Morses Club went into administration in November 2023. Morses Club was the largest doorstep lender in the UK after Provident stopped lending in 2021. See Morses Club goes under for details about why it failed. UPDATE Latest news on the future very small payments People who had been promised refunds of hundreds or thousands of pounds in the Scheme will now only get a very small amount. The … [Read more...]

Administrations and Schemes of Arrangement

These articles look at what has happened to some of the larger lenders when they have failed, either going into Administration or a Scheme of Arrangement.

Amigo Scheme – final payment of 6.01% will be paid in April 2025

UPDATE March 2025 - final scheme payment announced Amigo has announced the last percentage payment will be 6.01%. Together with the first percentage payment, this takes the total up to 18.51%. The amount you will receive will be a bit less than half the previous percentage payment you received. (If you have received 2 payments, the one from Amigo Loans was an "in full" refund … [Read more...]

NSF’s scheme for Everyday Loans, George Banco & Trust Two – now completed

If you had an Everyday Loan or Evlo loan (their rebrand) that started after 31 March 2021, you can make an affordability complaint about this. This isn't through the Scheme discussed on this page, so you may get a larger refund. Use my "large loan template ". If your complaint is rejected, send it to the Financial Ombudsman (FOS) straight away, as that article explains. FOS will be able to … [Read more...]

SafetyNet & Tappily loans are written off

The administrators of Indigo Michael Limited have announced that all current SafetyNet Credit and Tappliy balances are being written off. And that any affordability complaints have to be made within the next few weeks. My previous article SafetyNet Credit goes into administration gives details about why the lender failed. And also why, unusually, it was allowed to carry on lending to existing … [Read more...]

Morses Club goes under – in administration – Scheme fails

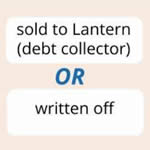

UPDATE - March 2024 - the administrators have sold some loans to Lantern and written off all the others. See Morses administration – what is happening to loans. That article is now the current Morses article and if you have any questions, please ask them in the comments there. Morses Club went into administration on 17 November 2023. Morses Club was the largest doorstep lender in the UK … [Read more...]

Buddy Loans administration – no money for cash refunds

UPDATE Advancis was dissolved in December 2023 Advancis Ltd, trading as Buddy Loans, went into administration on 7 September 2021. Buddy Loans was a small guarantor lender. Its loans were typical of the UK guarantor market - between £1,000 and £10,000 lent on a 1-5 year term at a 49.9% APR. The FCA describes these loans as "high cost". Buddy's slogan was: If you've got a good BUDDY, you … [Read more...]

Making a claim to the Morses Scheme [old article]

UPDATE - Morses Club went into administration on 17 November 2023. This scheme has now been terminated. See Morses Club goes under – in administration – Scheme fails for details and what customers should do. Morses sent out a batch of decisions on 6 July 2023. Many people have found these confusing - see the comments below this article. At one point the email says in a grey box: "Morses … [Read more...]

SafetyNet Credit goes into administration

UPDATE - in March 2024 the administrators announced they are no longer collecting any payments for the remaining loan balances. Also any more affordability complaints must made in the next few weeks. See SafetyNet & Tappily loans are written off for details. Indigo Michael Limited (IML) went into administration on 9 January 2023. It had two lending brands - SafetyNet Credit … [Read more...]

Provident Scheme is paying 4.2557p in the £

Quick overview Provident's Scheme of Arrangement is now in the final stages. The Scheme was proposed because Provident could not afford to carry on paying full refunds to customers winning affordability complaints. The Financial Ombudsman was upholding 75% of complaints against Provident. The FCA, Provident's regulator, said it did not approve of the Scheme. But as Provident has stopped … [Read more...]

Guarantor lender TFS Loans goes into administration

UPDATE: FCA fines TFS £880,000. On 10 June 2022, the FCA announced: TFS Loans Ltd (in administration) has been fined £811,900 by the Financial Conduct Authority (FCA) in relation to deficient affordability checks on 3,150 guarantors in its consumer credit business. The FCA has also imposed a requirement on TFS to redress the guarantors that were harmed by the firm not conducting appropriate … [Read more...]