This is the story of one of the very early payday loan affordability complaints, made in September 2015. Since then there have been literally tens of thousands of affordability complaints made. All the UK payday lenders have been receiving them. four years later, in October 2019, the cost of paying refunds on these affordability complaints had forced the "Big Three" lenders tp go out of … [Read more...]

Unknown debts on your credit file

A reader asked: I have recently signed up to Experian and Equifax. Experian's is what I was expecting to see but Equifax's has debts that I have no recollection of. I have taken this up with Equifax and all but two of the companies have responded by saying that the debt stands, please get in touch to discuss. Equifax say that they can’t remove anything from my report unless these companies give … [Read more...]

Can I add a debt to my IVA?

An IVA is binding on all the creditors for the debts included in the IVA - but what happens if a debt is accidentally forgotten at the time, or only later emerges? If this has happened to you, you are going to need to talk to your IVA firm about your situation because IVAs can be very "individual", but this article looks at what commonly can be done. First I'll look at the usual case where a … [Read more...]

Bankruptcy, IVA, DRO & your credit rating

If your debts are so bad that you are going to have to choose one of the three types of insolvency, you know this will wreck your credit rating, but how long will this continue? This article answers this and other you may have about the effect of insolvency on your credit record such as Will you ever be able to get credit again? What about a mortgage? Is bankruptcy worse than an IVA or a DRO for … [Read more...]

Creditfix’s proposed PJG IVA variation (2014)

In October 2014, some people who had IVAs with PJG Recovery had their cases transferred to Creditfix. The people who have been transferred were told that nothing else would change in their IVA. Two months on in December 2014 however, they are being asked to agree to a variation in the terms of their IVA, including increasing the fees that Creditfix charge. Some people have expressed unhappiness … [Read more...]

Is your pension safe in a DRO?

You may be worried about whether your pension will be safe if you are already in, or have finished, a Debt Relief order (DRO), or if you are thinking about applying for a DRO. The 2015 pension changes mean that many people over 55 can now withdraw some or all of their pension. so what happens if you take money out? Can you lose your pension? Can you get a DRO if you have a good pension? I … [Read more...]

Helping your son or daughter with debt or a house deposit

It's natural to want to help your children if they are in difficulty. But if your son or daughter has debts, can you afford to help them? And is paying their debts or giving them a loan the best thing to do, or are there better alternatives? I've written before about whether someone should help their parents with a debt problem - but helping your children has different implications, both … [Read more...]

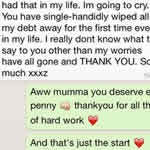

Helping your mum or dad with their debts

Is paying your mum or dad's debts really a good idea? There was a lovely story a couple of years ago about Tyrone Mings paying off his mum's debt But he was a successful professional footballer so he could no doubt afford it. For the not so rich, there isn't a simple answer as every case is different, but I've put together some pointers for you to look at the options. I'll talk … [Read more...]

Will my pension be safe in a DMP?

The pension changes that came in in 2015 gave many people over 55 a new option for paying off their debts, by taking money from their pension pot. I've looked at whether this is generally a good idea in Should you use your pension to pay your debts? but in this article I focus on people who are already in a Debt Management Plan (DMP). This article is relevant for people who are over 55 (or … [Read more...]

Should you use your pension to pay off your debts?

More people than ever are retiring with significant amounts of debt. One in three people planning to retire now expects to have debts - an average of over £17,000. And annuity rates have been low for a long while, although they should be starting to rise as interest rates edge up in 2022. So with more debt to pay and their likely pension income getting less, it's not surprising that many people … [Read more...]

Is your pension safe in an IVA?

Many people who are over 55 can take some or all of their pension pot in cash before they actually retire. You need to know how this may affect you if you are considering an IVA. If you already have an IVA, you may be wondering if your pension is safe. First a warning: IVAs are individual arrangements and it is possible for almost anything to be included or excluded in the detailed terms and … [Read more...]

New Insolvency Service guidelines on pensions

On 26 March 2015, the Insolvency Service published Undrawn pension entitlements: Summary of guidance for insolvency practitioners and debt advisors. With "pensions freedom" coming into force on 6th April 2015, the Insolvency Service's aim was to clarify the murky situation around bankruptcy and pensions. Further clarification then came with the Guidance Issued to Receivers and Guidance Issued to … [Read more...]

Repossession after bankruptcy – be careful!

What do you need to do if you want your house to be repossessed after you go bankrupt in England, Wales or Northern Ireland? Perhaps the house is unaffordable, has negative equity, or it's the wrong size for you. For whatever reason, you want to move out, are happy for the mortgage lender to repossess and may want to "hand back the keys" as fast as possible to get it all over with. The … [Read more...]

Bad credit loans to avoid

Logbook loans, guarantor loans, "pay weekly" shops such as BrightHouse - these may sound attractive if you are short on cash but have a poor credit rating or have been refused a payday loan. But this sort of debt can end in disaster if you have money problems. This article looks at bad credit loans, how they create a lot more problems than they solve and what alternatives might work better for … [Read more...]

How IVA, DRO or bankruptcy affect affordability complaints

If you have been insolvent - bankrupt, had an IVA or a Debt Relief Order (DRO) - then you need to know how this affects a claim for a refund for a financial product. You can't make a new claim for a PPI refund - the deadline for this passed at the end of August 2019. But you can still make affordability complaints and other sorts of compensation eg for packaged bank accounts. New credit … [Read more...]