The FCA says that over a hundred debt management firms who applied for authorisation have been refused or have withdrawn their application. In September 2016, Debt Clever became one of these firms. Some firms that are closing are looking for ways to continue to make money from their clients. This article looks at the approach that seems to have been adopted by Debt Clever. Background on Debt … [Read more...]

Debt news and policy

Debt Camel articles on what's changing - and what ought to change - in the world of personal debt in Britain.

If you are interested in a specific area, look at: High cost credit news & policy and Insolvency news & policy.

Pensions safe in bankruptcy after Appeal Court decision

Following an Appeal Court ruling on Horton vs Henry, published in October 2016, pensions are once again safe if you go bankrupt. The full judgment is here. The background to this case was: before 2000, pensions formed part of a bankrupt's estate and would be taken once the bankrupt reached pension age; the Welfare Reform and Pensions Act changed this. For people going bankrupt after … [Read more...]

IVA lead generators – the case for regulation

IVAs are now the most common form of personal insolvency in England. Clear Debt has recently stated: Individual Voluntary Arrangements) (IVAs) have become the procedure of choice for those people who have debts they can’t pay and a regular income to enable them to make contributions to their debts. But how often is the choice of an IVA based on accurate information about the alternatives and … [Read more...]

IVA early exit loans – Perinta/Creditfix and Sprout/Aperture

Early IVA exit loans from Perinta offered in 2016 to Creditfix customers Some people have been told they can end their IVA by taking an "early exit loan" from Perinta Finance Ltd, via a broker called Just Lending. Creditfix is sending these emails, but the loan may be available to people in IVAs with other firms. Pearse Flynn, the CEO of Creditfix, used to be a director of Perinta, but no longer … [Read more...]

Paying BadDebtor won’t help your credit record

A reader who had gone bankrupt recently was surprised to get a letter from "The Register of Bad Debtors". This offered to remove her name from their records if she pays them £49.95. She asked if BadDebtor can really do this? There are also reports that people with IVAs are receiving similar letters. In 2017 the Bad Debtor website was taken down. Before that, some people I had contacted - none … [Read more...]

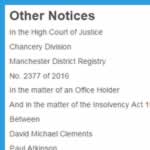

Varden Nuttall – what happened

Varden Nuttall, a mid-size Individual Voluntary Arrangement (IVA) firm, was placed into administration on 24 March 2016. The administrators discovered that £9million was missing from the client account and evidence of fraudulent practices by Philip Nuttall, one of the insolvency practitioners and a director of Varden Nuttall Limited, In October 2018, Philip Nuttall was found to be in … [Read more...]

IVAs – do you have to get a secured loan – a case story

A reader asked this in a comment, but it needs a whole article to tell the story properly: "We are currently 4.5 years into an IVA, we have got to raise £15,000 through remortgage. We have been told from the start to not worry as there is little to no chance of us being offered it, however we have been offered a £15,000 loan over 15 years and paying back £45,000. I can’t believe this is an … [Read more...]

New Insolvency Service guidelines on pensions

On 26 March 2015, the Insolvency Service published Undrawn pension entitlements: Summary of guidance for insolvency practitioners and debt advisors. With "pensions freedom" coming into force on 6th April 2015, the Insolvency Service's aim was to clarify the murky situation around bankruptcy and pensions. Further clarification then came with the Guidance Issued to Receivers and Guidance Issued to … [Read more...]

Do a million need payday loan compensation?

On 2nd October 2014 the Financial Conduct Authority (FCA) announced that Wonga had agreed to compensate an estimated 375,000 customers where Wonga's "affordability" checks are likely to have been inadequate. The common reactions were first that Wonga was being made an example of to warn other payday lenders and second that this was a huge number of refunds... But should many more people get … [Read more...]

- « Previous Page

- 1

- …

- 7

- 8

- 9