity leave.

I had minimum payments of around £50 but I would pay say £200 and then rely on the card all month again. (More than the minimums but obviously not clearing the debt anytime soon!)

Jan 23- late payment

Feb 23 -they INCREASED my limit to £5250.

March- another late payment

April- I did a balance transfer

May, another late payment

By June the balance was run straight back up.

I have since been around the 5k mark on this credit card since then.

The overdraft, I would be out of and back in again on the same day.

I’d be paid 2k, I’d pay £1250 to my husband for my part of the bills. which put me straight back in the overdraft. Paying multiple credit cards (even the one WITH TSB) using the overdraft.

During the time I had also taken out multiple other credit cards, a small personal loan and my income wasn’t increasing. I was just slowly drowning (alongside an ADHD diagnosis and postnatal depression, I just really couldn’t see the wood for the trees).

So I suppose my questions are:

– do you think I have a grounds to complain? Or should I put it down to a stupid tax and live and learn?

– If I do complain, do I put them in the same complaint, or separate complaints?

Sara (Debt Camel) says

I think you should complain.

Two separate complaints about the overdraft (template in article above) and credit card (template here https://debtcamel.co.uk/refunds-catalogue-credit-card/)

In the overdraft complaint, say you are making a separate complaint about the way they increased your credit limit.

In the credit card complaint, say they should never have increased your limit in Feb 23 as they could see from your overdraft and the missed card payment the month before that you were in major difficulty. Say that at that point they should have contacted you and offered to freeze interest on the card to help, so you would like a refund of all interest after that point.

Also look at affordability complaints against all the other cards you took out and that small personal loan (who was the lender? what was the interest rate?)

But I also think you should talk to StepChange NOW about a debt management plan that will get interest stopped on the the cards and the overdraft. Winning any affordability complaints will then really speed up the DMP, but these complaints can take many months to go through (a lot will have to go to the Ombudsman) and you need help right now.

L says

Hi,

It’s been 5 weeks since I submitted by complaint to NatWest. Please can you confirm how much longer I need to wait for a reply?

NatWest have acknowledged my complaint and I received an email a couple of weeks ago saying to allow them more time as they’re still looking into it. I’m not feeling hopeful mainly because the account is closed so I’d have liked to have gone through it myself to familiarise myself with it all. Still keen for a reply nonetheless!

Sara (Debt Camel) says

8 weeks from when you complained

Megan says

My complaint took 3 days, I think it depends on who you get and the nature of the complaint

David says

Hello,

Im reviewing my Santander overdraft history for complaint. as someone who has been stuck in a continuous loop of being stuck in my overdraft i would say from 2011 onwards where is started as a student account at £1500 limit

2014 – graduate account – increase to £2000 (2 years to pay it back interest fee. Dont recall this)

2017 – expired to a Everyday Account (Still £2000 limit)

2019 – Offered to Santander Switch account. limit decreased to £1700 on the premise that the account has a fixed rate of £30 per month fee)

I dont recall a time where im not at very best a couple days out of the overdraft becuase i had a “very decent” pay month but ultimately i have just gone by with accepting that being in my overdraft is my normal and that its actually my money. Worth noting that my credit score for most of the 2010s was terrible due to a family members inabiity to pay a for 2 mail order catalogue accounts in my name and ive had to wait till 2021 to see them get removed which has made me resistent to even attempt any form of credit card applications. quite a few different. jobs over time aswell to get by, even periods of low pay and some difficult periods where i was incurring charges but never looking like me getting out .This willingness to hold onto every penny i got meant i didnt want to save anything as you get a visual reminder that you are deeper into the overdraft.

welcome any thoughts Sara,

David

Sara (Debt Camel) says

so on the lower overdraft limit you are still in the overdraft all or almost all of the month?

what else do you get for the £30 a month charge?

“worth noting” much of the stuff in there is not very relevant to this sort of complaint – Santander should have seen that the overdraft was unaffordable from looking just at you bank statements, simple.

David says

Yes I was still in it all the time and have been since almost all the time. I’m not sure what else you get for the current £30 fixed rate but would you say this is worth a shot? Thank you Sara

Sara (Debt Camel) says

ask Santander what else you get for this £30 a month.

You do have a good claim before that, but these monthly charges can be complicated.

Awa says

Hello Sara,

Ombudsman have come back again after I asked them to look further into my case for the last 6years after I rejected an offer from the bank to refund last 4 years. The investigator has said that they are now considering cases that go further than 6yrs. To support this they would like to know. When did I realise the account was unaffordable and did I raise the issue with the bank. And what prompted me to complain recently about the overdraft.

I knew that my overdraft was unmanageable for the last 10 years as soon as my salary went in I had nothing left to live on or be able to reduce my overdraft incrementally. I honestly cannot remember reaching out to the bank as I did not think they could do anything. The reason I started my complaint now is that my financial situation has been worsened by the bank charges. More often than not the bank take my last 50-60 pounds leaving me unable to buy food items or top up my children’s lunch cards. Is it OK to say this Sara.

Sara (Debt Camel) says

what many people feel is that they didn;t complain before as they though it was their fault for borrowing too much, not the bank’s fault, so they didn’t think there was anything the bank had done wrong so the bank wouldn’t help. And that you found out that the bank should have made sure the account was affordable in [earlier this year?], and at that point you realised that the bank was partly responsible for your situation so you made a complaint.

Natalie says

I was wondering if anyone has had any recent responses/progress from the ombudsman in regards to overdraft complaints over the 6 year mark? I argued 6 months ago that they should go back further, since then I’m getting the same generic email off my handler each month saying they are reviewing it but they won’t tell me what exactly is going on?

R says

I am in the same position.

Claire says

Ive been getting a monthly generic messge too,.but no idead when this will be looked at. The message says

You may be aware that the Supreme Court issued some clarification around consumer credit agreements. Our Ombudsman are still considering this clarification so that we can ensure fair decisions are reached on complaints that have been referred to us.

Tracy sibley says

Santander have gone back to 2015 so over the 6 year mark, they did this in error though. My investigator said that even if they go back more than 6 years the payout is capped at the last 6 years? I did feel under pressure to accept, so I have but I have a 22 year massive overdraft that I’ve been in constantly for 22 year all bar a few months. I did ask what the review was that’s being undertaken and that is the response I received, that it’s capped at 6 years even if 22 years amounts to ££££ more. I think I may have been misled.

Sara (Debt Camel) says

That is not what is happening. Did you get that response in writing? From the adjudicator or an Ombudsman?

Tracy sibley says

Hi Sarah no he told me in a phone call, he positioned it that in error Santander had gone back to 2015 and had agreed to pay from then. When I said that I had been in the OD since 2002, to the tune of 5k, never once reviewed he said he had checked with his manager and even if they went back to 2002 which Santander refused, I would only be refunded for 6 years worth. He has sent the final decision to me and Santander. I’ve emailed him to ask for this in writing and I’m awaiting a response. I feel really stupid because I did challenge him about it but he was very sure of himself

Tracy sibley says

From the investigator. Santander accepted and I did because he told me it was pointless going back further because any payout would be capped. They’ve refunded me 2.5k today which has reduced OD to 2.5k left, I worked out if they’d agreed or looked at longer then the refund would have been closer to 10k. I feel the investigator misled me, he said Santander may also refuse altogether if I pushed it

Sara (Debt Camel) says

how long ago was the phone call when you feel you were misled?

Tracy sibley says

3 September, I’ve been waiting to hear from Santander and they refunded the 2.5 today, taking OD to 2.5, but yesterday I really thought about what had been said from previous post on here I was replying to, so I messaged adjudicator yesterday and received out of office

Sara (Debt Camel) says

OK I suggest you try again on Monday and if if you cant get hold of them, phone and say you want to make a complaint as you were mislded by the investigator in a phone call on that day.The calls should be recorded.

AB says

My complaint goes back to 2006. It has been waiting to be passed to an ombudsman since 1st December 2023. I occasionally hear something from the handler every few months to say I’m still in the queue, but nothing concrete. It’s very frustrating.

JD says

I have had something similar with an aged case since around august 2023. Sara, would you happen to have any update on these cases yet?

Sara (Debt Camel) says

There seems to be some movement but it’s slow.

L says

NatWest have since responded and don’t agree with my complaint. It was a student overdraft in 2015 which then became a graduate account that I had for years. The overdraft increased from £200 to £2,000 and I was constantly in it but managed to close this earlier this year. They feel that my account was managed and they’d also sent letters and emails advising me of interest, charges and support contacts for continued overdraft usage. So to them they have covered themselves. However, I feel that more could have been done about this rather than just routine emails that are automatically triggered for any customer who falls within this category? They’ve said to get back in touch if there’s anything further or take it to the FO. I’m not sure whether to go back to them or just leave it now as I don’t think I can go much further?

Sara (Debt Camel) says

Send this straight to the Ombudsman. NatWest had a regulatory duty to make sure your overdraft was affordable – sending generic communications is not good enough. Everyone gets those – and yet a lot of people win these complaints at FOS!

Richard says

Hi I’ve posted about my overdraft claim before. Bank paid out in august 2023 for the 6 years prior. But my overdraft was a problem long before this. So in September 23 I sent it to the ombudsman. I’ve had many pointless updates from the investigator. Nearly as soon as I sent it to the FOS the investigator rejected due to time restrictions so on your advice I asked for an ombudsman to take a look.

About 4 months ago I asked for an update and she replied with in a nutshell that that are looking at the rules and how the consider claims outside the six years rules.

Now last week I’ve had a response saying the way the FOS look at these claims regarding the 6 years as changed. So she as now been past back my claim from the ombudsman. And she will be looking at it again.

But she did not elaborate on how these rules have changed. So I’m just wondering if you know or have any information on what’s changed. Thanks in advance

Sara (Debt Camel) says

The changes are being brought in because of a case (Canada Square v Potter) last year which looked at when the “limitations period” to bring a court case ended.

I haven’t yet seen a new decision about overdrafts, but it is possible that it may now be easier to go back more than 6 years where the account was still open in the last 6 years, as yours was.

DO says

If you were previously rejected, due to being over 6 years, could you recomplain?

Sara (Debt Camel) says

I don’t think so :(

Pete says

Hi Sara,

I found your website through an article and was impressed by the help you’ve provided. I believe my case might be one of the more extreme ones you’ve encountered.

I’ve been banking with NatWest since 2011, starting with an interest-free overdraft as a student. After university, I cleared the overdraft but fell back into using it. In 2018, I received an email suggesting I increase my overdraft limit. I applied for a £15,000 limit on 25/10/2018, which was approved, despite my only employment income only being around £1,300 per month. At the time, my statements showed frequent gambling transactions and over the years spiralled out of control with large deposits to Forex brokers.

Since December 2018, I’ve been constantly in my overdraft and have paid over £19,000 in interest, with another £413.55 due soon. NatWest has only contacted me once, proposing a loan to settle the overdraft, but the repayment amount was similar to my current fees and my anxiety prevented me from pursuing it. I’ve since received generic emails about support options, but no direct help or fee freezes.

Despite everything, I’ve never missed a payment or exceeded my overdraft limit.

I’d like to know:

* Do I have grounds for a formal complaint?

* Can I request a freeze on interest payments during the investigation, and will it affect my credit score?

* Could the bank remove my overdraft limit if I complain? I rely on it to manage my bills.

Thank you for your advice.

Sara (Debt Camel) says

Yes you have grounds for complaint.They should not have offered an increased limit if there was a lot of gambling on your account. Let alone one that was so much larger than you income.

You can ask but it will hurt your credit record.

In theory yes. This is very rare, but so are cases with such a large limit. One serious option is for you to get a different bank account and move your income and bills there. Natwest is not your friend, they have been making a fortune out of you for many years, leave them behind.

Pete says

Hi Sara,

Thank you for your quick reply. I completely agree—it feels like I’ve been robbed over the years, and it’s time to take action. I will start looking into switching banks. However, my concern is that if I stop paying into the account, I may go over my arranged overdraft, which could negatively impact my credit.

If I request a freeze and win the complaint, either through NatWest or the Financial Ombudsman, do you know if any negative markers placed on my credit report would be overturned?

Thanks again for your help.

Sara (Debt Camel) says

If the refund clears your overdraft it is very likely the Ombudsman will say that any negative marks should be removed. On the numbers you have mentioned, that is possible.

If the refund doesn’t clear the overdraft, sometimes FOS say the negative marks should be removed because your limit should have been moch lower. Sometimes they say should be removed when the overdraft is cleared by you later,

The problem is there are no total guarantees here.

One option is to get a new account opened and ready and move the DDs over. Then you pay into that account the amount needed for the DDs and carry on using the old account. If the worst happens and Natwest close it (which is unlikely) then you just switch your income and all spending to the new account and just transfer the fees being charged each month to the old one.

Another variation is to move everything over to a new account and not spend at all from the Natwest one and just pay in the overdraft charges every month.

These two options help with the practical hassle. But there remains some residual risk to your credit record, that could either not occur or could only be temorary.

What you can’t do is nothing. You cant spend the rest of your life with a massive very expensive overdraft because you are worried about your credit record. Not least because this overdraft means you would fail many affordability checks, so a good credit score doesnt actually do you much good.

Pete says

NatWest has responded to my complaint and unsurprisingly they’ve rejected it. From what I’ve seen in previous discussions, it seems no one has succeeded with them directly and cases typically end up going through the FOS.

Do you have any additional tips for presenting my case to the FOS, based on the details provided below? I’ve tried to summarise it as clearly as possible since their response was seven pages long.

NatWest stated that my 2018 overdraft application was completed online without any manual intervention and it was approved based on factors such as credit scoring, income, account activity and their lending criteria. I find it unusual that they included “account activity,” given that my account showed significant gambling transactions, with thousands of pounds moving in and out.

The bank argued that they couldn’t have known about my vulnerabilities unless I had disclosed them and that it was my responsibility to ensure the accuracy of the income and expenditure information I provided. At the time of applying, all of the information I provided was up to date and accurate. Obviously this has changed over the years.

NatWest explained that due to record-keeping limitations, they no longer have documentation on affordability assessments from these older applications. However, they said that based on the lending criteria in place at the time, there was no reason to deny these applications. My inquiry wasn’t specifically about the affordability of past overdrafts; rather, I wanted to know the amount my overdraft was increased each time over the years. I requested that the investigation covered from October 25, 2018, onward when my limit was increased to 15k.

Sara (Debt Camel) says

yes send this straight to the Ombudsman. They could tell from your account that you had a gambling habit!

Pete says

Hi Sara,

Do you have an idea of how long it typically takes to receive a reference number from the FOS? I submitted my case last Friday but haven’t heard back yet. Is it normal for it to sometimes take longer than 7 days?

Here’s a snippet from the email I received when I submitted it:

“If we can help, you can expect to hear back from us within 7 days. Due to the volume of enquiries we receive, we are only able to reply to those customers we can help.”

Sara (Debt Camel) says

yes this is normal.

They will take the case on – the on;y ones they don’t are those from non UK firms or about a subject they don’t cover eg your water bills or council tax.

Pete says

Thanks Sara, I’ll wait for a response from them.

I made my complaint to NatWest just in time on the 4th October 24, my OD increase was on the 25 October 2018.

Will the FOS be able to take bank statements into consideration from October 2017 leading up to October 2018 if i provide them? This is when gambling transactions took place and the bank shouldn’t have increased my limit. That’s part of complaint.

Just conscious as that would take it over 6 years.

Cheers

Sara (Debt Camel) says

FOS will normally be prepared to look at things that happened before the 6 year point if they are relevant like that

Jennifer says

Hi Sara,

I got an offer from TSB to refund fees on my overdraft from Jan 2023 to now and that my overdraft would be closed on 30th sept and their team would be in touch as there may be an outstanding balance.

I decided to take my complaint to FOC as TSB never replied to me asking how much exactly I was being refunded and another couple questions.

I am awaiting to be assigned to an investigator but this morning I had an email from TSB saying I was in an unarranged overdraft by over £200, they have refunded fees and taken away the overdraft (that im not bothered about) but I had to borrow money to get out the unarranged one as I presumed that now my complaint was with FOC that it would stop this.

My issue is the lack of information and clarity I also presumed they would make my balance £0 and I would pay the balance in instalments, is this normal? I have email FOC today with my ref number also for advice.

Thank you

Sara (Debt Camel) says

Well you didn’t have to borrow to pay it, you could just have made a pay arrangement with TSB. But you can Reasonably complain that TSB told you want was being refunded and their team never got in touch about the outstanding balance.

jennifer says

Thank you, I guess it was a panic, knee jerk reaction. The email I send to FOS bounced back so I will see how to contact them now that iv had time to calm.

The best thing is now the overdraft is finally gone, I have a new bank. account with an app that helps me budget far better and can now tackle 2 remaining debts I have so im looking at the positives now!

Thanks again!

CM says

I have an ongoing co plaint that goes back over 6 years that has been with ombudsman for some time due to 6 year rule being looked at, today I have finally had a response, they are looking for the following, but unfortunately I no longer have them and rbs only goes back 7 years. Will this affect my claim?

Copies of your current account statements from 17 March 2008 to 4 January 2017.

A full copy of your most recent credit report. One agency that provides a free statutory report is:

Sara (Debt Camel) says

IF there are no bank statements it can be hard to prove unaffordabilty or to calculate a refund for that period.

JD says

Have you asked the chat support to send you statements? They provided me statements going back 10 years.

CM says

I contacted rbs this afternoon and they are able to provide statements from 10th October 2014 so I’ll wait till I have them then consider how best to respond, I have until 23rd October to get back. Fingers crossed. I’ve been trapped with a 1500 overdraft for the past 19 years.

Paul B says

I had a Santander overdraft of £2000, which I was in all the time and was charged around £60 interest every month for about 6 years, not sure if there is any hope in claiming back that now as I have paid the overdraft fully back and closed the account but just annoys me that I was unemployed for some of that when I was getting charged £60 interest a month so I did pay a lot of un needed interest.

This was from 2017-2023 and the account was closed on January 2024.

Sara (Debt Camel) says

You can a.ways go back 6 years with an overdraft, so that that would cover most of the time you had a problem. Send in the complaint as soon as possible!

John Wayne says

Hi Sara,

FOS replied to my complaint against Santander for the overdraft and it was in my favour. They asked Santander to reply to them by the 8th October either to accept the offer of resolving the complaint or provide additional information. I have not heard back just yet I know it’s only 2 days past the deadline, but what happens if the bank just ignores the request?

Sara (Debt Camel) says

First FOS usually gives them 2 or 3 more weeks to reply. If that doesn’t work, then the case gets put in the queue for an Ombudsman. Ombudsman-level decisions are binding on the firm, so Santander can’t ignore that.

Daisy says

I escalated a case to FOS back in March 2024 I still have no case handler assigned to my case 7 months later. I called for an update today usual turn around time the confirmed is 2 months I am over that and it’s still not assigned they couldn’t provide any further information or how much longer is there anything else I can do 7 months of waiting and no further forward! Very frustrated as silly amounts of interest being charged on 4k overdraft taking me in to an unarranged overdraft every month. Worried that Halifax will take further action soon making even more worse off.

Sara (Debt Camel) says

What are the rest of your finances like?

Daisy says

Not great unfortunately I was made redundant during covid and my hisband was furloughed we lost a significant amount on money so I git in to difficulty with credit cards,overdraft and loans. I have opened another account to manage this I have lots of arrangements which are all up to date and paid on time but my overdraft is getting deeper in to unauthorised od due to charges so only paying in as and when I can to try and stay afloat.

Sara (Debt Camel) says

Ok so your credit record is already poor because of the arrangements. I suggest you talk To StepChange about all your debts, the ones with payment arrangements and this overdraft – that will get interest stopped on the overdraft. It won’t harm you affordability complaint.

It’s also much simpler for you – just one payment a month. And it’s flexible – if things go well you can pay more, if they go badly you can pay less. – StepChange handle all the communications with creditors. StepChange don’t charge you any fees so all your money goes to the creditors. See https://www.stepchange.org/

Also look at complaints about all the loans and cards you have payment arrangements with. Winning any will help clear up your credit record and speed up the DMP.

AHB says

Hi Sara, after nearly a year of waiting, I’ve finally heard something regarding my case going to the Ombudsman due to my Lloyds overdraft issues going back to 2006. I am now for the first time being asked about debt charities: ‘Did you contact any debt help charity, like StepChange or other parties for debt help when you started to experience financial difficult due to the overdraft facility? If so can you provide evidence of this with your response’. No I didn’t. They are also asking the same question yet again which I have replied ‘no’ to many times before: ‘You’ve said that you have experienced financial difficulties due to this account. Please can you let me know if and when you have ever contacted Lloyd’s and raised this with them. Can you also confirm what the business did in response.’ I didn’t ever contact Lloyds because I thought it was my financial problem and it never occurred to me to contact them because the overdraft was the overdraft and that was that. I’ve pointed this out to them at length previously. I would be grateful for any advice you could please give at this stage. Do you think there is something specific they are trying to find out about by asking about contacting the charity at this stage? Perhaps I should be re-sending all my previous paperwork through to them again as it feels like they’re not reading it? Thank you for all your help.

Sara (Debt Camel) says

ok well it’s good that things are starting to move on some of these cases that have been paused. Frustrating that they seem to be asking some of the same questions… but it’s probably best to just reply and not offer to resend the old paperwork.

“Did you contact any debt help charity, like StepChange or other parties for debt help when you started to experience financial difficult due to the overdraft facility? If so can you provide evidence of this with your response”

No I didn’t as I thought I just had to improve my money management and hoped that pay increases would help me out of the mess I had got myself into. It is only now that I can see that with the size of my overdraft this was never likely to work.

“You’ve said that you have experienced financial difficulties due to this account. Please can you let me know if and when you have ever contacted Lloyd’s and raised this with them. Can you also confirm what the business did in response.”

No I didn’t. As I have explained before, I thought this was all my fault for borrowing too much and I didn’t blame Lloyds. I never thought about asking for help, because I thought they were helping by providing me with the the overdraft.

AHB says

Hi Sara, Thank you for such a quick and helpful reply.

Natalie says

Ive just had an email from my investigator saying the same thing.

-You’ve had your overdraft since 2007. When did you first think the bank might have done something wrong by letting you have the overdraft?

-When did you first think the bank might have done something wrong by allowing you to use the overdraft for a prolonged period of time?

-Have you complained about or asked the bank for help with the account previously? If so, what was this complaint about? When did you make the complaint and could you provide any evidence of this. Can you also confirm what the business did in response

-Did you ever contact any debt help charity, like StepChange or other parties for debt help when you started to experience financial difficult due to the overdraft facility?

Its a but frustrating but seems there is progress happening

Bek says

In September 2020, my graduate account became a current account with a £2000 overdraft already completely maxed out. I was charged £55-£60 a month for this from that date. Prior to this, I had stopped using Santander as my main account as I feared they would use any money paid in to then repay the overdraft and I would be left with nothing.

Since graduating and my account being changed to a current account, I have been employed and my main bank account is with LLOYDS.

I have simply paid £55 a month into my Santander account to cover the interest, and also to cover any other small bills or payments from that account. Since July, Santander have sent letters and emails about my overdraft which have caused significant worry as I already suffer with anxiety and money is one of those main worries, but they agreed to change my account to a choice account with a £30 per overdraft usage cap.

My question is, will they refuse as it is not my main account? Will they claim that my purchase of a finance car in 2021 and then a more expensive car in 2024 (needed bigger as I had another child) shows I didn’t have financial difficulties? My car finance is with Santander also. Can they say that we had a holiday in 2022 for example so we clearly had spare income or I purchased clothes and shoes etc? How far into my income and expenditure can they look if my salary is paid into another bank account?

Sara (Debt Camel) says

It is harder to win complaints when the account isn’t being used as a bank account. And it does sound as though Santander has being trying to get you to deal with it.

Santander can’t see what you spend with a different bank, but they are likely to reject the complaint and the ombudsman may ask for your other bank statements. Buying vlothes and shoes though is perfectly normal.

Have you considered just paying say £100 a month into the account and gradually chipping away at it?

lucy says

Can I complain about my Santander student account overdraft as i didn’t inform them that I dropped out after a year because I couldn’t pay off my overdraft? Or will I have no leg to stand on? I could say they should have noticed I wasn’t getting any student loan payments in the past four years.

Sara (Debt Camel) says

when did they start charging interest?

Concerned says

Hi Sara,

Can I complain about my Barclays Bank account overdraft of £700. I’ve had it since it was a student account and every month when I get paid, the money usually covers the overdraft but every month I always use all of it up. I’m currently unemployed so I’m constantly in my overdraft, it hasn’t been increased since I got it though.

Sara (Debt Camel) says

It sounds as though you were in the overdraft soon after you were paid for most months? This makes a good complaint.

do you have other problem debts at the moment? Cards or loans?

Concerned says

Yes. Ive been in my overdraft for the last 11 years since my second year at uni. I’ve never been able to pay it off. I do have other debt currently consolidated with step change to pay off monthly.

Sara (Debt Camel) says

ok well send an affordabil;ty complaint about the overdraft AND ask stepchange to include it in your DMP, that will get interest stopped. Its easy enough to move to a different bank.

Also look at affordability complaints against all the other debts in your DMP – winning any of them will really help speed up the DMP.

See https://debtcamel.co.uk/tag/refunds/ for articles with templates for different types of debt

Jess says

Hi,

I was wondering if there was any fall out with the bank if I make a complaint and I am still in my overdraft? Can they do anything to put up my charges or anything?

Sara (Debt Camel) says

They certainly wont put up charges!

For other common questions, see https://debtcamel.co.uk/affordability-complaint-credit-record-faqs/

Ems says

Hi Sara,

I made a complaint about my RBS overdraft. It was given to me in 2002 as a student overdraft at the time. In 2010 it converted to a normal overdraft I think. I complained to RBS as I have been in my overdraft forever, and the last correspondence from them regarding this was 2016. I feel that they should have seen I was struggling to repay this. I was overdrawn every month by the 1st or the month and was paid at the end of the month. They have responded with a big letter also responding to a complaint about a loan I had with them. They have basically said that it was my responsibility to contact them to say it was unaffordable etc. I had gambling transactions on my account and they have also said that they don’t monitor accounts manually and I should have contacted them to bar these transactions. The overdraft is £2000. I recently moved to a new bank so I can start repaying this. Do you think I should forward my complaint to ombudsman. They have also rejected my affordability complaint about a loan they gave me in 2019. My argument is that the loan was £19000 over 7 years, I was overdrawn in my current account held with them. I only had £400 left a month after bills and debt repayments. This £400 would have had to cover food, fuel and living expenses for me and my family. The loan repayment was £396 a month for 7 years. I also had 50k worth of debt on my credit file at this point. Thanks

Sara (Debt Camel) says

I suggest you send the overdraft and loan complaints straight to the Ombudsman

Bob Merry says

Hi Sara,

I have issued a complaint to Santander for interest back from an old overdraft due to unaffordable lending when I didn’t have a job after university and my account was at -£2000 OD they have offered me £900 compensation, is it worth going to the ombudsman as I believe the interest to be well over £3000 that I paid in interest, also what happens if I reject the £900 from Santander.

Sara (Debt Camel) says

what period are they offering to refund for? when did they start charging interest? what do you think a fair refund period would be?

Bob says

They did not say just that £900 was the offer, they started charging interest from 2018 when it went to a current account and still charge interest now, I have since cleared the overdraft but did not have full time employment for around 2 years when the interest was being charged , I worked out that I paid over £3000 in interest charges from 2018 – 2024.

Sara (Debt Camel) says

So it sounds like things were bad for 2 years and less bad for the rest? For how much of this period were you in the overdraft all month, and what charges did you pay for that time?

Bob Merry says

I was fully in the overdraft for 2 years paying around £50-£60 a month interest then around half of it paying £30-£50 for the other years

Sara (Debt Camel) says

Well 900 isnt the worst offer…

But you may well get more if you go to the ombudsman. Because if you hadn’t paid those charges when your were unemployed your overdraft would have been much lower when you got into work and you would have paid a lot less then.

I cant guess what you would be likely to get from the ombudsman though, this depends on the details of the case.

It sounds as though Santander has agreed it got things wrong, so this isn’t a “goodwill” offer? In that case it isn’t likely to be at risk if you go to FOS. In any case I would be surprised from what you have said if FOS thought a reasonable offer was less than that!

PWS says

Hello,

I recently complained to Barclays over irresponsible lending and charges on my overdraft from 2014 when my Overdraft limit was increased. I asked them to refund me any charges. I have received their response to my complaint and they have accepted no responsibility and said they have sent me statements, reminders that I am in my overdraft etc. However, they have offered me a gesture of goodwill payment of £3384. However this is only from 2018 as before that they have stated it is considered Time Barred?

I am unsure whether to accept the gesture of goodwill or refer this to the FOS to see if I should be paid more and they accept responsibility?

Sara (Debt Camel) says

When did your problems date from? How large is the overdraft at the moment?

Did you have any other borrowing from Barclays, card or loan?

Philip says

The problems dated from 2014 when the Overdraft limit was raised from £2000 to £2500 with an emergency borrowing up to £2650. The overdraft is currently -£2580. No I have borrowing with other companies but not Barclays.

Sara (Debt Camel) says

So I would ignore the issue of “them accepting responsibility” – what matter is the money you might get back.

Cases over 6 years go slower at the Ombudsman, as they first have to take a decision on time barring and only after that start looking at whether it was unaffordable. But as you still have the account FOS may well decide it can go back further than 6 years. It could be 6-12 months before a decision (or less or more).

In theory with a “goodwill offer” the Ombudamn could say you shouldn’t get anything, but that is normally only an issue with a low £50 to go away type offer. £3384 is a serious amount of money and Barclays must expect they wouldn’t win the case at the Ombudsman. the only question is how far back.

It’s up to you if you think it’s worth trying to get 4 more years refunded. This isn’t a dreadful offer, it clears the overdraft and gives you £800ish in cash.

Do you know what interest and charges you paid 2014-2018?

Philip says

Yes I agree. It’s would be great to clear the overdraft. The interest and charges from 2014-2018 total around £2400.

Sara (Debt Camel) says

so your call – take the quick win or hope for a bigger one

Philip says

Can I accept the gesture of goodwill on 2018 to Present but still get the ombudsman to investigate the 2014-2018 years?

Sara (Debt Camel) says

No. That’s why they are making the offer, to settle the whole claim.

TwoTwo says

Hi Sara,

Thanks to your blog, I successfully claimed back overdraft charges & fees on a natwest current account (this was c.2 years back). I also have a joint account (with my wife) that has been in overdrawn for 8+ years. It is usually over the overdraft limit. Can i submit a claim for this too?

Thanks so much

Sara (Debt Camel) says

yes, but it needs to be a joint complaint with your wife. Do this asap – it should really have been done 2 years ago.

JD says

Hi Sara,

I have now received a response from a 3/6 year related case from the FOS investigator. I have 2 overdrafts with RBS that I have had since 2012 and 2014. The investigator has agreed that these are unfair but is only going back 6 years from my original complaint, citing that I should have known I had cause to complaint before this. This is the same decision that the ombudsman provisionally issued a year ago, before the new guidance. The case was then sent back to the investigator to issue a decision on the updated guidance. Does this seem right to you? I had kind of expected a decision with the updated guidance to be more favourable and to extend further back, but this has not been the case.

Appreciate your input and support.

Sara (Debt Camel) says

does it go into details about when you should have known you could complain?

JD says

Yeah, here’s a snippet:

The Royal Bank of Scotland had sent JD repeat use communication for account ending from June 2020 onwards which stated overdrafts were for short-term borrowing purposes this ought to have made JD realise there was a problem with how he was using his overdraft account which was causing him a financial loss.

JD also held account ending XX with The Royal Bank of Scotland and had incurred a number of declined applications on that account by May 2016.

Therefore, I think JD ought to have reasonably known that he had cause for complaint about the lending decisions and overdraft charges on account ending XX which happened more than six years ago, and I also think this awareness was more than three years before the complaint was raised with The Royal Bank of Scotland… charges on the account from October 2015.

In Smith v Royal Bank of Scotland Plc [2023], the Supreme Court pointed out that remedies for unfair relationships are in the court’s discretion and the court may deny a remedy where the claimant had knowledge of the facts relevant to their claim, but substantially delayed making the claim. So when deciding a fair and reasonable outcome to JD complaint and fair redress, it’s important for me to take this into account as relevant law. There is no fixed period of delay that brings this principle into play, but the Supreme Court approved the District Judge’s comment in the case that a court would be slow to remedy unfairness in a situation where the claimant delayed more than six years after knowing the facts’

Sara (Debt Camel) says

I suggest you go back and say that that you were unaware the you had a cause to complain until (whenever you found out before making your complaint) and that is a crucial “fact” you did not know.

Most people say something like before then you had regarded your financial problems as your own fault for borrowing too much – if that was the case for you.

Say you thought some declined applications in 2016 just meant you couldn’t borrow any more and you can’t see why they should have prompted you to think that there was something unfair about the existing borrowing at the time.

Also point out that you think the communications RBS sent from 2020 were just generic onesthey were sending to anyone in an overdraft – RBS made no specific effort to co tact you and discuss options to reduce the overdraft usuage, which they should have if they were concerned about it.

And that these communications were within the last 6 years, so you feel you should be able to have the last 6 years overdraft considered anyway regardless of these communications as the unfair relationship caused by the overdraft was continuing.

Holly says

Just want to say thank you. As using this advice I have won 2/3 cases (one I haven’t won has gone to the ombudsman). Santander admitted partial fault from 2017 and refunded me £1200 and Monzo admitted full fault and admitted they didn’t do an adequate affordability check and have refunded me the full interest I’ve paid since 2019 + 8% which has totalled £1960 and with these I’ve managed to clear a credit card and outstanding overdrafts! Many many many thanks xx

Daisy says

Finally after 7 months my case has been assigned to someone at the FOS I now have to reply to them on a series of questions and I am not sure how to respond. Little bit of back ground I have been in a 4k overdraft since 2019 with no let up my wage wouldn’t even clear it and I would be straight back in the overdraft its been a vicious circle as the interest and fees being added has meant that i have been unable to clear the overdraft.

I have had pay day loans bounced direct debts etc this is why I have claimed cause BOS should have completed their checks properly and recognised this but have offered no support to recently when they have looked in to reducing my od by £80 a month to help me pay it off but the interest and fees are just as much so I haven’t reduced my OD at all.

The questions i have been asked by FOS;

When did you first realise that BOS might have done wrong when providing an arranged od facility?

What prompted you to realise that BOS might have done something wrong?

Why did you complain when you did and were there any exceptional circumstances that prevented you from claiming before

Did you speak to the bank and if not why not

I don’t want to put my foot in it here but i was not aware that i could raise this till i came across your blog i just thought it was my own stupid fault for getting in to a big od. I was made redundant during covid my wage reduces by 20k per year this is what heightened the situation for me

Sara (Debt Camel) says

so you are only asking for a refund of overdraft charges paid within the last 6 years?

the questions you have been asked are typically those that are asked for cases that go back further than 6 years

was the overdraft used little and was affordable before you lost your job?

Daisy says

No theybhave said that I have an account with an overdraft that is outside of 6 years but I am not claiming on that just from 2019 to date

Sara (Debt Camel) says

Then I suggest you reply that you are not making any complaint or asking for a refund for lending that was more than 6 years ago, so could the investigator explain why you are being asked these questions

Daisy says

I have replied and provided them with a copy of my complaint to clarify the situation.

I am making an affordability complaint about the overdraft You should have noticed in 2020 that my overdraft borrowing got worse. Overdrafts are meant for short-term borrowing but that was not what I was using the account for. The fees and charges you were adding were making my position worse. I am complaining that every year since 2020 you have failed to notice my difficulty during the annual reviews of my overdraft. You should have offered forbearance eg stopping interest and charges being added. Even before 2020 I had been in my overdraft constantly for many months, not getting back into the black even when I was paid. This hardcore borrowing is a clear sign of financial difficulty. My income was less than my overdraft after I paid bills, there was no way I could hope to clear an overdraft of £4000 in a reasonable length of time. In addition to this I entered in to an unauthorised overdraft on numerous occasions.

You should have noticed my financial difficulty due to decreases in my income especially in 2020 and 2021 and that my credit record shows multiple arrangements with other debtors. During this period I also had missed payments to credit providers and I took several payday loans. ETC…

Kelly says

Just wanted to say thank you for this guide, I raised a complaint with Lloyds and within 24 hours they messaged me to say their final response was in the post. They agreed that they should never have given me the £1,200 overdraft in the first place and refunded all charges and interest from the moment it was approved up until the date I made the complaint, plus a £50 cheque for any distress it had caused. My complaint was based around the fact in the couple of months I had the account before getting the overdraft, I had lots of direct debits being returned due to insufficient funds and payments into my bank account and repayments to what were clearly payday loan companies so already showed poor money management.

Sara (Debt Camel) says

a good result and quickly! Has that cleared the overdraft?

How long ago were these payday loan borrowing? Have you looked at affordability complaint about them too?

Kelly says

It’s reduced it by about 40%, I had a fee free amount with a club Lloyds account so my charges weren’t as much as some peoples. The amounts are pretty much what I’d worked out though. I have affordability complaints in with the payday loan companies too, as well as NewDay as I had an Aqua card with rapid credit limit increases and a NewDay finance account on AO when I’d gone over my limit on the credit card multiple times. Hopefully more updates to follow!

Mr W says

Hi Sara,

First of all thank you for all your help along my journey I have been successful in quite a few refunds over the last 18 months.

I have just had an email today from an investigator that has been with them for some time, could you advise on what I should be replying with?

I now need to investigate the claims of unfair relationships under the S140a guidance, which means I need to obtain as much information as possible to assess this from the start of the lending. Please can you provide the following:

Did you reach out to the business about your financial circumstances or repayments at any point since the lending was provided in 2013 onwards? If so, please provide the relevant dates and details, along with supporting evidence such as emails, call transcripts and letters.

Did you contact any external charities or debt management companies since the lending was first provided in 2013 onwards? If so, please provide the relevant dates and details, along with supporting evidence such as emails, call transcripts and letters.

If the bank contacted you about your overdraft usage, did you reach out to them regarding this? If so, please provide the relevant dates and details, along with supporting evidence such as emails, call transcripts and letters. If not, please provide details for the reason.

Sara (Debt Camel) says

so you are complaining about the overdraft for more than 8 years ago? is the account still open, if not when was it closed?

KQ says

Hi Sara,

Santander have come back to me via FOS with the following: any guidance would be appreciated.

You’ve had your overdraft since prior to 2015. When did you first think the bank might have done something wrong by letting you have the overdraft?

When did you first think the bank might have done something wrong by allowing you to use the overdraft for a prolonged period of time? If this was prior to when you raised the complaint, why didn’t you complain to the bank when you first realised the bank may have done something wrong in allowing this?

Have you complained about or asked the bank for help with the account previously? If so, what was this complaint about?

Are there any exceptional circumstances that prevented you from complaining sooner?

Sara (Debt Camel) says

Is this Santander asking this? Or FOS?

KQ says

Apologies, it is the FOS

Sara (Debt Camel) says

This account is still open? is it still a problem? can you give me some background on this account and what went wrong with it and how it improved (if it has!)?

KQ says

Yes, sorry, both still open and in financial difficulty. Santander originally said it had been over 6 years and they didn’t want to look in to it.

I did the affordability complaint due to lots of adverse credit since 2015, over 10 ccjs for illustration.

Sara (Debt Camel) says

so would it be fair to say that you knew your finances were in a mess as you had lots of CCJs from 2015 onwards, but you didn’t regard your Santander account as a major problem at the time, though with hindsight you can see the high charges made it impossible to escape, it did not feel as urgent or problematic as your other debts and you saw it as your own fault for borrowing too much?

Jamie says

Hi there

I am wanting to write a complaint about overdraft borrowing. I have been in long periods of hardcore borrowing and in financial difficulties for a long time. Since beginning of 2020. When I write a letter of complaint I would request the interest paid through the times of financial difficulty to be refunded but can you also ask for the accounts with the overdraft to be cleared? I worry I won’t get enough to cover clearing the overdraft debt which is £1500 I believe my refund for four nearly five years of interest will less than this still Leaving me with an overdraft I may struggle to clear.

Sara (Debt Camel) says

are you in financial difficulty with other debts as well?

Jamie says

Hi Sara. Yes I am I am trying to make a plan to pay them off and this would be made much easier if this overdraft wasn’t hanging over me. I have a credit card with the same bank which I just keep paying the minimum amount every month, As I struggle to afford much more. I live alone and bills are very hard to keep on top of. But I believe I can repay these debts and to get some help such as having the interest repaid would really help a lot, as I strongly feel this was irresponsible lending from the bank.

Sara (Debt Camel) says

The bank wont clear the overdraft if you win the complaint, just refund the charges.

was the credit card account with the bank opened when you were already in overdraft difficulty? Or did it have its credit limit increased when you were? or when you were only making minim payments to the card?

If it’s hard manage the bills (and yes, so much more difficult when you are on your own) then you are going to find it hard to pay off more than the minimums to the debts. I think it would be a good idea to look at a debt management plan with StepChange for all of your debts including these bank debts. Winning affordability complaint will then really speed up the DMP. With new interest stopped in a DMP, the debts actually start to drop! See https://www.stepchange.org/how-we-help/debt-management-plan.aspx

Jamie says

Hi Sara. I believe I had the credit card before my overdraft was increased. It was increased while my credit card was near max. So I would say I shouldn’t have been allowed to get such an increase of my overdraft at the time. Should I then write a letter of complaint explaining this? With the dmp I looked at that from your advice thanks for this. I would like to try and pay if off myself so my credit score can improve as much as possible. I would like to pay of debt then save for a house deposit. If I go for a dmp plan will that effect my ability to borrow in the future? Thanks again for your advice it’s very helpful.

Sara (Debt Camel) says

I am sure you would prefer to pay it off, but if you are worried you won’t be able to if the bank refunds all the interest, then this doesn’t sound very realistic? Especially if you have a credit card you can only pay the minimum to?

A DMP will harm your credit record, but it will be a LOT faster to clear the debts if no interest is added, and then you need time to save a deposit. During which time your credit record starts to improve. You can get a mortgage after a DMP if you have then saved a deposit.

Jamie says

Hi Sara. Yes that does make a lot of sense thanks so much for the help.

S says

Hi Sara,

I posted earlier about how Lloyds have upheld half of my overdraft complaint, but have rejected the other half. I’ve deliberately kept my complaint limited to the past six years. I’ve taken this to the ombudsman and have just got a request for the following information, which seems more tailored to an out-of-time complaint.