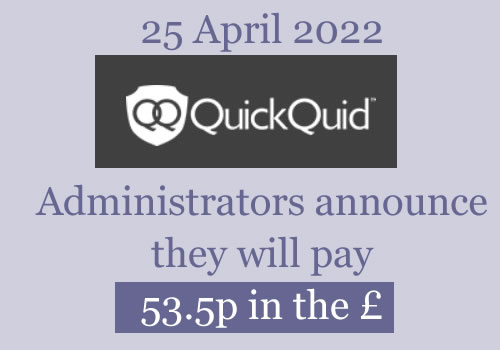

Payments – UPDATE – 25 April 2022

Administrators have started sending emails to everyone with an upheld claim telling them what they will be paid.

“The Joint Administrators are now in a position to declare a first and final dividend of 53.5p in the £”

The average claim value is c £1,700. Someone with that claim value will get a payout of about £910.

The payout details are given in the email:

- This will be paid over the next two weeks.

- If the administrators couldn’t validate your banking details, it will be sent by cheque. I don’t know how the administrators will “validate” your details.

- If you used a claims company, the money will be paid to them.

- Most people are not having any deduction for tax paid to HMRC, so there is no need to reclaim anything.

Credit records

The administrators may decide to :

– remove any negative marks on your credit record

– delete all loans that were upheld

– delete all your loans.

I don’t know what they have chosen to do – if people can check and report in the comments when they see a change, that would be great.

How much your credit score will change will depend on whether there were any negative marks. If you want to get a mortgage, you would like as many payday loans gone as possible, even if they were repaid on time and not hurting your credit score.

In a few months when the administrators no longer talk to the CRAs you can ask for any remaining loans to be “suppressed” so other lenders can’t see them. See https://debtcamel.co.uk/correct-credit-records-lender-administration/ but it is too soon to do that now.

QuickQuid went into administration in October 2019

CashEuroNet (CEU), which owns the QuickQuid, Pounds To Pocket and On Stride brands, stopped giving loans and went into administration on 25 October 2019.

I will be talking about QuickQuid (QQ) rather than CashEuroNet as it is the more familiar name. Everything here also applies to loans from Cashruronet’s other brands, Pounds To Pocket and On Stride.

Grant Thornton were appointed as Administrators. They set up a page about Redress Complaints – this is their term for people who have asked for a refund because they were given unaffordable loans.

Background to the QuickQuid Administration

QuickQuid was one of the “Big Three” payday lenders in Britain, starting out in 2007.

After Wonga and the Money Shop Group had all stopped lending and gone bust over the last fifteen months, QuickQuid was left as the largest UK payday lender.

QuickQuid had well over a million customers. When it went into administration there were c. 500,000 customers with outstanding loans.

Many of these customers had prolonged borrowing from QQ. They either rolling loans over or repaid one loan but were left so short of money that they had to borrow again.

These customers have good reasons to win an affordability complaint and get a refund of the interest they paid.

Affordability complaints started on a small scale in 2015 and increased in the next few years.

In 2018, complaints going to the Financial Ombudsman (FOS) jumped with the involvement of Claims Companies and QuickQuid became the most complained about firm to FOS, excluding PPI complaints.

For a long time QQ refused to refund interest on any loans taken more than 6 years before or where the loans were given in 2015 or afterwards. This resulted in a huge backlog of claims at the Financial Ombudsman, where QQ had made very poor offers to customers and then rejected an adjudicator decision.

In late July 2019, QQ agreed to accept several thousand FOS complaints it had previously rejected.

By accepting the FOS decisions on loans over 6 years, long chains of borrowing, and loans taken after 2015, the scale of QQ’s likely future liability for refunds will have become clear to the company.

After failing to persuade the FCA that a Scheme of Arrangement was appropriate, Enova, CEU’s large and profitable US parent, decided to close the UK business, blaming the UK regulatory environment.

How could the regulators let this happen?

This is an excellent question… Stella Creasy, MP called for an inquiry into the FCA over Wonga and QuickQuid.

What has happened in the administration

Customers with a valid claim for a refund are “unsecured creditors”. This includes:

- any refunds that were in progress after an amount was agreed or a Final Decision from a FOS Ombudsman (FOS);

- complaints that were underway at QQ or FOS when QQ went under;

- any new complaints sent to the Administrators.

All complaints at FOS legally had to stop and were been passed back to the Administrators. It isn’t possible to send any new complaints to FOS.

It is now too late to submit a Claim for unaffordable lending. The last date was 14 February 2021.

The administrators have given the following statistics about claims:

- 169,000 customers made claims for unaffordable lending;

- 78,000 claims were upheld by the administrators;

- the upheld claims had a total value of £136million, so an average of about £1,700 per claim.

Still owe a balance on a QuickQuid or On Stride loan?

More than 300,000 of the current loans were sold to Lantern in summer 2021. You should have been informed if your loan was sold.

The administrators have now stopped collecting any money from the remaining unsold loans.

This page is kept updated

The comments below this article are a good place to ask any questions. And you may be able to see where someone else has already found out the answer.

T hook says

Tried to claim against mr lender in 2018 and the replied with below

We regret that you are unhappy with our outcome however we feel it is important you are aware that the investigation into your complaint was full and thorough and we have detailed in our final response to your complaint how it was that we came to our decision, on this occasion there will be no further offer.

We do not consider your loans to be excessive borrowing or a sign of financial difficulty, with every new application made checks and assessments were reconducted to confirm each loan would be affordable and responsible. Mr Lender also have certain triggers in place to assess a consumer’s reliance on short term credit, which includes reviewing the number of loans that have been advanced and the period of time in which they were issued.

As a consumer it is your decision on how you proceed with your complaint however if there is any further information you require, please do not hesitate to contact us.

Can I still claim against them or is it too late now?

I have 5k redress from quick quid around the same time and a few other loans from the same period so definitely have a valid claim against mr lender

Thanks

Sara (Debt Camel) says

did Mr lender tell you you had the right to take the complaint to the Ombudsman?

T hook says

No just it was up to me how I proceed

It’s only 4 loans with them though over 2014/2015 so maybe not worth it

Regards

Sara (Debt Camel) says

If Mr Lender did not tell you you had the right to go to the ombudsman, you can still send your complaint there now.

How large were these loans?

T hook says

Please see below

Regards

T

Sara (Debt Camel) says

I am sorry but I deleted the numbers as there was no clue about what they meant. What you see should be legible as it is better formatted.

For each of the 4 loans – how much did you borrow? How much did you repay?

T hook says

Loan 1 £450 payed £770

Loan 2 £550 £980 paid

Loan 3 £639 £1000 paid

Loan 4 £390 £490 paid

All over 2014/15

Sara (Debt Camel) says

I think that is worth a complaint. I suggest you go back to mr Lender, explain that you would like them to look at this complaint again, that they never told you you had the right to send it to the ombudsman and unless they offer you a refund, you will now send it to FOS.

T says

Hi,

I’m wanting advice on my quickquid redress claim please. My accepted claim value has guide 3 written next to it in the table in the email I received from cash Euronet. Does this mean I won’t receive anything because guide 3 states less set off? My loan was sold to Lantern & I’ve paid it back fully to them. Thanks in advance.

Sara (Debt Camel) says

They should take into account the payments you made to Lantern so there is no set off to reduce your refund. Contact them and ask.

Jeanette says

Hi Sara,

I just received an unexpected £80 from lending stream. Are they the same company as quickquid? I have been keeping an eye on my emails for the the quickquid redress but had no clue about lending stream (or can’t remember making a claim to it). Nice little bonus if they are not connected

Sara (Debt Camel) says

No, totally different lender. Lending Stream are still very much in business.

How many Lending Stream loans did you have?

Jeanette says

To be honest, I can’t even remember. I will try an look later and let you know

Wayne says

Lucky u, I had loads from lending stream, I’ve not received anything, hopefully I will have a little surprise too

Sara (Debt Camel) says

Have you made a complaint? There is no sign that LS are contacting many people… read https://debtcamel.co.uk/payday-loan-refunds/ and send them a complaint now.

Jojo by the way says

I had many loans from lending stream. I made a affordability complaint on there online complainants form on 30/03/2022 they upheld some.

Had an offer on Thursday for £2220.56 I accepted and the money was in my bank within 15 mins of accepting.

It’s worth making a complaint to them directly.

Stressed says

Could I ask how you worded your complaint? Thanks

Sara (Debt Camel) says

use the template here https://debtcamel.co.uk/payday-loan-refunds/

Jojo by the way says

I just stated that I thought my loans were not affordable.

I went back through all my old emails and stated loan ref numbers.

I also said that they were unaffordable by taking another loan as soon as the last one was paid.

Goodluck.

Stressed says

Thanks both I have submitted a complaint today on there website, fingers crossed.

Your turn around was really quick so be interesting to see how long it takes for me get a reply.

Sam says

I made an affordability complaint to LS on 05/04/2022 – received the final response email today and about 3 quarters of my loans have been upheld. Had an offer of just under £2,000 today, I accepted and the money was in my account pretty much instantly.

Definitely worth making a complaint to them directly.

Certainly beats the 3 years I’ve been waiting for my QuickQuid refund! End of April… we shall see.

This website has been a huge help, so thank you to whoever runs it.

Starshine says

I don’t understand how they rejected mine and I had 15 in total , my fault as left too late to complain to ombudsman

Sara (Debt Camel) says

Lending Stream? Yes, they used to make some very poor decisions and rely on people not going to the Ombudsman.

Shaan Ali says

I was suppose to get my refund of 83.00 In January after the email I received but got nothing and after ringing them every week ever since all I keep getting is its been escalated, any advice on what to do next (quickquid)

Sara (Debt Camel) says

this is for an overpayment?

Shaan Ali says

Yeah the overpayment

Sara (Debt Camel) says

Just persevere. It will get sorted in the end.

Richard says

While I wait for possible payment, would it be possible to make a claim against HSBC bank? They kept letting me up my overdraft to over £4000 when I only took home £2000. I could never afford it, this went on for years and then last year took out a loan with them to repay the overdraft?

Sara (Debt Camel) says

So you were in this overdraft all the time literally? not even getting back “into the black” when you got paid? That sounds like a strong overdraft complaint! See https://debtcamel.co.uk/get-refund-overdraft/.

If HSBC dismisses it as it was more than 6 years ago, pay no attention and send this straight to the Ombudsman.

And more questions are best asked in the comments below that overdraft page.

Richard g says

I had the same issue with NatWest, they allowed me to raise my overdraft to £7000 , I was not earning as much as that. I did make a complaint and they denied irresponsible lending so I’ve now gone to the FOS and waiting to hear a outcome,

Tina says

When making these affordability claims by mail do I send them to my banks head office or the branch address ?

Sara (Debt Camel) says

Head office.

Guy says

Hi,

Has anyone made a successful claim against the credit card company “marbles” and if so how did you find the process?

Thanks!

Sara (Debt Camel) says

yes! See the comments below the credit card page https://debtcamel.co.uk/refunds-catalogue-credit-card/. Complaints can take a long while but people are winning a lot of them!

Sarah says

Hey. I put a claim in against marbles last year for increasing my limit repeatedly, I got a letter back saying it was upheld and the money offered not only cleared my outstanding balance but also put a little wedge in my pocket. The refund process was a little painful and I had to call twice as the two departments weren’t communicating effectively, but it was still sorted within two weeks.

I actually used one of Sara’s templates to complain, so definitely recommend starting there!

Matthew Cox says

Hi I too had a marbles and aqua card,do you know what template you used to claim about raising credit limit often,thanks

Sara (Debt Camel) says

There is one here: https://debtcamel.co.uk/refunds-catalogue-credit-card/

Garry says

What’s the furthest back you can potentially go? I think my card with Marbles was about 2006-2010. I realise it’s easy beyond FOS’ 6 year rule but I could argue the 3 year one. Is there another time constraint? Thanks

Sara (Debt Camel) says

April 2007 – that is when the law changed allowing these complaints.

Colin says

Any one No anything about myjar ? I emailed a complaint last week and got a reply from them today saying I had been added to there scheme

Helen says

Myjar will be emailing everyone entitled to redress by the end of April and payment should be by the end of May, according to their administration website.

Colin says

This is the reply I got from them today.

“We are currently reviewing all records with regards to complaints, which includes pending redress enquiries. Once we have completed the review and you are to be awarded redress, we will write to you. Your interest in redress has been registered.

At present the quantum and timing of any potential redress is unclear. The Administrators are presently reviewing claims made in the loan portfolio in accordance with recognised industry guidance to establish the potential sums due to claimants.

The conclusion of the review and any subsequent re-imbursements is unknown, likewise payments to unsecured creditors are unknown and won’t be known for some time.”

ven says

Hi Sara

can we file affordability complaints on Over Drafts that is over 10years ago

thanks

Sara (Debt Camel) says

yes you can if you have only found out in the last 3 years that you can complain. But if the accounts have been closed for over 6 years, it may be hard to get much evidence. See https://debtcamel.co.uk/get-refund-overdraft/ which looks at these complaints and has a template too use

Colin Brown says

I haven’t had anything yet.

My complaint with the ombudsman was upheld against QQ before they went bust and I was told that is standing and haven’t heard anything yet.

What should I do?

Sara (Debt Camel) says

was this a final decision from an Ombudsman?

Karl says

Nerves are really kicking in, really need this payment and with only two weeks of the month left I am losing more and more confidence the payment will be this month

Sara (Debt Camel) says

This is understandable.

As I have said many times before=, people CANNOT RELY on receiving the money this month. Even if payments are started, you may not receive yours.

Karl says

Unfortunately my position is relying on it. Not through choice

Sara (Debt Camel) says

Then you need to consider what you will do if the money does not arrive – what commitment have you made? Even if most people are paid by the end of the month there will be someone where the payments failed and they will take time to be retried.

Fiona says

Hi Sarah, I am in the same position with Quickquid payment, feeling unerved as so little info from cash euronet and nothing online, neither have they confirmed whether it will be 30 or 50p in the pound, surely they should update us soon?!

Fiona

Sara (Debt Camel) says

Actually the administrators have given more information than most administrators do. Administrators are not under any obligation to issue more than 6 monthly progress reports.

I hope everyone will be told soon what the % is and when it will start being paid.

sharon says

don’t know about anybody else but i cant see any of us been payed out by the end of April they have not even stated the settled percentage yet.

personally i think its getting beyond a joke now.

Timbo says

You have to remember that they may only release the percentage a day before payments are starting being made so still plenty of time! The update at the very start of March regarding the slight delay was made very early in the month and if they were expecting any further delays I would have expected it to be communicated by now.

The journey is nearly over!

Saralou says

I think it will happen really quickly once percentages are announced. I prefer to believe that ‘no news is good news’, and that they’re beavering away in the background.

I’m anxiously looking forward to receiving payment too 😊

Daniel James says

I had a claim accepted for EuroCash/QQ and was receiving emails from the administrators last year. Just wondering if the latest update was emailed out as I never got this one – saying payments could be made as early as this month.

The good news I guess is that my claim for both Wonga and QQ were around £2000 – but whilst Wonga only paid around 5% of that – this seems to be much higher.

But did everyone else get an email with the latest update?

Mark S says

I would try not to worry too much, I recently received my 247 moneybox redress payment, in the same week the percentage was confirmed, I know these are different administrations but they may work in similar ways

Christine says

My question does Grant Thornton get interest in this money that we are all owed?

Sara (Debt Camel) says

NO the interest goes into th refund pot.

Not so stressed now says

Hi Sara

Firstly what a fantastic job you are doing ! I used one of your templates for a complaint against lending stream and have had a fantastic offer this morning! I had 21 loans with them and they have refunded 16 of them. A massive amount offered back which I accepted straight away. I can’t thank you enough for your help and advice on here.

Advice needed! says

Hey, how did you go around doing this? I had loads with lending stream. Any advice would be perfect! Stu

Sara (Debt Camel) says

Read https://debtcamel.co.uk/payday-loan-refunds/ which explains how these claims works and has a template you can use.

They like you to use their online complaint form but you can try email the complaint to lisa.middleton@gaincredit.com

J says

Does anyone know if payments have started?

Anyone received emails yet of their amounts?

QQ and Casheuro net still advising by end of April so fingers crossed!

Sara (Debt Camel) says

No payments and no emails about the amounts.

james says

they are still advising but with only 11 working days left i would say the same as everyone else and say we are not getting it this month, like we never got it last month. or last november or when i was first promised payment 2 weeks before they went into admin.

sharon says

i keep checking Grant Thornton site but still nothing.

Catherine says

Hi all. There is still hope. I just recently got a redress from 247 moneybox and got the email after the payment was received.

Mark H says

I am afraid worrying about it won’t make any difference. I still believe we’ll receive the payment on time and they have much less to process than they did for Wonga. I am hoping for news tomorrow as 13 is my lucky number and maybe no news is good news. Anyway, just be patient as we’re on the home straight.

Quiggers says

Hi there, here’s a response I got this morning.

Thank you for contacting CashEuroNet UK, LLC.

The Joint Administrators expect to pay the dividend to all creditors by the 30 April 2022. If anything changes an update will be provided. The exact payout amounts are yet to be released. Please continue to monitor your email.

Updates will be provided as they become available and will be forwarded to all creditors. We appreciate your patience.

Yours sincerely,

Claudia

For and on behalf of CashEuroNet UK, LLC

The Joint Administrators

Claudia C

sam says

Anyone have any experience with claiming from Cash4uNow? Had 11 loans from them over the last couple of years.

Sara (Debt Camel) says

They often reject good complaints and sometimes send threatening sounding emails talking about fraud. No one has had any problem with fraus when they have ignored the lender and sent the rejection to the ombudsman. 11 loans sounds like a good case.

Saralou says

Hello can anyone help with an up to date lending stream email address?? I am trying to file a complaint through their portal and it just keeps giving an ‘oops’ message and sending me round in circles. I have loan numbers, I’m just trying to send the template over. So frustrating!!

Sara (Debt Camel) says

try lisa.middleton@gaincredit.com and put COMPLAINT in the title of the email.

Saralou says

Thank you 😊

Stressed says

Hi there

How long did the process take? I had a large number of loans with LS too so just wondered how long it might take. Others on here have had really quick responses from when they first complained

Thanks

Kiki says

Hello, I put in a complaint to lending stream in February, I used the template and I too received a lovely large amount for the high interest i had paid. I received payment in march. It was very quick. I am so happy.

Emma says

Lending Stream were one of the best at complaint handling in my experience and I’ve dealt with dozens now. They quickly accepted that 21 loans were missold. We took the other 4 to the ombudsman because we were at deadlock about those and in the end only 2 were sold responsibly. Lending Stream processed the refunds and changes to my credit report quickly.

Myjar on the other hand agreed they had lent irresponsibly and they were paying a settlement but then they conveniently dragged their feet for weeks (while promising it would be paid and it was just internal delays) then they went into administration and my agreed payment disappeared into the pot which I may or may not see (depending on what the administrator decides about my claim). I hope the myjar administrators are looking into the offshore secure ‘creditors’ who have first slice of the pie. I’m wondering if the offshore creditors are actually the owners protecting their assets to our detriment but I don’t know for sure.

Lucas says

I had lots with them. Complaint once and they rejected…complained again and still rejected because the rejected before…should i report the

Sara (Debt Camel) says

No. Unless they did not tell you you could go to the ombudsman the first time, you cannot make a second complaint and take that to the ombudsman.

Paul says

I blundered massively with Lending Stream. They offered me a couple of hundred and I accepted the offer when in reality I could have got significantly more.

This was a few years ago and at the time there was big all round panic about lending companies going bust any day.

I decided to take any more before they shut down…. But they didn’t go bust.

Lesson learned.

USHA DABYCHARUN says

I know I feel like beating a dead horse, but with no emails and no information from QQ- would experience dictate this to be positive or negative?

Sara (Debt Camel) says

No news is no news. It isn’t good or bad.

Sabrina says

Hi – just had this email about QQ. So with it mentioning that we should hear soon is good news I guess.

Thank you for contacting CashEuroNet UK, LLC

At this time our Joint Administrators do expect to have payouts made by the 30th of April.

We do apologise, there is no update in regards to individual claim payout amounts to provide just yet however, this information will be sent soon, please continue to monitor your email.

Updates will be provided as they become available and will be forwarded to all creditors. We appreciate your patience.

Sal says

Hi

Is there anything I can do about 3 sunny loans that have been passed to debt collection agency sll capital, ( now changed to a different company) I have been slowly paying them off since 2017. I know sunny went bust and it’s to late to claim off them, but curious to know if I can get them written off

Sara (Debt Camel) says

no but the debt purchaser may well accept a lower settlelent offer.

Graham says

Hi sara I had multiple loans with various loan companies.. I eventually could not afford to pay them back so got the loans consolidated and interest frozen.. I was just wondering if I can still put in affordability complaints against any of these companies.

Sara (Debt Camel) says

Yes you can.

Who is the consolidation loans with – a lender? At what interest rate? or a debt management company?

Graham says

Sorry I worded that wrongly. It was more of an agreement to pay back a set amount over two years and it was organised by Step Change. I have finished paying it now.

Sara (Debt Camel) says

Ok that is fine – it is a lot like a 0% consolidation loan. Yes you can still make affordability complaints about the debts in it.

Tom says

Hi everyone. This is perhaps a little off topic but I would appreciate some advice if possible. I had a credit card with Aqua which I couldn’t afford to keep up with and eventually lead to me having to go to a debt management firm. Would I be able to make a claim for unaffordable lending? Or would the debt management plan stop me from being able to do that?

Sara (Debt Camel) says

The DMP doesn’t stop this.

your Aqua card – did they increase your credit limit too high? While you had already only been making minimum payments?

Tom says

Pretty much yeah. There was an occasion or two where I regrettably asked to have my limit increased. For most of the time I had the card I was just paying the minimum amount each month.

Sara (Debt Camel) says

That sounds like a good complaint. Even if you asked for the increase, they should still have checked it would be affordable for you.

Read https://debtcamel.co.uk/refunds-catalogue-credit-card/ which explains how these complaints work and has a template you can use to complain.

The email address for aqua is complaints@newday.co.uk

Tom says

Brilliant. I’ll give that a try. Thank you.

Gemma says

Is there a template letter and a contact to claim from MyJar?

Thanks

Sara (Debt Camel) says

No, they are in administration, just send a short email asap to myjar@harrisons.uk.com with CLAIM as the subject saying your loans were unaffordable.

Steve says

In relation to QQ I had an outstanding loan that was subsequently sold to lamtern this loan was also deemed unfordable. Will this amount be deducted from any payment I recieve?

Sara (Debt Camel) says

You need to ask QQ this.

Denise says

Hello there.

I am in the same predicament as you. My loan was sold to Lantern. I spoke to a lady at QQ last week and mentioned this very situation, she told me that we would receive all funds and it was up to us to negotiate with our respective debt collection agencies.

I hope that this helps answer your question?

M A says

I have an outstanding amount with Lantern that QQ sold on the them. With the redress imminent, would lantern write off the outstanding amount or would this still need to be paid regardless of the redress?

Sara (Debt Camel) says

see my reply above to Steve

Wayne says

Any updates?

Sara (Debt Camel) says

no

paul roffey says

Is it just me getting anxious about QQ?

I know end of the month but…

Sara (Debt Camel) says

lots of people are.

Lukasz says

Please people stop excpecting payment this month. It’s 50/50 it will happen, but excpect it won’t. There is many factors that could delay payouts. We are half way through the month and there was no update yet. Just dont spend money just because you think there will be money coming in by the end of the month.

Ta says

Why 50/50 ? The administrators are quite clearly saying they are on track to payout by 30th April. I think people have waited long enough and if they are not paying out by 30th April then I would of thought their updates would say differently. I am sure that people are already feeling anxious about this so I don’t think there’s need to make people feel worse,

Stressed says

It’s making me feel sick now… I know we can’t control it and worrying doesn’t help, but it doesn’t stop the concerns. I like many really need the money now and it’s getting me down

Paul says

I really, really need the money as well.

I feel like staying under the duvet until it arrives in my account :(

Jason says

I feel the same Paul, it would make a real difference and allow me to begin to rebuild. I do get what everyone is saying i just wish there was something, anything from them. If it is delayed then that is something i will have to deal with i just don’t want a situation where, on 29th april, there is an e-mail saying another 6 months. Not much we can do but i share your pain and am very anxious

BT says

It should be a nice sunny long weekend in the UK. Try

getting busy with other things and forget about QQ for the time being. There is nothing you (we) can do to speed things up so just try focusing on other things.

Paul says

I emailed a while back as I wanted to check if they have my correct banking details ( been that long I can’t remember what I gave ) and got this email this morning:

Hi Paul,

I can confirm that we are still on track to meet out deadline for making the dividend payment by 30 April, and all customers will be advised of the dividend rate prior to payment.

Regarding your query on your bank details, Unfortunately, the Administrators do not have direct live access to your account details and are therefore unable to look into this query for you.

Seems like it’s still on track and I feel it would take something big to make and extension now!!

My guess is the emails will start next Tuesday/Wednesday after the Easter holiday.

Kelly says

Sounds positive 🤞

Susan says

Thanks like everyone keen to get know rate and get payment. Mine is probably one of the largest (yes I was in a complete mess) This page really helps my nerves.

Andy says

Morning Susan I’m same as you £13700 from quick quid £19000 from wageday I recently got £9100 back from lending stream as I had a online gambling problem but lending stream money helped me clear most debts stay positive it will come soon

Sara (Debt Camel) says

hi Andy – did you also have an overdraft problem? Many people with a gambling problem do… See https://debtcamel.co.uk/get-refund-overdraft/

Jason says

thanks for posting that Paul, it does help when someone gives us some information

Mike D says

Hi Paul,

I emailed QQ ( support@quickquid.co.uk ) on the 31st March, and they were able to confirm the bank details I originally gave them.

Paul says

Thanks Mike, I shall give them an email just to check.

J says

Hi Sara,

Just wanted to say a huge thank you to you for this amazing site and all the advice – I used your template to contact Lending Stream earlier this week, and today received my refund outcome, accepted and entered my details and the money was paid out within minutes. If I hadn’t had your site I wouldn’t have known I could apply through them so thank you!

Jayne says

How did you contact them the Email won’t work for me?

J says

I logged on on the site and used the contact form on their website, and used the complaints template from here, once i sent it i got a confirmation email to say they had received it.

paul roffey says

Well done

I wasn’t so lucky with mine.

It was rejected within one day.

Sent it on the Ombudsman!!

Greg says

I really sympathise with people who are hoping to get the money this month. The morale deficiency of these companies is a disgrace and should never have been allowed to trade. Payday lenders are locusts who spotted a gap in the market to prey on vulnerable people.

The fact that casheuronet I believe still trade in America, they should be made to pay the full redress values for all claimants. The fact companies can just enter administration because they’ve broken the rules and received thousands of valid affordability complaints again is so unjust.

This administration has been so drawn out and whether rightly or wrongly people are understandably at the end of there tether now.

People can talk all they want about we got ourselves in this mess etc however these companies preyed on a certain group of people, they make me sick and such companies should be shut down with tougher legislations.

It wouldn’t take a lot for grant Thornton to post a single sentence on there website saying payments are still due to be made on the 30th, they will be fully aware of the anxiety being suffered by many currently. Whether they are obligated to or not it’s morally right to do so. It’s been 3 years, wonder if QQ and the others would of gone 3 years without us paying loans back.

Hopefully all you fellow claimants get your money soon and can start to get certain things our lives straightened out. God bless to you all. Keep going you’re all doing a fab job, stay strong.

Greg

AN says

Brilliantly put sir .. they would have had us straight to court if we had gone so long with payment or contact . The last delay was for clearance of tax issues … which they got the very next day … meaning payments should have started start of April instead of end of March.

People on here say they have done great getting a decent payout .. yes ,, but it’s their job and they certainly will have been well rewarded financially. They taking us for fools ..

Christine says

Agree with Greg a one line update would be polite to address thousands due a redress makes me feel second class, which I’m not just needed QQ at a certain time.

Good luck to us all

Mark H says

I don’t agree with Greg whatsoever. Yes, a one line update if there’s something new to tell us but we haven’t gone beyond 30 April 2022 yet. I can understand people getting anxious but everyone just needs to be patient. However angry or frustrated anyone feels there’s absolutely nothing we can do about it.

Amy says

Hi

Just a little hope for everyone , I emailed Cash4u about a week ago about 4 loans I had back in 2019 and I had a response today saying they are giving me a refund for unfair lending of £534.45 and that was it , I’m not saying they should all end this way but it’s a little hope for us all , fingers crossed for a QQ payout soon

Claire says

Is this cash4unow? I sent them the template about 4 weeks ago and haven’t heard anything except an email to say they have Acknowledged my email. Fingers crossed

Amy says

Hi

Yeh cash4u I just said in my email that I think they lender to me irresponsibly and I would like a refund , and had my email with the refund yesterday, email them again on this email

complaints@cash4unow.co.uk Hope this helps

Gemma says

Has anyone put a claim in fir MyJar and either heard anything back or been given a refund?

If so, how long did this take?

Sara (Debt Camel) says

send a claim to the administrators asap. Email myjar@harrisons.uk.com with CLAIM as the subject, just say your loans were unaffordable.

People are starting to hear back about whether their claims have been upheld. See comments on the payday loan page: https://debtcamel.co.uk/payday-loan-refunds/

At some point, which may be soon, they will stop taking claims. Pay out will be after all claims are assessed.

Vh says

My jar administration replied to me February no claims upheld an no redress to ombudsman said it would cost me in court instead

Now with debt collection perch

Is it worth writing back £550 was total loan owed still.

4 loans in total

Sara (Debt Camel) says

Your 4 loans only added up to 800, you said. Those were all pretty small and you would probably have lost that case at the Ombudsman.

the debt collector may well accept a settlement offer.

Vh says

Thanks I’ll ask worth a try at least an I have QQ to come hopefully which total was £9520 so even if 30% be wonderful bonus

Thankyou

Now I hope you have a lovely weekend off at Easter without to much blog lol

Thankyou

Charles says

I may be wrong, but is it fair to assume that if there was to be any further delay we would have been informed by now?

Sara (Debt Camel) says

no.

Administrators are always uncommunicative. They don’t tend to say they are on track or to announce a delay is likely.

No news is just no news.

It isn’t bad or good.

James says

I had forgot all about Lending Stream.

Applied for a refund on Tuesday…. Offered over £1000 in refubd yesterday.

Accepted the offer today and cash was in my account instantlu.

Thanks Lending Stream and Thanks to other members contributions ,

I hope Quick Quid can sort this soon in the same way.

Rc says

What was the contact email for this?

James says

I logged into my LENDING STREAM account (I had to reset my password as it had been many years since I used it).

I then complained using the template via the MAKE A COMPLAINT /CONTACT US section. Amazed how fast and simple it was….

V says

Hi, I just wondered with the redress payment would it be 30/50p payout of the overall accepted claim value? Or would it be 30/50p of the total redress payment plus the interest on top? Thease figures are shown on my breakdown email. I just wondered how it is normally worked out. Thankyou

Sara (Debt Camel) says

it will be 30/50p on the overall accepted claim vcalue. There is no special post of money that will let them pay the 8% interest part in full.

Mike says

Hi Sara,

I have an issue that is worrying me. I received an email from Cash Euronet sometime in November 2020 in which they indicated that my claim had been assessed and not accepted and I would not be getting any refund. I appealed within 21 days and they sent another email giving a partial refund figure. Now the problem is I seem to have deleted the email correspondence with the figures and I worry I might need it to appeal if I don’t get any refund. What I wanted to know is whether there will be any further grounds for appeal once they start paying out. Thank you

Sara (Debt Camel) says

You can’t appeal the amount. But if they don’t pay you, yes you can complain.

mb says

hi QUESTION i still have loans now with leaning stream, can i still say these loans are unafordable loan theres a total of 5 loans can you help me please im new on hear thanks

Sara (Debt Camel) says

Yes, you can make these complaints if yo7 have repaid the loans or if you are still paying them.

MK says

hi sorry if off topic hope qq pay out soon for you all, i tried to claim a few year ago to lending stream via oubsamen and they requested bank statements which at the time i wasnt in great place and didnt have energy to source them and my claim was rejected although i had mutiple loans at the same time and rolled many times if i reapply will i automatically be rejected?

thank you

Sara (Debt Camel) says

yes.

Carl says

Hi Sara,

I complained to Lending Stream in December 2019 and got a final response of rejection. I replied to the email asking for the claims to be looked into further due to the reasons behind them being unaffordable but got not reply. I then chased a response in 2020, 2021 and finally got a reply after chasing again this year only to be told that the decision was the same and that I can no longer refer it to the FO as don’t have their permission. It appears they did give a 6 month deadline in their first response which I didn’t act on as wasn’t really aware at the time but did reply to LS and didn’t get any replies. Based on this, would the FO look into this if I escalated it to them? Thank you

Sara (Debt Camel) says

well you could send FOS a complaint saying that LS have not treated you fairly by not replying to your emails. I don’t know what FOS will decide abiout this, but it seems worth a try.

mr mark brooks says

hi sara. can you tell how do i go about claiming from leanding stream..ie email.

Sara (Debt Camel) says

they would like you to fill out their complaint form here https://www.lendingstream.co.uk/contactus-step2/?sel_val=customer

You could try emailing lisa.middleton@gaincredit.com – I don’t know if it will work. Let me know how it goes?

Claire says

Hi, just wanted to say thanks for all the advice Sara. I am waiting for my big QQ payout, but I used your template for Lending Stream in the meantime and got £340 within 3 days so pretty happy!

Thanks for all you do :-)

Claire

Sharon says

One of my QQ loans was sold, in my email it shows that the claim was successful but now I’m being hounded by lantern and bpo for this loan amount,

Sara (Debt Camel) says

So you can tell them you will look at settling this debt when you get the QQ pay out.

How much do you owe on this defaulted debt? How large was that loan? How much have you paid to the loan so far?

And what is the rest of your financial situation like – do you have any priority debts that you have problems with – rent, council tax, energy, car finance etc?

Stus says

I missed the deadline for a claim by miles and my loan had been sold to Lantern which has been paid off over a year.

If I had put in a claim for that last loan I think I would have had good chances with it been deemed unaffordable.

Did someone try yet to contact administrators and CRA about suppressing records from QQ?

Sara (Debt Camel) says

1) this is way too early to try this – the QQ administrators are still talking to the CRAs

2) even if you can get the QQ record suppressed, that may make no difference to the defaulted Lantern record.

elizabeth moss says

hi just wondering if i can claim from loans at home please .

Sara (Debt Camel) says

yes but they have gone into administration. Send an email to customerservice@loansathome.co.uk with AFFORDABILITY CLAIM as the subject.

Do you still have a loan from them which it is hard to repay? What is the rest of your current

situation like, do you have any priority debts?

Elizabeth moss says

I’ve recently paid up at a lower rate and no priority debts .

Katie says

Why are the administrators dragging this out? I need this cash or I am in trouble. They promised it would he end of march, I borrowed money from family members in anticipation and now I can’t pay it back. I’m so skint. I got an acceptance at 5k so hopefully I get at least 2.5k retuned to me. I’m relying on getting this payment within two weeks.

Sara (Debt Camel) says

They aren’t dragging it out.

They said things like “At this time our Joint Administrators anticipate that payment details and payouts will be made by the end of March.” That was NOT a “promise”.

They said they expect to pay between 30% and 50% – I don’t know why you are hopeful it will be 50% or more.

No one should be relying on this money arriving in the next two weeks – I hope it will but it is not safe to rely on it.

Colin Brown says

Hi All.

I won my complaint with Quick Quid pre administration and was told I don’t need to do anything is this correct? I have an email ages ago from the administrator.

Just worried I need to do something?

Ricky Fisher says

I’m the same

Jo says

I was in the same position. Was due to be paid 2 weeks before they went into administration, I was gutted. Just to be in the safe side I contacted them and they told me to make a claim, which I did. And like everyone else I’m playing the waiting game.

Rich says

Hi Sara,

I recently used the template to contact safety net credit regarding affordability which they are currently looking into however my credit report now shows that the account with safety net has been reopened. Obviously I don’t want a link to a lender like this on my file, is this normal practice for the account to be opened whilst they assess my claim?

Sara (Debt Camel) says

It sounds like an error – it doesn’t usually happen. Contact them, ask them to correct your credit record.

Rich says

OK, thanks will try contacting them and get it removed

Daniel Oliver says

I made a complaint to safetynet.credit 2 weeks ago and my file has just been reopened. Had it since 2019 hopefully they will agree with my statement.

Sara (Debt Camel) says

And agree or not, they will close the account again. If they don’t, ask the Ombudsman for additional compensation.

Mandy says

Safetynet rejected my claim so have escalated to ombudsman reopened account but cant borrow from it not that i need or want too

Reckoned i could afford yet would pay back and have borrow again few years ago rhey closed account 2017

Sara (Debt Camel) says

tell FOS about the reopened account. This doesn’t in practice harm you with no balance on there. Other lenders can’t see who the creditor is. But it is stupid of them to have reopened an account which you have told them was unaffordable!

Carl Hirst says

So has mine Rich, following a complaint.. Funnily enough I noticed it this morning so have emailed them asking why as the account was closed some time ago.

Rich says

It’s annoying isn’t it, I’ve worked hard to clear up my credit report, let us know if you get a reply

Sara (Debt Camel) says

This will get sorted.

Carl says

They have replied to advise that it has been reopened to look into my complaint but will be closed again once resolved. I guess it will be the same with you.

Carol says

I’m saddened by the people who are desperate for this money from QQ. Never count your chickens and all that. I don’t understand how you can borrow from people on the back of it? None of us knows what the final percentage will be. I will be grateful for it too but nothing was promised or guaranteed so it’s just a case of waiting. I’m not the most patient either lol

Paul says

Well said. Indeed, I am as curious as anyone what they will be paying out in percentage terms.. whatever it is, it’s going to be more than the normal 3,4,5,6p in the pound other lenders have been paying back! Hoping it comes this month, although I won’t bank on it. Should be worth the wait, to get 30% back… which is a right result, so anything above, and it’s a real brucie bonus!

Ricky Fisher says

Clearly you are in a better financial position than most, I, like others, am struggling, having a potential 6k in my bank means I can make plans that otherwise I cannot (for me that would be a rental deposit), that’s not simply sitting back and waiting for some money that I may or may not receive and carrying on with life regardless, it is for me a life changing amount of money…

So yeah I’m anxious, and yes every day I am waiting in anticipation, and when you are choosing which bill’s to pay you will be counting those chicken’s because it’s the only eggs you have.

Happy Easter, let’s hope to this bunny hatches!

Bob says

I think this particular month unfortunately is hitting people hard, what with gas electric increases fuel increases. Income stagnant.

Many people waiting for the £150 council tax rebate that hasn’t happened and qq that should of happened.

The fact is we are all falling behind with the cost of living no matter how on top of things you think you are.

I’ve had pay outs that the redress was near 4k but in reality walked away with less than £60. Personally I feel in these situations the compensation should not be touched.

Certainly would not advise on expecting this money soon. I know people that have switched their gas and electricity off and only put it on to cook and wash.

Whilst borrowing against this payout is not wise, for many it’s a necessity to catch up after being out of work or long term ssp from Covid. With no support. For some it’s one thing after another hitting every way they turn. Trust me what you see from many is completely different behind closed doors at the moment.

BT says

I agree and I am too saddened to see that people are still in such a tough situation, relying on short term lending whether it is from payday loans or family.

The major financial issues I’ve had between 2016-2018 are well behind me after learning the hard lessons that I should live within my means. I really hope this cash people may receive (myself included) will help them to catch their breath financially and take the opportunity to rethink their personal/family budgets to never end up in this situation again.

Wish you all the best!

rachael allison says

I have had no emails since last may, I have asked for an update but also asked them to confirm my bank details and what my redress will be.

I have also seen just now that the redress could be taxed, redress is not allowed to be taxed as is of compensation.

Pls can someone tell me what is going on xxxx

Sara (Debt Camel) says

in a normal redress for unaffordable lending, the 8% added interest is taxable. This is standard. It is what happened on all PPI claims.

But in an administration sometimes no tax is deducted. We do not know yet what will happen with QuickQuid loans.

Andrew says

Hopefully we will all get emails this week . It won’t take long to make the payments electronically .So we still could get a payment by the end of the month.

LK says

I too am waiting for a large payout from QQ, but I am in a good financial position now and that is why I am posting. I don’t want to be sanctimonious or preach but it has taken me many years to become in this position and on a salary of £20k.

I was in a cycle of payday loans and nearly lost my house and while people like QQ made it easy for me to do that, ultimately it was my fault and I believe that this is the key to taking back your finances. Once I was honest with myself that it was my fault I was able to be honest and open with everyone that I owed money and it took many years of hard work and careful money planning but I am debt free and retained my house and have an excellent credit score.

I guess what I’m trying to say is don’t rely on anyone or any payouts to help you financially be honest with yourself and those you owe and take responsibility, it isn’t easy but with dedication it is possible I’m not a huge earner, I’ve just taken responsibility and sorted it. I know I’m lucky and it is a struggle for me with rising bills, but I will make the necessary cuts and won’t ever be reliant on loans ever again.

I hope those relying on the money get it this montj and I hope that you can use it as a kick start to take back your financial responsibility to yourselves.

You can do it, good luck everyone.

Th says

I have just phoned them to see if the ere is any updates and as again they are saying we will get an email before 30th April they still don’t know the percentage, I’d thought I’d share this in case anyone else is thinking of phoning them. It is frustrating it’s been a long time waiting, good luck everyone not long now to wait

Sara (Debt Camel) says

there is no point in phoning them. The customer services people are often the last to know anything. Don’t waste your time trying this.

Robert James says

Anyway, good news got my remaining £628 debt to Loan2Go written off. They keep the £400 I’ve already paid for a £250 loan. But it’s a result, £628 is a lot of dosh to pay.

Awsan says

How did u go about it?

Sara (Debt Camel) says

Template to complain to Loans2Go is here: https://debtcamel.co.uk/worst-loan-in-britain/

Plus you need to be persistent – they will often make a poor offer at the start.

Lukasz says

What if i can’t log in anymore?

Sara (Debt Camel) says

Email customerservices@loans2go.co.uk and ps@loans2go.co.uk

Lucas says

Ok. Thank You for reply :)

Susan says

I know we are all nervous about this but peeps please stay nice to each other. This has been a difficult time waiting. Here of all places we should be able to understand each other and as we know how easy it is to get into a financial mess.

Gemma says

Slightly different note. Ive had an email from a company called ‘strokes’ this morning regarding Satsuma.

They have said I will be getting a redress of just over £150.

Has anyone else received this? I wasn’t even aware that I had a claim outstanding.

Dave says

Yes. I had an email today too. It was related to loans I had through Satsuma and a company called provident got in touch with me last week to say I would be receiving a redress – a massive £11.72! Lol. These guys only paid 4p-6p in the £ though.

Sara (Debt Camel) says

This was an email from the Provident scheme. Everyone who voted on it was treated as submitting a claim to it.