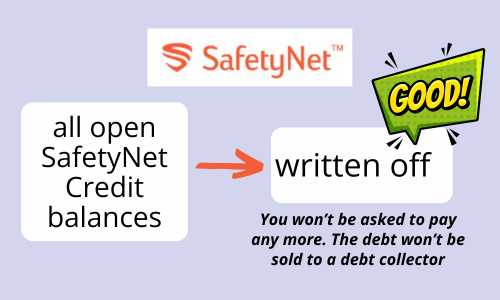

The administrators of Indigo Michael Limited have announced that all current SafetyNet Credit and Tappliy balances are being written off. And that any affordability complaints have to be made within the next few weeks.

The administrators of Indigo Michael Limited have announced that all current SafetyNet Credit and Tappliy balances are being written off. And that any affordability complaints have to be made within the next few weeks.

My previous article SafetyNet Credit goes into administration gives details about why the lender failed. And also why, unusually, it was allowed to carry on lending to existing customers for a few months in administration.

Loan write-offs

Their website said:

Collections for outstanding SafetyNet and Tappily loans will cease after 9 April 2024. For any customers who still have an outstanding balance at this point, this will be marked as partially settled on their credit file to reflect that the loan was not fully repaid.

Customers who still owe a balance are getting an email that also says:

- no scheduled payments will be attempted to be taken;

- any Standing Orders will bounce and customers should cancel them.

How many loans are affected?

It isn’t clear at the moment how many SafetyNet Credit and Tappily debts have been written off.

At the start of the administration in January 2023, there were 142,000 customers with open loans. 41,000 of these accounts were not in arrears and had borrowed in the previous 30 days.

As SafetyNet Credit was a form of “rolling credit”, many customers who were not actively trying to clear a balance would borrow each month. So a lot of the remaining 100,000 loans may have been in default. But some of these loans will now have been repaid.

Loans that had been sold to a debt collector before the administration in January 2023 are not affected.

Good news if your loan has been written off

The administrations have been using CRS to collect debt repayments. It is likely that all of the remaining loans that have been written off will have been defaulted or will have missed payments on their credit record.

In this situation, getting the remaining balance cleared and the debt marked as partially settled is normally very good news.

You should stop paying CRS if you have been. If you are in a DMP, tell the DMP firm to stop paying and remove the debt.

This debt is not going to be sold to a debt collector.

What about your credit record?

How long the debt stays on your credit record will depend on whether it has defaulted:

- if there is a default recorded on the debt on your credit record, then the record will drop off 6 years after the date of the default;

- if there is no default recorded, just missed payments / arrears, then the debt will drop off 6 years from the settlement date, which will be this month.

If you think there is an error on your credit report – perhaps some of the dates or amounts are wrong, perhaps a default should have been added but wasn’t, or was added when it should not have been – you have two options.

At the moment, you can email help@imladmin.co.uk and ask them to correct your credit record. People in other administrations have found getting administrators to listen and take a problem seriously is a difficult and frustrating procedure, but it may work.

Or you can wait 6-12 months, by which time the administrators will no longer be replying to any queries. At that point you can ask the Credit Reference Agencies to “suppress” the incorrect record so it isn’t visible to other lenders. See Correct credit records by “suppressing” them if the lender has disappeared for details on what to do. But at the moment – March 2024 – it is too early to do this.

Any affordability complaints must be made now

If you win an affordability complaint, you may be owed a refund. Customers who are owed refunds for unaffordable lending are treated as “unsecured creditors” by the administrators.

The latest administrators report (Feb 24) says that unsecured creditors may be paid 3-4p in the £, or possibly a bit more. So if you should have had a refund of £1,000, you may receive £30-40.

The administrators’ website says:

We will no longer be able to accept new complaints from 15 April 2024. Complaints submitted prior to this date will be assessed and customers advised of the outcome as usual.

So if you want to make a complaint, you should do this quickly. Email help@imladmin.co.uk with the subject AFFORDABILITY COMPLAINT. You don’t have to go into detail., just say how long you were borrowing and how it was hard to repay this.

Any questions?

Ask them in the comments below.

Karen says

Hi

I have recently set a payment plan up with CRS for safetynet due to my complaint being rejected and constant telephone calls to pay the amount I owed should I have set this up?

Sara (Debt Camel) says

You should cancel the payment plan now. CRS will probably be doing this anyway, but tell them you will not being paying.

John doe says

The message came direct from the overarchijg comoany Indigo Michael. Theyve already put late payment markers on since 2022. Happy with that as due to statute barrings and me disputing others I now have no defaults for the first time in 5+ years. No chance ill pay them anything, then. Glad that theyve effectively just given up, albeit hecause they know the firm was behaving badly.

Sara (Debt Camel) says

as the article above says, in 6-12 months you can probably get the late payments markers removed. They should have added a default after 6 months – so your records are currently wrong. this will harm you as late payment markers will stay on your record for longer than a default would have…

John Doe says

Thanks, Sarah. I understand. I understand and will try and get them removed in the next 12 months or so.

Frank Doe says

Hi,

I had a loan with safetynet back in Feb 2020, defaulted in May 2022 and sold to Lantern in Dec 2022.

How do I go about raising a complaint and claim against them, Hopefully get something back to reduce the debt or write it off?

Thanks

Sara (Debt Camel) says

This Lantern debt will not be affected by the write offs. You can submit a n affordability complaint to the administrators but you nee to do this very soon.

If you have this upheld, you may get a bit of cash back. But having the evidence that the loan has been found to be unaffordable may let you get Lantern to reduce the balance…

Richard Bagshaw says

Had a (multiple) loan with them but they didn’t uphold my complaint, I was in the process of a complaint to the ombudsman.

They then went into liquidation, I haven’t had any contact from them and the loan isn’t visible on my CRF and I’ve had no contact from collectors

Should I be expecting to hear something ?

Sara (Debt Camel) says

did you think you still owed a balance?

Richard Bagshaw says

I do and I’m sure of it.

It doesn’t show up on any of my credit report though. Which is really baffling, I’ve had no contact after they told me the company had gone into administration.

Sara (Debt Camel) says

which credit reports have you checked?

Richard Bagshaw says

I use ClearScore and credit karma hopefully that covers all the agencies.

I may put another complaint in anyway so it covers me hopefully that will take me over the statute barred period.

There were multiple loans and if they had checked my income at any point they would have realised they were taking my whole wage packet on payday. Forcing me to borrow to pay my bills. One of the reasons they gave for not upholding the complaint was that they had access to my bank and were able to see my income/outgoings if they did have access it would have been obvious I was struggling.

Sara (Debt Camel) says

that doesn’t cover Experian – I suggest you check their Statutory Credit report – it’s free – see https://debtcamel.co.uk/best-way-to-check-credit-score/

How long ago was your last borrowing from them?

It is pretty hard to make a complaint and not acknowledge the debt so restarting the 6 year statute barred time. But here that doesn’t matter (unless the loan was previously sold) as any debt is being written off.

NATALIE GALLACHER says

This email isn’t working is there another one?

Sara (Debt Camel) says

What email and what is your situation?

Mandy says

I have set up a payment plan with CRS they have my card details should I email them and advise to cancel as I am struggling to get through,

Do you have a template to complain about the affordability complaint at all Sara.

Thanks so much

Sara (Debt Camel) says

Debit card details?

You don’t need a template – just write a couple of sentences about how you could not get out of the cycle of reborrowing.

Jemma Ball says

Are those that paid in full able to claim any money back?

Sara (Debt Camel) says

yes, see the section in the article above on making affordability complaints -you have to do this fast.

Aneleh says

I’ve already made a complaint and they upheld it but nothing was done or paid as they claimed to have sold the loan to lantern etccc , are we now supposed to make a new complaint ? I was emailed details to a portal log in etc .. also do I added my redress amount on the interest I paid or calculate by how much I actually borrowed from them in total ? I was using SafetyNet for 5 years so that’s a lotttt of money to calculate

Sara (Debt Camel) says

The redress should have been the interest charged from the point it was decided to be unaffordable – that may not have been right at the start of the account.

They should be blue to tell you that number at the moment even though they do not yet know what the percentage cash payout rate will be.

When was the debt sold – before or after the start of he administration in January 2023?

Emily says

Hi,

My partner has a debt with them which was transferred to a DMP in 2018. Could she put a complaint in? And if so how? She still owes £455, and has been paying £1 a month. Thanks

Sara (Debt Camel) says

the debt was still with Safetynet credit? Not sold to a debt collector?

Emily says

Apologies is was 2020 and no it hasn’t been sold to a debt collector

Sara (Debt Camel) says

and have you had the email saying that it has been written off?

Emily says

This is what the email said:

We are writing to let you know that collections for outstanding SafetyNet and Tappily loans will cease after 9th April 2024. No scheduled payments will be attempted and any Standing Orders will bounce and should be cancelled. If you still have an outstanding balance at this point, this will be marked as partially settled on your credit file to reflect that you did not fully repay your loan..

You can find more information on what this means and how credit files work https://ico.org.uk/for-the-public/credit.

You will no longer be able to access your dashboard after this date so if you require a record of your transactions you should download this as soon as possible.

———————-

So does that mean the remainder will be written off? If so, shall I now contact Payplan so they can update the balance?

Thanks

Sara (Debt Camel) says

That is exactly what it means. Yes, tell Payplan.

Do you have other high cost lending in your DMP? You may be anblevto win affordability complaints about them.

Emily says

Thank you so much. Yes one with Lending stream and one with Uncle buck which were both transferred to CRS in 2018. Is there anything I can do for those? Thanks

Sara (Debt Camel) says

Lending Stream – how many times did you borrow from them before this last loan? How large was the last loan?

Yvonne Tranter says

Bit of advice please I had ongoing account with safety net which they apparently sold to lantern, when lantern contacted me I contacted administrator of safety net who then upheld the claim I originally submitted to safety net on 2 occasions but didn’t give me a redress figure I contacted them back and asked if my redress figure was a secret they responded by saying they were asked not to provide figures as it may confuse people (don’t know who asked them) upshot is my redress is nearly double what lantern says I owe them. Still waiting for lantern to come back to me but will I still owe lantern money

Sara (Debt Camel) says

well not on what you have said – if lantern say you do, ask for a statement of account for the loan.

Yvonne Tranter says

Thanks for your help

John doe says

CRS just text my phone for the hundredth time (i’ve always ignored them) advising me not to “lose my discount” and to preserve it by paying off the reduced balance. Funny thing is they’re asking for the full undiscounted balance anyway.

Could this just be an error? I wonder if it would actually accept payment. Even if an accident, surely dodgy or even illegal?

Sara (Debt Camel) says

you have been told the balance has been wiped?

John doe says

Yes, i had the email. I was the first to comment on it here, on the old thrrad.

Sara (Debt Camel) says

then ask CRS why you are being asked to pay this as you have been told it had been written off

john doe says

Looking again at the email. It says “Collections activity will cease on April 9th”. They are then, bizarrely attempting to collect on something they’ve already announced will be written off in 17 days. Perhaps there’s a minimum period between deciding to write-off and actually stopping collections, to ‘protect’ the DCA’s income…

Sara (Debt Camel) says

No there isn’t. Ask CRS.

Leanne says

I am currently in a DMP with PayPlan and have been since 2017.

Safetynet Credit is 1 of the creditors I pay each month.

Will my loan be written off? Or is it just accounts sold to CRS that are affected?

Sara (Debt Camel) says

have you received an email about this? If you haven’t, email help@imladmin.co.uk and ask if your loan has been written off.

Leanne says

No I haven’t received any emails since the beginning of 2023 to say it had went into administration.

I will email them to find out if my loan has been written off

Mark says

How does ‘partially settled’ on a credit report look compared to what I assume would be ‘satisfied’ if debts were paid back fully?

April is my last payment on my DMP (yey!)so debating borrowing the final payment from family so it can be paid before 9th April if it was to look better on my credit report over time?

Sara (Debt Camel) says

What is the default date?

This payment is being made to SNC?

Mark says

July 2022, so still a few years to go remaining on credit report, was just wondering how ‘partially settled’ is viewed compared to ‘satisfied’.

The debt is paid directly to them, and been told by DMP that I don’t have to pay them next month, but if it would benefit my credit report long term to pay off the remaining payment then I don’t mind that

Thanks in advance

RM says

Just an update to this, had an email today saying there is going to be a small pot available to pay out unsecured creditors, and will be paid at between 3-4p in the £. They plan to start these payments within 3 months. £125 for the £4k I was owed is a bit of a sickener, but better than nothing I guess.

Gareth says

Hi CRS first contacted my in October 2023 regarding a SafetyNetCredit debt? It is likely this debt would be written off? CRS are still pursuing but with increasing discounts on the sum. Should I reply?

Sara (Debt Camel) says

I suggest you reply saying that you understand the debt has been cleared.

Leanne says

I emailed to do an affordability complaint but as my account was opened in 2013 they said it wasn’t possible.

They said as I had been making regular payments through my DMP with PayPlan that my account will be marked as fully settled on my credit score rather than partially settled.

Not the best outcome but at least it’s off my credit report now

Julie says

I also made an affordability complaint. My first loan was in 2016 for £400 and my limit increased to £1,000 and the loans were cleared and taken out again every month. I couldn’t have managed without taking out the loan again each month yet my complain was declined. I didn’t miss payments as I paid and borrowed again. The balance of £400 was written off as settled in full. Can I appeal as I had the loans for years as I couldn’t afford not to take them. I was also on a debt management plan which finished a few years ago.

Sara (Debt Camel) says

You can ask the administrators if you can appeal, but the payout will be very low – only 3 or 4% – so you may decide not to bother

Julie says

Thank you Sara. Do they pay the 3/4% just on the interest? From 2016 to 2024 I dread to think how much it was.

Sara (Debt Camel) says

on the interest on the loans that are upheld.

Hotpocket says

CRS still spamming emails and texts chasing the debt. Hilariously they’re offering a “50% discount”, but only until April 8th. That’ll be because the balances are being written off on April 9th, then. Lowlifes.

Yeb De Jong says

That answered my question!

Thanks Hot pocket 😁

Yeb De Jong says

Hi Sarah,

I set up a payment plan with CRS but after reading the articles I cancelled it. However, today (06/04)

I had this letter from CRS. Any advice on how to respond. Thank you for all the advice.

Yeb

Discount Offer Available

We are writing to let you know that our client is now willing to offer a 50% discounted settlement against the balance due.

Should you wish to accept the offer to reduce your outstanding balance by 50%, our client is willing to update your credit file to show as fully satisfied.

Please ensure to log into the customer portal using your reference number in order to take advantage of this offer by 8th April 2024.

Discuss your settlement offer today by calling 01422324510 or log in online – mycrs.co.uk

Yours Sincerely,

CRS

Dean says

Hi Sarah,

I set up a payment plan with CRS but after reading the article about payments being written off by Tappily, cancelled it. CRS have since sent me an email with an offer of 50% discount but do I need to keep paying them or should I just stop? When I clicked to see the 50% discount, it wasn’t there anymore as I missed the deadline I think. Please advise on how to proceed best, thank you so much

Sara (Debt Camel) says

Ask CRS if the debt is being written off. If they say No, ask the administrators why not.

Joanne says

To everyone who are worried about CRS and their payments

I have just checked my CRS account and it said closed and amount to pay 0

My outstanding amount was £580

So really pleased this has now gone. Even though my credit file will say partially settled I’m really not fussed. So please don’t worry, they even asked if I’d like to pay 50% the other day and I messaged them saying I won’t be paying anymore as they are stopping collections from 9th April

Looked today and account is zero

Yt says

After submitting a claim to administration and having it upheld indigo Michael has now been removed from my credit file but still waiting for a response from lantern after advising them of upheld claim

DEBORAH LYON says

I had only a very small balance of 42 to pay on safety net and paid 20 as it emerged not to pay any more. I’m not in default at all and have just always paid every month.. Now I have had my credit report update which states I am in arrears with safety net even though we were told not to pay any more. My credit score has gone down as a result. What do I do?

Sara (Debt Camel) says

so you didn’t have a payment arrangement at all? You always made the standard payments?

Ben says

I was paying back the amount owed and had £328 left to pay. My account was never in default and I was making my payments on time each month. I’ve now had an email saying my account has been cleared and will show on my credit report as partially settled. How much will this likely to affect my score as I don’t see how this is fair when I was happily just paying of my loan and had no say in this?

Sara (Debt Camel) says

A partially settled marker doesn’t affect your credit score. Some lenders may take account of it but most will just be happy that you have one fewer debt to pay!

John Dong says

help@imladmin.co.uk have sent another email reiterating that the debts will be written off and that this “includes accounts transferred to CRS”. I take it as a soft way of stopping CRS still trying to collect on the debts (which they are doing) without calling them out directly.

Logging into CRS it states my balance is zero but debt still not written off as it appears on my credit report under Tappily.

Caroline says

RE: Safetynet

Hi can somebody help – I have been told by QDR Solicitors that I should be paying for this debt as it was sold to Lantern in 2020. Should I make the payment scheduled for May? I advised them that Safetynet debts had been written off – I assume Lantern Purchased the debt for pennies and want this amount paid in full!. This is their response:

Our Reference: 3663109

Client Reference: M5850482

Our Client: Lantern Debt Recovery Services Limited

Outstanding Balance: £475.20

Thank you for recent correspondence, the contents of which we have noted.

Whilst we appreciate the evidence supplied the Safety Net are no longer the legal owners of the debt. As of 27/09/2020 our clients purchased the above debt.

In light of the comments you have made, we have referred this matter to our client, and will return to you in due course with the statement of accounts and consumer credit agreement. The above account has been placed on hold during this time.

Should you wish to discuss this matter further, please contact us on the methods provided below:

Sara (Debt Camel) says

Safetynet Credit are only writing off the debts that they owned. As Lantern’s solicitors have pointed out, Lantern own your debt not Safetynet credit.

what is the rest of your financial situation like – do you have other debts with debt collectors? any arrears on bills? and debts you aren’t paying at all?

Have you had other expensive debts you may be able to win an affordability complaint about?

Caroline says

Hi Sara

Many thanks for your response. Yes I do have other debts which does include arrears on Utility bills/Council tax. I am in the Scheme for TFS Loans and awaiting an outcome (I have commented on this here). I am somewhat confused over the whole Amigo Loans scenario – I think I may have mentioned on here. I checked my credit file over a year ago and it showed “Amigo Paid and Closed” I was then contacted by Intrum and told to set up an arrangement which I did, I then received the scheme notification from Amigo saying I was included and that I should stop all payments which I did to Intrum over a year ago and have not heard anything. I checked the status of the scheme and it read “You have not yet received your FRL yet” so I am a little confused with it all. I have just put arrangement in place with my local Conuncil for unpaid Council Tax and am waiting to speak to my energy provider.

Sara (Debt Camel) says

is the TFS loan a current one? Because you should be able to get that reduced / cleared even if there is no money for refunds.

Caroline says

Hi Sara

Yes it was still live when they first went into administration. I was told not to pay anymore. I believe they have also removed a charge they put on my Guarantors house.

Thank you for your assistance.

Sara (Debt Camel) says

well that sounds as though will be upholding your TFS claim.

And probably your Amigo claim as well.

When those are sorted, it may be good to take debt advice on all your options, as the guarantors will have been removed. Insolvency or a debt management possibly. Talk to National Debtline on 0808 808 4000

Marianne says

Hi Sara, i received this email today. What does this mean?

“Please see below notice of the Administrators’ intention to declare a first and final dividend to unsecured creditors of the Company.

Please be advised that the Administrators intend to treat the debt due to you, being £1,000 or less, as proved for the purposes of paying the dividend. On this basis, your claim has been agreed at £ 194.26 .

The dividend on this claim will be paid to you electronically using the bank account details you previously supplied to the Company. If no bank details are held, payment will be sent to you by cheque to the address held on our files.”

Will they pay the total £194.26?

Sara (Debt Camel) says

I think you may only get a percentage of that.

hotpocket says

I emailed the administrator asking why, despite claims to the contrary, they haven’t updated credit files at all since March, let alone with “partially settled”. They responded:

“Please be advised, final customer credit reports are currently being reconciled for all customers and will be issued to the credit bureau soon. All customer credit reports will be provided at one time and not on an individual basis. Once provided to the bureau, this may take a couple of weeks to be reflected on customers credit files.”

I translate this as ‘total bullshit’ and don’t expect my credit file to be updated any time soon. I’ll wait until September or so and then request the record be suppressed.

Deborah Grant says

I’ve been told that since the company no longer exists nothing will change on our credit reports. My default was added in 2023 when it should have been added in 2019/2020. Are the administrators still around then?

I’m currently trying to get the CFA’s to suppress the information. How long once they said they will do it do they get round to it? Transunion said they’d do it on 28th May.

Sara (Debt Camel) says

I would expect this to be done in the next month.

Did the debt also show on Experian or Equifax reports?

Deborah Grant says

On all 3 and I’ve contacted them also, just waiting to hear from them.

Deborah Grant says

So my SafetyNet account got removed from my reports this month :)

RM says

Got my refund today from the administrators. £274 from a nearly 5k claim, not great but at least it’s all over.

Becky Laurie says

Can those who recieved a payment back from an upheld complaint claim back the tax paid on the interest?

Sara (Debt Camel) says

Yes, see https://debtcamel.co.uk/ppi-payday-refund-get-back-tax/

Becky says

Thank you.

Sent the form and got a bit more back. Not quite the £2k for all my refund but considering the tax deducted wasn’t much less than the actual amount I recieved from the Administrators I thought I would chance it. 😁

Richard Bagshaw says

I have been contacted by lantern, they have shown the original CCA for safety net.

I haven’t written to them further yet.

I understand they have bought the debt, I was reading step changes advice on the matter below

https://www.stepchange.org/debt-info/debt-collection/can-debts-be-sold-on.aspx

They appear to be saying that I still have exactly the same rights as if they didn’t own the debt.

Who is best to contact for advice on this

Sara (Debt Camel) says

They appear to be saying that I still have exactly the same rights as if they didn’t own the debt

I am not sure what you mean by that. Lantern can take you to court for a CCJ, if that is your concern. Or is there something else?

Richard Bagshaw says

Sara,

That’s isn’t my concern.

I’m a little confused by the advice that stepchange gives regarding debts that have been sold on.

I wanted to confirm whether there has been some kind of agreement with the courts/ombudsmen how the written off debts that have been sold on to lantern will be dealt with. I am trying to understand why the normal process does not apply.

Sara (Debt Camel) says

are you saying the administrators told you the debt had been written off?

Richard Bagshaw says

Yes,

That is correct. Would I be better to speak to the administrators before I write back to lantern.

Sara (Debt Camel) says

what date was the debt sold to Lantern?

Zanda says

Hello

I had loan with Tappliy .

But right now I can’t contact them numbers don’t work anymore.

How can I pay them back?

Sara (Debt Camel) says

You can’t. There is no way to repay this.

How does it show on your credit record?

Zanda says

That’s mean is been written off?

Is this will affect my credit score?

Sara (Debt Camel) says

What shows on your credit record?

Zanda says

That I don’t have any loans.

Sara (Debt Camel) says

what report are you looking at?

John Doe says

I had an account with SafetyNet in 2021, it went into arrears and was sold to Lantern. I was not informed that the debt was sold on and i moved house in 2022. In 2024 Lantern sent me a letter and an email informing me once again the debt was sold to them requesting that i make arrangements to pay the balance.

I wrote back to Lantern informing them of the situation with SafetyNet however i am aware that debts sold on are not affected. I did also raise with them that i believe i was mis-sold the credit product and was unable to clear the balance without borrowing again. What would be the best steps moving forward?

I have written back requesting the following.

1. A copy of the Notice of Assignment from SafetyNet Credit.

2. A copy of the Deed of Assignment, proving that you have the legal right to collect this debt.

3. Confirmation that this debt was assigned in accordance with FCA regulations.

4. A copy of the original credit agreement as per the Consumer Credit Act 1974

And informed that i do not acknowledge the debt until this has been provided. If they do provide this, the debt is 2 years away from becoming statute barred, would it be worth delaying until this date? Or would i be at high risk of a CCJ.

Sara (Debt Camel) says

If they can produce the CCA agreement, then my guess is you are at high risk of a CCJ unless you set up a payment arrangement.

Janet says

Hi Sara

I had a loan with Safety net over 5 years ago.

Recently I have received an email from lantern chasing funds for safety net credit.

I was going to call and pay the outstanding balance but now I have seen they have ceased trading, i believe this was cleared under indigo micheal but I cannot find it on my credit report. Where does this leave me? Do I still need to pay lantern?

Sara (Debt Camel) says

I suggest you ask Lantern to produce a statement of account for the alledged debt as you believe this was cleared many years ago.

Hannah says

Hello,

I have been paying lantern for my safety net debt since 2021, I am only just learning of complaints etc and just checking as this was sold to lantern the debt is still valid and I can’t get this wiped?

Sara (Debt Camel) says

I am afraid only debts with Safety net were written off. The administrators stopped accepting complaints more than a year ago.

how large is the remaining balance?

do you have other debts as well, defaulted or that you are paying normally?