Mobile phone companies have a bad reputation for complaint handling, from shockingly high bills, incorrect charges and billing errors to poor debt collection practices. For example, Vodafone was fined £4.6million in 2016 for "serious and sustained breaches of consumer protection rules." Hopefully this fine will make Vodafone and the other mobile companies improve their complaints … [Read more...]

Debt Clever – trying to profit from closing down?

The FCA says that over a hundred debt management firms who applied for authorisation have been refused or have withdrawn their application. In September 2016, Debt Clever became one of these firms. Some firms that are closing are looking for ways to continue to make money from their clients. My previous article, Why the FCA should ban the Compass debt advice model, has some examples. This … [Read more...]

What to do if you can’t pay a water bill

If you have just received a water bill you can't afford, what can you do? If you ignore it, can they cut off your water? This article looks at the questions people often ask about paying water bills in England and Wales. Making an arrangement to pay The best thing is to phone your water company when you find you can't pay the bill. Sometimes there is a phone number for people who have payment … [Read more...]

Pensions safe in bankruptcy after Appeal Court decision

Following an Appeal Court ruling on Horton vs Henry, published in October 2016, pensions are once again safe if you go bankrupt. The full judgment is here. The background to this case was: before 2000, pensions formed part of a bankrupt's estate and would be taken once the bankrupt reached pension age; the Welfare Reform and Pensions Act changed this. For people going bankrupt after … [Read more...]

Is my house safe if my new partner goes bankrupt

Ms P asked "I want my partner to move in with me but he may have to go bankrupt so we need advice on the timing. He has got a lot of debt trying to keep his business going but it doesn't seem to be working. I have a house with a lot of equity and we don't want this to be at risk at all. The question is if he moves in now and goes bankrupt in a few months, will that cause a problem? Or is it … [Read more...]

IVA lead generators – the case for regulation

IVAs are now the most common form of personal insolvency in England. Clear Debt has recently stated: Individual Voluntary Arrangements) (IVAs) have become the procedure of choice for those people who have debts they can’t pay and a regular income to enable them to make contributions to their debts. But how often is the choice of an IVA based on accurate information about the alternatives and … [Read more...]

IVA early exit loans – Perinta/Creditfix and Sprout/Aperture

Early IVA exit loans from Perinta offered in 2016 to Creditfix customers Some people have been told they can end their IVA by taking an "early exit loan" from Perinta Finance Ltd, via a broker called Just Lending. Creditfix is sending these emails, but the loan may be available to people in IVAs with other firms. Pearse Flynn, the CEO of Creditfix, used to be a director of Perinta, but no longer … [Read more...]

Paying BadDebtor won’t help your credit record

A reader who had gone bankrupt recently was surprised to get a letter from "The Register of Bad Debtors". This offered to remove her name from their records if she pays them £49.95. She asked if BadDebtor can really do this? There are also reports that people with IVAs are receiving similar letters. In 2017 the Bad Debtor website was taken down. Before that, some people I had contacted - none … [Read more...]

Do you need help to escape from unaffordable debt?

My articles on How to ask for refunds looks at how to make affordability complaints about different sorts of debt - overdafts, loans, credit cards, catalogues, even car finance. It also applies if you have repaid the credit already or if you are still repaying a balance. But what do you do about this month's repayments if you can't manage them? You can't put in a complaint and then carry on … [Read more...]

Wonga refunds – what happened before administration

This page covered the complaints and refunds process before Wonga went under on 30 August. Events in August 2018 August 4 - Wonga forced to ask investors for £10million in funding as the cost of affordability complaints increases. 26 August - news reports that Wonga was in trouble. Sky News reported that: Directors of the payday lender Wonga could appoint Grant Thornton as the … [Read more...]

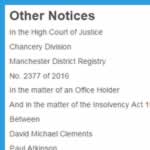

Varden Nuttall – what happened

Varden Nuttall, a mid-size Individual Voluntary Arrangement (IVA) firm, was placed into administration on 24 March 2016. The administrators discovered that £9million was missing from the client account and evidence of fraudulent practices by Philip Nuttall, one of the insolvency practitioners and a director of Varden Nuttall Limited, In October 2018, Philip Nuttall was found to be in … [Read more...]

“Can I use the Right to Buy my council house when I have debts?”

A reader asked: I moved in with my parents into their council house several years ago and we are looking into the right to buy scheme. We received the paperwork and it stated that you are not entitled to the right to buy if you owe money to creditors. Five years ago I lost my job and had a relationship breakup and unfortunately got into debt. Two accounts were defaulted and I went into a payment … [Read more...]

How to complete the online bankruptcy application

In 2016, an online Bankruptcy Application was introduced in England and Wales. When you submit the online Application it is checked by the Insolvency Service Adjudicator who makes the Bankruptcy Order. The online application is a huge improvement on the old court forms! The online application is pretty long and you may need to find some information for parts of it. You don't have to … [Read more...]

How to pay your bankruptcy fees

You can pay your bankruptcy application by debit card or cash. If you are paying by card, you can do this in instalments. The payment methods are all explained in the new online application. I'm going through it in detail here as you might like to understand how this will work but don't yet want to start a bankruptcy application. If you want to know more about the rest of the bankruptcy … [Read more...]

Why the FCA should ban the Compass debt advice model

In March 2016, the clients of Compass Debt Counsellors found out their debt management firm had gone into administration. Many people had thousands of pounds being held by Compass and may not get this money back. In This Compass points to Debt Misery, Legal Beagles points out: "This form of daylight robbery is hugely rewarding because no one ever seems to go to prison for such crime. If I … [Read more...]