Here are some recent questions from people worried about going bankrupt and possible Bankruptcy Restriction Orders (BROs): I gambled a lot but stopped over a year ago. I want to apply for bankruptcy, but will I get a bankruptcy restrictions order? I have credit card debts which I can't pay as I have had to stop work because of a disability. I went bankrupt in 2008 and had a DRO in 2018. Will I … [Read more...]

Articles about Bankruptcy

This page lists all Debt Camel's articles about Bankruptcy in date order.

This page lists all Debt Camel's articles about Bankruptcy in date order.

If you are thinking about going bankrupt, or are already bankrupt and have a problem, start by reading Debt Camel's Guide to Bankruptcy. That looks at how to decide if bankruptcy is right for you by providing you with the information you need. It also looks at the process of going bankrupt and what can happen when you are bankrupt. From "will I lose my house" to "how can I repair my credit record after bankruptcy" it covers all the common questions people have.

How to repair your credit record after bankruptcy

Bankruptcy badly affects your credit record for six years. This article looks at what should show on your credit record after you are discharged from bankruptcy. For almost everyone, discharge happens after a year. But if lenders don't record bankruptcy and your discharge correctly, they will continue to damage your credit record for longer than they should. Even if you … [Read more...]

What happens after discharge from bankruptcy?

This article looks in detail at what happens when you are discharged from bankruptcy: the practicalities, the implications for savings and gifts and the restrictions that end after discharge. Discharge is almost always after 12 months Almost everyone is discharged from bankruptcy automatically 12 months after the date they went bankrupt. During these 12 months when you are bankrupt, you have … [Read more...]

What happens to your possessions in bankruptcy?

The bankruptcy application says "It is very unlikely that items you need for your daily life (eg washing machine, sofa, refrigerator) will be sold". Here are a selection of questions here that people have asked about what may happen to the things they own if in bankrupty. I may not have mentioned your exact situation, but the answers here try explain how the Official Receiver makes … [Read more...]

Bankruptcy – should you get a new job? Or work overtime?

A couple of readers have asked recently about whether it's sensible to turn down a job or overtime when you are bankrupt. Two things matter in this sort of situation. First, have you been discharged from bankruptcy? Almost everyone is discharged from bankruptcy after a year. And secondly, do you have an Income Payments Agreement (IPA) set? In an IPA, you have to make monthly payments for … [Read more...]

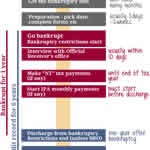

Bankruptcy timeline – what happens & when?

This bankruptcy timeline shows WHAT is likely to happen and WHEN if you go bankrupt in England, Wales or Northern Ireland. Some of the times are fixed - the bankruptcy marker is definitely going to drop off your credit file after six years. Others are less definite, but the indications in the timeline here should be right for a large majority of the people who go bankrupt. Take the decision … [Read more...]

Will my bankruptcy application be refused?

"Can I go bankrupt?" is a very common question. People worry that their bankruptcy application will be rejected because their debts aren't large enough. Or the Official Receiver will say they should repay the money they owe. Or that they don't meet the legal criteria. Or they have just borrowed some money. But less than 1% of bankruptcy applications are rejected by the Insolvency Service, … [Read more...]

Help with bankruptcy fees

A reader asked: I can't afford to go bankrupt! Is there anyone that can help with the fees? The bankruptcy fees in England and Wales are £680. This is made up of the £550 Official Receiver's fee and the £130 application fee. £680 is just stupidly high - most people go bankrupt because they are broke and they don't have hundreds of pounds in their bank account. The fees used to be reduced if … [Read more...]

Who should you tell before you go bankrupt? And afterwards?

It is normally a good idea to tell your creditors if you are in financial difficulties, not ignore them. So should you tell people you are planning on going bankrupt? And who do you have to tell afterwards? Before bankruptcy - you won’t gain from telling your creditors Few creditors will feel sorry for you and stop pestering you if you tell them you are going bankrupt. So you aren’t … [Read more...]

Is your pension safe if you go bankrupt?

If you expect to go bankrupt soon you may be worried about whether your pension will be safe. The Insolvency Service published a summary of its new guidance on pensions and bankruptcy in England and Wales in 2015 after the "Pension Freedom" changes that year made it possible for many people to take money out of their pension from age 55, even if they are still working. There was some legal … [Read more...]