Loans2Go offers what I have called the worst loans in Britain.

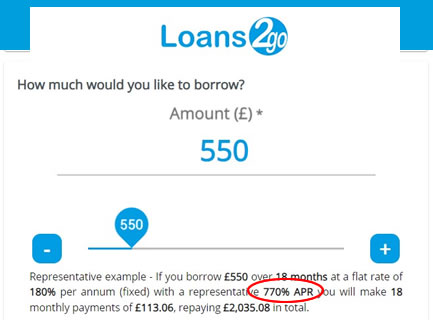

Since 2021 they have been charging 770% APR. See the representative example Loans2Go quotes on its website:

- £550 borrowed for 18 months is a monthly payment of £113

- this adds up to £2035, a bit less than four times what was borrowed.

Contents

MUCH cheaper to get a payday loan than a Loans2Go loan

Of course Loans2Go don’t point this out on their website, but check out these numbers!

With a payday loan for £550, the maximum interest that could legally be charged is £550 – the amount borrowed. So you would only have to repay £1,100 – the £550 borrowed plus the £550 interest. And the monthly repayments for a payday loan for 12 months can’t be more than £92.

So you would pay a payday lender £92 for 12 months

but Loans2Go is charging MORE PER MONTH (£113) for MUCH LONGER (18 months).

Loans2Go also used to offer logbook loans, but this article is just about their standard personal loans. If you had a logbook loan from them, use the template on this other page.

Is this legal?

The Financial Conduct Authority (FCA) calls payday loans “High Cost Short Term Credit”. Its definition of High Cost Short Term Credit is a loan over 100% in APR and of 12 months or less.

So the Loans2go loan is outside that definition because it is 18 months long. So it isn’t caught by the price cap rule.

Unfortunately, this means its loans have crept through a loophole and are legal. I think the FCA should close this loophole.

Many people are winning affordability complaints about Loans2Go loans

I think this is the worst loan in Britain.

A loan is unaffordable for you if the monthly repayments were so high you couldn’t afford to pay them without hardship, borrowing more or getting behind with important bills. This is a standard affordability complaint, used for many other sorts of loans. If you win this you will get a refund of all the interest.

Because Loans2Go loans are so expensive they are often unaffordable. Many people are winning Financial Ombudsman (FOS) complaints about these loans – here is just one example: Miss R’s personal loan provided by Loans 2 Go.

No-one who isn’t desperate would take one of these loans out, and the ombudsman says Loans2Go should make more detailed checks on affordability when it thinks the borrower may be in difficulty.

Several people have said they were not given the full details about the loan before the money was given to them. If this happened to you, say this in your complaint as well.

First complain to Loans2Go

It doesn’t matter if you have repaid the loan or you are still paying, you can still complain.

You have to complain to Loans2Go first, you can’t go directly to the Ombudsman.

Email customerservices@loans2go.co.uk and copy it to ps@loans2go.co.uk. Put AFFORDABILITY COMPLAINT as the title.

Use this template as a basis and make any changes so it reflects your case:

I am also complaining that the interest rate was grossly excessive. It is unfair to charge someone more per month over 18 months than they would have paid to a payday lender for a loan the same size over 12 months.

[only add this next sentence if the date of your loan was after the end of July 2023] This loan does not represent fair value and it is in breach of the FCA’s Consumer Duty.

[only add this if you were not told the loan terms] The loan was not adequately described to me before I was given the money. This is an unfair way to give high cost credit.

I am asking you to refund the interest and any charges I paid, plus statutory interest, and to delete any negative information from my credit record.

[delete if you have repaid the loan] I would also like an affordable repayment plan to be put in place if I still owe a balance after this refund.

I am also making a Subject Access Request (SAR) for all the personal information you hold about me including, but not limited to, my applications, all credit and other affordability checks, a statement of account for my borrowing, and a record of all phone calls.

Let me know in the comments below if you are making a complaint about a loan that started after the end of July 2023, as there are some new regulations about those.

Is an offer from L2G a good one?

If L2G has offered to wipe a small balance or take some money off what you owe, you have to decide whether this is a good enough offer to accept.

For example, they may offer 50% of the interest off “as a goodwill gesture”. Or to reduce your balance by 50%. These are often very poor offers, you could get a lot more by going to the Ombudsman.

Sometimes Loans2Go will increase an offer if you push them. Here is what one reader said:

They replied firstly with the offer to half what was left and agree a payment plan and I refused and they immediately came back and wiped the loan clean and removed it from my credit file.

It’s up to you what you think a good offer is. But you can’t change your mind later if you accept and then think you shouldn’t have.

So ask a question in the comments below if you aren’t sure.

Take a rejection or a poor offer to the Ombudsman

You can send your complaint to FOS if Loans2Go has rejected it or has made you a poor offer. This is easy, just use this simple FOS form which asks you what they need to know to set up your case.

Send your bank statements to the Ombudsman – 3 months before and 3 months after the date of the loan. These are the best evidence that the loan was unaffordable for you.

Bella says

Hi,

I submitted a complaint using the above template last week and L2G have sent me my requested SAR documents however it is just my agreement with them?

Sara (Debt Camel) says

What was the date of the loan? How large was it? Do you still owe a balance?

Bella says

The loan was from December 2023, for £1000. I will be paying over £3000 back with interest now. I have paid £650 of the loan back and intend to pay it off however due to financial difficulties and taking on other loans I fell behind on payments. The SAR showed nothing regarding any credit checks that had been done it was just the agreement that I had with them. L2G wrote to me yesterday detailing that they will not be upholding any complaints and all appropriate checks were made. What should I do now?

Sara (Debt Camel) says

Send this straight to the Ombudsman. Use the link in the article above to the Ombudsmans form.

In the bit that asks what you are complaining about, say it was unaffordable and L2G didn’t make proper checks. Say you have Asked for a SAR showing what checks were made but weren’t sent anything. And include this sentence from the complaint “ This loan does not represent fair value and it is in breach of the FCA’s Consumer Duty.”

Connor says

I recently engaged with an external company to file a complaint on my behalf against Loans2Go in regards to irresponsible lending. I took a £600 loan out in March this year, having to pay back ~£2200. I instructed said company, during my 14 day cooling off period, I wished to cancel it and carry out the complaint myself after reading this website.

After contacting Loans2Go I have been forwarded a final response, already sent to the external company, which doesn’t go in my favour. They noted they requested bank statements which were never sent as they were never requested from me.

Can I use the final response letter to go to the FOS now, or what are my next steps? Any advice would be appreciated, feeling like I’m at a bit of a road block now at no fault of my own. Also, my SAR (which Loans2Go did send me at my initial point of contact) is account notes, no credit check etc.

Sara (Debt Camel) says

You can send the bank statements to L2G and ask them to review their decision because it goes to the Ombudsman if they don’t make an acceptable offer.

BUT you only have 6 months from l2G’s first decision to go to the Ombudsman. Don’t let them drag this out so you are over the limit.

Courtney says

Has anyone found that loans2go has a really bad effect on your credit file I’m currently trying to pay mine off I got this loan out March of 2023 £700 was the loan amount I wanted, I’m now paying 15% APR ( I didn’t know of this until I’ve just looked through the contract that has been signed for me off loans2go) and they gave me this contract after it had all got sorted I’m now paying back £143.89 per month over 18 months it works out at £2,590.02, I couldn’t keep up the payments so I’m now still paying this back, I’m now petrified that when I do pay this loan off it’s still going to have a negative effect on my credit file for years to come.

Any help is appreciated.

Sara (Debt Camel) says

Main an affordability complaint as described in the article above. Not only will that reduce the amount you have to pay, it may also help clear up your credit record

Leila says

Hi I’m not sure if you received my other comments but any help will be greatly appreciated

I took a loan £650 I’m having to pay £2400 something back I cannot afford this I’m in overdraft and have several credit cards I have missed payments with. I went to the ombudsman and all I provided was my medical sick notes to show not working and that I had not been working every 3/4 months I didn’t think of sending my bank statements they closed the case and decided I can afford it

But it’s strange because I don’t even work, in a month I’m at work like 4 times and the rest im off km on probation and I know I am losing my job because I have way to much absence

I really don’t know what to do please can you advise me :(

Sara (Debt Camel) says

Talk to a debt adviser eg National Debtline on 0808 898 4000

It sounds as though you shouldn’t be making any payments to your debts, although the Loans2go may feel like a massive problem, so are the others. You need a solution that will cover them all, nit just remove interest from this one. National Debtline can talk about your options including a Debt Relief Order.

Paul says

My son got into trouble with gambling where he used this company for a loan to use for gambling. He got a £1000 loan from them, they are looking at over 3000 back, i have taken over running of his bank and accounts etc and he is getting help with his addiction. Do you think they would drop the interest if I explain the situation. Would I have a case due to my sons addiction and has been on a few occasions where he has lapsed.

Sara (Debt Camel) says

You are hoping they will be sympathetic? No chance.

But should your son have been lent this? Had his debts been increasing? Were the repayments affordable?

How much else does your son owe? Loans2go may be the worst, but by the time someone is so desperate as to borrow from them, they normally have a lot of other expensive borrowing too. Look at affordability complaints against all of them too.

BUT Does he have any assets? If he he’s relapsed several times, there are arguments in favour of bankruptcy, as making it massively harder for him to borrow for the next 6 years. And removing the mental pressure caused by debts can help make it easier to stay clean.

Paul says

Thanks Sara.

Yes I’m afraid his debts has been increasing the whole time. This is not the only loan he has taken out for gambling.

I wouldn’t say the repayments have been affordable as he has had to go into debt for his car loan which he has too as they are taking near 300 a month from him where his car loan is 260 a month. That’s not including all the other money lending he has done through friends and family which I am trying to pay back by managing his finances. The car loan is about 4 months behind in the repayment plan due to this company taking the payment out of the bank as soon as his wage goes in. I even changed his bank card to try and stop them but they are still taking it. Is there anything I can do to stop them taking the amount automatically out the bank and then arrange a repayment plan? I’m thinking maybe that he will have to go on some debt management plan but as he has a few debts to friends and family, i don’t think this would be taken into account. Even if have bailed him out previously to near 2000 on his last time he lapsed.

Any help would be appreciated, thanks.

Sara (Debt Camel) says

Who is the car loan with?

total debt amount not including friends and family?

And how large are the friends and family?

Paul says

Car loan is with MBNA. Roughly 8000 left.

Total debt not including family is about 13000 including the car loan.

Owes family and friends near 6000.

Esther says

Loans2go sold my debt to another company. I sent affordability complaint to Loans2go. I’ve been told to contact new company.

#1000 Loan, paid 900, thus far been told bal now £2652.96.

Please advise what to do next

Sara (Debt Camel) says

What exactly did Loans2go say?

What other debts do you – no one falls into the clutches of a loans2go loan without other expensive debts first

Sara (Debt Camel) says

ok so that car loan is just a loan, not car finance, secured on the car? MBNA have sent this to a debt collector, what repayment agreed?

how much is the car worth? does he need a car?

how much does he earn a month?

what are his housing costs (rent, council tax, utilities etc)?

James says

Hi there, I need your advice on this, please

I took 2 Loans with Loans2Go

1) April 2024: £750 – paid back a total of £842.38 (1st installment of £154.17 + settled it for £688.21 less than a month after the agreement)

2) £650 July 2024 – paid back a total of £1002.05 (2 installments (£127.11 and £177.00 and final payment of £697.94 in September)

Do you think there’s room to challenge them with an affordability complaint, despite the loans being settled?

Thank you so much in advance for your opinions/suggestion

Sara (Debt Camel) says

where did the money come from to settle the debts?

James says

Thanks for replying Sara

To give you context, I used both of the Loans2go loans to clear other short term loans, then both of the times I took other loans before settling with Loans2Go

Sara (Debt Camel) says

So the most important thing is you have to STOP borrowing money to pay other debts.

Definitely complain to L2G – you only cleared the loans by borrowing – that doesn’t mean they were affordable.

But also complain to all the other lenders you have used in the last couple of years.

And next time you are in difficulty, don’t borrow more to repay some debt but ask for a repayment plan … or if you have a lot of other debts like cards talk to StepChange about a debt management plan for all of your debts.

James says

Hi Sara, I sent the email and Loans2Go replied few mins ago saying they are not upholding my complaint.

Please find below a detailed breakdown of the information used when assessing the affordability of your loans:

Principle: Loan Term: Total Payable: Total Paid: Status: Agreement date: 09/04/2024 £750.00 18 months £2,775.06 £842.38 Completed I note you declared your monthly income as £2,100.00 and we verified you received a minimum of around £2,050.47 monthly via an online income verification tool. Following an extensive review of your application and credit file, we calculated your monthly expenses to be around £1,426.41. Therefore, the contractual loan repayment of £154.17 monthly instalments per 18 months would have still been affordable.

Principle: Loan Term: Total Payable: Total Paid: Status: £650.00 18 months £2,287.98 £1,002.05 Completed I note you declared your monthly income as £2,171.00 and we verified you received a minimum of around £2,169.90 monthly via an online income verification tool. Following an extensive review of your application and credit file, we calculated your monthly expenses to be around £1,813.38. Therefore, the contractual loan repayment of £127.11 monthly instalments per 18 months would have still been affordable.

Any suggestions? Should I raise the dispute straight away with Financial Ombudsman?

Thanks

Sara (Debt Camel) says

Straight to the Ombudsman.

Carmen says

I am about to make a complaint using your template for a loan taken out in aug 2024.

Should I be adding any extra information to the template?

The loan was for £960 but the total amount payable is £3003.

It’s been absolutely crippling me and I could kick myself for taking it out in the first place. They couldn’t have done the necessary checks as my house was at risk with mortgage arrears at the time of taking it out and my debts already were quite substantial.

I just need to get something sorted with this one as I can’t bare another year of struggling!

Many thanks

Sara (Debt Camel) says

Add that you had mortgage arrears – they should never have lent to you when they saw that on your credit record

If they reject this or make a poor offer to take a few hundred off the balance, send this to the Ombudsman immediately.

What are your other debts? Current and recently cleared. You may be able to win other affordability complaints too. L2G are totally the worst but you were Already in a mess when you fell into their clutches.

Do you have an arrangement in place for the mortgage arrears?

How much are you paing To other debts at the moment every month?

Carmen says

Hi,

Thanks for getting back to me.

I’ve sent the complaint this morning.

I have an arrangement set up for my mortgage, however loans2go have this morning taken another payment which should have been ‘on hold’ of £187 leaving me absolutely broke after paying my mortgage today! I’m so upset and stressed! And I’m guessing trying to get them to give me this back immediately will be impossible!

I have a final payment to lending stream in February and the other debts are catalogues that I pay around £70 a month to.

Thanks for your advice!

Sara (Debt Camel) says

Cancel the direct debit or continous payment authority to L2G nopw, dont let this happen again. It doesnt matter if this harms your credit record, it’s very poor anyway

lending stream – how much did you borrow? have you had loans from them before?

have you used other payday lenders before?

the catalogue debts, are £70 a payment arrangement? can you list the lenders and the balances?

Carmen says

I’ve cancelled the continuous payment to them just now. My bank has also said to ring them when today’s payment is no longer showing as ‘pending’ and they will try to get it back for me.

Lending streams original loan was for £1000 over 12 months. Total amount payable back is £2000. I only have one more payment next month to them for £93.33. Is there anything I can do regarding this one? I was also in arrears with my mortgage at the time of taking it out.

I’ve never used any other payday lenders before this these ones.

I have a £1500 overdraft on my bank account that I pay no interest on that I’m always very far into.

The catalogues, there is no arrangement for yet but I’m hoping to sort this out too soon!

Thank you so much for your help! I honestly am starting to feel like I’m seeing light at the end of the tunnel!

I will have to list these later when I’ve put my little one to bed.

Sara (Debt Camel) says

Send lending stream a complaint too: https://debtcamel.co.uk/refunds-large-high-cost-loans/

Mention the mortgage arrears and send straight to the Ombudsman if LS reject it

Think about talking to Stepchange about a DMP – it will get all the interest stopped by the catalogues without you having to talk to them

Carmen says

I’ve had a final response from loans2go saying that the loan was affordable. There is no record on there of what was on my credit file. Do I just send this direct to the ombudsman, what other things should I include?

Kind regards

Sara (Debt Camel) says

yes send this straight to the Ombudsman. Attach the rejection from L2G. And 6 months of bank statements – 3 before the loan started and 3 after.

Carmen says

Thank you, I’ll do that.

Shall I send the letters stating I was in arrears with my mortgage too?

Sara (Debt Camel) says

yes

manny says

How long to L2G usually take to respond with an offer ? took out a £1500 in April 2024 over 24 month with £4848 as the pay back about. (I know cant believe i got myself into this nonsense) been in arrears with it since the 2nd month and todate have payed back £1552. Was way into my overdraft at the time and still am hopefully they write this off 320% APR is borderline criminal and the ways they try to mask this awful rates

Sara (Debt Camel) says

When did you complain? They may well take 8 weeks and then reject this. During which time you have made another payment…

If the repayments aren’t affordable, tell them you need a lower payment arrangement and stop them taking the full amount by cancelling the DD or continuous payment authority with your bank. This harms your credit rating but it must have already been bad to be reduced to borrowing from them.

What other debts do your have, what do they add up to? Look at affordability complaints against all of them too. How many days a month are you in your overdraft?

Chloe says

Hello, I took a loan on with loans2go in August 2024 out of complete desperation. I had a mental breakdown in 2023, lost my job and ended up with council tax arrears. I couldn’t cope with the councils constant threats of court, so I did everything I could to get a loan. Once loans2go accepted me and the money was in my account, I knew immediately that I wouldn’t be able to pay it back so I transferred £2,100 out of the £2,200 back to loans2go. I couldn’t give the remaining £100 back as this had been taken by a pending bill in my account. I went to pay the £100 back the following month, and the ‘early settlement discount’ was over £600. I couldn’t and can not afford this, I went to pay some money back on it last week and i now owe £2,300+ and early settlement is )£1, 223. There is no way I can pay this back especially on a loan for £100. I have complained, they just said I signed the contract so you need to pay it. I have also complained to FOS. My credit score at the time of taking out the loan was 23 out of 1000, I don’t think the loan should have been offered to me and the company want my medical records to prove my mental state at the time, which I do not want to provide them with. Please do you have any advice?

Sara (Debt Camel) says

Provide your mental health records and also pursue the case with the Ombudsman if l2G have rejected this.

Chloe says

I just wanted to pop back and say thank you for the support around this. Loans2go we’re of course, not budging. So I went to the Ombudsman who offered Loans2go the same offer I had presented to them, and they accepted. The Ombudsman also told the to remove any negative remarks on my credit file.

Sara (Debt Camel) says

Well persevered. What a horrible lender.

Sam says

I hope people have been succesful with this, I havent seen anyone come back with heaps of praise.

Hopefully in the future I can leave that post :)

November 2023, £700,I’ve paid back £1,647.38 and have an early repayment reduced balance of £841.39 left lmfao.

The problem is the interest, my repayments have been £143 every month always on time. But it never catches up.

I fell into arrears and have started a payment plan, That started in Feb, I have again missed Marches payment. Out of the £100 spare each month they take £60.

If a third party has ever contacted them does that mean I can’t? (I think Morgan Sanderson did but they were a weird unorganised company and I never fully got what they were actually doing)

Today I have an arrears letter basically saying I’ve defaulted. Thats why I called to arrange the payment plan in Feb!

I’m getting my email together atm.

Sara (Debt Camel) says

If a claims company has ever made a claim on your behalf, you may just get your claim rejected as “already answered” and you may be outside the time limit to go the Ombudsman.

Loans2go lose about 40% of cases at the Ombudsman so this is always worth trying if you are in time.

Sam says

I think Im just within time, deffo within time with the ombudsmen.

In the article it mentions “…loan that started after the end of July 2023, as there are some new regulations about those.”

Mine started in Nov 23, is there anything else I should know?

Appreciate the help!!

Sara (Debt Camel) says

The time limit to go to the Ombudsman is 6 months after the rejection from the lender.

Ciro Casella says

Hi Sara,

I just saw now about your help, about the L2g, and I follow today, the your advice, I ask 2000£ in febbruary 2024 and on my ignorance, I didn’t read about the interest, and they got me…so I pay 270£ a month for 2 year, and is al most 6000£ that, they take, I all ready pay half and left me other 2.800£ to pay, which is ridiculous on 1 loan to pay 4.000£ of interest, I just wondering, if really help the template, that you give as example? Thank you for this metter

Sara (Debt Camel) says

yes this can help. For such a large loan, L2G should have consider your situation very carefully. Send this to the ombudsman (it’s free) if L2G reject this.

Pasquale says

I was take from loan2go 500 pouund in 2023 during was pandemic period I was little bit struggling to pay they change me 2500 pound back in still paid plus they put me on bed credit as well I would like claim all this money back anyone can help me thanks

Sara (Debt Camel) says

There is a template you can use to complain in the article above these comments.

Ciro Casella says

Thank you Sara, I follow the your advice and template and in less of 1 week, they aswer me whit offert,the my loan was of 2000£ and they charge me over of 6000£ to pay in 24 month after that I was a bit tired to pay all this money back, I find this article, and I just follow, what she was suggesting, for the refund…

They offer me the refund of 1.6k plus to remove the my history of credit store, and to stop to pay,, still the loan.

So when I get the email, of this choise, that they make, I was extra happy…

Thank you Sara

Sara (Debt Camel) says

that is a very good result!

Dj says

Hi I wonder when you get your money I am in a similar situation awaiting payment

Emma says

Hi, can i ask how long it took to get your refund? I have agreed to a final offer from them following my complaint and just wondering how long it took to get your refund?

DJ says

Hi

I have been reading the comments in this thread, I have had a very different experience, I recently paid off my loan that was £1,000 over 18 months over £4,000 paid back, I launched an affordability complaint earlier this week and within 24 hours I had acknowledgement of my email and an email confirming they are upholding my complaint offering me almost £3,500 refund which I am absolutely amazed by, now starts the process of trying to actually get the money, I will be contacting them most days to find out what’s happening.

I am nervous as years ago I had a similar situation with Wonga they offered me a pay out but went into administration and I got a tiny fraction of the payout many months later.

Fingers crossed

Sara (Debt Camel) says

there was another good result reported yesterday, immediately above this comment.

DJ says

Very happy Update

So this afternoon I received an email saying my account details were passed to finance and I should receive the funds by end of play Monday at 15.10pm and by 16.10pm I had a notification to say funds had reached my account, I am actually shaking I can’t believe it, I am so grateful Sara without information like this we wouldn’t know where to start

I would never of thought that if I complained earlier in the week by Friday I would have had a payout.

I know Loans2go are a terrible company and are ripping so many people off, but there complaints procedure can’t be faulted it’s non biased and incredibly fair I feel like I am incredibly lucky, they didn’t ask for every document under the sun. They offered me almost £3,500 way more then I ever imagined and I didn’t even have to argue for a better payout.

I literally copied and pasted Saras example changed a couple of things and sent it. Within 24 hours they had agreed with my complaint saying they could of done more during the length of my loan as I had to set up a CPA as the payments were unfordable.

If anyone is thinking is it worth complaining I would urge you to.

Again thank you Sara life saver

G Lock says

I’ve just sent a complaint, so glad i found this website, i was heavy into an over draft and taking other loans at the same time and before so this was definitely un affordable.

Sara (Debt Camel) says

Look at complaints about the overdraft and other loans too! L2G may be much the worse, but it was the other debts that meant you were already in a desperate situation to even consider l2G… so the other debts were unaffordable as well

G L says

I have done 3 affordability complaints, i’ve had an email back from ps@loans2go.co.uk and i can’t make out what i need to do if anything.

It’s my first email back from ps@loans2go.co.uk after my complaint.

Sara (Debt Camel) says

Sure

G L says

Thank you for getting in touch with us on 07/05/2025 to log your complaint and DSAR Request

Rest assured, any harm caused by Loans 2 Go’s failure to uphold its own, or its regulatory standards will be properly reported on, and a full log of the steps taken to avoid this repeating, and how we will attempt to improve in future will be kept.

Likewise, following our investigation, if we are unable to find fault with how we have handled your case relating to your complaint, we will provide you with a full explanation of why this is, along with the provision of all available next steps you may take.

We may ask for your cooperation at certain points during the investigation process as we gather information, so it’s important you let us know of any special requirements you might have, and any vulnerabilities you may need to make us aware of that might allow us to appropriately support you throughout. A preferred contact method is a great place to start.

We understand there may be mitigating circumstances you need to make us aware of, and we welcome this information if supplied if it helps us more efficiently conduct our investigation. If you do have any documentation, images/screenshots, correspondence etc. you think might be important for us to see during this process, may we ask you send this to us by email (in the first instance) to ps@loans2go.co.uk, including your name, agreement number/reference number (if you have one).

i’ve cut the email short as is too long to send

G L says

So from that email i can make out i need to send some bits supporting my claim. I can send bank statements from months within. What else can i send that would support my claim?

in terms of credit file and stuff, is there anyway of knowing what my score and accounts open from the year and month from said loan?

I’ll send across my bank statements, what else would you recommend could be useful in back my claim up? i could potentially find missed payments forms letters etc.

Appreciate your time.

Sara (Debt Camel) says

what date did the L2G loan start?

G L says

17/06/2024 is when the load started

i borrowed £930

i’ve paid £1385

i still have £1885 to go

and im £545 in arrears

Sara (Debt Camel) says

I suggest you send bank statements from March to September last year.

And add that as your lender they can check your credit record that shows your other debts.

And say email is your preferred method of contact

What other debts do you have, as you need to loo’ at complaints against them too

G L says

i’ve had a response before I have sent bank statements and i think the loan would stay

i can assure you, the affordability assessment was conducted with consideration to your declared income which we verified using online income verification tool, and we also reviewed your credit file.

However, I believe we could have done more checks for you to establish whether you could afford the loan 3 sustainably over the loan term. Therefore, I am upholding your complaint with regards to Loan 3 only and as a result, we have worked out an offer we believe will fully compensate you for any loss you may have experienced. Therefore, it has been agreed to offer a refund of the interest paid on this loan agreement. The refund amount would be £465.58. We would also remove any negative information from your credit file in relation to this loan. This would be a full and final settlement of your complaint.

Sara (Debt Camel) says

It isnt clear to me if they are wiping the rest of the loan – if they are then that is a “full refund” for this loan. You need to ask them this.

If they aren’t, then this is a very poor offer and you should send it to the Ombudsman.

But what were the other two loans? How large were they, how much interest did you pay on each of them?

PS please do not leave duplicate comments!

GL says

It isn’t clear to me either, i’ve asked them to explain better because it doesn’t mention my current loan so i’d imagine they’re offer refund on interest and that’s it.

as they gave me 1 day to send all documents i’ve asked if i can send it now because it suggests i can on the email.

The other two loans are 118 118 money £1400 borrowed and £1877 paid back

i also had a tick tock loan, money platform loan, x2 barclay loans, barclay card, likely loans and credit spring open at the time. All proven on my bank statements

Sara (Debt Camel) says

So if they aren’t clearing the balance, send this to the ombudsman as it is a very poor offer.

And start making affordability complaints about the others: 118, barcalys loans, likely loans – see https://debtcamel.co.uk/refunds-large-high-cost-loans/

money platform – just one loan? how large?

G L says

118 i have sent. Barclays i will do. i borrowed £2300 off barclays in january 2022, in july 2022 they lent me another £5400 still paying both of these loans off not even half way through them, cant afford the payments, been on payment plan since december

money platform was £250 loan £509 back

Sara (Debt Camel) says

Ok you aren’t likely to win a complaint for one £250 loan

I suggest you also put all your debts into a debt management plan with StepChange now. Including the L2G loan.

See https://www.stepchange.org/how-we-help/debt-management-plan.aspx. This gets you into safe place while complaints to lenders and the Ombudsman go through

G L says

Barclays is my bank which i have an £1800 over draft barclay card i’ve been maxed out for for years, and the two loans, is it going to cause problems if i started issuing conplaints to them

Sara (Debt Camel) says

You need a new bank and to put all the Barclays debts, including the overdraft, into a DMP. Then make affordability complaints about all the Barclays debts

G L says

Really, you want me to change banks before doing complaints to barclays?

As for L2G i’ve asked them to compromise there decision other wise i’ll take to ombudsman. so ill see what they say before i take further.

Thankyou for your help so far

Sara (Debt Camel) says

I am suggesting a DMP for all your debts including the Barclays overdraft. This means getting a new bank account.

Your bank has made a fortune out of you, starting with a new one is a good idea anyway. And it means you don’t have to worry about complaining to Barclays s they will no longer be your bank

G L says

I wasn’t accepted on the one you sent me as i’m self employed but done everything with businessdebtline so will ring them monday to discuss options and then seek a new bank. Thankyou

I will let you know of any updates moving forward

G L says

Sara i have great news. I’m so chuffed with this response.

I am sorry to learn that you are not happy with the outcome provided in our Final Response to you. However, I would like to assure you that your complaint was fully investigated.

Please be advised that as per our final response, we are Upholding your complaint and making an offer for Loan 3 which is your current loan.

As we are upholding your complaint on Loan 3, it means that if you accept our offer, we will write off the remaining balance of £1,888.65 and close the account.

We will also remove any negative information reported on your credit file with regards to loan 3 and will pay you a redress of £465.58 which is the Interest and Charges you paid over principal borrowed for loan 3 plus 8% as recommended by the Financial Ombudsman.

Kerr Hunter says

Hi,

I just made a complaint as I have had 2 previous loans and one current, they have since emailed me back with all the details and each loan saying that they were affordable etc in a huge 4 page document and with no offer from them. What do I do now?

Sara (Debt Camel) says

Did that say it was a decision on your complaint? That would have included information about how to go to the Ombudsman

If it didn’t, it’s just a the details of your debts and they will reply a bit later with a response.

NB with 3 loans from them this needs to be a good offer! Sometimes their offers are very confusingly worded, so check here if you aren’t totally sure it’s good enough before accepting it

Kerr Hunter says

Hello,

They haven’t offered me anything and because I didn’t send them bank statements as support they are using that as a reason as to why it was still affordable for me.

This was the wording used

“In the circumstances and after considering all the evidence available to me, I cannot uphold any

aspect of your complaint.”

They have let me know on how to go to the ombudsman but what is the best way to go about that if you can help please?

Sara (Debt Camel) says

Use the Ombudsman’s online form, as the article above says

Len says

Hi,

I’m currently going through the complaint process and the case handler has asked me these following questions:

“Can I ask why you picked Loans 2 Go over any other lender? How did you find Loans 2 Go? Why did you choose Loans 2 Go even though the interest rate was so high?”

Is there a template for how to answer these particular questions, I am worried that if I answer this wrong that they might reject my initial complaint which I made following your template – any help or advice would be greatly appreciated !

Sara (Debt Camel) says

How did you fall into this trap – was it though a credit report? was the L2G interest rate actually clear to you when you agreed? Other people have said they found they had the loan before they really knew the details

Len says

Thank you for the guidance, I sent off my response and now I’m just waiting for the reply.

Also just wanted to ask you how long this process usually takes from start to finish ? I’m reading some comments and it looks like people are getting responses/results pretty fast – I first got in touch with the ombudsman on 4th Feb 2025 and its still on going so just wanted to know if this was normal ?

Sara (Debt Camel) says

I’m sorry I don’t see enough L2G cases to have a good feel for timescales at the Ombudsman

P says

Hi Len. I first sent the template to loans 2 go on the 7th February and they rejected my claim within 2 hours on the same day. I then contacted the FOS on the 13th February and got a reply from them saying L2G agree that they didn’t do enough checks on me and agree with the FOS. The FOS said L2G will contact me directly to settle the claim on the 10th June but I am still waiting for them to contact me. The FOS said if L2G hasn’t been in touch within 4 weeks to let them know. Hope this helps.

Aaron says

Hi there i considering making a complaint to get something back as I got £1240 for 18months to pay back £4588 which is ridiculous because in just finished paying off that loan so would I be able to still claim for some of it back I did do a early settlement offer

Sara (Debt Camel) says

You can make a complaint now, yes. Did you have to borrow to clear the loan?

Aaron says

No i didn’t I just repaid the payments which wasn’t a very good 18 months

Sara (Debt Camel) says

But you settled it early?

did you take out any other borrowing during this time, payday loans, more on a credit card etc?

Aaron says

Yeah I settled it early i did actually get another payday loan while this one was active mainly try to clear the loans2go off

Sara (Debt Camel) says

Then the L2G was unaffordable. Complain and mention you had To get a payday loan to pay it

Had you had other payday loans? Other expensive loans or debts? People desperate enough to borrow from L2G are usually already in a mess so make complaints about the other debts as well

Tom says

Hi I sent I’m this template to l2g. But I got car finance about 2 weeks before if I sent them document of start date and how much my monthly payments are will this help my case.

Sara (Debt Camel) says

hard to tell.

Jonathan says

Hey! I’m intending to help my adult son make a complaint of failing to check affordability and the reasons for an £800 loan he took out in June 2024. When you look at his bank statements it’s clear his salary went primarily on gambling. In your article you make reference to changes in 2023. What may I need to include with respect to those?

Many thanks,

Jonathan

Sara (Debt Camel) says

My template has in this sentence to use in this case: “This loan does not represent fair value and it is in breach of the FCA’s Consumer Duty.”

This may be his worst loan, but he should also make complaints to any payday or other expensive lenders that he has used, including ones that have been settled.

Georgina says

Hi I borrowed £1000 from loans2go. I have paid £800 off I have emailed loans2go to state the loan does not represent fair value and have explained my job has cut my hours and have had to get payday loans to keep up with loans2go payments and they have emailed me back saying he still have to make the £195 monthly payments not even a offer to lower the interest.

Sara (Debt Camel) says

Have you made an affordability complaint, like the one in the article above?

What other debts do you have?

georgina barnard says

Hi, Yes i have made an affordability complaint to loans2go i used the information you provided regarding representing fair value. I owe quid market and cash float nearly £1000 combined due to loans2go interest. I have explained this to loans2go.

Sara (Debt Camel) says

Send the Loans2Go complaint to the Ombudsman now. Emphasise the “unafffordable” part and that you have had to take payday loans to because the l2G loan left you so short. The “fair value” is just an extra comment, not the main part of your complaint.

Have you borrowed from QWuid Market, Cash Float or any other payday lenders before?

What other high costs debt do you have, most people who have to get a loans2go loan are already in dire financial problems with other debts. loans2Go may feel like the worst (it is) but you need to also complain to the earlier lenders that put you into that bad position.

Kelly White says

Loans 2 go sold my debt to united kash because I just couldn’t pay it. Can I still make a complaint?

Sara (Debt Camel) says

yes to Loans2go

Josh says

Hi Sara

I took out a loan with L2G about 15 months ago.

I have paid back about half of it but I have arrears of £1000, they have agreed to a payment plan and there is about £1500 remaining – the original loan was £700.

My question is if I use your template and complain is there a chance they can cancel the payment plan and demand the full arrears (which I can’t afford).

I ask as I really do not want a default and I am currently paying them back so don’t want to rock the boat but if the worst that can happen is they just reject the claim and I continue as I am then it’s worth a go.

Sara (Debt Camel) says

My question is if I use your template and complain is there a chance they can cancel the payment plan and demand the full arrears (which I can’t afford).

No. I have never known a lender do that.

If they reject your complaint, send it straight to the ombudsman where lots of these are upheld, you know its unaffordable and so do they or they wouldnt have given you a payment plan.

Josh says

Hi Sara

I just wanted to thank you for this because if I hadn’t stumbled upon this website I wouldn’t have known that there was any redress.

I’ve received a final response from L2G today agreeing to write off the balance of £1500 and refund £356 to my account in full and final settlement along with removing any negative credit markings.

To say I’m pleased would be an understatement.

Loans2go victim says

Hi

I had a really bad experience with them. Borrowed in Nov 2024. Somehow, struggled with payment due to their higher interest rates. In April I changed my payment date. Then I spoke to them and agreed to pay it along with my May pay date, precisely on 29th May. And I had a loan from my family and cleared the entire debt with them and settled the account on 4th June. But they reported my April payemt as a missed payment. Even though I spoke to them about it. This has a detrimental effect on my credit report. Any help and advise would be much appreciated.

Sara (Debt Camel) says

It sounds as though the loan wasn’t affordable if you got a family loan to clear it. So why not make an affordability complaint? Win that and the negative mark on your credit record should be cleared.

Also did you have other high cost loans? most people do before being so desperate as to borrow from L2G… look at affordability complaints about them too

Dan says

Good morning.

Firstly I’d like to say that I have paid my loan off back in full.

I first got a loan on £300 in Feb 22.

I topped this up by £250 twice.

In total I borrowed £800.

From Feb 22 – Feb 24 I paid back a total of approximately £1975.

Does this seem fair and do you think I could claim back unfair interest?

Sara (Debt Camel) says

were the top ups because it was hard to repay the exiting loan?

was it hard repaying this?

did it cause you to get into other debts elsewhere?

Jamela says

Hello I’m in the process of filing a few affordability complaints to a few other companies already. I requested my loan history from L2G and they said it should arrive by Monday. It still hasn’t arrived. Should I just send the affordability complaint in with the info I can get from my transunion report? I have had loans from fernovo, myfinanceclub, bamboo, MCB and a few others but only on a few do I have repetitive loaning so I’m going for them. These are a result of gambling and L2G didn’t check my bank statements. I also have a balance remaining but happy to continue making payments..

Sara (Debt Camel) says

Just send in the complaint. Change the template in the article about to also ask for the dates and amounts of the loans and how much interest you paid on each.

Are you sure the repayments are affordable?

Most complaints involving gambling are rejected by most lenders, so send them to the Ombudsman when this happens

Rebecca says

Hi Sara

I filed an affordability complaint with loans2go

The original loan I took was £2000 over a 24 month period. The payable amount was £6463.92. I paid it back early, paying £4532.83 in 8 months

They have just offered me £2741.56

Sara (Debt Camel) says

Excellent. I am very please they settled this directly without it having to go to the ombudsman

Cora says

Hello Sara,

I took out a loan from Loans2Go in 2024 for £500, for which they demanded I pay £1,850. I paid £594 and then stopped because I could no longer afford it and it didn’t seem right to have to pay £1,350 in charges for only £500. This year I contacted Doorstep Refunds, who got in touch with Loans2Go; they agreed with Doorstep Refunds to refund me £93, saying they had charged me too many fees, but they still want the full £1,850 to be paid. They are harassing me with phone calls; I don’t know what I can do to get rid of them and avoid paying this huge amount. Can you give me some advice, please? Thank you.

Sara (Debt Camel) says

did this claims firm ask if you wanted this to go to the ombudsman?

what other debts do you have at the moment, can you list them – lender, rough balance

Corina says

Good evening Sara,

No, they did not suggest this to me. But £93 is absolutely nothing compared to how much they want me to pay them for the £500 I borrowed. I took the first loan and couldn’t pay it back, then I took another one to cover the first, and so on, until I ended up with almost £6000 that I can no longer pay.

I also have these loans or credit cards, most of them from before Loans2Go, which had already affected my credit score a lot by the time L2G offered me that £500 loan.

Capital One £319

PRA Group UK £378

Capital One £313

My Finance Club £635

Perch Capital Ltd £842

Mr Lender £597

I started taking out loans after a period when I was very ill; I was in and out of hospitals and was diagnosed with systemic lupus erythematosus. I borrowed money from family to pay the medical costs and later had to repay them, and I have ended up in a terrible situation from which I see no way out.

Sara (Debt Camel) says

what date was the £93 refund?

About your whole situation, I suggest you talk to Stepchange about a debt management plan or a debt relief order. Your credit record is already badly affected. https://www.stepchange.org/how-we-help/debt-management-plan.aspx

Cora says

Hello Sara,

DMP is not helping, I tried but they are paying a very small amount to the creditors and it will last 5 years to pay everything.

Regarding the DRO, does it not affect me? Isn’t there a possibility that the bank where I have my current account will close it? I work full time, I don’t know if I would be accepted for the DRO.

Sara (Debt Camel) says

Lots of people get DROs who are working full time.

Yes you will need to change your bank account, but that is a small thing to do to be able to clear these impossible debts.

Talk to National Debtline on 0808 808 4000 for details

Sara (Debt Camel) says

Paying your debts in 5 years is better than having to keep taking payday loans to pay other loans and never ever clearing them.

A DRO does affect you, it is a simple form of insolvency, but it gets you a clean start from this mess. You will need to switch bank accounts. Lots of people who work full time qualify for a DRO.

I suggest you fill out the Stepchange online advice form here https://www.stepchange.org/how-we-help/debt-management-plan.aspx and see what they suggest. Do NOT leave any debts out. Do not underestimate your expenses, include all the little things that sometimes happen than can wreck a tight monthly budget and make you borrow more.

Jade says

Hi Sara, I used your template to file an affordability complaint with loans2go as I took out a £250 loan end of 2023 i had to pay nearly £1000 back I paid it back in the 18 months I had to skip some payments so this meant it took longer to pay back. I was on a DMP at the time of taking the loan out so this clearly wasn’t affordable to me however it’s been over 4 weeks since I put the complaint in. Does it normally take them this long to reply back and do you think I’m in the right to put an affordability complaint in with them?

Thank you.

Sara (Debt Camel) says

Definitely right. Many lenders take most of the 8 weeks to reply.

Send this to the ombudsman if they don’t refund the interest, don’t be fobbed off with a poor offer

PS have you made affordability complaints about other debts too?

Jade says

Thank you! I haven’t made any other complaints so far but I definitely will be looking into do it with others.

Sara (Debt Camel) says

do this asap. You can’t guess which complaints will be upheld and which will be quick and which will need to go to the ombudsman

Jade says

Hi Sara I just received my final response from loans2go and they haven’t offered me any refund, they said on the 27/08 they sent me an email asking for bank statements and any other documentation I think they may need I’ve just gone back to that email and they didn’t ask for bank statements at all.

Sara (Debt Camel) says

Send this to the Ombudsman now. Use the FOS online form here https://help.financial-ombudsman.org.uk/help

ALso send the Ombudsman your bank statements and point out Loans2Go never asked you for them.

Chad says

I raised a complaint about older loans and an existing loan back in August 2024 using the template. Will the current loan be time barred after already receiving a final response?

Sara (Debt Camel) says

did they reject it? why didnt you send it to the Ombudsman?

Chad says

Yes it was rejected. Regrettably I do not remember the reason why I didn’t raise with ombudsman at time – Most likely overwhelmed by level of debt and chose to ignore things rather than dealing with it.

Sara (Debt Camel) says

This is now to late to send the complaint to the Ombudsman and and new complaint will just be rejected

Have you complained to other lenders? How much difficulty are you in at the moment?,

Chad says

Hi Sara,

Today I received a remediation final response from L2G. It states as follows:

I write further to you regarding a previously reviewed complaint received on 26/08/2024.

I note a final response letter was emailed to you on 17/09/2024, detailing we were not upholding your complaint and the reasons why.

The reason for your complaint was as follows:

• Irresponsible lending and the loan being mis-sold to you

In our ongoing commitment to providing outstanding support, we’ve concluded a thorough internal review of historical complaints. This comprehensive analysis revealed instances where, in hindsight, different decisions might have been made based on specific indicators present at the loan application stage. While the original complaints were not upheld, we have pinpointed these areas as opportunities for enhancement and are implementing measures to rectify them.

In your case, we’ve determined we should have upheld your complaint. Here’s why:

• I believe we could have done more checks to establish whether you could afford loans 2 and 4 sustainably over the loan term. Therefore, I am upholding your complaint in regard to loans 2 and 4.

Do you think it’s worth escalating further to the ombudsman?

Sara (Debt Camel) says

how large were each of the 4 loans?

How much have they offered you now?

I assume you didnt originally go to the ombudsman? Does the current letter say you now can?

Phil says

Hi Sara,

I sent off a loan complaint using your template for a loan I had in 2022-2024 and I wanted to share with you the result. I took out £1500 over 2 years and repaid almost £5k in that time, although I did settle 2 or 3 months early but there were alot of late payments made over the course of the loan term as I was struggling financially.

I sent off my complaint 6 weeks ago and yesterday I had a response from L2G that they were upholding my complaint and refunding me £3800+ as in their words “they could have done more to establish the loan was affordable and assist me”.

I am overjoyed at the result so thank you so much as this page has been a godsend!

It’s worth noting that they did email me within a few days of initially complaining asking for further evidence however the wording is not straight forward on this email. I did NOT send bank statements or other evidence so the complaint was upheld merely off using your template!

Hope that inspires other to complain with your advice.

Phil :-)

Nikos says

In July 2024 I had my complaint about loans 2 go rejected by them and then by the ombudsman, I’ve just had an email from loans 2 go today saying they have reviewed old complaints and have decided I actually should have been refunded the interest! a nice surprise

Sara (Debt Camel) says

excellent. Very good news and what a surprise

Sherry says

Hi Nikos, did you actually receive the refund still waiting?

Thanks

Anonymous says

I made a complaint against L2G using the template back in September 2024 and they offered my £150 which I stupidly accepted as it was my first complaint. However this week they emailed me out of the blue saying they are reviewing their previous complaint decisions and decided they should have fully upheld my complaint and were therefore sending me £663! After confirming my bank details, the refund was in the bank the next day. I borrowed £300 from them and had to pay back over £1100!

Sherry says

Hi Sara

L2go rejected my complaint in 2021 but wiped remaining loan balance as a good will gesture. I accepted this at the time as was relieved just to be shot of them. Out of the blue last week I received an email advising they are reviewing historic complaints and are now going to uphold mine. I ignored it at first assuming it was scam but I have just received a follow up and I have to say it looks legit. The address and ps email address look right and it’s even signed off by the same contact. They attached a final response which is professionally written and rings true of other refunds I have had, the loan history and accompanying breakdown of interest look right and they have quoted my original complaint reference number and gesture of good will amount. They are not asking for anything other than confirmation of acceptance and have stated if I don’t reply they will assume acceptance and refund to the bank details they have on file (stated correctly) unless I advise of a change. Could it be legitimate? I’m wondering if you were aware of the review actual they advise of and have received similar queries? It’s for £1400 so I’m trying hard not to get too chuffed as can’t see why they would do this given the years passed and my acceptance of the good will gesture.

Sara (Debt Camel) says

yes this is legitimate, I have seen several other people mention it.

Sherry says

Sorry for quick follow up – I can now see others saying the same thing, so I am hopeful this is legit after all. Can I ask Sara, is this just a L2Go initiative or is pressure being applied from a regulatory body – I.e could we see more unfavourably historic decisions overturned by other similar lenders?

Sara (Debt Camel) says

My guess it is either pressure from the FCA or L2G being worried about getting pressure from the FCA.

Loans2Go is a uniquely horrible lender. The current representative example on their website says “If you borrow £550 over 18 months… with a representative 679% APR you will make 18 monthly payments of £107.56, repaying £1,936.08 in total.”

Borrowing from payday lenders is much cheaper!

There are no similar lenders, no one else comes close. I would love to see other lenders revisit their poor previous decisions, but no one else is doing this, that I have heard. I don’t think you should even hope this may happen.

If you ever have to make these complaints in future, don’t be fobbed off with a rejection or a poor offer, send the case to the Ombudsman!

Sherry says

Huge thanks Sara

Priscila says

Hello, I would like ask for advise i took 1000 pound from loans to go on 2021 I paid 640 but after I stopped paying they wanted me to repay 4640 I stopped they didn’t contact me and now I see on my credit record I own them 3800 what I can do with this thank you for help

Sara (Debt Camel) says

What is the rest of your debt situation like? Getting much better or worse?

Anon says

Hi Sara, I submitted a complaint 2023, was turned down. Due to family bereavement I submitted to FOS late and they didnt take it due to being late. I have resubmitted a fresh complaint today same reason but basically tearing apart their response and have requested they accept this on fresh grounds based of the inconsistencies throughout their response and the terrible reasons they gave, I was able contradict and put forward a lot stronger complaint. Do you think they will pass of as a duplicate or take it as new conplaint? Thanks.

Sara (Debt Camel) says

I would be surprised if this is accepted as a complaint.

Ann says

I took out two Loans 2 Go loans:

• Sept 2024 – £1,000 over 18 months, repayment £195.56/month

• Feb 2025 – £1,097.43 over 18 months, repayment £214.61/month

– This loan refinanced the first loan, and I only received £500 cash.

At the time of the first loan, I already had significant existing debt ≈ £606-£626/month

Adding Loans 2 Go loan 1 brought this to ≈ £820/month, around 45% of my net income

Loans 2 Go later accepted that Loan 2 was unaffordable and offered to refund the interest paid on Loan 2 only (~£735), but did not agree to write off the remaining balance.

I escalated to the Financial Ombudsman Service.

The FOS investigator has said:

• Loan 2 is already upheld (so they will not review it)

• Loan 1 was affordable based on declared income/expenditure and credit file

• They believe Loans 2 Go’s checks were proportionate

• They do not recommend further redress

I disagree because:

• Loan 2 refinanced Loan 1 – indicating a borrowing cycle

• Combined debt commitments were extremely high relative to income

• The repayments were only maintained by juggling credit

• High-cost lending + refinancing should have triggered enhanced checks under FCA CONC

• FOS guidance often treats linked/refinanced loans together, not in isolation

Based on your experience, do you think an Ombudsman is likely to overturn the investigator’s view and uphold both loans, or at least require Loan 2 to be written off, given the debt levels and refinancing pattern?

Sara (Debt Camel) says

I really hope loan one should be upheld. If it is, that should clear the remaining balance on loan 2

Anon R says

Hi I had a successful outcome from using your template and sending to loans2go complaints. I borrowed £500 in 2023 and was expected to pay 2k back. I paid around £1500. Then I thought why on earth am I paying anymore so proceeded with the complaint.

They paid me back 1k and have wiped all negative reports from them off of my credit report. Positive result. So glad I found your website and complaints template – thank you.

S.J says

Hi, I took out a 700 loan with l2g in aug 25, I have been paying off 136:98pm now I’ve paid £684:45 back my next payment is in Feb . This should clear my balance. The remaining payment to term is showing at £1,779.57 ?? I have too out previous loans to try and help with the payments . Surely I don’t have to pay this amount back . I cannot afford as I still owe mr lender £150 and lending stream £104 . Please advise me as I am making myself sick with worry .

Sara (Debt Camel) says

are these your only three debts?

Send L2G a complaint immediately as the articly above suggests.

Have you had previous loans from lending Stream or Mr lender? Is so, how many and how large were the loans?

Sj says

Lending steam £600

Me lender £300

Quid market £300 (paid off this month )

Fernovo (£300 (paid off )

By march I was hoping to be clear of all loans , now just this remaining interest charge .

Sara (Debt Camel) says

no cheaper loans, catalogues, credit cards?

did you only have one loan from each of the payday lenders?

Sj says

I have a Barclaycard which I have maxed out £2000 limit , since the loans have been coming out on payday I have not been able to pay the minimum payments , this has now gone to collections . I had 2 from mr lender . The rest just 1 each .

Sara (Debt Camel) says

How large were the mr lender loans?

Have you made a complaint to Barclaycard too?

I suggest a debt management plan with StepChange if loans2Go don’t uphold your complaint and this has to go to the ombudsman

Sj says

I sent of my complaint templates yesterday ,

Received email from l2g which I’m guessing is an automated response to complaints stating the outcome should be resolved in up to 8 weeks !

Should I await a response or go straight to the ombudsman? .

Sara (Debt Camel) says

You can’t go to the Ombudsman until EITHER L2G have given you a decision OR it has been at least 8 weeks

Sj says

Hi,

I have just received a reply from an investigator declining my Loans2go affordability claim . I have 3 weeks to provide more evidence of I disagree with the decision . She says it’s adequate that I have £213 disposable income left after essentials ??? I have disagreed with the decision and I have attached bank statements 3 month prior and 3 months after I got the £700 . This will show how much persistent debt I was in , I.e overdraft constant even after wages , plus various other loans . Plata , salary finance , mr lender , quid market and lending stream . Do you think they will reconsider ? Thanks x

Sara (Debt Camel) says

I hope so. If they don’t, ask for this to go to an ombudsman.

Have you also made complaints to Plata, Salary finance, Mr Lender, Quidmarket and lending stream? Go after them all!