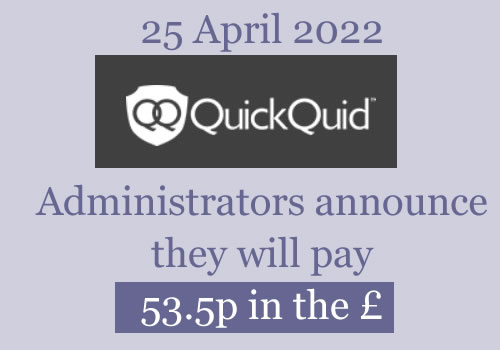

Payments – UPDATE – 25 April 2022

Administrators have started sending emails to everyone with an upheld claim telling them what they will be paid.

“The Joint Administrators are now in a position to declare a first and final dividend of 53.5p in the £”

The average claim value is c £1,700. Someone with that claim value will get a payout of about £910.

The payout details are given in the email:

- This will be paid over the next two weeks.

- If the administrators couldn’t validate your banking details, it will be sent by cheque. I don’t know how the administrators will “validate” your details.

- If you used a claims company, the money will be paid to them.

- Most people are not having any deduction for tax paid to HMRC, so there is no need to reclaim anything.

Credit records

The administrators may decide to :

– remove any negative marks on your credit record

– delete all loans that were upheld

– delete all your loans.

I don’t know what they have chosen to do – if people can check and report in the comments when they see a change, that would be great.

How much your credit score will change will depend on whether there were any negative marks. If you want to get a mortgage, you would like as many payday loans gone as possible, even if they were repaid on time and not hurting your credit score.

In a few months when the administrators no longer talk to the CRAs you can ask for any remaining loans to be “suppressed” so other lenders can’t see them. See https://debtcamel.co.uk/correct-credit-records-lender-administration/ but it is too soon to do that now.

QuickQuid went into administration in October 2019

CashEuroNet (CEU), which owns the QuickQuid, Pounds To Pocket and On Stride brands, stopped giving loans and went into administration on 25 October 2019.

I will be talking about QuickQuid (QQ) rather than CashEuroNet as it is the more familiar name. Everything here also applies to loans from Cashruronet’s other brands, Pounds To Pocket and On Stride.

Grant Thornton were appointed as Administrators. They set up a page about Redress Complaints – this is their term for people who have asked for a refund because they were given unaffordable loans.

Background to the QuickQuid Administration

QuickQuid was one of the “Big Three” payday lenders in Britain, starting out in 2007.

After Wonga and the Money Shop Group had all stopped lending and gone bust over the last fifteen months, QuickQuid was left as the largest UK payday lender.

QuickQuid had well over a million customers. When it went into administration there were c. 500,000 customers with outstanding loans.

Many of these customers had prolonged borrowing from QQ. They either rolling loans over or repaid one loan but were left so short of money that they had to borrow again.

These customers have good reasons to win an affordability complaint and get a refund of the interest they paid.

Affordability complaints started on a small scale in 2015 and increased in the next few years.

In 2018, complaints going to the Financial Ombudsman (FOS) jumped with the involvement of Claims Companies and QuickQuid became the most complained about firm to FOS, excluding PPI complaints.

For a long time QQ refused to refund interest on any loans taken more than 6 years before or where the loans were given in 2015 or afterwards. This resulted in a huge backlog of claims at the Financial Ombudsman, where QQ had made very poor offers to customers and then rejected an adjudicator decision.

In late July 2019, QQ agreed to accept several thousand FOS complaints it had previously rejected.

By accepting the FOS decisions on loans over 6 years, long chains of borrowing, and loans taken after 2015, the scale of QQ’s likely future liability for refunds will have become clear to the company.

After failing to persuade the FCA that a Scheme of Arrangement was appropriate, Enova, CEU’s large and profitable US parent, decided to close the UK business, blaming the UK regulatory environment.

How could the regulators let this happen?

This is an excellent question… Stella Creasy, MP called for an inquiry into the FCA over Wonga and QuickQuid.

What has happened in the administration

Customers with a valid claim for a refund are “unsecured creditors”. This includes:

- any refunds that were in progress after an amount was agreed or a Final Decision from a FOS Ombudsman (FOS);

- complaints that were underway at QQ or FOS when QQ went under;

- any new complaints sent to the Administrators.

All complaints at FOS legally had to stop and were been passed back to the Administrators. It isn’t possible to send any new complaints to FOS.

It is now too late to submit a Claim for unaffordable lending. The last date was 14 February 2021.

The administrators have given the following statistics about claims:

- 169,000 customers made claims for unaffordable lending;

- 78,000 claims were upheld by the administrators;

- the upheld claims had a total value of £136million, so an average of about £1,700 per claim.

Still owe a balance on a QuickQuid or On Stride loan?

More than 300,000 of the current loans were sold to Lantern in summer 2021. You should have been informed if your loan was sold.

The administrators have now stopped collecting any money from the remaining unsold loans.

This page is kept updated

The comments below this article are a good place to ask any questions. And you may be able to see where someone else has already found out the answer.

John says

Hi Sara,

Firstly, thank you for all the comments on here about the QQ, it is annoying how it is taking so long to get payment, i also was in need of this payment by the end of this month but i also used your templates for an other guarantor loan that i took out about 5 years ago and today had a final response which is being upheld and giving me and also my guarantor a nice payment back so thank you for all your help

Jo f says

I didn’t realise guarantor loans payed out to both. That’s great, congrats! X

Sara (Debt Camel) says

A guarantor should get a refund of any payments they made. If that wasn’t a lot, the borrower may also have paid some interest and would get a refund of that.

Patrick says

I don’t want to put a downer on this thread but it is really hard to believe that we will get 30% to 50% when all other companies are only paying 4% to 6% etc, I also received that email today from satsuma, redress was over 6k but il only receive between 250 and 450

Sara (Debt Camel) says

It’s not correct that all other companies paid 4-6%.

247 Moneybox paid about 10% last week.

Swift Sterling paid about 20%.

There is NO reason why the administrators would want to indicate a 30-50% range if they weren’t confident of the number being within that range. What on earth would they gain by doing this?

Tina M says

The reason the redress is 30/50% is a lot of people didn’t pursue it and didn’t respond to the 3rd and final reminder which was sent out to all us so the take up was a lot lower hence the reason why we are getting a much bigger payout

But we’ll worth the wait

Stressed says

I know we say it’s a waiting game and will be worth the wait but do we know what we are waiting for now? Back in Nov the key thing was HMRC which they have had since the beginning of March. I guess what I am hoping for is that there are no real obstacles now to stop them paying out in April? Thanks

Sara (Debt Camel) says

You are waiting for the announcement of the % to be paid and then for payment to start.

Clare says

But what is holding the announcement up?

Stressed says

Thanks Sara I understand that, I guess my question really was what is stopping them from making that announcement as from what I can see everything should be in line now. But worrying about what is going on behind the scenes doesn’t make it quicker I guess.

Sara (Debt Camel) says

There are a lot of things to be done in an administration. There is no reason to believe this is being held up by something.

The administrators said in November that the HMRC tax clearence was required prior to distribution. They did NOT say that that was the only thing preventing an immediate distribution. There may well be a series of minior points that need to be ticked off so the next one can be dealt with before the announcement.

Administrators do not give a running commentary on how things are going. These administrators have been more forthcoming than most by giving the 30-50p range.

I know this is frustrating but there is nothing anyone can do about it.

Some people seem to want to blame Grant Thornton. Perhaps it will make them feel better. But it won’t speed things up and there is no reason to think it is fair.

The real people to blame here are the regulators. They let QuickQuid and Onstride carry on handing out unaffordable loans. They let them get away with very poor complaint handling. They didnt insist the company held enough capital to pay customerd with complaints in full. they failed to set up a safety net for customers who are now losing out in administration.

When a PPI firm went under because it could not pay refunds, customers could get their full refund from the Financial Services Compensation Scheme. In 2014 the FCA sais it would be looking at extending that to cover lender administrations but it decided not to… blame the FCA!

Paul says

7 more working days to go yet I am still wondering why they are waiting until the last possible minute to finalise everything.

Is the person who does the final sign-off on an extended Easter holiday, or do they just want to gain the maximum interest on the money sitting in the account ? Is there a deliberate policy to wait until the last day ?

Anyway the Ray of light is that 247MoneyBox sent out the payment before the email stating the amount. No reason why the money couldn’t suddenly appear in accounts.

Sara (Debt Camel) says

The administrators do not pocket any interest earned. It goes onto the pot to be distributed.

Robert James says

There must be a cut of point on interest accrued otherwise you end up an intractable mathematical problem.

Sara (Debt Camel) says

The administrators just need to be able to work out a good estimate for what interest will have been paid at the point the money is paid out.

But the interest is actually tiny. It may even be zero.

This is not an issue – the administrators are NOT delaying anything to make money from the interestest

NATALIE says

The administrators or bosses are probably on annual leave, as is their right. Whether extended or not, still their right..

They have told us BY 30 April, so this could mean any day now or ON the 30 April. They can’t tell you anything else until there is something to tell.

Any day now, you could be getting a surprise amount in your bank account.. be patient. Anyone one of us could have been declined.

I for one, am enjoying the suspense.. I have made no plans for the payment, as it isn’t mine until its mine.

Mark H says

Thank you for this thread Sara. I have decided to stop reading it now as I am just going to wait until I receive my email. If that’s this month, next month or in a year’s time there’s nothing I can do to affect that. Basically, what will be will be and for anyone still thinking about phoning customer services to hear some breaking news just be patient.

DawnM says

Following an email to check bank details were correct:

At this time our Joint Administrators do expect to have payouts made by the 30th of April 2022.

We do apologise, there is no update in regards to individual claim payout amounts to provide just yet however, this information will be sent soon. Please continue to monitor your email.

Updates will be provided as they become available and will be forwarded to all creditors. We appreciate your patience.

Kay says

Hi Sara, thanks for all you are doing it’s so helpful. Quick question I wanted to approach lending stream regarding a refund but I’m worried they might then open some sort of account and this reflect on my credit report which I really can’t risk right now do you know if this is standard practice? Thanks

Sara (Debt Camel) says

No it’s isn’t. I have heard of it being done before.

Aaron says

Recently emailed loans 2 go with regards to a refund, got a response explaining they done everything in line with how it should be. The loan was for £1000 in 2019 and it worked out I was paying back £4000 over the loan period. The balance was £1392 when I emailed them and they have offered a goodwill gesture of setting the remainder of the balance. Do you think I should take this offer?

Sara (Debt Camel) says

how much have you paid them so far? CAn you add this up?

Aaron says

Roughly around £2500

Louise Stratford says

If you aren’t bothered about getting some of the interest refunded I would personally take it. I wanted the remainder of my balance written off as I cannot afford to pay the rest I have already paid double what I borrowed from them and they never upheld my complaint. It has been with Financial ombudsman since November 2021 and still isn’t solved yet so just waiting for a final decision. If you don’t want to go down that route I would just accept their offer.

Sara (Debt Camel) says

If you go to FOS and win the case (which may well be likely – L2G would not have suggested writing off the balance if they thought there was nothing wrong with giving your the loan!) the balance would be written off and you would get a cash refund of the interest you have paid – which is about £2500-1000=£1,500 at the moment.

It depends on your situation. If this is your only problem debt, then you may be happy just to get it cleared. If you have a lot of other problems then you may really need that extra £1,500 refund to sort out some of those.

You could also go back to l2G and say you think you have a strong case and would get a refund of £1500 if you go to the Ombudsman but in the interest of a speedy settlelent you would be happy to settle the case now if the agree to clear your balance and refund you half of the interest, £750. L2G are often prepered to negotiate. But if you want the full refudn you will have to go to FOS.

Dylan says

Just like to say thank you to this thread. Some one on here mentioned Lending Stream were dealing with redress complaints, and as I had used them in the past I decided to try my luck (i couldnt remember times and amounts). Anyway – online form completed 11th April, Final response received 14th April, refund of £750 then transferred same day after I signed to agree happy with settlement. Fantastic result – when I was only checking this thread re: QQ payout updates. Thanks Sara and Others

Julie says

Lending Stream were super quick with me also. £2500 was in my bank within seconds of me accepting the offer. The whole thing took 6 days

Dave B says

Did lensingstream go into liquidation?

Sara (Debt Camel) says

no they are very much in business, so you will get paid the full value of any upheld complaint, not a small percentage of it.

Jayne says

I completed online form on 14/4/22 and have heard nothing else since wonder why mines is taking so long!

Do you know approximately how they worked out what they owed you?

I’m now waiting 7 x days and heard nothing back don’t know if that’s good or bad

Sara (Debt Camel) says

well yours has been over Easter…

Jayne says

Yes sorry just so stressed at the moment… I’ve received an email in last few minutes with details of my access request but still yes mention of my affordability complaint! I’m currently going through a separation and any money at all would help me so much to towards a new home to rent

Kw says

Just had an email from a as I’d asked because I lost the one with the amounts… looks like no redress sue for me, but it does say remaining loan balance potentially due to cash euronet LLC. There is no outstanding balance.. ( this email was sent in 2020) do you think they will see that now and amend, or will it stay as it is?

Sara (Debt Camel) says

do you mean there was a balance but you have since cleared it? Or that it was incorrect and there wasn’t a balance?

Wojtek says

Did any1 had payout yet?

Sara (Debt Camel) says

No. As soon as they start paying there will be a LOT of comments here.

lorraine brown says

Yes just had my email 53.5p in the pound

Payment within 2 weeks

Sara (Debt Camel) says

not sure who you were replying to?

Melissa says

Is there anything you can do, Sara, with your position and website etc, to find out how realistic it is that we all get paid within the next ten days? I think to the likes of Martin Lewis who manages to speak to these big companies and find out what’s happening for the common man. We are all so desperate.

Sara (Debt Camel) says

No there isn’t.

I understand why people are worried. It is possible this will turn out all right. But it has never been sensible to assume you will be paid until the money lands in your bank account.

Cameron T says

Hi Sara, sometimes I think it’s forgotten that we have all been exploited by QQ. We should be getting our full refunds back. The administrators should be dealing with this sensitively given that most of us have money problems, I feel for some people on here being told not to take this refund for granted, thats joke advice if I’ve ever heard one. The whole situation is toxic. Our money was exploited from us, stolen actually and so it would be could if some people on here would kindly remembered that.

Sara (Debt Camel) says

Of course you were exploited by this payday lender and the regulators let you down badly by failing to protect you from this. I campaign for regulatory changes that will prevent this from happening in future and to provide a back up so that compensation for customers is paid in full. But that is not going to make a difference here.

The situation at the moment is that the only practical advice for people anxiously waiting is that they should not make plans based on the money being paid by any specific date.

Darren says

I rang up two days ago with a query as I will be paid by cheque rather than bank transfer. The lady said that the position is still that they anticipate sending out emails with the amounts to be paid and paying those amounts out by the end of April. She said for me, with a cheque coming in the post, to allow a few days past the end of the month but that’s understandable and acceptable to me. She said once the amounts were confirmed, payments would quickly follow. So I’m still very hopeful.

Adam says

Hi Sara, i’m guessing people are worried because some will be paying very high interest charges on money they owe out while the administrators take over two and a half years to make payments.

Sara (Debt Camel) says

I understand why people are worried. That doesn’t mean that the administrators have done anything wrong.

J says

Hi has anyone tried challenging dotdot? They just said that I provided the info to them and told them I could afford it. Not really sure what to go back k with. Any help would be much appreciated thanks

Sara (Debt Camel) says

how many loans did you have from them and how large were they?

J says

I only had one not very large but I was in debt with other lenders and had fallen back on other payments hence my loan with dot dot and not a high street lender

Sara (Debt Camel) says

ok, how large was “not very large”?

J says

£500- I was behind on other payments, house hold bills and in a relationship were I was being financially abused.

DD just replied saying I signed the docs so it’s due

Sara (Debt Camel) says

so £500 is a bit marginal.

Do you still owe money at the moment or was it paid off?

What is the rest of your finaces like at the moment?

Have you looked at claims to the other credit you had at that time/

It’s worth going back to DotDot, the question is what to say to them.

mark says

HI sara thank you for your info about raising a unafordable complaint with leanding stream of which i did on 20th april , the complaint was made by there web site. one question will this complaint effect my credit rateing thanks mark

Sara (Debt Camel) says

No, you credit rating is only affected if you stop paying them. Making a complaint saying it is unaffordable doesn’t affect your credit record.

Mark brooks says

Sara. thank you

J says

Hi,

I have just had an email from QQ who have confirmed that the administrators are still aiming to make payment by 30th and that it very much expected to be between £30-£50 per £100

Not an exact date but no reason to believe it won’t be by 30th as anticipated

Wojtek says

Hi i Got email from them, it was saying That :Please be advised that payments are to be paid by 30/04/2022.

Please note that we are currently awaiting dividend details. Once we have received this information we’ll be sure to follow up via email.

Tim says

Should I be worried I haven’t had email? Had you recently contacted them ?

Sue says

Wouldnt worry .. these emails sound like replies so guess they contacted the company to enquire. The next email we should receive en masse is the one informing individuals of their personal redress amount

Bw Sue

Jason says

I didn’t get an e-mail either :(

Lewis says

This is the first good news .I have had no response for ages last one was around Christmas 2years ago my accepted claim was £7816 . Fingers crossed nothing from administrators

sharon says

i still dont think this will happen because it states once redress amount known it may take a few weeks for payment (a few to me doesnt mean within 1wk) i think if nothing announced by today/tomorrow we wont get it by 30/4/2022

Dave Bareham says

I beg to differ but it’s just my opinion. I suspect once a dividend value has been agreed the payment will follow soon afterwards and as I suspect it will appear in peoples accounts pretty soon after them hitting the right buttons.

I do believe that they will make payment within the timescales they seem to have stuck to, I don’t have any background information to support this apart from the fact that the administrators have repeatedly said they will make payment by 30th of April.

Must as I think most of us would like the money ASAP we have to be patient.!

Tim says

Agree Dave I don’t see why there should be a delay as all messaging does say payments by the 30th April. Sharon where have you seen the line about ‘payments may take a few weeks’ as I have not seen this anywhere?

sharon says

Tim read the head line on this page

Anticipate is the word which is concerning

The payouts themselves maybe a few weeks after the amounts are announced. (nothing has even been announced)

We anticipate making payment of dividends to all creditors by 30 April 2022

Tim says

I think that was a line taken from the press realise about original March date . Not saying it will or won’t happen by 30th April but nothing has been reported by quickquid or GT that payments won’t be made by 30/4.

sharon says

this month has been a tight month for us all with bills going through the roof & trying to keep up on payments would be nice to get the money sooner rather than later as this has been going on to long & just needs to come to an end… just hopefully they are beavering away in the back ground & hit a button & in our account within a couple days of the announcement. just seems to be dragging out.

Paul says

Yes, I have an incredible sinking feeling that we won’t get the money by 30/4. Each banking day without news makes the feeling worse.

Lukasz says

Please stop assuming you get money this month. People waiting for money including me, but i dont excpect money this month and i dont hope for it. It will happen just dont excpect them this week or next.

Anita says

Anyone heard anything yet?

Sara (Debt Camel) says

no

Rob G says

I have some great news. Just got this reply by email from the administrator themselves :

Hi Robert

Thanks for your email.

I can confirm we are on schedule to complete the dividend process by the target date of 30-Apr-22.

All creditors will be issued with the Joint Administrators’ dividend declaration email shortly which will provide further information.

Kind regards

Mark Birbeck

For Chris Laverty

Joint Administrator

Mark Birbeck

Associate Director, Advisory

Grant Thornton UK LLP

KarenH says

Hi Rob,

Thank you for posting. Very reassuring for everyone.

VH says

That IS great news, thank you for sharing this.

Hayley says

Great news! Thanks for letting us know. Anyone else manically checking their emails now?! Haha

USHA DABYCHARUN says

I do hope that this time next week this will all be over, irrespective of how much we get. It has taken such a great toll and I can almost feel a weight on me every day as I check for more updates. Having an accepted claims value of £6885, even 30% would be highly welcomed. I had also received an email a few days ago (after sending them one) which said

‘At this time our Joint Administrators do expect to have payouts made by the 30th of April’, and it was the ‘ do expect’ that made me optimistic.

Fingers crossed!!

Andre says

Hey All,

Firstly thanks so much Sara, your site is great and the comments section has been so helpful with keeping up to date with everything also!

I decided to take it upon myself to speak with QQ after following everyone’s updates on here for a while, and while the advisor has pretty much said the same to me today – as everyone’s already been told on here – an interesting admission, was that she expects that the payments will follow “shortly” after the dividend emails are sent out! 👀

Now I’m no expert on tone, but the way she said this gave both the impression that she KNEW that to be fact, and also the entire convo gave the impression that we are very much on track and they haven’t been told otherwise.

I hope this helps to provide an update for everyone, and let’s hope the matter is resolved by the 30th!

Dave B says

Hi Andre – I genuinely think you are trying to be helpful BUT I don’t think trying to offer opinions based on the tone of what someone said is advisable (but I hope you are right!)

It will happen when the administrators are ready and not before.

Dave

Andre says

I mentioned the tone Dave, but it’s actually more about what she SAID. She said verbatim, that the email will come first and then the payment would follow shortly after.

Interestingly, right after I posted that on here – Rob posted separately after having communication from the Administrators directly – who basically said the exact same thing.

Now funnily enough, I actually called Matthew at Grant Thornton earlier – and while he didn’t want to say much, he just re-confirmed they are on schedule and the dividend will be paid out by “the end of April”.

I pressed about how soon beforehand we would receive the email also, and he said he “can’t be specific about dates” but that it would indeed be sent to us before the payment is made.

I hope that helps everyone – I’m in the same boat as you all.

John says

Is it me or is it just starting to feel really close?! If this doesn’t happen on time I am going to be so deflated.

I am checking this forum about 100 times a day!

paul says

I check 110 times a day!

Paul says

How long will the (now closed) QQ account remain on my credit report?

Will it be removed once administration is complete, or does it stay on for the foreseeable?

Sara (Debt Camel) says

did you make a claim this debt was unaffordable and if so, was it upheld?

Paul says

Yes, I have made a claim, majority of loans were accepted.

Sara (Debt Camel) says

Then we don’t know yet what the administrators will do. Sometimes they just remove negative marks. Sometimes they take the easy option and delete the unaffordable debts or indeed all the debts.

BT says

They deleted all my upheld loans so I assume this is what they will do

I specifically ask them to delete them during my appeal when they initially rejected my claim. They deleted them diligently shortly after.

Sharon says

this is the below i have got today

By way of update, I can confirm The Joint Administrators are aiming to make the dividend payment by 30 April 2022 (next week).

The Joint Administrators anticipate there to be a dividend to unsecured creditors in the range of 30p to 50p in the £.

“For example, if your accepted claim was for £100 you can expect to receive between £30 to £50 as your dividend payment.”

Hayley says

Thanks for this – sorry if this seems thick but, how do you work out the £30.00 answer, what is the theory???

Sara (Debt Camel) says

paying “30p in the £” is 30pence for every pound. So if you were owed £100, you would have 100 x 30pence = £30

Hayley Bradley says

ahhhh – great, thank you!

Paul says

Sara…

I’m sorry and I know you work so hard(Thank You).

Is 8% interest on top of your accepted claim value(quick quid) or already included?

Sara (Debt Camel) says

You will have been told a total redress amount that includes the 8% added

Nadine Wood says

Hey, whata the 8% interest about?

USHA DABYCHARUN says

For those not receiving these automatic emails (me included), I hope this does not affect anything..? Will we still receive the email with out final percentage?

Sara (Debt Camel) says

Yes

DawnM says

Sara – as with all on here thanks for your expertise on these matters. Maybe a thick question but in the reply to me QQ said individual claim amounts will be confirmed – does this simply mean based on your agreed claim you will get x or does it mean that individuals will have varying amounts because % will vary? In other words will the % be the same for all? Thanks again.

Sara (Debt Camel) says

everyone will get the same %

Mr and Mrs C says

yes – it has to be distributed evenly and fairly – so we all get the same %

Awsan Teina says

Once we all get our payment I think we should do a collection for Sara

Sara (Debt Camel) says

If anyone wants to make a donation, please send it to your local Citizens Advice – that would be lovely.

Awsan Teina says

Will do. You and their work is to be applauded.

Ian h says

Or a new keyboard – hers must be worn out from typing responses to our thousands of thoughts, questions, challenges and general nonsense :-)

Kelly says

Has anyone heard anything yet I am not getting any emails about this but my claim was accepted December 2020?

Sara (Debt Camel) says

no.

Read the comments here – you will see when people start to get told what will be paid and also when payments start being made.

paul says

Kelly,

I’m the same.

Don’t worry

We are on the list!

Gemma says

No email today.

It’s 25th on Monday and 30th being a Saturday means we have until Friday 29th for banking.

Realistically I’m not expecting this to be completed. I’m only thinking that, the majority of time, companies give 5-7working days for payments to clear. If this is likely the case, and I’m not saying it will be, we have already passed this threshold.

I’m anticipating an email thread that states they are extending due to ‘unforeseen circumstances’.

Just being realistic about the situation.

Sara (Debt Camel) says

companies give 5-7working days for payments to clear

this isn’t correct.

And anyway, the administrators have been talking about when they will pay you, not when the money will clear in your account.

Tina M says

The payment will be made by bacs u will probably find the payment will hit your account before the email that’s what generally happens

Dave B says

I would guess that most payments to bank accounts will fall in the limits for faster payments so would appear fairly quickly unless- for any reason – they are sending them from an account which doesn’t support FPS

Sara (Debt Camel) says

They will almost certainly be made by BACS for faster payments.

Paul Mc says

Next week should be interesting on here.

Awsan Teina says

Got 5 bags of popcorn 🍿 ready for it! 😆

Clare Johnson says

Hi Sara I’ve had a response from Vanquis regards irresponsible lending this is the outcome. Is this correct that because it was all that time ago they won’t do nothing nor will FOS?

The Ombudsman might not be able to consider your complaint if:

• What you’re complaining about happened more than six years ago, and

• You’re complaining more than three years after you realised (or should have realised) that there was a problem.

Sara (Debt Camel) says

You need to send this to FOS. Your case should come under the second of those points – you only found out recently, within the last three years, that Vanquis should have made sure your credit limit increases were affordable… before that you didn’t realise you had a cause to complain.

Clare says

Hi Sara I will send it to the FOS thank you for confirming what to do

neil says

Let us know how you get on Clare, I have a similar situation with vanquis. I made my first claim through FOS more than 3 years ago, but didn’t know credit cards were in scope so not sure whether there’s any point…

Sara (Debt Camel) says

have you sent your complaint to the Ombudsman Neil? Don’t wait for someone else to report back, it is one of the most frustrating things here when people come back after a year or so and say their second complaint has been rejected as they did not send their first complaint to the ombudsman straight away…

Emma says

Hi Clare, there is also something called forbearance. Even if your card was issued more than 6 years ago you can still go for forbearance. For example, maybe the bank should have done more to help you to manage your account, especially if they knew or should have known you were in trouble. You can also go for irresponsible lending if they increased your credit limit in the last 6 years if they shouldn’t have based in what they should have known from your account. We recently complained about a credit card and while irresponsible lending was ruled out due to the timeline, the adjudicator decided that we were actually complaining about forbearance because it was about the bank not stopping spending and interest when they knew I was in trouble. It’s with the ombudsman at the moment due to deadlock but forbearance is an interesting requirement for banks/lenders.

Clare says

Thanks Emma this is really helpful

Sara (Debt Camel) says

Interesting, let me know how this goes

Suzy says

There’s still plenty time to hear from QQ, The email they sent me confirming my claim amount was sent at 8.51pm, out of normal office hours. Still feeling hopeful we will hear something soon. No news is good news!

Lynzloo says

I haven’t heard anything by email since my claim was accepted

Paul says

Five day countdown begins Monday.. will they achieve their objetive of end of April? We shall see… going to be tense on here, for those in dire need of this cash… keep the faith everyone! Email Monday morning would be nice?

Paul M says

In my experience, if I’m sending out an email containing news that people don’t want to hear, I send it last thing on a Friday so I then have 2 clear days for the dust to settle and tempers to calm down. So in the case of QQ rebates, I’ve now switched to really hoping that we don’t get an email in the next hour or two! :)

Once we get to Monday morning we can get back to refreshing our inboxes full of hope and optimism once again!

Next week will bring the happy news we’ve been waiting for. Have a great weekend everyone – especially Sara for your endless patience and guidance.

Scott says

I thought this but also thought there is only 4 days left given the bank holiday so the amount of working days left is little, I don’t understand why they would lie as if they estimated it could have been later, they would have said may for example as I’m sure they would expect a lot of emails, hopefully they’re on track as they say so and everyone has good news next week fingers crossed

Nicola says

@Scott

There’s no bank holiday next week? Bank Holiday Monday is the week after – 2nd May

Nicola says

This is exactly what I was thinking! I’d send it right before I switch off my computer for the weekend!

Fingers crossed…

Wojtek says

Sara is there any chance to check with What companies i had loans?

Sara (Debt Camel) says

you can look at your credit records?

Wojtek says

I think sobie,there is any Sitę for this?

Sara (Debt Camel) says

see https://debtcamel.co.uk/best-way-to-check-credit-score/

Frank says

The disappointing thing from my point of view is they kept giving dates which they haven’t been able to keep to.

The likelihood is we wont get the payments before the 30th id imagine which is a shame for those in desperate need.

It is also a shame that we feel we cannot trust the administrators but such is life. Hoping we get an update soon with a positive outcome as they have had more than enough time now so fingers crossed, expect nothing and then we wont be disappointed i guess.

Jos says

I sent an email yesterday to confirm my bank details and i rcvd a response today.

“Please contact us at 0800 016 3250 if your details need to be updated”

They are still open to update bank records and does not say any deadline or last date to update any records. I don’t think this payout will start next week.

Dave B says

I disagree (just my opinion)

I do trust the administrators to fulfil their obligations and I am still optimistic they will delivery before the magic date of April 30th.

When you say “you don’t trust them” do you mean you think they are doing something dodgy or that you don’t think they are competent?

Scott says

Yeah I agree I got an email reply from them yesterday after I specifically asked if it’s on track and I was i formed “ In regards to your query, there is no further updates to provide at this time. We still on track to pay the dividend to all creditors by the 30 April 2022. The exact payout amounts are still to be determined and yet to be released. You will be contacted once payments are available” but you can never 100% believe it

Laura says

The “you will be contacted once payments are available” makes it sound like the email and payment will be very close together. Which is reassuring with days to go until the end of the month.

John says

I think that everything will go smoothly in next week.

Once the % decision is taken, the transactions and confirmation emails can be done in the same day.

I am sure they have the batch script ready for this. We are in 2022 and technology can finish such tasks in seconds.

No need to worry so much about it.

Richard says

Ive heard nothing since end of 2020 sent my claim figure which has disappeard, I then had email saying 1 or 2 of my loans were sold on and it dosent effect my claim and it will take 120days to resolve! Over a year later I ask for a copy of my claim in dec 2021, and still nothing! Only that its been esculated every time I ring them! That was 4 months ago! So now I dont even know what my claim amount is! It Was around £5500 before they esculated it. Apart from that I know nothing else about my claim or whats going on with it.

Ed says

I think there’s quite a few of us in that boat. I’ve emailed and called several times and have received the same “escalated” response every time although I’ve at least been assured that “my claim has been upheld”. I still don’t have a clue how much that might be so I’m just waiting now until the emails are sent out and all will be revealed. Or at least I hope so… the total lack of engagement so far – especially compared with lots of other people on here who seem to have got their enquiries resolved just like that – is still a bit of a concern to me at this late stage.

Jak says

I would have thought that had they not been on track they would have issued an update on their website before now as the previous delay was signposted very early in March. So not long now everyone hopefully but it will arrive when it arrives just keep calm and carry on 😂

Holly says

Like others, I’m not feeling overly hopeful for 30th! But let’s hope we’re wrong! I feel addicted looking at my emails! Lol.

Don’t get me wrong, I’m not desperate for the money. But I’m quite an impatient person!!! 🤞🏼We hear something over the weekend!

J says

I may be wrong but I imagine if they were not going to pay by next week there would be some sort of regulation where we would of been told by now given it is the week before?

Also they may be leaving it last minute to release figures as there seems to be so many of us waiting for payment that if they released anything too early they would be bombarded with emails and calls chasing payments?!

Sara (Debt Camel) says

I imagine if they were not going to pay by next week there would be some sort of regulation where we would of been told by now given it is the week before?

no. Administrators have to maximise the money available for distribution and distribute it fairly. They do not have to provide a running commentary on what they will or will not do next week.

Maria says

I’ve not had an email either. Is it worth contacting them? My claim was successful and the Accepted claim value is £7,756.53.

Not holding my breath though 🙄

Sara (Debt Camel) says

no, not worth contacting them

J says

It’s not about providing a running commentary but surely just like others they are governed and regulated so must advise creditors in a reasonable time frame if they are not going to paid on the date they were originally told.

Sorry Sara, don’t mean to sound like I am questioning your knowledge nor am I being disrespectful but may I ask how you know so much about this?

I just may ask someone who knows about this kind of thing on Monday

Thanks

Sara (Debt Camel) says

they are governed and regulated

Well after a fashion. There are laws and regulations. There are some timescales laid down and Insolvency Practitioners (IPs) have to go to court when they need extensions – this is routine and happens frequently. They also report at 6 monthly intervals on progress, which they are doing in this case.

But there is no independent complaints system such as the Financial Ombudsman where you could go with complaints and hope for compensation. The Insolvency Service started consulting in December on major changes to IP regulation including an independent complaints system. I will be surprised if anything much changes before 2024.

I am a debt adviser who does a lot of work on policy including high cost credit and insolvency. I would love to see a better system in place that was more friendly to customers of companies in administration. This includes not just these payday lenders but also the energy companies going bust having spent their customers money.

Danny carmody says

Well said Sara, thanks for all the good help you have given over the last years on the case, lets hope it all ends good next week, thanks again,

Sue says

Thank you Sara – Your knowledge has been so welcomed.

I am hopeful – yet have tried to not rely on on any payment and payment date – although it would be amazing and solve a fair few financial issues. When I first put my claim through thought I would be lucky to receive 3% so to be in a position where I may receive 30 – 50p would be amazing.

Just wanted to thank you for your ongoing support.

Noel mccready says

Have a nice day everyone we are on the last lap

Carl says

We only know if we are on the last lap if we can see the finishing line.

Caroline says

I like to be an optimist and I think that they would have made an update by now if they weren’t going to make the timescale of paying this month.

Andre says

*Sings* “It’s the finallll countdownnn”

We’re hopefully at the end game now peeps! Would love a start of week email to put our minds at rest, but it’s only 5 more days til the 30th…🙏🏾

Robert James says

I just want to be realistic if they are using BACS as payment, which requires three working days to process, and if payments are to be done in batches, there is only enough time to process two batches one on Monday and one on Tuesday to guarantee clearance by Friday. The rest of us will get it the following week after bank holiday.. Unless they have already set up the BACS payments up and have omitted to tell us the amounts, so they start clearing from tomorrow onwards.

Sara (Debt Camel) says

the administrators said

“We anticipate making payment of dividends to all creditors by 30 April 2022”.

That refers to them making a payment, not to it clearing in your account.

Once again I say, no-one should assume they will receive this money this month.

Timbo says

Payments of course could all be sent on the same day to everyone. I think it was Wonga that sent them in batches over a few weeks. All of the messaging suggests that they intend to make payments by 30th April ( so appreciate it could be Wednesday the week after before money is recieved.

Sara (Debt Camel) says

Most administrators send payments in batches.

Dave B says

I’ve not had any experience of being a creditor of an insolvent company but logic tells me that the amount owed to unsecured creditors will be calculated at the same time even if payments are staggered.

I’m guessing that because payments take the form of dividends based on the assets of the company at the time of accounts closure. So one customer who has an assessed value of 8k (example) would get double the value of someone with an assessed value of 4k.

So although most people reading this know what their assessed value is we only have a margin (30-50%) which the dividends are valued at.

I guess – having written all of that – we have to accept that only time will tell!

Sara (Debt Camel) says

All unsecured creditors will be paid the same pence in the £. Someone in a later batch, or who was in an earlier batch but the payment failed for somer eason, will get exactly the same percentage.

Graeme says

This is the same administrators as the Wonga administration.

Jim says

I think we can assume that the payments will be made in batches, especially as the same administrator is involved in both Wonga and QQ. They are likely to keep to the same process.

Wonga had 401k redress creditors, and the payments took about 4 weeks. QQ has only about 78k payments to make, so it is conceivable that the payments could be made in a week or less.

So end of April is still possible, but they are certainly going down to the wire.

Julie says

Lending stream paid me my money within minutes of me accepting their offer. It said it could take 2-5 days to hit my account but it was there straight away so this could be exactly the same. All bank accounts are different so it may land within minutes in a certain bank and days for another.

Craig says

Hi Julie.

I have just started my process with lending stream. May i ask how long it took them approximately from start to the payout?

Thanks

Julie says

Hi Craig it took a week in total. It was very quick indeed. I filled in the contact form on the Thursday evening and had £2500 in my bank account the following Thursday

Kim says

Hi. I did mine with lending stream a year or so back and they were really efficient and fast replying and offering a settlement as soon as I accepted the offer it was in my account within minutes.

Billy says

Hi Julie , please can you let me know how you complained and what you put in your complaint just so I can try and maximise my complaint with lending stream that I am starting as you got such a good result with them. Thanks Bill

Julie says

Hi Billy, I logged into my account and went onto the contact form. Out irresponsible lending complaint as the title and copied the template that Sara put up. I tweaked it slightly and I just said that it was obvious I was struggling to repay as I had to take out further loans with them to pay off the first loan but they carried on lending and allowing me to apply for more loans. They acknowledged it within minutes and the following week, they responded with the offer. Very quick. Good luck. I’m sure you will have a positive response.

Adam says

Hi Sara, there’s no denying you do a great job on here for which we are very grateful. However you do seem quite defensive towards any criticism of Grant Thornton. I presume you’ve not been waiting for a redress payment for the last two and a half years?

Sara (Debt Camel) says

I am a debt adviser and I am not awaiting any redress.

I have seen a lot of these administrations over the last few years so what I am saying is based on relevant experience.

I am not being defensive about Grant Thornton, I am pointing out that no one should expect their money to be in their account by any particular date.

Nic says

Thats massively unfair. At no point has she ever been defensive toward Grant Thornton and its way off to suggest that the fact she isnt due any redress would effect her advice. Sara set this website up to support people who have/are gaving debt issues. Shes passionate about making changes to regulations and create a fair system. She has a no nonsene approach and cant afford to become emotionally involved, she has to remain resilient to be able to provide practical advice.

Jax says

I agree; hugely unfair. I appreciate that emotions about this are running high and people are feeling let down by Quickquid; after all, 2 and a half years is a long time. This site has been a great source of advice and support for me and I appreciate the realism that Sara brings. The only people who have any control over redress payments being made are the administrators. Sara is simply saying not to expect payment by a particular date. I really hope that the administrators pay those waiting in line with the timescales they have stated.

J says

Surely we would know by now if they weren’t intending to make payment? As of yesterday I have still been told that they are on track to make payment to all creditors by 30th…fingers crossed!

Sara (Debt Camel) says

There is no reason to think they won’t, but it’s natural for people to be suspicious.

Tim says

To be fair they have said they expect payments to be made by 30th April so until the 30th there is no need to think otherwise. Thankfully it appears the % is likely to higher than some of the other redresses ( 30p-50p in the pound) so fingers crossed everyone!

Carl says

Regarding payments, comparing QQ to Wonga is surely irrelevant on account of how fewer payments QQ have to make?

Sara (Debt Camel) says

Nevertheless, there are a lot of payments to be made. Most administrators make them in batches.

Jos says

I phone them to update my bank details on friday but I been told to phone them on monday as they having technical issue to login. my concern is they are still open to update bank details. Is there any deadline to update these details before payout begin this week?. The money shop closed at least 4 or 8 weeks before payout. I badly need this money end of this month to pay my bills.

Sara (Debt Camel) says

You cannot rely on this money arriving this week, especially if you need to change your bank details.

If you have an immediate problem paying bills, read https://debtcamel.co.uk/bills-debts-help/ and talk to National Debtline on 0808 808 4000. Do this today, don’t wait until later in the week.

Danny carmody says

Hi Jos, sorry to here your new on your bills, customer services will stay open as to any money been paid out we all hope this week, as to any payout returns from banks, so the customer services will stay open for some weeks, just wait for the main email which will let you know the % and what you will get and date been paid out, all the best,

Satah says

I have only read this for a long time and thank Sara for the updates. I had an email yesterday from Grant Thornton as I’m sure other people have also.

This will soon be finished and I thank everyone for this final time.

Tommy says

Hello all,

Not one for commenting usually but some of these comments are really worrying me that people are possibly getting back into trouble/ cycles of debt around the impeding payouts. At no point have GT confirmed dates or amounts. Words such as “anticipate” and “intend” are NOT guarantees or confirmations on either payment dates or amounts. If you have borrowed further money based on X date/ X amount or a combination of both or even assigned this to pay bills then the is really risky. If this is the case then as Sara states please seek some advice. I know it’s hard at the moment but such behaviour isn’t going to help/ could make things worse.

Matt says

Yea I really think a lot of people here need to change their mindset and finances, first thing sit down and do a budget everything in and out. ( I use Petes from meaningful money https://meaningfulmoney.tv/budget-planner/ )

If you have more out than going in spend less or earn more if u can, but don’t pretend it’s OK to yourself. Get help I went to stepchange and sorted everything, now life is so much better and less stressful.

Noel mccready says

I was 25 grsnd in debt at one stage so went to xxxx who sorted me out. U have to pay them a.monthly fee but they will sort most if not all if ure creditors with affordable and lower payments. Debt free now but it can ce done took me 4 years though. Do not depend on this money from QQ

Sara (Debt Camel) says

go to National Debtline or StepChange – never go to firm that charges you

Sara (Debt Camel) says

Whilst everyone is waiting and worrying, here is something positive you can do.

Think about whether you can make any other affordability complaints! Make them now before a lender goes but so you may be repaid in full.

I have different template letters for different sorts of borrowing, it’s not just payday loans any more…

– for lending Stream, Moneyboat, Mt Lender and all the other payday lenders, use debtcamel.co.uk.

That template also works well for SafetyNet Credit and Drafty which are often easy to win as the lender could see your bank account!

– credit card or catalogue limit raised too high when you were only making minimum payments? See https://debtcamel.co.uk/refunds-catalogue-credit-card/. This applies to the bad credit lenders such as Vanquis, Aqua, Very, Littlewoods, JD Williams but also all the bank credit cards as well.

– have you been in your overdraft for all or almost all of the month for years? See https://debtcamel.co.uk/get-refund-overdraft/

– for large loans and car finance see https://debtcamel.co.uk/refunds-large-high-cost-loans/.

You can make a complaint whether you have repaid the credit, you are still paying it and have never missed a payment or if you have missed payments or it has defaulted.

LSC says

Thanks for this Sara, I did just that a month ago and I am now awaiting two claim assessments to come through.

Matt says

I claimed back £2600 from a Halifax overdraft which I was constantly in for 6 yrs. It took about 4 weeks from complaint to payout. I stressed in the complaint about payday loans and gambling transactions. They were very apologetic :)

Many thanks to Sara

Liam says

Hi Matt

I’m struggling to locate a direct email for Halifax re Overdraft, would you be kind enough to share pls?

Thanks

Sara (Debt Camel) says

if your account is still open it’s easiest to use the secure messaging via the app.

Lexy says

I made a claim to my bank also they have said they did nothing wrong so I have escalated it to the ombudsman. Like you I’ve been in a constant overdraft for many years not due to gambling but a debt cycle. My bank were also very apologetic but still said they were not in the wrong. Hoping to get some sort of compensation because they could see I wasn’t earning enough to get out of the overdraft.

Sean says

Hi Sara,

Thanks for this. If you have partially settled with the company, will that impact a complaint? I.e could they come back with requests for the full settlement?

Many thanks

Sara (Debt Camel) says

do you mean you have settled the credit you are complaining about with a partial settlement?

or you have an unrelated loan/card with them that you settled with a partial settlelemnt?

Nick says

Hi Sara if some of these lenders are being payed back via a DMP does this impact an ability to claim/complain at all?

Sara (Debt Camel) says

Being in a DMP is a very good place to make these complaints as it means you are in a safe financial place and can wait for them to go through at the Ombudsman and get a proper refund

Andy says

Sara

Is there a time limit? I went on a StepChange DMP in 2015, £45k in debt at the time. Its paid off now but can I still go after firms like Virgin CC etc even though I ended up paying it back via a DMP. I’ve had refunds from Barclaycard/ Barclays over the past few years for affordability even though I never complained(and quite good amounts), but I had numerous cards/loans, some with limits of £10k+, often with limits raised automatically. I’d never thought of claiming as I very much blame myself for getting in debt, but looking back so much of my woes came from big limit increases that I just fell in to the trap of using. I was earning quite well but I’d still been lent more unsecured credit than I earned in a year, and that was before tax and living costs.

Thanks for all the advice, I’ve found it so useful to help me to realise that although I got myself in this position and I have to accept that mistake, none of these companies did anything much to stop me digging that hole.

Sara (Debt Camel) says

April 2007 is as far back as you can go.

Many lenders will automatically reject complaints about things that happened over 6 years ago, but you can send this to the Ombudsman who can accept complaints if you have only found in the last three years that you have a cause to complaint. So for you, obviously you knew in 2015 that you were in a big financial mess, but at that point you probably didn’t know that a lender should have checked a credit increase was affordable. As you said, you blamed yourself. But you have now found out what the lender should have done when you were finding out about your QuickQuid redress this year.

Andy says

Thankyou, so probably worth a try but don’t get my hopes up. Much appreciated.

Sara (Debt Camel) says

Dont be fobbed off by a rejection form lender – send striaght to the Ombudsman.

neil says

You’ve inspire me to go ahead and stick ones in for vanquis and my bank account which I remember going into the branch and trying to get a loan to get out of payday loan hell and them giving me an overdraft instead which was about 1.5 times my wage before paying bills. I will report back if I get any luck. Thanks again!

Sara (Debt Camel) says

good luck – it’s best to “report back” on the credit card page for Vanquis and the overdraft page for your bank.

Kelvin says

Hi Sara, just looking through my old pay day letters etc and was wondering does Lending Stream come up as Lending Stream on bank statements? Regards.

Sara (Debt Camel) says

it may show as Gain Credit

kelvin says

Thanks Sara x

Mark H says

Against my better judgment I called Customer Support this morning and was told that payment of the claims are very much on track to be completed by 30/04/2022. The lady I spoke to said that we’d receive emails around the same time as the payments are made. I work in accounts and we usually make payments by BACS and send a letter/email on the day that the payment is processed. They usually take 2 working days to clear.

chris says

Thank you for this Mark really nice to have some reassuring clarity

Beth Hughes says

Fingers crossed!!!

sharon says

so we should know something by Wednesday then really at the 30/4/2022 is a saturday so we should get a payment by friday really.

just cant wait for this to be over.

Sara (Debt Camel) says

the administrators said:

“We anticipate making payment of dividends to all creditors by 30 April 2022”

Anticipating is not a promise, it is what they expect to happen. And they are talking about making payments, that is them sending the payments, not saying it will clear into your account this month.

it would be good if the money does arrive into your account this week but please do not talk yourself into think the administrators have said this will happen. They haven’t.

USHA DABYCHARUN says

I am so hoping that this will be the case! Though I am not (completely!) dependent on any money coming in, I really wish this to be over and to move on. The impact this is having on me and of course, so many others is so big! I will be absolutely gutted if anything else happens! Fingers and everything else crossed!!!

J says

Email from casheuronet- still on track for having all creditors paid out by 30th and emails will only be sent prior to payment

Benn says

Been following this conversation for the past couple of weeks regarding payment for QQ redress & im patiently waiting for “the email” aswel like many others, I really hope this comes to a conclusion this week as it’s been going on for too long now, my feeling for the widely anticipated news is that it will go right to the wire and people will start receiving news on Friday with payments following next week, fingers crossed this draws to an end for everyone concerned.