The Financial Ombudsman (FOS) complaint statistics for Oct-Dec 2019 have just been published, see Product Complaints Data. For guarantor loans, FOS decided in favour of the consumer in 90% of cases: this is even higher than the 83% that were won in April-Jun 2019. these figures are a dramatic increase from the uphold rate of only 32% for the 2018 financial year. This … [Read more...]

Debt news and policy

Debt Camel articles on what's changing - and what ought to change - in the world of personal debt in Britain.

If you are interested in a specific area, look at: High cost credit news & policy and Insolvency news & policy.

New “simpler” overdraft charges in 2020 – the gainers and losers

In 2019, the bank regulator, the FCA, announced new rules about overdraft charges. It called these: the biggest shake-up to the overdraft market for a generation. Banks had to change their overdraft charging before April 2020. In January 2020, the last of the banks announced how they were changing their rates. In 2020 the FCA admitted that about 8 million people will be paying more under the … [Read more...]

Holding Money & Debt up to the Light: Transparency and the Standard Financial Statement

This is a guest post by Dr Joseph Spooner, Assistant Professor of Insolvency Law at the LSE and the author of Bankruptcy – the Case for Relief in an Economy of Debt. He had previously worked at the Law Reform Commission of Ireland, where his papers influenced the enactment of the Irish Personal Insolvency Act 2012. Systems for addressing difficulties of over-indebted households in England … [Read more...]

UK credit records & scores – not fit for purpose!

In summer 2019, the Financial Conduct Authority (FCA) has started a Credit Information Market Study. In the consultation on its terms of reference, the FCA asked: Do you consider that the credit information market is working well? I think it has grown up over the years into a poorly understood, complex system which has many problems. It isn't working well for consumers or lenders. The … [Read more...]

Why the Ombudsman released a guarantor from a loan

The Financial Ombudsman (FOS) has recently published two important decisions about guarantor loans, one where a borrower complained and one where the guarantor complained. I have covered the borrower case here: Ombudsman – Amigo did not check properly that a borrower could afford the loan. This article looks at the FOS decision about the guarantor for a loan. I have selected points from the … [Read more...]

Ombudsman – Amigo did not check properly that a borrower could afford the loan

The Financial Ombudsman (FOS) has recently published its decision on Miss G's complaint against Amigo. This FOS decision criticised Amigo's inadequate assessment of Miss G's income and expenses. It said her poor credit record meant Amigo should have verified the figures, for example by looking at bank statements. So FOS ordered Amigo to refund all the interest and charges she paid, plus 8% … [Read more...]

Guarantor loans – why guarantors & borrowers need extra protection

Guarantor loans are coming into the regulatory spotlight. The FCA wrote to CEOs in March 2019 saying it will be looking at affordability and whether potential guarantors have enough information to understand how likely it is that they may have to make the loan payments. In a speech, Jonathan Davis said: Recent work we have done in this area showed that many guarantors are making at least 1 … [Read more...]

Wonga – the adminstrators’ report – March 2019

The Wonga Administrators’ six month progress report to end February 2019 was emailed to creditors on 27 March 2019. The creditors include the so-called "redress creditors". These are the customers who complained to Wonga saying they were given unaffordable payday loans. Collecting outstanding loans When Wonga went into administration, the Gross Loan Book totalled £77 million. So far … [Read more...]

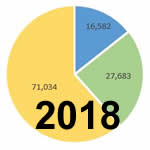

IVAs in 2018 – numbers jump and so do failure rates

On 29 January 2019 the Insolvency Service published two sets of statistics for 2018: Insolvency Statistics: October to December 2018 Individual Voluntary Arrangements: Outcome Status 1990 – 2017. Here are what I think are the three most interesting points. 1. IVA numbers again rose faster than bankruptcy & DROs In 2018 IVAs increased by 20%. Already the most common type of … [Read more...]

Barclays & Barclaycard send letters offering a refund

UPDATE Spring 2024 Barclays is sending people some “NOSIA” letters – because Barclays failed to send you a Notice of Sums In Arrears letter and because of that it is refunding interest after the date the letter should have been sent. The Response Form can be found here https://www.barclays.co.uk/help/remediation/orf/ – that is a genuine page. It says some people may need to send a picture of … [Read more...]

- « Previous Page

- 1

- …

- 6

- 7

- 8

- 9

- 10

- …

- 12

- Next Page »