There are three ways you may find out you have a County Court Judgement (CCJ): you get a letter from the court; the creditor tells you, asking for payment; or you see it on a credit report - possibly after you have been unexpectedly rejected for credit. A CCJ is a decision by a judge that you ("the defendant") should pay someone ("the claimant") an amount of money. In mid 2025, there … [Read more...]

CCJs

If a creditor takes you to court you will get a County Court Judgment (CCJ). This is not a criminal conviction, but it will badly damage your credit record and may lead to problems with bailiffs etc if you do not deal with it properly. In the first quarter of 2015, there were 209,000 CCJs - this is up over 20% on the number a year ago. It seems that debt collectors are going to court more often and for smaller amounts.

If a creditor takes you to court you will get a County Court Judgment (CCJ). This is not a criminal conviction, but it will badly damage your credit record and may lead to problems with bailiffs etc if you do not deal with it properly. In the first quarter of 2015, there were 209,000 CCJs - this is up over 20% on the number a year ago. It seems that debt collectors are going to court more often and for smaller amounts.

A creditor or debt collector may threaten to take you to court but they may just be bluffing. You need to know the facts, what to do if you do get court forms and what happens after you get a CCJ.

This page has all Debt Camel's posts about CCJs in date order. Also check out Worried about CCJ's - common questions and problems, which gives an overview with links to more detailed explanations.

I have a letter from a debt collector – what can they do?

If you get a letter saying that a debt has been sold to a debt collector you may be very worried. This article answers common questions about what has happened and how it will affect you: will the debt collection agency (DCA) be horrible to deal with? is it legal to do this? do you still have to pay the money? what about your credit record? what if you don't owe the money? I … [Read more...]

The debt collector wants to review my monthly payment

Mr A asks: I have had an arrangement with a debt collector for a number of years, paying £10 a month. They have sent a letter asking for a review. Do I have to do this? Can they do anything if I just continue with my current payments? You don't have to give these numbers but... It is a good idea to give revised details Everyone was happy when the arrangement was set up. Mr A was relieved … [Read more...]

“A mystery CCJ on my credit record – I know nothing about it”

A reader, Ms J asked about a CCJ that suddenly appeared on her credit report. "I check my credit record a couple of times a year and there is now a CCJ on there. It looks like it was added 2 months ago at an address I left ages ago, possibly 8 years. I don't even know if this is real or some sort of error. It's only a few hundred but I don't want to pay it if I don't have to and I don't know … [Read more...]

How to get a paid CCJ marked as Satisfied

A reader asked: In August 2019 a CCJ was registered against me for £211. I paid off the balance, but not within the month. I have bank statements to prove its been paid. On my credit report it shows the status as “active” even though I have paid it. I’ve contacted the debt collector multiple times but they say as it’s an old case it’s no longer on their system and they can’t help me. I don’t … [Read more...]

Court papers for a CCJ – FAQs about the N9A form & how much to offer to pay?

Mrs E asked: I have a catalogue debt of about £2000 from 2014. I was paying through a debt management company until March 2016 when I stopped. They are going to court for a CCJ. I don't know how to fill in the form with my expenses or which debts I should include. Mrs E's questions are about completing the N9A Admission form that was included with the Claim Form she has received. This is the … [Read more...]

Threats of CCJs and bailiffs – are debt collectors bluffing?

Have you received scary letters from a debt collector demanding payments? These letters may threaten defaults, county court judgments (CCJs) and bailiffs taking your possessions. Sometimes the letters are bluffing, but the number of CCJs is continuing to go up. In the first half of 2019, there were 586,765 CCJs and more than half were for less than £650. This article covers consumer debts … [Read more...]

What to do if you get a Claim Form

If you receive a Claim Form from a County Court through the post you need to respond rapidly. Ignoring court papers is a bad idea, even if you think the debt is too old or you are worried you can't pay the money. If you agree you owe the money you will get a County Court Judgment (CCJ) but if you complete the Claim Form papers properly you will be able to make monthly payments and won't … [Read more...]

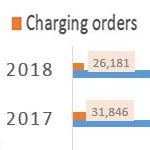

Are you worried about a charging order?

Can your house really be at risk if you get into difficulties repaying something like a credit card bill? You might think the answer is "no", but there are some very rare situations where this can happen. It helps to know the facts, so you can make good decisions about how to deal with your debts. To be able to sell your house a creditor has to: start by getting a County Court Judgment … [Read more...]

How to reply to a Letter Before Claim about a debt

A creditor has to send a Letter Before Claim before they take you to court for a debt in England, Wales and Northern Ireland. This letter may be headed something like Letter Before Action or Notice of Pending Legal Action or even Letter of Claim. You can tell if you have been sent one of these as there will be various attachments including one headed Reply Form. This letter is part of the … [Read more...]