Many people with a gambling problem have been given unaffordable credit. This fueled their gambling and they got deeper into debt. Credit is affordable if you can repay it and still pay your other debts, bills and expenses. If it is unaffordable, then you can ask for a refund of interest and charges and take a complaint the lender declines to the Financial Ombudsman (FOS). But gambling … [Read more...]

Getting out of debt

Practical articles about the different debt options, which might work for you and different ways of dealing with creditors

What happens to your possessions in bankruptcy?

The bankruptcy application says "It is very unlikely that items you need for your daily life (eg washing machine, sofa, refrigerator) will be sold". Here are a selection of questions here that people have asked about what may happen to the things they own if in bankrupty. I may not have mentioned your exact situation, but the answers here try explain how the Official Receiver makes … [Read more...]

Is your name in a fraud database?

There are three large UK databases aimed at alerting lenders to possible fraudulent applications for borrowing: National Hunter, Cifas and Sira. If your name is on one of these connected with fraud you may find it difficult or impossible to take out credit and your bank account may be closed. But sometimes the information on the databases may be wrong and you need to get it corrected. In … [Read more...]

Bankruptcy – should you get a new job? Or work overtime?

A couple of readers have asked recently about whether it's sensible to turn down a job or overtime when you are bankrupt. Two things matter in this sort of situation. First, have you been discharged from bankruptcy? Almost everyone is discharged from bankruptcy after a year. And secondly, do you have an Income Payments Agreement (IPA) set? In an IPA, you have to make monthly payments for … [Read more...]

Overtime, bonuses & pay rises – what happens in an IVA

A reader asked about a friend who is looking at an Individual Voluntary Arrangement (IVA): Mr X is 23 and owes just over 10k on various credit cards and loans. He earns £20k and hopes to get a £10k bonus this year. The IVA firm says the bonus doesn’t matter as it's not guaranteed. But won't the IVA take half of it? Would it be better if he got a job with a larger basic salary and no bonus, or … [Read more...]

Should I end my IVA and change to a DRO?

In 2024 the Debt Relief Order (DRO) rules have been relaxed so a lot more people qualify. For example, the maximum limit of debts in a DRO has now been increased to £50,000 and you can also own a car worth up to £4,000. Will you now qualify for a DRO? If you are in an IVA, you are renting and your IVA payments are less than about £120 a month, you may be much better off switching from an IVA … [Read more...]

How does a payment arrangement work & is one right for you?

A typical payment arrangement is an agreement to repay a credit card, catalogue or loan in affordable monthly amounts. This is also called an arrangement to pay. You can ask a lender for an arrangement to pay, or a debt collector. The key points are: an arrangement is needed if you can't afford the normal debt repayments; do not offer more than you can afford; ask the lender or … [Read more...]

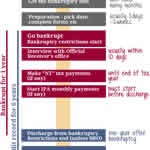

Bankruptcy timeline – what happens & when?

This bankruptcy timeline shows WHAT is likely to happen and WHEN if you go bankrupt in England, Wales or Northern Ireland. Some of the times are fixed - the bankruptcy marker is definitely going to drop off your credit file after six years. Others are less definite, but the indications in the timeline here should be right for a large majority of the people who go bankrupt. Take the decision … [Read more...]

No set off in a Scheme/Administration when debt had been sold?

In 2021, the Instant Cash Loans (ICL) Scheme Arrangement, Money Shop, Payday UK and Payday Express customers whose debts were sold to PRAC Financial (PRAC) have not been given set-off between their ICL redress and the loan they still owe. The same situation could occur with other Schemes of Arrangement and other debt collectors. In 2022, it seems to have happened to some Provident loans that … [Read more...]

Doorstep lending – a template letter to ask for a refund

UPDATE: The Morses Scheme has failed. See Morses - what is happening to loans and refunds UPDATE: in March 2022, Loans At Home went into administration. There is no money to pay any refunds. Any remaining loans have been written off and you should not make any payments to them. UPDATE: The Provident Scheme has now closed and it is too late to make any Provident complaints.Doorstep lending - … [Read more...]

- « Previous Page

- 1

- …

- 7

- 8

- 9

- 10

- 11

- …

- 16

- Next Page »