UPDATE: 27 February 2018 – Victory! Vanquis is made by the FCA, its regulator, to offer refunds of the additional interest charged to all cardholders who have had ROP.

UPFATE: 2 August 2018 – Well only a partial victory :( The refunds Vanquis is actually paying out are a lot smaller than they should be. Read Why the ROP refunds are too small and how to complain.

I am leaving this old article here as a lot of readers commented on it.

Vanquis Bank’s Repayment Option Plan (ROP) for its credit cards is being investigated by the regulator, the Financial Conduct Authority (FCA). This was announced by Provident, who own Vanquis, on 22nd August 2017.

This article looks at whether you should cancel this ROP if you are still paying for it and complain and ask for a refund of ROP. The details of one refund are shown – you may get a large amount back because you also get a refund of all the interest that was charged on your ROP fees.

Many readers have got hundreds or even thousands back, see all the comments below.

What is the ROP and why is the FCA looking at it?

Vanquis’s ROP is a bit like insurance, offering some features that could help if you have difficulty with repayments to the credit card.

The main feature is an “account freeze” if you get into financial difficulty: no payments needed, no interest being added and your credit record is protected. You can’t just ask for a freeze, you have to supply evidence eg that you have lost your job, send an income and expenditure sheet etc

There are also some other short-term options if you miss a payment or want to miss a month’s payment, but the ROP would be a VERY expensive way to get these minor benefits. The “no impact on your credit rating” feature may sound nice, but it’s not worth much unless your credit rating was actually good. People with a credit rating worth protecting don’t usually have a Vanquis card at all!

The cost – £1.29 per £100 outstanding – may not sound high. But that monthly charge adds up to a lot over the year.

The ROP charge is also treated as a purchase on your Vanquis card, so unless you repay the whole balance every month, the next month you will be paying interest on the previous months ROP charges.

If you only repay the minimum amount and you are having ROP charge added, your balance is hardly going to drop at all.

What are the FCA concerns likely to be?

The Provident announcement said:

The FCA indicated that it has concerns about the ROP product and is investigating the period from 1 April 2014 to 19 April 2016. Vanquis Bank agreed with the FCA to enter into a voluntary requirement to suspend all new sales of the ROP in April 2016 and to conduct a customer contact exercise, which has now been completed.

That’s the only public information – the rest of this is my speculation.

The FCA’s main objection is probably the fact that Vanquis are charging for this account freeze, which is something they should be offering to all customers in difficulty without any charge. FCA rules (CONC 7.3.4) say:

A firm must treat customers in default or in arrears difficulties with forbearance and due consideration.

“Forbearance” in this sort of situation often involves freezing interest. So the FCA rule means that all customers may have their interest frozen when they are in difficulties.

If Vanquis didn’t explain this to customers when it was selling them the ROP, this may well have been misleading and the product may have been mis-sold.

Why only from 2014 to 2016?

The FCA’s investigation starts from 2014, when the FCA took over regulating this sort of debt.

But the previous regulator, the OFT, had very similar wording. It described failing to treat borrowers in default or arrears difficulties with forbearance as an unsatisfactory business procedure, and said creditors should consider reducing or stopping interest and charges when a borrower evidences that he is in financial difficulty.

So although the FCA isn’t looking at older cases, this suggests that the customers who paid for the ROP before 2014 were not fairly treated either so they too can complain.

How much could a refund be?

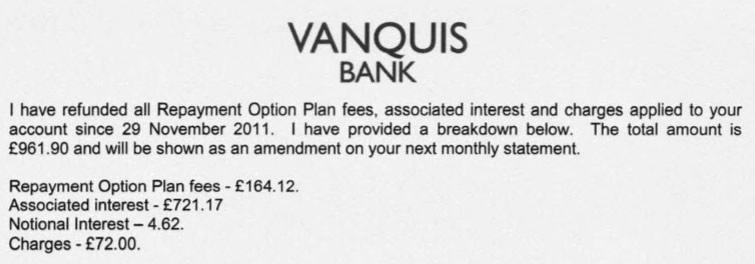

One Debt Camel reader, Mr N, complained to Vanquis about the ROP earlier this year. This is the refund he was given:

He only had the ROP for a short period in 2011/12 so the ROP fees weren’t high. But look at the extra interest that was refunded – £720 – wow!

This is high because Mr N didn’t repay his card balance in full every month. Paying for the ROP meant he was paying less off the balance on the card. He was effectively paying 39% interest on his ROP payments for nearly 5 years and that is what he is being compensated for.

How did Mr N get that refund from Vanquis?

Mr N complained that he felt he had been pressured into signing up to the ROP which wasn’t right for him. Vanquis listened to the phone call from 2011 when he signed up to the ROP to check that certain points had been properly explained to him. The investigator concluded:

although you did accept the repayment option Plan as a feature of your account, I do not feel all these points were satisfied when discussing the plan with you.

What should you do now?

Cancel the ROP?

It’s always hard to suggest that people should cancel insurance, however ridiculously over-priced it is. You might cancel the ROP and then lose your job next month… But the regulator’s rules mean that if you do get into difficulty, you can ask Vanquis to freeze interest on your account, see What to do if you can’t pay a bill this month.

You have to think about the cost of the ROP. Not the headline £1.29 a month per £100 charge… look at what the true cost to Mr N was for his ROP product. Paying ROP makes it much harder to get your Vanquis balance to drop as so much of your monthly payment is eaten up by the ROP charge, so you are actually more likely to end up in financial difficulty!

There may be hundreds of thousands of people who still have ROP on their Vanquis cards. I think they should all be seriously considering cancelling it!

Complain about it? (this was written before the FCA’s decision in February 2018)

If you took out the ROP after April 2014, your case will be among those being looked at by the FCA. You could decide to wait and see if you get awarded any automatic compensation. But if you have financial problems at the moment, you may want to ask for a refund now as there is no indication how long the FCA investigation may take.

People who were sold the ROP before April 2014 are unlikely to be included in any redress scheme the FCA proposes. But they can still get refunds if they ask for them. So complain to Vanquis now and asking for a refund of the ROP fees plus the associated interest you paid on the card.

You can complain if you are still paying the ROP or if you cancelled it. It doesn’t matter if you still have the Vanquis card and owe a balance, or you have closed the card. You can also complain if you are currently in debt management.

Don’t complain if:

- you have gone bankrupt after you got the Vanquis card (the refund would go to the Official Receiver)

- you are currently in an IVA (the refund would go to your IVA firm);

- you are currently in a DRO (your DRO could be cancelled if you get a refund).

October 2017 update – some of the first complaints upheld

About 8 weeks since the first complaints went in based on this article we have the first few results:

- people have been offered refunds of £418, just under 3k, £1600, £507, £285 (that was only for 6 months ROP) and £531;

- most are happy with the offered refund but one is going to the Ombudsman as the numbers don’t reflect what he thinks he paid;

- people who applied for the card more than 6 years ago have had their complaints rejected – some of these are going to the Ombudsman;

- 3 people who took out the ROP in the last 6 years have had their complaint rejected.

Obviously there could have been a lot more decisions – I am just going on what has been reported in the comments below this article.

November 2017 update – more complaints upheld

Increasing numbers of results reported:

- refunds offered of £448, £321, £508, £1,255, £1,286, “full refund”, £4,279.

- 4 people who took out the card within the last 6 years have had their complaint rejected, 1 person asked for a copy of his phone call and was sent one that clearly showed he had rejected the ROP – he has sent the case to the Ombudsman.

- 2 people who opened accounts more than 6 years ago have had their complaint rejected.

- Vanquis have missed the 8 week deadline in a few cases.

December 2017 onwards

Lots more people have been getting refunds, too many for me to keep track of. See the comments below for recent examples.

A few interesting cases:

- one reader has her complain accepted because Vanquis couldn’t find the call recording;

- one reader has had a decision from an adjudicator at the Financial Ombudsman that the FO can look at cases where the account was opened over 6 years ago. Good news – although it could still be challenged by Vanquis.

Dave G says

Hi Sara

I put a claim using your ROP template, I didn’t personally think I would be successful as my account started in 2003 , I also stated that if I wasn’t successful claiming my ROP then I would want to try the Plevin route, yesterday was the 57th day and I called up and asked what was happening, they said a letter was in post explaining the situation. So I didn’t think I would be successful …..I have opened up my vanquis this morning and found a 0 balance and a exgratia payment of £2998 has been paid clearing my balance , I only paid a payment of £197 yesterday for this months payment which isn’t showing on transactions , does this mean I will get this back too ? So thanks to you Sara I am going to close my vanquis and am now £200 a month better off on my outgoings , Thankyou, Thankyou , Thankyou, I will put info of letter on website when it arrives

Sara (Debt Camel) says

Nice one! If you have a credit on your account when you close it, you will get that money back.

David Varley says

Hi Dave,

Did you enter into the ROP at the same time as you opened the account, or was it later? Vanquis have rejected my complaint on the basis that I took ROP out more than six years ago (January 2011) but I note you started your account in 2003.

Thanks,

David

Dave G says

Hi Dave

The ROP was taken out the time of opening , I really don’t know why my claim was successful tbh, maybe because I mentioned Plevin , I don’t really know or maybe I was just lucky ,as soon as I get the letter I will pop the main points on here form on here to read, on a bad point , my very complaint has been turned down due to the fact that making the minimum payment for many a years is not a valid reason in their eyes so off to ombudsman I go in the new year , merry xma severyone and keep trying , Sara keep up the good work

David Varley says

Hi Dave,

Thanks for that. I’d be interested to know what the letter says – them making an ex gratia payment. Good luck with the ombudsman and Merry Christmas.

Regards,

David

Sam says

Hi all, I hope everyones xmas break is off to good start.

I recently complained to Vanquis regarding ROP and they have rejected since:

1. It was itemised on statement.

2. Following conversation where plan was discussed a summary of product was apparently sent.

3. The ROP was applied during a phone call on 5th October 2009. Over six years ago.

I honestly did not know there was a reason to complain until recently when noting the large amounts of additional interest that would if been paid over five year period (I was sat at £3000 balance for most of this time)

Any further suggestions here? Straight to Ombudsmen or ask for transcript of telephone conversation first (or both simultaneously)

Would be very grateful for any advice or help.

Sam

Sara (Debt Camel) says

Vanquis are rejecting all complaints about ROP taken out more than 6 years ago. You can send the case to the ombudsman, it is possible they may look at it but you have to explain why you didn’t complain before. For example if you think you were told that the ROP was compulsory, then you wouldn’t have complained because you didn’t realise anything could be done about it.

Vanquis seem to be taking a VERY long time to provide transcripts, so I suggest you put in your complaint to the Ombudsman first anf=d then ask for the transcript.

David Varley says

Hi Sara,

I took out my card in January 2011 and ROP was applied immediately.

Having complained, Vanquis have now written to me saying that they are unable to uphold my complaint as the ROP was applied more than six years ago and that they believe that I had ‘reasonable awareness’ of the plan on the basis that it was charged to my account every month.

I know it might be a long-shot but I intend to follow this up as I wasn’t aware until November this year that I could complain about the selling of the plan and that as far as I can recall it wasn’t properly explained to me how the plan worked.

One question though if I may – I’ve read elsewhere that the six year rule only takes effect from the date on which the policy came to an end, and that provided that the complaint is made within six years of the policy coming to an end it’s not a time-barred complaint.

Is that correct?

Thanks for your help.

Sara (Debt Camel) says

VAnquis’s argument is that the “mis-selling” took place at the start, so it’s 6 years from that which matters. However it is the Ombudsman that makes the actual decision on this, so send it to the Ombudsman if you want.

David Varley says

Thanks for responding so quickly Sara – I’ll do that and let you know, what happens though going by what’s happend to others (see Dave G’s above) Vanquis do seem to be paying out even where the accounts go back more than six years.

Thanks again and all the best for Christmas and the New Year.

alison carr says

Hi all,

I have only had the credit card for just over a year but have been paying substantial amounts of ROP and associated interest –

I used the template above and have just been sent a reply to say that they have’ processed my request to opt out of the Repayment option plan’ however if i have any concerns about the way the plan was sold, or any complaints to phone customer services – no mention of a refund. I do feel cheated out of a load of money and would like a refund – has anybody else had success recently?

Any advice gratefully received- thanks!

Lucy says

I also got that letter, give it until the 56/57th day. I think they have to send that out first as a formality. Next I got a letter saying they were still looking into my claim….then a credit to my account on the very last day. No letter explaining anything yet. Good luck x I thought the same as you and wrote off hearing anything else.

Philippa says

I just wanted to say thank you. I saw this site, sent in a complaint as described. On the 57th day, Vanquis credited my full balance (£150) and the next day I received a letter confirming my complaint had been upheld and another £673 will be sent to me by cheque within 28 days.

This is SO worth doing for anyone who is hesitating! I really assumed they’d reject my claim. I can’t remember what year I got my card and have a low limit of £150 so never in a million years expected to receive so much back.

Good luck everyone :)

Richard says

Hi Phillipa

Well done, Good that they gave in.

Do you know roughly how long you had your card for?

Philippa says

Thanks. At a guess maybe 5 years? But I was worried it was over 6 so really not sure.

S says

This is exactly the kind of response I was hoping to see! I have had my card for around four years and only fully cleared the balance in November. I didn’t think I’d get much as I only have a low limit – £150 too.

I’ll be putting my complaint in later. :)

Philippa says

Just an update as I found my letter:

I took the card and ROP out in October 2012, I remember feeling pressured in the call to take out ROP but I just wanted the card so gave in.

The complaint has been upheld on the basis that although I did accept ROP, they didn’t feel all the usual points were satisfied when discussing the plan with me.

My balance has pretty much been consistently at the £150 limit.

Breakdown :

ROP fees £130

interest £256

Charges £360

Notional interest £102

Withheld tax £20

Hope the full info is helpful. I received the balance cheque today (just under 28 days which isn’t bad considering Christmas has been in the middle).

Lucy says

Hi,

Thank you so much! After reading this I simply sent an email pretty much following the template above and on the 56th day got a refund onto my vanquis card of £2300! On the 29/12/17 I have had my card since 2014/2015 and had maxed it out to almost £3000. Now just £600 to clear :)

I’ve not received any letters yet about it, just happened to look in to my account. I did receive a letter stating they were looking into it and would answer by the 56th day. It’s so worth doing if you have any suspicion of a mis-sale. I remember being talked into it on the phone after saying no thank you at least three times!! I’d cancelled it at the same time I sent the complaint…you don’t need an agency to do it for you! I’ve not had any telephone conversations either.

Claire says

Hi Everyone, I emailed my complaint on 4th November, received letter later saying they had cancelled my ROP and then a further letter saying they had 56 days. I hadn’t heard anything up until yesterday so I called, unsurprisingly they said that they were making a decision that day and would send me an email by close of business. They didn’t. So I called again and they resent the email which apparently hadn’t sent earlier! Unfortunately the email said my claim had been rejected. It was a very long letter saying no. They asked if I would like the person who made the decision to call me today, I said yes.

The lady called today and asked her twice whether if I didn’t have the ROP would the interest be frozen on my account if I got into difficulties and she said it definitely wouldn’t but they had other ways to help. I’m confused I thought they had to, is she right?

I also asked her what the word forebearance meant as it had been mentioned in her rejection letter several times, she said she didn’t know.

I have asked for a transcript of my original call, she said she would try and sort by the end of the week. I suppose I will have to try the ombudsman route now.

Sara (Debt Camel) says

The FCA (Vanquis’s regulator)’s rules say:

“CONC 7.3.4 A firm must treat customers in default or in arrears difficulties with forbearance and due consideration.

CONC 7.3.5 Examples of treating a customer with forbearance would include the firm doing one or more of the following, as may be relevant in the circumstances:

(1) considering suspending, reducing, waiving or cancelling any further interest or charges (for example, when a customer provides evidence of financial difficulties and is unable to meet repayments as they fall due or is only able to make token repayments, where in either case the level of debt would continue to rise if interest and charges continue to be applied)”

Now this doesn’t mean that they have to freeze interest just because you say you are in difficulty, but if you supply an Income & Expenditure sheet showing you can only make low or no payments, then yes, they should be looking at frezing interest. And lenders usually do.

NB Vanquis wouldn’t allow you to get interest frozen under ROP just because you ask for it – you have to show them that you have been made redundant or something like that. The same sort of evidence that would normally lead to Vanquis offering forbearance if you didn’t have the ROP.

Darren says

Received an exgratia payment this morning of £1437.77

Don’t know the breakdown yet or weather this is full and final payment. Will post when I find out more info.

Phil says

Why are some being paid out and others rejected regardless if you excepted it or it was explained? Bottom line is they never told anyone about the interest being added

Claire says

I agree is it just the luck of the draw?

Sara (Debt Camel) says

There does seem to be a random element. That’s why i suggest everyone who is refused sends their case to the ombudsman.

Chris Jubert says

I sent my complaint on to the ombudsman as soon as you suggested Sara, so fingers crossed.

Maria says

I had ROP on my card since I opened my account in August 2011 (over 6 years ago) and somehow Vanquis were able to listen to my call even though they have rejected others for being over 6 years ago? Vanquis have rejected my complaint by saying I accept the ROP on the call by saying “yeah, yeah that’s fine”, I have asked for the transcript and gone to the Ombudsmen as I know I was pressured into this. I know I’ve paid extortionate amounts of money because of this product and was only able to settle my balance with a balance transfer onto a card with a lower APR. Might be worth noting that my rejection letter mentioned that when applying for a Vanquis card online the T&Cs detail that ROP is treated as a transaction and you will pay interest on this…i.e telling me I should have known! I find it ridiculous that they are trying to get out of mis-selling this product by saying the interest was mentioned in the T&Cs before you even open the account and not mentioned on the call.

Kara says

I took out a Vanquis credit card and ROP in Jan 2011 and remember feeling pressurised into taking the ROP. After submitting an enquiry through Resolver, vanquis have said they won’t uphold the complaint as it’s over 6 years old. I sent it onto the FOS and have received an email from the investigator who’s reviewing the complaint to see if it’s under their jurisdiction, given that it’s older than 6 years. Has anyone had any success in this regard? I have paid > £800 so would like to see this rectified.

Thanks.

Sara (Debt Camel) says

Hi Kara, these are the first jurisdiction complaints going through… I suggest you email the investigator saying that you had no idea that a credit card company such as Vanquis would have to consider forbearance if you were in financial difficulty – Vanquis never explained this to you at the start and that you put in a complaint as soon as you were aware of this.

Kara says

Thanks, I’ve done as you suggest. I’ll let you know!

Eve M says

Hi Kara, I too have now had to go the Ombudsman route as Vanquis have told me I’m time barred. (I had the same problem with MBNA PPI). I cancelled my ROP in November 2015 when it finally dawned on me what was causing me all the stress of going overlimit and unable to get my balance down. The reason being the ROP and interest on it. I also had overlimit fees nearly every month despite payment the minimum payment requested by Vanquis. The ROP was first added to my account when I opened the account in June 2010.

I have forwarded statements to the FO which I found from 2012 & 2013 which show that despite me not using the card that my balance was increasing every month and I have also let them know that not once did Vanquis ever advise me on how to stop this happening. Yes I was naïve in taking so long to realise the problem but they are the financial people who advertise this card to help your credit rating and pressure you into taking this product.

I didn’t realise until October 2017 that it was possible to claim this back and the time bar ruling seems really unfair but I know that is what some banks etc are doing. I’ll keep you updated how I get on once I hear anything. Good luck with your case and all others reclaiming.

Kara says

Thanks Eve. I have been advised by the FOS that Vanqus have an arrangement whereby they are given 4 weeks to provide files as opposed to 2 weeks which is what most banks operate by.

It seems quite problematic as the FOS need to agree with me about being able to look into it despite it being > 6 years, and if they do agree to it Vanquis have to agree that the FOS can review it.

Not holding my breath….

Good luck with yours!

James says

I received a strange email back in November that said about this ROP scheme, which I had never heard about. Subsequently I though there must be something strange going on so I called Vanquis to ask what ROP was – he immediately said I will issue this as a complaint, to which I questioned why are you issuing a complaint, I was just querying what it was all about. Obviously this sounded the alarm bells in my head!

After this complaint being filed I googled for more information and found this blog (which I have been following closely since the complaint was raised!).

I have had this Vanquis card since 2013 and have used it fairly lightly, always maintaining that I pay back the full balance every month, that was until we bought a new house last year and I have been holding quite a large amount of debt on it c.£2k. The complaint was raised with Vanquis back on the 11th Nov and the ROP was cancelled. Obviously I hadn’t seen this blog so didn’t follow the complaint template, however Vanquis agreed that it was miss sold and are going to repay a total of £817.91, which is broken down as follows;

Repayment Option Plan fees – £547.30

Associated interest – £237.07

Notional Interest at 8%*- £41.92

Withheld Tax Amount – £8.38

The whole process took 53 days. I haven’t got a clue whether this is the actual figure I should be receiving or whether it should be higher, is there a way that this can be verified?

Thanks

Waytogowoman says

First of all, thank you Sara for providing advice/information wrt ROP. Much appreciated!

So ….update..

I sent an email to Vanquis on 14th November and as my 56 days were up today, I rang Vanquis. They confirmed that I am to receive a refund of £1150. The letter is in the post and the refund will be applied within 28 days. I was told that the customer care representative looking into my complaint had reviewed the original transcript and asserted that although I had the ROP ‘generally’ explained to me, it was not ‘explained fully’ to his satisfaction. I will check the breakdown of my ROP costs when I receive the letter but I have to admit, Vanquis have acted pretty decently since my original email. I received two letters and an email during the investigation period and one telephone conversation with a helpful member of the customer care team as part of the update process.

I have had my Vanquis card since June 2014.

Good luck to those still waiting for a decision, and for those who have just landed here – Get Writing!

Mark Bickerdyke says

My other half has just been paid out took about 7 weeks from start to finish

Repayment Option Plan Fees £265.25

Associated Interest £339.91

National Interest at 8% £113.64

Withheld Tax Amount £22.72

Total Refund £696.08

Darren says

Hello again Sara. Has further follow up I received my letter from Vanquis this morning. The ROP started on May 17 2012 they’ve upheld my complaint and are paying me back £2399.05 broken down as follows

ROP Fees £1276.76

Ass Int £1019.64

Not Int @8% £128.31

Withheld Tax £25.66

I am more than happy . They’ve paid £1432.77 straight of my balance leaving me £39.80 to pay and a cheque will be with me before the end of the month for the remaining£966.28.

Thank you so much for the template letter as I used this and didn’t really think I had a chance. Anyone else reading this try your luck you never know.

Helen says

I complained to Vanquis in the 1st of November and have since had a letter telling me they are looking into this issue. Unfortunately I’ve misplaced this letter so I can’t find their phone number or my reference number.

Anyway, I had a text from them yesterday, asking me to score my experience of the complaints procedure. To me this suggests they think this issue is resolved? However I have had no emails or letters from them.

Is it normal to get this text despite the complaint still being looked at?

Michelle Mitchell says

0345 130 7088

I am still waiting on an update from November about my complaint.

Gerard says

Helen judging by your complaint date of November 1st, your complaint should’ve been dealt with by now, as it’s over 8wks. Perhaps they think you’ve received a refund already! Let’s hope it’s on it’s way. If I were you I would call them to find out what’s happening.

Helen says

Bad news! I managed to find the details to contact them on my resolver page.

They did not uphold my complaint, they are saying they’ve listened to my call and I said “yes please”. :-(

Darren says

Mine was upheld and in the letter it said that they’d listened to the telephone call and although I’d agreed to have the ROP the product hadn’t been explained correctly. Try that as a reason.

Sara (Debt Camel) says

Send the complaint to the Ombudsman – most people aren’t saying they said “no”, but that it wasn’t explained to them that either

– Vanquis would consider freezing interest if you were in financial difficulty even if you didn’t pay for the ROP and/or

– that the ROP charge was being treated as a purchase on your card, so you were being charged interest on it every month.

Helen says

Thanks Sara. This is some of the content from the letter. Do you think they’ve explained it clearly enough?

During the call, the agent made clear that the Repayment Option Plan was an optional feature. The agent also clearly explained the cost of the Repayment Option Plan, stating that “all it costs is just £1.29 for every £100 for your outstanding balance each month so £100 balance would only cost you £1.29 and of course if have no balance on your statement you won’t be charged”. After also being provided with details of the features of the product, you opted into the Repayment Option Plan, saying “yes please”. The agent then reiterated that you had opted into the Plan and that it could be cancelled at any time.

Prior to this call, when making your application for a credit card, you would have received a copy of the credit card terms and conditions containing the Repayment Option Plan terms and conditions. These explained that the Repayment Option Plan was treated as a purchase transaction and, like all purchase transactions, attracted interest at the purchase rate where the balance was not fully paid each month. It made clear that interest is calculated on the daily outstanding balance on their account. The terms and conditions also stated that: “We add the interest we charge to the outstanding balance on your Account at the date of each statement. This means that you will generally pay interest on interest”.

Sara (Debt Camel) says

I don’t think the explanation in the telephone call was clear enough – it did not make the point that this fee was treated as a purchase so you would be paying interest on it.

They can’t rely on what was in the T&C. If they could, then they wouldn’t have needed to explain the pricing etc in the phone call to you! the phone call was a sales job and it omitted a VERY important point about the true cost you would end up paying.

Also the phone call would not have mentioned the fact that if you were in financial trouble, Vanquis would have considered freezing interest on your debt anyway… for many people the interest freeze was the most important feature of the ROP and not to mention that interest may be frozen even if you don’t pay for it was misleading.

i suggest you send your complaint to the ombudsman.

Phild says

Had my rejection letter today which says I agreed to the ROP (I did) and that it was fully explained to me stating “All it costs is £1.29 for every £100 of your outstanding balance each month so a £100 balance will cost £1.29 and of course if you have no balance on your statement you won’t be charged”. It states all was explained and I agreed. It also states in the online application t&c it explains the ROP will be treated as a purchase transaction and will attract interest like all purchase transactions stating “we add the interest we charge to the outstanding balance on your Account at the date of each statement. This means that you will generally pay interest on interest”

It also states that under the ROP t&c I have a guaranteed right to a freeze on interest and payments for up to 24 months which is not available under standard forbearance and that it is not correct to say that Vanquis is obliged to freeze accounts in the same way that the ROP provides for. We do not consider it to be necessary or appropriate to discuss with you what forbearance options might be available in advance of difficulties occurring.

After the letter I do not feel any confidence in getting a successful claim at all. I have passed to the Ombudsman but still not confident at all.

Does being self employed come into it ? any advice appreciated Sara

Sara (Debt Camel) says

something may have been in the T&Cs but this wasn’t explained to you during the phone call describing the ROP – this was so important that you think it should have been explained to you as it meant the tre cost of the ROP was much more than they said during that call.

“it is not correct to say that Vanquis is obliged to freeze accounts in the same way that the ROP provides for” true, but it should have been explained to you that Vanquis would consider freezing interest even if you didn’t have the ROP. Vanquis isn’t allowed to sell the ROP anymore and guess what, customers can still get interest frozen if they are in difficulty.

Being self-employed does make a difference – you can’t “claim on the ROP” because you have lost your job! they should have asked you if you were self-employed.

Phild says

Sara, I have actually found my original t&c’s from 2012 and it does not state “we add the interest we charge to the outstanding balance on your Account at the date of each statement. This means that you will generally pay interest on interest” anywhere on the paperwork.

Is it worth calling them to point this out or just sending a copy on to the Ombudsman ?

Sara (Debt Camel) says

OMG. I suggest you send it to the ombudsman as I think they should know about this – I suggest you are pretty frank and say that Vanquis appear to have lied to you in their response to your complaint and ask for some compensation for this as well. You can omit the word “appear” if you feel like it…

I would also like to see a copy – I have sent you an email.

Phild says

I’ve just received the transcript of my call and after listening to it nowhere does it state that I would be paying interest upon interest, that is now a phone call, my ROP terms and conditions and also the “credit cardt” terms and conditions that all fail to state the ROP is a purchase transaction and that I would be paying interest upon interest.

The term “this means that you will generally pay interest upon interest” is only ever stated once in the “credit card” terms and conditions which is under the section for CREDIT LIMITS AND INTEREST RATES and nowhere is the ROP mentioned.

I have passed all to the Ombudsman but have also spoken to Vanquis 3 times in the last few days as this has disgusted me as well as baffled me and my case has now been passed upstairs to a manager.

On a seperate note in the call the hard sell to try to get me to have the ID Fraud was amazing, not sure how many times I said no before he took it for an answer so what he would have been like if i’d said no to the ROP is something that would have been interesting to hear (which I would have done if it had been explained correctly)

Village Idiot says

Also if you are self employed aren’t you mean to pay at the lower rate….£1.19 per £100….because some features aren’t available to you?

Gerard says

Another incorrect statement from Vanquis is “and of course if you have no balance on your statement then you won’t be charged”…. If you had a balance but then paid it off to zero, e.g. a week before your payment due date, you would still be charged ROP fees, but during telephone calls they’re effectively saying that you won’t… On the FOS website, “Mr N” complained about this very fact to Vanquis in 2015, who rejected his claim. But the FOS upheld his complaint, saying that although Mr. N was sent written T&Cs that were accurate, the conversation during the telephone call would’ve lead to Mr. N being confused, and that he most probably wouldn’t have taken out the ROP if this was explained accurately on the phone.

I thought this may be worth mentioning Phild and for anyone else who is looking to head to the FOS with their complaint. Just another angle to work with.

Cath says

HI, I stumbled across this site when I received a random email from Vanquis stating how much ROP I had paid in 2017 and how much was expected to be paid in 2018. Stupidly I was unaware of ROP and would have accepted any terms and conditions just to have credit at that time however I don’t recall accepting it and it was not fully explained about the interest. Using the information on this site I emailed my complaint and asked for the ROP to be cancelled. Vanquis have cancelled the ROP and finally rejected my complaint due to it being older than 6 years and that I have been charged for the plan on a monthly basis. No other explanation. Can I please ask if it is worth going to the Ombudsman? I am at my limit with my Vanquis card even though I don’t use it and this is due to the ROP and interest each month. It is only after their email I was alerted to what I was actually paying and decided to investigate. Thanks.

Sara (Debt Camel) says

I suggest you send the case to the Ombudsman and ask them to look at it as you have only recently become aware that you could complain about this.

It will only take about 10 minutes to do this using the Ombudsman’s online form https://help.financial-ombudsman.org.uk/help so it’s worth a go!

Eve M says

Sara, I hope it’s okay for me to let others know how my case is progressing if they have a similar case with the Ombudsman. This is all new to me and I just hope I’m doing it correctly as I’m just trying to follow all the fantastic advice from yourself and others through this site.

Eve M says

Hi Cath

Last week I got rejected due to the ROP being added on in June 2010 even though I cancelled the ROP in Nov 2015 when I finally realised that was what was causing me to go overlimit every month and unable to get my balance to decrease despite paying the minimum payments requested every month by Vanquis.

It was November 2015 that I first became aware what the problem had been and it wasn’t until November 2017 that I realised I could complain about this. I have given this information to the Ombudsman and also forwarded copies of statements that I had from 2012 & 2013 showing that every single month the ROP and interest on it was making me go overlimit despite the fact that I was not using my card. I was naïve in not realising the problem for so long but Vanquis didn’t explain this would happen when the ROP was added or ever try to help me solve this or highlight that if I removed the ROP that my balance would start decreasing. Since cancelling the ROP I have had no problems with the account and no longer go overlimit.

Thanks to Sara (Debt Camel) and others with good advice on here, I have been encouraged to try to reclaim.

Cath says

Thank you and Sara for your replies. I will be sending all my information to the Ombudsman. I think the 6 year rule is very unfair, they have happily taken my money for the ROP and interest on it for 6 years and never mentioned the yearly costs before now. In those 6 years I have only received one email stating the costs of ROP and that was in November 2017 when I immediately complained to Vanquis. There was no mention of the phone call or me accepting the ROP in my rejection letter it just stated the account was over 6 years old. I am foolish for never checking it properly but then I never knew what I was looking for. I will update my post if I hear back. If you don’t mind me asking when you contacted the Ombudsman how did you word the section on the form asking what I want them to do for me? Do I just state that I am looking for their help in getting a refund of the ROP paid and the interest incurred? Many thanks to all on this feed for the fantastic advice given and received.

Eve M says

Hi Cath, I’m still learning and have just been following Sara’s advice given to others so I’m not sure I’m def doing things correctly. I didn’t send my complaint via the form I sent mine via e-mail to complaint.info@financial-ombudsman.org.uk with the subject heading “Vanquis Repayment Option Plan Complaint”. I sent the e-mail on Thurs 4th Jan and got a standard reply to say they would be in touch, it may take up to 10 days. I then received another e-mail this morning to say they will be looking carefully into everything I had sent them and that they will get back to me within the next four weeks to let me know how they can help. I asked them to please look into a complaint I have with Vanquis Bank regarding their ROP. I informed them that I would like them to help me getting a refund of the ROP and interest incurred and if it was not possible to remove the timebar then could they please consider a Plevin case. I mentioned and enclosed everything that I have written in the above post and told them of the financial stress this plan put me in but because I was naive I didn’t realise that was what was causing it (which is all true, it is only now I am learning more). I told them I’m awaiting copies of the calls from May 2015 and Nov 2015. I’m hoping the statements will let the FO see just how much this plan was adding to people’s debts. I feel it was even worse than PPI. Good luck and I’ll keep you updated on how I get on.

Cath says

I have contacted the FOS but have yet to hear anything from them. I used the link from above in the section about complaining. I did read on their site that they will acknowledge receipt of the form within 5 days which would be Friday. I also emailed Vanquis customer relations to say I was unhappy with their decision and had contacted FOS. I also requested a transcript of my call with themselves so I could look over it. I received a reply today stating they do not provide transcripts of calls. I have copied and pasted their email response below. Is this correct? I thought I could request this under the Data Protection Act?

I am sorry to hear that we have been unable to resolve the complaint to your satisfaction.

As you are in your rights to refer the complaint to the Financial Ombudsman we would await their contact and all relevant and requested information would be sent to them.

If they have chosen to the accept the complaint we would securely send recordings of relevant calls for them to review.

I regret that we do not provide transcripts of telephone calls.

Yours Sincerely

Christian

Customer Relations

Sara (Debt Camel) says

You can ask for a copy of the recording of the call. You eventually get sent a CD but it can take a long while.

Eve says

It was 6 days after my initial e-mail that I received my reply from the FOS Cath and in it they informed me they would be looking into everything I had sent them and would get back to me within 4 weeks.

I phoned Vanquis yesterday to ask when I would receive the copies of calls that I had requested. . The lady I spoke to informed me they were due to be dispatched yesterday and that I should receive them by Thurs/Friday. She said she wasn’t sure if both the phone calls were on the same CD or not. I’ll keep you updated when I have any progress.

Cath says

Great thank you, don’t know what I would do without the support on this site, it’s been invaluable. Hopefully they will look into my case too. I have emailed Vanquis back to request a copy of the recording of my call. Will keep you updated.

Cath says

I still haven’t heard back from FOS not sure if I should ring them or wait it out a little longer. I did hear back from Vanquis who originally said they do not provide transcripts of calls and are now saying that they don’t have a copy of the call. Surely this means they can’t prove if ROP was mis sold or not?

On another note my brother took out his Vanquis card at the same time as me (over 6 years ago and at the same address) and has been sent a cheque with no breakdown of payment. His debt was sold onto a debt company and his account is closed with Vanquis but the debt remains. I have asked him to post on here with his information.

Eve says

Hi Cath, Sara is the best to advise you of what to do but I can let you know that I have kept the FOS updated with any extra information I can find regarding my complaint and I can only comment that if it were me, I would let the FOS know about your brother’s payment if his ROP was the same time factor.

I couldn’t get a copy of the phone call from 2010 but I have since received copies of calls I requested from May and Nov 2015. I have found from these calls that I cancelled the ROP in May and then was persuaded into taking it back out. The May call actually cancelled the first plan and activated a second one. I ask in the first call what the Repayment Plan is and when asked in the second half of that call if I knew what any of the features were on the Plan, I say “no”. I honestly didn’t. In both the May and Nov calls the ROP is mentioned but there is no mention that there is interest on it, and in the Nov call I explain how I couldn’t keep it under limit and was in trouble because of it yet the guy still kept trying to talk me into it but I refused as by that time I had realised the ROP was what was causing me huge problems.

I’m not feeling hopeful due to Vanquis sticking to the timebars but I have sent every bit of information I have to the FOS investigator. Good luck with your complaint, I really hope it is successful for you.

Sarah says

Had my refund through from Vanquis. £1555 ex gratia payment. I didn’t realise they’d done it until I logged into my account. They waited until the day after the 8 week time limited but I had actively chased them for updates. When I got home I had a letter explaining the refund.

Refund of rop – £216.80

Interest – £1184.85

Charges – £96

Notional interest – £72.57

Withheld tax – (£14.51)

I used the template format from here and is well worth doing. It’s 5 minutes out of your time and a short wait.

Thank you again Sara and debt camel. Got a large refund from wonga and now this. Great start to the year :-)

Eve M says

Hi Sarah

Well done on your success. I hope you don’t mind me asking when you’re ROP was taken out as your interest payout is higher than those who’ve had ROP recently. I’m only wondering as my complaint is currently at the FO due to it having been taken out more than six years ago. I’ve noticed a few folk have had their complaints upheld outwith the 6 year limit but lots of us are being rejected by Vanquis for this reason. Again, well done on your success, it is great hearing of so many people getting their money back.

scott green says

Thank you to this website for opening my eyes to the rip off that’s ROP. I was struggling for months to pay down the debt owed on my credit card without realising the true cost of the ROP. Once I cancelled it I started to make a real difference.

Finally this morning I checked my account to discover I was reimbursed by £733 and my debt has now almost cleared. A big thank to the people who helped me on this site

Dean Unsworth says

Was this on the 56th day? I’m on day 55 now so praying something goes into my account tomorrow

Philippa says

Hi, mine went into my account on the 57th day (after 9pm). I assumed the same as you and when nothing changed in my account on the 56th day I thought that meant they had rejected my complaint! Good luck :)

Natalie says

Thank you so much to this thread I’ve just called today on Day 57 and was told my complaint has been upheld I’m receiving around £2030 and there’s already a letter in the post!

I’ll send a breakdown when I have more information.

Just to give people an idea I took out my card in sept 2012… paid it off in full in April 2016 and have had a 0 balance since then

I’m so happy thanks Sara!

Sara (Debt Camel) says

I bet you are happy! What a great start to the year.

Natalie says

Got my letter today they were unable to locate the call when ROP was added to my account in sept 2012 therefore there is no guarantee that the sale process was correctly followed so complaint has been upheld

Total amount £2030.86

ROP fees – £1208.59

Associated interest- £675.36

Notional Interest at 8% – £183.64

Withheld Tax Amount – £36.72

Thanks again

Sara (Debt Camel) says

Thanks for letting us know! Can I ask how long did you have the account for? Did you ever reduce your balance to low levels?

Natalie says

Yes I took it out sept 2012, was quite often at £3500 limit, paid it off twice in between for a few months and used it again back up to £3500 until April 2017 when I cleared it and haven’t used it since. So quite a big sum of money considering I’ve cleared it a few times!

Dean Unsworth says

I got a rejection letter yesterday and have requested a copy of the transcript, also just to check a few things Vanquis claim being self employed would not have affected my ROP yet I’ve heard otherwise, also they claim they sent my account T&C’s to me when I opened my account which include the ROP T&C’s, they claim these were sent by post on 12th May 2015 by post (not recorded delivery) and I have no recollection of receiving them, would this be useful to my claim?

Sara (Debt Camel) says

“Vanquis claim being self employed would not have affected my ROP” really? if you page back through the comments here you will find people being told what they had to provide if they wanted to claim on the ROP eg evidence they had lost their job.

You can deny receiving the T&Cs, but this is hard to prove.

See my recent comments to Helen above for other reasons to send your claim to the ombudsman. Don’t wait for the transcript, this can take a very long while.

Gerard says

I would definitely mention not receiving a Welcome Pack if you don’t recall getting one. Cases have gone to the Ombudsman and this reason was cited. Vanquis couldn’t prove it either, so they paid out. Nothing to lose by mentioning it. It seems to be an important aspect of the overall sale

Dean Unsworth says

I’ve just had another interesting call with Pauline who is dealing with my case (it took me over a week to get in touch with her, she admitted I rejected ROP 3 times in the 12 months leading up to me finally accepting and I’ve requested these transcripts too as I’m sure I requested they stop cold calling me for this on at least one of these occasions, also I thought I’d cancelled my ROP over a year ago but they have no record of this on their notes and they have not gone through all the transcripts as there has been over 30 phone calls made in total, she now has to “apply for time” to go through every single phone call from her line manager so we’ll see where I get with that

Gerard says

Hi Sara, Hi all

First of all, Sara, what a fantastic website this is. I too was sold ROP back in Jan 2013 on the back of some heavy pressure from their sales rep. All I did was phone up to activate my card. I said I don’t need it more than once. “Why not?” was his response. He didn’t explain anything about ROP whatsoever. I actually took Vanquis at their word when they said it was a credit repair card (lol) and my credit rating was atrocious, so thought I’d better opt in, as they may not activate my card.

Fast forward almost 5yrs, and my original starting balance of £250 is now £3500. I made the minimum payment and guess what, ended up £110 overlimit… I then checked and then finally realised how much the ROP was actually costing me. There and then I called Vanquis to cancel the ROP and I put a formal complaint in. That was on Nov 18th. 8wks is up tomorrow, so I thought I’d check my account tonight. I was overjoyed to see an exgratia payment for just under £3400, which clears my balance. I believe I’m due more, so will wait for the explanation letter.

Once again thankyou so much Sara for your efforts, and thanks to everyone who has contributed their experience, it has helped me immensely. If you’re waiting for a positive result, I hope you all get it. And if you haven’t put in a complaint yet, what you waiting for? Get your money back for the rip off that was ROP. May ROP now RIP!

Becky s says

Hi Sarah and everyone,

I’ve put a complaint in also this week, as in April last year, after having the card since 2012, i called vanquis to see if I could take a payment break/holiday or whatever it’s called as was struggling due to loosing hours at work. I was informed at that point that I had ROP on my account…. news to me as the only thing ever stated on my statements was ‘purchase interest’ not specifically ROP … but I didn’t fit the criteria so couldnt activate it. I asked what ROP was and it was explained that I had been paying around £20-30 per month due to my balance and actually the only benefit I would be entitled to was wavering, once per year, a late payment charge of £12!!! It was then suggested that if I was struggling then I needed to contact a debt management company. I immediately cancelled the ROP. Nothing about this had been explained to me and vanquis couldn’t even confirm the date it was applied to my account! It wasn’t until I received a random letter just after Christmas outlining that over the last twelve months I’ve paid £196 for ROP. funny thing is that amount only covers around four months as since the call in April when I cancelled it, I did indeed contact step change and am now in a plan which seemed the only way to get interest and account etc. Frozen with no offer of help from vanquis. Hopefully I get a decent response….. fingers crossed for everyone!!

Gerard says

There is a previous case on the FOS website where a customer complained to Vanquis that they had no knowledge of ROP being agreed for their account.. Vanquis rejected his complaint so he went to the Ombudsman. While the case was with the adjudicator, Vanquis buckled and made him a full offer, finally admitting that they could not find evidence that a Welcome Pack had been sent out to him, explaining the details of ROP.. Definitely worth mentioning in any complaint if you didn’t receive a Welcome Pack. And it just goes to show that sneaky tactics like applying ROP to an account without the consent of the customer does happen. All the best with your complaint Becky. If they can’t even tell you when ROP was added, it’s looking good for you!

Village Idiot says

Hi, just seen this website and thread after googling something about Vanquis.

I took out a card in Sept 2014, I’ll be honest, I have tended to max it out most of the time, now up to £4000. I had ROP until this time last year, then I got in touch to cancel it. I also remember getting the weird letter a few months ago telling me what it had cost me, I presumed it related to me cancelling it.

I can’t tell if this thread is only about people who took out the card before 2014…..someone like me who took it out after, can they just wait for the FCA to order Vanquis to refund me?

Alternatively is there any downside to making a complaint…we have other Provident products and in some ways a good relationship with the company could be useful to us in the future.

Also, is there any way I could mess this up and then regret not waiting for the FCA…for example I can’t remember how I said yes to the ROP, was it in a call? – I don’t even remember…so maybe they will have me bang to rights and I will regret not waiting?

Thanks for any help or advice offered!

Sara (Debt Camel) says

There is no downside to making a complaint. They won’t be able to call in your provident or Moneybarn loans if you do. No one needs a good relationship with Provident in future so much as they need a cash refund now! Nor is there any point in waiting – as you can see from the comments here a lot of people are getting refunds now.

It’s not a question of whether you said Yes to the ROP – so far only a couple of people are saying they actually said No. Everyone else getting refunds agrees they said yes but it was still mis-sold.

Two main reasons why it may have been mis-sold to you:

1) during the sales call they will not have explained that the ROP fee was treated as a purchase so you would be paying interest on it. That was stated in the T&C,s but not mentioning it in the sales call, when they told you what the charge for the ROP was, was misleading – if you had realised how much the interest on this added up to you would probably never have agreed to the ROP.

2) the phone call would not have mentioned the fact that if you were in financial trouble, Vanquis have to consider freezing interest on your debt anyway, For many people the interest freeze was the most important feature of the ROP and not to mention that interest may be frozen even if you don’t pay for it was misleading.

Kara says

The FOS investigator has advised me that he has decided that my complaint is within their jurisdiction and that he has informed Vanquis that they would like to investigate my concerns. The investigator doesn’t feel that the 3 year rule applies, despite Vanquis saying that the ROP was itemised on my monthly statements and thus I had reasonable awareness of it. I made it clear in my complaint to Vanquis that I was aware that I had the product, but I feel that it was mis-sold as the benefits were purported to be more useful than they actually are to my circumstances. If Vanquis don’t agree to the investigation the case will go to an ombudsman.

Sara (Debt Camel) says

You opened it in Jan 2011?

That is VERY good news. It sounds as though the FOS may be taking the sensible view that if you had the account open during the last 6 years you are within the 6 year timescale, so it doesn’t matter if you opened the account more than 6 years ago.

I am afraid it is likely that Vanquis will not agree so this has to go to an ombudsman – this decision could cost them a LOT of money.

Kara says

Yes, Jan ’11.

It says that as the same took place more than 6 years ago it was down to whether the 3 year rule needed to be applied or not. As there’s no reason why I could have been expected to have become aware about the mis-selling more than

3 years ago the investigator

is satisfied that it need not apply. Vanquis wrote to me about the ROP in October 2017 which prompted me to look into it.

They have 2 weeks to object.

Kara says

*sale not same.

Sara (Debt Camel) says

OK, let us know what happens!

Eve says

Hi Kara, I’m so glad they are going to investigate your complaint, I’ve still to get a decision on mine and my timescales for when it was added to my account are close to your timescale. I’ll keep everything crossed. I’m still awaiting copies of the calls I have requested. I’ll update when I have more news. Good luck.

Kara says

Thanks Eve. I didn’t ask for copies of the calls but I think they may have mentioned when I spoke to them that they don’t have the calls anymore due to it being over 6 years ago. I’m a bit concerned about the calls as I recall speaking to them twice – once to activate the card

at which point I think they pushed the ROP & another occasion when I didn’t necessarily give them my details so it might not be on my account but i made enquiries about the ROP as I think I was hesitant. I’m sure they said credit limit increases were more likely etc but I don’t know in which call this happened. I may be getting confused but I think that’s how it went. Hopefully the FOS will see how the product wasn’t of value to me and must therefore have been mis-sold. I hope you hear positive news soon too.

Robert says

I received a rejection letter from Vanquis today for two accounts held by me at different times. The first period was Aug 09 to Feb 13. They rejected because of six year rule or 3 years after I was supposed to realise.

The second period was Jan 15 to July 16. They listened to my call and we’re satisfied all procedures followed.

However the second paragraph was puzzling to me, can anyone explain what they mean?

“Further to listening to the call where you agreed to opt into the ROP. I have also reviewed your account to understand if the ROP has been maintained in the way we expect it to be.

Although you have not taken advantage of the other features I am unable to locate a time when you met the criteria for them to be highlighted or offered to you.” I really do not understand what they mean.

Sara (Debt Camel) says

Hi Robert,

My guess is they are looking for a time when you could have used one of the ROP features but didn’t, as perhaps it should have been offered to you. So it’s pretty irrelevant, doesn’t prove anything either way.

But anyway, I suggest you send your case to the Ombudsman. Today some said that an adjudicator at the Ombudsman has agreed they will look at a case that is over 6 years old.

Robert says

Thank you Sara, I will send it off to the FOS.

Donna Rawlinson says

Have had ROP on Vanquis card since 2012, heard about this site and rang to cancel ROP and lodged a complaint there and then.

Yesterday was day 56 so I called today to find my complaint had been upheld and I was to receive £3331.27. My limit was 3000 which I was almost up to. Advisor told me they woukd pay majority off my balance and the rest in a cheque. I am waiting for the letter with details of breakdown

It does seem its the luck of the draw who is successful and who is not!

Thanks to all the invaluable comments as I was able to state my case clearly using examples from the posts on rhis site.

Teddy says

Just to add to this. I Emailed the above template on Nov 20th.

Got letter confirming cancellation of ROP within 7 days – assume this is done the moment someone complains about ROP

Day 56 was on Jan 15th but had heard nothing nor was my account credited. Checked again at 9am on day 57 and had an ex gratia payment added to my account. Received letter on Jan 17th, albeit dated Jan 12th saying the following:

“I have located a call which took place on 12 June 2014 you were offered the ROP during this call. When reviewing our ROP calls we are looking to ensure the following points are met:

– you understood the plan

– the script was followed

– all additional information relating to the plan was correct and not misleading

– you accepted the plan as a feature of your account

– there was no pressure on you to accept the plan

I have now listened to the call taking all of the above points into account. Although you did accept the ROP as a feature of your account, I do not feel that all of these points were satisfied when discussing the plan with you.”

Refund total was £886.72:

– ROP fees: £426.72

– associated interest: £343.36

– charges: £108

– notional interest: £10.79

– withheld tax amount: £2.15

I did have a vague recollection of asking confirmation that it was only going to cost me like a pound a month and agreeing on that basis. So that might be why, but definitely worth an ask regardless!

Thanks for identifying this issue and sharing it!

paul martin says

hi I complained to the designated email specified on Dec 21st (got email next day and letter that it was in hand etc) so hopefully will find out in the coming weeks if successful. I was wondering though how would I work out (in the hope it is a successful complaint) what I would roughly be owed back….

I started with a £500 limit in oct 2015 was always near limit every month until they decided on increase to £1500 in November 2016 was then always at limit pretty much. They increased again in march 2017 to 2250 was at limit often, then again to £2900 in june again have always been pretty much at limit with ROP until cancelling in novmeber 2017

kind regards

paul

Alex says

Hi what if you don’t have the account number anymore how do you find this out ?

Many thanks

Alex

Sara (Debt Camel) says

So your account is closed? I suggest you put in a complaint giving the rough times the account was open (eg “from 2013 to 2015”) and as much details as possible so they can identify you – your full name, the address you were at then, your email address then (and say if either of these have changed), your date of birth.

Sharon M says

I have received my complaint outcome from Vanquis today.

They have rejected my claim as they said I agreed in a phone call to the plan – they have quoted what I allegedly said – and feel it was explained to me.

I now intend to request a recording of the call in the first place and will complain to the Financial Ombudsman. I honestly dont recall them pointing out that i would be charged interest on this plan or that it was treated as a purchase each month. I also don’t believe that it was explained that one of the main benefits of the plan – freezing interest – would always be considered even if I didn’t agree to the plan. Lastly I never received any welcome back which detailed the terms and conditions and in particular how the plan worked.

From reading this thread, complaints to Vanquis seem to be hit and miss so I do think it’s worth challenging Vanquis’ version of events.

Eve says

Hi, I was wondering if anyone could please help me. I today received the copies of my calls on disk. When trying to open the file containing the calls it is asking for a passphrase as the file is a PGP Self Decrypting Archive File. This is double dutch to me as I’m not very techy. Would it be Vanquis who should give me the passphrase or is that something I should know from my laptop?

Has anyone else had this problem? Any help would be gratefully received, thank you

Jay says

Award came through! Thank you so much, I would not have known where to start with my complaint if it hadn’t been for your very clear article. ROP since 2012, awarded £739 due to the points of good practice not being followed.

That will make a good difference in January!

Thank you

andrea says

Hi,

I opened account with Vanquis in Jan 2011, realised had been paying ROP in 2016, Phoned and complained and cancelled the ROP. Vanquis said I agreed on phone and they had listened to the call, said they would send a copy of the recording but I wasn’t due a refund of payments made.

Never received recording, just a letter with a summary of t&cs. Summary does not mention any charges/costs. Letter states I understood the plan, script was followed, additional info relating to plan was correct and not misleading, pricing clear and given correctly, I accepted as feature of account, no pressure on me to accept the plan.

Should I still request refund? Any help much appreciated.

Thank you :)

Sara (Debt Camel) says

yes definitely send this to the Ombudsman. It’s not a question of whether you said Yes to the ROP – so far only a couple of people are saying they actually said No. Everyone else getting refunds agrees they said yes but it was still mis-sold.

There are 2 main reasons why it may have been mis-sold to you:

– in the sales call they will not have explained that the ROP fee was treated as a purchase so you would be paying interest on it. It doesn’t matter if that was said in the T&Cs not mentioning it in the sales call, when they told you what the charge for the ROP was, was misleading – if you had realised how much the interest on the ROP added up to you would probably never have agreed to the ROP.

– the sales call would not have mentioned the fact that if you were in financial trouble, Vanquis have to consider freezing interest on your debt anyway. For many people the interest freeze was the most important feature of the ROP and not to mention that interest could be frozen even if you don’t pay for the ROP was misleading.

Eve says

Sara my complaint is similar to this one and I have been following all your great advice on here. Taken out in June 2010, cancelled in Nov 2015. Vanquis couldn’t give me the original call as it is more than 6 years ago but I received a copy of call from when I cancelled it. In the call I’m paying my account in full and cancelling the ROP. When asked why, I explain that it was putting me into a lot of trouble and kept putting me overlimit. The guy kept trying to push me into keeping the ROP. He just kept saying it is £1.29 for every £100 and that if I only had £100 balance then it would be £1.29 I was charged, no mention of interest. And even though I told him I had got into difficulty he didn’t mention they would consider freezing it anyway. He was only interested in pushing this product onto me.

The guy in the call also says I opted into the plan in May (2015). When I had queried this 2 weeks ago with Vanquis, because of a welcome letter I have from that date, they told me that my ROP had never been cancelled or re-started. Is it worth me querying these concerns with Vanquis today or letting my FOS investigator know this information? I’m naïve at how to pursue this kind of thing and would really appreciate any advice. Thank you so much.

Sara (Debt Camel) says

I think it’s best to send the whole case to the Ombudsman. Vanquis seem to be in a mess about it, it could be weeks more and they still may not give you a refund. Better to not waste time. The points that you have made are all important for your complaint.

Eve says

Many thanks Sara, your advice is very much appreciated. I’ll let my investigator know this additional information.

Sophie says

Hi,

Can you tell me whether the ROP appears on your transactions statement as ‘Repayment Option Plan’ or just ‘Purchase Interest’?

Thanks

Richard says

Hi Sophie,

it appears clearly as “Repayment Option Plan” completely separate to “purchase interest” or “cash interest”

cheers

Richard

andrea says

Many thanks for your advice, this site has been extremely helpful to me.

No, I most definitely would not have agreed to the ROP if they had explained the cost to me, my balance was never going down! I am concerned the Ombudsman would not review the case as I did not ask them to within 6 months and Vanquis say they will not have their permission to review it. Vanquis are saying they are looking into it but not starting a new complaint, just carrying on from the old one.

They will be sending me a copy of the call although, they have said this a couple of times previously.

Kara says

The FOS investigator has informed me that my ROP – taken out in January 2011 – that he was investigating after agreeing that it was within their jurisdiction was sold responsibly. The basis for this decision is an e-mail from Vanquis to me in 2013 setting out new terms and conditions, with particular reference to freezing the account. I didn’t complain within 3 years of that e-mail and hence the investigator is in agreement with Vanquis.

However, what I haven’t discussed with the investigator is the ‘interest on interest’ that ROP attracts and I’m wondering if I should mention this now to see if he can look at it on these grounds?

This is so frustrating!

Thanks.

Sara (Debt Camel) says

Yes, you should – always complain about as many things as possible!

Also what exactly does this 2013 email say? And what was the title of the email?

Kara says

Sara, thanks for your quick response. “The subject was ‘changes to your credit agreement’ and starts ‘We are making some changes to the terms and conditions for Repayment Option Plan’. Amongst other changes the email spoke about changes to the terms of the ‘payment holiday’ – i.e. what would ‘freeze the account’ in periods of financial difficulty…”

Should I ask to see the e-mail first or should I mention my concerns re the interest? The first reference that I can find with regards to the interest payable on the ROP is in a letter that they sent to me in November 2016, which I think was part of a mailout that they did to address awareness of the ROP? I still don’t feel that the forebearance issue has been considered…

Sara (Debt Camel) says

I suggest you ask to see a copy of the email AND your concern that the interest was not properly explained.

Kara says

Have done. Thanks.

Kara says

The investigator has sent me a copy of the e-mail that was sent to many Vanquis customers in 2013. It shows that I was made aware of the payment holiday situation and that it was not an insurance policy that covered payments (my complaint said that it was sold to me on this basis).

I have now asked the investigator to look into the interest situation as I don’t believe I was told about interest payable on the ROP until the letter that Vanquis sent out in 2016 reminding customers that they had ROP.

Kara says

The investigator has now told me that they can’t look into any of my complaint as Vanquis won’t agree to it and it is the sale that is time-barred. I feel I should escalate this to an ombudsman but I don’t know how to strengthen my case although I do feel that it’s a worthy one.

Sara (Debt Camel) says

You don’t need to strengthen your case, just ask for it to be looked it at by an Ombudsman.

Gary says

I have sent them 2 emails on 11th and 15th jan and they have not replied in any way! Should I have received a reply by now?

Kara says

Thanks Gary. I am going to mention that, as far as I know, a recording of the call has not been brought into the investigation yet.

Gary says

Just received letter stating to continue paying minimum payment whilst being investigated up to 56 days under FCA complaint rules! But I’ve cancelled ROP payments.

Phil says

If i were you Kara ask for every call you made to them and see how many times they tried to sell it to you. I’ve mentioned this in my complaint because they were trying to sell it to me when I activated my card with zero balance. Might be worth a try

Kara says

Thanks Phil, I might try that. I don’t think the calls have been listened to for my case; it seems the e-mail that they allegedly sent me 4 years ago has just stopped the complaint in its tracks for now. I have the opportunity to add comments to the file before it goes in the queue for an ombudsman so I’m going to mention phone calls and also the lack of explanation of interest upon interest.

Mrs Jaime roper says

I’m so glad I came across this! I decided to thoroughly check my statements and realised for the last few years I’ve been paying £45 a month on ROP! As I’ve been making the minimum payments for my credit card.

I rang up today and asked exactly what this debit was and got told. I told them to cancel, as I don’t and didn’t need it. He’s cancelled it as effective from today.

I’ve emailed them ,with the template you have left on here.

So time will tell. Thanks.

Gina Chandler says

Hi there, I’ve only just discovered this today too! Approx £45 per month going back, for at least over 2 years I’m guessing. I’ve been making slightly more than the minimum payments and couldn’t understand the fact that no matter how little I used my card, the balance was barely going down. Even though you cancelled it, did they mention refunding you?

Gary says

Just rang then and they cancelled my ROP on 17th and apparently sent a letter out! We shall see later ??? Good advice team ????????????

Eve says

Hi

How are others getting on with the FOS? I have received another e-mail today from the FOS Investigator to inform me that they have now asked Vanquis to send them the information for this complaint so they can look into it. Once they receive the info one of the adjudicators will begin to investigate and should be in touch within 12 weeks.

I had send the FOS copy statements, proof that I can contacted Stepchange 5 months before I cancelled the ROP due to the difficulty it put me in and also informed them of the information that was on the copy of the calls.

I’m not sure how co-operative Vanquis will be though due to their reason for objection was the timebar.

charlene says

Hi,

I got a refund of £685.25 from Vanquis

ROP fees – £206.64

Associated interest -£452.84

charges-£24.00

Notional interest-£2.21

Withheld Tax Amount -£0.44

is this an okay amount or should i ask for more?

Gerard says

Hi Charlene, nice to see another complaint upheld :)

With regards to your sum awarded, it’s difficult to tell. It all depends on what your credit limit was, how long you had your card for, whether your balance was regularly near your credit limit and a few other permutations… The associated interest figure could be about right based on your ROP figure assuming that’s correct, but again, there are a few factors involved. You could always ask Vanquis for a full breakdown of how they arrived at that sum if you feel you’re owed more.

Gaynor says

Hi Charlene

Well done on your vanquis payout , can I ask how long you waited on cheque ? I received letter dates 1/2 and they have agreed to refund £1919.25 = ROP Fees £1122.47 Interest £664.16 charges £60 notional interest rate 8%£90.77

Delighted and big thanks to this site for the help

Gerard says

Hello Gaynor

Personally I received my cheque eight days after first being notified of my refund. Seems as though the average wait is somewhere between 7-14days.