Loans2Go offers what I have called the worst loans in Britain.

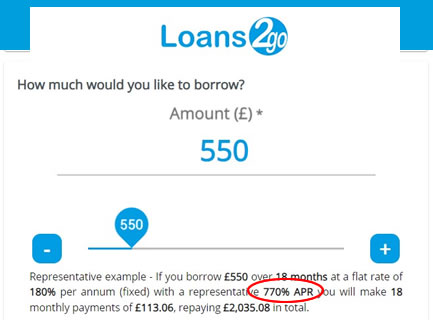

Since 2021 they have been charging 770% APR. See the representative example Loans2Go quotes on its website:

- £550 borrowed for 18 months is a monthly payment of £113

- this adds up to £2035, a bit less than four times what was borrowed.

Contents

MUCH cheaper to get a payday loan than a Loans2Go loan

Of course Loans2Go don’t point this out on their website, but check out these numbers!

With a payday loan for £550, the maximum interest that could legally be charged is £550 – the amount borrowed. So you would only have to repay £1,100 – the £550 borrowed plus the £550 interest. And the monthly repayments for a payday loan for 12 months can’t be more than £92.

So you would pay a payday lender £92 for 12 months

but Loans2Go is charging MORE PER MONTH (£113) for MUCH LONGER (18 months).

Loans2Go also used to offer logbook loans, but this article is just about their standard personal loans. If you had a logbook loan from them, use the template on this other page.

Is this legal?

The Financial Conduct Authority (FCA) calls payday loans “High Cost Short Term Credit”. Its definition of High Cost Short Term Credit is a loan over 100% in APR and of 12 months or less.

So the Loans2go loan is outside that definition because it is 18 months long. So it isn’t caught by the price cap rule.

Unfortunately, this means its loans have crept through a loophole and are legal. I think the FCA should close this loophole.

Many people are winning affordability complaints about Loans2Go loans

I think this is the worst loan in Britain.

A loan is unaffordable for you if the monthly repayments were so high you couldn’t afford to pay them without hardship, borrowing more or getting behind with important bills. This is a standard affordability complaint, used for many other sorts of loans. If you win this you will get a refund of all the interest.

Because Loans2Go loans are so expensive they are often unaffordable. Many people are winning Financial Ombudsman (FOS) complaints about these loans – here is just one example: Miss R’s personal loan provided by Loans 2 Go.

No-one who isn’t desperate would take one of these loans out, and the ombudsman says Loans2Go should make more detailed checks on affordability when it thinks the borrower may be in difficulty.

Several people have said they were not given the full details about the loan before the money was given to them. If this happened to you, say this in your complaint as well.

First complain to Loans2Go

It doesn’t matter if you have repaid the loan or you are still paying, you can still complain.

You have to complain to Loans2Go first, you can’t go directly to the Ombudsman.

Email customerservices@loans2go.co.uk and copy it to ps@loans2go.co.uk. Put AFFORDABILITY COMPLAINT as the title.

Use this template as a basis and make any changes so it reflects your case:

I am also complaining that the interest rate was grossly excessive. It is unfair to charge someone more per month over 18 months than they would have paid to a payday lender for a loan the same size over 12 months.

[only add this next sentence if the date of your loan was after the end of July 2023] This loan does not represent fair value and it is in breach of the FCA’s Consumer Duty.

[only add this if you were not told the loan terms] The loan was not adequately described to me before I was given the money. This is an unfair way to give high cost credit.

I am asking you to refund the interest and any charges I paid, plus statutory interest, and to delete any negative information from my credit record.

[delete if you have repaid the loan] I would also like an affordable repayment plan to be put in place if I still owe a balance after this refund.

I am also making a Subject Access Request (SAR) for all the personal information you hold about me including, but not limited to, my applications, all credit and other affordability checks, a statement of account for my borrowing, and a record of all phone calls.

Let me know in the comments below if you are making a complaint about a loan that started after the end of July 2023, as there are some new regulations about those.

Is an offer from L2G a good one?

If L2G has offered to wipe a small balance or take some money off what you owe, you have to decide whether this is a good enough offer to accept.

For example, they may offer 50% of the interest off “as a goodwill gesture”. Or to reduce your balance by 50%. These are often very poor offers, you could get a lot more by going to the Ombudsman.

Sometimes Loans2Go will increase an offer if you push them. Here is what one reader said:

They replied firstly with the offer to half what was left and agree a payment plan and I refused and they immediately came back and wiped the loan clean and removed it from my credit file.

It’s up to you what you think a good offer is. But you can’t change your mind later if you accept and then think you shouldn’t have.

So ask a question in the comments below if you aren’t sure.

Take a rejection or a poor offer to the Ombudsman

You can send your complaint to FOS if Loans2Go has rejected it or has made you a poor offer. This is easy, just use this simple FOS form which asks you what they need to know to set up your case.

Send your bank statements to the Ombudsman – 3 months before and 3 months after the date of the loan. These are the best evidence that the loan was unaffordable for you.

Kirstie says

Hi Sara

I have been following this thread for a while as both me and my husband stupidly took loans out with this company. My loan was for £500 his for £1000. We settled the loans earlier due to a family member giving us the money to be able to do so to help us get out of debt. We both sent affordability complaints and they argued that we have no case as we paid on timeand the terms had been set out at point of agreeing to the loan. But have offered £70 each for being ‘good customers’ I am not sure what to do next as on paper I suppose £307 per month for our household income doesnt sound unaffordable however we both have poor credit history and a lot of other creditors. My loan was for £500 and I paid £1500 at point of settlement and my husbands loan was £1000 which he paid £2716 back to them. I am not sure if I am in a position to argue further with l2g or if the FOS would throw this out too. Do you have any advice please? Thank you for all you do on this website.

Sara (Debt Camel) says

L2G can sometimes be persuaded to improve an offer. but this has to be a compromise – if you want the full refund you may be able to get from the ombudsman (that would be c £1000 for you and C £1700 for your husband) then you should send the complaints to FOS now.

If you want to offer a compromise, you could say that you would be prepared to accept £500 and your husband £700 to settle the case quickly without going to the Ombudsman.

Lee says

Sara

I am thinking of putting in a complaint to L2G, I have a poor credit file with a CCJ and defaults as well as having other loans over the last couple of years.

since July 2021 I have had 6 loans with L2G and there was also two times they declined to lend me money but then lent to me again a couple of months later, do you think I have good case to put in a complaint as even though I was paying off the loans early I was borrowing again almost straight away.

Hard to work out exactly what I paid in interest to them.

1st Loan £250 – 17/07/2021 paid back 29/07/2021

2nd Loan £250 – 03/08/2021 paid back 25/11/2021

3rd Loan £250 – 16/12/2021 paid back 26/01/2022

4th Loan £250 – 04/02/2022 paid back 28/02/2022

04/03/2022 – Loan declined

05/05/2022 – Loan declined

5th Loan £250 – 12/07/2022 paid back 25/08/2022

6th Loan £300 – 31/08/202 paid back 03/04/2023

My last loan defaulted and I paid back a total of £690.46 to them as finally settled it, I have tried to work out the interest of the other loans and in total it looks like i have paid around £785 in interest to them

I assume the first couple of loans will maybe be deemed affordable but surly the loans after they have rejected to me twice should be deemed unaffordable ? I would be happy just to get the interest back from the last loan as was almost £400

Do you think I have a case for a complaint?

Sara (Debt Camel) says

yes – the loans were small but you had 6 of them

Lauren says

Hi. My husband took out a loan and at that time, he had 7 defaults on his credit score. Complained to L2G, they offered 50% back (I ended up lending him the money to pay it all back after it was defaulted). He declined this offer and submitted to FOS today. Just wondering if having 7 defaults at the time the loan was given would be enough to prove irresponsible lending? When we did an FOI request, L2G sent their credit score they did before lending to him and all the defaults show on there too.

Sara (Debt Camel) says

Yes and No. obviously 7 defaults suggested big problems, especially if any were recent. This means L2G should have looked closely at his situation to see if the repayments would be affordable.

Mr E says

Hi all, been reading this thread and it’s very interesting.

I stupidly took out a £2k loan with loans to go and they wanted me to pay back £6.5k

I’ve emailed an affordability complaint to L2G as I cannot afford the repayments and I’m shocked they even gave me a loan given I’ve been struggling financially over the last 4/5 years and I’ve got defaulted accounts and missed payments clearly shown on my credit file.

They’ve offered a 25%! Reduction on my loan but I’ve rejected and requested I pay back only the loan amount and have any interest I’ve paid refunded towards my loan amount – waiting to hear back before I go the ombudsman – will they budge?

Sara (Debt Camel) says

Sometimes. Fingers crossed this gets sorted.

Have you had other high cost debt you could make an affordability complaint about?

Mr E says

I’d like to thank everyone on here for sharing their stories and advise because after lots of back and forth today with Loans 2 Go they have agreed to wipe all the interest on the loan and allow me to pay back only the loan amount of £2k

I received the below today after arguing my case and after the only wanted to reduce my balance by 25%

Further her to reviewing the additional information provided, in order to assist you as best as we can and bring your complaint to a satisfactory closure, whilst I still cannot agree to uphold your complaint, it has been agreed to increase our gesture of goodwill offer to write off all of the interest applied to the borrowing, meaning that you would only be liable to repay the £2,000 borrowed without any interest.

Please find below a breakdown of the increased gesture of goodwill offer:

Current balance outstanding: £5,579.26

Proposed write off amount: £4,463.92 (Total Interest)

Payments made so far: £884.66

Proposed new balance: £1,115.34

Funny how they can write off £4.5k as soon as you challenge them isn’t it??

I’m on an agreement payment plan with them so this debt will be settled in 12 months. I am so relieved because I can see the end of the tunnel – I thought I was tied into this mess for the next 6 years or my life.

PLEASE if you have had a loan with these animals, take Sara’s advice and fight it!!!

Sara (Debt Camel) says

very good news for you!

Lauren says

Hi Sara,

Unfortunately FOS have come back and said the complaint cannot be upheld, despite 7 defaults on my husbands account, with the most recent one being 6 months prior to the L2G application, from a debt management company. But because all the previous defaults were settled (by borrowing money from friends and family), FOS say this doesn’t show financial difficulties. Along with the affordability calculation (husband obviously had lied about outgoings to ensure he was accepted for the loan).

Where do we go from here? FOS have said we can provide more evidence and ask for a final statement, but I’m not sure what else we can give, so assume the final statement will be the same. What are the chances we can now go back to L2G and somehow ask for the 50% refund that they initially offered?

Sara (Debt Camel) says

How large was the loan?

Lauren says

£700. 18 monthly payments of £143.89, total paid £2,446.02. I ended up lending him the money to pay it all off in 1 go when the debt was sold to debt collectors.

Sara (Debt Camel) says

so go back to the Ombudsman and say that you don’t think this is reasonable. A loan of £700 at such a very high interest should have been checked in detail for affordability, especially with a a default only 6 months before. Ask for the case to go to an ombudsman for a final decision if the adjudicator doesn’t change their mind.

Lauren says

Adjudicator didn’t change her mind so asked for it to go to FO and he upheld our complaint! All money is to be refunded and default removed. Thank you SO much Sara for everything. We wouldn’t have even thought about fighting this if it wasn’t for you. Thank you!

Sara (Debt Camel) says

Very good news. And no long delay for Ombudsman decision either!

Tom Griffiths says

Sounds like many of these debt companies are breaking the law and obviously cheating people out of refunds.

Obviously these companies mostly never did proper credit checks on most people I know I should get pretty much all my loans back am looking into it now.

Good luck keep at it.

tax advisor in uk says

Loans2Go has been criticized for offering some of the worst loans in Britain. In 2019, a reader shared a loan experience with an interest rate of 990% over 18 months. Although the interest rate was reduced to 770% in 2021, it remains significantly higher than payday loans. Loans2Go’s representative example on their website shows that borrowing £550 over 18 months would result in total repayments of £2035, nearly four times the amount borrowed. In comparison, a payday loan for the same amount would have a maximum interest charge of £550, with monthly repayments capped at £92.

Tom says

Hi,

I wanted to ask if the loan has defaulted and been passed to a debt collector, should I raise the complaint with Loans2go still? I have paid £700 of a £300 loan and I genuinely cannot afford to pay anymore. They are threatening me with court action worth over £1000 and I am really worried as I am a single parent living with my child.

I have sent my complaint to Loans2go but I am just concerned that this is not the correct course of action due to the stage it is at.

Sara (Debt Camel) says

Yes your complaint goes to Loans2Go.

What other debts do you have at the moment? Are you buying or renting?

John says

I had a loan off loans2 go for 250 pound and did not realise that it was over 18 months which was total off 900 pound to pay back. I stopped paying it due to rent going up. And they now passed it on to this company unlimited kash for collection. And they kash have sent a txt to me saying they are going to start legal proceedings against me in court and get a deattachment of earning from my employer. I’d like to known if they can do that straight away without me filling in the court paperwork first on my detaching send to the court?

Regards

John

Sara (Debt Camel) says

They can’t get an attachment of earnings without first getting a CCJ in court.

They can’t go to court unless they have first sent you a letter before action/claim – see https://debtcamel.co.uk/letter-before-claim-ccj/ which describes what this looks like.

What are your finances like at the moment? Do you have other problem debts. Anyone so desperate as to get a L2G loan typically has other high cost debts?

How long did you think this loan was for?

John says

I thought it was over 8 months at 52.50 a month

Sara (Debt Camel) says

so was there something in the application that made you think it was for 8 months? Was that what you requested?

You are not the firms person to have said this.

John says

I had done the application online

I had miss read and only seen the 8 not 18 months as never thought for this so much low money any company charge you this amount of interest as thought the government had cracked down on theses type of lenders. And that why I took the loan at the time.

Sara (Debt Camel) says

yeah this firm is going through a legal loophole – it is more expensive than the maximum amount a payday lender can legally charge.

Sara (Debt Camel) says

What are your finances like at the moment? Do you have other problem debts. Anyone so desperate as to get a L2G loan typically has other high cost debts?

Mo says

Hi Sara

I used your template and this is the response they gave me

it’s important for me to reiterate that a credit provider is only required to undertake reasonable and proportionate checks into an applicant’s financial position at the time of an application and that additional checks – such as the business asking to review the applicant’s bank account statements – would only be expected to request where the initial checks undertaken by the business give reasonable cause for concern that such checks might be merited. And I have not seen enough evidence to suggest that these extra checks would have been necessary at the time.

However having looked at everything again and taking into consideration the evidence you have provided, as a gesture of goodwill and testament to Loans2Go Limited’s commitment to assisting and treating our customers fairly, we are offering to write off the balance and refund you the sum of £250.

Please advise us if you are satisfied with the resolution provided and accept this as full and final settlement of the complaint within 7 days of this letter to ps@loans2go.co.uk and provide the following details of the account that you wish the refund to be paid into:

Sara (Debt Camel) says

how large was your loan? how large is the current balance that they are offering to clear?

Mo says

It was 1450 for the loan I have paid back 5240 and only have 2 payments of 241 left

Sara (Debt Camel) says

so they are offering you c £730. If you win at the Ombudsman you could get back a full refund of all money paid over the 1450 you borrowed, which will be over £4000 after you have made the last two payments.

it doesn’t sound like a good offer to me. The Ombudsman says (https://www.financial-ombudsman.org.uk/businesses/complaints-deal/consumer-credit/unaffordable-lending):

“a less detailed affordability assessment, without the need for verification, is far more likely to be fair, reasonable and proportionate where the amount to be repaid is relatively small, the consumer’s financial situation is stable and they will be indebted for a relatively short period.”

This is a large loan for someone in finacial difficulty and I think they should have made adequate checks.

Mo says

Thanks Sara I have sent the complaint to the FOS with the the final response letter

Andrew says

I currently have a loan with Loans2Go and I am on payment 23/24. I initially borrowed £1600 with repayments of £200.31 over 24 months, totalling a repayment of over £4800. This has caused me great financial difficulties but I have maintained payments over the last 2 years, with 2 defaulted payments which were caught up, with 0 arrears. My last payment is due 20th August. What will happen if I raise a complaint now that I am almost finished? Will this be looked at negatively because I’ve maintain my payments & paid off the loan

Sara (Debt Camel) says

No it’s fine to complain now. The difficulties that you have had support your case that the loan was unaffordable.

Andrew says

Do I use the above template & alter it according to my situation?

With the loan having 1 outstanding payment left, would this result in a refund of the interest paid? I’ve never approached anything like this as I felt the likelihood of a positive outcome would be small. In total I will have paid £3207.45 in interest on a £1600 loan. Would I expect an offer of 75% of the interest back or would I push for 100%

Sara (Debt Camel) says

yes use the template above

If the complaint is upheld by the Ombudsman it would result in a refund, it will result in a refund of the amount you have paid less what you borrowed.

If Loans2Go makes you an offer that is less than that, come back here and ask? If they reject it, send it straight to the Ombudsman.

Also you need to make that last payment unless you can’t manage it.

Andrew says

How long does it usually take to receive a reply? I sent the email complaint on 3/8/2023. Should I expect an email reply or a posted letter?

Sara (Debt Camel) says

they have 8 weeks to reply.

Andrew says

Hi Sara, me again! I have just received word from Loans2Go with an offer of £100 refund, which if course I am not going to accept. Do I reply to the email to advise that I am not accepting this ludicrous offer or do you I simply refer to the FOS?

Thanks A

Sara (Debt Camel) says

You can just send it to the Ombudsman. They will tell L2G

Andrew says

Do I send the documents sent to me to the ombudsman

Sara (Debt Camel) says

attach the rejection letter and your bank statements for the 3 months before and 3 months after the loan.

You don’t have to attache the original contract etc – L2G will send that in their case file.

Saif says

I took out a loan for £1,700 and I saw the repayments were £238 approximately but I didn’t see that they were for 24 months. This would mean I would be paying over £5,000 back. When I complained and said this was unaffordable and irresponsible on their side, they offered to take off 40% of the interest. When I refused to accept the offer, they sent me an email as to why they have done that and how it is affordable to me. Where do I go from here as I do not want to pay. Thanks and look forward to hearing back from you.

Sara (Debt Camel) says

do you agree the repayments are affordable? That is, you can pay L2Ge and still be able to pay your other debts, essential bills and living expenses without being so short of money that you have to borrow more?

Saif says

Hi. Thank you for your response. After paying all my essential bills and also the monthly £240 to loans2go, I would only have about £50-100 left over. So no, the repayments are not affordable for me. What would you suggest my next steps be?

Sara (Debt Camel) says

how much have you paid so far to them?

Saif says

I have only made one payment so far, which is £238 roughly, and I can already tell that I’m not going to have enough money left over to survive for the rest of the month.

Sara (Debt Camel) says

ok, what other debts do you currently have? Because this sound as though it has to go to the Ombudsman and that can take a long while for a decision.

So you need to get yourself into a safe place while this goes though. Also most people with a L2G loan also have other expensive debts,so you should be looking at complaints against those as well – you can complain not just about loans but overdrafts and credit cards.

Saif says

Credit card and overdraft comes up to about £1400. I will complete the form tonight. They have given me 14 days to accept the offer, which I am not going to do so I will tell them that I am going to go through FOS. And also complain about overdrafts and credit cards like you said. Thanks.

Sara (Debt Camel) says

And also talk to StepChange about a debt management plan – this will get you through until the results of the complaints are known. Wining any will really speed the DMP up.

Kate says

In 2018 i took out a loan with loans 2 go. At the time i was in the worst situation and desperate for money which was used to clear other debts and it just spiralled out of control.. eventually cleared my balance and still disgusted of them for taking advantage of my sitaution. I took out a £1000 loan and had to pay back £4113. Ive copied and pasted the template hopefully i can get something back from them.. how long isit until they have to respond.. thanks

Sara (Debt Camel) says

8 weeks. Unless you get a good offer, not just a few hundred, I suggest you send this to the ombudsman if repaying the loan caused your big problems

Kate says

Ive just had a letter from l2g and as a gesture of goodwill they are offering me £150. They are saying all correct check were made and that the loan was affordable to me. Will that be there final offer or is there anything else i can do before going to the financial ombudsman

Sara (Debt Camel) says

They will sometime negotiate. But probably not more than a few hundred more. They seem happier to reduce people’s balances than pay out cash when a loan has been settled.

If you go back and say you will accept £1500 or whatever, say your complaint goes to the ombudsman in a week if they don’t accept this. One person here tried to negotiate, sent them info they asked for, but ended up missing the 6m time to go to FOS. So don’t let them string you along – one week max then go to FOS.

Kate says

Do they usually respond with a offer or tell me to take it to the fos.

Thanks

Sara (Debt Camel) says

All these cases are quite individual. Realistically they have offered you a tiny amount, they aren’t likely to make a good offer. So it may be best to simply send the case to the ombudsman now.

Most of the people who they will negotiate have a significant balance owing on the last loan, that isn’t you. But these things are unpredictable, I can’t say it definitely isn’t worth trying to get more.

Roy says

I have been out of work for 10 years but I got a 1000£ loan off loans 2 go I have paid back roughly 2400 but still have 1300 to go of which I am struggling and am now on a payment plan .. at no stage was I asked for bank statements before receiving loan do you think I have a case against them

Sara (Debt Camel) says

Yes. Send them a complaint.

What other debts do you have? Most people with Loans2Go have a other expensive or problems debts – nothing is as expensive as L2G should Lao look at affordability complaints against the others as the cost of those probably led to you taking this horrible loan.

Are your renting? Social or private? Are you behind on any bills?

Roy says

Live with a relative .. am in debt with others..loan was only for 1000 with interest want 3800 back .. paid off about 2400

Sara (Debt Camel) says

How large are your total debts?

Roy says

Including credit cards and other loans about 6000

Peter says

I have been arguing with this company for the last 3 months now, telling them I didn’t agree to such stupidly high interest rates and that I agreed to borrow £1000 and pay back £1500 over 18 months.

Friday they emailed saying they’ve cancelled the agreement and are now looking at 1 of 3 options, contacting employed for attachments to earnings, or taking my car or taking me to court and getting a warrant to remove goods.

I’ve just emailed them the template above so will update as and when they reply.

I told them I would pay back £1500 minus the £200 they took 9 days earlier then what was agreed in the contract which caused me issues but they wasn’t having none of it. I told them I would of never agreed to the rates they charge because I couldn’t afford £200 per month over 18 months, which would make a £1000 loan after paying £3600 which is day light robbery.

I applied for £1000 pay back £1500 over 18 months, didn’t hear nothing for about a week then money was in my account, wasn’t made aware of the high interest rates or even contacted to see if I still wanted the loan.

Sara (Debt Camel) says

Could you copy and paste the bit about taking your car please?

Peter says

Please note that this letter constitutes notice to you that we may now commence proceedings to issue legal proceedings for the recovery of monies owed or if applicable, commence proceedings for the recovery of the security vehicle. If proceedings are issued you will become liable for additional costs involved.

Sara (Debt Camel) says

ah ok, “the security vehicle” sounds is a leftover from when Loans2Go did logbook lending, which was secured on your car. Yours is just a standard loan I assume – so you can ignore that.

All of the other 3 “options” will require them to have gone to court for a CCJ first.

Peter says

Yes just a standard loan. I’ll update as and when they reply. Thank you

Sara (Debt Camel) says

OK so you have objected to them the loan was never properly described to you, and also complained about ehm taking the 200 too early, and you have now made an affordability complaint. Good.

They may come back with an offer. A good offer is to remove all the interest leaving you with 1300 to pay and allow you to repay at a lower more affordable amount eg 50.

Loans2Go has a habit of making rather poor offers… sometimes they can be persuaded to improve these. Leave another comment here if this happens. But some cases have to go to the Ombudsman.

Loans3Go should not start court proceedings while this is going through. Let me know if your receiver a Letter before Action/Claim – see https://debtcamel.co.uk/letter-before-claim-ccj/

peter brozych says

So they wiped soome of and came up with a figure of 2600, told them still to high and its not what i agreed to. unsure what to do next

Sara (Debt Camel) says

Can you go into more details about what happened when you took this loan, and why you think it was not properly described to you when you agreed to it?

Mo says

Hi Sara the Financial Ombudsman got back to me and they have took my side and loans2go have accepted they should not have gave me a loan so I’m getting back all the interest I paid.

Thanks for your help it’s much appreciated.

Laura says

I have just raised a complaint to them regarding my loan from earlier in the year. I regretfully borrowed £1000.

Backstory – my credit score is very low due to an IVA that has long finished. I have been clearing up my credit report and have since obtained credit cards as a reset essentially (following post clean up advisories of credit report)

Due to unforeseen circumstances, I needed money quickly and no panel of lenders would look at me twice with such a low score, it was such a blow so when I applied and this company accepted, I bit their hand off.

A few months later, the monthly £205.56 payment was taking it’s toll on my outgoings so I opted for an early settlement and thankfully a different loan company (Salad Money) accepted my request. Not only were the funds in my account the same day after an application that took no longer than 15 minutes to complete (with wageslips for proof), they offered me the loan with zero interest for the year so I am now paying £83 for 12 months as oppose to £205.56 for 18 months.

Fingers crossed I receive a response from L2G within the next week, will update you once I hear back.

Sara (Debt Camel) says

Good luck with this.

But why is an IVA that finished a long time ago still affecting your credit score?

Nathan says

Wish I’d read this article sooner! Please be careful before agreeing to a loan from this company! £1000 loan over 18 months for a total repayment of £3708.08 costing £205.56 per month. Having had the loan for 1 week I have already incurred £84.55 in interest charges. My circumstances changed and I made a payment of £450 (soon to be more). I perhaps didn’t read the contract as thoroughly as I should have but I have found out this doesn’t affect / reduce the monthly payments (unlike any other companies in my experience) so they will still charge £205.56 per month and the overall total to repay over 18 months only dropped to £3,288.96. I will be paying the rest off asap so not to incur too much interest. As an example of how bad this company is on terms of payment and interest charges I also had a Finio loan for the same ammount £1000 over 18 months and am paying £70 per month with a total repayment of £1,344.70 over the term of the loan… so if you do need a loan of this nature due to your circumstances please try other providers first, the fast payment pro is by no means worth paying WAY over the odds on a loan!

Charlie says

Hi Sara

I’m back to seek advice, this time concerning Loans2Go, you were the first person I thought could help me, I was involved in the threads for amigo and received a successful upheld, your advice and dedication to that cause was incredible, you are a real champion for the people, thank you.

So, similar to Amigo, i have complained on the grounds of unaffordability, mis sold loan, the loan was only for £250 over 18 months, I had paid around £170 of this off before it defaulted and was sold to PRAC , PRAC have been looking £838 to clear as this is the full contractual amount. the timelines are similar to amigo, this was back in Oct 2018 when i took it out and defaulted Apr 2019. I requested the same as Amigo to retract the loan, clear my credit file etc….

To Loans2Go they responded within one day saying the following “Please note, Loans 2 Go have assigned all their rights, title, interest, and benefits in and to your account referenced above to PRAC Financial and outsourced to BW Legal

This means that Loans 2 Go no longer own the debt.

All future contact, queries, dealings, and payments regarding the debt should be made to PRAC Financial. They have a team of friendly agents ready to help. If you have any further questions regarding this debt, we kindly ask that you contact PRAC Financial using the details below”.

Surely the fault and or onus is on Loans2Go to rectify this?

Thanks

Charlie

Sara (Debt Camel) says

reply to Loans2Go that you are making an affordability complaint that this loan was not affordable in 2018 when they gave it to you. And say you will be sending the complaint to the Financial Ombudsman if they do not make you a suitable offer to settle it.

Charlie says

Hi Sara

Thanks, I have.

Are they correct though, that PRAC now hold all legal responsibilities or are they just trying to fob me off?

Thanks

Charlie

Sara (Debt Camel) says

You now owe the debt to PRAC. But it was L2G who missold you an unaffordable loan, so the complaint about this goes to them – if the complaint is upheld at the Ombudsman, L2G will have to sort out the balance with PRAC.

Roy says

My offer from them was to wipe 1300 interest that was left.. which I accepted.. not sure if was right decision … but accepted it

Darren says

Hi Sara.

I stupidly took a £300 loan out from Loans 2 Go in November 2023, when I thought I had no other options. I’m paying back £61.67 per month over 18 months which, as you can see, is ridiculous.

You mentioned new regulations for complaints made on loans taken out after July 2023 – is there something I should be aware of before using the above template?

Thank you.

Sara (Debt Camel) says

The template now contains an extra sentence for these more recent loans:

[only add this next sentence if the date of your loan was after the end of July 2023] “This loan does not represent fair value and it is in breach of the FCA’s Consumer Duty.”

Let me know what response you get to this complaint please.

Darren says

Thanks, Sara – I’ll keep you posted!

Dan says

Hi Darren, did you receive a response from them? I’m in an identical situation so I’m interested in what you heard from them.

Darren says

Hi Dan and Sara.

I’ve just received my final response today and perhaps unsurprisingly, my complaint has not been upheld.

“In the circumstances and after considering all the evidence available, I cannot uphold any aspect

of your complaint.”

I guess I now need to consider referring my complaint and their response to the ombudsman.

Sara (Debt Camel) says

What is there to think about? As you said, that is a ridiculous interest rate…

In your complaint to FOS, say “I do not think this loan represents fair value for money for any consumer and is in breach of the Consumer Duty. I consider Loans2Go have found a way to evade the payday loan price cap regulations. The price cap regulations were not intended to apply to loans over 12 months as longer term loans usually have the advantage of lower monthly payments. But in the case of this Loans2Go loan, the monthly payments – which continue for 18 months – are higher than the legal maximum a lender could charge for a loan that only lasted 12 months. There is no possible gain to the conusmer here from the longer term.”

Graeme says

I have only just came across this information,I have just taken out £2000 this year,and the interest on top of that is around £6000 to pay back over two years,I wasn’t properly informed of this and would never of taken it if I knew the interest was nearly £4000 on top of the £2000 I borrowed.I don’t know what to do I’m in a panic now

Sara (Debt Camel) says

I am very sorry to hear this. What other debts do you have at the moment?

Can you describe the process of taking out this loan – other people have also said it wasn’t clear to them how much interest they would pay. Can you say What happened and why you were Unsure?

Gina says

I took out a £1000 loan in 2019. Payments were £205 a month. Then not long after covid and lock down happened. Payments became unaffordable. Set up a payment plan. But then the interest kept going up. And I could no longer afford it. They don’t care. I defaulted a couple times through no fault of my own ( I emailed them the reasons) I was in a desperate situation when I took out this loan. I still owe £900 and because my payment was late they cancelled the new plan again. I’ve used the template to complain.

AQ says

Hello Sara,

I made affordability/irresponsible lending complaint to loans2go. They came back today and are offering £250 gesture of goodwill.. They rejected the complaint on all avenues but because of about £15k gambling transactions “ which I provided when I lodged the complaint” he offered this. What would you advice should I take it to FOS, I mean do you think I have a case for FOS. Thank you

Sara (Debt Camel) says

How large was the loan from them? When did it start? Do you still owe a balance?

AQ says

Principle £1000

Loan term 24 months

Total payable £3233

Total paid 3142

Loan settled about 2 months ago

Loan start date February 2022

Sara (Debt Camel) says

So this was a large loan. What would your credit record have shown at the time you applies – recent proiblems? increasing debt?

£250 is a pretty pathetic offer here – if you win the case at the Ombudsman you would get £2142 refunded…

Yoru choices are to pocket the £250 and give up, sent this to FOS or go back to l2G and say you would settle for a larger amount, eg £1000.

Jae says

I took a loan from L2go in 2021 for 1000 paid back 3690. I had multiple payday loans, CCJ and was paying bills from my overdraft every month. I made complaint Dec23 using your template and 3 weeks ago they offered 400 as a good will gestures. I refused went to FOS who said they did do right checks but did not basically look holistically at my spending. this week the fos agreed in my favour and said they should pay me back 2690 and the 8% interest. Thank you Sara your website has been extremely helpful.

Sara (Debt Camel) says

That is a very fast decision from FOS! Nice one.

Rob says

So thought I’d provide an update I received today from the FOS. Note that my decision was by an Ombudsman and not the reviewer. It’s pending a final response so could change but we’ll see how this goes.

I took a loan out for £1750 back in 2022 and had been paying roughly £236 per month. At the time I had a long history of taking out payday loans (some of which were repeated which I claimed irresponsible lending and won) others were simply repaid. I also had roughly £20k in credit card debt that had been increasing and was never below 95% total usage. What’s also worth noting was high levels of gambling at the time.

After submitting the complaint, L2G first offered to remove some of the interest going forward and that was it. They still wanted £1900 to repay the loan off (full interest would’ve taken the loan to around £5.5k).

I declined and sent this to the FOS. The reviewer agreed that L2G had actually done due diligence so I chose to go to an Ombudsman for formal review. This morning they agreed to uphold my complaint and took onboard everything I said.

They’ve instructed L2G to remove all interest, use any amounts paid already to be used to repay the initial loan amount then refund any overpayments with 8% interest. The amount due back would only be around £100-£200 but the good thing is the loan would be finished and any negative impact on my credit report would be removed.

Amy says

Hi, I have read through your advice here and also the comments.

I took out a loan with Loans2Go last year for £600. I fell behind on a couple of payments and without any warning got referred to United Kash Ltd who they use as a debt collector. I am now paying back almost £2000 to United Kash in monthly instalments. They are extremely aggressive and for example if I haven’t sent my payment to them by say 10am on the date agreed, they bombard me with emails/texts/calls threatening an attachment of earnings. Has anyone else had this? Do I have any wiggle room for a fight with these people? I’m going on maternity leave soon so it’s the last thing I want to worry about.

Totally take responsibility from my side of falling behind on payments.

Sara (Debt Camel) says

What date did you take the loan out? How large was it? What is the remaining balance?

What was your financial situation like at the time you took the loan?

What other expensive debts did you have? Any arrears on priority bills?

How large are your other debts at the moment?

Amy says

I took the loan out march 2023. The loan was for £600 and the balance is now £1700. Financial situation was that I have a poor credit rating and was behind on all bills really. This was never asked. Just needed cash to get by and these were the only lender that would borrow to me. The only checks they did were my bank details as I’d incorrectly entered my sort code. I have around £5k in other debt (utilities etc) but they are currently being managed with pay plans etc.

Sara (Debt Camel) says

I think you should send Loans2Go an affordability complaint using the template in the article above. And if your payment agreement with UK is for more than you can afford, saying you need it reduced.

I also think as you are going on maternity leave that you should talk to a debt adviser about all your debts, as you may need to reducece the payments to all of them. Phone National Debtline on 0808 808 4000 or contact your loacal Citizens Advice.

Dan says

I’m glad I’ve come across this. I took out a £300 loan last October, as I was a bit of a tight spot with money, and I was in the process of cleaning up my credit score. I’ve gone to look today about repaying the loan early as the payments seemed high, and they want £378 to settle it early after I’ve already paid £240 on a £300 loan. That means I’d have paid double the loan cost if I am to settle early and over 3 times as much if I stay for the course. I’m always going to stick to an agreement and I’ve had very little trouble with credit issues in the past, but loans2go strike me as unfair lenders, and the fact the balance still hasn’t reduced (when it’s infact increased) seems a bit unfair.

Sara (Debt Camel) says

How did you end up borrowing at such a horrible rate if you had very few credit issues in the past?

Danny says

I have a default marker on my account which I have stuck to repayments with for over a year, I think my credit utilisation was pretty high and I had another lender I was using quite regularly. I first took a loan with lending stream, then cashasap and then L2G, and I’ve since took out and cleared the ones with cashasap, and cleared 2 with lending stream but have 3 still running currently. I’ve always stuck with repayments but found myself taking another loan to cover the costs of paying others on more than 1 occasion. I’ve more or less paid everything off really, but when I noticed the cost of settling the L2G one early, I was a bit shocked that the balance had actually increased as opposed to reduced

Sara (Debt Camel) says

How large are your total debts at the moment including the L2G? Who are the lenders?

Danny says

If I am to settle them all today would be around £1000 to L2G and lending stream. But on my credit file, L2G shows me as owing £925

Sara (Debt Camel) says

Then I suggest you send affordability complaints to LS, cashasap and L2G.

but you have no other debts at all? credit cards/ overdrafts? that is really unusual.

Danny says

I have an overdraft which I use, but I come out of every month. I have a credit card with a £200 limit

Emily Goodall says

Hi – I have emailed loans to go today with the template provided.

I have had a response within 20 mins with a lengthy reply, stating that I need to speak to united kash however it’s hellix that are emailing me threatening a ccj and applying for an attachment of earnings.

They have refused any refund.

Sara (Debt Camel) says

How large was the L2G loan? When was it taken out?

What other debts do you have at the moment?

Emily says

Hi Sara, the loan was for £250. Interest rate at 770% I have a ccj with £384 outstanding, multiple repayments to lowel for 15 other separate debts, 2 x William accounts and a credit card. Currently my debts are a total of around £4000 – this however isn’t including a child tax credit over payment that I am repaying for £4000

Sara (Debt Camel) says

i think you should talk to a Debt Adviser about your options for all your debts, including the tax credit overpayment – phone National Debtline on 0808 808 4000. If a DRO is your most suitable options it will clear all the debts, including the CCJ, the tax credit overpayment and the L2G horror.

In the meanwhile, send the L2G debt to the ombudsman, but you cannot rely on that working and even if it does, you are still in a total financial mess.

K adams says

I have done an affordability complaint and they only offered just over 800 pounds off a 4000 debt i asked for the subject access request which shows that i had several other debts and a ccj but they claim they did all the proper checks and deemed the loan affirdable i rejected the offer they made and asked if they would reconsider the offer and they have said if i want the.m to reconsider the offer then i need to send 2 months banks statements from the date the loan was issued should i send the bank statements ?

Sara (Debt Camel) says

what is your current balance?

are they asking for the 2 months before or after the loan?

K adams says

Current balance is 3400 and they are asking for statemwnts 2 months after

Sara (Debt Camel) says

I don’t think you have much chance of getting them to make you a good offer on this so I wouldn’t waste your time – just send this straight to the Ombudsman.

When did the loan start?

K adams says

The loan started in jan 23 and they didnt ask for bank statements during the application or phone me

Sara (Debt Camel) says

ok I would send it straight to the Ombudsman with 6 months of bank statement – 3 before the application and the 3 after.

K adams says

I will thank you

Rob says

Just had it confirmed this morning that the ombudsman has upheld my complaint with L2G. Main reasons being they didn’t perform sufficient checks and should have checked bank statements etc.

Had L2G done this, they’d have sufficient evidence of being unable to manage finances and evidence of gambling. Their defence of “he confirmed he wasn’t gambling” was dismissed and criticised as pointless.

For anyone who had a relatively high level of debt to earnings, those who have a history of repeated high cost lending and those who have gambling addiction, I’d urge you to complain.

Rob says

I’ve been getting hounded over my loans2go balance of £3376.80 for years by different companies as the debt is clearly being sold between collection agencies. The latest is Hellix which have emailed today stating that they intend to apply for a CCJ and attachment of earnings if I don’t respond in 30 days. The debt however is from 2017 and the last payment towards the debt was made 24/4/2018 and it looks like a settlement letter was requested 08/05/2018. Does this mean that 08/05/2024 is when the debt is statute barred? And is that why it seems like efforts are being ramped up to enforce the debt through court?

Sara (Debt Camel) says

Talk to National Debtline on 0808 808 4000 about whether this debt is coming up to being statute barred. And tell ND if you have been sent a Letter Before Action/Claim

Tracy says

Hi Sara,

Please Help !! I had loan with these rip off merchants L2GO back in December 2019. I could never afford this borrowed £250 paying back £1208.52 back !! I remember on the online form it was very misleading as some areas were greyed out wasn’t till after I properly read it & to me horror saw 18th months & the interest !

I was severly in finianicial trouble & needed it unfortunately. I did then miss payments & it was passed to United cash to recover. I paid it all off but have default because it. Now I’m in such a better place financially I need to get this removed & complain how I was taken advantage of like many other in desperation.

I contact L2GO by email but they said we can’t help you as United cash took the debt on. Where do I stand with please ? Any advice would be greatly appreciated 🙏

Delete my surname please !!

Sara (Debt Camel) says

This has nothing to do with the debt collector, Lons2go should not have told you that.

I assume L2G said you could go to the Financial Ombudsman. It’s easy to do.

Tracy says

Thanks for replying. No they never said anything about the financial ombudsman. Is that who I should now contact instead of L2G ?

Sara (Debt Camel) says

That is very poor of them.

Go back to L2G and say is that their final decision, because you will be sending this to the the Financial Ombudsman if it is.

And when your complaint does go to the Financial Ombudsman, include in it these lines in addition to you original complaint about unaffordability: “I also want to complain about Loans2Go’s poor complaint handling. They told me to take my afford ability complaint to the the debt collector for this loan, which I am told is incorrect as I am complaining about the original lending decision. they also failed to tell me of my right to take this complaint to the Ombudsman. This is a very poor way to handle complaints, it is misleading and inbreach of the Consumer Duty, so I would like to ask for extra compensation for that.”

Rob says

I’m getting some very unsettling emails from Hellix regarding my loans2go debt from 2017, i’ve just had a pre-litigation email from them.

the last payment i made on the account was 25/04/2018 however i sent them this email on 08/05/2018:

To whom it may concern,

I am making a complaint to you about irresponsible lending. To help me explain the details, I would like a list of my loans, showing when they were taken out and how much was repaid when. Please note I am only asking for details of my loans, I am not making a Subject Access Request.

Does this mean my debt will be statute barred on 25/4/2024 6 years after the last payment, or will sending that email extend the deadline to 08/05/2024?

Thanks

Sara (Debt Camel) says

Talk to National Debtline on 0808 808 4000 about this.

Eleanor says

My son took out a L2G loan for £2,000 in August 2023. He has only just told me as he knows I would not be happy after working in the debt advce sector for over 20 years and finaicial litigation since 2019. I have done some work with unaffordable lender but didn’t know how the landscape might have changed.

The story is that he needed a loan, I think he may have said for a car, not sure but it was to pay rent and household expenditure. He wasn’t asked for proof of income, as he doesn’t work and there were no financial affordability checks that I am aware of. I know that at the time he had a default notice on his aqua card.

Is the above template okay to use or do I need a different one as it is after July 2023

Sara (Debt Camel) says

He can use the above template – there is an optional sentence in there that he should include as his loan was after July last year.

Eleanon says

Many thanks Sara. I will keep the group updated

Lousie says

Hello,

I took out a loan with L2G last May for £1700.00 with the amount repayable being £5494.32

Prior to this I had taken out a store credit account missing 4/6 payments and continuously taking out other payday loans. I also have 2 maxed credit cards with promise to pay agreements in place. Thanks to your template I have finally had the courage to email about irresponsible lending. I sent an email today and await their reply.

Natalie says

It’s REALLY scary reading all of these comments.

When I took a loan with Loans2go I had NO money, I was a mature student with little other money and dependents, multiple other cards and small loans, missed payments the lot. My credit score was very poor.

I actually don’t recall directly applying to them, but for a small loan, I suppose through a broker, to get me through a few days until I received my student finance. A few days later £700 appeared in my account from loans2go, but I had no idea of the interest rate etc and I ended up not being able to keep up with the repayments and defaulting on other things.

I am still attempting to sort out all of my debt issues but have now sent a complaint to them so fingers crossed I get a response.

Natalie says

Just as an update – I heard back quite quickly and they said my debt had been sold to Hellix and I needed to contact them. I replied to their email stating my complaint was not about any money owed but about unaffordable lending, to which they replied they had referred my complaint to their customer complaints department. This was about 3 weeks ago and I’ve not heard anything since so I intend to chase this up.

Sara (Debt Camel) says

you can send your complaint to the Financial Ombudsman if you haven’t had a reply after 8 weeks

Mark says

My complaint was not upheld. I guess I take this to Ombudsman. What sort of evidence do they need? What is it they are going to take from my bank statements etc? thanks

Sara (Debt Camel) says

I don’t think you have posted here about your case before.

Bank statements for 3 months before and three months after is best – this is evidence that the loan was unaffordable. Plus a copy of your current credit report.

K adams says

My complaint about loans 2 go hasnt been upheld i did ask loans 2 go for a dsar what sort of things should i be looking for on that that would show they didnt do their checks correctly

Sara (Debt Camel) says

Just send this straight to the Ombudsman. That is an extremely large loan – they should have checked carefully.

S Nat says

I just wanted to thank you, I stupidly took out a loan from this company in Sept 23 for around £1700 I was horrified when I saw I’d be paying back over £5k.

Reading through I saw that I could complain before this was paid so I did my complaint wasn’t upheld so I went straight to the ombudsman with 3 months of bank statements before and after the agreement date to show they had not conducted the correct checks, I had council tax and utility debt.

The ombudsman decided in my favour and I was awarded the money that I had paid out on top of my loan amount back around £138 but the best bit they were told to clear/write off just under 4k of interest.

So put those letters in.

Dave says

Hi

I had several loans with Loans2go but can’t access my online account how do I find the details out

Thanks

Sara (Debt Camel) says

Just send them a complaint and add a sentence asking for the the details of your three loans.

Dave says

Great thanks

Nathan says

I recently used your proforma with loan2go saying how they basically shouldn’t have lended and requested i am refunded my interest. They have provided me with a response basically saying they done everything correctly and are not on the wrong but have offered me a “£100 goodwill gesture” What would you advice moving forward? Do i accept or refuse? I paid my loan off a year or so ago however did struggle at the time keeping up payments.

Sara (Debt Camel) says

how large was the loan and how much did you repay?

nathan says

So i borrowed £1500 over 24 months and due to payback £4848 but got rid a bit earlier, paying £4040

Sara (Debt Camel) says

How bad was your situation when you took the loan?

Nathan says

I mean back then it was pretty bad, i think i had multiple loans out plus car finance etc

Sara (Debt Camel) says

well you would get back 4040 less the 1500 you borrowed, plus about 8% extra interest if you win the case at the ombudsman. If you struggled to keep up the L2G loan repayments I suggest you take the case the ombudsman as the amount you have been offered is tiny.

Agnieszka says

Hello . Two years ago I took out a loan from them of £650. There was 2,400 to pay! I also have other loans and generally had a bad credit history when they gave me this loan. I paid as much as I could, but I still have to pay 1,650 pounds. Today they sent me an e-mail saying that if I don’t pay the full amount immediately, they will take me to court. I’m on maternity leave, I have no way to pay. I sent the above template but I’m very afraid…

Sara (Debt Camel) says

They shouldn’t take you court while you have a complaint in progress. If they reject it, send it to the ombudsman straight away so your complaint continues.

They also shouldn’t take you to court before sending you a formal Letter Before Action/Claim. See https://debtcamel.co.uk/letter-before-claim-ccj/ for one of these looks like. Let me know if you get one.

Do you have a lot of other problem debt as well?

Agnieszka says

They send me 1 month ago Final Demand letter and now they say like they can take me to the court ..

Sara (Debt Camel) says

have they sent you a Letter Before Action/Claim?

Agnieszka says

Only a final demand for payment and now this e-mail

Please note that this letter constitutes notice to you that we may now commence proceedings to issue legal proceedings for the recovery of monies owed or if applicable, commence proceedings for the recovery of the security vehicle. If proceedings are issued you will become liable for additional costs involved.

Should obtaining a County Court Judgement (CCJ) be the only remaining method of recovering the money you owe, we may seek to enforce such payments in the following ways:

• Attachment Of Earnings – Contacting your employer and instructing them to make payments directly to Loans 2 Go from your wages;

• Charging Order – Securing the debt against a property you own;

• Warrant of Execution – Instructing a County Court Bailiff to attend your residence and recover goods to the value of the debt owed.

If you wish to settle the outstanding liability and avoid any of the aforementioned actions, please contact us without delay.

Sara (Debt Camel) says

so to be clear, you have NOT had a Letter before Claim/Action? That would have had enclosed sever attachments including one that said Reply Form.

If you have had a response that is too long, post what seem to be the most important bits here.

Agnieszka says

No , I didn’t get that letter .

Today they send me this

Please be advised, the amount borrowed was £650.00 agreed to be repaid in 18 equal payments of £133.61 totalling to £2,404.98. You have paid so far £766.70 therefore, your total outstanding balance is £1638.28.

As your loan expired in November 2023 we are not able to generate Early Settlement Figure so amount of £1638.28 is require to be paid to close the account.

However if you are experiencing financial difficulties we are more than happy to assist you in setting up a suitable arrangement that is both affordable and sustainable, however before we take any further action you will need to complete an affordability assessment.

We are sorry to learn that you have been dissatisfied with the service. I can confirm we have passed your complaint to our Customer Satisfaction Department for a full investigation and response.

Sara (Debt Camel) says

I suggest you reply to them saying:

I am disputing this debt as I believe it was mis-sold to me and you did not conduct adequate affordability checks.

I remind you that CONC 7.14.1 says ” A firm must suspend any steps it takes or its agent takes in the recovery of a debt from a customer where the customer disputes the debt on valid grounds or what may be valid grounds.”

Also that although you said “Please note that this letter constitutes notice to you that we may now commence proceedings to issue legal proceedings for the recovery of monies owed” I note that you have not yet complied with the PRE-ACTION PROTOCOL FOR DEBT CLAIMS bu sending me a Letter Of Claim.

Agnieszka says

Welcome back. I received a reply from them offering to reduce the balance to approximately £1,200. This is less than £500 difference. I’m on maternity leave and I can’t afford it. I don’t know what to do in this situation.

Sara (Debt Camel) says

I suggest you reply saying that unless the6 agree to wipe the remaining balance your complaint will go to the Ombudsman. Point out you have already repaid more than you borrowed.

Agnieszka says

Can I ask for a template on what to write to the Ombudsman?

Sara (Debt Camel) says

The ombudsman form asks you questions. You can use bits of what you wrote in the complaint to loans2go to answer some of these

Dave says

Loans2go have sent me my SAR but it only includes one loan which was my most recent should it not contain info on all my loans? Had at least 5 or 6 going back over 2 years but won’t allow me access to the website to check.

Sara (Debt Camel) says

Yes, go back to them and ask for the rest of the information.

You may Also be able to see it on your credit record.

JDB says

This company has ruined my life with the harrassment and interest loan taken out when struggling with mental health and homelessness. Please anyone affected complain and go to the ombudsmen this company needs financial reprocussioons.

Dave says

Hi I submitted a complaint to Loans2go who have offered the standard £75 compensation. My loans are below and the figures where I paid no interest were because I cancelled them on the day after gambling and winning. The other loans with low interest were as I paid them off early with other loans. The total interest is £415.69, is it worth taking it to the FOS?

15/07/20 £250 paid £276

17/11/20 £250 paid £285.50

14/04/21 £250 paid £262.79

16/08/21 £300 paid £300

18/05/22 £250 paid £269.67

30/01/23 £600 paid £764.94

07/11/23 £500 paid £500

11/12/23 £500 paid £656.79

Sara (Debt Camel) says

Well this is up to you. It’s hard to guess what the Ombudsman would say.

Michael says

SUCCESS STORY !!

After using the template from debt camel I put a complaint into L2G in February regarding my £800 loan in 2018 that required me to pay back around £2,400.

As expected, they rejected my claim and said everything was done properly on their end so I decided to pursue the claim via the ombudsman. After a couple of months of back and fourth I finally reached an agreement today where they are going to wipe off the entire debt left to pay, reimburse all payments made to the debt collection agency (just under £300) and to remove the negative mark on my credit file.

I have to give so much thanks to DebtCamel for providing the templates and always being available when I had questions. I still have 1 more loan 2 go which is with another loan company. But I’m over the moon that I can put this all behind me now.

Thanks again to DebtCamel. The best 🫶

Matt says

I took out a L2G loan in Aug 2020 for £250 with a repayment of just over £1000. At the time of taking out the loan I had defaulted on a credit card and a bank loan for £11k. I struggled with payments and the loan defaulted in Jul 2021. As of now I still owe £334 however the loan has been sold to a third party debt collector.

I put an affordability complaint in and have recieved a final response letter saying they don’t uphold the complaint as they said they did everything right, however as a good will gesture they are willing to settle the remaining balance of £334.

The original default is still on my credit report but the third part debt collector isn’t and I have never been contacted by them.

Do you think it’s worth going to the FOA to get interest refunded? They said they did a credit check and an affordability check but surely my 2 defaults on my report would have raised red flags

Sara (Debt Camel) says

How much have you paid to L2G so far?

What happened to the bank loan you defaulted on, have you looked at a complaint against them too?

Matt says

So I have paid £631.05 to L2G and have paid £55 to the third party debt collector (this was a payment through my IVA which is now been discharged).

I have complained about the bank loan to Barclays which they didn’t uphold so it is currently with the FOA.

Sara (Debt Camel) says

So the L2G debt was in your IVA and has now been wiped? Then what does “as a good will gesture they are willing to settle the remaining balance of £334.” mean as there is no remaining debt? Are they offering to refund you that much in cash?

Matt says

No I didn’t complete the IVA, I cancelled it early so there is still £334 remaining on the debt. I’m not sure whether to just accept and get the loan paid off or to go to the FOA to try and get them to admit fault, get interest repaid (around £400 cash refund after loan is paid) and get the marker removed off my credit file.

Sara (Debt Camel) says

It can’t be guaranteed that you will win at FOS. It’s your choice whether this offer is good enough to accept now

Nikki says

I took out a £250 loan on 28.07.23. So far I have repaid £565.51 and still have £359.51 left to pay!! I have sent the template to them and hoping for a helpedul response.

Sara (Debt Camel) says

let us know how it goes!

Nikki says

I’ve had a really long response. To which I don’t understand most of, due to the professional wording,, but from it I’ve got that they believe I could afford this loan and that they will do nothing

Sara (Debt Camel) says

Send it to the Ombudsman.

Nikki says

Just as an update I went to the ombudsman, it took ages and they’ve got back to me today that the loan was fair and loans2go do not need to take any action

Hen says

In 2022 I was desperate for cash and with having a low credit score, was backed into a corner of having to take a loan out for L2G, I lent 2000 for 24 months, the monthly payments was up towards 300 a month, after a month or two, they payments became to effect me and I got a reduced payment plan, but I’d already racked up some amount of arrears, I am still currently playing the loan, I have paid 3000 back, but I still owe 3600 in arrears. I had history of struggling with other loans and yet this company still decided to accept me on a 2000 loan although i had a bad history of credit. I have only just realised you could complain, as i always put it down to me being an idiot and I should have to pay for this mistake, but since seeing this page, I have realised that maybe it wasn’t all my fault, I have today sent an email of complaint and I hope I can solve this massive weight off my shoulders!

Michael CP says

I guarantee you now that they’ll say they did nothing wrong. Don’t be discouraged and just take it too the ombudsman. Call the ombudsman as well, don’t email. I found it so much easier talking about the situation rather than trying to cram everything into an email. Also they tend to pass your case on quicker.

I’m not going to say you will in the end, but don’t give up when they say they’re not at fault because they will say that because they did to me and you can see my success story a couple of posts up from yours. But good luck

Ben says

Yeah I got a reply before saying they’re passing it to the correct team but they was basically saying they had done all the correct checks etc, but no other company at the time would accept me for a loan but L2G, but I was backed into a corner where I had no option to use them, would you recommend going straight to ombudsman then??

Sara (Debt Camel) says

you cant go to the Ombudsman until they have rejected your complaint.

Ben says

They sent me a email after I sent the template and they basically sent a email saying all the correct checks had been done, and they can’t refund no interest.

Then they sent this “ We hope that this email finds you well.

We are sorry to learn that you have been dissatisfied with our service. I can confirm we have passed your complaint to our Customer Satisfaction Department for a full investigation and response.“

Does this mean they’re looking into it or they’ve rejected it, as the first email was just them saying how they’ve done everything fairly etc

Sara (Debt Camel) says

That is not a reply to your complaint. When that arrives, it will say you have the right to go to the Financial Ombudsman. If you have nor received a reply with 8 weeks, you can send the case to the ombudsman at that point.

Have you also made complaints about your other loans? L2G may have been the worst, but other loans too may have been unaffordable. See https://debtcamel.co.uk/refunds-large-high-cost-loans/. Are you in financial difficulty at the moment? If you are, then i suggest you talk to StepChange (https://www.stepchange.org/how-we-help/debt-management-plan.aspx) about a debt management plan for all of your debts. Winning any affordability complaints will then speed that up.

Ben says

I currently don’t have any more, I have settled and paid my other two! This is is the one that’s been causing me the most issues, I took this loan out on 2022, 2000, and the repayment was 6560 and I’m currently still paying it, a friend had recommended looking into making a unfair lending complaint, which is when I found this site. Which I was going to before finding this site, I was going to just paid for what they asked, I even asked for a early settlement figure before finding your site, and they was telling me I couldn’t have one, because I had been put on a payment plan with smaller payments, so they wanted the full amount to close the loan. Luckily I found this site and didn’t pay the final figure

Sara (Debt Camel) says

You can still make an affordability complaint if you have repaid a loan. If the other two loans were the start of your problems, then complain about them too!

Ben says

Oh really! I’ll do this also! Thank you for the advice

Ben says

So I have had a reply off loans2go, my loan I took out was 2000, current balance was 3602 till the loan is paid, I have currently paid 2860 as I had to shorten my payments due to them being so high each month. But they have offered to make the remaining balance 1817, 40% off. This is their first offer, how would you respond to this, I don’t think it’s the best of offer as by the end of that would have still paid 4677 in total, what should I reply to them? Should I take it straight to ombudsman?

Sara (Debt Camel) says

did you also complain about the 2 previous loans?

Stephanie says

I logged a complaint against loans 2 go. I received a case handler on Monday and a deicidon was made on Thursday that Loans 2 go should have not given me the loan. They have 2 weeks to reply. What is the likelyhood that they counter argue? Also how long does it take to receive money owed back from them? I also have a DD coming out of nearly £300 for my next payment. Can I reach out to them to pause this – while I await their response , the payments are crippling me.

Sara (Debt Camel) says

I’m sorry I can’t guess at the probability.

If the loan is upheld, will the balance be cleared?

If you cant afford to make the next payment, then you need to cancel and ask for a payment arrangement. Ig L2G wants this to go to an Ombudsman, it can take months.

Len says

Hi, I submitted a complaint yesterday using your template and they’ve got back to me today saying in summary that everything that they’ve done is fine and that I’m able to either request an early settlement figure or request a more suitable arrangement of how I should payback the loan but doesn’t mention anything about refunding the interest or charges which was the main thing I was hoping for.

I took out the loan of £500 out in November 2023 in desperate need of some cash but didn’t realise the interest was so high and now I’ve paid back £1,130.58 already but still got £719.46 left to pay.

I just wanted to ask how I should reply next for the best possible outcome or if I can take it to the Ombudsman after this response ? I know little to nothing about these loans or that you could even complain about them so I’m really grateful for the information you’ve provided!

Sara (Debt Camel) says

send it straight to the Ombudsman.