If you have decided to take control of your expenditure, you may get depressed when it doesn’t all go to plan.

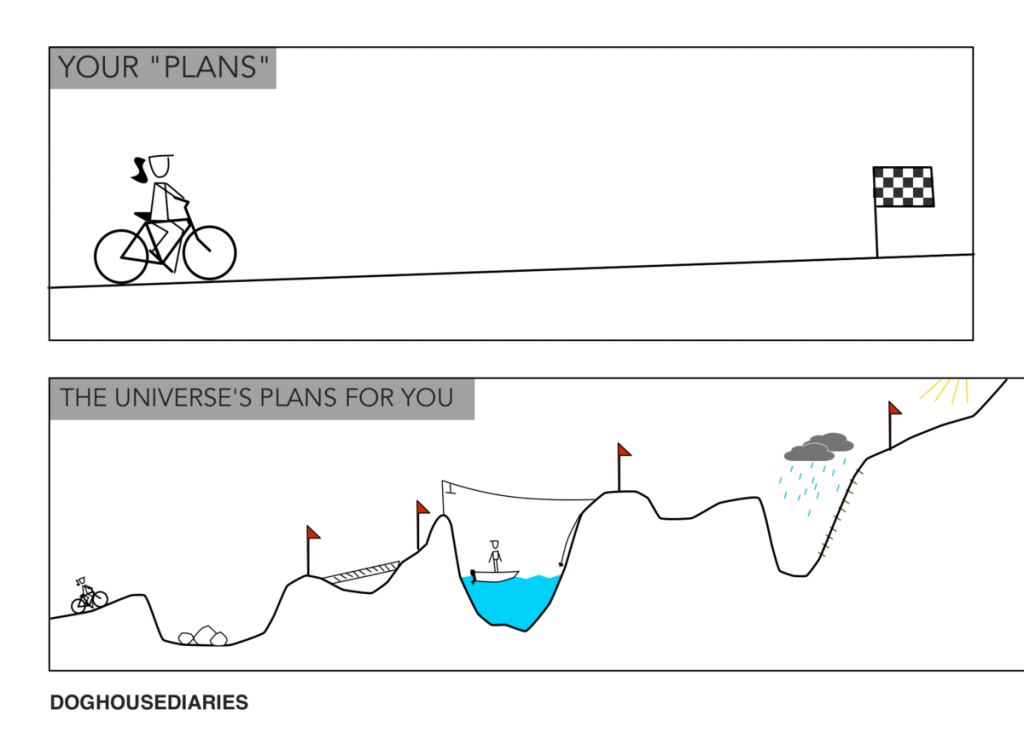

But improving your finances is a journey – one that takes time and planning. And as with all journeys, there can be stops and starts along the way. Don’t let these derail your plan.

Why budgets go astray

Some of these reasons can be unexpected. A big bill that’s landed on your mat that you’ve forgotten about, or something that you feel unable to say no to – a close friend’s wedding for example, or a school trip for your children.

Your spending also might not be a conscious activity. According to Santander, the typical UK adult spends £948 a year on ‘invisible’ items such as coffee, treats for their children, or shop-bought lunches (adding up to an average of £18.23 a week). If you aren’t tracking these, it may be difficult to see exactly where your budget has gone wrong.

Maybe it’s not you that’s caused the derailment, either. If you’re taking a debt journey with a fellow passenger it’s important you’re both fully on board and willing to move forward. If your partner doesn’t agree with your joint budget or is more of a spender than you, it can make things more difficult.

Just one of these when you’re on a tight budget can distract you from your end goal. Whatever the reason, if it happens to you, don’t despair. The worst thing you can do is use minor blips as a reason to give up.

Here are six ways to jumpstart your debt journey after a fall.

1. Cut yourself some slack – remind yourself of how you have come

Now is a good time to look at how far you’ve come already. If you’ve made the decision to get out of debt and have started the steps to get there, although it may not feel like it, you’ve done the hardest part.

You don’t have to get everything right every time. Making progress in the right direction is better than giving up.

Also, don’t forget your journey is a personal one – as one blogger has put it Don’t Compare Your Beginning to Someone Else’s Middle.

2. Remind yourself of your goals

There are lots of abstract reasons to try to get out of debt – better credit rating, taking back control of your money and not using it on interest or paying off your creditors, and increasing your current earnings.

But there are also plenty of personal reasons for doing it too. Perhaps you want to be able to take your children on holiday or change jobs which may mean earning less or save for a house deposit.

Studies have shown writing down a tangible goal can make you much more likely to reach it.

So remind yourself why getting out of debt is important to you and the benefits it will bring. If it’s a joint goal, talk about it with your partner too and remind each other.

If you don’t have a partner, put a reminder of your goal on the fridge, or somewhere you see it often.

3. Think of the reasons why your derailment happened

Be as honest as you can be. Granted, not all reasons are within your control, and the good thing about being out of debt is that you’ll be a lot more prepared to cover any little knocks.

Sometimes it’s not one single large bill that caused the problem, but a lot of smaller spending decisions. here it’s important to know your triggers. If you can identify the situations that cause problems, you can work on ways to minimise these in future:

- Did you feel like you deserved a takeaway after working hard? Plan ahead for an easy and quick stoecupboard or freezer meal.

- Is shopping online your big weakness? Here are 5 ways to spend less.

- Went along with spending with friends or family? Would it help to tell more people that you are saving money? You can say you are saving for a holiday or a house deposit if you don’t want to say you have too much debt.

4. If the plan was simply unrealistic – go for a rethink

Sometimes your plan was predictably never going to work.

You may have planned a “no spend” year say…

That’s a bit like going on a diet that consists only of water and grapefruit. You would definitely lose weight… except you are very, very unlikely to be able to stick to it for more than a week or two. And when you snap, the weight loss goes right back on.

If you have planned to cut back everywhere to the bone all at one, then you may not be able manage it for long enough to make a real difference. It is better to get a less dramatic plan that you can actually stick to. You aren’t a failure in this situation, just over-ambitions.

Read Top tips for simple & realistic budgeting that works and think what you need to change.

If you want, you can incorporate some “no spend” elements. A dry January. A resolve to only buy secondhand clothes and books.

Many adults could decide not to buy any clothes for the next year and be fine. But spending nothing on clothes or entertainment or alcohol or presents… it’s a hair-shirt approach to cutting back that will work for very few people.

5. Could a bit of tinkering help?

If you’ve just stopped making progress, it usually just takes determination to restart the journey.

But perhaps some tinkering with your budget would help. Starting to put aside a small amount each month in an emergency fund may make future problems just a bit easier to manage. Or a quick blitz – decide you won’t buy any new clothes for 6 months (this doesn’t work if you have children!) or plan to have a holiday at home this year.

If you have been jolted off track with a loss of income or big new expenses or furlough during Covid-19, you may need a more major rethink. If you are already in debt management or an IVA, talk to the firm that has set this up for you

Using an app can make it very easy and quick to see at a glance how much has been spent and what is still going to come out of your bank account each month. See my page on Apps that can help you budget for more details. One of them would probably work really well for you!

6. Get some expert advice

Stepchange say more than 40% of their clients take a year or more to get help with their debt problems. If you or your partner need help, debt advisers are trained to give you the hand you need – and might have tips and tricks you haven’t thought of.

There are lots of different places for advice, depending on where you live and what sort of issues you have, see information on where to get help.

Picture from Doghouse Diaries.

Leave a Reply