If you are thinking of going bankrupt, there will probably be a lot of things that you want to ask.

This page looks at the nine most common questions people have about how bankruptcy will affect your life.

Contents

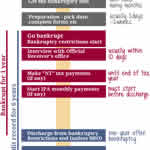

A brief overview of bankruptcy

You apply to go bankrupt online. The old days of having to go to court, before a judge, with masses of paperwork have ended.

Bankruptcy writes off almost all of your debts. It can give you a new beginning, a clean start in life.

When you go bankrupt, the Official Receiver (OR) will decide:

- if any of your assets will be sold. But most people do not lose any assets!

- if you have to make monthly payments for three years, called an Income Payments Agreement. But five out of six people do not have to make any monthly payments!

You will be discharged from bankruptcy after a year. After you are discharged you will find it harder and more expensive to get credit for the six years that bankruptcy shows on your credit record.

Everyone should get advice from a good free sector debt adviser before deciding to go bankrupt. No matter how obvious you think bankruptcy is, it is always worth 30 minutes of your time to talk to an expert as you may have better alternatives. Read A guide to bankruptcy which looks at these.

1. Will I be allowed to go bankrupt?

Yes! People often worry that they will be told they can’t go bankrupt as they will be told they just have to pay off their debts. This doesn’t happen.

When you make a bankruptcy application, this has to be approved by the Insolvency Service’s Adjudicator, who will look at various technical matters, including whether you are “insolvent”. The most common reason for an application to be rejected is that the person doesn’t normally live in this country.

If you have taken advice from a good free sector debt adviser and have been told that bankruptcy is a good option for you, then your bankruptcy is going to be approved.

2. What about my job?

There are some jobs which you cannot do as a bankrupt eg be an MP, be a company director. In some professions – solicitors, accountants, financial advisers – you may be prohibited by your professional body from practising until you are discahrged from bankruptcy after a year. It may be possible to find a similar role for which you do not technically need to have the relevant professional qualification.

If you are in the police, need a security check or you must inform your employer if you go bankrupt (this includes some jobs with banks), you might assume you will lose your job. However, the important thing for this sort of job is normally that they don’t like employing people with large financial problems because of concerns about fraud or blackmail. By going bankrupt you are getting rid of your debts and by telling your HR department you are eliminating the chance of blackmail.

So have a discussion with your HR department in confidence as it is possible that you will not lose your job. If you are a member of a Trade Union, they will have come across other people in this situation and know what happens in practice.

Lots of people worry unnecessarily about their job and bankruptcy. Unless you work in one of the areas mentioned above it is extremely unlikely that you will have any employment problems.

Ask yourself if you have ever been asked if you are bankrupt when applying for a job? If the answer is no, your employer probably doesn’t care.

Business Debtline can advise if bankruptcy is a good option for the self-employed and people with small limited companies.You are allowed to be self-employed as a bankrupt, but your existing business will be closed down and you will have to start to trade again. If you are a decorator and you just have the tools of your trade this won’t be a problem. If you employ other people and have a lease on a building, this gets more complex and you should take professional advice.

3. I’m renting – will bankruptcy affect this?

There may be a clause in your Tenancy Agreement which allows your landlord to end it if you are made bankrupt. If you live in council or housing association property, it is extremely unlikely that you will lose your home. If you are renting privately, your landlord is highly likely to want to keep you as a tenant – after all, if you have managed to keep paying the rent so far despite your other debts! It is a rare landlord who would prefer to get rid of a good tenant and have to look for a new one.

Renting somewhere new when you are bankrupt can be difficult because you will fail any credit check. But if your credit rating is already very poor, going bankrupt may not make much difference!

There are four ways around this sort of problem: find somewhere to rent privately, not through a letting agent, as landlords can apply common sense to your situation whereas letting agents normally have no discretion; get a guarantor; have a very large deposit; or delay your bankruptcy until after you have moved.

4. I’m buying – what happens to my mortgage and my house?

The Insolvency Service page Bankrupt’s Home covers many of the questions you may have about this.

Your mortgage and any secured loans are included in your bankruptcy. If you have handed back the keys to the lender or you have been evicted by the lender any shortfall after the property is sold will be a debt that is wiped out by your bankruptcy. This applies even if you pay the mortgage for a while and then hand back the keys.

But if you carry on paying your mortgage and secured loans your lenders will not repossess the property, so it may feel as though bankruptcy hasn’t affected your secured debts.

How much equity do you own?

If your house is worth more than the amount owed on any mortgage plus secured loan, then there is equity in the property and the OR will want to sell it.

When deciding how much equity you have, it can be reasonably argued to the OR that a lower value of the house should be agreed because of the need to sell the property relatively quickly and because lower sales costs are incurred (no estate agents or solicitors). Think of all the problems with your property – it needs a new roof, the boiler is 20 years old etc – as these can all reduce the amount of money needed to purchase your equity.

When you own the house jointly, the OR can still force a sale of the house, but your partner will be able to keep all their share of the equity. You can argue that your share of the equity is less than 50% if, say, your partner provided more than half of the deposit for the house, or if your partner has paid for large improvements such as installing central heating or building a conservatory.

If you have never owned any part of the property, the OR may still decide you have some beneficial interest in the property if you have contributed towards the deposit for the mortgage, if you have paid the mortgage or if you have paid for large improvements to the house. This is a complex area – discuss your situation with National Debtline if you think it might apply to you.

Ways to avoid losing your house

The OR has three years to decide what to do with your property. If there is no equity at the end of this time, the house will usually be returned to you.

You can avoid losing your home if a relative or friend can “buy” your equity from the Official Receiver:

- this could be your partner who owns the other half of the house if they are not going bankrupt;

- if there is no equity in the property a relative or friend can buy your interest for a nominal sum from the OR plus costs of a few hundred pounds.

If you cannot arrange for someone to buy your equity then you are going to lose your home:

- you should explore the alternatives of a DMP and an IVA in detail before deciding that bankruptcy is preferable.

- when your family are living with you, you are usually given 12 months before the sale to give time to make other living arrangements.

- if you have children or a disability, having your house sold by the OR will usually mean that your local council will be obliged to re-house you when you are made homeless.

- if you prefer to rent privately you will be allowed to save up a deposit for renting. Sometimes this could be done by stopping paying the mortgage.

There is no point in trying to transfer your half of the house to your partner (or anyone else) before you go bankrupt to avoid losing it. If your name is not on the deeds of your house so that you are not its legal owner, the OR may still decide that you have a beneficial interest in the property.

5. What about my car?

If you have a car, you may lose it unless it is essential. The simple case is where you have to have a car to get to work, perhaps there is no practical public transport or you have to travel for your job. You may also be able to have a car if it is essential for other reasons – health problems, school runs, caring responsibilities. You will need to explain why this is the cheapest or only practical alternative you have.

But if you drive a car that belongs to your partner or a relative, it is safe. This applies even if you are the registered keeper of the car. You may need to produce proof of who bought the car.

If a car is essential, you will be allowed to keep yours if it is worth less than about £4,000. Otherwise, it will probably be sold and you will be given £3,250 to purchase a cheaper car.

Cars on finance

The exception here is a car on finance. Here you do not own the car but it is more complicated and you should talk to a debt adviser. Some finance agreements have a clause which allows the lender to end the agreement if you go bankrupt or enter an IVA.

If you have HP which is just about to end, you may soon own the car. But early in finance or with PCP, most cars on finance will have negative equity, so the OR will not want to sell them.

Whether you are allowed to make the finance payments will depend on how large they are and whether you need the car for work.

6. What about all my other possessions?

You will lose any savings and investments (except your pension, see below) even if they are very small, such as £25 in premium bonds.

For possessions, you have to list your “assets” on your bankruptcy application if they are worth more than £500.

This £500 is their second-hand value, what you could sell them for, not what they originally cost. Even a new laptop or large fridge freezer is unlikely to be worth £500 second-hand!

It’s important to emphasise what doesn’t happen and what is not at risk:

- no-one will visit your house to make a list of stuff to be sold.

- the OR is not interested in the tools of your trade, your personal possessions, clothes or household goods unless they are of unusual value. Will I lose my lawnmower? looks in detail at this subject.

- your partner’s things and your children’s toys don’t have to be listed and are not at risk.

Your partner or a friend can offer to buy any items which the OR does claim, such as your car.

As a general rule, you should not give away or sell assets for less than they are worth before you go bankrupt. This doesn’t apply to normal presents, eg to children at Xmas.

The OR can go back and overturn transactions up to five years in the past. You may already have done this without any intention to defraud the OR. If this is the case, you should list the sale/gift on your bankruptcy application.

7. Will my pension be affected?

If you are already drawing money from your pension, then the income from this is included in the Income Payment Agreement calculations, see What happens after I go bankrupt?

If you are under 55 and not yet drawing money from your pension then it is not at risk except under extremely unusual circumstances eg you have made extremely large contributions to it which seem to have been funded by debts; a normal company pension will not be touched.

This is a bit more complicated if you are over 55 and have a defined contribution pension. Basically your pension will not be touched but if your pension pot is large you may be considered not to be insolvent, so you cannot go bankrupt, See this article on Pensions and Bankruptcy if this might affect you.

8. Who will know that I have gone bankrupt?

The OR will inform your creditors and, sometimes, your landlord about your bankruptcy.

Your employer is not informed of your bankruptcy. In theory, an employer could guess what has happened because your tax code will be changed to a nil code. But this isn’t likely – people’s tax codes change all the time and there are plenty of other reasons you may have a nil tax code apart from bankruptcy.

The Insolvency Register has the official list of names of people who have gone bankrupt, had a DRO or an IVA.

If you are at risk of violence, it is possible for your address not to be published – talk to a debt adviser about how to do this.

Bankruptcy Notices used to be printed in a local newspaper, but this is now very rare. It is usually only done if you are self-employed and the Official Receiver thinks you may have some local creditors. A small notice about your bankruptcy is placed in the London Gazette.

9. Can I get a mortgage afterwards?

It will be harder and you should assume that you will need a larger deposit than someone on the same income who has not been bankrupt. Read the page on Bankruptcy and your Credit Rating for a more detailed explanation. ]

The other insolvency options (IVAs and DROs) all have the same effect on your chance of getting a mortgage in future.

But also step back and ask yourself whether you have any chance of getting a mortgage if you don’t go bankrupt.

If you aren’t that young, or you don’t have a well-paid job and you live in an expensive part of the country, then owning your own house may just be a dream with no real chance of ever happening. Don’t let this sort of wishful thinking stop you taking the necessary measures to deal with your debts.

Help – a creditor is proposing to make me bankrupt

If one of your creditors is threatening to make you bankrupt, it may be a bluff to get you to pay them more money. It is very unusual to be made bankrupt for a normal credit card or loan type of debt. It happens more often for tax, including council tax, and commercial loans – did you guarantee a loan to your business?

But if you receive a Statutory Demand for any debt, this is not a bluff and you should take this very seriously as you need to settle the debt or get debt advice very fast to prevent yourself being made bankrupt. Phone National Debtline on 0808 808 4000.

If your assets are worth more than your debts, you should do everything you can to avoid being made bankrupt by a creditor.

Don’t think that bankruptcy can just be reversed later – although this can be possible it is likely to cost you tens of thousands of pounds in extra fees.

If you have a house with equity, then you could consider offering a charge over your house, but if you do this establish what (if any) interest will accrue and decide if you are happy with this.

What to do next

The next bankruptcy information page The process of going bankrupt looks at the timing of going bankrupt, the fees and completing the online bankruptcy application.

If you don’t like the sound of bankruptcy, see if you have a better alternative!

If you owe less than £50,000, are renting and have little spare income, a Debt Relief Order could be better for you – it has almost all the advantages of bankruptcy but there is no fee to pay!

Read about the Hard Choices – on those pages I compare the pros and cons of different options: DMP vs insolvency, IVA vs bankruptcy and Selling the house.

But if nothing else is looking better, sometimes you have to go for the least bad option, even if it’s not what you would have liked.

You should always take debt advice before going bankrupt – this is a big step and even if you think it is your only option, it is always worth half an hour of your time to talk to an expert about this.

Ceilidh says

I am a separated mother with several physical, mental and neurological conditions and I receive PIP and benefits for my daughter. These are my only income and I use 85% to pay for debts (hire purchase, loans, debt made in my name that I was unaware of etc) and I live payday to payday and I barely have enough to support both myself and my daughter… It’s got to the point I’ve had to ask family members and do a few things I’m not proud of to get by ?… I have tried debt helplines and C.A.B and failed miserably… My mum and aunt have suggested bankruptcy but I have no clue how it works, reading the information is confusing and information from a person is difficult due to limited hearing. Any help would be appreciated. x

Sara (Debt Camel) says

You really need someone to help you look though your options in detail. Most debt firms work on a telephone service, but it doesn’t sound as though this will suit you. Face to Face would be best, if you don’t want to go to your local CAB, I suggest you contact CAP https://capuk.org/i-want-help/our-services/cap-debt-help/introduction.

Andrew Page says

Sara:

I plan to declare bankruptcy in England during the next two weeks and have a couple of quick questions:

1. I have received an offer to do a masters in the EU, starting in November. I asked a debt charity whether declaring bankruptcy could impact on my ability to undertake this course. Their response was that it is up to the discretion of the official receiver and suggested I contact the Insolvency Service. Can you confirm whether is is the case?

2. I have lived in London since February 2017, however between March 2018 and August 2018 I ‘house sat’ for friends in London. None of the bills therefore were in my name, although I could certainly ‘prove’ my residence there through:

a) Mail redirection

b) Food delivery records

Are these likely to be sufficient?

3. At the end of August until two days ago, and on the advice that this was permissible from the debt charity above, I took a trip to Sweden. Again, I stayed in the house of friends. Purpose was to look round various universities before applying and receiving an offer. Strictly speaking I didn’t have a London address during this time. I plan to stay at my girlfriends for the next two weeks and will be using her address when I make the bankruptcy application. Does any of the above create a potential issue in terms of eligibility?

Many thanks for your help.

Sara (Debt Camel) says

1. See https://debtcamel.co.uk/bankruptcy-qs-or-make/ That says it may be sensible to stay in England for a month or two after your bankruptcy. I don’t know the details of your situation nor what you said to the debt charity. So I won’t say that they are wrong.

2. & 3. You don’t have to “prove” exactly where you were living unless there is some reason to doubt that it is in England. If before Feb 2017 you were resident in Sweden for years and you have just been there for 2 months and are proposing to go back there for this masters, then you may need to prove you were in England from Feb 17 to Aug 18. Were you employed?

Megan Wood says

Have stayed in council house over four years the council know am staying in house but my friend who has tennancy in house has moved out and declared himself bankrupt we were going through stage of changing names how will this affect Me for tennancy

Sara (Debt Camel) says

I don’t think your friends bankruptcy is relevant to the change of tenancy name (unless there were rent arrears?). But it is often difficult to get a tenancy name changed – go to your local Citizens Advice if you need any help with this.

Vee says

I’m curious about this: “As a general rule, you should not give away or sell assets for less than they are worth before you go bankrupt. This doesn’t apply to normal presents, eg to children at Xmas. The OR can go back and overturn transactions up to 5 years in the past. You may already have done this without any intention to defraud the OR. If this is the case, you should list the sale/gift on your bankruptcy application.”

Does that mean that the OR have the legal power to request monies to be returned? I went into a scheme which I now realise was dubious last year whereby I “gifted” an investment with the promise of a return (which may or may not materialise but is certainly taking longer than initially suggested. I signed a document confirming that I gave these monies freely as a gift. But from what you are saying, it sounds as though they OR could reclaim this towards my debts? (Which is absolutely fine with me!) Thanks :-)

Sara (Debt Camel) says

What was this “investment”?

karl abercrombie says

If your current car is under a finance agreement with 3 years to complete will and can they make you return the car.

Sara (Debt Camel) says

There are various things that can happen with a car on finance if you go bankrupt.

1) there may be some value in your finance agreement. If you had a car on HP and you had paid it for 3 and half years with only 6 months to go, the car would actually be worth something! That isn’t going to apply to you with 3 years to go.

2) the OR may consider that you need a car to get to work and carrying on paying the HP is the cheapest way to get you a car – in that case you may be allowed to continue to make the HP payments

3) even if the OR allows you to carry on making the payments, it is possible there will be an insolvency clause in your car finance which says the finance company can repossess the car if you go bankrupt or have an IVA even if you don’t miss a payment.

4) if the OR doesn’t think you need the car, then you won’t be MADE to return it, but the monthly payments won’t be an allowable expense when calculating an IPA. A friend or relative could make them if you can’t afford them?

This is the sort of area where talking to a debt adviser is a good idea, as they would be able to say which is most likely to happen for you, not just list the possibilities.

Paul Ward says

Hi

I’m nearly out of bankruptcy, can they still ask questions and take things after my release date? Or can I relax and move on?

Sara (Debt Camel) says

You can probably relax – see this article about Discharge and what happens afterwards https://debtcamel.co.uk/discharged-from-bankruptcy/

John says

Hello there,

I am considering bankruptcy due to an unexpected change in my personal circumstances which leaves me unable to service all my debts. I was advised by StepChange to either take out a Debt Management Plan or bankruptcy, and the latter still seems the most suitable.

However, the one thing that is causing me concern about this course of action is the possibility of an IPA. I cannot seem to find a clear answer on how this is worked out and when it is likely to be applied. It seems that more than 80% of bankruptcies are discharged without an IPA ever being imposed, but I cannot seem to find a definitive answer on when an OR is likely to think an IPA is necessary. I will continue to have a fixed income after bankruptcy as my job would not be affected, but I would still have to cover 3/4 of living costs at home as my partner’s income is intermittent.

Any help or advice would be much appreciated!

Thanks,

John

Sara (Debt Camel) says

If StepChange think bankruptcy is suitable then it usually is! Presumably a DMP would take a very long time.

An IPA has to be set up in the first year, before you are discharged. You could post a Statement of Affairs on here: https://forums.moneysavingexpert.com/forumdisplay.php?f=136 – they like the format you can get from https://www.stoozing.com/soa.php. With that they may be able to say something specific about the chance of you getting an IPA.

Jess says

Hi Sara, so my husband has now gone bankrupt just over 1wk ago he has a car on pcp (in negative value) which the OR has no interest in but the finance company (alpheria) have today sent us a default notice even though he has never missed payments and he has been allowed the money to carry on paying it what should he do? If he calls and explains the situation do you think they will let him keep it I’m so worried as if they don’t he can’t get to work then we are in trouble plus he would owe them £4580 they are demanding by 15th May 2019 😫 and obvs he can’t pay this with just going bankrupt I’m just going through a DRO aswell 😣 so worried we cant speak to them as its wkend they are shut

Sara (Debt Camel) says

This sometimes happens with all the sorts of insolvency – bankruptcy, IVA and DRO. Whoever gave you advice about his bankruptcy should have mentioned that it is a possibility.

Sometimes the lender will not repossess the car if he carries on paying. Definitely talk to them on Monday! But sometimes they don’t seem to apply any common sense and would rather have the car back and take a loss.

Is there anyone in your family that could help you out with buying an old second-hand car to get by with?

“plus he would owe them £4580 they are demanding by 15th May 2019” No, that debt will form part of his bankruptcy. His Official Receiver’s office will confirm that.

Jess says

Thanks for your reply Sara, theres no-one to lend us money for another car we was told the OR would let you have £1000 for another car but as he’s not taken the car himself it looks like we may be in trouble or could we ask this of him of we find out the car has to go back?. Fingers crossed that we hear back from the finance company tomorrow 🤞😬

Laura says

Hi I have been overpaid for housing benefit even though I notified the council about changes of circumstances.

Via online and phone. They said by phone they would look into it and never did.

Now I get a letter right when I’m about to file for bankruptcy.

What’s the next step? Really confused right now.

Sara (Debt Camel) says

What does the letter say?

Laura says

That I have been overpaid £3300 and that I am responsible for it. If unpaid, they’ll take it from my wages.

Sara (Debt Camel) says

The reason why I asked is that if there was a suggestion that you may have committed fraud, you need urgent legal advice and debts results from fraud are not wiped out by bankruptcy.

It sounds as though there is no suggestion of that, so this is a debt that can be included in your bankruptcy. Add it to your bankruptcy application form. (Even if you don’t, the debt is still included but it’s just simpler to list everything.)

If you go back to the person you had debt advice about bankruptcy from, they should confirm this. If you haven’t had any advice I ALWAYS suggest you should talk to someone, no matter how clear you think your situation is. See https://debtcamel.co.uk/more-information/ for who to talk to.

Laura says

Thank you for the information. As I’m saving money to be able to apply for bankruptcy, hopefully in June, can I call the council and make them aware that I will be going bankrupt? I’m afraid they’ll try to collect it from my wages.

Sara (Debt Camel) says

I don’t suggest you tell the council. It’s unlikely they will be sympathetic I am afraid. In practice it is likely to take them a while to get an attachment of earnings so I would be very surprised if they manage this before June.

Graham says

Can I rent a property and go bankrupt to have my current home repossessed, I cant get another mortgage due to poor credit and the house is in negative equity, I need a bigger home as my wife is pregnant and we need more space

Sara (Debt Camel) says

Yes you can. See https://debtcamel.co.uk/repossession-deed-of-acknowledgement/which looks at repossession after bankruptcy.

If you haven’t already, I always suggest people should get debt advice on their options, even if you feel sure bankruptcy is best for you. Phone National Debtline on 0808 808 4000.

Nelly says

Hi I am considering bankruptcy as i am going tk have to keae my job tk become a full tkme carer for my little girl who is disabled meaning I will loose 50k per year. I currently rent a medium sized 3 bedroomed home for 1.5k per month with the average rent being between 1 and 1.3k for my area.

Do you think the OR may ask me to leave my home and find a new cheaper one? My little girl loves it here and the thought is filling me with doom.

Kind regards

Nelly

Sara (Debt Camel) says

Hi Nelly, sorry to hear of your predicament. I would suggest not applying for bankruptcy until you have left your job and settled down on benefits. That way you =r situation is clearer. national debtline on 0808 808 4000 are good people for advice at that point.

But I wouldn’t worry about your rent, see https://debtcamel.co.uk/bankruptcy-qs-or-make/

Kellie says

Hi – I’m considering bankruptcy. My Dad bought me a car a couple of months ago as my old one had died. It’s worth £2500. Will I be made to sell the car? It’s putting me off bankruptcy as my Dad will have lost so much money, and I need a reliable car as we live in the middle of nowhere.

Sara (Debt Camel) says

So perhaps it’s still really your dad’s car and he is letting you drive it and insure it? In that case, it won’t be affected by your bankruptcy. You will need to produce a receipt or similar showing that he bought it.

T. Blake says

My estranged husband went bankrupt without my knowledge and 2 months later, I commenced divorce proceedings. I don’t know how much the debt was for. I don’t know many things about him as it transpires. I owned my own home before we married 4 years ago. I have a 16 year old child by my late husband that died when our son was 2. My question is, is he now entitled to any of my home in the divorce? Is he entitled to any of my inheritance as my Mother passed away 3 years ago? He declared himself bankrupt in April 2018 but didn’t tell me until July. Then he moved out 1 week later. If he went to court and said he owned no assets, is this not perjury if he comes after my assets now? I knew nothing of his spending habits or debts. How is he able to make a financial claim on my assets after bankruptcy? Surely he had to state in court he owned no assets and no part of my home or they would have come after me? I heard/ received nothing though the post. No debt collectors. No letters through the door. We were married 4 years. He is definitely bankrupt I have looked on line. Your knowledge would be appreciated.

Sara (Debt Camel) says

“How is he able to make a financial claim on my assets after bankruptcy? ” is he trying to do this or are you just worried that he might?

Bob says

Hi,

I have a car through a company salary scheme as I need it for work to drive between jobs and visiting customers. Work pay most of the cost and I pay £180 a month to use it at weekends and for maintenance. If go bankruptcy, would I be able to keep paying the £180 for it. I would lose my job as it is used for my job.

Sara (Debt Camel) says

In general it’s not in the OR’s interest to do anything that means you would lose your job. If you are not buying this car through the scheme, then what matters is whether the £180 is an allowable expense for calculating your IPA. I think you should talk to a debt adviser about whether you are likely to be paying an IPA – a majority of people going bankrupt don’t. I suggest you call National Debtline on 0808 808 4000.

Angela says

Hi I am thinking of filing for bankruptcy some of my debts go back quite few years at least some of them go back at least 7 years some maybe more . I tried a dmp. And an iva I’ve always tried to pay them but then get more in debt over the years as financial things change . I’ve filled my online form in but can not pay all at once it may take me 6 months to pay for the fee I’m behind on my household Bills too. I’m single mum and find hard to cope with all this stress I finally plucked the courage do the form .when I did I have at least 13 creditors some of these details I took of iva creditors list but some of the creditors have passed on to others .I’ve put down an estimate on some of them what I owe as dont have the paperwork. Is this ok to do as I dont want to get it wrong? Some of the names of companies I dont even know.

Sara (Debt Camel) says

Hi Angela,

This isn’t going to be a problem :) I have answered your question in this article: https://debtcamel.co.uk/forgot-debt-bankruptcy/

Trevor says

Hi Sara,

I was in a car crash and my father bought me a car on finance in November 2018, not realising my debt. If I go bankrupt, will the car be taken? My father is paying the finance which would end in 2022, starting in November/ December 2018. I am the Registered Keeper. Thank you.

Sara (Debt Camel) says

That sounds as though the car should be safe – the finance is in your father’s name and he is paying for it – it is legally his car, he is just letting you drive it.

I always suggest people should talk to a good debt adviser before going bankrupt – no matter how obvious it may seem to you that this is your best option, it is worth half an hour of your time to talk to an expert about. Phone national Debtline on 0808 808 4000 – and they can also confirm what i have said about the car.

CK says

My husband was sadly made bankrupt 6 months ago by one creditor due to historic business debts he has been made liable for. We have a joint property with equity that could pay it off but are too young for equity release options. We’ve explored expensive bridge loans with sale exit routes as we cannot find a lender willing to lend otherwise. I cannot afford to pay what’s owed alone and don’t have anyway to fund it. Lawyers and the OR have suggested annulment but interested to hear if I should sell independently without the bridge loan instead? Has anyone had trustees involved and can they force a sale when we have school aged children and the debt is not joint? What does actually happen? Lawyers and supposed annulment specialists have issued large bills and I’m fed up paying out without a resolution. The annulment court hearings have been repeatedly adjourned due to problems with paperwork and proof of debt from smaller creditors aren’t forthcoming so lenders cannot commit fully without this. We have paid some smaller creditors off in full as advised but they fail to prove payment – what can we do as an annulment would fail in any case? I want to ensure we do what’s best for our family in the long run, without the need to unsettle and potentially uproot us further away from family/school as what we would be left with, would force us outside our local area due to affordability. Are there other options we could explore? Many thanks.

Sara (Debt Camel) says

“Has anyone had trustees involved and can they force a sale when we have school aged children and the debt is not joint? ” yes but this will not be in the first year after bankruptcy. During this time the trustee’s fees build up, so the amount your husband will have to pay from his share of the equity increases.

Sorry but if the OR and your lawyers say the bankruptcy should be annulled, I am not going to suggest alternatives. You need professional advice from someone that knows the full situation.

tasha says

Just wondering if anyone can help me with a few questions,

My partner and I have been in an IVA for about 7 months at the moment, It is going ok but I have had a repossession letter off the mortgage people (was in arrears before the IVA was set up and they wanted more then the IVA people had budgeted for) anyway that’s another point.

I have come to the conclusion that even if I was to clear all my debts and get debt free I will never have the money to do the house up or the repair work it needs etc. (there is a lot of damp and bits and bobs that need sorting out)

I am now considering going bankrupt and letting them take the house and starting completely fresh. new home new area etc. However i am concerned I will not be able to rent anywhere due to already being in an IVA and my credit rating being shot, obviously if I go bankrupt I will have even less of a chance of renting. What are my options for housing if I go down this route ? does anyone know.

how long would I have before they repossess the house ? it is only the first letter to say they will look into repossession if I do not contact them?

Sara (Debt Camel) says

I suggest you talk to your local Citizens Advice about housing options as it can be quite local. If you have children you may be rehoused by the council. If your house is going to be repossessed, then you don’t really have much option about moving – CAB can also talk to you about your options for the mortgage arrears and whether failing your IVA and going bankrupt is the best way forward.

tasha says

fter looking into bankruptcy I obviously don’t want to shout it from the roof tops or let my work know, however if my tax code is changed won’t they know because of this?

I also have questions in regards to IPA with us both being in IVA they take our surplus incomer roughly 240 a month and pay the IVA with this figure, will this likely be the figure used for the IPA ??) also what happens with bankruptcy and bonus from work or over time? I cant seem to find a definite answer on this on line.

Thanks for making it to the end, I would really appreciate some advice

Sara (Debt Camel) says

There are lots of reasons that tax codes change, your work is just likely to think you have had some tax problem and this is how it is being sorted.

An IPA will be considered for each of you. This may not be the same as your IVA payment, what it will be will of course be largely affected by what your living costs are if you move somewhere else – different rent, council tax, utilities, commute costs etc.

5 out of 6 people who go bankrupt don’t make any monthly payments at all. If one of you is paying an IPA, then there is little point in them working overtaime as all the payments may be taken by the IVA.

Jul says

Hi,

I’ve gone bankrupt whilst being unemployed and they obviously haven’t asked me for an IPA. Now my question is if I start claiming benefits such as job seekers allowance will that mean I have to tell the OR and will they ask me to make monthly payments from the job seekers allowance money I receive? Also if Im on job seekers allowance and after a period I decide to come off it if I don’t find a job what would happen? Will they say ‘you should have found work ‘? Thanks in advance

Sara (Debt Camel) says

Until you are discharged, you should tell the OR about any new income. But if your only income is JSA or Universal Credit, you aren’t likely to have to pay a IPA!

Why would you come off JSA if you can’t find a job?

But the OR is never going to have a discussion with you that says you should have found a job – nothing to do with them. You can put your feet up and sleep through the year until your discharged and the OR won’t care.

L says

Hi Sara, I hope you’re having a good week.

I was declared bankrupt in May 2019, after I submitted an application. My interview with the Official Receiver was straightforward – no assets other than a pension, no savings, and no income as no longer able to work due to 3 health conditions. The Official Receiver wrote to all 6 of my creditors saying that there was unlikely to be any further debt repayments.

Since then Post Office Money has sent me letters almost monthly that mention arrears amounts, a default notice, etc. I tried calling them to remind them I’d been declared bankrupt, and the Official Receiver also wrote to them reminding them. But today yet another letter has come from them, mentioning arrears, default, suggesting I make arrangements to repay the debt. Please can you confirm if creditors are allowed to send such letters after a person has been declared bankrupt? Is there any organisation I can report them to if they happen to be in breach of any laws / rules?

Thank you for your time.

Sara (Debt Camel) says

I am pleased everything else has gone smoothly for you so far. This is actually what normally happens, but other people reading this will be relieved to hear a “real person” saying this, not just a debt advisor!

Is this a current account with an overdraft, a loan or a credit card? Have you looked on your credit record – does this debt to POM have a default date on or before the date of your bankruptcy?

L says

Hi Sara, it’s a personal loan, not attached to any current account. I haven’t looked at my credit record. I’ve just confirmed the POM loan’s default date is about 8 days after I was declared bankrupt – I’m guessing that receiving a letter from the Official Receiver triggered that. Before that my account was in arrears and I was receiving letters referring to the arrears. Thinking about it some more, every other creditor had sent me a default notice months before I was declared bankrupt. So now I can understand POM sending the first default notice in May, it’s the subsequent stream of letters that’s frustrating.

Sara (Debt Camel) says

ok, I think the loan then came from the Bank of Ireland. If it did, the details of how to complain are here: https://www.bankofirelanduk.com/help-and-support/how-to-complain/customers-in-gb/. I suggest sending them a Complaint using their online form, saying you went bankrupt on dd/mm/yy and despite you and the official receiver telling them several times, you are continuing to get letters about the arrears asking for you to make payments, which as an undischarged bankrupt you are not allowed to do. Ask for the letters to stop or you will be sending the complaint to the Financial Ombudsman.

You have to give them 8 weeks to reply to this.

Alternatively you could just try to see the funny side of this, stick all the letters in a file and ignore them until you get a communication threatening court action.

L says

Thanks Sara, that’s very helpful! If I get any more arrears or default letters from them I’ll submit a complaint online and see how it goes. Alas I’m too cautious / a worrier – incapable of ignoring the letters.

Mrs J says

Hello my son has declared himself bankrupt he repaid me 24000 pounds 2 years ago what he owed me and his father after he sold his house he was working at the time and was managing his money well at the time now he has gone bankrupt they are now asking for the 24000 back from us which we have not got how do we stand

Sara (Debt Camel) says

Was this less than 2 years before he went bankrupt?

Was the debt to you documented eg with letters? Was there an agreement between you that he would repay the debt when he sold the house?

Did he pay off other debts at that time? How large were his other debts at that time?

Did your son take advice before he went bankrupt?

Mrs J says

No paperwork was provided this was between just me and my husband he was in full time employment and was managing his bank loan well for a year with no other debts until a year ago he was made unemployed and up to date has had no income for 6 months which we have funded him again. We are now retired and have no income apart from pensions we are afraid we are going to have to repay this £24000 how do we stand. The £24000 was used for home improvements and to pay off debts we had as we knew we would shortly retire.

Sara (Debt Camel) says

and the repayment to you was less than two years before he went bankrupt?

did he take debt advice before going bankrupt?

Was there proof that you gave him the 24k in the first place? eg bank statements?

Mrs j says

It was 16 months from when he sold property to bankruptcy he didn’t take advice before going bankrupt. The £24,000 was given to him in cash over a long period of time over a matter of 10 years or more.

P S says

Hi I have a question re bankruptcy …

I’m considering going bankrupt.

I had car finance in my name for my daughters car which she paid every month. The car was bought in her name and is registered on the log book in her name as it is her car. It was just the finance that was in my name. My mum paid off that finance as a gift to my daughter. This has all just happened recently. Please can you tell me if when I go bankrupt will they try and claim my daughters car as the finance was originally in my name even though the car ownership has never been in my name? Thank you

Sara (Debt Camel) says

I suggest you talk to National Debtline on 0808 808 4000 about your finances and if bankruptcy is a good option for you. They will also be able to talk about this issue with your daughter’s car.

Lydia says

I’m planning on filing for bankruptcy I have a few questions

1. I live in my husbands house, he owns it and pays the mortgage. I signed forms to say it wasn’t mine. Are they able to take it?

2. I have a car in my name but my husband bought it and pays the finance, can they take this?

3. Iv heard that they shut your bank down for 30 days, I get paid weekly can I get my pay changed to go into my husbands bank?

4. I don’t have any assets worth over £500 will I have any bailiffs at my door to check?

Sara (Debt Camel) says

1. I live in my husbands house, he owns it and pays the mortgage. I signed forms to say it wasn’t mine. Are they able to take it?

This is rarely a problem. Cases where it could be include if part of the deposit for the house came from you (eg from the previous house that you and your husband had owned together) or where you have paid for big works on the house eg adding a conservatory, putting in new a new kitchen or windows etc.

There is also the situation where your husband is paying the mortgage but you pay for everything else for the household. This is VERY rare and it would probably have to have persisted for many years for the Official Receiver to be interested in it.

I suggest you talk to National Debtline in 0808 808 4000. everyone should talk to a good debt adviser before deciding to go bankrupt, even if you think it is your only option, get it confirmed. And they may be able to set your mind at rest about the house.

2. I have a car in my name but my husband bought it and pays the finance, can they take this?

No, the official receiver won’t be interested as it belongs to the finance company, not to you. And the finance company won’t care that you have gone bankrupt as to them it is your husband’s car and he is paying for it.

3. Iv heard that they shut your bank down for 30 days, I get paid weekly can I get my pay changed to go into my husband’s bank?

Well you could. But most people don’t have a 30 day freeze on their bank account! You may need to get a new account though, see https://debtcamel.co.uk/bank-accounts-after-bankruptcy/

4. I don’t have any assets worth over £500 will I have any bailiffs at my door to check?

No.

Dave says

Hi. I was discharged from bankruptcy few months ago. Before going bankrupt I borrowed money from my friend, I didn’t included in my bankruptcy because I didn’t know I can includ loans from friends. I know my fault. I still don’t have money to pay him back thou. He is threatening me with court case. Was this loan wipped off as well? Even I didn’t includ it? Or it had to be put into application? I hope you can help me because I don’t know what to do now. Thank you

Sara (Debt Camel) says

It was included in your bankruptcy, see https://debtcamel.co.uk/forgot-debt-bankruptcy/. If you talk to your Official Receivers office they will confirm this.

I suggest you tell your friend that you went bankrupt on dd/mm/yy and his debt no longer exists as you have been discharged.

If he does start court action despite you telling him this, talk to National Debtline on 0808 808 4000 and they will explain how to defend the court case so you do not get a CCJ for this debt.

Ryan says

Hi

I was declared bankrupt this week and I’ve got an appointment with the OR on Tuesday. Reading all the forums the only asset I had was a tag watch which I bought 4 years ago for £2700. I sold the watch for £1500 14 months ago to pay wages, it was my only option as things where about to turn nasty.

I carried on paying the finance although the watch was no longer in my possession. Should I tell the OR? The person who I sold it to moved to Glasgow recently and I can’t see how I would ever be able to retrieve the watch now.

Sara (Debt Camel) says

I am not sure that is much to worry about. Second hand watches are always worth less than you paid For it.

It would be an issue if you had bought the watch on a a credit card for 2700 then very quickly sold it it a relative or friend for 1500 and soon after went bankrupt.

But what you have said sounds like someone trying their best to keep their business afloat (or to keep themselves afloat if the wages you refer to are your own if you are self employed).

If you are Worried about the OR interview, you could chat to Business Debtline on Monday – they may be able to explain more about what you are likely to be asked. https://www.businessdebtline.org/

Leanne says

Hiya, quick question, I got accepted for my bankruptcy today, I have 3 attachment of earnings on my wages, how quickly will they be taken off? I get paid the 20th of every month and wondered if it doesn’t get taken off in time what will happen? Someone said I would get the money back if it comes off my wages after I’m bankrupt?

Simon says

Hello. I was just wondering if anyone knows the address i send my paperwork back to?

Nowhere in the package does it state the address, it just says sign and return within 5 days.

Sara (Debt Camel) says

Hi Simon, can you say what paperwork it is?

Aga says

Hi,

I am going to go bankrupt. I am Self-employed. Do I have to close my business after bankruptcy? I have any business debts.

Aga

Sara (Debt Camel) says

The best people to talk to about this are Business Debtline https://www.businessdebtline.org/. I know it may be hard using the phone as you aren’t English, but give it a go, they are the experts.

Aga says

Thank you. I will do it.

Aga

Taylor says

Hi I am leaving my company and getting a normal job (business partner remaining) I have signed 3 personal guarantees on 3 shop leases however – these are in 3 separate limited company names.

Should trade deteriorate and the businesses not be able to pay the rent, the landlords will come after my PG. Thankfully I have no assets to worry about.

I know bankruptcy wipes off any money owed to a 3rd party by a PG. But will all the landlords need to be chasing money at the same time? These are 15 year leases, so could perhaps 1 landlord chase me for the money, I go bankrupt and then after bankruptcy a second one calls in the personal guarantee a few years later?

Or does bankruptcy void all personal guarantees signed before it? I would like to avoid going bankrupt 3 times for obvious reasons!!

Thanks for your help!

Sara (Debt Camel) says

At the moment these PGs are “contingent debts” – you don’t owe the money now but may do in the future. Contingent debts are included in bankruptcy so if you go bankrupt once it will get rid of them all.

I suggest you talk to Business Debtline on https://www.businessdebtline.org/ about your situation. I don’t know if you have any other debts? It may be a good idea to go bankrupt now and get a clean start at a point where you don’t owe any assets. In a few years you may be better off and have more to lose.

Taylor says

Thanks Sara, that was exactly the answer I was hoping for! Definitely something to consider as like you say I don’t have much to lose at the moment and could easily take a year out and stay with family. Start a fresh on a clean slate.

I will have a chat with the business debtline and confirm everything!

James says

I was a director of a limited company that took three loans from individuals (not connected) totalling £200k, I signed a letter agreeing to PG each loan individually. The company went in administration, loans weren’t paid. A year later one of the individuals wants to come after me personally for a £50k loan under the PG

I genuinely don’t have a penny to my name, I live in rented and have a few personal house items I share with wife and children but he thinks I have some secret stash of cash somewhere. I have started a new business and offered him shares in that and a new agreement in the hope that in another three years time I will have the money then to pay him but he declined this – he wants his money now. if i sold all my house contents I would be lucky to get £2k.

1. If he appointed a bailiff could they just come and take my house contents even though they are worth little. could I get my mom to pay whatever the bailiff dreamed them to be worth?

2. If I do nothing and he files bankruptcy against me I don’t see how he would get his money? From his point of view I guess just concrete proof I don’t have hidden assets?

3. In a bankrupt situation should I tell the other two creditors so they bring their £150k claims forward. As it stands they haven’t bothered to go after me as they know I have nothing left.

Sara (Debt Camel) says

1. He can’t just “appoint a bailiff“. First he has to get a CCJ. Then you can vary the terms of a CCJ so that you can pay an affordable amount each month. Then he can only send round a bailiff if you don’t make those monthly payments.

2. Unfortunately some private individuals and HMRC can be totally irrational and make people bankrupt when there is no likely prospect of getting any money back.

3. If you are made bankrupt then the other two debts will be automatically included.

I think you should consider bankruptcy now, while you have no assets and get a clean start. Otherwise in 3 or 4 years when. your new business is going well the creditors may then emerge with these old PGs. I suggest you talk to Business Debtline on 0800 197 6026 about this and your current situation.

Maria says

Hi Sara

Please could you give me some advise? My husband has with his ex_ wife a mortgage in an investment property, well into negative equity, and it is to be paid in full in 2 years time. She already told him that she will not pay her share. My husband doesn’t have enough money to pay the full amount neither to pay his share in total only part of it. The house we live is in my sole name. We are very worried because i if she doesn’t pay her share could my husband ending up paying the full amount? Also , if my husband consider going for a bankrupcy can I be forced to sell the house we live in to pay his debt? Thanks .

Sara (Debt Camel) says

if she doesn’t pay her share could my husband ending up paying the full amount?

That is what would normally happen – they would both be jointly liable for the whole amount.

How much is the deficit likely to be?

Your house – is it in your name because you owned it before you met him?

Keiren says

I have a second charge on my property. I have a relative that can pay the beneficial interest in the property in bankruptcy, so I may be able to keep my home but how does the second charge get handled? The combined charges 1&2 severely outweigh any equity in the property. I notice in the US they have section 13 lien stripping. Is there similar in the UK?

Sara (Debt Camel) says

The combined charges 1&2 severely outweigh any equity in the property.

That suggests you don’t have any beneficial interest in the property…

You will still have to pay the second charge or the creditor can take steps to repossess your house.If that is not practical, then it may be sensible for you to look at handing back the keys so the negative equity is wiped out with your bankruptcy.

There is no concept of “lien stripping” in bankruptcy in England. I have no knowledge of how it works in the US.

I think you need to talk to a debt adviser about bankruptcy, whether it is a good options for you and the effect on your house. I suggest you phone National Debtline on 0808 808 4000.

Enzo says

Hi Sara

My wife has £12k debt as per loan and credit cards.

I have £4k credit card debt. All payments up to date. We have never missed any payment in our lives. We are tenants for over 4 years with good credit score. We don’t have any asset, all equipment is landlords. We own old car which is worth less then £800. Due to covid-19 situation our lives drastically changed and we would have to permanently leave uk very soon. We will go back to EU

What would be best option for us? Thank you for your help! I wish you all the best.

Sara (Debt Camel) says

Hi Enzo, I think you two should talk through the details if your situation with a debt adviser, including thinking about what may happen in the next few mints and years. I suggest you phone National Debtline on 0808 808 4000.

Abul says

Hello, all.

I have around £29k credit card debt (and an overdraft) accumulated over many years, and stopped paying monthly payments in 2016. I’ve not paid a penny since and have managed my relationships with all creditors by letter and email myself, and sometimes with a debt adviser.

I’ve been out of work since 2015 and was reliant on benefits until July of last year when I got a low-paying job (around minimum wage). All creditors agreed to moratoria (which all expire in July next month) because of my benefits status at the time (June 2019) and because of mental health issues (still not fully clear of).

I’ve been working for nearly a year and I’ve yet to tell any of my creditors that I’m working, and fear not telling them will count against me by an Official Receiver if I decide to go bankrupt. I am also keen on pushing for another moratorium by citing low pay and continued mental health concerns.

My query is this – with an income of around £21,000pa, would I be stopped from going bankrupt (because I have money spare after all expenses/outgoings)? Or would I be subject to a bankruptcy with monthly payments to be made (for 1 to 3 years or however long)?

My concern is if I move home and my rent goes up, I will need more of my income for rent. And at the moment, I’m holding back from applying for better-paid jobs because of my situation with my debts.. I’d rather not be earning more until I am clear of bankruptcy.

Sara (Debt Camel) says

I’ve yet to tell any of my creditors that I’m working, and fear not telling them will count against me by an Official Receiver if I decide to go bankrupt

The OR isn’t judgemental like that.

I am also keen on pushing for another moratorium by citing low pay and continued mental health concerns.

29k of debt is a lot. If you have a temporary problem and can get back to a great paying job, then a moratorium makes sense. But if you are holding back from applying for well-paid jobs, aren’t you going to be in exactly the same situation in another 6 months or a year? Wouldn’t it be better to make a decision to go for bankruptcy now, if that is your best option and get it over with?

I think you need to talk to a debt adviser now about how much spare income you have, what your options are and whether you would have to pay an income payments order for 3 years in bankruptcy. I suggest you phone National Debtline on 0808 808 4000.

Also do you want to move? Because if you move now and then wouldn’t have any spare income that could be a good option. If you move after your bankruptcy then increased rent would result in any monthly payments being reduced – but being bankrupt can make it harder to get a new tenancy, so moving first may be better.

You won’t be refused bankruptcy because of your income, but sometimes your income is too high for bankruptcy to be a good option for you. 21k a year doesn’t sound that much to me, but it would depend what your expenses are.

vlad says

hi. im almosr close to pay the full fee for the application but i have 2 concerns:

1- do i have to list only my creditors ,or any agency wich is dealling on behalf of them because i get dozens of letters sometimes even 3 different agencies trying to collect the same debt?

2- i read that i dont have to contact my creditors and tell them about going bankrupt, however a collection agency moved very fast and got a CCJ in matter of 2 months (compared with other creditors).. im expecting anytime soon baillifs at my door, how should i proceed in that event considering im renting from a private landlord and i have no income given the circumstances ,so i can’t offer their monthly required payments.. thank you

Sara (Debt Camel) says

You only have to list the creditor, not a debt collector trying to collect the debt.

Bailiffs can’t visit people at home at the moment because of coronavirus. Visits may resume from August 23. What sort of debt was this CCJ for?

Have you had debt advice about going bankrupt? Even if you think it is obvious this is the best thing for you, it is still worth talking to a debt adviser. I suggest you phone National Debtline on 0808 808 4000.

Michelle Foynes says

Do I have to let the official reciever no if I get back pay in my wages as I have been underpaid for a year

Sara (Debt Camel) says

Are you currently bankrupt? discharged? with an IPA?

michelle foynes says

Made bankrupt 20 April. Had straight forward interview with official reciever said I didn’t need another one. I haven’t heard anything else off them and no ipa as of yer

Sara (Debt Camel) says

yes you do need to tell the OR then.

Adem says

I have been made bankruptcy 3 months ago . Can i do cash in hand jobs.?

Sara (Debt Camel) says

being paid in cash is not illegal, but you do need to tell the Official Receiver about it.

Jake Parkes says

How would OR find out though?

Sara (Debt Camel) says

it’s a criminal offense to conceal income from the OR. Not sensible.

Jul says

Hi, Thanks for your answer in the other post. I wanted to ask a new question but I lost the link to the post where you answer me before. I wanted to know this I have been declared bankrupt in August last year. So far I really haven’t been contacted by the official receiver apart from the initial phone call. I haven’t been asked to make payments (IPA). My question is if the official receiver decides to give me a BRO (or BRU) would they have told me already or can they tell me just like a couple days before I’m discharged? Also after being discharged will I be asked to make payments if I get a new job with a good pay or if for example I win the lottery or get an inheritance? Thanks for all the help again.

Sara (Debt Camel) says

You have asked questions on several different pages.

It was never clear why you were worried about a BRO? If you haven’t heard from the OR since the initial interview it would seem pretty unlikely that they are still thinking about you at all…

What happened to the parking ticket? Was the parking offence before you had gone bankrupt?

Jul says

Yes it’s just I forget which page I ask the questions. The reasons I was worried about a BRO it’s because my debt was quite big and although I never gamblef or anything I thought it could have been considered reckless behaviour by the OR. The parking ticket was paid in the end that’s was after going bankrupt. Reason I ask about if I need to make any payments after being discharged it’s because I thought with this covid situation bankruptcy rules could could change…. Thanks

Sara (Debt Camel) says

A lot more people are worried about a BRO than ever get one.

Reason I ask about if I need to make any payments after being discharged it’s because I thought with this covid situation bankruptcy rules could change

If you do get a BRO, this does not change the amounts you may have to pay to the OR. You will still be discharged at 12 months. If an IPA has not been imposed by the time you are discharged, it cannot later be imposed. See https://debtcamel.co.uk/discharged-from-bankruptcy/ for details.

Jul says

OK Thanks a lot.

Armando says

Hi,

I have over 20,000 debts on cards and bank loans. I lost money trying to invest in the stock market. Besides, for many years I have been sending almost half of my salary to my parents who live in Portugal, which is no longer possible because I lost my job. Will the Official Receiver somehow try to get the money back from my parents, or will he agree to go bankrupt due to gambling?

Sara (Debt Camel) says

Were the payments to your parents and your debts affordable until you lost your job?

Armando says

Last payment to my parents was made 2 month before i lost job. So far i always was paying back my debts for credit cards and loan till now because i don’t have enough money for next payment (august) so i am thinking of personal bankruptcy.

Armando says

That was not a problem to pay to my parents and debt at the same time. Problems started when i lost my job.

Marie says

Hi,

I’m in touch with Payplan and they’ve given me 3 options for insolvency. DMP, IVA and bankrupty. I’m leaning most towards the bankruptcy. I am concerned though as in the 8 steps of applying for bankruptcy through the gov website that need to be done (as per the great step by step example given on Debt Camel) it asks for any foreign bank accounts. I own 50% of a house with a joint mortgage with my ex spouse. this house is abroad in an EU country. I am concerned that they will want details of this house as I do not want 1. my ex-spouse to know about my possible bankruptcy and 2. I want the house not involved in my situation and foreign bank accounts to be kept open. I have 3 accounts and 1 purely credit card. 3 of the accounts have credit card debts (it’s a debit /creditcard).

I just don’t want the forign banks to get involved and fear that the situation will get even messier with the debt and will involve my ex-spouse then as well.

Due to this I’m thinking IVA, but that seems like a 5 year nightmare. With IVA would I be able to keep foreign bank accounts separate from my application? I’ve searched for info on this but have found none so far.

Any advice on this, please?

Many thanks!

Sara (Debt Camel) says

Did you mention these foreign assets and bank accounts to Payplan? If you didn’t, they cannot give you good advice!

You have to give details of the house abroad and bank accounts on a bankruptcy application. Normally it doesn’t matter if someone misses a loan off by accident, but to deliberately conceal assets and accounts is a VERY BAD IDEA.

In an IVA you also have to tell the IVA firm about the house abroad and the foreign bank accounts. But the IVA firm may be prepared to change the IVA so that they are excluded.

How much would you be asked to pay a month in an IVA? If your income is variable or your financial situation is generally uncertain or you may need to move house in the 5 year IVA period then an IVA may be a bad idea. A depressingly large number of IVAs fail, leaving people back with the debts after a couple of years of major stress.

I understand you don’t want your ex to know or be involved, but there may be no other simple way forward.

If you decide bankruptcy or an IVA isn’t right for you, then your fall back is a DMP. This may sound as though it will take forever to repay. But once your debts are defaulted and sold, you may later get offers to settle the debts for a lower amount, so sometimes this can work better than you expect. But this can’t be relied on.

What I can say is that the scaremongering IVA sales stuff about DMPs not being legally binding and you may still be taken to court or face bailiffs etc is VERY rare in a DMP. If you do not own a house in this country it is highly unlikely.

Marie says

Hi Sara,

thank you for this. Very helpful info!

PayPlan has said that after all the figures I’ve given that the diposable income would be £59 which then would be given to creditors.

I’ve told that I have 3 foreign credit card debts to an EU country and if these could be added to the list of creditors, but have not mentioned the house as I didn’t even think of it as it’s not a debt I cannot pay for.

We have a tenant in the house and this pays off the joint mortgage we took.

Trick is the mortgage is in my and my ex’s name , but the tenant pays the rent to the account which the mortgage is debited out of, and that is solely in my name. So it’ s not a joint account where the money comes into.

That is why I am concerned, as if I file for bankruptcy or IVA the OR will want to probably see the statements of this account? But half of the money isn’t mine. And would I have to liquidate my share of the house? The foreign banks will then get also involved and that would just get so messy. Not sure what I can do in this case.

With DMP– if I default on my debts who sells the debts and to whom and how does that benefit me? I have not heard of debts being sold. I understood from Payplan that if I do a DMP, Payplan would help with the arrangement but I would be paying the creditors directly for the 20 odd years. Is this not correct?

Really appreciate your knowledge on this.

Marie

Sara (Debt Camel) says

You HAVE to put the house on a bankruptcy application. And you HAVE to tell Payplan about it for an IVA and ask Payplan to exclude it from the IVA. To keep quiet about it is fraud and possibly a criminal offence.

And would I have to liquidate my share of the house? The foreign banks will then get also involved and that would just get so messy. Not sure what I can do in this case.

If you go bankrupt, it’s not your problem. No real hassle for you. The Official Receiver has to deal with it all.

It may be a large problem for your ex though.

is there actually any equity in this house?

£59 is an appallingly low amount for an IVA. If anything at all goes wrong with your finances – your bills go up more than your wages for example – you would no longer be able to manage that. If you were paying say £200, you could ask for that to be reduced, but with only £59 there is no room to cut this.

About 30% of IVAs are failing at the moment. It is the very low payments ones that seem most likely to.

How large are the UK debts you have? what sort of debts are these?

Marie says

Thank you. I’ll let them know of the house and see what they say.

There isn’t much equity in the house yet. I know my ex will have an issue with it. I might need to find an alternative solution than IVA or bankruptcy, just because I don’t wish to have the ex involved. But not sure what my options are except maybe contact then the creditors myself and arrnage something directly with them? that’s a bit risky, though?

I see what you mean about the amont for IVA. I didn’t think of this. I’m not so keen on the IVA anyway, but will discuss this more thoroughly with the debt charity. I had to double check the amount they said I’d have as the disposable income and it’s £151, not £59. I confused this with something else.

The Uk debts are at £38500, several credit cards and 1 personal loan +overdraft. The loan is about half of this.

Dave JF says

Hi Sara,

Following a dramatic loss of income and debts mounting due to Covid and other issues, I have £30k+ of personal debt and am seriously considering bankruptcy. I am not a home owner and have a company car and no such assets worth £500+.

I am concerned however that I had to replace a TV and bought my daughters birthday present on finance (Buy now pay later Argos Card) during lockdown when I was lead to believe I would be financially stable. I truly believed I would be ok.

I am guessing we would lose these items? If so is it worth trying to get a family member to pay off the outstanding before doing so, I dont want to break her heart.

Sara (Debt Camel) says

Are you still employed? Have you lost hours / commission / had a pay cut or what? And this has been quite recent?

How much was the TV? The present for your daughter? How old is your daughter?

Dave JF says

I am still employed but have gone from £50k+ to £28k max for the next 12 months as I have had to take a lesser role within my own business. I found out a week or so ago. The purchase was within the last 2 months for both. She is 8 and the laptop is for school work etc, TV was £450 and literally a replacement for a broken main TV in the living room.

The laptop was £200.

I am down anywhere between 500-800 per month and have returned from furlough now.

Sara (Debt Camel) says

Ouch, what a drop.

a lesser role within my own business

Just checking, you don’t mean you own the company, just that you have had to take a lesser role within the same business?

The TV & laptop, were they from the same catalogue? do you have any other balances owing to that catalogue?

Dave JF says

No, my management role was made redundant and i was offered a lesser role. I am work for a business.

I do totaling £1,500 which are still presently being paid.

sunny says

Hi Sara

Total debt £20800. loss in gambling about £6000.sent money abroad ranging £500 to £2000 (Oct 15 to Aug 20) .Daughter had cleared credit card in April 2018 (£2500) and then March 2020(£2700) Have paid back to daughter about £5000 in last two year.Have paid regularly since 2015 all loans and credit card with interest. Have paid more than £30000 towards loan and credit card payment since 2015. Made redundant in August 2020. At present on UC and unemployed..Have two bedroom house out of EU jointly. with spouse who died in 2015.After her death her share has gone to children. Does not have any document for ownership of the house If OR ask me any documents for house I don’t have anything.Now house is jointly held with two grown up children. In this situation if I go bankrupt am I committing any criminal offence? Can OR sale the house? Value of house will be app. £12000. I am sure to get bankruptcy restriction order my question is in case I am refused bankruptcy will I be tried for criminal offense?How far OR can check record and do my daughter has to return money and how much? Living in rented apartment and tenancy is jointly held with daughter. . Can OR informed landlord? I have read all your comment and find it very easy to understand..Would like to hear your views on my situation.

Thanks a lot in advance sara.

Sara (Debt Camel) says

Are you still gambling, if not, when did this stop?

You were paying all your debts up until August?

When did you last make a payment to your daughter?

Is she living in the apartment with you, if so is he paying the bills at the moment?

Can you say where the house is?

sunny says

Hi Sara

Thanks a lot for prompt response.I have stopped gambling this month.deleted all the gambling app. till now we have paid all bills together.last payment to my daughter is in Aug 2020. my daughter is staying with me.House is in india .I have paid all my installment towards loans till Aug. from Aug I am paying through overdraft so personal loan decreases but overdraft increases.I am about to hit my overdraft limit.

Sara (Debt Camel) says

ok, so if you can get another job, you would have real spare money and be able to pay down your debts? Is there any reason to think you can’t get another job in 6 months or a year?

sunny says

yes

If I get job I don’t mind paying all the extra money paying towards my debts. It’s very difficult to get job. I have osteoarthritis and can not bend my knees and can’t stand for long hours. I was working in reputed airlines and airlines will take at least two years more to start full operations. I have got job in royal mail for christmas casual for one month.

Sara (Debt Camel) says

There are 4 reasons why going bankrupt now may not be a good idea, but nothing you have said suggests that you have committed any criminal offence. Or that your bankruptcy would be refused.

I’ll give you some points to think about, but you need debt advice, not just some pointers from me because someone needs to look at your case in detail So I think you should talk to National Debtline on 0808 808 4000.

Some reasons for not going bankrupt now are:

1) your gambling. This won’t stop your bankruptcy being accepted. You may get a Bankruptcy Restriction Order but you know that and realistically you may not care. On its own a BRO would only be a minor factor and probably shouldn’t make any difference to your decision, But you have other problems as well.

2) the payments to your daughter. The Official Receiver looks for where people have “given preference” to some creditors in the last two years eg paying a relative rather than your other creditors. It may be possible to argue that you were paying the normal payments to your other debts at the time. It is up to the Official Receiver to decide if this was “preference” in which case your daughter may be asked to return the money.

3) the house in India. When you bankrupt, your interest in this property becomes the property of the OR. You have a duty to co-operate with the OR in his actions. He may want it sold. Or the other owners could offer to buy it from him. I have no idea how this works in India or what the costs of doing this would be. If you are right that it is worth only 12k, then there probably be a limit on how much the OR want to spend in legal costs to get your half of that value. But it may be unwise to assume that this can’t be done. National Debtline may have a better idea.

4) your own position may improve. Obviously you think it’s unlikely you will get a good job soon. But it may happen. And even a not great job may allow you strat making some repayments to your debts. This seems an early point to rush into banklruptcy as you were paying all your debts before redundancy and now you have stopped gambling (congratulations – one day at a time – but that is the best news) that will help.