UPDATES: Do not use the template on this page for Amigo, Buddy, George Banco, Trust Two, Glo. It is now too late to complain about them. For TFS see TFS Loans goes into administration. Guarantor loans are very expensive. Often the lender didn’t check properly that you will be able to manage the loan repayments without having to borrow more. If proper checks would have shown that you … [Read more...]

How to get a paid CCJ marked as Satisfied

A reader asked: In August 2019 a CCJ was registered against me for £211. I paid off the balance, but not within the month. I have bank statements to prove its been paid. On my credit report it shows the status as “active” even though I have paid it. I’ve contacted the debt collector multiple times but they say as it’s an old case it’s no longer on their system and they can’t help me. I don’t … [Read more...]

Court papers for a CCJ – FAQs about the N9A form & how much to offer to pay?

Mrs E asked: I have a catalogue debt of about £2000 from 2014. I was paying through a debt management company until March 2016 when I stopped. They are going to court for a CCJ. I don't know how to fill in the form with my expenses or which debts I should include. Mrs E's questions are about completing the N9A Admission form that was included with the Claim Form she has received. This is the … [Read more...]

If a lender took tax off a refund, reclaim some using the R40 form

If you have received a refund from a lender, you may see that there is an "8%" element included. This applies in many situations, including PPI, affordability refunds and NOSIA refunds. Often the lender will have deducted basic rate tax from this 8% part. Since April 2016 non taxpayers and basic rate taxpayers can probably get some or all of this back from the HMRC. This article looks at … [Read more...]

Should I keep paying an old debt?

Do you have to keep making payments to old debts? It can be easy to get stuck in a long-term Debt Management Plan (DMP) or payment arrangements. If you are paying little each month, your debts will take a very long while to be gone. This article looks at the questions people often ask about old debts where they have been making monthly payments to the debts. If you haven't been making … [Read more...]

Help with bankruptcy fees

A reader asked: I can't afford to go bankrupt! Is there anyone that can help with the fees? The bankruptcy fees in England and Wales are £680. This is made up of the £550 Official Receiver's fee and the £130 application fee. £680 is just stupidly high - most people go bankrupt because they are broke and they don't have hundreds of pounds in their bank account. The fees used to be reduced if … [Read more...]

Threats of CCJs and bailiffs – are debt collectors bluffing?

Have you received scary letters from a debt collector demanding payments? These letters may threaten defaults, county court judgments (CCJs) and bailiffs taking your possessions. Sometimes the letters are bluffing, but the number of CCJs is continuing to go up. In the first half of 2019, there were 586,765 CCJs and more than half were for less than £650. This article covers consumer debts … [Read more...]

Who should you tell before you go bankrupt? And afterwards?

It is normally a good idea to tell your creditors if you are in financial difficulties, not ignore them. So should you tell people you are planning on going bankrupt? And who do you have to tell afterwards? Before bankruptcy - you won’t gain from telling your creditors Few creditors will feel sorry for you and stop pestering you if you tell them you are going bankrupt. So you aren’t … [Read more...]

What to do if you get a Claim Form

If you receive a Claim Form from a County Court through the post you need to respond rapidly. Ignoring court papers is a bad idea, even if you think the debt is too old or you are worried you can't pay the money. If you agree you owe the money you will get a County Court Judgment (CCJ) but if you complete the Claim Form papers properly you will be able to make monthly payments and won't … [Read more...]

“Can mortgage lenders see old debts, no longer on my credit record?”

A reader asked: I know a debt drops off my credit file 6 years after it was settled or defaulted. I just want to ask when I apply for a mortgage, can the lender dig up unpaid debts if they are no longer showing on my credit report? This is a common question. The answer is Yes, sometimes because a lender can see other information that may show the debts. Let's look at what the lender can see, … [Read more...]

Is your pension safe if you go bankrupt?

If you expect to go bankrupt soon you may be worried about whether your pension will be safe. The Insolvency Service published a summary of its new guidance on pensions and bankruptcy in England and Wales in 2015 after the "Pension Freedom" changes that year made it possible for many people to take money out of their pension from age 55, even if they are still working. There was some legal … [Read more...]

Holding Money & Debt up to the Light: Transparency and the Standard Financial Statement

This is a guest post by Dr Joseph Spooner, Assistant Professor of Insolvency Law at the LSE and the author of Bankruptcy – the Case for Relief in an Economy of Debt. He had previously worked at the Law Reform Commission of Ireland, where his papers influenced the enactment of the Irish Personal Insolvency Act 2012. Systems for addressing difficulties of over-indebted households in England … [Read more...]

“£20,000 credit card debt due to gambling – what should I do?”

A reader asked: "I have nearly £20,000 in credit card debts due to 8 years of gambling addiction. I asked several times to lower my interest, defaulted a couple of times and also they could see gambling on my account yet they still increased my credit limits. I was taking cash advances to pay for food. I have not gambled for 18 months now, but I am left with this horrible debt that I cannot … [Read more...]

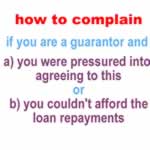

How to complain when you are the guarantor for a loan

UPDATE: Do not use the template on this page for Amigo, Buddy, George Banco, Trust Two, Glo. It is now too late to complain about them. For TFS see TFS Loans goes into administration. If you are a guarantor for a loan you can ask to be removed as the guarantor: if you couldn't afford to repay the loan without difficulty; or you were pressured into becoming the guarantor; or … [Read more...]

“Lender says I lied – what should I do?”

Some lenders responding to affordability complaints by saying your application wasn't accurate about your income or expenses when you took out the loans. They are doing this to try to put you off taking your case to the Financial Ombudsman. That may save them a lot of money! Let's see why applications may have been inaccurate and whether this is a problem for your complaint. Most of the … [Read more...]

- « Previous Page

- 1

- …

- 8

- 9

- 10

- 11

- 12

- …

- 14

- Next Page »