Loans2Go offers what I have called the worst loans in Britain.

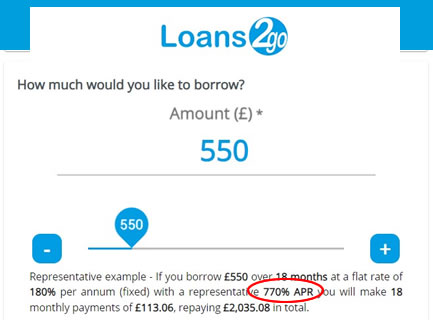

Since 2021 they have been charging 770% APR. See the representative example Loans2Go quotes on its website:

- £550 borrowed for 18 months is a monthly payment of £113

- this adds up to £2035, a bit less than four times what was borrowed.

Contents

MUCH cheaper to get a payday loan than a Loans2Go loan

Of course Loans2Go don’t point this out on their website, but check out these numbers!

With a payday loan for £550, the maximum interest that could legally be charged is £550 – the amount borrowed. So you would only have to repay £1,100 – the £550 borrowed plus the £550 interest. And the monthly repayments for a payday loan for 12 months can’t be more than £92.

So you would pay a payday lender £92 for 12 months

but Loans2Go is charging MORE PER MONTH (£113) for MUCH LONGER (18 months).

Loans2Go also used to offer logbook loans, but this article is just about their standard personal loans. If you had a logbook loan from them, use the template on this other page.

Is this legal?

The Financial Conduct Authority (FCA) calls payday loans “High Cost Short Term Credit”. Its definition of High Cost Short Term Credit is a loan over 100% in APR and of 12 months or less.

So the Loans2go loan is outside that definition because it is 18 months long. So it isn’t caught by the price cap rule.

Unfortunately, this means its loans have crept through a loophole and are legal. I think the FCA should close this loophole.

Many people are winning affordability complaints about Loans2Go loans

I think this is the worst loan in Britain.

A loan is unaffordable for you if the monthly repayments were so high you couldn’t afford to pay them without hardship, borrowing more or getting behind with important bills. This is a standard affordability complaint, used for many other sorts of loans. If you win this you will get a refund of all the interest.

Because Loans2Go loans are so expensive they are often unaffordable. Many people are winning Financial Ombudsman (FOS) complaints about these loans – here is just one example: Miss R’s personal loan provided by Loans 2 Go.

No-one who isn’t desperate would take one of these loans out, and the ombudsman says Loans2Go should make more detailed checks on affordability when it thinks the borrower may be in difficulty.

Several people have said they were not given the full details about the loan before the money was given to them. If this happened to you, say this in your complaint as well.

First complain to Loans2Go

It doesn’t matter if you have repaid the loan or you are still paying, you can still complain.

You have to complain to Loans2Go first, you can’t go directly to the Ombudsman.

Email customerservices@loans2go.co.uk and copy it to ps@loans2go.co.uk. Put AFFORDABILITY COMPLAINT as the title.

Use this template as a basis and make any changes so it reflects your case:

I am also complaining that the interest rate was grossly excessive. It is unfair to charge someone more per month over 18 months than they would have paid to a payday lender for a loan the same size over 12 months.

[only add this next sentence if the date of your loan was after the end of July 2023] This loan does not represent fair value and it is in breach of the FCA’s Consumer Duty.

[only add this if you were not told the loan terms] The loan was not adequately described to me before I was given the money. This is an unfair way to give high cost credit.

I am asking you to refund the interest and any charges I paid, plus statutory interest, and to delete any negative information from my credit record.

[delete if you have repaid the loan] I would also like an affordable repayment plan to be put in place if I still owe a balance after this refund.

I am also making a Subject Access Request (SAR) for all the personal information you hold about me including, but not limited to, my applications, all credit and other affordability checks, a statement of account for my borrowing, and a record of all phone calls.

Let me know in the comments below if you are making a complaint about a loan that started after the end of July 2023, as there are some new regulations about those.

Is an offer from L2G a good one?

If L2G has offered to wipe a small balance or take some money off what you owe, you have to decide whether this is a good enough offer to accept.

For example, they may offer 50% of the interest off “as a goodwill gesture”. Or to reduce your balance by 50%. These are often very poor offers, you could get a lot more by going to the Ombudsman.

Sometimes Loans2Go will increase an offer if you push them. Here is what one reader said:

They replied firstly with the offer to half what was left and agree a payment plan and I refused and they immediately came back and wiped the loan clean and removed it from my credit file.

It’s up to you what you think a good offer is. But you can’t change your mind later if you accept and then think you shouldn’t have.

So ask a question in the comments below if you aren’t sure.

Take a rejection or a poor offer to the Ombudsman

You can send your complaint to FOS if Loans2Go has rejected it or has made you a poor offer. This is easy, just use this simple FOS form which asks you what they need to know to set up your case.

Send your bank statements to the Ombudsman – 3 months before and 3 months after the date of the loan. These are the best evidence that the loan was unaffordable for you.

Jack says

I’m struggling with loans2go and wondering if I can get some advice.

I took out a £250 loan in November 2019 and still have a balance of £850. I made a complaint about affordability as it was the last of 12 loans I took to fund gambling which was denied. I’ve since escalated to ombudsmen but seems to be a big backlog of cases.

I’m not too sure where I stand. Other lenders I’ve contacted that gave earlier loans have agreed to remove interest and credit listing but loans2go are having none of it. Any advice would be really welcome.

Sara (Debt Camel) says

There isn’t anything you can do to speed the FOS complaint up.

Are you still making payments? Are they manageable?

Jack says

I’m making payments through a DMP currently and they’re manageable. I think my best bet is to continue with that and wait on the ombudsmen. I’m amazed this company is allowed to so blatantly avoid rules on extreme interest by increasing the length of the loan.

Sara (Debt Camel) says

ok, can I ask what the debts in your DMP add up to? and how much are you paying a month?

Jack says

I’ve been making payments for a while and my current balance is just over £1600. Paying £275 currently so hoping to be clear by late spring.

Thank you

dvid says

Hi I have complained with the fo and they’re initial recommendation is that they agree with me and l2g should pay me back the interest and remove the default. I’m guessing l2g will disagree with this. I’m just wondering how likely it is that the ombudsman will disagree with the initial investigation when making a final decision?

luc donato says

could you please help about a personal loan provided by Loans 2 Go Limited in

December 2018. L2G is saying that i owes £3,850.00 when

i only borrowed £900. im having difficulty repaying her loan. it was 12 month and changed to 18 month

Sara (Debt Camel) says

So you applied for a 12 month loan but they gave you an 18 month one?

This is a normal loan, nothing to do with your car?

Lindsay says

Hi, I took a loan out with loans2go while manic ( I have bipolar and ended up sectioned in hospital. I am obviously responsible for the debt but wasn’t in my right mind to read the T&C properly, i borrowed £250 and have offered to pay £500 to settle the account, money I’m borrowing off my family as I’m currently on ESA (temporarily I’m hoping to find a job soon) Is my offer reasonable? Do they need a good reason not to accept it? Thanks in advance for any advice

Sara (Debt Camel) says

when you took the loan, could you afford the repayments without getting further into debt?

Have you made the repayments so far?

do you have other problem debts as well? are you behind with any priority bills?

Danielle says

Want to say thank for all your efforts and the great advise you provide here it’s really very much appreciated!!:)

I have been dealing with Loans to go for several months now in an attempt to have them clear their interest charges on an affordability basis complaint.

The loan was taken out by my brother back in 2019 for the amount of £1000 to be paid back over 18months with total of £4000 to be paid back. My brother has an awful credit record to the extent of not being able to get a phone contract under his own name. At the time they issued the loan he was also in difficult financial circumstances already £1000 in overdraft with his own bank and incruing further unplanned overdraft charges. Nearly £800 has been paid back to date but they still want a further £3500. I have discussed all this information with them and sent the relevant bank statements but they are refusing the complaint stating that they have ‘confirmed they have not erred in their decision to grant the loan and that is was fair’?! His financial situation is not much better to date and he has small amounts still outstanding with two other payday lenders dating back before the loans 2 go loan, i honestly can’t wrap my head around how these poeple are able to give out money under such terms to people with situations like this!!

I just wonder if you think we have a case to escalate this with the ombudsmen?

Thanks kindly for any advise you have

Sara (Debt Camel) says

yes, send this straight to the Ombudsman.

Also look at helping him with payday loan complaints?

And that overdraft, does he still have it? how much does he use every month?

Danielle says

Thanks Sara, was feeling at a loss with the situation as getting nowhere with Loans to Go themselves. I mistakenly made the initial complaint by telephone before coming across your information and they responded with a lengthy letter, with a lot of fancy statistics they had used to work out the loan was affordable. Then i emailed his bank statements and explained the situation, and had to chase them for a reply which was that they are upholding their decision.

The payday loans that i’m aware of are old from companies that have gone into liquidation that creditors are trying to revover.

He still has an overdraft of £1000 which he uses every month and incrues a charge of £100 when he exceeds this amount. That was the situation he was in with unplanned overdraft charges at time of taking out the loan, which they mentioned flagging up in his credit check, stating ‘your credit report was on the whole very positive. Whilst i admit there is some adverse information, this would normally be ecpected given the type of lending that Loans2Go provide’.

Thank you again, i will pursue this with the ombudsmen hopefully have some more luck with them.

Martin says

Iv recently complained and they have offered to cut my interest owed by 50%, should I accept it

Sara (Debt Camel) says

can you say some more about your loan – how large was it? was it your first from them? how much have you paid so far? what is your balance and what are they offering to reduce it to?

L2G can often be persuaded to “improve” offers so it’s worth thinking about this.

Martin says

Loan was for £300, made 5 payments , balance left is

Current Balance: £801.38

Proposed Write Off Amount: £405.03

Proposed New Balance: £396.35

They say reduce it as a good will gesture

Sara (Debt Camel) says

how large are the payments?

Martin says

£61.67 a month for a total of 18 months, Iv made 5 payments

Sara (Debt Camel) says

ok so you have already paid off the amount you borrowed.

If this was a payday loan, then you would have to repay another £300, they are suggesting you should pay £396.

Your options are:

1) to accept their offer

2) to reject and send it to the Financial Ombudsman. For a £300 loan it isnt always easy to guess what FOS would say. But L2G will be hit with a £650 charge if you so this, whather the decision on the case is, which is why they may be prepared to compromise.

3) to offer some compromise – eg you will accept this if they reduce the balance to £200 , or £300.

Lindsay says

Hi I can’t find my original comment but I got a reply asking me some questions, I’ll just recap, borrowed money £250, while manic (have bipolar) NOT using it as an excuse. I know I’m responsible for the debt. I do feel like I wasn’t in the right mind to understand the interest and terms though, regardless I’ve paid just over £700 altogether. Tried speaking to them to see if they would take that as final settlement (they wouldn’t but thought I’d try!) I’m on benefits after losing my job after I took the loan out, so my income has reduced by a great deal so am now struggling to pay my priority bills as my payment to loans 2 go is £54 a month. I’m surprised they lent to me at all since I had only been with my employer for a month so still in the probation period, but I guess they still saw it as a regular income and it was at the time

Sara (Debt Camel) says

apart from this, do you have other problem debts?

Lindsay says

Thanks for the response

Yes I’m 20k in debt actually, I made some very bad choices In the last ten years, I get ESA and PIP at the minute (because of my mental health conditions) but it’s not a big amount, so im in agreements with most of time creditors but the payments are low

Sara (Debt Camel) says

In that case I think you should go back and say you have already paid much more interest that you would with a payday loan, say you are unemployed and have problems paying your priority bills such as [rent? council tax? energy bills? and food?]. Say you want them to clear the debt or you will be sending it to the Finaical Ombudsman who may order you to get a refund. Add that you canniot afford to pay them anything at the moment so you are canceling the direct debit to them (if that is how they are taking the money?)

But really I think in addition to this you need to talk to a good debt adviser. Because 20k is a mountain of debt and it won’t be helping your mental health. If your only income is benefits at the moment and is likley to be for a while, then a debt relief order may get you a clean start, see https://debtcamel.co.uk/debt-options/dro/. I suggest you phone National debtline on 0808 808 4000.

Lindsay says

Thank you for the advice

Net says

Hello Sara, Do you have any advice for CashFloat. I got a loan last month for £500, I’ve missed my first payment which is £202, I’m really struggling and in payment plans with other lenders.

Sara (Debt Camel) says

Can you say some more about your situation? Are you in work? Do you have priority debts – rest, council tax, energy bills etc! Do you have a lot of other high cost borrowing? Have you added up the total amount of your debts?

Nets says

Thank Sara, for responding

This is my first post so I hope I’ve followed the guidelines and posted in the correct place.

I’m working but on low salary. I have other borrowing Credit Spring, Fund Ourselves and Mr Lender. Cashfloat gave me the loan extremely quickly, i had already missed payments with Credit Spring and Fund Ourselves. Cashfloat seem very aggressive.

Any guidance would be appreciated. I suffer from anxiety and this issues is not helping.

Best wishes and thank you

Sara (Debt Camel) says

Suppose all those 4 debts you have mentioned weren’t there….

Do you have any other debts? Overdraft, catalogues, Klarna, anything else?

Could you manage your money then, or don’t you have enough for your expenses?

Sara (Debt Camel) says

I am asking because I am not sure if it is the expensive debt that is the cause of your problems or there is something deeper.

Shaun says

Hi

I had a loan 18 months ago from L2G. I took out £300 and have paid back £1234 in total. I have now cleared the loan and made a complaint. I’m being offered £250 in compensation. Should I accept this or refuse the offer? Would I get more if I refused? Would the offer disappear if I went to the ombudsman and they ruled against me?

Please help.

I have 6 days to respond.

Many thanks

Sara (Debt Camel) says

You could go back to them and say you don’t think £250 is enough – that if you had taken a payday loan you would have had to repay £300 in interest, so £300 overall, so you would be happy to compromise on a refund of £500?

I can’t tell if they would accept – they do seem prepared to compromise so this could be worth trying.

It’s unpredictable what may happen at FOS – you could win your case and get £934 back. The Ombudsman could say £250 is a reasonable offer and you should accept it. Or they could withdraw the offer.

sarah says

did you accept the offer? I have been offered a £300 “good will gesture” for my 2 loans taken out… I have already paid 3 times what i borrowed, they are writing off the rest of the payments owed and paying me £300. i have just sent an email to accept. I was in the same position as you are in, and wondered if you went back to them and what did they say?

A sheeran says

I recently took out a loan with this company ..it wasn’t adequately explained to me about the 770% apr ..

The funds were literally in my bank account before I finished reading the fine print …this interest rate should be illegal no doubt

Sara (Debt Camel) says

Are the repayments affordable for you.

A sheeran says

Not at all ,I’ve just been made unemployed and it’s all very worrying

Sara (Debt Camel) says

do you have other problem debts as well?

A sheeran says

I had a sizable United utilities debt but I’ve came to an affordable monthly repayment with them

Sara (Debt Camel) says

people don’t usually take a Loans2Go loan if they have no other problems debts?

Camilla says

Hi Sara,

Thank you for all of your help in this article it’s much appreciated.

I took out a loan of £250 in September 2021. I’m now paying £51 for 18 months, I’ve paid over £250 already but the total paid once finished will be over £900. I’ve been given a settlement figure now of another £250 (I can’t afford to pay the settlement now so this isn’t an option for me).

When I took out the loan admittedly I was desperate for a short term quick loan, I do read everything carefully and there was definitely no information about the loan being over 18 months and over £900 total when finished.

I don’t know what to do? I am in debt, I do have an overdraft but I do manage it all. It’s not affordable to me, and is causing a lot of stress. I’ve also recently been in hospital and therefore on a reduced income. I’m refusing to pay loans 2 go until this is resolved.

What do I do?

Sara (Debt Camel) says

Loans2Go will sometimes negotiate. Do you know how much you have paid so far?

How much do your other debts add up to?

Your overdraft – how large is it? Are you in the overdraft all the time, not getting back into a positive balance at all during the month?

Camilla says

My other debts are in the thousands, but I do keep on top of them (with most of my income). I am slowly paying them off. I am always in my overdraft (£1400), My salary brings me out of my overdraft but after bills I go into it each month.

I have currently paid just over £250 to loans 2 go.

Camilla says

I also have a default on my account. If they had made the appropriate credit checks then they would have realised that this loan was unaffordable.

Neil C says

Hi Sara, I have an outstanding loans2go debt, I borrowed £250 then 8 months later borrowed another £250. As I had made payments between loans the agreement was for sum of £387:55 & they wanted £1594:44 paid back

At the time these loans were taken out I had other loans that they would’ve seen on my statements. I ended up defaulting on this loan & they passed it to United Kash & it’s well over £1600 that they want me to pay. With the loan being passed to United Kash what should I do for making a complaint? Do I use your form for Loans2go or contact United Kash. I’ve setup payments for United Kash but I’m not paying much & will take long time to pay it off.

Sara (Debt Camel) says

You make the complaint to L2G. They should have looked closely at why you needed The second loan before the first one was half way through. Send it to the Ombudsman if they reject it.

What other debts do you still have? Are you behind with any bills? Will you be able to manage the repayments with energy bills, National Insurance, council tax, broadband, mobiles etc all going up in April? And rising petrol and food?

Michelle says

Is there a time limit claiming from loans2go, I had logbook loans from them years ago

Thanks

Sara (Debt Camel) says

2007.

But if it is alder than 6 years, FOS has an extra check that it can take the case.

Richard says

Hi Sara. I made a complaint to loans to go. They have not upheld my complaint. I had other loans at the time. And was gambling a lot and constantly in overdraft. These are figures on the loan

Principle: £1,000

Total Payable: £4,114.08

Total Paid: £2,471.32

Balance Outstanding: Status: £1,642.76

Taken on the 19/8/2020

They have offered to write off the outstanding balance. Do they often negotiate. Does this seem fair. Thanks

Sara (Debt Camel) says

They will sometimes negotiate.

If you go to FOS and win (and them offering to wipe the balance suggests they don’t think they are in a strong position) the balance would be wiped and you would get £1471 back.

What do you think would be acceptable compromise?

Richard says

And that won’t include the 8%. Correct? I will reply and see what I get from them. Thanks

Sara (Debt Camel) says

the 8% will be negligible, not worth arguing about.

Richard says

Thanks. For the sake of information for all. I’ll let you know what they come back with. But if it’s nothing good. I’ll be taking it to the FOS. Thanks again

Richard says

How long does it usually take on average for the FOS to deal with it. Thanks

Louise Stratford says

the FOS have finally got in touch with me today saying they will let me know of the outcome of my complaint in 2 weeks.

I sent my complaint in November as soon as I got the rejection from Loans2go. So I’ve waited from November up to today…

Louise says

I sent a complaint and had it rejected in November. I sent my complaint straight to FOS in November and I’m still awaiting to hear back from them regarding the complaint… anyone else has similar? I know covid has changed everything but still taking a long time…

Sara (Debt Camel) says

have you had a confirmation they have the complaint?

Louise says

Yes had confirmation I even rang about a month ago to make sure they have it and they said it’s in the right place. I assume I’ve just got to keep waiting..

Sara (Debt Camel) says

yes

Patricia E says

Hi Sara

I took out an initial loan with loans2go in 2019 for £250 (monthly payments £57.14). Followed by a top up loan 5 months later (monthly payments £114.28). Final loan in 2020 for £726.69 ( monthly payments £166.09 x 18 months £2989.62). This was cleared last year. I did not miss one single payment. Can I claim back some of this exorbitant interest? Please advise.

Last but not least, your service is excellent. Really appreciate you.

Sara (Debt Camel) says

Taking out 2 top up loans is often a sign the loans were unaffordable. I suggest you send a complaint in now. If they make you an offer you are not sure is good enough, come back here and check.

Robert James says

Loans2Go have ‘sold’ my what remains of a £250 18 month loan to United Kash Limited debt collectors and are demanding £628.45.

I have only miss 4 payments and the loan is less than year old, but they are charging 18 months interest.

Also, I believe payday loans are not allowed to charged more than double the loan- or is it the debt.

Who can I speak to legally and cheaply to get them to reduce the amount owed to say under £250? Perhaps I could sue Loans2go for wrongful lending and get them to pay it, that’ll teach ’em. Can I force Loans2Go to be shut down and put into administration so they can no longer operate? Legally of course.

Sara (Debt Camel) says

Unfortunately as this loan is 18 months long, it is treated as a payday loan and the “only pay double” rule doesn’t apply.

What is the rest of your financial situation like at the moment?

Robert James says

I owe money to 3 other payday loans and a credit card. But the loans2Go trumps the payday loans in value. I could set up a a £50 a month standing order, I wouldn’t trust with my card details they may leave me with no money. And try to reclaim the money from Loans2Go.

With this quickquid redress I can pay the other stuff and be left with plenty, but I don’t want to waste £628 on Loans2Go. I need to get a new bike ,etc with the remaining money.

Sara (Debt Camel) says

Look at affordability complaints against the payday loans and l2G. If the loan has been sold, the debt collector may accept a settlement offer.

Robert James says

If I politely ask the debt collector and demonstrate my financial history , they probably would. Is it possibe Loans2Go sold the debt without the interest to Uk Kash Limited and they are trying to make the profit?

Sara (Debt Camel) says

no, the debt would have ben sold, not just part of it,

Lynne says

L2G have said they’ll half the outstanding balance so the amount due is £643.36. Im still not happy.

Sara (Debt Camel) says

You borrowed £300 – how much have you paid them so far?

Lynne says

I’ve paid £180 so far

Sara (Debt Camel) says

so if you went to the Ombudsman and they agree the loan is unaffordable, your balance would be reduced to 300 – 180 = £120.

You can say that their offer is unacceptable and unless they reduce the balance to £120 you will send it to FOS.

Or you could offere a compromise, saying that in the interest of a speedy settlelent, you would agree to the balance being reduced to ££420 – which means you will have paid interest as though it is a payday loan. And ask for your credit record to be cleared and to be allowed to repay at an affordable rate of £x a month. Otherwise you will send the complaibnt to FOS.

Robert James says

The sneaky dogs, that are Loans2Go, have sold my loan to UK Kash limited for £628. This is for a £250 loan. I’ve already paid £399 of it off but missed three months of payments at £57.00 per month. The loan was taken out in March 2021,so not even a year has passed. The total owed would’ve been £1028. I think the £399 of payments would’ve classed as a substantial payment towards the loan so should be covered by FCA rules against this type of lending.

I see Loan2Go have sold the loan and charged a full 18 months interest to the UK Kash LTD, It’s my understanding if a loan go to collections interest and charges accrued are frozen not and added after the fact.

I have sent a written response to Loans2Go telling them what I think of there practices in my own immutable style. Including stating that selling the loan at that value amounts to fraud. Poor UK Kash LTD, I determined to make lose on this one!!!

All I can say, Loans2Go are ‘CRIMINALS and SEMI-LEGAL LOAN SHARKS ‘ and prison’s too good for them.

Sara (Debt Camel) says

Unfortunately with a loan all the interest is due at the start. If you settle early, the cost is reduced. If you default, it is all due. So they haven’t done anything wrong. They haven’t committed fraud and you aren’t going to help an affordability complaint by adding on this sort of accusation.

Have you actually made an affordability complaint?

Robert James says

Not sure what’s the best way to do that? Also, United Kash LTD might be amicable to a reduced settlement if I paid upfront rather than say £30 a month?

Is it true once Loans2Go have sold it to United Kash Ltd it is no longer their concern and I should be dealing the United Kash ?

Sara (Debt Camel) says

There is a template in the article above. The complaint still goes to L2G – they were the ones that made the poor decision to lend.

yes a debt collector may accept a settlement offer, but one big advantage of winning a complaint against L2G is that they have to remove the default and ensure the debt collector does the same.

Caroline says

Hi Sara,

Firstly thank you for all your help,

I took a loans2go loan may 2021, £500, 18 monthly payments of £114.28, I made 10 payments and was missing priority bills, I used your template, told them I had also just received an attachment to earnings for council tax, and emailed 21/3, on the 25/3 received

acknowledgement letter of my complaint, today 29/3, have received final response, after reading through the usual “we did everything right ” they said they would not accept my complaint but because of my circumstances they would write off the remaining balance (£914) and give me £250 compensation.

I’m happy with this and have accepted.

Sara (Debt Camel) says

Good.

What about the rest of your debts – do you have other high cost credit debt now? that has been repaid or defaulted?

Aprt form council tax, do you have other priority debts – rent, energy bills?

Caroline says

Hi Sara,

I am contacting likely loans who I still have a balance with and my credit cards are on a payment plan, do you have an email for very?

Thanks to you I have a claim in the schemes with quick quid and provident.

My energy is pre payment meters so I try to use as little as I can.

Sara (Debt Camel) says

they don’t like getting emails…

You have to complaint by phone or letter: https://www.very.co.uk/help/en/online-help-system.page#help-contact-us?PPI%20Complaint

David says

I stupidly took out a 2k loan from these sharks in February 2022 and the repayments will total almost 6.5k over 24 months, repaying 268 a month.

I got the money in minutes, no bank statements or payslips requested, didn’t speak to anyone.

I’ll be getting a conplaint based on this thread, and hope to have oayments reduced to an affordable amouny.

thank you.

Sara (Debt Camel) says

they often make poor offers and can sometimes be persuaded to increase them.

David says

Ahhh found the original post…

Loans2go offered to reduce interest by 50% and arrange more affordable repayments.

Should I accept?

They’ve agreed they used national averages and not my actual expenditure, they also confirmed they didn’t do a credit check or ask for bank statements as I’d already passed their “stringent checks”?

David says

Should I write to L2Go to inform them I want to cancel the CPA for the monthly repayment now that they have offered a reduced payment and interest reduction, even though I will likely escalate to FOS? Or if I reject their offer do I have to continue paying the full amount on the original agreement please?

Sara (Debt Camel) says

If you stop paying them, this will affect your credit record in the short term, but the negative marks will be removed if you win the case at the Ombudsman.

Are the repayments causing you problems? If you are, it’s better to not pay L2G – hoping that these negative marks will be removed – that to not pay another lender or get behind with priority bills.

If the payments aren’t causing you a problem, then you can continue paying – this will increase the refund you eventually gte. This will only go wrong if L2G go into administration, when you may get back little of the extra money you have paid them. I have no particular reason to think they are in difficulty at the moment, but this is a difficult time for many bad credit lenders.

If you decide to stop paying them, you need to phone up your bank and insist the CPA is cancelled. And tell L2G you are not paying. You aren’t asking for their permission.

David says

Thank you. I’m currently awaiting their response to my counter of their final response, which was to remove all interest and reduce payments rather then their offer of reducing the interest by 50% and reduce payments. I will advise them on my CPA, I appreciate the advice again.

David says

Hello. L2GO have accepted reduced payments for a period of 3 months and have agreed to not negatively impact my credit score. In their response they have asked me what I feel a suitable solution would be, why would they ask this? I’ve already requested the removal of interest and reduced reoayments, but it seems that may not be sufficient and they are implying I should ask for an alternative solution. What should I do?

Sara (Debt Camel) says

I suggest you repeat what you have said – that you would like all interest removed so you only have to repay what you borrowed and at a reduced rate.

What is the rest of your current financial situation like?

David says

OK thank you. I’m in arrangements with all other debtors, have been since around 2019, while I have one other loan for £333 which will be paid off by July and I have no issues with that one.

I’ve only repaid £538 of a £2k loan with L2Go, so I will ask for reduced payments and removal of interest. I don’t think I can get away with having the debt cleared of course, so I’ll go with that. Thank you!

david says

Hello Sara,

L2G have again countered and offered to reduce interest by only 75%. They have also said my credit report will now show this account with a Q (Query) Status. As this is their 2nd offer after their initial offer of reducing interest by 50% and they are still ultimately rejecting my complaint do you think it wise to escalate to the FOS now or try to negotiate with L2G further?

David says

Hello DC.

For anyone following people’s progress in order to get an idea of their own potential results, FOS have upheld my complaint. Asked L2G to remove all interest and negative markers from credit report. I can arrange an affordable repayment to clear the outstanding balance.

Good luck.

Emily56 says

I had complained to loans to go about my loan and they said that they will not remove marks from credit file as they refunded me out of a ‘gesture of good will’, is there anything I can do to get these marks removed please?

Also, Vanquis rejected my complaint, is there anything else I can do to get Marks removed or is it only if they uphold my complaint?

Thank you

Sara (Debt Camel) says

Have you accepted the offer? If not, you can send the complaint to the ombudsman

Emily56 says

Yes I have

Sara (Debt Camel) says

then I am sorry but it’s too late.

Emily56 says

My case is still open on resolver, would it be worth asking anyway or not?

Sara (Debt Camel) says

well you can try.

Tina says

Hi Sara,

I raised a complaint with L2G about unaffordable lending yesterday.

They replied back and attached a response that they sent me in 2019 when I raised it before stating they aren’t upholding my complaint.

I cannot recall ever receiving this response.

If I raise a complaint with FOS what do you think there chances are of saying that this is going to be to long as I got the final response over six months ago (even though I never).

I think they are the biggest scam company going.

Cheers x

Sara (Debt Camel) says

did you complain before?

Tracey says

Hi Sarah

I have also complained to l2go about a loan I I’d with them.i had repayed much more than I borrowed and feel the loan was unaffordable. Bank state8support this. I originally contacted them as I was diagnosed with breast cancer in May and struggled to pay but did so up until this year as they didn’t respond.

They have said they till write of the balance as a good will gesture but I’m wondering if I should ask for compensation given how much I had repayed. Thanks

Sara (Debt Camel) says

Can you say how large the loan was and how much you have paid so far?

Tracey says

The loan was for 300 and I repayed 959. I made 14 out of 18 payments continuously.

Sara (Debt Camel) says

So you contacted them in May last year saying you had been diagnosed with breast cancer and asked for lower payments or something? And they never replied to you? That is disgusting, even for Loans2Go…

And their offer is very poor too. You have already paid £659 in interest…

If you want the full refund – £659 – then you will have to send the case to the Financial Ombudsman. In which case you should also ask for compensation for their failure to respond to a customer who had told them of a severe health problem.

But if you would be happy with less as a compromise to get this sorted quickly, You could go back and say that although you tning the Ombudsman would order a full refund, you would be happy to compromise now on your balance being cleared, a refund of £400 and the negative marks being removed from your credit record. Add that if it goes to the Ombudsman you will also be asking for additional compensation for their failure to respond to your request for help lat May when you told them you had cancer.

Loans2Go are sometimes be prepared to negotiate.

Tracey says

Yes, they said they did reply telling me to send over income and expenditure but I honestly don’t remember seeing the email so continued with payments. It was only when I realised through your website that I could challenge them and cancel the cpa that I contacted them again, it still took several emails before getting a response and I think this was more as a result of payment not being collected.

I will think about next steps, part of me feels I should be refunded but also I’m tired of the hassle and stress of trying to communicate. Thank you so much x

T says

Hi Sara

Just to update l2go replied today albeit they got my name wrong!!! and stated they will not refund or remove negative marks from my credit file.

I’m happy to proceed to the ombudsmen but just wanted to know the best way to do this and what info they will need. Many thanks.

Sara (Debt Camel) says

The article above these comments explains how to send a complaint to the Ombudsman. get your bank statements from 3 months before to 3 months after the loan and send those to the Ombudsman. And download a copy of your current credit record and send that too.

kiki says

Can you tell me what email address you contacted them on ! i am trying to email them an affordability complaint but I cannot find an email address. thank you kindly.

Tracey says

Professional Standards • ps@loans2go.co.uk

Robert James says

Good news. My complaint to Loans2Go has been upheld , they have proposed to write of the £628 I still owe, but they keep the £399 I’ve already paid. This was for a £250 18 Month loan.

Shall I accept or should I pursue further compensation?I think writing of the debt is a result, that is one less thing to worry about. £628 out of my Quickquid redress makes me shudder.

Sara (Debt Camel) says

It will mean you have paid less interest than you would on a payday loan.

It’s quite a personal decision – although it could be better it isn’t a bad offer. And ombudsman decisions about one small loan can sometimes be erratic.

Robert James says

Hi, thanks. I best accept at least I won’t have to waste a further £628 and no worry. You never know I might get a surprise in the bank, but that’s unlikely.

Jack says

Hi Sara,

Just wanted to say thanks so much. After following your template and advice L2G have agreed to write off my remaining debt and clear my credit file.

You’re a star.

d says

Hello Sara, i believe i had already added some initial comments to your site but unfortunately I’m unable to trace it, so apologies for any duplication here…

I took out a 2k loan from Loans2Go over 24 months in feb 2022, having within the last 12 months prior already taken out 4 new credit cards which are about 80% of limits as things stand, and also x2 £500 loans from CreditResource. The repayments are more than 300% interest, total repayment will be 6.5k!

I’ve made a complaint to them and to be fair to them, responded within 1 week.

They have fully rejected my complaint, but offered to reduce interest by 50% over the term and reduce my monthly repayments. At first glance that seems like a win, but i just want to make sure i’m not being taken for a mug before i return to them with my response.

david says

In their response they have commented the following:

Credit Reports are not always up to date, but the issues i mentioned in my complaint such as 8 defaults and arrangements to pay and debt management plans were all evident on my credit report already at the time of application, and all within the last 6 years.

Theyve confirmed they used UK Consumer Averages when determining affordability from rather then my actual income and expenditure, provided in part as part of their online application. This is despite in my complaint me accusing them of this, yet they said they fully rejected all elements of my complaint?!

They calculated my disposable income to be approx £900, yes £900 a month more than it actually was, having used their “online verification tool”.

Theyve confirmed they did not complete a full credit check or require bank statement as i’d already passed their “stringent checks” prior to that stage.

One mistake i did make which they mentioned was not to mark “YES” on their question about drug, alcohol or gambling” question. i misread this and did not see the gambling element, so ticked “NO”, but to be fair, i am registered with Gamstop so cannot use online sites anyway.

Like i say, theyve provided a good will gesture, but i’m on the fence about whether to accept it or not, so any advice woudl be truly appreciated. Many thanks!

Sara (Debt Camel) says

For a small loan, there is an argument that a lender does not have to look too closely. But £2000 is a very large loan.

what is your current financial situation like?

What other problem debts do you have at the moment, how much do the other ones add up to and are you making payments to all of them?

Are you behind on any essential bills – rent, council tax, energy etc?

Are you still gambling?

David says

Hi Sara. I’ve been registered with Gamstop since 2018 so gambling is not currently an issue.

I’ve been behind with rent and council tax and utilities in the last 12 months yes, but currently up to date. Just! And that was what this 2k loan was partially used for, to bring those back up to date. I have proof from council tax and utility bills that I’ve been in arrears and also my bank statements would show the bounced direct debits etc.

My other debts total approx 12k and I’m in repayment plans for them all, 8 of those are defaulted from between 2018 and 2021, all evidenced on my credit report so they would have seen them had they checked I’d imagine.

Sara (Debt Camel) says

So how much are you paying to these other payment arrangements?

How much do you think you can pay to L2G?

And do these figures allow for the increase in your energy bills by 50% from This month?

The reason for these questions there is no point in you accepting an offer which still leaves you in a complete mess…

better to tell L2G that you want all the interest removed or the case goes to the Ombudsman. And probably put the L2G debt along with all the others into a debt management plan with StepChange so they can deal with your creditors not you. You can still make affordability complaints when you are in a DMP. Winning them will speed up the DMP a lot.

Lynne says

They did exactly the sane to me. I made an Unaffordability claim which they rejected but said as a ‘goodwill gesture’ they’d reduce the balance by 50%. It’s a joke the way they operate. I get text messages every day several times, despite me asking them to stop and blocking the numbers.

David says

I think based on these comments I will reject their offer and try mu luck. Arranging a more affordable repayment would help of course, but ultimately yes it would still be a struggle to stay on top of things. Many thanks!

Helen says

Hi, I put in a complaint to loans to go last Saturday (the 9th) after reading all the comments on here about them. I’ve not even received an automated response to acknowledge my complaint, is that normal? I’ve put in complaints to 3 other lenders and received automated acknowledgments straight away.

Lynne says

There’s usually an automated message comes through Helen. And in fact I’d say thereafter they’re pretty quick in replying in general. These are the ones I used. customerservices@loans2go.co.uk and professional standards ps@loans2go.co.uk

Helen says

Thank you, I used ps@loans2go.co.uk I’ll try sending to the other one aswell just to be on the safe side.

Dave says

Hi thanks for the guidance on here Sara, had a loans2go account £600 borrowed, over £2000 repayable….paid off the original £600 borrowed and then used the above template tailored to my personal circumstances.

Received a reply stating complaint was not upheld as loans2go had not done anything wrong but as a gesture of goodwill we’re willing to reduce the remaining balance by 50% leaving me to pay the best part of £800 remaining.

I rejected this offer and stated I would be taking this to the financial ombudsman as I know they have a charge of £750 per complaint that goes to them.

Loans2go then replied a day later and agreed to then write off the full remaining balance of just over £1600 and to mark this as settled on my credit file……this was all done withing 2 weeks of the original email I sent.

So just a thank you to Sara and this site for the help and info here, and a FYI for anybody else who may be considering sending a letter to loans2go this was my experience….many thanks

Florian says

Hi ,I am in simular to your situation ,I took 950 ,payed 2 instalments ,then now payed all 950 £I borrowed and first had a claim company to send them affordability complaint ,then fired them and send it my self ,been 3 days since I have send them a complaint -nothing so far.

So you had all cleared up by them ?

Thanks.

David says

Hi Florian? Yes I raised a complaint directly with L2G, within the 1st week had a response stating this wasn’t upheld, however I was offered 50% off remaining balance. I thought this was contradictory, if L2G were offering me 50% off after saying they had done nothing wrong it begs the question why?? I didn’t think they were just being a nice friendly company and just helping me out!

Maybe 3/4 days later I basically emailed back and said no to the offer informing them I would escalate the complaint to the ombudsman to be looked at independently, the next morning I was told that they would write off the whole remaining balance roughly £1600! as i had paid back the original amount of £600 this was all interest and then wrote it off

In the 3rd week I received confirmation the debt was gone, and checked my credit file a few weeks later. my credit file had not been impacted negatively it had actually improved as the debt now shows that it’s paid in full. I hope you have a similar experience as mine good luck and keep the faith!

Angela says

Hi I currently have an affordability complaint with an adjudicator after being rejected by Loans 2 Go. My loans were back in 2013/14. Today I received this from the adjudicator:

Dear Angela

I’m contacting you about your complaint against Loans 2 Go (L2G).

As you know, L2G think you referred the complaint to us too late and we shouldn’t be allowed to consider it. But I wrote to them to say I disagreed with their reading of the rules.

I need a little bit more information from you before I can move your case forward again.

Thinking back to the time when you took out this loan, L2G say you would’ve met with one of their agents to process the application for the loan.

At that meeting you were asked to give them copies of your bank statements and asked about your income and expenditure. Can you tell me what you thought about that at the time? Can you tell me what you thought they were doing all that for?

I appreciate those questions might sound a little odd (and that the conversation I’m referring to happened nearly 10 years ago so it might be difficult to remember exactly what you thought at the time) but it would be really helpful if you tell me as much as you possibly can.

Has anyone had similar follow up by an adjudicator? Not quite sure how to respond, I don’t have a cleat recollection of what happened at the time other than being in significant debt and continually stressed about trying to keep my head above water. Any advice appreciated.

Thanks

Sara (Debt Camel) says

I haven’t heard of anyone being asked this.

was this a log book loan or a normal unsecured loan?

do you remember if you completed an application form or if you were asked questions and the agent completed it?

were you given the impression this was just some formality? or that the agent would help you get the loan?

was it suggested that you should borrow more that you asked for?

do you remember being asked about a lot of expenses or did it seem some quick check?

Of course you may remember very little, that’s unsurprising.

Angela says

Now that I’m thinking about it I think the first loan I had was a logbook loan then it was later topped up. I think an agent filled in the form, asking me questions about my income and outgoings. When it was topped up it was done over the phone, not face to face. I really can’t remember specifics though.

I

Sara (Debt Camel) says

I think you should just say that – that you think the agent asked you some questions and completed the form but you don’t remember much about it.

Angela says

Ok thanks that’s what I’ll do.

Darren says

Hi Sara

You offered me some good advice regarding L2Go, and their initial offer to me of reducing the amount owed by 50% (to £1500, which is with a DCA). I replied to them asking for my credit file (a default) to be amended as an additional request. They have come back to me refusing to do this on the basis they are “a responsible lender so have to record what happened”. Now their claim to be a responsible lender maybe be debatable (!) but, is this a fair point on their part? What are the chances of a complaint to the FCA being realised and indeed would this force the change? They are not the only default on my account, regrettably. Would i be better to take this 50%?

as a FYI my only basis for claim was your template, i have no other exceptional circumstances such as gambling etc. I did simply, miss payments due to a combination of payday loans and cashflow issues at the time. Their extensive initial reply showed my income and expenditure but as i pointed out they wouldnt have seen my out of pocket expenses i have to make as part of my job which gave me at the time the cashflow issues. Many thanks again, in advance.

Sara (Debt Camel) says

I don’t remember replying to you about L2G?

how good is this offer? How much did you borrow, how much have you repaid so far?

have they also agreed to let you repay the balance at a lower affordable rate?

If you could get more by going to FOS, that tilts your decision in favour of that!

If you couldn’t get more, well if your credit record is poor for a lot of reasons, getting one sorted out won’t help it much.

Darren says

hi Sara

Currently owe£3000, loan was £500. so its a 50% reduction. The debt is with a DCA who don’t pressure me on payments at all, and £50 a month is comfortable for me. I have 5 defaults, one or two i expect to get removed due to other situations i.e Satsuma. As i understand it, settling a debt in default does’nt really affect the credit scoring so much so to at least get it reduced so much is a bonus? The possibility of getting more from the FOSin terms of them instructing a correction is i guess, the guidance i’m looking for. Other than their unfair interest rate (which i signed up to) i’m not sure what if the FOS process would give me more, unless your experience suggests otherwise. Many thanks, again.

Sara (Debt Camel) says

the question is, are the repayments afforable? If not you may win the FOS case and then you would only have to repay the £500 borrowed, no interest.

darren says

hi Sara

very affordable, i’m in full time employment. So i guess i’m best advised to take the offer they’ve made.

Your help as ever is much appreciated.

Liam says

Hi Sara,

I took a loan out with L2G back in June 2020 for emergency repairs.

The loan amount was £1000 with monthly repayments of £228.56 over 18 months, totaling £4,114.08. That’s a total interest rate of £3,114.08 for a £1000 loan.

I used your template above but they are stating that I am liable for all charges. The loan was given to me with a much lower APR before I took it out and afterwards the APR shot up.

I’ve been through the Ombudsman as well bud they’re saying they can’t uphold it. Is there anything I can do or am I stuck with the insane interest to pay?

Kind regards.

Sara (Debt Camel) says

have you had a final decision from an Ombudsman? or just from an adjuicator?

what is the rest of your finances like?

how much did the APR go up?

Liam says

This was from an adjudicator, not from an ombudsman.

I’ve given them a breakdown of my monthly income & expenditure which basically breaks even with some weeks having me needing to make some adjustments on what I spend money on more carefully.

Sara (Debt Camel) says

well you can ask for it to go to an Ombudsman.

but it doesn’t sound as though the repayments were clearly unaffordable for you?

Liam says

My income was around £1,600 & my outgoings for everything were coming to around £1,660 a month before the loan repayments were coming out.

I was having to make sacrifices in other areas in order to pay the loan or having to borrow off my parents, leading up to me owing them around £1000 before they told me they could no longer keep bailing me out.

Sara (Debt Camel) says

then go back to your adjudicator and explain this. Ask for it to go to an Ombudsman if the adjudicator won’t change their mind.

Liam says

Hi Sara,

Quick follow up to my last comment. I asked the adjudicator to pass my case on to the Ombudsman a few weeks ago.

I finally heard back from them today with a provisional decision with the following “Put Things Right” terms”

•Remove all interest, fees and charges applied to the loan.

•Treat any payments made by Mr L as payments towards the capital amount of £1,000.

•If Mr L has paid more than the capital, refund any overpayments to him with 8%* simple interest from the date they were paid to the date of settlement.

But if there’s still an outstanding balance, Loans 2 Go should come to a reasonable repayment plan with Mr L.

•Remove any adverse information about the loan from Mr L’s credit file.

I think this is a great outcome for a bad situation of outrageous APR rates. I’m waiting to hear back from them with the final result but they’ve said their final decision will be along them lines.

Lynne says

I complained with Loans 2 go who didnt uphold the complaint. They kept texting about the loan so I asked them to stop (for about the 10th time). They replied by saying because I don’t have an arrangement to pay in place that the messages can’t be stopped.

My reply was that they needed to acknowledge that the loan wasn’t affordable in the first place and that it’s now with the ombudsman. They just replied ‘Could you please confirm if you are looking to make a complaint regarding your loan?’!!

Lynne says

Now they’ve sent me this! Does anyone there know what they’re doing!

We are sorry to learn that you have been dissatisfied with the service. I can confirm we have passed your complaint to our Customer Satisfaction Department for a full investigation and response.

Please find information about our Complaints Procedure on our website https://loans2go.co.uk/complaints-data/. Please take time to read this as it explains how we will deal with your complaint and when we will contact you again.

Sara (Debt Camel) says

If the payments are unaffordable, I suggest you just ignore this until they start threatening legal action.

Helen says

Hi Sara,

I put in an affordability complaint and complaint about the rate of interest to loans2go as per your article. The below is their response. I have just read a comment from someone which is quite old but they were advised to go back to loans to go after they received an offer to wright off half their outstanding balance (which is what I was offered) and ask for all their interest to be refunded. Is this still what you suggest? This is the reply I received in relation to costs/interest and refunds (the first loan was repaid early as my partner let me transfer my balance on some loans to his interest free credit card and I repaid him.)

Agreement date 12/10/2019

Principle: £250

Duration: 18 Months

Total Payable: £1,028.52

Total Paid: £809.20

Status: Completed

Agreement date: 13/12/2021

Principle: £300

Duration: 18 Months

Total Payable: £1,110.06

Total Paid: £123.04

Outstanding balance: £986.72

Status: Active

Current balance outstanding: £986.72

Proposed goodwill write off: £405.03 (50% of interest)

New amended balance to pay: £581.69

Sara (Debt Camel) says

This depends on your situation.

So you paid about £510 interest on loan 1. but there was then a large gap until the second loan.

What is the rest of your current financial situation? I am asking because I guess you must have been desperate to borrow from them again knowing how horribly expensive they were the first time. Do you have other high cost loans, credit cards or catalogues? Do you have defaulted debt – are you making payments to that? Are you behind on any important bills, rent, council tax, energy etc?

Helen says

Thank for your reply. Yes I was desperate, I was making repayments of around £500 in total over several loans (with about 5 different providers I think) over the Christmas period. I defaulted on 2 of the loans. All priority bills are up to date but they are paid by my partner not me.

Sara (Debt Camel) says

If you were in an OK situation, then you could just try to get a bit more off the balance and start repaying it.

But with a lot of other problem , you can’t pay much if anything to this, can you?

One option is to go back to l2G – who will often negotiate – and say that as you paid £510 interest on the first loan, which is more than you borrowed on the second one, unless they clear your balance you will be sending the case to the ombudsman.

Another option is to talk to National Debtline on 0808 808 4000 about your whole financial situation. Your partner should not be paying all the bills so you can pay your debts. National Debtline will explain what your options are, this could include a debt management plan or a debt releief order, see https://debtcamel.co.uk/debt-options/dro/. If a DRO is a good idea for you it will wipe all these debts and there is no point in stressing about trying to negotiate with your creditors.

Lynne says

Final response from loans 2 go.

Current Balance £1,048.39

Offer reduction £405.03.

Balance after offer £643.36.

So they’re not prepared to ad it it was unaffordable so it’s with the Ombudsmsn now anyway.

Gabster says

Hi Sara,

I got £3500 from QQ last week – over the moon. But this is about something else – a log book loan with Loans2go (asking for a friend).

Details of payments: 12 x payments from March 2019 to Feb 2020 (just before lockdown for Covid-19) totalling £993.36 and 2 further payments of £70 on 15/10/21 and 13/09/21. Total paid to date: £1133.36 Total due: £1490.04

Debt outstanding £256.68

They originally borrowed £500 on 14th February 2019

Their financial situation isn’t stable and wasn’t stable at that time, They had some other payday loans/HandT pawn broker loan for an item. And had some arrears with other debts (credit cards and phone company)

After putting in an affordability complaint in early April that have offered to write off the outstanding balance but that’s all (final response) Should they pursue this and send onto to the Financial Ombudsman, it seems like a very high interest loan, your advice please. Thanks!

Sara (Debt Camel) says

who is the lender?

Gabster says

Loans2go – a logbook loan (thanks)

Sara (Debt Camel) says

If your friend wants a “full refund” then they need to send this to the Ombudsman where they could get back 1133-500 = £633, which would be a refund of just over 3400 after the balance is cleared.

But L2G will sometimes negotiate. If your friend would prefer a quicker solution, they could go back and say they think the Ombudsman would uphold their claim, but in the interest of a speedy resolution they would be happy to accept the bapance being cleared and a refund of 3200 say. I don’t know how likely that is to work.

But what is their finacial situation like now? You say “not stable”. If they have a lot of other debts, then it may be better to talk to a debt adviser about all their options, I suggest they call National Debtline on 0808 808 4000

Gabster says

Thanks, Sara. Bit confused on your calculations – sounds great, but think you may have mixed-up his calcs with someone elses? £3200? Sorry, my maths isn’t all that either ;) please explain figures.

FYI, all priority debts were paid (it’s my husband) and I pay mortgage, bills, CT etc. He has a few debts, totalling £4-6k maybe, nothing too heavy now. But his work vehicle was stolen on 2nd Jan 2022 and still waiting for payout from insurance (imminent, but no work in 2022.) Self-emplyed and affected by Covid heavily as couldn’t work due to restrictions We’ve had 3-4 illnesses in the family since 2014 (elderly parents) and have been caring for them on and off, and have 4 children, 2 born after 2014. (2 are 18+ and we help with Uni and college fees/care/accommodation So all very busy…and expensive.

His bank statements 2 month prior to this loan shows 1 payday loan (MyJar) and 2 x unpaid bills FYI.

Thanks again for your support and advice, what do you think we should do, offer for them to clear balance and give him back XXX ? sorry calculations were beyond my capabilities LOL

Sara (Debt Camel) says

Sorry, two of those “3”s should have been £ signs. This is how it should have read.

If your friend wants a “full refund” then they need to send this to the Ombudsman where they could get back 1133-500 = £633, which would be a refund of just over £400 after the balance is cleared.

But L2G will sometimes negotiate. If your friend would prefer a quicker solution, they could go back and say they think the Ombudsman would uphold their claim, but in the interest of a speedy resolution they would be happy to accept the balance being cleared and a refund of £200 say. I don’t know how likely that is to work.

But what is their financial situation like now? You say “not stable”. If they have a lot of other debts, then it may be better to talk to a debt adviser about all their options, I suggest they call National Debtline on 0808 808 4000

—————————————————————————

It is a stupidly high interest rate, but you win these complaints by showing it was unaffordable, not complaining the rate was too high.

I think he has to stop borrowing completely at the moment. And if he has no income he should look at token £1 a month payments until he is back working.

It’s up to you if you want to try to negotiate a bit of a better offer, take what has been offered (which sorts one problem – make sure they agree to remove any default or missed payments…) or send it to the Ombudsman.

Gabster says

Great, thank you so much for your help. Good advice, we will challenge their final decision and if not, we will take it to the FOS.

And thank you for the other advice, he has stopped borrowing, and we’re finally paying off a few things. Van insurance due to payout any day now, so hope we can get back on our feet one he has a work vehicle again. I have put in affordability complaints with Money Platform, Advantage Car Finance and Safety Net, all using your templates, about these loans being unaffordable. I’ll keep you posted on any good news regarding these, as and when. THANKS again for your support and advice.

Gabster says

Hi Sara. Good news. Loans2go have agreed to write off the balance, and pay my husband £250 and mark the credit file as closed. Thank you!! With your your advice, we’re finally getting on track!

Have a lovely weekend!

Sara (Debt Camel) says

Good result

Hels22 says

Hi Sara,

I stupidly took out a L2go loan in Feb of this year for £1200, over 18 months at £160 a month. I have paid 3 instalments. Obviously, the interest is hideously high and i am going to end up paying £3800. Can i submit an affordability complaint now even though i have only paid 3 lots? I have 1 other payday loan on the go at present & 3 credit cards.

Sara (Debt Camel) says

are the amounts actually affordable – can you pay them and still be able to pay your other debts, bills and living expenses?

Hels22 says

Its a big struggle i will be honest. Its 24 months, not 18 months as i said above.

Hels22 says

Hi Sara, had a very quick response. Loans to go offered to remove 50% interest. This takes my balance from £3400 down to £2054. Is this offer good or should i push for 75%? Anything helps but ive read they sometimes can negotiate?

Sara (Debt Camel) says

Can you afford to repay £2054 and still pay your other bills, debts and living expenses? Gwetting abalance reduced if you still can’t afford it doesn’t get you very far.

So what your problem debts do you have that you aren’t paying or are only making payment arrangements to? What other debts are you paying in full? Are you in arrears with any important bills – rent, council tax, energy etc?

Hels22 says

Not in debt with priority bills at all. They actually did negotiate with me and wiped 80% off the interest. That leaves me in a much better position than a balance of £3400! Ive learnt my lesson! Luckily for me, they were actually v easy & quick to deal with.

Louise says

Just out of curiosity has anyone on here won a case with these at financial ombudsman and how long did loans2go take to contact you regarding settling the way the ombudsman has decided? I just won a case and ombudsman said they should refund the interest and 8% on top. I know they have 4 weeks to do this but just wondering if they normally do it quicker…

Sara (Debt Camel) says

Hundreds of cases have been won at the Ombudsman.

Is your decision from an adjuidcator/investigator or an Ombudsman?

Louise says

Firstly the adjudicator agreed but Loans2go disagreed so I had a final decision from an ombudsman who upheld the complaint just wondered if it normally takes the full 4 weeks for Loans2go to payout…

Lauren says

Recently sent a complaint regarding unaffordable lending to loans 2 go.

Principle: £1,000.00

Total payable £4,114.08

Total paid £799.96

I note that you declared your monthly income as £2,250.00 we verified that you received a minimum of around £1,269.10 monthly via an online income verification tool. Following an extensive review of your application, in addition to your credit file, we calculated your monthly expenses to be around £815.40. Therefore, the contractual loan repayment of £228.56 per month would have still been affordable.

e. As a gesture of goodwill and testament to Loans2Go Limited’s commitment to assisting and treating our customers fairly, we are offering to reduce the interest on the active Loan Agreement by 50%.

Authorised and Regulated by the Financial Conduct

Current Balance: £3,314.12

Proposed Write Off Amount: £1,557.04 (0% of Total Interest) Proposed New Balance: £1,757.08.

Wanting some advice or maybe some feedback on anyone who has been in a similar situation x

Sara (Debt Camel) says

They will often negotiate on their offers.

What is the rest of your financial situation like at the moment? Do you have a lot of other problem debts? Are you in arrears on any important bills?

David says

I recently got offered a reduction of 50% then 75% of interest, but they maintained the loan was affordable despite admitting not using my actual income and expenditure when assessing affordability during my application.

It’s now with the FOS because they have marked my account as in arrears only 10 days after agreeing to allow reduced repayments for a period of 3 months.

Good thing is though that if you escalate to FOS and the fos don’t uphold your conplaint, l2g cannot backtrack on their original offer either. Go for it. Nothing to lose I reckon.

Louise Stratford says

go to financial ombudsman you’ve got nothing to lose. I didn’t expect them to uphold my complaint and they did. Currently waiting for loans to go to pay me redress. They’ve got 2 weeks left to sort it.

Lauren says

Thankyou all for your input and advice. Does anyone have a template they used to send to the FOS. Did you notify loans to go you was taking it to the FOS and what did you say. I’m rubbish with words, any input would be really grateful. X

Sara (Debt Camel) says

there isn’t a template. You just use the FOS form here https://help.financial-ombudsman.org.uk/help which asks all the questions they need the answers to set up your complaint in their system – things like what is your date of birth and is this a single account or a joint one with someone else.

Just say a bit of what you said to L2G to make your complaint.

Richard says

Hi. Does anyone know the current average wait to when sending to FOS. Sent mine to them on the 18th of March. Thanks

Helen says

Hi I have had a letter from Loans2go saying they will not look into my claim of unaffordability and on the end of the letter its states this…….Please note that, under terms of our Complaints Procedure, this is our final response. As the complaint was received outside the time limits stated in DISP 2.8.2, we do not consent to refer the complaint to Financial Ombudsman Service.

Does that mean I cannot take it any further? many thanks

Sara (Debt Camel) says

yes you can still take this further.

Does it say that you have the right to take your complaint to the Financial Ombudsman within 6 months?

Helen says

No I don’t think it did say about the 6 month part. I did ask previous for a list of all loans I had received from them but I never took anything any further. I shall recheck email they sent me. But in total I paid, just in interest alone over £1200

Sara (Debt Camel) says

then send this to the Ombudsmn. It may be slow but why give up?

Helen says

Thank you, yes I plan on doing it over the weekend! That loans2go were brutal and harassed customers! They actually looked at my bank statements and advised me on ways I could work things better so I could afford to pay the loan!!! Absolute sharks!

Angela says

Hi

They said the same to me because my complaint dated back to 2013/14. I referred to ombudsman and an adjudicator said they didn’t agree with Loans2go and told them that but they didn’t budge. Adjudicator said he was of the view it could be looked at because i only found out about affordability complaints within the past 2 years. Now in the queue for an Ombudsman.

Tom says

Hi, really good to have found this page. I took a L2G loan last year for £250. The interest wasn’t explained very well at all and now I’m paying back something stupid like £900. My circumstances have since changed and I’m no longer in full time work and I’m claiming carers allowence for my partner. I have sent your template to the email and I’m waiting to hear back.

Sara (Debt Camel) says

Do you have other problem debts too?

Tom says

I have other debts that I’ve managed to arrange into payment plans. I’ve paid the full amount I believe of my L2G payment it’s just the ridiculous interest

Tom says

They’ve also just asked for bank statements. I’ve sent proof of my benefit income.

Sara (Debt Camel) says

if they want bank statements then send bank statements.

Robert says

Hi Sara,

I contacted L2G using your template and this is the reply I have received:

We are sorry to learn that you have been dissatisfied with the service. I can confirm we have passed your complaint regarding irresponsible lending to our Customer Satisfaction Department for a full investigation and response.

As requested, I have forwarded on your request for a Data Subject Access Request (DSAR) to the relevant department.

With regards to your loan please be advised that the interest is frontloaded, which means that all the interest which will become payable over the term of a loan was added at the beginning of the loan term. You agreed to repay £1,000.00 over an 18-month term at a 17.3% interest rate meaning the total amount repayable is £4,114.08. The loan repayments and duration are clearly stated within the credit agreement you signed on 15/06/2021. So far, you have paid £1,419.96 therefore your balance outstanding is £2,694.12 (£1,094.20 of which is in arrears)

The Pre contract and Credit Agreement were both available for you to view and download before you electronically signed & accepted the credit agreement and it is your responsibility to ensure you fully read and understood the terms of the credit agreement before accepting this.

Do I wait to hear back from the customer satisfaction department and DSAR before responding?

Thanks

Sara (Debt Camel) says

Yes just ignore that. It has nothing to do with whether the loan was affordable for you.

Robert says

Hi Sara,

I waited as per your above advice…

Just wanted to say thanks so much, L2G have agreed to write off my remaining debt and close my account!!!

Thank you :)

Florian says

Hello,

I am in the same boat with Loans2go, for 950£ pay it back 950£,what you did after your personal complaint of unafordability lending.Did you waited 8 weeks for their “answer”.?How you made them to close your account?Have you paid them anything in 8 weeks.

They not only have their money lended to you, but they make 500£ profit. They robbing oracle in their tragedies.

Robert says

Hi,

I used the template from Sara… that was sent to them on 6th June, by 8th they had responded with the above.

I waited as per advice from Sara.

I did not make any further contact with them and I did not make any payments.

Yesterday I received an email from them that the balance would be written off and account closed.

The only action I took was to send them the template Sara provided.

Robert says

Along with a lengthy letter this was the reply I received (I was on a reduced payment plan);

In the circumstances and after considering all the evidence available to me, I cannot uphold any aspect of your complaint. However, based on the information you have provided about your current circumstances, I believe that it is important that we show that we care, and we try to help you, especially in these difficult times. As a gesture of goodwill and testament of Loans2Go Limited’s commitment to helping our customers and treating them fairly, I am offering to write off the outstanding balance of £2,694.12 on your loan and close your account with nothing left to pay. We are doing this in full and final resolution of your complaint.

Please advise us if you are satisfied with the resolution provided and accepts this as full and final settlement of the complaint within 14 days of this letter by emailing to ps@loans2go.co.uk

Florian says

Thank you for sharing,so that is after Saras advice.

God bless you,Sara!

Actually after the complaint you made and after 8 weeks.?

How long was it after complaint?

Thank you!

Robert says

I made my complaint on 6th June and received the reply on 27th June. No other correspondence apart from the template off Sara

Yohannes says

I Barrowed 250 pound. Know they are told me to pay back 925 pounds. Please help me

Sara (Debt Camel) says

Can you say how many other debts you have? What do they all add up to?

T says

Can i ask about the fso service. I asked them to look at loans2 go after advice frim yourself. Their reply said they woyld be in touch jn 7 days if thet could help. I received an email asking for the final offer from l2go i had aleeady sent this but resent it again. I havnt hard anything back. L 2 go are sending several texts a day about it.

Sara (Debt Camel) says

it sounds as though FOS is now setting up your case. It’s a good service but not fast. You may not hear anything more for a couple of months.

are these texts asking about whether you accept their offer? or wanting you to pay?

T says