UPDATE: 27 February 2018 – Victory! Vanquis is made by the FCA, its regulator, to offer refunds of the additional interest charged to all cardholders who have had ROP.

UPFATE: 2 August 2018 – Well only a partial victory :( The refunds Vanquis is actually paying out are a lot smaller than they should be. Read Why the ROP refunds are too small and how to complain.

I am leaving this old article here as a lot of readers commented on it.

Vanquis Bank’s Repayment Option Plan (ROP) for its credit cards is being investigated by the regulator, the Financial Conduct Authority (FCA). This was announced by Provident, who own Vanquis, on 22nd August 2017.

This article looks at whether you should cancel this ROP if you are still paying for it and complain and ask for a refund of ROP. The details of one refund are shown – you may get a large amount back because you also get a refund of all the interest that was charged on your ROP fees.

Many readers have got hundreds or even thousands back, see all the comments below.

What is the ROP and why is the FCA looking at it?

Vanquis’s ROP is a bit like insurance, offering some features that could help if you have difficulty with repayments to the credit card.

The main feature is an “account freeze” if you get into financial difficulty: no payments needed, no interest being added and your credit record is protected. You can’t just ask for a freeze, you have to supply evidence eg that you have lost your job, send an income and expenditure sheet etc

There are also some other short-term options if you miss a payment or want to miss a month’s payment, but the ROP would be a VERY expensive way to get these minor benefits. The “no impact on your credit rating” feature may sound nice, but it’s not worth much unless your credit rating was actually good. People with a credit rating worth protecting don’t usually have a Vanquis card at all!

The cost – £1.29 per £100 outstanding – may not sound high. But that monthly charge adds up to a lot over the year.

The ROP charge is also treated as a purchase on your Vanquis card, so unless you repay the whole balance every month, the next month you will be paying interest on the previous months ROP charges.

If you only repay the minimum amount and you are having ROP charge added, your balance is hardly going to drop at all.

What are the FCA concerns likely to be?

The Provident announcement said:

The FCA indicated that it has concerns about the ROP product and is investigating the period from 1 April 2014 to 19 April 2016. Vanquis Bank agreed with the FCA to enter into a voluntary requirement to suspend all new sales of the ROP in April 2016 and to conduct a customer contact exercise, which has now been completed.

That’s the only public information – the rest of this is my speculation.

The FCA’s main objection is probably the fact that Vanquis are charging for this account freeze, which is something they should be offering to all customers in difficulty without any charge. FCA rules (CONC 7.3.4) say:

A firm must treat customers in default or in arrears difficulties with forbearance and due consideration.

“Forbearance” in this sort of situation often involves freezing interest. So the FCA rule means that all customers may have their interest frozen when they are in difficulties.

If Vanquis didn’t explain this to customers when it was selling them the ROP, this may well have been misleading and the product may have been mis-sold.

Why only from 2014 to 2016?

The FCA’s investigation starts from 2014, when the FCA took over regulating this sort of debt.

But the previous regulator, the OFT, had very similar wording. It described failing to treat borrowers in default or arrears difficulties with forbearance as an unsatisfactory business procedure, and said creditors should consider reducing or stopping interest and charges when a borrower evidences that he is in financial difficulty.

So although the FCA isn’t looking at older cases, this suggests that the customers who paid for the ROP before 2014 were not fairly treated either so they too can complain.

How much could a refund be?

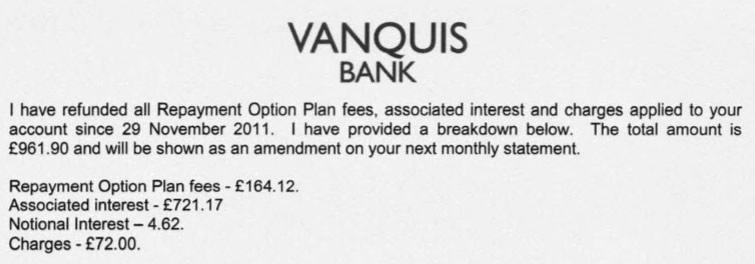

One Debt Camel reader, Mr N, complained to Vanquis about the ROP earlier this year. This is the refund he was given:

He only had the ROP for a short period in 2011/12 so the ROP fees weren’t high. But look at the extra interest that was refunded – £720 – wow!

This is high because Mr N didn’t repay his card balance in full every month. Paying for the ROP meant he was paying less off the balance on the card. He was effectively paying 39% interest on his ROP payments for nearly 5 years and that is what he is being compensated for.

How did Mr N get that refund from Vanquis?

Mr N complained that he felt he had been pressured into signing up to the ROP which wasn’t right for him. Vanquis listened to the phone call from 2011 when he signed up to the ROP to check that certain points had been properly explained to him. The investigator concluded:

although you did accept the repayment option Plan as a feature of your account, I do not feel all these points were satisfied when discussing the plan with you.

What should you do now?

Cancel the ROP?

It’s always hard to suggest that people should cancel insurance, however ridiculously over-priced it is. You might cancel the ROP and then lose your job next month… But the regulator’s rules mean that if you do get into difficulty, you can ask Vanquis to freeze interest on your account, see What to do if you can’t pay a bill this month.

You have to think about the cost of the ROP. Not the headline £1.29 a month per £100 charge… look at what the true cost to Mr N was for his ROP product. Paying ROP makes it much harder to get your Vanquis balance to drop as so much of your monthly payment is eaten up by the ROP charge, so you are actually more likely to end up in financial difficulty!

There may be hundreds of thousands of people who still have ROP on their Vanquis cards. I think they should all be seriously considering cancelling it!

Complain about it? (this was written before the FCA’s decision in February 2018)

If you took out the ROP after April 2014, your case will be among those being looked at by the FCA. You could decide to wait and see if you get awarded any automatic compensation. But if you have financial problems at the moment, you may want to ask for a refund now as there is no indication how long the FCA investigation may take.

People who were sold the ROP before April 2014 are unlikely to be included in any redress scheme the FCA proposes. But they can still get refunds if they ask for them. So complain to Vanquis now and asking for a refund of the ROP fees plus the associated interest you paid on the card.

You can complain if you are still paying the ROP or if you cancelled it. It doesn’t matter if you still have the Vanquis card and owe a balance, or you have closed the card. You can also complain if you are currently in debt management.

Don’t complain if:

- you have gone bankrupt after you got the Vanquis card (the refund would go to the Official Receiver)

- you are currently in an IVA (the refund would go to your IVA firm);

- you are currently in a DRO (your DRO could be cancelled if you get a refund).

October 2017 update – some of the first complaints upheld

About 8 weeks since the first complaints went in based on this article we have the first few results:

- people have been offered refunds of £418, just under 3k, £1600, £507, £285 (that was only for 6 months ROP) and £531;

- most are happy with the offered refund but one is going to the Ombudsman as the numbers don’t reflect what he thinks he paid;

- people who applied for the card more than 6 years ago have had their complaints rejected – some of these are going to the Ombudsman;

- 3 people who took out the ROP in the last 6 years have had their complaint rejected.

Obviously there could have been a lot more decisions – I am just going on what has been reported in the comments below this article.

November 2017 update – more complaints upheld

Increasing numbers of results reported:

- refunds offered of £448, £321, £508, £1,255, £1,286, “full refund”, £4,279.

- 4 people who took out the card within the last 6 years have had their complaint rejected, 1 person asked for a copy of his phone call and was sent one that clearly showed he had rejected the ROP – he has sent the case to the Ombudsman.

- 2 people who opened accounts more than 6 years ago have had their complaint rejected.

- Vanquis have missed the 8 week deadline in a few cases.

December 2017 onwards

Lots more people have been getting refunds, too many for me to keep track of. See the comments below for recent examples.

A few interesting cases:

- one reader has her complain accepted because Vanquis couldn’t find the call recording;

- one reader has had a decision from an adjudicator at the Financial Ombudsman that the FO can look at cases where the account was opened over 6 years ago. Good news – although it could still be challenged by Vanquis.

Rick says

Hi,

This maybe a silly question but I took my Vanquis card out after April 2014. I used the ROP for a period of 6 plus months because I got made redundant. Would it be worth me complaining ?

Thanks,

Rick

Sara (Debt Camel) says

Yes, though the fact you have used it may mean you get less back. But you still may not have realised what it was costing you because it was never properly explained that you would be paying interest on the ROP payments.

Antony says

Sent a email today,

My account was opened October 2011 :/

I cleared the debt September 2017, the card was maxed on a £3k limit, on ROP took me over the £3k each month. As far as I’m aware ROP was on the card from the beginning. My last payment was £3118.

I can only imagine the payout would be huge if I’m successful, but let’s wait and see.

Fingers crossed

Louise M Crowley says

My situation is very similar to yours. Mine too was an old account started in 2005. I have mostly all of my statements. I have today posted a letter to the Ombudsman in complaint of Vanquis ROP charges from 2005 -2013. Can you tell me if you had or you were asked to provide copies of all of your statements.

Many thanks.

Sara (Debt Camel) says

I haven’t heard of any customers being asked for these. If the Ombudsman wants them, they would expect Vanquis to provide them.

Shane says

I had a Vanquis card over six years ago, three years ago I made a complaint about the ROP I was paying at the time. This case was rejected on the basis there was nothing wrong with the ROP I was sold. After finding a similar thread about ROP just before Christmas, I re-submitted a complaint form and it has again been rejected. I had the maximum amount of credit offered by Vanquis. The letter I received suggested ‘if’ I wanted to take it further I should go to the Ombudsman, is this a futile cause? I was told I basically had to have the ROP for my own protection, but I didn’t need it at all.

Any help would be greatly appreciated

Sara (Debt Camel) says

Yes send it to the Ombudsman.

ANDREA says

Hi,

I am in a similar situation. Opened the account Jan 2011, was paying ROP until April 2016 when I realised that was the reason my balance wasn’t coming down, never actually knew what it was for. Complained to Vanquis, Wastold it was sold correctly, price fully explained etc. I did not realise what the Ombudsman was for at that time or what to do. Had family and health issues going on so they took priority at the time. I found this site Jan 18 and decided to send the template email and raise a concern again with the mis selling and not being told about the full cost etc. They have rejected this. April 2016 they said would send a copy of the call in which I agreed to the ROP, they never did, I queried this on more than one occasion. Also raised this in the recent complaint, rejection letter dated 05/02/18 said they will send me a cheque for £50 due to not receiving the Disc, and also included a copy of the call with the letter. Tried playing it, it said the disc was blank! I phoned, they said my Laptop probably erased it due to my security? Another copy in the post, I still have the Vanquis account and it is still used, usually maxed since beginning. Do you think I have a case? Is the Ombudsman likely to even look at this complaint?

This is such a good site and has helped me so much.

Many thanks.

Sara (Debt Camel) says

yes this sounds like a good case to send to the Ombudsman. They didn’t repond to your comnplaint properly in 2016.

Andrea says

Thank you Sara. I have put all of this to the ombudsman. I shall keep you posted. Many thanks for your advice.

Chris Mclean says

Just had letter back from vanquis saying no refund due

* i understood the plan

* the script was followed

* all additional info relating to the plan was correct and not misleading

*the pricing was clear and given correctly

* i accepted the plan as a feature of my account

* there was no pressure on me to accept it

Is this the end of the road or do you think i should go to the ombudsman?

Any replys advice welcome

Cheers

Sara (Debt Camel) says

Take it to the Ombudsman. If they followed the script it would NOT have been explained to you that the ROP was treated as a purchase on your account and so the next month and every month afterwards you would be paying interest at the interest rate of your card (probably high!) on this. it would also NOT have been explained to you that if you didn’t take the ROP and you got into financial triouble, eg you lost your job, Vanquis would still have had to consider freezing interest on your accout. most people thought paying for the ROP was the only way to get this and that is just misleading.

Those two points – and any others you think relate to your own case – should be in your complaint to the Ombudsman. It’s really quick to send a complaint in using the Ombudsman’s online system. And some people have then had Vanquis get back to them and change their mind and offer a refund before someone from the ombudsman even looks at the case!

Chris Mclean says

I appreciate your advice, i have now asked the ombudsman to investigate, even from their letter to me it sounds dodgy.

Will keep ya’ll posted ????

Andrea says

That’s exactly what they said in my letter. Must be a generic one they send.

Nicola says

I had my vanquis credit card since August 2014 to March 2016. Saw something on resolver cancelled it and complained on the 12 December through resolver got letter today to say I have been rejected because they said when they asked me did I want it I said yes I wouldn’t of agreed to it if they had told me that if I would get interest on it were do I go from here

Sara (Debt Camel) says

Hi Nicola, I suggest you send the complain t to the Ombudsman. I think you can probably do this through Resolver as you started the complaint there?

read the reply i have just sent to Chris which points out 2 things that you can compalin to the Ombudsman about – the being charged interest on the ROP (as you say) and also the fact they may freeze interest even if you didn’t have the ROP.

Brian says

Got a reply from FOS investigator (not adjudicator) saying they can’t look into my complaint as it falls outside the time limits.

Had a Vanquis card + ROP from 2008, cancelled ROP after about 18 months when i realised it was a millstone on my balance.

FOS argue that because Vanquis sent a letter to me with ROP t&cs on it, it is sufficient to them to consider that as the starting point of when i could reasonably consider to have grounds for complaint. As such, the 6+3 rule isn’t applicable unless i can prove exceptional circumstances why i haven’t complained beyond 2014.

I don’t ever recall receiving any letter, and Vanquis claim they don’t have a recording of the original sales call. Seems strange to me that they have a record of one and not the other…

Anyhow, do i have any options? I’ve asked for an Ombudsman to look at the complaint, but the investigator has refused.

Sara (Debt Camel) says

I think you are going to struggle here. The people that have been getting the FOS to look at over 6 year complaints have all had the account opebn within the 6 year period, it was just started before then.

Unless you complained to vanquis about the cost of the ROP and that it wasn’t properly explained back in 2010 when you cancelled it? If you did say you were complaining, not just cancelling, then they shouldn have told you then of your right to take this to the Ombudsman. If they rejected a complaint and just cancelled the ROP you could go back to the Ombudsman and say you were unaware that you could have taken your complaint to them and Vanquis should have infomred you about this.

But if you simply cancelled, i doubt this will work.

Brian says

The account is still open, but subject to a payment arrangement which has been ongoing since 2013.

I am actually questioning the validity of the letter that Vanquis have provided; I am 100% sure I never received any letter from them after I opened the account originally, and I feel the letter may have been fabricated. I actually think I did complain at the time I cancelled that the ROP payment was too high; the customer service agent actively tried to dissuade me from cancelling after I told him I wanted to cancel because it was costing too much of my monthly payment.

Sara (Debt Camel) says

I suggest you put those points in writing to the person dealing with your case.

Nikki says

After receiving an odd email from Vanquis regarding ROP, I came across the feed – so glad I did. Used the template letter and after receiving confirmation of my complaint and 56 days later received a £920 refund. Thanks so much. It’s one of those you never know until you try. So grateful!

Jordan Nairn says

Just an update on how my case is going.. originally emailed on the 2nd of January had a letter on the 9th cancelling ROP. Nothing heard untill today received a letter updating me on my complaint and they are still investigating and if they have not resolved in the 8 week window they will write again to me. So they have till the end of this month to reply. Fingers crossed I had been paying ROP since I toke the card out in 2015 my limit has slowly increased from £500 to £2000 and has always been close to limit. Can’t thank you enough sara for this as I had no idea I was paying it!!

Dave says

Hi

I recently made a complaint and received the letter informing me of cancellation of ROP. I recently paid off my balance in full. My question is , if I do receive compensation and I have no balance to clear will they send a cheque or put my account in to credit as I have a 0 balance.

Thanks

Dave

Davr says

You would receive a cheque.

Kevin says

Received a letter saying my complaint had been rejected as it was over 6 years ago, or if later, more than 3 years after I realised (or should have realised).

I enquired to a third party company about claiming vanquis a couple of years ago and was told ROP was not being refunded.

I only realised in August of last year when I seen in the press that a case had been opened against them.

Is this worth taking to the ombudsman?

Many thanks

Sara (Debt Camel) says

Do you still have a Vanquis account? If not, when did you close it?

Kevin says

Unfortunately I came into financial difficulties in 2013 and the account defaulted, I have been paying the debt to an agency. If I had fully understood the Rop I would have used it at that time

Sara (Debt Camel) says

Defintely worth a complaint – Vanquis should have asked you in 2013 if you would like to use the interest freeze feature of the ROP. The fact you didn’t ask is good evidence that you were unaware of it.

gillian says

hi sara i have had a letter from vanquish rejecting my claim for refund from the letter i think the argument is i took the card out in 2009 and only cancelled the rop in nov2017 due to the fact that in oct of 2017 i recieved a letter telling me how much it had cost me in the last 12 months this being the only letter i have ever recieved while having it they also state all the benefits of the plan ie freezing intrest if your hours are changed well in nov 2010 due to a job change my hours went from 40 to 16 a week for about 6 months until the new job upped my hours to 35 also i was often overlimit late payments and missed payments all the time yet they never offered me any help when surley they could see i was struggling the only thing is i have cleared that account it was near to 2000 pound due to your help in claiming payday refund in nov2017 due you think i have anything to lose by sending it to the ombudsman service ty for your help again

Sara (Debt Camel) says

The factv you have cleared the account doesn’t matter.

I suggest you send this to the Ombudsman. Vanquis should have suggested to youm in 2010 that ROP could help but my guess is they never mentioned it. the fact you dind’t claim on it is good evidence that you were unaware of it.

Kara says

I’ve just had a frustrating email from an investigator at the FOS who initially agreed that my complaint should be looked into, then decided that it was outside of both the 6- and 3- year time bars due to an e-mail that Vanquis allegedly sent me in 2013, at which point I asked for it to be referred to an Ombudsman. The investigator initially provided the email that Vanquis allege to have sent me and although it mentioned some of the features that I raised doubts about, it didn’t mention the interest so when I added some comments for the Ombudsman I focussed on the interest situation (as well as saying that I don’t believe I received the email and also the issue of forebearance etc). He is now saying that he didn’t send me a copy of the full email and that it did explain the interest. He also seems to be suggesting that the Ombudsman may well agree with him that it’s outside of the time statutes and therefore can’t be upheld.

I don’t feel like he’s handled the case terribly well, and I’ve lost faith in it being upheld, despite the fact that I believe that it was mis-sold.

Kara says

One other thing that I have mentioned is that Vanquis wrote to me in 2016 and 2017 to remind me that I had the ROP and to outline the product. I believe these letters were sent as they knew that they had missold the product to a lot of people and therefore they were trying to cover their back to limit the complaints.

Maria says

Just wondering if anyone else has received a recording of their call and found their paraphrase isn’t working i.e. the complaint reference number. Getting really fed up with Vanquis now

Eve says

Hi Maria

I had the same problem. You have to not enter the “/” and the CAT should be in smaller letters.

You should enter it for example : cat00123456

It should work by entering it like that. I had 2 calls on one disk. One call played no problem on media player but the other I had to download the full disk to get the other call to play. Hope this helps.

ANDREA says

I received a blank disc, phoned Vanquis and they told me my laptop has probably erased it! Sending another and they told me to turn off my internet security before I play it.

Gaynor says

Vanquis update

My success with Vanquis thanks to this site and all who shared updates and stories

card opened in 2011 £3000 limit ran up and paid off then used again . Submitted template via resolver 5th January and letter dates 1st February refund of £1919.25 due . Call showed although Agreed not all points covered . Called to day 9/2 to query refund cheque and they advised posted today. I used the rop once a few years back and took one payment holiday I do remember although was never sure on how it worked etc

My account more than 6 years old and they upheld complaint so definitely worth chasing . I was surprised at how easy it was they acknowledged complaint and then provided. Resolution no hassle and I’m so happy at amount at a push I though maybe have got if anything a few hundred :-) so glad I came across this site as I would never have known about this

Thanks again to all and good luck to all chasing refunds :-)

Kara says

Amazing result, well done! I’m confused as to why my case has taken such a different turn….i too took my card out in 2011 but my call hasn’t been listened to by the FOS yet as they’ve been provided with an email from 2013 that Vanquis allegedly sent that outlines the terms of the product. Apparently they’ll maybe ask for the call if the ombudsman upholds my complaint.

So random.

Gaynor says

Good luck with it Kara let us know how you go. I expected hassle to be honest only issue really was settlement letter said payment would be credited to my account ! I called as not used card in years and right away ranted how I paid this £ and wanted a cheque but they advised typing error and cheque be sent within 28 days .so resolution and offer 1/2/18 and cheque arrived Saturday 10/2/18

Got to say compared to other ppi claims I’ve done they dealt with this very efficiently- acknowledged complaint and advised timescales , I did few weeks in ask for update and they replied age of my case and be in touch as soon as investigated .I also asked for statements etc which they advised would send but never did – then letter for offer .

Hope you get success also

Kara says

Thanks Gaynor. I don’t think the FOS investigator has helped things unfortunately. He inadvertently only passed on some of the info that Vanquis provided and led to me focusing on the wrong points in my comments to be passed to the ombudsman. Apparently i’ll get an outcome this coming week but I’m not hopeful.

Sara (Debt Camel) says

You can ask for additional comments to be sent to the Ombudsman if you feel you weren’t given the full picture earlier.

Kara says

Thanks Sara. I’m going to say that my earlier comments were in response to the partial info the investigator passed on from Vanquis, but that ultimately there are several issues with the sale and features of the product, and therefore I would like them to look at the whole picture and the point at which I was made aware of the mis-selling which is when I received the ROP reminder letters in 2016/7. Any alleged correspondence before that date (and out of the 3 year time bar) may have included some info that attempted to rectify the mis-selling but 1) I didnt receive the email and 2) it didn’t seem to cover forebearance or the claim that ROP could help credit limit increases etc.

Worth a try…

Ashleigh Miller says

Hi Sara, I submitted your template and I received a response. However all they said in the letter was we have cancelled the ROP, which is not all I asked. They haven’t acknowledged that I have asked for a refund, how did others get acknowledged and refunded :(

Sara (Debt Camel) says

This is always their first step in handling your complaint.

Paul says

Hi,

I have had the same letter today confiming cancellation of ROP after sending template.

Then goes on to say if you have concerns about the plan, the way it was offered to yo or would like to make a complaint please call customer services.

Surly I don’t have to do that as complaint was in original email and the letter is proof of acknowledgment?

Cheers

Paul

Sara (Debt Camel) says

Well technically you may not have to, but If I was sent that letter, I would call up customer services and say that I still wanted them to consider my complaint. Better safe than sorry!

Paul says

Thanks Sara,

I’ve just called and complaint is still open and they advised they will reply within the 56day period.

The letter is a standard letter for when ROP is cancelled.

Paul

Gaynor says

Hi Ashleigh

I got the usual acknowledgement quoting timescales etc , few weeks in emailed asking for update again they advised timescale and be in touch as soon as reached decision . Letter in post received 1/2/18 advising looked into complaint and upholding complaint as having listened to call although I agreed to rop not all points scored to me . Refunded from 2012 and breakdown given . I then recieved cheque 9 days later 10/2/18

Good luck with yours

Ashleigh Miller says

Thanks, how come all I got then is a letter saying we’ve cancelled your ROP at your request.. I emailed them back saying that’s not what I asked in the template… No response. I’m fed up, everyone seems to be helped except me…. :(

Ashleigh Miller says

Oh sorry just seen the above comments. Thanks, fingers crossed eh :)

Natalie says

Hi Sara following my Previous post where my complaint has been upheld letter dated 10th January. I still haven’t received my cheque past the 28 day mark. Just gave them a call and they said they’re really sorry they don’t know what’s happened and they’re looking to re issue it within one week and then it’ll be sent out. Surely this is against their own guidelines of 28days. Is there anything I can do about this? I was expecting her to say it’s already on its way! Has anyone else has this problem? Thanks

Sara (Debt Camel) says

It sounds like an error which they are busy correcting. If it doesn’t arrive in another week you could ask for some compensation I suppose.

Dave O says

I had a Vanquis card that closed in 2012, i initially complained about PPI to be told it wasn’t PPI it was ROP and that they would not uphold the comaplaint. Their reason was that because it was itemised on the statement each month i knew everything there was to know about it. I have since submitted a complaint regarding ROP as it was completely useless for me. I am awaiting a response this week from Vanquis, would my chances be limited as the card was closed back in 2012?

Dave O says

Any able to provide any feedback to this ??, i’ve just logged it with the ombudsman

Eve says

Hi Dave

My complaint is currently with the FOS so I’m not sure how things will proceed. I personally gave the FOS every bit of evidence that I had on why I thought it was mis-sold, how severely it affected my finances and had I known previously that I could have complained then I would have. I was told by my investigator that any information I thought was relevant to my case then they would like to have it. Good luck with your complaint.

Andy D says

I’ve just spoke to Vanquis as it’s been 60 days today, and they say my complaint has been rejected on the fact that it was sold correctly to me over the phone, I’ve requested a copy of the call what are the next stages?

Sara (Debt Camel) says

The next stage is to send your complaint to the Ombudsman. The two main points most people have (you may think of other when you hear the recording of the call but don’t wait for that, it can take a long while. You can always add points to your complaint to the Ombudsman later) are:

1) They did not explain to you on the phone that the ROP was treated as a purchase on your account and so the next month and every month afterwards you would be paying interest at the interest rate of your card (probably high!) on this. The explanation on the phone made it sound quite cheap and this was misleading.

2) They did not explain to you that if you didn’t take the ROP and you got into financial trouble, eg you lost your job, Vanquis would still have had to consider freezing interest on your account. You were given the impression that paying for the ROP was the only way to get this and that was also misleading.

Andy D says

Many thanks.

I’ll crack on with this soon as I can!

And. H says

Hi Sara, following advice from this great site, I sent my complaint to the FOS as Vanquis rejected it on the basis is was over 6 months since final letter. FOS agreed it could be looked at and have sent an email to Vanquis stating this. Just wondering any idea what is likely to happen now, are Vanquis known to likely reject again and not look at it? Are they able to do that? Still not received copies of the calls from them that I requested again after they sent me a blank disc!

Many thanks.

Sara (Debt Camel) says

There isn’t a long history here so I can’t really guess what Vanquis will do. Let’s hope they don’t challenge it so the FOS can look at your actual complaint.

And. H says

They have said its been accepted under the exceptional circumstances and they have advised Vanquis of this in the email, and also that if they don’t agree it can be passed to the Ombudsman. Hopefully they will look into it again, fingers crossed.

David says

Hi my complaint has been with fos for 12 weeks now and the only letter I’ve had is to say they are requesting information from vanquis when this has been sent they will contact me within 12 weeks. It’s now over that anyone else the same ?

David Varley says

I contacted the FOS just after Christmas and got an e-mail from them on 2 January advising me that they were looking into things and would get back to me within four weeks to let me know how they could help (Vanquis had rejected my complaint on the basis that I took out ROP more than six years before I complianed).

Not having heard anything from the FOS since that initial e-mail, I contacted them again on 9 February to ask for an update and was told that they’ve asked Vanquis for their file and that once they’ve received it they’ll be able to let me know if I complained in time for them to be able to consider the matter (when I contacted the FOS initially I’d pointed out that whilst it was more than six years since I took out ROP, I’d only cancelled it last year and hadn’t previously been aware that it was something that I could complain about).

They haven’t given me a timescale for how long it’s going to take for them to get the file and come to a view – I think I’m just going to have to be patient, not that I’m holding out much hope of a successful complaint given some of the recent comments about decisions the FOS are making.

And.H says

Hi,

How would I work out roughly what I would get back in a successful claim? If they did happen to make an offer, although I think they will reject it again – it is currently with FOS, I would like to know if it is fair or not.

Have had the account since Jan 2011, ROP stopped in April 2016. Balance around £250 – £300 in 2011-2015 when it went up to over £900 end of 2015. been over £1000 since.

Not sure what should be a fair amount.

Many thanks.

Sara (Debt Camel) says

We haven’t seen a case in which Vanquis made a poor, low offer. If there is an offer it is for all the ROP you paid plus interest. if you want to calculate it yourself you need to get all your old statements and find what ROP you were charged.

Stacey cotter says

Hi Sara,

I originally complained directly to Vanquis about ROP I had on my card from about 2006 to closing the card, and paying off the balance in 2012.

They rejected it due to six year rule, but I escalated to the Ombudsman in October.

In January the investigator contacted me advising that upon review of the paperwork, she agreed I had been missold and Vanquis agreed to offer a full refund.

Do you have any idea how long it takes to get the subsequent calculation/refund from Vanquis if arranged through the Ombudsman?

Many thanks for any info

Stacey

David Woods says

I sadly received a note from Vanquis saying that the ROP started just over 6 years ago, and that I should of noticed this 3 years ago they are not going to uphold my complaint. Will be following this up with a complaint to the Ombudsman and hope they can help.

Vanquis absolutely did not make the charges or process clear.

Sonya says

I have just realised I’ve got a ROP. I called up vanquis and have asked them to cancel it. The lady on the phone said I’ve had it since I opened the account in 2013 and she was putting my call through as a complaint. I don’t t remember ever agreeing to this and I would never have agreed knowing how much it costs. I did pay off my card in full a while ago but started using it again last October. I’ll wait to see how it goes but I’m not giving up on this.

David says

I am also trying to calculate a rough figure of what I have paid over the years in ROP and subsequent interest, so that I know if their offer of redress is correct (should my complaint be successful).

I have had the card since Feb 2012, and I have around £3000 outstanding, starting at £500 and my current credit limit is £2250 which I am well over due to losing my job (part of my complaint is that they have frozen my account for the past 8 months without even bothering to mention that I have this protection, which is being added to my account every single month still!)

Should I be looking at the interest I have paid on the ROP in simple terms? ie in 2012 I paid roughly £100 in ROP, card is 40% APR, I had a balance of circa £500 making minimum payments per month, therefore at the end of the year that amount became £140?

For 2013 do I then start with the £140 (accruing interest on the interest) or do I use the £100 that I paid in 2012? Then work it out for 2013s payments, then 2014s etc.

Hope that makes sense?! I look forward to hearing from you,

Sara (Debt Camel) says

The interest at the card rate – 40% you say – accrues as compound interest, not simple, so interest accrues on the interest.

David says

Many thanks Sara,

That makes a huge difference to any potential return…. I reckon I’ve paid out roughly £1200 in ROP charges, but it’s cost me around £2500 extra in interest!

Lil says

Hi

After reading this forum I wrote to Vanquis about ROP. For several years I had payment issues with Vanquis and I agreed a set payment amount every month which took around 3 years to pay back.

I’m not sure if I had ROP or not. Would that mean that I did? They still have 3 weeks to reply before the 8 week deadline is up.

Eve says

Hi Lil, I think that unless you remember specifically saying no to the ROP when you activated the card then you probably did have it, but obviously I can’t say for sure. It was shown as Repayment Option Plan on the statements. Can you remember if when you were paying the minimum amount requested that your balance would still exceed your credit limit the following month even if you didn’t use your card? That’s the kind of problems I had when it was on my account and I was finding it impossible to stay under my credit limit. From this forum it seems most people knew it was there, but like myself saw it on their statements but had no idea what it was for and I personally had never been made aware of it’s benefits or that it was optional until I queried it a few years later and subsequently cancelled it.

Lil says

Thanks for the reply Eve. I don’t remember if i’m honest but I do recall the balance never going down any despite the payments. Not sure if that was purely down to the high interest or ROP though. I guess I’ll just have to wait and see what they say as I don’t have any statements to refer to either. Thanks again.

Samantha says

Hi, Glad I found this website, I have had this for about 6 years! I sent them an email requesting to cancel it and a refund. How long do they have to reply to action the requests?

dan says

They have 56 days for your complaint, they should cancel it sooner than that though – I’d personally phone them to confirm the cancellation and then settle back and wait for the complaint to be resolved… it could be 56 days for initial, then you refer to FOS, then will be contacted for further details and then case assigned to adjudicator, then they liaise with you and Vanquis and then you go to an ombudsman who reviews your case from start to finish again. You COULD be waiting many months for the whole thing to play out, unless they make and you accept and offer at any point before this.

Kara says

I’ve just heard that the ombudsman hasn’t upheld my ROP complaint due to it being take out in 2011 and Vanquis having allegedly emailed me notifying me as to a variation to the product in 2013. Thereboth both the 6- and 3-year time bar were applied. I’m a bit disappointed as I paid £880 and genuinely feel it was mis-sold but I was prepared for the outcome so I’m not devastated.

One word of advice: if your adjudicator rejects your case based on evidence from Vanquis and you decide to refer it to an ombudsman, make sure you get a full copy of the evidence before you submit your comments for the ombudsman. My adjudicator only sent me part of the email that Vanquis sent him and I submitted comments focussing on the bits that weren’t covered in the letter. The adjudicator eventually sent me the full email from Vanquis which made my further comments futile and I would’ve focused on other points had I had the full info.

Just one of those things I guess. Good luck to everyone else – I hope there are some well-deserved refunds!

Maria says

Surely if Vanquis sent out a mass email in 2013 regarding a variation to the product then anyone who took out the product before this will have their complaint rejected? I too took mine out in 2011 and mine is currently with an investigator so I can see mine going the same way. Would be interesting to know how many complaints are upheld for people who apparently received this email in 2013.

Samantha says

Think mine will be the same way, it took it out 6 years and 10 months ago :(

Sara (Debt Camel) says

No one knows if a mass email was sent out or what it said. I suggest not worrying about this.

Susie Prior says

I stumbled on this page when searching to find out more about ROP. I’ve had my account for about 5 years. I’ve always wondered what it was for but kept paying because It was the only Card I thought I could get due to credit problems when I was younger. I have now a 3000 credit limit and have normally paid about £40 a month! Although the card is virtually paid off now I thought I would give it a try. I emailed them on Friday and doubled it up with a letter. I had a text message yesterday to say my complaint has been logged. Now to sit and wait! Thank you. Will keep you posted!

Robert says

So I received a second letter from Vanquis ‘re my disk. The letter also stated “you’ve mentioned that the features of the ROP plan were not explored whilst you were exoeriencing financial difficulties and in a debt management plan. I have been unable to locate a time when you were eligible to use one of the features of the plan and for them to be offered to you. Therefore my decision not to uphold remains the same.”

I am really confused, does anyone know what they mean, should I have had the plan in the first place if I was not eligible for it? I have referred the original decision from Vanquis to the FOS and am waiting for the case to be set up.

laura says

I phoned vanquis to cancel my R O P and made a complaint their and then , I thought it had been on my account for about 2 years and couldn’t remember asking for it to be added.was paying £25 per month, they said that they would look at my complaint but it would take about 2-3 months before they could answer me back. Received a reply after 2 months saying : I had no case for a refund as it had been more than 6 years and that they do not keep recordings of phone calls over 6 years and if not happy to get in touch with ombudsman. So thought that was that until about 1 hour ago after stumbling across this thread.

Cat says

What I don’t understand is some people have their complaint upheld going back prior to 2011 and others don’t because their account was opened over 6 years ago and they don’t hold the phone call any more. So do the have some old call but not the others?? Confused. Mine was opened Jul 11 and vanquis have 4 weeks left to ‘provide a resolution’ as they call it. I think everyone who has their claim rejected needs to go to the FO. Fingers crossed for you. I’ll keep my progress updated.

Cat

Maria says

This is something that confuses me also, I opened my account in August 2011 and they rejected my claim stating that all the points were covered in the call and I have since received a copy of the call. So obviously not all records are deleted after 6 years.

Andy D says

I have just spoken to the FOS about my complaint and they are currently giving a timeframe of approximately three months due to the large number of complaints, I’ll keep you updated and keep an eye on the thread.

Amelia says

I just wanted to say a massive thank you to whomever wrote this artical.

I wrote to Vanquis in early December. Although I opted into the plan I felt horrendously mis sold as I was unaware that they could freeze my account regardless of ROP and the plan itself caused me massive issues repaying my account.

I followed the template mentioned above and initially recived no answer. I chased them and they informed me it can take up to 90 days to process . Fast forward to mid Janurary I recived an letter saying my ROP plan has been cancelled and a second letter saying they are still looking into my complaint .

Today I receive a letter stating I will receive £666 by cheque in the post in the next 28 days.

Very long winded but 100% worth it. Thank you so much :)

Dee says

Hi, I’ve had my card and ROP since April 2013.

I haven’t used the card for 18 months plus, set up an auto monthly payment higher than the minimum payment a long while ago so I could forget about it and just pay it off. February 18 I decided to login to Vanquis to see how my balance was getting along only to find it has not reduced at all, and at times has taken me over limit incurring further charges. I was so disappointed so started to look at my charges and saw ROP itemised. Looked for more info about it with intention to cancelling it and found this site. Wouldn’t have known to complain without this.

I complained using the template on 13th Feb which was really useful as my memory of the conversation is very vague.

Received letter dated 15th acknowledging complaint etc. Logged into my account to see that I have not been charged ROP on this months statement dated 15th so they have cancelled it. Just a waiting game now for the 8 weeks to be up. At the very least my balance will start to come down from this month now the ROP is not being added which is the important thing, I’ve wasted so much money trying to pay this off, made me really angry.

I will update on how my case goes and good luck to all with your complaints, I’ve been checking how everyone’s getting on.

Sara (Debt Camel) says

“At the very least my balance will start to come down from this month now the ROP is not being added which is the important thing”

Quite right. Even if you are unlucky and get nothing back, you are still better off each month!

laura says

The most annoying thing is that they advertise their card as a credit builder for people that are having credit problems.

At the end of the day all they are doing is making it worse. So thank you very much vanquis for making my life more difficult.

Cat says

The funny thing is after finding this thread and fully understanding what impact ROP has had on my account, I have really looked into it. In Jan 17 vanquis reported I missed a payment to my credit file. I have looked through the history of my bank statements and all payments were paid on time except Jan 17. According to ROP features my ‘lifeline’ should have been automatically activated and they don’t send this information to credit file. All my payments have been on time prior to this incident and after. Effectively paying ROP for this so called service and they didn’t even activate it. Worth checking credit files for these. If course this was added to my complaint.

mo says

I have had a reply from vanquis stating as I took this out in 2011 they will not refund me. I was also sent a letter regarding Rop. I cant ever remember getting this.

Dave O says

So Vanquis have not upheld my complaint as it doesn’t fall within the 6/3 year window rule. I took out the card in 2006 and closed it in 2012, it was only September 2017 after finding this site did I feel the need to complain. Vanquis have offered no insight into how it was sold but have basically said because its on the statement then i agree to it. I have logged this with the Ombudsman and has been logged for about a week. How long will it be before I here anything from the Ombudsman?

Sara (Debt Camel) says

probably 2 to 3 months – they are getting a lot of these complaints!

Gail says

Hi Dave. I am in exactly the same situation as you with the same dates.. also with the fos. Pls keep me informed with progress

Phil says

Your probably looking at over 3 months. The Ombudsman is still looking how to deal with this sort of complaint. So I was told Friday. I sent mine complaint to the ombudsman middle of November

Sam says

Hi,

How have people been notified about their complaint being refused or acknowledged? I submitted a refund using the same sort of explanation on here and just wondered how long it would take to get a response? Also if I applied via email would I expect to have an email return? Or a letter sent to my address. In my complaint I explained that I have moved and appraised them of my change of address. Hopefully this is successful, just wondered how long people had been waiting for an acknowledgment.

Thank you in advance

Dee says

Hi Sam,

I complained on 13th Feb via email and on the 21st Feb I received an acknowledgement letter in the post that was dated 15th Feb.

Sara (Debt Camel) says

NEWS!

The FCA has announced today that everyone will be getting a refund of the interest they were charged on the ROP, going back to 2003. https://www.fca.org.uk/news/press-releases/fca-fines-vanquis-1976000-and-orders-vanquis-pay-compensation-customers

I will be writing a full article on this today so look out for it!

EDIT here it is : https://debtcamel.co.uk/vanquis-refunds-168m-for-rop/

Gail says

(Hopefully) excellent news !!!

FourMenHadADream says

This is fantastic news. Credit to you Sara and your team for highlighting the ROP scandal while also being persistent on making sure everyone raised this with Vanquis and FOS!

Sara (Debt Camel) says

my team… haha…. I wish ….

FourMenHadADream says

Sara, from reading the article on the link that you provided, have Vanquis only been instructed to pay back the interest on the ROP as opposed to the ROP fee + interest?

David O'Boyle says

Sorry Sara, just to confirm what I have read, is it the ROP + interest or just purely the interest accrued from ROP that had been charged?

Sara (Debt Camel) says

Just the interest. For many people that is more than they paid on the ROP.

Kk says

Wow brilliant news!!!

Kara says

Just reading the full document via the FCA article – they received £28m through sales of ROP and the associated interest during this period. Astonishing. I’m so glad they’re being made to put this right. And on a personal level, I’m glad that those of us who have had our complaints rejected by Vanquis & FOS are going to be compensated.

Sam says

Hi Sara,

How will this be done though? The article states that no one has to do anything and that Vanquis will refund it? I have moved since I had the card and I am hoping that they have read my email complaint as my card was pretty high into the £2K mark and more as I just couldn’t pay it off? I had it for about 3 years I think? I have stated in my email complaint that my address has changed and provided my new one. Fingers crossed.

Thank you by the way for this information? So many of us would have been none the wiser!

Sam

Maria says

Vanquis now have a page about the investigation on their website, it says they have “agreed to refund at interest relating to ROP together with 8& statutory interest” – so it doesn’t sound like the ROP fee is being refunded by Vanquis. It will be interesting to see what happens with those complaints currently with the FOS given that some people have already been refunded ROP fees on top of interest

Sara (Debt Camel) says

I am closing comments on this page – all queries and comments on the new page https://debtcamel.co.uk/vanquis-refunds-168m-for-rop/ please or it will get very confusing!