Loans2Go offers what I have called the worst loans in Britain.

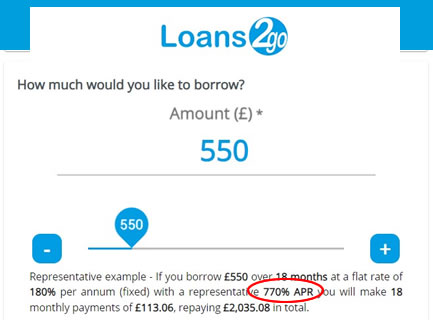

Since 2021 they have been charging 770% APR. See the representative example Loans2Go quotes on its website:

- £550 borrowed for 18 months is a monthly payment of £113

- this adds up to £2035, a bit less than four times what was borrowed.

Contents

MUCH cheaper to get a payday loan than a Loans2Go loan

Of course Loans2Go don’t point this out on their website, but check out these numbers!

With a payday loan for £550, the maximum interest that could legally be charged is £550 – the amount borrowed. So you would only have to repay £1,100 – the £550 borrowed plus the £550 interest. And the monthly repayments for a payday loan for 12 months can’t be more than £92.

So you would pay a payday lender £92 for 12 months

but Loans2Go is charging MORE PER MONTH (£113) for MUCH LONGER (18 months).

Loans2Go also used to offer logbook loans, but this article is just about their standard personal loans. If you had a logbook loan from them, use the template on this other page.

Is this legal?

The Financial Conduct Authority (FCA) calls payday loans “High Cost Short Term Credit”. Its definition of High Cost Short Term Credit is a loan over 100% in APR and of 12 months or less.

So the Loans2go loan is outside that definition because it is 18 months long. So it isn’t caught by the price cap rule.

Unfortunately, this means its loans have crept through a loophole and are legal. I think the FCA should close this loophole.

Many people are winning affordability complaints about Loans2Go loans

I think this is the worst loan in Britain.

A loan is unaffordable for you if the monthly repayments were so high you couldn’t afford to pay them without hardship, borrowing more or getting behind with important bills. This is a standard affordability complaint, used for many other sorts of loans. If you win this you will get a refund of all the interest.

Because Loans2Go loans are so expensive they are often unaffordable. Many people are winning Financial Ombudsman (FOS) complaints about these loans – here is just one example: Miss R’s personal loan provided by Loans 2 Go.

No-one who isn’t desperate would take one of these loans out, and the ombudsman says Loans2Go should make more detailed checks on affordability when it thinks the borrower may be in difficulty.

Several people have said they were not given the full details about the loan before the money was given to them. If this happened to you, say this in your complaint as well.

First complain to Loans2Go

It doesn’t matter if you have repaid the loan or you are still paying, you can still complain.

You have to complain to Loans2Go first, you can’t go directly to the Ombudsman.

Email customerservices@loans2go.co.uk and copy it to ps@loans2go.co.uk. Put AFFORDABILITY COMPLAINT as the title.

Use this template as a basis and make any changes so it reflects your case:

I am also complaining that the interest rate was grossly excessive. It is unfair to charge someone more per month over 18 months than they would have paid to a payday lender for a loan the same size over 12 months.

[only add this next sentence if the date of your loan was after the end of July 2023] This loan does not represent fair value and it is in breach of the FCA’s Consumer Duty.

[only add this if you were not told the loan terms] The loan was not adequately described to me before I was given the money. This is an unfair way to give high cost credit.

I am asking you to refund the interest and any charges I paid, plus statutory interest, and to delete any negative information from my credit record.

[delete if you have repaid the loan] I would also like an affordable repayment plan to be put in place if I still owe a balance after this refund.

I am also making a Subject Access Request (SAR) for all the personal information you hold about me including, but not limited to, my applications, all credit and other affordability checks, a statement of account for my borrowing, and a record of all phone calls.

Let me know in the comments below if you are making a complaint about a loan that started after the end of July 2023, as there are some new regulations about those.

Is an offer from L2G a good one?

If L2G has offered to wipe a small balance or take some money off what you owe, you have to decide whether this is a good enough offer to accept.

For example, they may offer 50% of the interest off “as a goodwill gesture”. Or to reduce your balance by 50%. These are often very poor offers, you could get a lot more by going to the Ombudsman.

Sometimes Loans2Go will increase an offer if you push them. Here is what one reader said:

They replied firstly with the offer to half what was left and agree a payment plan and I refused and they immediately came back and wiped the loan clean and removed it from my credit file.

It’s up to you what you think a good offer is. But you can’t change your mind later if you accept and then think you shouldn’t have.

So ask a question in the comments below if you aren’t sure.

Take a rejection or a poor offer to the Ombudsman

You can send your complaint to FOS if Loans2Go has rejected it or has made you a poor offer. This is easy, just use this simple FOS form which asks you what they need to know to set up your case.

Send your bank statements to the Ombudsman – 3 months before and 3 months after the date of the loan. These are the best evidence that the loan was unaffordable for you.

Thomas says

Hi

It leaves me tight every month with nothing else to really spend but I just want to pay the loan off. I have realised the amount of interest I have been charged is ridiculous. At the time of taking the loan I was desperate so the amount of interest wasn’t a worry, stupid I know!

Sara (Debt Camel) says

That sounds too tight to be manageable for more than a couple of months. You could ask for an affordable payment arrangement?

Thomas says

Hi, the below response is some of the response I received from L 2 go. Should I send them bank statements?

Good Afternoon,

We are sorry to learn that you have been dissatisfied with the service we have provided and can confirm that your complaint will be dealt with by our Customer Satisfaction Department for a full investigation and response. This department is responsible for handling complaints submitted to the company and will be conducting a thorough investigation into your concerns. Once we have completed our investigation, we will write to you again with our response.

In order to investigate your concerns properly, could you please send us your 2 months’ worth of bank statements showing transactions 2 months prior to your loan being issued and any supporting documents (such as benefit letters, doctor’s note/medical report etc.) that you feel will help us in understanding your situation better at the time your loan application was approved by Loans 2 Go.

Please send us this information within 7 days from the date of this email to prevent any delays in the investigation of your complaint. However, if you are not able to provide this information, please let us know and we will investigate your complaint using the information we hold on your file to date.

We have performed a preliminary review of your complaint and have made the decision to hold all further action while the matter is under investigation.

Sara (Debt Camel) says

Yes, I suggest you send the bank statements – they are likely to support your complaint that the loan was unaffordable for you.

Katie says

I sent bank statements and within there final response they stated they believed they didn’t think it was irresponsible- but offered to knock £500 off so I still had to pay £2500+.. I insisted that it was irresponsible and they should re look at the final response as they hadn’t included certain information in it.. last week they have offered to write off the whole balance, and that’s that Loan gone (without going to the ombudsman) . So make sure you are persistent with them, and they will soon come round.

Thomas says

Hi Katie,

Many thanks for the information. How long did it take from start to finish? I have already paid around £1000 in interest. I have gone back to them today

Katie says

I first sent my complaint to them 04/02/20 I got my final response on 02/03/20 – early as I stated I was having severe financial hardship (as I unfortunately lost my job because of coronavirus) – I think went back and fourth a few times, and then finally they offered to write off the final amount on 30/04/20. They stated- Good morning,

Thank you for your email.

Please note that whilst we stand by our lending terms being responsible, in order to bring your complaint to a satisfactory closure we will write off the outstanding balance and close your account; therefore, you would no longer be liable to make any further payments to Loans2Go.

Please confirm by reply that this would be acceptable.

Sam says

I went to the ombudsman took a year but it went in my favour, have pay back only what I borrowed, minus any interest, I’d advise going to the ombudsman .

Siobhan says

I made a complaint in March stating that whilst the affordability check was passed my credit file showed I had lots of unsettled payday loan debts and the application should have never been approved. It was a long shot I know but as many others were, I was desperate and didn’t consider the extortionate interest rate at the time. For a 1.5k loan the total sum owed was almost 6k. I’ve paid 1k off. Loans2go are not going to uphold my complaint but have offered to write off half the remaining balance. Does anyone have any idea of the best way to proceed?

Sara (Debt Camel) says

so the balance is now 5k and they are offering to reduce it to 2500?

siobhan says

Yes that’s right

Sara (Debt Camel) says

Well that is a pretty rubbish offer – if your loan was unaffordable your balance should be reduced to £500.

Did you send them bank statements? If not, i think it’s worth going back to them and sending them, saying it is obvious that the loan was unaffordable and that you want the balance reduced to £500 or you will be sending the case to the ombudsman. If you look just above in comments, Katie got a good result from going back and being persistent.

Siobhan says

Thank you I will try that.

They’ve described quite clearly how they’ve come to the conclusion I should have had enough spare each month for the refunds to be affordable but my bank statements did show that I didn’t have any spare funds at the end of the month and my credit file showed I had numerous unsecured loans outstanding which were in arrears.

Thank you so much for your help

Roland says

I got quite a few top ups without providing how much I had to pay out think it’s called an expenditure could I claim any back

Sara (Debt Camel) says

were these “normal” loans or logbook loans?

Aaa says

I received a loan in December 2018 but had trouble keeping up with payments and my last payment was in May 2019. I sent an affordability complaint to loans2go in August 2019 with the template above. Is there something I can complain about other than affordability as they are now saying I am not eligible to complain. The issue I have is the huge interest charges which I could not afford to pay! I sent another affordability complaint on 23rd June 2020 and received the following response.

Good afternoon,

Thank you for your email.

However, you had previously raised an irresponsible lending complaint to us on 30 August 2019, with a final response letter issued on 6 September 2019; within that response, we stated the following:

If you do not refer your complaint in time, the Ombudsman will not have our permission to consider your complaint and so will only be able to do so in very limited circumstances. For example, if the Ombudsman believes that the delay was as a result of exceptional circumstances.’

Therefore, you had until 6 March 2020, to escalate your complaint to the Financial Ombudsman Service; however, this is now out of time, and is not an eligible complaint.

I did not receive the letters they sent and I also expected a response via the same method I sent the original complaint in which would have been via email.

Please can you advise what I can do about this now?

Tyler (Just a guy, paying off my debts) says

Raise your expired complaint to the Financial Ombudsman Service, explain their final response wasnt sent to you and you wasnt aware until you raised the query about your complaint again, the Ombudsman will likely agree your case was exceptionally delayed (you wasnt aware after all).. Theres absolutely no harm in trying anyway. I had a similar situation with Sunny, the Ombudsman was happy to take my case 8 months after their final response (2 months past expiry)

Stephen says

Hi there I had a loan of £250 from loans 2go didn’t mention anything about how much I would of had to pay back just said it’s a high interest loan at the time I didn’t think of it just needed the money for newborn baby, I was up to date with the £250 loan I had kept receiving texts in need of a top up so I rang them to see how much I could have £500 top up didn’t even get the full £500 they took £150 out of it but didn’t say that over the phone there exact words £500 will clear in to your bank within a couple of minutes, was in starting getting decorating stuff ready for newborn baby. After that I started getting into real difficulties with this lender total rip off be very careful.

Jimmy says

I sent them an email in April of a loan I took out with them at Xmas. Usual story, 2 years to pay back £1800 on a £400 loan. I didn’t miss a payment but the thought of £98 a month for another year and a bit was annoying me. They replied firstly with the offer to half what was left and agree a payment plan and I refused and they immediately came back and wiped the loan clean and removed it from my credit file. Don’t take what they say at first as gospel. The interests they charge are abhorrent and they are playing on vulnerable people!

Katie says

Hi Sara,

I know I was stupid to take out these loans with Loans2go.

This was a top up loan in January for £400 which bought the total loan amount to £609.59 repayments £139.32 a month for 18 months.

This is the response to my affordability complaint in short

• you declared your monthly income as £1,250.00

• we verified that you received a minimum of £1,162.61 monthly via an online income verification tool.

• You declared your monthly expenditure and credit commitments to total £650.00, however, we calculated them to total £969.03. We also added a buffer of 10% to your verified expenditure to account for any fluctuations in your monthly income or expenditure, even after which, your Monthly contractual loan repayment of £139.32 would have still been affordable.

• it was determined that you had enough disposable income to afford your contractual instalments. Had there been any cause for concern at that stage, then the loan application would have been declined to avoid any detriment to you.

I am unable to uphold any aspect of your complaint.

As a gesture of goodwill and a testament of Loans2Go Limited’s commitment to being there for our customers, I am offering to write off 50% of your balance of £2,159.12 as full and final resolution of your complaint. What this means is that, as opposed to having the full balance left to pay, if you accept our resolution, your balance will be reduced to £1,079.56.

Sara (Debt Camel) says

That sounds a very poor offer.

Do you know how much you have paid to the first loan? To the top up? The top up loan, how much did you get in cash?

Katie says

The first loan was for £310 I had paid £425.10 (6 installments of £70.85) The top up I had £400 in cash

Sara (Debt Camel) says

And how much have you paid to the top up loan?

Katie says

£383.64 so far currently in an arrangement paying £35 per month

Sara (Debt Camel) says

Then you have nearly repaid as much as you have borrowed, about £75 to go.

I suggest you tell L2G that there offer is unacceptable, you would be happy as a compromise for your balance to be reduced to £200 which you will continue to pay at £35 a month, other your complaint will be sent to the ombudsman.

You could get a bit more than this by going to FOS, but you may think it’s good to get this settled now if possible.

Katie says

Thank you, will let you know what they say

Katie says

Just want to chk the Top up loan was for £609.59 as it included the outstanding from loan 1. So Loan 2 £400 + Loan 1 outstanding £209.59. Will this make a difference

Sara (Debt Camel) says

Those are in the round number calculation I gave.

Katie says

Hi, Just want to double check this before I send them the email. The top up loan was for £400 but with the outstanding on loan 1 is was for £609.59. Will this make a difference to what i should go back to them with

Sara (Debt Camel) says

You have paid £115 in interest to the first loan before the top-up – that should be refunded.

In round numbers you have then borrowed £610 and paid them £385 so far.

610 -385 -115 = £110.

So if you went to FOS that is what your balance would probably be reduced to if you win your case (and most L2G cases sem to be being won).

I am suggesting you offer a compromise of £200 or you will go to FOS.

Katie says

Hi Sara,

I would just like to say Thank you.

This is the response I have now had from Loans2go

‘Thank you for your last email to us and please accept my apologies for the late response.

It is important to us that we reach an amicable resolution to your complaint. Your custom is very much appreciated and we are grateful that you are communicating with us and making a conscious effort for this to be resolved.

After much deliberation, it has been agreed to write off the Interest on your Loan Agreement, which means you will now only be liable to pay off the remainder of the principle amount borrowed for your existing loan. To be precise, the amount that will be leftover for you to pay after you have accepted our offer is £225.95.’

Much better than the original offer!

Sara (Debt Camel) says

well done – for a speedy result that feels like a reasonable compromise.

Pierce says

Hi all,

I put in my complaint last week for an £800 loan I took out in Jan (costing £3k+ for 18months). Went back and forth, received final response where they rejected my complaint the letter implied that they sent me an email requesting bank statements and other evidence as to help with my claims of the loan being unaffordable (which I never received). However, looking at my statements previous to taking the loan it looks like I can afford the repayments, but during the term of my repayments now I’m having difficulty and ended up borrowing from other places. I don’t know what to do I’ve already paid £914.20 to them. Should I send them the statements and my credit report? They’ve already seen that my score was very bad before but its gone up a bit since then and I’ve had previous defaults etc. and I’ve settled all of my previous debts last year. Their current settlement figure is at £908 and some change… what else can I do?

Sara (Debt Camel) says

I suggest you reply (assuming this is all accurate obviously) that they never asked for your bank statements or credit record and that you have already repaid more than you borrowed. Say that as a compromise you will be happy if the balance is written off [or reduced to £200 say? this is up to you. I guess they will be more prepared to accept a higher about rather a complete write off] otherwise you will be sending your complaint to the Ombudsman.

B says

Soooo….. Update on Loans2Go…

initially requested bank statements as proof of gambling which i refused to provide as I had instead sent them several emails from gambling companies closing my accounts due to my activity ( not something i’m proud of). They sent a final response stating they won’t be upholding my complaint but offered to reduce the interest by 50% (1.7k down to £800). I replied stating they could reduce the interest with immediate effect but that i would be taking the case to the ombudsman to determine the rest of the complaint, they responded today stating if i go to the ombudsman they will not be reducing my interest and that the offer was un full and final settlement of my complaint but if i wanted to provide bank statements they would re-look at my complaint. At this point, i dont see what relevence the statements have and I know i’ll win if i go to the ombudsman as i’ve won every complaint to date, so I’m sending it straight there!

Sara (Debt Camel) says

Why not send them your bank statements? You may know you will win at FOS, but isn’t it better to get your case settled sooner rather than later?

B says

I can send them but i just feel like they are playing games and have no intention of changing their decision. They’ve already said to me in their response “As lenders, we are not expected to know that a customer has been gambling from a credit application and it would be impossible for us to have known” – therefore based on that logic, they’ve already made their position clear on that and i’m confused as to what difference seeing the statements now will make?

Equally, I sent them all the other stuff detailed above which is as good as the statements without being invasive on my personal banking! if a gambling company felt my problem was bad enough to close my account(s) then surely that’s suffiencent enough for them to determine i did have an issue, which is what they are querying

B says

Also worth noting that i haven;t asked them for a refund, I asked for my current loan to be settled, which i have already repaid the principle borrowed so they are not losing anything

stu says

I currently have a complaint with the FOS regarding my complaint against Loans2Go. It took 13 months for an adjudicator to look at my case and I am now 6 months waiting for an ombudsman to pick it up. I would personally send the bank statements but it is up to you.

Sara (Debt Camel) says

It’s up to you but I really can’t see the downside.

Rikki heron says

What did you say in your letter to them pls, I borrowed 1k and have to pay back well over 4k

Sara (Debt Camel) says

the article above has a template that you can use.

Marie says

Hi Sara

I put in a complaint with loans2go about their outrageous interest and it wasn’t upheld.

Since then they have been hounding me and I’ve just received a final demand letter saying if I don’t pay £520 (on a £250 loan that I’ve already paid over £500) that they will take me to court, contact my employer asking them to make the payments from my salary, or come to my house and repossess my items to pay for the outstanding items.

I am going to make a complaint to the Ombudsman but the letter has left me feeling terrified, during a time where I’m already experiencing intense anxiety.

Could you pls advise me on next steps with them whilst I wait for the ombudsman to deal with the complaint?

Thanks

Marie

Sara (Debt Camel) says

ok, so they are being unpleasant and trying to pressure you to pay them money.

But when you have a complaint in with the Ombudsman, they should not start court action. So send your complaint to FOS now and tell L2G that you have done this and that as you are disputing the debt and ask them not to start court action.

I haven’t seen them try to take anyone to court when there is a FOS case.

But what if they do? Worst case? I don’t think this is going to happen but here are the facts so you know just how looooong it would take!

They can’t get money taken from your wages or send bailiffs around unless they have already gone to court and got a CCJ.

The first stage in getting a CCJ is for them to send you a special letter with a Reply Form attached. See https://debtcamel.co.uk/letter-before-claim-ccj/ for what this looks like. until you get this form they are just bluffing.

If you get that letter you have 30 days to reply. so you can sit on it for 3 weeks and then send back the reply Form asking for more information (that link explains what to say). They then have to send you that information and they can’t start court case for 30 days after that. So this will have taken 2 months so far.

If you ever get a court form (which I do NOT expect! – and I can say where you can get help if you do so you know what to put on the form!) you have 28 days to send in a defence if you have acknowledged getting the form. So that’s another month.

After that you can request a “stay” of the court case so that it goes on hold while the Ombudsman case is held. At this point FOS should give your case priority.

If you didn’t ask for a stay but just carried on with the case, it took on average 9 months in 2019 for a case to go to court. And things will probably have got a lot slower now post Covid-19 as there is a backlog built up.

Marie says

Thanks so much Sara, I will put the complaint into the ombudsman now. I’ve felt so anxious all morning! Thank you for this website and all the support you give

Thomas says

Hi,

Does anyone know the response times of the financial ombudsman?

I put a complaint on about loans 2 go around 8 weeks ago? I’ve only had one email saying they had received it. I understand things will be slower with COVID-19.

Loans 2 go have taken one payment since me putting the complaint in then I have cancelled the payment and they’ve sent me a letter saying my account is in arrears etc.

Any help would be appreciated

Sara (Debt Camel) says

How much did you borrow and how much have you paid so far?

Thomas says

Hi I borrowed 750

I have currently paid £1,700 back and still have another £1000 roughly to pay.

They rejected my complaint around 9 weeks ago

Sara (Debt Camel) says

ok, well it’s best not to pay them any more but they will push you to. See my reply to Marie above.

Ross says

I put a complaint in in July 2019 for 10 loans with Loans 2 Go and an adjudicator got assigned last month. It’s getting an adjudicator assigned that takes the time, then the process moves fairly quickly.

Thomas says

Hi,

Thanks for the update. As mine was put in June 2020 I could have a few months to wait. What would be the best way to move forward for now with them, should I agree to pay them a small amount every month?

My usual repayments would be £170, what do you think they would accept before threatening to take me to court etc?

Thanks for your help

Sara (Debt Camel) says

they shouldn’t take you to court while you have an open complaint at the ombudsman.

Thomas says

Would you recommend me still paying something back to them each month?

Sara (Debt Camel) says

If you can afford to make the monthly repayments without that leaving you so short you have to borrow more money, that protects your credit record and means you will not be hassled by the creditor

But if the payments are unaffordable, the simplest approach is often to pay nothing – you have already repaid more than you borrowed.

Tyler N says

Just wanna contribute a little if you dont mind Sara, im sure you’ll want to shorten it after a read.

I have an active affordability complaint against loans2go.. I recently spoke to the financial ombudsman service to find out an update on my case as its been over 11 months since i raised it with FOS after Loans2go fully rejected my complaint (after only 3 days of raising it believe it or not)

The FOS told me i would receive a full decision in about 2 weeks as they are 12-13 months behind on short term cases at the moment..

But the adjucator i was on the phone to had just made a decision a few minutes ago on a loans2go case so was well aware of the company, but he had a quick look at my case regarding how unaffordable the loan was too me (because of the interest being so high its unaffordable sustainably) the adjucator agreed based on the decision he just made i will very likely receive all the interest back.

An important point The adjucator told me loans2go are the recently being investigated so all cases being referred to them are now being investigated separately by another team which may add to the delay before a decision can be made..

So id highly recommended anyone who has taken a loans2go loan that was unaffordable to them to put in a complaint soon, this could be the next loan company “2go”

K Smith says

Hi can someone help.

I stupidly took a loan with loans 2 go, didn’t even realise till today that its for 18 months, ive been paying 70 a month back for 6 months and just went on the account to check how much was left as again ive had no paperwork…theres no way I can afford another 12 payments….what do I do??? Thanks

Sara (Debt Camel) says

Read the article above and send in a complaint as it says!

What are the rest of your finances like, do you have other problem debts?

k smith says

Hi….i do have debts with other companies yeah that are either in dispute or I have set up on payment plans for really small amounts as I am a single parent, now unemployed and struggling

Sara (Debt Camel) says

ok so as well as putting in a complaint, I suggest you ask for a payment arrangement for a really small amount.

k Smith says

Brilliant thanks for the help

J Jones says

I used your template complaint letter which was great. They are asking me for a copy of my bank statements 2 months prior to giving me a top up loan should I give them my salary was halved and they still gave me a top up loan which turned out to be a whole new loan agreement which I did contest and offered to pay back the money which was topped up but they asked for the full amount loaned…

Sara (Debt Camel) says

So you made a complaint just about the top up loan? or both loans? What was their offer?

J Jones says

They’ve not offered anything as of yet. They’ve asked to see bank statements as part of the complaint procedure I’m presuming to check my income. Should I give them to them? Or if they’d carried out the correct checks to see if the payments of £227 a month were affordable why would they need these?

Sara (Debt Camel) says

To win a complaint you need 2 things. First is for them to not have made adequate cheks. And second is that the adequate checks would have showed you couldn’t afford the loan.

Suppose you could easily afford the loan. (NB I am not saying you could, this is trying to explain how complaints are decided at the Ombidsman.) Then FOS might decide that L2G hadn’t made the checks but those checks would have shown you were OK, You would lose the case.

So by supplying bank statements you PROVE that the loan was unaffordable.

This doesn’t mean that L2G will uphold your case, but it gives you a bigger chance they will. If they then reject, send it to FOS!

J Jones says

Ok that’s great I will send them over today. The first loan I could afford but what I didn’t realise was that when they gave up the top up loan the payments would quadruple and it was a completely new loan agreement. Which I contested but didn’t win. I’m now earning less being furloughed currently than the loan repayment!

J Jones says

I sent over bank statements and received a response from loans 2 go today who have looked at my affordability complaint. They have said they cannot uphold my complaint but are willing to take 50% of the interest off as a goodwill gesture. Should I accept this or go to FCO?

Claire says

Send to FOS they did the same to me. It took nearly 12 months with the FOS but last week I got a redress payment of £9000 back. It can be a long wait but it’s worth it

tom says

Hi,

I’ve had 6 loans with them over a 20 month, total borrowed was 2200. The interest ive paid on this is 1600. I never had the one loan for longer than 6 months as I always paid it earlier.

Do you think I have a good case to complain and get some if this interest back as surely they should have done better checks, bank statements would have shown gambling.

Sara (Debt Camel) says

Yes that is worth making a complaint because of the repeat lending and the high interest rate.

Tom says

Thanks Sara. I was looking at looking at one loan which I paid in 3 months and the interest was almost the same as the original capital. I honestly don’t know how they get away with this!

Lisa says

Hi

I applied to a payday lender for £800 who also acted as a broker and loans2go accepted me over 18 months no confirmation. Of the monthly payment and automatically set up a CPA, was advised would be contacted the next day and them all of a sudden the money was in my account and it wasn’t until then they confirmed the monthly payment of £182 paying back £3.2k, I withdrew from the loan and was given 30 days to bay it back but couldn’t afford it, I complained and they said they were not a payday lender and I had to pay the interest, they agreed for me to pay £80 a month but had to be reviewed every 2 months, on the last review they dropped it to £40 they know I cant afford this loan but when I complained they said I would not pay all this interest of i paid it off early, I cant even afford the monthly payment, they have also sent me a final demand, although I complained about the interest initially can I go striagjt the ombudsman or would I need to complain again first.

Sara (Debt Camel) says

So you made a complaint? How long ago? What exactly was it? And what was their reply?

Lisa says

I took the loan out in Jan and complained in February, this was there reaponse

In relation to your comment about the interest rate; payday loans have an interest cap of 100% of the principle borrowed which may have caused the confusion, due to our products not being considered a payday loan (our minimum loan duration is 12 months) this interest cap wouldn’t apply.

Please be reassured that the interest is frontloaded, which means that all the interest which will become payable over the term of a loan is added at the beginning of the loan term. Therefore, you do not have to factor the accrual of any further interest into your calculations nor will you incur any charges.

Sara (Debt Camel) says

was your complaint that the interest rate was too high, or that it broke the payday loan interest rate cap? And what date did L2G reply to you?

lisa says

My complaint was the interest rate was too high, and that I thought they could not charge more than 100% of the initial amount borrowed, i wasn’t aware that they were not a payday lender as I did not apply with them direct.

their reply:

In relation to your comment about the interest rate; payday loans have an interest cap of 100% of the principle borrowed which may have caused the confusion, due to our products not being considered a payday loan (our minimum loan duration is 12 months) this interest cap wouldn’t apply.

Please be reassured that the interest is frontloaded, which means that all the interest which will become payable over the term of a loan is added at the beginning of the loan term. Therefore, you do not have to factor the accrual of any further interest into your calculations nor will you incur any charges.

they replied to me on 22nd Feb they responded on the 28th with the details above

Sara (Debt Camel) says

Neither of those points are “affordability” complaints. Did you say L2G had not checked that you could afford the repayments? Or something like that?

(This matters as you are now past the 6 month point at which you can take your previous complaint to the Ombudsman. So I am asking to see if there is a “new and different” complaint you could make.)

What are the rest of your finances like at the moment?

lisa says

Hi Sara many thanks.

My initial complaint was the loan was totally unaffordable for me due to the interest rate being to high amd seeing as I didnt apply to them direct I was not made aware of the monthly payments until after the finds had been transferred, I also queried the interest cap being charged, their response is below

I am sorry to hear of your situation.

There is the option of setting up a temporary reduced payment plan, and then requesting an early settlement figure at a later date when you would be in a better position if you wished to settle the loan, and you would be entitled to a statutory rebate which would reduce the total amount repayable significantly

In relation to your comment about the interest rate; payday loans have an interest cap of 100% of the principle borrowed which may have caused the confusion, due to our products not being considered a payday loan (our minimum loan duration is 12 months) this interest cap wouldn’t apply

I sent an email back saying thank-you for the confirmation and nothing has been done since and they issued the final demand which I have now stopped.

I do kot understand why this would not be an affordability complaint and I am also in arrangements with other creditors .

Many thanks for all your help

Sara (Debt Camel) says

did they tell you you had the right to take to complaint to the Financial Ombudsman within 6 months?

lisa says

Hi Sara no they never mentioned the ombudsman at all

Sara (Debt Camel) says

OK – in that case the 6 month time limit I was worried about doesn’t matter and you can send your previous complaint to the Ombudsman right away. Say you complained in February but they never told you you could go to the ombudsman.

lisa says

Ok thank you Sara for all your help much appreciated

J Jones says

I have decided to go to the FOS even after L2G offered a 50% reduction on the interest charged as to me they are admitting some liability that the loan was unaffordable. Even with that deduction I owe over £2500 and they will not reduce the payments even with proof I have lost my job. Do I tell them I am going to FOS and what do I do about payments if I can’t afford them???

Sara (Debt Camel) says

Do you have other problem debts as well? How much do they add up to? How soon are you likely to get another job?

If the loan was unaffordable they should remove ALL the interest not 50%. Quite right to go to FOS.

J Jones says

So lastly do I tell them that I am going to the FOS and what do I do about continuing to make payments. I have debts but none are for payday loans just store account for Next and a credit card which I am paying off a set amount each month which is affordable. There’s not much left on it. In regards to getting another job I am actively seeking employment but it’s thin on the ground to fit in with a family and childcare arrangements.

Sara (Debt Camel) says

Yes tell them you are going to FOS. If you are out of work I suggest you just offer them a token 31 a month. And the same to the Next & store card accounts as well.

Kate says

I was dumb enough to take one of their loans, however within an hour of the money arriving I repaid 2/3 of it immediately. This went completely unacknowledged by them, in fact they went ahead and took repayments on the basis of the original amount. When I disputed this they at first tried to pay me the amount I had repaid so that the original agreement would stand! I refused this and disputed the amount they took three times that was based on the original principal loan amount. Now they are saying that the 2/3 of the original principal loan amount that I sent back within an hour of receiving it was a repayment on the original loan principal. So I had this money for less than an hour but should still repay as if I had the use of it as per a loan? Now they still want to take money from me on the basis of the original loan and I have that on my credit report. My position is that on a loan of £1200 I sent back £800 in an hour and have repaid 3 x £260? So they owe me, they have been lax in not contacting me and taking the money as per the original amount and not acknowledged that I sent back most of it in an hour. Then their trying to get me to accept the money that I had sent back was blatantly irresponsible lending!

Sara (Debt Camel) says

Could you have afforded the £260 a month repayments and still paid all your other debts and bills and normal expenses?

Brett says

Hi,

Please can I have some advice

I stupidly took a loan out with Loans2go, I was in desperate need and when filling out the application i obviously down played what I pay out each month etc to try and get the loan which I desperately needed to pay off other debts.

I have been paying £97 a month but it has come to the point where I can’t afford this and I sent a complaint and advised I could not afford the loan repayments.

That payment payment I missed was for 31/08/2020 – its the first one I’ve missed. I took a £407.65 loan but need to do 15 more payments of £93.17 which I just can’t afford.

So they never even acknowledged my complaint and have now just taken to calling me every half an hour and sending around 2 to 3 messages a day saying they keep trying to take the money.

I’ve asked for a response to my complaint and asked if thy can lower the payments anyway.

Is there anything else I can do ?

Thank you for your time – I look forward to hearing from you

Sara (Debt Camel) says

When did you complain?

Do you have other problem debts?

Brett says

I complained about a month ago now and have today sent them a message for a reply to my complaint and the request if they can lower the payments but not had anything back yet at all apart from chasers for this payment.

Yes i have 2 other pay day loans – 1 with Mr Lender and 1 with Sunny. I havent missed any Mr Lender ones but currently not paying Sunny.

Thank you for your reply

Sara (Debt Camel) says

If yoh can’t afford the repayments, you need to tell them what you can afford, not ask them…

So you only have payday loan debt? No credit cards or overdraft?

Brett says

Hi Sara, thanks again for your reply

Ok, so if I tell them that i can only afford £50 payment each month – how do i stop them just trying to take the full amounts out? It’s not a DD – they just put a request in on my pay day.

So when it comes to this pay day on Weds they will attempt to take 2 x £97 which I just can’t afford.

I have a £1000 overdraft that I live in and always end up over that after my daily charges

Again I appreciate your time – thank you

Sara (Debt Camel) says

If this is not a DD then it is a Continuous Payment Authority (CPA). Phone your bank up ASAP and say you want this cancelled.

Brett Dance says

Hi Sara,

Ok I have cancelled the payment. They keep contacting me to say payment failed and keep trying to chase the money. They to date have never even acknowledged my complaint and that I can’t afford the payments. How would you recommenced I move forward with this ?

Thank you for your time

Brett

Aaa says

Hi,

I raised an affordability complaint and escalated my case to the financial ombudsman in June. I have now received a letter from a debt collector notifying me, loans2go have instructed them to take legal action in the form of issuing a claim against me at the county court. What do I do? who do I contact? My claim has gone to the Financial ombudsman so I didn’t think they could take legal action until my claim has been processed? Any advice would be great, I need to respond or pay in full by the 26th of October. I do not have the money to pay it in full.

Sara (Debt Camel) says

Have you been sent a letter like this one, with a reply form, https://debtcamel.co.uk/letter-before-claim-ccj/?

Sam says

Hi,

My situation with L2G is perhaps a little bit different as I didn’t actually make any repayments on their loan, and I am now making repayments to all my debts with Step Change. I assumed that the price cap would apply to this loan and that I could complain about this, but now I’m learning it doesn’t is making me feel awful.

I borrowed £250 early this year and supposedly owe just over £1000 now. I don’t think I realised at the time that the total debt would be this high, I was just desperate to get something. My financial situation worsened soon after this and I made the decision to not make any payment and seek further advice for all my debts, and then a few months later I started a debt solution with Step Change. As I haven’t made any significant repayment towards this debt I am not really seeking a refund, instead I’d like to see if they will consider reducing the total debt in line with the price cap ‘short term’ lenders adhere to (so £500 in this case).

Does anyone have any advice on how to approach this with Loans 2 Go?

Thanks,

Sam

Sara (Debt Camel) says

The price cap does not legally apply to this loan so there is no point in asking them to reduce the amount outstanding to that.

If you use the template in the article above it asks them to remove all the interest so the balance would reduce to 250 less the small amounts that have been paid.

Can you say what the rest of your financial situation is like? How large are the other debts in your DMP? Are any of them payday loans and other high interest credit?

Sam says

Hi Sara,

Thank you for your response, I will certainly try the template with them to see how it goes.

I have a few credit card debts that range from £200-£900, a few other pay day loans again in the same range, such as Indigo Michael and Cash 4 U Now. Other than a store card debt with Very (£1700), Loans 2 Go would be my largest debt unless they reduce the balance to £250 like you say.

I am paying £5 towards most of these on the DMP, which is unfortunately a small amount but I am much happier for doing so and have not got into any further debt since.

Sam

Sara (Debt Camel) says

Indigo Michael – is that SafetyNet Credit? They can be one of the easier firms to get a refund from / have the interest removed from as they could see your bank account and the mess you were in… See https://debtcamel.co.uk/payday-loan-refunds/ and use the template there for the other payday loans.

Who is your DMP with? did they talk to you about other options?

Sam says

Yes it is SafetyNet credit. I will try to speak with them too, thanks.

My DMP is with Step Change. I don’t think I had a choice, just that they offered me what they thought was best for my financial situation. It found it easier for me at the time rather than trying to deal with it myself.

Nat says

I have finally had an email saying an adjudicator is looking at my complaint with loans 2 go. I complained to them last october. Sent to fos in February. Is there a rough time how long an adjudicator takes to come to a decision and has anybody had a refund with an adjudicator. I am so fed up with this company i borrwed £250 not realising it was over 18 months !! I have paid £500 back in interest already and they still want another £367 on top of that. Only now they have finally put me on an affordable repayment plan.

Nat says

Also the amount of loans and defaults and other debt i had and they still think this loan was affordable to me. They said i told them my income was 1200 andd my outgoings were 490 but when they did their checks my outgoings were 990 (that was just credit payments)my income was 1100. Even though they seen this they still lent me the money and it was affordable?

salem says

hey i had a loan of 400 of them i have paid over 1100 with them and sitll paying now i still have another 600 to pay i feel tgere robbing me to the max. what can i do about this.

Sara (Debt Camel) says

Read the article above. As that says, if you think the loan is unaffordable, send them a complaint.

Do you have other problem debts as well?

Dariosollazzo says

Hi I did the letter as you show on this website.

And had a final response, that they can’t hold up my complaint.

I borrowed several times from loan2go and previously I missed payments, but yet they would ask me if I wanted another loan, as soon I would clear the last.

They reposed 2 cars of me.

The last one a borrowed 1600. And the total amount was over 6k!!!! I couldn’t afford it and give the. The car, and lost my job as I needed my car for work. But I feel they not going to accept my complaint what shall I do?.

Many thanks.

Sara (Debt Camel) says

Send the complaint to the Financial Ombudsman! Many people are winning these complaints at the ombudsman.

Reece says

Hi, I have logged a complaint using the template letter. They have requested bank statements of doctors notes etc at the time of taking the loan out. As this was the best part of 4 years ago, i don’t have anything like that. I don’t recall anything like that being requested at the time.

They have also told me the loan was sold in june 2019. Are they still Liable, what’s the best way to answer them? Thanks

Sara (Debt Camel) says

You can get bank statements from your bank going back 4 years. Even if the account has been closed.

But for now you can just tell L2G that you want them to respond to your complaint and it will be going to the ombudsman if they don’t make you a reasonable offer. And that you will supply your bank statements to the ombudsman.

Wanttobedebtfree says

How long does an adjudicator take to give an answer. I have had an email 2 weeks ago saying hes looking at my case now but im just curious how long roughly it takes

Tyler N says

I have a nearly completed case with the FOS about Loans2go.

Heres my timeline..

29/09/19- Complaint send to L2G.

02/10/19- Rejected with final response in post.

15/11/19- Esculated complaint to FOS.

23/01/20-First communication from FOS.

06/05/20- FOS received case info from L2G.

09/10/20- First communication from adjucator.

04/11/20- Decision from adjucator.

Loans2go have until 17th Nov to respond with any further information.

but the decision was to refund all interest plus 8% simple interest.. I discussed issues with the interest rate being excessive and the lack of information provided before i received the loan. But the FOS only discussed the single fact that the loan was unaffordable, no other points.

Happy though, I should get a full refund on the interest if they dont reject the adjucator’s decision.

Good luck everyone!

Sara (Debt Camel) says

I discussed issues with the interest rate being excessive and the lack of information provided before i received the loan. But the FOS only discussed the single fact that the loan was unaffordable, no other points.

the adjudicator is saying you should have a full refund. You wouldn’t be likely to get more even if FOS decided the interest rate was excessive. So FOS understandably take the easy route – no need to make a complicated decision when the simple one gets you the same result.

Tyler N says

Ofcourse im more than happy with the outcome (if they dont reject the adjucator decision or go into administration) especially with the 8% interest ontop i wouldnt expect a penny more :). Its just to share incase others are putting in their own complaint.

I used the other points as backup incase the FOS thought loans2go didnt have to thoroughly check my income or expenditure as i only had one loan with them. But it was unnecessary as the affordability aspect of my complaint was the only point i needed to make in the end.

Goodluck with your last complaint Wanttobedebtfree.. You’ll have to tweek your name slightly in the near future im guessing haha

Sara (Debt Camel) says

Yes it’s good to have back-up points. If the adjudicator decides the loan was affordable for you, you then have those to argue.

Wanttobedebtfree says

So i had an email from adjudicator 14/10/20 so its looking promising then maybe a month wait on their decision. Thank you so much for replying. I hope to get this refund as this is my last loan to sort out :)

Tyler N says

Just a little further update on my case..

Loans2go accepted the adjucator proposals within a couple of days.

The adjucator said L2G will contact me within the next 4 weeks to settle.

Hopefully be in my pocket before Christmas :)

Wanttobedebtfree says

That is absolutely fab news 😀 👏 thanks for the update

Wanttobedebtfree says

Mine was a single £250 loan but ive already paid £770 and they still want £368. Its absolute madness i didn’t realise it was over 18 months and i was desperate at the time i just hope the adjudicator upholds for me

Tyler N says

Just a final update with Loans2go..

Their “professional standards team” contacted me yesterday (10/11/20) confirming the amount of my refund. Which did add up to all interest plus 8%. Asked for bank details. Was in my bank at 4pm same day.

Thats the only part of this case i can say was positive..but yay :)

Sara (Debt Camel) says

Many people here may be surprised that they know what the words professional standards mean…

Tyler N says

Professional crooks to be fair. The FCA are a joke too allowing them to exist.

But even my refund is nothing when they will already be charging another 10 people £16.79 interest per day on a £1000 loan.

Debtfreewannabe says

How much was your loan you complained about?. I still haven’t heard back from adjudicator its been 4 weeks today since the first email. Well done on getting a refund .

Tyler Nicholls says

Mine was for a single £1000 loan. I seen the ridiculous interest but managed to lend money from family to pay it off, but still charged me £362 interest in 3 weeks.

I hope things speed along for you!

Julie Haime says

I had a response from L2go they said they did affordability checks and in there words said I could afford the repayments, I wasn’t given an option on how long the loan was for or how much the loan was for as I was passed to them from payday pig a loan broker, this broker asked how much I earned a year I told them £20,000 and L2go said I told them I earned £2000 a month which is a lie I would never say I earned more than I do, as a result I ended up with a £1000 pound loan with £3000 interest at a monthly payment of £228.00 per month, I tried to ring and cancel it but couldn’t get through, I have made a complaint to the FOC but still waiting.

Worried mum says

Hi,

My son stupidly took out a loan from loans 2 go after losing his job through covid19 in March. He was unemployed and had terrible credit score due to unpaid payday loans from the previous year. They are saying he owes 7900 now he only borrowed a few hundred pounds originally. He says he never realised the interest charges and now just throws any mail he receives from them in the bin without even reading. Can we complain since they didnt make proper checks about hos employment or credit score

Sara (Debt Camel) says

They are saying he owes 7900 now he only borrowed a few hundred pounds originally.

Even for Loans2Go that sounds excessive. Are you sure about the amounts? Can you get him to post here himself?

Also what are his other debts like? If he has unpaid payday loans and still isn’t in work, it may be better to look at getting the clean start of a debt relief order?

Tracy says

Could I have advise I took a 2000 loan out this year for 24 months and pay 339 a month back interest is massive how can I put a complaint in like you’ve suggested I don’t know where to start although the l2g didn’t even ask me about f I could afford u applied then within 5 minutes money was in the bank

Sara (Debt Camel) says

The article above explains how to put in a complaint if you think the loan was unaffordable for you.

Karly says

Hi I took out loan with loans to go back in December last year. £280 loan and paying over £1000 back, if I had know how much the interest was I’d have never taken the loan out but before I new it the money was In my bank. I’m a single parent and struggling to pay the monthly £64. Is there any advice you can give me please in what to do?

Thanks

Sara (Debt Camel) says

Read the article above. If the loan was unaffordable for you, send them a complaint as it says.

Kane says

Hi

What advice would you give for someone who’s just got a claim form for the courts through because of loans 2 go?

I have 28 days to respond, I didn’t make any complaints before

Thanks

Kane

Sara (Debt Camel) says

Were you sent a Letter before Claim/Action before the court forms?

Can you say more about the rest of your financial situation – do you have other debts you can’t pay? any bills such as rent/council tax/utilities where you are behind?

Are you in work? Do you expect your situation to improve?

Kane says

Hi Sara

I moved house and didn’t update my address for l2g so I didn’t get the rest of the correspondence ‘schoolboy error I know’

I am working through my debts but I’m not there just yet and struggling to be honest

I am in work yeah

Sara (Debt Camel) says

OK I suggest you should talk to National Debtline about the court forms – phone them on 0808 808 4000. Say you could make an affordability complaint but what should you put on the forms?

Also talk to them about the rest of your finances. If they advise that a debt relief order or another form of insolvency is your best option, there may be little point in struggling on with a court case and an affordability complaint.

A LOT of L2G complaints are being won so I am not trying to put you off this. But if your other debts are too large you need to take a practical view.

Sarah says

Hi,

I made a complaint to Loans2Go at the start of the year and they agreed to settle by reducing 50% of the balance, letting me pay 50 pounds a month to pay off the remaining balance, and to remove all trace from my credit file once paid off. Over the last few months they have been sending daily, if not twice daily, text messages saying I am in arrears and need to pay it off and now I have also recieved a fine demand letter. This is even though I have been making the payments as agreed. I have contacted them and been advised that they review reduced payment plans every 3 to 6 months and I am still legally obliged to be making the original 198 pounds monthly payment. They ‘apologised’ in the email that I was not told this in my settlement letter. Can this be right? If they had told me this originally then I would not have agreed to settle.

Sara (Debt Camel) says

Tell them either they carry on letting you pay £50 a month and stop the demanding texts or you will be sending the case to the Ombudsman as this was not what you agreed to.

Thomas says

Hi,

Just wondered if anyone knows the timescales for progress once the Financial Ombudsman has asked for more information like bank statements etc?

I have also provided my bank statements but at the time of taking out the loan I was gambling a lot hoping I would win money to clear my debt (thankfully this has stopped now). Do you know if this will hinder my complaint?

Thanks,

Thomas

Sara (Debt Camel) says

FOs normally sees gambling as an addiction, they don’t make moral judgments on it.

Tom says

Hello,

I made a complaint with L2G and have sent bank statements at their request. I had 3 loans. 2 I paid early with winnings from Gambling. Prior to the wins I was borrowing from a variety of different places to meet payments and stupidly fund my gambling. I have now quit gambling and still have the last loan. I wondered if anyone knew how long they take to make a decision?

Sara (Debt Camel) says

I don’t know, but if they reject your complaint, send it straight to the Ombudsman.

Meee says

Hi. I complained last year to loans 2 go. Sent to fos at the beginning of this year. Adjudicator contacted me 7 weeks ago to say he’s looking into my complaint. Can i keep asking for updates? i don’t want to be rude but all others ive had with Adjudicator seem alot quicker than this?

Sara (Debt Camel) says

Yes, go back and ask if there is any more info you can provide – a polite nudge!

Meee says

Thanks im just getting slight annoyed now as im still paying them. I just want it over with. I am going to email adjudicator now

Sara (Debt Camel) says

are you making the normal payments or a reduced amount? Have you paid them more than you borrowed?

Meee says

I borrowed £250 i have repaid £782 and they say i still owe £350. I am paying £20 a month at the moment. This is on a 3 month payment plan. So next month i have £20 then it will resume to £57 monthly

Sara (Debt Camel) says

is this 3 month plan because of coronavirus?

Meee says

No because i couldn’t afford the payments

I have just logged into my loans to go account and now its saying my session has expired. Do you think maybe they have closed my account?

Sara (Debt Camel) says

ok, so your credit record is already affected by the repayment plan. If you win the complaint – and a LOT of these cases are being won – all negative marks will be removed from your record .

So one option for you is just to stop paying them anything. They will mark your credit record as being in default. They can’t take you to court with a complaint going in – at least they would be stupid to try as FOS would then give your case priority.

Meee says

I think i will just stop paying now then they have had like £530 in interest already. Thank you for your help. Hopefully adjudicator will get back to me sooner than my next payment

Meee says

This is my reply from adjudicator.

At this time the service is currently considering our approach to working complaints against the business. Consequently, it its taking longer than we would wish. However, be assured we will progress your case as soon as possible. I appreciate your wish for us to begin our investigation and I am sorry it is taking longer than expected. However, I would ask for your continued patience whilst we determine the best possible way forward.

I don’t quite understand this message?

Sara (Debt Camel) says

people often seem to get told a variation on this and it never seems to amount to much.

Meee says

7 weeks he ago he told me he’s looking into my complaint and has everything he needs. I hope its not going to take months :(

David Smith says

Today received letter from FOS upholding my complaint. It said there written to loans to go to see if they agree with the findings or not and to make a offer of redress to me within 28 days. Does this mean I get all my 3 loans plus interest repaid minus original loan figure. These were 3 £500 log book loans??

Sara (Debt Camel) says

it sounds like it… If you ask your adjudicator they will confirm if all three loans are decided to be unaffordable.

Adam says

Hi Sara,

I’ve used this site before and did so well and nearly had all my debts cleared but sadly fell foul to gambling once again and began taking out loans to fund it. I had taken a loan of £900 from L2G and couple of other loans from other companies.

I can sort of afford the payments between loans, credit cards, store cards etc but leaves with pounds each month to live on. I don’t know what way to go about this with L2G because it was a single loan. I am currently paying £205 for next 18 months, I have made one payment to them.

Sara (Debt Camel) says

It is always worth making a complaint againt L2G even for only one loan.

But are you still gambling? because if you are this is pretty much all pointless.

Adam says

I am not. I have been in contact with gamcare to get support and advice and have added a block on my debit card for gambling transactions and excluded myself from all gambling websites.

I will make a complaint to L2G and go from there. Thank you.

Tyler N says

Hello Adam,

I was a compulsive gambler for some years. (spent 62k in my worst year).

I’m glad your looking for help again. But you need to make sure you don’t relapse repeatedly, I assume you signed up to GamStop if you’ve blocked yourself from gambling but what term did you block yourself for? if you haven’t block yourself for the maximum period already..then please contact them and extend it to 5 years. Any shorter than that will not give you the time to recover mentally or financially.

Sorry if it seems a little direct, I just know the damage a gambling addicition can cause if each relapse gets worse because you “missed” gambling, counting down the days until your gambling block ends.

Don’t fall into the trap mate, keep the money safe in your pocket today and it will still be there for tomorrow

Adam says

I appreciate the reply. Yes when I contacted gamcare they directed me to Gamstop and it was set to 5 years, this last time was my 3rd relapse and I think it was the one that finally made me seek help.

Dont be sorry at all, I totally appreciate the reply, honestly and advice. It’s nice to know there’s support there even from strangers.

Tyler N says

I’m glad your getting the help you need.

It’s a real battle for sure, it also took me 3 times until I realised I’ve hit rock bottom, the amount I spent still sickens me.

Nearly 2 years into my recovery now, with great answers from Sara and her articles along the way, I’m getting there. And receiving these refunds is much more satisfying, it helped me re-evaluate the value of money fighting through these complaints.

And I’m going to extend my GamStop by a further 2 years when it lets me soon, we don’t need this misery.

Keep on that long old road!

Take care mate.

Raj says

Hi Sara,

I wonder if you could help me with a calculation of the 8% interest.

Loans 2 Go have offered me a redress figure after the Ombudsman upheld my complaint.

The loan was taken on 29/9/2014

The refund should be £2979.94 so I calculated as follows

2979.94 x 2261 x 8/36500 = 1476.74 (total interest)

1476.74 x 0.2 = 295.34 (20% tax)

1476.74- 295.34 = 1181.4

Total = 2979.94 + 1181.4 = £4161.34.

Does this sound about right? As Loans 2 Go have offered £3953.78

Thanks

Sara (Debt Camel) says

when was the loan repaid?

Raj says

It was for 18 months so 2016

Lisa Taylor says

Hi Sara I used this site back in September regarding Loans2go, I initially complained to them about the interest charge but only to customer services and not the personal standards email, You mentioned to go the ombudsman as 6 months had passed and they never mentioned I could go to the ombudsman, I complained again to personal standards on 18.10.20 regarding affordability and the interest charge, they responded with an email to say my complaint had been received and I received a letter on 23.10.20 to say they have performed a preliminary review of my complaint and are satisfied no interim action is required while the matter is under investigation my account is not on hold. I have not received any further updates from them. The letter says they endeavour to acknowledge all complaints in writing within 5 working days of their receipt and aim to send a final response within 4 weeks and are obliged to send this within 8 weeks, It is now over 8 weeks should I be contacting them for an update or can I go striaght to the ombudsman, many thanks

Sara (Debt Camel) says

I suggest you go straight to the Ombudsman.

Lesley says

Hello

My son took out a loan with Loans2Go a couple of years ago I think. This loan was unaffordable for him and he fell behind on his payments. He is now paying a nominal amount each month to a debt collection agency. If a complaint is make and upheld, hopefully, would what happen to the outstanding debt with the agency? I don’t have all the information but, I would assume the debt has increased because of the agency charges being added.

Thank you

Sara (Debt Camel) says

If the loan is upheld he will only have to repay in total the amount he borrowed,. So if he borrowed £400 and repaid L2G £120 then has repaid the debt collector £100, L2G have to arrange for him to only have to repay £280 – all interest and any late fees and charges are removed.

It would be up to L2G whether they arrange for the loan with the debt collector to be reduced to 180 or they buy the loan back and reduce it to 180.

Lesley says

Thank you for the info.

Adam says

So Loans2go came back with final response in just under 3 weeks. They haven’t upheld my complaint but have offered to reduce the interest by 50%.

Amount of Credit: £900.00

Total Amount Payable: £3,702.60

Total Amount Paid: £205.70

Current Balance: £3,496.90

Proposed Write Off Amount: £1,401.30 (50% of Total Interest) Proposed New Balance: £2,095.60

I sent them bank statements which showed all my transactions and gambling and other loans etc and they said this

“ I note that on your Online Application, you declared your monthly income as £1,500.00, we verified that you received a minimum of £1,487.73 monthly via an online income verification tool. You declared your monthly expenditure and credit commitments to total £450.00, however, following an extensive review of your application, in addition to your credit file, we calculated them to total £1,131.93. We also added a buffer of 10% to your verified expenditure to account for any fluctuations in your monthly income or expenditure, even after which, your Monthly contractual loan repayment of £205.70 would have still been affordable.”

Do you think I should go to FOS, I would hate to go through the long wait etc for it to possibly be rejected.

Sara (Debt Camel) says

Obviously I don’t know the details of your case.

But I doubt L2G would offer you that reduction if they thought they would win a FOS case.

And LOTS of people are winning FOS cases against L2G.

Bank statements showing gambling makes your case stronger – make sure you show them to FOS.

Tyler N says

I had similar circumstances and loans2go gave me exactly the same email but didn’t offer me a 50% reduction. I took the case to the ombudsman and won a full refund plus 8%. (I already repaid so was entitled to 8% on top)

If your statements show you didn’t have enough to cover your bills and the gambling left you borrowing elsewhere or having no money until your next payday, then take your case to ombudsman as they should of asked for this additional information before approving the first loan, as the amounts your expected to repay over the duration of the loan, generally require more checks that other first time loans.

if it applys in your case, then if they asked for statements, it would of shown the loan being unaffordable.

Hope it’s of some use to you, good luck.

Thomas says

Hi

How long did it take once speaking with the financial ombudsman if you don’t mind me asking?

They asked me to send statements etc around 4 weeks ago but heard nothing since.

Thanks

Tyler N says

Once the adjudicator was assigned it took a month to receive a decision.. but I was struggling so I was phoning them every week with friendly reminders for 6 months straight.

Definitely phone them! they will ask the adjudicator to contact you or atleast let you know it’s still awaiting to be assigned to one.

After receiving the adjudicator decision loans2go agreed and settled 7 days later.

Tom says

I recently complained to the L2G had the same response as you. I replied with a couple of points about how they should have done more checks etc. And asked to write off the whole loan and then I would be happy.

A week later they offered to close the account and pay off the loan so was a good result. I only did this as I had worked out that I would only be due a £300 refund anyway and preferred to just have it over and done with.

It seems they are willing to negotiate.

Emilie says

Ho my name is emilie I did a loan with loan to go of 1k they ask me 4k back . I apply for this loan on February I was paying like 53 pound every week then with the covid I ask to put my weekly paiement lower at 15 pound what they did. The 7 December I received a final demand asking me to pay immediately 3008 pound as I did not comply the default notice so they terminate my agreement and have to pay this money before bring the case to court. I just send them the template u did and they reply that they hold my requests plus ask me my bank statement prior loan. Could u help me im desperate. Thanks in advance.

Sara (Debt Camel) says

have they rejected your complaint?

are they asking for your bank statement now?

do you have other debt problems too?

Emilie says

They didn’t reject my complaint they said its under investigation and if I can give them my statement before I contract the loan if I can’t they said they gonna investigate with what they have in my file

I don’t have other dbt it’s the only one I contract im just guarantor of another loan .

Plus beginning of December I called them for putting back my normal paiement per week as 53 pound because as I put my paiement lower for the covid period they put my account in arrears so I decide to pay them as it was to avoid more problem so thats why don’t understand really im lost .

Thanks for ur reply btw

Sara (Debt Camel) says

OK, so definitely send them that bank statement.

What is this loan you are a guarantor of? Is the borrower paying it? is the borrower in any difficulty? who is the lender?

Emilie says

Hi sara thanks for your reply im gonna send as you said…

The loan im guarantor its amigoloan its a loan of 5000 pound its my partner loan that im the guarantor for the moment je had a breathing space for this lender until February but he always this loan so I don’t have particular problem with this.

Sara (Debt Camel) says

OK, tell your partner to read this https://debtcamel.co.uk/how-to-complain-guarantor-loan/ and consider if he should send Amigo an affordability complaint. If he wins this, interest will be removed from the loan so he only has to repay what he borrowed and you will be released as guarantor.

Good luck with the L2G complaint – come back here with what L2G say to you?

Emilie says

Hi sara im emilie send u a comment about loan to go on 23 Rd December they didn’t accept my complaint and said if im not happy with the decision I can make a complaint to financial ombudsman. Yesterday I call loan 2 go to cancelled my weekly paiemeny as they gave me a final demand on 7 December to pay immediately 3008 pound so if they terminate my agreement why should I keep paying them weekly? Can u advice me please

Sara (Debt Camel) says

So you have sent the complaint to the Ombudsman?

If you can’t afford to pay it, then stopping the payment is the right decision. This is an unsecured loan – other more important things such as the rent, utilities and food come first!

If you aren’t sure, please talk to a debt adviser, eg National Debtline on 0808 808 4000 – they are very helpful.

Emilie says

I m gonna send the complaint to the ombudsman today with all the document they send me as you said food , rent and utilities come first so thank you very much for your availability you have been very helpful.

Luke c says

Hello I took one of these loans out recently and I’m within the 14 day cooling of period. I now realise I can’t afford these payments. Can I simply cancel the contract with them and just return the money?

Sara (Debt Camel) says

yes you can. You will be charged interest for the few days you have had it so don’t delay!

Andrew Green says

Hi I took out a £1,500 loan and I am currently being chased for over £6,000!!!! I have used the template to submit a personalised complaint to Loans2 Go but reading the comments above I anticipate that they will most likely ask for bank statements which I am not minded to give them. My complaint is on the basis of immoral and not legally enforceable interest rates (over 1000%) so my bank statements shouldn’t be required for that. My complaint was only issued a few moments ago – should I await their response before proceeding with a complaint to the Financial Ombudsman, or is it worth getting my complaint to FOS started asap? Many thanks. Andrew

Sara (Debt Camel) says

You can’t go to the Ombudsman until the lender has had 8 weeks to respond.

If they ask you for bank statements I strongly suggest you send them. That gives you a much better chance to win the complaint quickly.

Adam says

Have you heard of any reports that they can’t get their complaints submitted on the FOS website, I’ve tried on maybe 5 different occasions now and when I hit submit I get an internal server error. I have tried different times on different days.

Sara (Debt Camel) says

no-one has mentioned this problem. I suggest you phone them up on Monday.

Stu says

Update on my Loan2go complaint. I am now over 24 months since I first submitted my complaint. 13 months for an adjudicator and now been waiting 11+ months for an ombudsman to pick it up. This is despite me putting a complaint to a manager and being told my complaint was prioritised. 2+ months later and still nothing. This is getting beyond a joke and to say my patience is waring thin is an understatement.

Thomas says

Hi,

Is anyone actually getting any response or complaints been resolved with the ombudsman? I was asked for documents at the start of November. Since sending them a day later I have not received one email from them.