In a Debt Relief Order (DRO):

In a Debt Relief Order (DRO):

- you don’t have to make any monthly payments at all;

- your creditors can’t ask you to pay them, take you to court or send bailiffs;

- at the end of a year, the debts in your DRO are wiped out.

If you meet the DRO criteria, it is often your best debt option, unless you expect your situation to improve a lot very soon.

DROs were introduced in 2008. In the first ten years, a quarter of a million DROs were set up. In 2023, DRO numbers increased with the costs of living crisis – now more than 2,500 people a month choose a DRO.

This article looks at the important things you need to know about DROs:

- are you are likely to meet the DRO criteria;

- is this is the best option for your financial problems;

- what can happen during a DRO and after it ends.

Contents

Are you eligible for a DRO?

The main criteria

Unlike most of the other debt solutions, you have to be able to meet all of the rules to get a DRO, there isn’t any “wriggle room”. The most important ones are:

- your total debts have to be under £50,000 You can’t decide to leave a debt out to get under this limit;

- you can’t own a house or have a mortgage. This applies even if you only own part of the house, you don’t live in it, the property is in another country, you can’t sell it, or it has negative equity;

- the second-hand value of your assets must be less than £2,000. That doesn’t sound much, but ordinary household objects and clothes etc are not counted at all. There is also an additional allowance for a car, see below. The second-hand value is what you could sell it for, eg on eBay. Few people have a problem with this £2,000 limit;

- you can’t own a car or motorbike worth more than £4,000 You may be able to have a car on finance – read Can I have a car on finance in a DRO for details;

- you must have less than £75 a month spare income after paying all your normal bills and expenses. See below for more about this.

- you can’t have had a DRO within the last 6 years.

The £75 “spare income” test

The hardest rule for most people to understand is that you can’t have a DRO if you have “more than £75 a month spare income“:

- this is the amount of money you have left over after paying your bills and other everyday expenses;

- it doesn’t take into account the payments you are currently making to your debts, because those payments stop in a DRO.

The level of spare income will be assessed by the debt advisor who sets up your DRO. You aren’t expected to live on a very tight budget. You can have some money for Xmas, replacing household goods, kids costs etc

I have come across people who have had an IVA payment of over £150 proposed who would have been easily “under £75” on the DRO criteria.

You don’t need to worry that disability benefits such as DLA or PIP will mean that you have too large an income for a DRO. When you have a disability-related benefit, you are allowed to offset that income with a line called “adult disability expenses.”

Some people who have been struggling with debt repayments find the expenditure allowances surprisingly generous. This may be the first time in a long while that you have any money to spend on clothes.

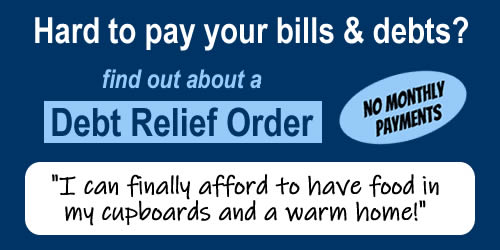

The quote in the picture at the top of this article from a reader sums this up:

“I can finally afford to have food in my cupboards and a warm home.”

Other technical criteria

Apart from these main rules, some other reasons could stop you from getting a DRO. These are much less common – your DRO adviser will check if any are a problem for you.

A few debts can’t be included

A DRO will clear most kinds of debt, not just money you have borrowed such as credit cards, but also council tax and energy arrears, tax debts and benefit overpayments.

Three that cannot be included in a DRO are:

- student debts;

- magistrate’s court fines, including TV license fines (but fixed penalty charges such as parking fines and the London Congestion Charge can be included); and

- debts incurred through fraud.

See this National Debtline factsheet for a complete list of debts that are included and excluded.

The DRO total debt limit is only for included debts – so if you have a large student loan debt that is ignored in checking if you are under the limit.

What about my partner?

You won’t be refused a DRO because you live with someone who has assets or a good income.

If you and your partner both have debts and want a DRO then you each have to apply for one – there isn’t any such thing as a joint DRO.

If you have a DRO and your partner doesn’t, then they will become fully responsible for any previously joint debts that you had together. This applies to things like council tax arrears and a joint bank loan.

What happens during the year a DRO takes?

“The DRO year”

In a DRO, your debts are cleared after a “moratorium period” of 12 months.

During this year your creditors are not allowed to ask you to pay the debt or take you to court.

No monthly payments during the DRO year

A DRO is designed for people with little or no spare income, so you don’t have to make any monthly payments.

From 6 April 2024, the £90 fee to set up a DRO has been scrapped.

This is a major advantage over an IVA, where you have to make payments for five or six years usually. And over a DMP, which could last a long time if you can only make low payments.

If something changes during the year

Once a DRO has been set up, you will find the DRO very low-key. No one from the Insolvency Service checks what you spend money on or asks for your bank statements,

But if you have a change of circumstances during the year (pay rise? inherit money?) you have to inform the Insolvency Service.

If you no longer meet the DRO criteria, your DRO may be cancelled. This is pretty rare, because often if your income goes up, your benefits are reduced.

It’s best not to try to make affordability or other refund claims while you are in a DRO. Wait until the year has ended and then think about them. BUT if the refund relates to a debt which was included in the DRO the creditor may choose to offset the refund against the debt – even though you think your debt has been written off at the end of the DRO.

Some detailed articles:

- what happens to my DRO if my pay increases or I get a lump sum of money?

- inheriting money in a DRO

- do not take money out of your pension during the DRO year.

A DRO harms your credit score

A DRO is a form of insolvency and has the same bad effect on your credit rating as bankruptcy or an IVA. See how does insolvency affect my credit record? for details.

The DRO marker stays on your credit record for 6 years.

A DRO won’t affect the credit score of anyone else in your house unless you have joint financial products, such as a joint bank account.

At the end of the DRO year

At the end of the DRO year, there is no check that you still meet the requirements. Your DRO simply ends and your debts are written off, see What happens at the end of a DRO?

After the DRO year has ended, you can start to “repair” your credit record. It only gets better slowly until the DRO and the debts in the DRO drop off your credit record.

Who does a DRO suit?

A DRO is frequently the best option with a low income or where much of your income comes from benefits.

This includes:

- where you have caring responsibilities;

- pensioners;

- people with long-term health conditions;

- when you have high childcare costs.

When you only have a short-term money problem, a DRO is unlikely to be your best option. It gets rid of your debts after a year, but it will have a very bad effect on your credit file for six years from when it begins. This downside is well worth it if you have a larger debt problem, but not for a short-term difficulty. Here look at a temporary token payment plan.

If you qualify for a DRO, it is always a better option than an IVA. In a DRO you don’t have to make any monthly repayments and it is very rare for a DRO to fail, but more than a third of IVAs fail, leaving you back with your debts.

DROs affect your credit record for 6 years in the same way that IVAs and bankruptcy do. This can make it harder or impossible to take out new credit at a reasonable interest rate and harder to get a new private tenancy – but if you have large debt problems you may well have a poor credit record anyway.

It is unusual for a DRO to cause any problems with your employment – talk to your adviser if you are worried about this.

How to set up a DRO

Who to talk to

Contact Citizens Advice. They can also help if you have problems with priority debts such as rent arrears.

If you would prefer to do this on the phone, contact National Debtline. Or Business Debtline if you are self-employed.

After the debt adviser decides that you are eligible for a DRO they will talk you through the details. You are often sent an application pack to complete.

Setting up your application

Your adviser does all the necessary checks before submitting your application. This can take two or three months sometimes. Your adviser may set up a Breathing Space for you during this time so you don’t get hassle from creditors.

I’ve looked at some common questions about DRO applications here: DRO application FAQs. But talk to your adviser about anything you are uncertain about or would like confirmed.

This includes:

- anything you have on Hire Purchase or any unusual debts ;

- if you are owed money by someone. Or you expect to get money in the next year, possibly from benefits backdating;

- what happens to bills such as council tax and utilities if you have a partner.

It’s important that all your debts are listed on a DRO as you cannot add another one later. Let your adviser know if you are worried you may owe council tax for previous year, owe HMRC and tax credits ocerpayment, oew the DWP any benefit overpayments, may have parking tickets you haven’t kept track of.

Approving your application

As the adviser makes all the detailed checks, the process of approval is very fast once your application is submitted to the Insolvency Service:

- there is no court hearing;

- no-one visits your house;

- DRO applications are usually approved within 2 working days of being submitted;

- more than 98% of DRO applications are approved.

When your DRO application is approved, the Official Receiver send you a letter called the Debtor’s Notice. Keep this letter safe even when your DRO has finished – it is a simple proof that a debt has been included in your DRO.

Michael says

I’m in the process of filling out my forms for a DRO but I’ve just received £1000 from a complaint I made a few months back on a guarantor loan. The payment has gone into my bank account that will be part of my DRO, my question is can I take the money out of the account or have I lost the payment?

Sara (Debt Camel) says

so it has just cleared part of an overdraft? are you still using this account?

do you have any rent arrears? or any debts that will not be included in your DRO?

Michael says

That’s right it’s taken £1000 off my overdraft and I am still using the account at the moment. No arrears and the only debt that’s not included is my mobile contract it’s on o2 refresh so the mobile is a loan

Emma says

Hi Sara,

I finished my DRO 2 years ago now!!! But one company is still sending me letters every month saying what my balance is on the account… I have sent them letters as advised on your site and emails and they keep telling me that they cannot close the account and therefore debt even though they were included in the order….

What else can I do??

Sara (Debt Camel) says

Who is this company? Is the debt marked as defaulted on your credit record record with a default date on or before the date of your DRO?

Emma says

Satsuma loans… And no it is still down as open.

There are a few other that are defaulted but the dates are after dro, again I wrote to them but one said thst there was nothing they can do And the others didn’t reply… I had used the template you placed on here

Sara (Debt Camel) says

Have you sent Satsuma a formal complaint? If not, then do so. And send it to the Financial Ombudsman if they refuse to correct this. The most important thing is that there is a default on if before your DRO started, but the balance should also show as zero with the account marked as satisfied or partially satisfied.

Same for the other accounts with defaults later than the start date of your DArAo – although if it’s it’s only a mknth I’d do. You may decide this isn’t worth the hassle.

Emma says

No not yet, can I do this via email? Just I don’t have access to a printer or computer at moment..

The others are all by 1 or 2 months so I’m guessing it doesn’t affect it to much?

Thanks for your help

Sara (Debt Camel) says

fill in their complaint form

If the default dates are out by 1 or 2 months it just delays the time until your credit record is clear by 1 or 2 months. You may think that doesn’t matter much.

Emma says

Sorry forgot to ask what’s the best credit file website to check? When I have checked in past on clear score, and another but can’t remember the name it (think was experian) showed on one everything closed but satsuma and another that there was still 4 open????

Sara (Debt Camel) says

check reports on all three credit reference agencies – there will be a big overlap but it’s the only way to make sure you don’t miss something. See https://debtcamel.co.uk/best-way-to-check-credit-score/ for how to do this for free.

Emma says

Thank you.. Will do this later today and hopefully they take notice this time

Eva says

Hi Sara,

I hope you could help me.

Due to financial situation I’ve stopped paying my loan and credit card in November (total outstanding balance of roughly £10,000). Recently I’ve split up with my husband. He moved out 2 months ago while I and my 1 year old daughter live on the boat.

Because of redundancy I couldn’t come back to work after my maternity leave ended so I am left with no earnings. Since a month Universal Credit and Child Benefit is my only income.

The boat that we live on was bought by my husband 2 years ago, he paid for her but the insurance is on my name.

I believe that DRO may be the best option for me as I cannot see my situation improving any time soon but I am really worry how boat ownership may be seen by DRO officials.

The boat is worth more than £1000 but by selling her to pay my debts I would make myself homeless.

Also the boat really belongs to my husband as he took a loan and bought her but as I figure on insurance policy I am worrying that if I don’t declare the boat as my asset I may commit a fraud.

I am also not sure if I should declare things like generator which I have bought but without it I would be left with no electricity.

I am sorry for a long post and thank you for running this blog as it’s really helpfull and informative!

Eva

Sara (Debt Camel) says

Does your ex think he still owns the boat? So you would not be able to sell it surely?

If he does, then you should certainly tell your DRO adviser about the boat, that your ex owns it but you insure it. I don’t think this will matter – insuring and having use of something is not the same as owning it.

How much did the generator cost? What would its second value be if it was sold? (I am not suggesting you do this.)

Eva says

Thank you for your reply.

He definitely would not allow me to sell her but I was not sure how the law works. He bought the boat while we were still in good relations and living together and also I insured her and currently live ther so I was not sure if either DRO officers may refuse my application because of that or worst scenario bailiffs may request to cover my debts by selling the boat.

Generator is worth probably around £500- £600 if sold second hand.

Sara (Debt Camel) says

It doesn’t sound to me as though you will have any problems because of the boat – it isn’t yours. Or the generator – it’s an essential item for you and it has a value of less than £1000.

I suggest you talk to National Debtline on 0808 808 4000 about your situation, whether a DRO is a good options for you and mention these 2 things.

Eva says

Thank you :)

I will call Debline asap.

Nikki says

I dont know what to do i need to do a dro order but my car was on finance but I payed it of about 4 months ago now everything has changed and its worth about 5000 I need the car to get to and from work both myself and my partner are insured on the car but I owe it we both use it what should I do any help plzz

Sara (Debt Camel) says

have you checked its value on Parkers? Bad condition?

Can you say something about your debts? What sort ? How large? Have you defaulted?

Are you renting privately or social?

Does your partner also have debts?

Nicola says

Me and my husband have a joint account but all of the accounts are in my name with debts on. Will a dro affect his chance of getting a mortgage in the near future? I am out of work (self employed and was on maternity until March) and unable to get benefits so relying on him as we have a little boy so think a dro is the best way forward as I cannot pay anything towards my dmp

Sara (Debt Camel) says

Who is your DMP firm? You could talk to them about getting a DRO.

In a DMP your credit score will already be affected and this will affect Your husbands chance of a mortgage as the joint account means you two are financially linked. Thus will be worse if you gave A DRO.

If your husband wants a mortgage in future you need to stop having a joint bank account now.

Laura says

I pay for a car through a salary sacrifice scheme, I have paid 18 months out of 4 years so far. Is this classed as an asset still even though it is not paid off? I am enquiring due to looking into a debt relief order.

Sara (Debt Camel) says

Most car salary sacrifice schemes are, I think, leasing.

Assuming yours is a lease, then the car is not an asset as you will not own it at the end (correct?)

The debt adviser that sets up your DRO will look into whether you have any better alternatives to this lease. Do you need the car for your job? Would public transport be practical for your job? Would it be cheaper?

Laura says

Thank you, I do need the car, if I was to sell it, it would only just cover what is outstanding. I will own the car after 4 years of paying for it. But like I say I’ve only paid 18 months so I’m a way off now, and is only valued now at £2000

Sara (Debt Camel) says

ok, you do need to talk to a DRO adviser about this as it comes down to the specifics of your case as you have to have a car. If you haven’t yet started talking to a DRO adviser, I suggest you phone National Debtline on 0808 808 4000.

Mimosa says

Hi Sara,

I have a DRO since June 2020. I still receive text messages from one debt agency asking for a payment and asking to call them etc… It is not pleasant, but I don’t care anymore. I have received messages, phone calls, letters from collection agencies during the years, and it does not bother me anymore. Is it ok to ignore them? and not send them the usual letter, telling them not to disturb me and informing them that I have a dro etc…This is 13 year old alleged debt, it is included in the DRO. I just don’t think they deserve the time to not ignore them and go to an explanation mode with them.

Sara (Debt Camel) says

Well it’s up to you. In the time you took to post this comment you could have responded to them and told them about your DRO…

The messages will probably stop soon, see https://debtcamel.co.uk/debts-collectors-dro/. But if you get a letter like the one described here https://debtcamel.co.uk/letter-before-claim-ccj/ don’t ignore it or you will then have a defend a court case – which you would win, but best to avoid the hassle!

Mimosa says

Thanks Sara.

Lauren says

Hi Sara.

I’m currently in an IVA and just found out im being made redundant. I worked 16 hours a week whilst the children went into private childcare. However now I’m not working I will have to take them out. They are only 3 and due to their pre school hours And being a single mother it will be almost impossible to work whilst being a full time mum. Which will mean my Iva will fail. Could I look at getting a DRO once the Iva fails. I do have a car on finance but with not working I won’t be able to keep up the payments. So thinking of selling and settling the finance. It’s valued at 3,000 however there is a lot of damage to it and it’s on its last legs so I don’t suppose it’s worth even £1000 now! I’m just stuck as what’s best to do.

Sara (Debt Camel) says

What did your IVA start?

How large are the debts in your IVA?

I assume you are renting?

The car, it’s normally not possible to sell a car on finance. How much is still owed on it? Do you need a car?

Kirstie says

My income has increased slightly still under the £50 spare income as I need the money for my son he has a health condition. I emailed the DRO unit they said as long as I’m spending the obey I’m okay. They didn’t ask for any of my details to find out who I am. Will. I be okay? Also my UC has risen I understand that I won’t be affected as it’s due to covid. Is this the case? Thanks

Sara (Debt Camel) says

If you gave them a reasonable description in your email and they said they didn’t need the details, that is fine. keep your email and their reply in case it is ever queried, but that is unlikely.

They don’t need to be told that your UC has gone up because of covid.

Jon says

My DRO has been granted on the 10th June 2020 however I am worried. The person I was living with has decided to leave the house (end September ). Recently I have had to claim universal credit as my work has slowed up and had Covid grant. Some months I got some, some £0 .I am due another grant shortly so £0 UC this month I imagine. I have found place to live cheaper rent plus all utilities etc as before. They won’t change much really but my expenses will go up as I have animals now to look after solely (Dog, Cat, Chickens about a £1 a day for each). I recently lost my driving license for 3 years. I would be distraught if revoked because I am in no position to pay back whatsoever. I would rather stop UC altogether and live like a pauper for the next 9 months to see the DRO go through if that is the best way?

Can you please advise me on what I should do next? Do I have to inform the OR of moving? Do I have to inform the OR of claiming UC (sometimes as not regular as my earnings have been lower) My earnings are very erratic at the moment, August is always terrible month as people are on holiday and with Caronavirus people are tightening their belts and I seem to be one of the first to cancel.

Do I have to contact the OR or could my DRO intermediary do it on my behalf?

Sara (Debt Camel) says

it sounds as though a lot has changed in your life. I think you should go back to your DRO intermediary and ask them to do a new income & expenditure for you so you can show that to the DRO Unit. Many people who work and get UC will meet the DRO criteria but you need your whole situation looked at.

Llauren says

Hi could you tell me please if child maintenance is counted towards income for the £50 spare income? Thank you

Sara (Debt Camel) says

yes it is.

Rickrack says

Hi, I’m seriously considering doing a DRO, however I own a car that is worth more than £1000. My Mum actually bought the car for me a couple of year ago but I’m registered keeper etc. Can I put the car in my Mums name so that it doesn’t show as an asset to me?

Also, I had 2 bank accounts with the same company, one account had an overdraft, that account is now closed and is with debt collection but would be included in the DRO. The other account is the account I get wages paid into and use daily, could this account be affected? Should I open a new account?

My main concern is getting a DRO without losing my car.

Sick of sleepless nights now. To put the car in my Mums name I would also have to tell her about my debt problems which is making my anxiety really bad.

Sara (Debt Camel) says

You can be the registered keeper of a car which is owned by someone else. Perhaps your mum is just letting you use her car, so you couldn’t sell it? Talk to a DRO adviser about this and whether it would need a letter from your mum to confirm it. If it needs a letter, then I am afraid you have to choose between the stress of explaining to your mum and living with the stress of unrepeatable debts.

Rickrack says

Thanks Sara. In regards to the bank accounts could the bank take money from my current account without permission?

Would it be best to open a new bank account and start getting my wage and UC paid into that?

Sara (Debt Camel) says

I normally suggest you open a new bank account with a bank you don’t owe any money to AFTER your DRO is approved. See https://debtcamel.co.uk/bank-accounts-after-bankruptcy/

Tammy says

Hi Sarah,

thanks for all the info you give! I have 2 queries please:

I was left with a lot of debt (over £40k) when I left an abusive relationship, and am signed off with LCWRA element of universal credit long term, single parent to 2 kids. As my biggest creditor has agreed to mark the debt as uncollectable (I complained to the Financial ombidsman as this was debt he got in my name) I am now left with £18k outstanding.

Will I be allowed a DRO as the other has been marked uncollectable ( it shows on my credit file as uncollectable and is in writing Lloyds have basically disregarded it as I won’t be going back to work and it was having a huge impact on my mental health), so I have £18000 to repay in real terms?

Secondly I have more than £50 ONLY if you count child maintenance and my LCWRA element of universal credit. I know if you used to get DLA on the old system they counted that element of income as essential as it is specific to meeting the needs you have from your disability, is this the case with the LCWRA of universal credit, or is that taken fully into account?

I have UC basic element, then for 2 children, then LCWRA, and also rent to me. On top I get child benefit and £160 a month in child maintenance for my eldest (nothing for youngest, and my eldest is 18 in 3 months so the money from her dad will stop then)….. not sure what they will count it all as included income, or if they discount the £300 for my disability?

Thankyou

Sara (Debt Camel) says

Child maintenance is classed as income – but this stops in 3 months time.

In general you will be assessed as meeting the “less than £50 spare income” test if your only income is from benefits.

The large uncollectable debt – your DRO adviser will have to convince the DRO unit that this debt can be excluded – this may be possible if the creditor has clearly stated this in writing.

I suggest you talk to National Debtline about a DRO. If they think you don’t qualify for whatever reason, then bankruptcy is the simple fall back – apart from the need to save up the bankruptcy fees.

ana says

I want a guide on debt relief order that is where I can get full guidance about that.

Sara (Debt Camel) says

The article above is a brief introduction. For a detailed guide, see https://debtcamel.co.uk/debt-options/guide-to-debt-relief-orders/. And then talk a good debt adviser such as National Debtline on 0808 808 4000 – they can check you will qualify for a DRO and see if you have any better options.

If you have serious long term financial problems and you qualify for a DRO then it is better – cheaper, simpler, over quicker – than a DMP, an IVA or bankruptcy.

Sam davies says

Hi I have been told that I meet the criteria for a dro. When looking on Parker’s they are valuing my car at £2200 but I know with everything that is wrong with it that it isn’t worth that amount and no where near. The only reason this is so high is because my mileage is so low. I need this car to get me to work and my daughter to school it’s all I have. Is there anything I can do to help me through this?

If I get an independent valuation will they still check the Parker’s guide of there poor price too? Or just go off the independent valuation?

Thank you in advance x

Sara (Debt Camel) says

Who told you that you meet the DRO criteria?

Rachel says

Hi Sara!

I have had a dro and I am thinking about setting up a limited company. Will I have to wait until my 12 months is up? Or are you not allowed to be a director for the full 6 years?

I can’t seem to find a clear answer online. Thank you for your enquiry help

Sara (Debt Camel) says

You can’t be a company director for the 12 months of your DRO without getting permission from the court. I have never heard of anyone asking for this so my suspicion it is it incredibly rare.

But after the DRO years ends, that restriction ends.

See https://www.businessdebtline.org/fact-sheet-library/debt-relief-orders-ew/ and Business Debtline would be good people to talk to if you have any queries about this.

Franco says

Dear Sara,

hope this message finds you well.

I need to apply for a DRO (actually I did through Payplan, and the assessor stopped replying). The CAB information reads: ” you should not have more than £1000 including cash”. Dim question, but is by “cash” meant any basic bank savings? (no interests earned).

Thanks and regards,

Franco

Sara (Debt Camel) says

Hi Franco – I am fine, thanks for asking.

Money in your bank account that you need for essentials this month is disregarded. SO if you have just been paid but you haven’t yet paid the rent, council tax, utuilities, and need money for food etc, what looks like a healthy amount of cash can be little left by your next payday.

DRO limits are anyway changing at the end of June so that you can have £1000 in assetsgoes uo to £2000. I am not sure exactly what CAB info you are looking at but they will be updating it.

Leanne C says

Just been reading about DROs and was wondering – would a DRO stop me getting car insurance or would it have an impact when I come to renew every year?

Sara (Debt Camel) says

It doesn’t stop you getting car insurance. There is a rule which says you can’t get credit for more then £500 without informing the lender about your DRO, but that doesn’t apply for things like insurance where you are signing up to take a service over the next year.

Some insurance companies may reject you but others won’t – there are thousands of people who have had a DRO with a car!

Leanne C says

That’s brilliant. Thanks Sara.

Now trying to work out if DRO is best thing for me. On a low income (working) and really struggling financially and have some debts I’d love help with. So this might be the answer

Sara (Debt Camel) says

It might be! I would say talk to National Debtline now, 0808 808 4000. They can help you look at all your possible options and the pros and cons – it’s your choice what to do.

sam says

Hi Sarah quick question regarding DRO , I know you can not qualify for a DRO if you have had one in the last 6 years , my question is , is the 6 years from approved for the DRO or is it from when you was discharged from the DRO ?

Sara (Debt Camel) says

It is from the date your DRO started.

Getting a DRO normally takes a couple of months, so if you are coming up to the 6 year point and think you need another one, talk to a debt adviser now about getting it underway so you can submit the application as soon as the 6 year point is passed.

Maria says

My partner and I live together permanently. I am in full-time employment, but on low pay. He was working, but is now unemployed due to illness, and in receipt of ESA & PIP. He has credit card and monthly payment plan debts totalling around £15k. The monthly repayments are more than his monthly income now he is unemployed, so I have been making the payments for them (in addition to the rent, food, electricity, gas, etc). None of his debts are in joint names. Would my income be mcluded in calculating spare income for a DRO?

Sara (Debt Camel) says

A partner’s income is taken into account but only in working out how much of the household bills he has to pay. He will also have expense lines allowed – so his PIP income will be offset by “adult care costs”. In practice if his only income is benefits he will pass the “less than £75 spare income a month” test from a DRO.

Does he expect to get back to work in the next year? If he doesn’t, a DRO is probably a very good option for him.

But he should not be paying credit card bills in full and repayment plans to other debts. He should be treating all his creditors equally. Even if a DRO is not an option for him because he doesn’t pass sone other criteria or he thinks he will soon be back in work, he should only be making them all low monthly payments, say £5 a month.

I suggest ge talks to National Debtline now on 0808 808 4000. They are good at assessing DROs Shen disability benefits are involved. If they confirm he is eligible then he should either stop paying them anything while the DRO application is set up or switch to paying them all a low token amount. It can take 2 or 3 months for a DRO to go though.

Michelle says

Hi Sara.

I was just wondering if you would be able to give me some advice about a DRO.

I owe £5000 in overdraft fees and I am a single person in rented accommodation currently receiving standard Universal Credit allowence with no other income, no assets and practically zero disposable income after I pay food and bills etc so I gather I would be eligible for a DRO but my only question is my ex partner who I haven’t seen for 16 years owes me almost £3000 in child maintenance arrears but he has only payed me about 6 times in the last 8 years although the child maintenance service have been chasing him all this time whenever they enforce a payment he leaves a job etc so although I get paid now and again (between £120-160 a month) I very rarely receive these payments. This last two years I have been receiving them about once every 6 months so I don’t know how this will affect a DRO application as these aren’t regular payments? Sorry for the long message but I wasn’t sure what to do. Thanks :)

Sara (Debt Camel) says

do you have a lot of other debts apart from the overdraft?

Michelle says

Hi Sara.

I only have the overdraft and have never had any other debts before, I ended up moving from London to Northern Ireland to stay with my aunt who unfortunately has a gambling problem and was constantly asking me for money which I felt I couldn’t say no to as I was staying in her house, I then found a landlord willing to receive housing benefit so I applied for UC and moved into the flat I live in now and used what was left of my overdraft to buy essentials. I have now set up a token payment plan with them for £1 a month but Advice NI have told me a DRO would be better for somebody in my current situation. I’m not sure whether to go ahead with the DRO application or keep with token payments as I am hoping to find a job soon but as I live in an area with very high unemployment jobs are very hard to come by. Sorry for the long post, I thought I better explain my full situation.

Thanks.

Sara (Debt Camel) says

were you in work when the overdaft was being used? did the bank increase your overdraft limit?

Michelle says

Hi Sara, I didn’t have a job or any income but I had around £800 in my bank which I was hoping would last me until I got a job here but my aunt’s gambling problem and not being able to get a job caused me to go back into my overdraft and then eventually go up to the £5000 limit that was still on the account from around 15 years ago when I was struggling but had all been paid off. It was very silly of me seeing as I have no other debts but the pressure of living with a relative who was using me for money to feed her addiction and then moving into a flat took every penny of this money. My advisor said I am almost certainly eligible for a DRO so I’m thinking of going ahead with this but was just checking that this would be the best option. Thanks :)

Sara (Debt Camel) says

I asked because if the bank had increased your ovedraft while you were out of work then you could make an affordabilty complaint. But in your case it doesn’t sound as though that will work.

So your options probably are:

1) a DRO to clear the debt. If Advice NI sets this up, they will look in detail at the child maintenece issue – it sounds too irregular to be a problem to me, but they will check. The “odd” maintenance payment in the 12 months of your DRO won’t be a problem, it would be treated as a small windfall. If you suddenly started getting them every month, that would be different, but that doesn’t sound very likely, does it?

2) get the bank to freeze overdraft charges (perhaps they already have?) and wait until you get a job and then start chipping away at it.

It comes down to how likely you are to get a job that will let you start paying at least £100 a month to this overdaft debt. If that isn’t likely, then a DRO is probably your best best.

These choices always involve trying to predict the future – that’s difficult, but it’s better to make a guess and go with that than just not make a choice and be in limbo while you wait for the future to turn up at some point!

I would say go back to the Advice NI adviser and talk this through with them. They won’t tell you what to do – sometimes you wish they would – but just talking about it can clarify it in your mind.

Laurence says

Hi Sara

Can counselling fees be included in dro budget? I am having private counselling sessions long term as am recovering from mental health issues. Costs are 240 per four weeks.

Sara (Debt Camel) says

Are you getting any disability benefits?

sam says

quick question i have my final telephone call this week to finalize my dro application before it gets sent to the insolvency service , i have incurred a couple of more debts since sending my application 2 doorstep loans purley to get by , can i tell them about these or will this affect my application ? Or is it best just not saying anything

Sara (Debt Camel) says

Are you making any payments to your other debts?

Sam says

Hi Sara thanks for your reply and I hope I made some sense , no I am not making any payments to any debts as there is no money to pay them hence the DRO , i am just worried if I tell them at this stage I have incurred 2 more debts my application could be declined , I have been waiting about 3 months to get to this stage ,

Sara (Debt Camel) says

You absolutely have to declare all the debts. If you don’t your DRO may be rejected as they have not all been listed. This is NOT optional.

And you want these loans included in your DRO. Otherwise there is no way you will be able to repay them.

You need to talk to the person setting up your DRO – they may suggest you need to wait a while before applying for the DRO

Why did you need this money? Because when you are in a DRO, you won’t be able to borrow at all.

Sam says

hi sara many thanks for your reply , I needed the money to buy food etc , because having little money left after all outgoings are paid , I absolutely understand the situation but I felt they was no other way to get by. Equally not blaming the lender but the loans should no way of been issued either.

The loans were £200 X 2

Sara (Debt Camel) says

I think you need to discuss this in detail with your DRO adviser. There may be some situations where you will be OK in a DR because at the moment you are having a lot of money taken off your benefits that will end in the DRO.

Nicholas says

Hiya, can someone advise when my DRO will disappear from my credit record? I applied for my DRO in March 2017, is it 6 years from that date or from 2018 moratorium date?

Sara (Debt Camel) says

It is 6 years from the start date, so March 2017.

See https://debtcamel.co.uk/repair-credit-record-dro/ for more details on your credit record after a DRO.

Shellyt says

Hi

My dro finalised in October but I didn’t realise I should have told Insolvency Service that my father had died & there was a likelihood that I wd receive an inheritance when it happened. I thought it logically & morally right that when I actually received any funds (warning to others) i would pay mydebts – which I still haven’t & unlikely to as brother wants to remain in the main asset & unless I have the funds to take him to court to remove him – which I don’t – its going to be a long wait.

I realise my dro cd be revoked by the courts due to my error in contacting them late & as disappointed as I would be because it puts me back at square one I accept why.

My question is in these circumstances would I be able to apply for another dro if my brother gets to keep the property & I receive £1-2k not the larger sum which would have put me over.

Thank you

Sara (Debt Camel) says

This may depend on how the Will was drafted. I am sorry but I am reluctant to guess… If there is a Law Centre near you (see https://www.lawcentres.org.uk/about-law-centres/law-centres-on-google-maps/geographically) that would be a good place to start as they may be able to advise both on the Will and on your DRO.

MACK says

Hi,

I have question regarding a car before apply to DRO. My girlfriend bought a car for her money at cost approx £7k, but I’m main driver and registered car on my names , because I have 15 years NCB and is cheaper cost. I’m the person who have debts and wanna using DRO, what you suggest to doing with a car ?

Thank you

Sara (Debt Camel) says

So this is still your girlfriend’s car? Does she also drive it?

Rachel Sergent says

I am in the process of getting a DRO. My partner and I have a car loan, the car is in my name, but the loan is joint, but has always come out of my partners account. Will this have to be declared and will this be counted as my asset as it is worth £9500.00. We still have 10.000 debt left on car.

Sara (Debt Camel) says

was there a deposit paid on the car?

Sally says

Hello I am considering a Dro as my basic income doesn’t leave me with much to spare. Question if I get commission payments how is my income worked out (they are not every month they are adhoc) but can be 1-1.5k. Will they average this over 3 months for example or will they see this as my monthly income (for reference I have only received 2 commission payments of this size in 8 months)

Also how far back at Bank statements do they look? My brother loaned me 6000 nearly 3 years ago which I pay back 100 a month and would like to continue paying him, he does look after my son once a week so could I say this is childcare costs?

Is there an expendature form a dro adviser will use that I can look at to confirm I am below the £75 a month?

Sara (Debt Camel) says

Can I ask how large your other debts are? Does this include any priority debts – rent, council tax, energy bills?

Have you missed any payments to cards, loans etc?

Jane says

I have an IVA with Hanover Insolvency and have been unable to contact them since November 2021. I haven’t a clue what amount is left on there and when it ends. I pay £127 per month without fail. Is there any way of cancelling my IVA and changing it to a DRO? Is it worth it? I’m just so frustrated with Hanover. I looked on my credit file through Equifax and it mentions the IVA with a balance of £0 which I know is incorrect. What is the best option for me as I am single, registered disabled with 3 registered disabled children and my income is through UC and disability benefits? Thank you

I started my IVA in October 2018 and am paying £127.50 per month. I have emailed them with getting no response since November 2021 and I am totally stressed out by it all. I have no idea what my debt is now, when it ends etc. what can I do please? I have recently been diagnosed with Autism & ADHD and am registered disabled along with my 3 children who have the same diagnosis as myself. My mental health has declined rapidly and I am feeling suffocated by my IVA with Hanover Insolvency due to no communication on their part. What is the process of trying to end an IVA and my debts just being written off? Can I just ask for this to happen? What can I do if they haven’t responded to my emails for 9 months now? Is there an official governing body complaints dept I can contact? Any help will be appreciated as this is making me so ill with all the worry. Thank you

Sara (Debt Camel) says

What email address have you been trying to contact them on? Have you tried phoning them?

Do you know the name of your Insolvency practitioner – that would have been on your IVA paperwork. It is likely to be either Dylan Quail or Ian Millington.

If your IVA started in Oct 2028, then this would normally be for 5 years although 6 is possible. Do you know how large the debts were that went into your IVA?

Do you now have any new debts eg arrears on bills?

Are you finding it difficult to pay the £127 a month because of cost of living putting prices up?

Jo says

I have a salary sacrifice lease car with nhs for work deductible before tax etc I am thinking of applying for DRO will this lease be allowed I need for my job

Sara (Debt Camel) says

I think it should be – talk to a DRO adviser about this he the rest of your situation.

sil says

hi, i have debts around 15k but am paying private student loans which are not through student finance, I know these cant be included in in the 30k list, do i list these as course fees?

Sara (Debt Camel) says

are you sure? If these loans are not from Student Finance England, talk to National Debtline on 0808 808 4000.

Sil says

Hi Sara, I pay student fees privately I didn’t have access to student finance. Will these fees be classed under professional fees regrading stepchange application?

Sara (Debt Camel) says

I don’t know and I think you should talk to National Debtline about thius.

Danni says

Hello, I am drowning in debts just under £30k and have been advised by step-change a DRO would be my best option. However… I haven’t told them I have a car on HP which I still Owe £7k as this would take me over the £30k. I don’t need the car I can use public transport for work so I am thinking about selling it before I apply for a dro and clearing the finance to take my overall debt limit down. they would be very little left from the sale (approx £800 – £1000)Would this be allowed? Even with the monthly hp payment removed from my monthly expenditure still at a minus as my monthly debt payments are over £1000 pm. I’m making all my payments each month but there’s nothing leftover for cost of living so find myself living on credit and borrowing of family to buy clothes and food etc for my family.

Sara (Debt Camel) says

You need to go back to StepChange asap and explain about the car and what you are hoping to do.

They will have to rework what your income & expenditure will look like without the car and all its associated expenses and using public transport. You may well still qualify for a DRO but you cannot assume this is right without going through the details. Your current debt repayments are irrelevant to the I&E calculation as it is done looking at what your expenses are after a DRO, so there won’t be any debt repayments.

———————————————————————————-

A HP debt for a car does not have to be listed in a DRO as a debt

IF there are no arrears

AND either the repayments will be made by someone else (usually a family member) OR the car is an allowable expense. The debt adviser setting up the DRO will look at thuis.

But in your case as you can use public transport it is very unlikely the payments would be considered as an allowable expense. So keeping the car is unlikely to be possible.

——————————————————-

You also need to talk to the car finance about selling the car to settle the finance. This can be possible. If you end up with say £1000 in cash this is not an obstacle to a DRO as you are allowed assets of up to £2000.

If selling the car will still leave you owing money which would take you over the £30k DRO limit, then another alternative if you are more than half way through the HP is to voluntarility terminate the car finance, see https://debtcamel.co.uk/vt-end-car-finance-early/

Fra mc says

Hi, I am a carer for my wife, live in ni.she gets pip, i get carers allowance. we have joint esa claim, I have about 10 grand debts mostly credit cards, overdraft of near 800, morses 150. Am getting letters from DCA over credit cards which I cant afford to pay now. Should I tell them I’m on benefits then ignore them and hope it wont go to court because of this? what about a DRO? Heard its £90 what if I cant afford that as things tight now with rising food and energy prices?

Sara (Debt Camel) says

creditors don’t tend to go away if you tell them you are only living on benefits.

As your only income is benefits, you are very likely to qualify for a DRO if you are renting and don’t own a car worth more than £1,000 (this is a lower limit in Northern Ireland than in England and wales. That makes no sense, but those are the rules.)

I think you should talk to a Debt Adviser now. There is no reason to delay and have to put up with letters and calls from debt collectors. Contact your local Citizens Advice or phone the NI Debt Helpline: 0800 028 1881.

If you do qualify for a DRO, they can talk about options for paying the fee.

Fra mc says

Would my wifes disability car that is taken from her pip each month count towards the 1000?

Sara (Debt Camel) says

This is leased through Motability? That shouldn’t be a problem. She doesn’t own it.

See https://debtcamel.co.uk/dro-car-hp/ which is a new article just published today which looks at cars and DROs.

Damien says

If I got a DRO, when it drops off in 6 years, if someone performs a credit check, will they see I had a DRO in the past… or is it history, as it’s dropped off and not there anymore?

Sara (Debt Camel) says

No.

The only exception is a creditor who had a debt in your DRO – they may still be able to see from their own records but it isn’t on your credit record any longer.

Flora says

I am nearing the end of my moratorium period and about to start a new job on a much higher wage. However, my first pay day will not be until after the 12 months has officially ended. Do I still have to inform the Official Receiver?

Sara (Debt Camel) says

I think you should talk to the Adviser who set up your DRO about this.

Flora says

Update – I called the Insolvency Service and they said it was fine to start a new job on a higher salary before the moratorium period finishes, as long as I get paid AFTER it finishes – because during that time I still won’t have any extra income to give to them. It’s reassuring to know that I can search for better jobs during the moratorium and I hope this helps others in the same situation.

Sara (Debt Camel) says

That is useful to know. And good luck with the new job!

Connor says

I’m a bit lost, I have lots of debts totalling 10k and I don’t have a job. Would a DRO be my best option? I worry because I’m a 29 year old man and I still live with my parents. I just don’t know what my best option is? I currently pay all the companies £10 per month, so I never hear from them, but I can’t get credit at all, not even for a £10 per month phone. I think I just fear being homeless one day. Is it better to get a job asap and just throw all my wages into the debts and clear them that way, or is it better too do the DRO? If I can’t even get a phone contract, how will I ever rent my own place? It’s detrimental to my mental health

Sara (Debt Camel) says

So your only income is benefits? Do you have a car?

How easy would it be to find a job?

How long ago were your debts defaulted?

Connor says

I don’t have a car, trust me, my mental health is too bad for me to drive. 4 defaults in the last 4 months, they’re in payment plans with collections, 3 haven’t defaulted yet, I was hoping to put them into plans too. When I try hard, a job is easy to find. I don’t mind if I’m unhappy at a job, asking as these problems don’t make me homeless in ten years. I’ve given myself that long to pay everything and build credit. Which, surely should be enough time

Sara (Debt Camel) says

if you can get and keep a job and will earn enough to start really clearing the debts within a few years, that sounds sensible.

At this point you probably should want all the debts to default as soon as possible – that means they will be off your credit record in 6 years. A debt that is in a payment arrangement will stay for 6 years after its cleared – so if it takes you 5 years to clear it, it will still be there in 11 years time.

But if in 6 months the job isnt going well or the debt clearing is going very slowly, come back at that point and look at a DRO?

Connor says

I’d say realistically, it would take me 12-18 months to clear, so before I’m 31 years old. Then I planned to start building credit then… even with the defaults still on, a head start you could say. Then by the time they’ve dropped my credit will only be getting stronger? Right now it’s diabolical. But I’m trying to stay focused on the end game. I keep telling myself there’s millions of people in my boat, if not worse who aren’t worrying. I’m being proactive, but I think if the rest of these debts don’t default before 2023, I might go down the DRO route, have a year off working to sort out my mental health, then when the DRO ends, start putting myself into a position where in 6 years time, it’ll drop off and my credit will be better. I’m a bit lost, I might go to citizens advice too, but your forums are amazing.

Harry says

If I get a DRO (I am eligible), will it affect me for the rest of my life? Or in 6 years will it be completely wiped from my credit record… like a fresh start? Or is it better to ring up the debt collection companies up and offer them a small amount a month and avoid the debt relief order? I say this because I know I can pay my 9k debts inside 2 years and if I already have the defaults, will it make any difference what I decide to do?

Edit: I’m genuinely thinking of ending my life over this now, just been honest

Sara (Debt Camel) says

will it affect me for the rest of my life? Or in 6 years will it be completely wiped from my credit record

The DRO and all the debts in it will drop off your credit record after 6 years

I know I can pay my 9k debts inside 2 years

That would mean you could pay £375 a month every month for 2 years. In that case it is unlikely you would qualify for a DRO now.

What did you talk to about a DRO? Did you explain you think you can clear the debts in 2 years? I think you should go bank and talk about the option of just repaying your debts without a DRO – the debt adviser can talk about the pros and cons of your options.

If after that you are unsure, you could try repaying them and see how it goes for 6 months? Then opt for a DRO if you haven’t managed to clear much?

Deppi says

Hi Sara, while on DRO, can a creditor raise a default on the credit file? I think they do, but want to check.

Sara (Debt Camel) says

a creditor should add a default that is on or before the date the DRO started.

This means that when the DRO drops off your credit record after 6 years, the debts that were in the DRO will all drop off at the same time.

Deppi says

Thank you Sara

Gary says

Hi Sara

I’m thinking that a DRO is my best option, basically I only have state pension and housing benefit to live on. I have about £22000 of debts to credit cards that have built up over a long time, I now cannot afford the repayments. All cards are maxed out with no way of ever repaying them now.

One bank cancelled my card as I was in persistent debt, shortly after I stopped paint it and they have now cancelled the agreement and it will default in the next few days.

The other cards at the moment I am paying minimum payments using the little available credit there is so these will never end. My question is is it better to let all accounts default before applying for a DRO?

The other question is the highest card limit is £10950 this is with my usual bank. Would I be better getting another account before I apply for a DRO?

Thank you

Sara (Debt Camel) says

basically I only have state pension and housing benefit to live on

Have you looked at whether you are entitled to Pension Credit? Use this benefit calculator here: https://benefits-calculator.turn2us.org.uk/. Hundreds of thousands of people who are entitled to PC do not claim it, but this is a “passport benefit” – even if you only get a few poinds a month PC, you will also be entitled to other benefits and help as well because of the PC.

My question is is it better to let all accounts default before applying for a DRO?

No, there is no reason to do this.

Would I be better getting another account before I apply for a DRO?

Possibly – the DRO adviser will discuss this with you.

Jon says

Hi Sara. I’m probably missing something, but is the £75 monthly threshold what is left over if you don’t have any debts, or when working out the figures does it take into account monthly debt repayments?

I get a total £1,100 a month through state pension, pension credit, and company pension. Out of this I am paying about £550 on food, energy, water etc, and the rest is spent on reducing debts and paying interest.

In other words, I have no money left over each month. But if I wasn’t paying debts, interest etc, I could not qualify for the £75 threshold.

Sara (Debt Camel) says

Can I ask if you are single?

Jon says

No, I am married

Sara (Debt Camel) says

The £75 figure is ignoring any debt repayment. But £550 sounds a lot too low an amount to be sustainable for two people long term. It has to cover not just the bare essentials for a month, but broadband, mobiles, TV license, toiletries, replacing household items, transport, clothes, hairdressers, laundry, Xmas presents, insurance etc.

I suggest you talk to National Debtline on 0808 808 4000.

Jon says

Thank you Sara. I will contact them. While here, can I just say what a brilliant site you have created. In the past you have helped me, and probably hundreds of others, with your advice. It was thanks to Debt Camel that I was able to get a small refund on Provident loans, and I have taken your advice on other matters too. Thank you again and I hope you and your family have a great Christmas and 2023!

Jake says

I currently have £8k of debt, for about 7 different debts (all non priority) but they’re all defaulting. This is bad, I know.

I currently live with my parents and I’m on benefits, due to mental health. I’m paying £10 per month to all these debts out of my UC, not a DMP, I set them up myself by ringing the debt collectors… but I feel like unless I get a job, I’m going to be paying this forever, which leaves me little hope of finding my own home one day and HUGE fears of been homeless.

Do you think, in your personal opinion, that a DRO may be my best bet? If I’m debt free in 12 months, I can then focus on building up and after 6 years (I’ll be 37 years old) my credit will be clean and I should be able to rent because it will have dropped off? If everything is defaulting anyway and my credit file is bad, then had I may aswell just do this?

Sara (Debt Camel) says

If you don’t think you will be able to get a job in the next year then that may well be a good plan your credit record will be clean after 6 years so this will giv3 you a clean start.

The money you are currently paying th3 debt collectors may be better spent helping out your parents with increased energy and other bills.

Deppi says

Hi Sara,

I have received a PIP back payment of £4000. I understand from reading your articles and the PIP guidance, this will be disregarded as asset. Is that correct? It is only PIp and no other money of disability premiums.

The second question is, does it matter how i spend that money? i need certain equipment related to my disability and this amount will go toward that.

Third, my Pip monthly payments are near £600. I understand once again, this is offset to adult care costs. But what is that costs? will i have to send to the DRO team a detail how i am going to spend that money monthly?

Sara (Debt Camel) says

Is your only income from benefits?

Deppi says

Yes, PIP, Housing Benefit, Child Tax Credit and Child Benefit.

Sara (Debt Camel) says

So you have to tell the DRO team at the Insolvency service about this extra income and the backdating.

Explain that your only income comes from those benefits. And be clear that the backdate money is for PIP only.

You should not have to detail how you will spend the backdated money (but if I were you I would keep the receipts just in case. It souldnt be necessary, but why not.)

And you shouldn’t be asked how your budget will change with the money.

Any problems, talk to the adviser that set up your DRO straight away.

Deppi says

Thank you, Sara.

Sara (Debt Camel) says

PS have you looked at whether you would be better off on Universal Credit? Use a calculator https://benefits-calculator.turn2us.org.uk/ or talk to your local Citizens Advice.

Deppi says

Thank you for that. I would indeed be better off with UC. My DRO ends in July, I will hold on until then, as I will be eligible for a number of things and dont want to affect the DRO.

Happy New Year, Sara.

Alison Gray says

I was granted a DRO 18/0/2018 and as one of the debts was a nationwide overdraft I closed the account. I have just opened a new Nationwide FlexDirect account (haven’t put any money in yet) and it’s just dawned on me …..could they take the £1200 I owed them out of the new account?

Sara (Debt Camel) says

No they can’t do this. You no longer owe them this money.

Alison Gray says

Thanks for quick reply Sara 😀

Matt says

Hi Sara

Hope you can help me , I looking to take out a dro in next couple of weeks

I have about 26500 worth of debt and my job hours have been cut , I have a lease car

With over two and half years left . Will I still be granted a dro if I have a car lease .

I have also less than £50 left a month and rent . I need my car for work.

Thanks

Matt

Sara (Debt Camel) says

A lease car is not an asset that you own. The question here will be whether the payments are acceptable expenses for a DRO. You need to talk to a DRO adviser who will look at your full situation – I suggest you call National Debtline on 0808 808 4000

Dan Crane says

Hi Sara im just hoping for a bit of advise ive been self employed for a round 5 or 6 years now and have around 15k worth of debt business loans and a personal loans etc ive managed to always pay my bills up until about a year ago when my business started taking a turn for the worse its come to the point where i can no longer afford to keep the business running and i have had to take a significant pay cut working for a previous employer i am just about covering my household bills with this new wage but have stopped making payments on my debts i considered an iva but i have 0 left over after paying household bills so i want to apply for a dro as i dont see my situation getting any better at least any time soon. The issue i have is the company was ltd for a short anount of time..i have paid the fee and have started the process of disolving the business is this going to delay or stop me from applying for the dro. Any advise is really appreciated Thanks Dan

Sara (Debt Camel) says

Talk to Business Debtline straight away! https://www.businessdebtline.org/

They specialise in advice to people who are self employed or with a small limited company. They cover both business debts and your personal debts.

Joanne says

I had a debt relief order that came off my credit file in December 2022, but a provident account is still showing on there and won’t go for another year. I cannot contact Provident and the credit reference agency refused to remove it. How do I get this taken off?

Sara (Debt Camel) says

have you asked the credit reference agency to “suppress” this debt? See https://debtcamel.co.uk/correct-credit-records-lender-administration/

Naomi Kenneth says

A client of mine has just had a DRO agreed on the 4th January. Last summer, Scottish Power forced a prepayment meter on her through a court order, a guy turned up at her door to say he was fitting a smart meter which turned out to be a prepayment with it set to recover £5 a week for her arrears. We got this changed to £3.75. What I’m wondering is, now that her DRO is in place, who do I contact to get Scottish Power to stop taking money from her as the debt will be wiped?

Sara (Debt Camel) says

Did you set the DRO up for her?

Georgina says

Hi Sara,

I’m hoping you can help, I can seem to find a definitive answer to this!

I had a DRO, the moratorium ended in February 2021. I’m part of a village organisation that are looking to become a Community Interest Company. Does my previous DRO prevent me from being a company director if this does go ahead?

Thank you!

Sara (Debt Camel) says

No – you can now go head and be a Company director.

During the DRO moratorium there are some restrictions on what you can do, being a director is one of them those restrictions. They all ended when the DRO finished.

Matthew Smith says

DRO Question – if a client has a vehicle, worth under £2K, but without a valid MOT. How would this impact when completing the DRO Application? Would the Insolvency Service request the removal of the vehicle, as it’s no longer roadworthy? Unless, client pays current car insurance? I am unable to find anything specific to answer this question.

Sara (Debt Camel) says

Does your client intend to get this repaired? Or are they one of those people who likes having complicated bits of metal sitting on the driveway?

If it is repaired, will it be worth more?

Lisa says

Hello,

Your DRO section has been very helpful! Im applying for a DRO as we speak after financial advice. Can I ask…

If I want to make extra money through matched betting, surveys, vinted, online odd jobs do I have to declare them? The amounts would obviously fluctuate each month.

And secondly how much in savings can I have? Eg emergency fund for breakages

Thank you from a…

Single parent to a 2 year old on Universal Credit and have no childcare or access to a funded nursery nearby to get a regular job. Trying to do my best so the next 12 months is not so awful financially.

Sara (Debt Camel) says

You can have £2000 in assests, including money in the bank. This doesnt include normal clothes, household items etc and any other expensive items are valued at their second hand price.

You would need to take benefit advice as to how much you can earn before this affects your Universal Credit.

Your debt adviser will draw up an income & expensiditure sheet with you. You are allowed £&5 a month speare income. So how much extra money you can make will depend on your starting point – which may be negative. Talk to your debt adviser about this.

Matched betting would not count as income. Nor would Vinted sales if you are selling your own things, but they would if you were buying thinmgs to resell.

James says

perhaps you can help with my current issue..

i have been struggling with debt on and off since 2015. between 2015 and 2017 i was using my credit card as a way to exist while i struggled to find work.. generally in and out of my overdraft, but in 2018 i found a job and took a loan out to cover it so was paying this off. i left my job in 2020 and the credit card use started creeping back in and topped my loan up to £6500.. but as off today this is down to around. £5100 and my credit card has once again reached £6300. i also owe around £1500 elsewhere. my bank increased my Credit card limit from 5500 to 6500 last year and my bank account from 200 to 500. i am constantly in my overdraft and would say i have been for at least a year now.

im currently looking after my child while my partner works full time and earns a good wage. i might be able to put my child into nursery soon, but the hours are short.

i feel like i have no way out of this debt.. ive been just about scraping by with handouts or moving things around, but feel this could be where i lose all control and will miss a payment on at least one of these things. any advise would be great.

thanks

Sara (Debt Camel) says

Was the loan from your bank, or which lender? What interest rate is it now, is this higher than it was before you topped it up?

At the time the bank increased your credit limit to 6500, were you already struggling and only making minimum payments?

Are you buying or renting? Do you own a car?

James says

the loan was from HSBC, my bank.. with credit card owed just under £3000 when offered the credit card increase from 5.5k to 6.5k. only ever been making minimum payments. was 200 same month credit card limit was increased.

had a part time job then, but also was on universal credit.

i dont own a car.. live in a house we own and have been in for a month.. but im not on mortgage as felt that wouldn’t have helped the applicaton.

loan went from 9.9% to 4.9% when i topped up.

Sara (Debt Camel) says

I suggest you talk to National Debtline about a DRO. Phone 0808 808 4000.

If for some reason you are not eligible, then you could also look at making affordability complaints against your bank. But a DRO would be a simpler way to get a clean start.

Shan says

Hoping for some help here please…I applied for a DRO Dec 2019 after being young and foolish. It covered 5 accounts but 2 of the accounts are showing as default still on my credit file and are also showing that the credit is still available to me…is this correct? The other 3 accounts were closed down. One of accounts still showing is Barclaycard and they did attempt to contact me in 2020 after acknowledging my credit limit was set to high but i ignored this as it was during my 12 month period so didn’t feel right to contact them for a refund of £50.00 but now i’m thinking do i contact both accounts to check they are aware of my debt relief order as i’ve had no other correspondence? Many Thanks for your help.

Sara (Debt Camel) says

See https://debtcamel.co.uk/repair-credit-record-dro/ which says how your credit record should be affected by a DRO and how to challenge any records that aren’t correct

Martin says

Hi Sara,

What are the rules about uc advances and dro. Can/must they be included?

And same question for student loan overpayments while the course is still running?

Thank you

Sara (Debt Camel) says

A UC advance must be included in a DRO.

Student loan overpayments – I will check. Can you say why these occurred?

Deppi says

Student Loan Overpayment is a qualifying debt for DRO only when it is a Grand or Bursary. e.g. Childcare Grand overpayment. Student Loan for Tution Fees are exluided for DRO purposes, but it does not count towards the £30000.

I know all that as I did include a debt from Student Finance for an Overpayment of Childcare. If that is the case, make sure when you submit the DRO that you have called Student Finance (if thats your loan provider) and ask an up to date balance. They are late to update amounts and you may found yourself with a new bill, and a higher amount, from SFE AFTER your DRO and this will take a lot of energy to resolve.

Guidance: https://www.gov.uk/guidance/debt-relief-orders-guidance-for-debt-advisers#student-loans

Deppi says

Just to add, you said the course is still running. If you have a letter notifying you of the overpayment and asking to pay it, and it is a Grand or Bursary, then you are good to include it. You need this paper of overpayment asking for the payment. make sure its the final amount as they add interest as it goes, so you need the final amount on the date of your DRO submision.

Sarah S says

Hi Sarah,

I have an ongoing IVA, I took this out in 2019. Firstly I was told it was 6 years but when I look on my app it says my finishing date is 2026, how can this be?

Also can you tell me if a member of my family can pay the rest of my IVA off please?

Any advice would be appreciated.

Thank you

Sarah

Sara (Debt Camel) says

Have you taken any payment breaks?

How large are the current payments and are they affordable at the moment?

Lily says

Hi, I had my DRO approved on 30/06/23. How long does it take for them to notify the companies I have credit with?

Thanks

Sara (Debt Camel) says

Not long. I hope you have stopped paying them all?

Lily says

Hi, yes I stopped paying them about 2 months prior to obtaining the DRO. But they keep calling (although I don’t answer) and just wondered how long it took – thanks for all your help!

Sara (Debt Camel) says

It’s going to be easiest if you do answer and tell them you now have a DRO.

Ella says

Hi, I have a current account with Barclays, that i never had an overdraft with etc, however I had Barclays partner finance as a debt paid off in my DRO. Will my Barclays current account be affected by the DRO? And will it be closed down?

Sara (Debt Camel) says

A bank may choose to close a current account if it wants. It may well be simpler to plan to switch to a new bank that you don’t owe any money to. the challenger banks such as Starling have a good reputation for nice apps that can help you budget.