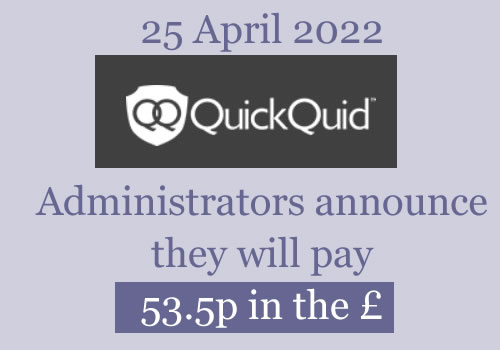

Payments – UPDATE – 25 April 2022

Administrators have started sending emails to everyone with an upheld claim telling them what they will be paid.

“The Joint Administrators are now in a position to declare a first and final dividend of 53.5p in the £”

The average claim value is c £1,700. Someone with that claim value will get a payout of about £910.

The payout details are given in the email:

- This will be paid over the next two weeks.

- If the administrators couldn’t validate your banking details, it will be sent by cheque. I don’t know how the administrators will “validate” your details.

- If you used a claims company, the money will be paid to them.

- Most people are not having any deduction for tax paid to HMRC, so there is no need to reclaim anything.

Credit records

The administrators may decide to :

– remove any negative marks on your credit record

– delete all loans that were upheld

– delete all your loans.

I don’t know what they have chosen to do – if people can check and report in the comments when they see a change, that would be great.

How much your credit score will change will depend on whether there were any negative marks. If you want to get a mortgage, you would like as many payday loans gone as possible, even if they were repaid on time and not hurting your credit score.

In a few months when the administrators no longer talk to the CRAs you can ask for any remaining loans to be “suppressed” so other lenders can’t see them. See https://debtcamel.co.uk/correct-credit-records-lender-administration/ but it is too soon to do that now.

QuickQuid went into administration in October 2019

CashEuroNet (CEU), which owns the QuickQuid, Pounds To Pocket and On Stride brands, stopped giving loans and went into administration on 25 October 2019.

I will be talking about QuickQuid (QQ) rather than CashEuroNet as it is the more familiar name. Everything here also applies to loans from Cashruronet’s other brands, Pounds To Pocket and On Stride.

Grant Thornton were appointed as Administrators. They set up a page about Redress Complaints – this is their term for people who have asked for a refund because they were given unaffordable loans.

Background to the QuickQuid Administration

QuickQuid was one of the “Big Three” payday lenders in Britain, starting out in 2007.

After Wonga and the Money Shop Group had all stopped lending and gone bust over the last fifteen months, QuickQuid was left as the largest UK payday lender.

QuickQuid had well over a million customers. When it went into administration there were c. 500,000 customers with outstanding loans.

Many of these customers had prolonged borrowing from QQ. They either rolling loans over or repaid one loan but were left so short of money that they had to borrow again.

These customers have good reasons to win an affordability complaint and get a refund of the interest they paid.

Affordability complaints started on a small scale in 2015 and increased in the next few years.

In 2018, complaints going to the Financial Ombudsman (FOS) jumped with the involvement of Claims Companies and QuickQuid became the most complained about firm to FOS, excluding PPI complaints.

For a long time QQ refused to refund interest on any loans taken more than 6 years before or where the loans were given in 2015 or afterwards. This resulted in a huge backlog of claims at the Financial Ombudsman, where QQ had made very poor offers to customers and then rejected an adjudicator decision.

In late July 2019, QQ agreed to accept several thousand FOS complaints it had previously rejected.

By accepting the FOS decisions on loans over 6 years, long chains of borrowing, and loans taken after 2015, the scale of QQ’s likely future liability for refunds will have become clear to the company.

After failing to persuade the FCA that a Scheme of Arrangement was appropriate, Enova, CEU’s large and profitable US parent, decided to close the UK business, blaming the UK regulatory environment.

How could the regulators let this happen?

This is an excellent question… Stella Creasy, MP called for an inquiry into the FCA over Wonga and QuickQuid.

What has happened in the administration

Customers with a valid claim for a refund are “unsecured creditors”. This includes:

- any refunds that were in progress after an amount was agreed or a Final Decision from a FOS Ombudsman (FOS);

- complaints that were underway at QQ or FOS when QQ went under;

- any new complaints sent to the Administrators.

All complaints at FOS legally had to stop and were been passed back to the Administrators. It isn’t possible to send any new complaints to FOS.

It is now too late to submit a Claim for unaffordable lending. The last date was 14 February 2021.

The administrators have given the following statistics about claims:

- 169,000 customers made claims for unaffordable lending;

- 78,000 claims were upheld by the administrators;

- the upheld claims had a total value of £136million, so an average of about £1,700 per claim.

Still owe a balance on a QuickQuid or On Stride loan?

More than 300,000 of the current loans were sold to Lantern in summer 2021. You should have been informed if your loan was sold.

The administrators have now stopped collecting any money from the remaining unsold loans.

This page is kept updated

The comments below this article are a good place to ask any questions. And you may be able to see where someone else has already found out the answer.

Fred says

Hi Sara,

I already had a complaint in that was in the FOS queue.

I emailed them to ask them if i need submit a new claim since this latest news.

Unsuprisingly they have just sent me the usual template they always send asking for my payslips etc.

This must be the most frustrating company of all of them that i’ve had to deal with.

this was a onstride loan.

leona says

I had a loan with On stride and borrowed every month and then got into difficulity where i could not pay back in full every month never stopped them from trying though. My file has now been passed to ARC Europe Ltd and are threatening to take me to court for 300.00 and adding on solicitors costs and all sorts which im freaking out about.

As on stride have now gone into administration can the above still happen i have today posted a complaint via the resolver website to try and claim something back as the interest i paid on these loans was shocking

Sara (Debt Camel) says

You should tell ARC that you are disputing the debt as you believe the loan was unaffordable and you have submitted a complaint to Onstride. Sat FCA rules say they should not start court action if a debt is in dispute.

Look out for being sent a Letter Before Action/Claim. See https://debtcamel.co.uk/letter-before-claim-ccj/ for what one looks like. You should respond to this, not ignore it.

And if you get court papers – which i hope you don’t, your complaint should stop this until the complaint is resolved, then you should both put in a complaint to Arc and defend the court case… come back here if that happens.

Rob says

Hi Sara,

I wonder if i could ask your opinion please?

I submitted a complaint against On Stride 19 months ago to which they rejected and i passed to the FOS. The adjudicator ruled in their favour in October 2018 and i disagreed as i had 3 loans with them and i felt that loan 3 shouldnt have been lent to me as they didnt ask to see any bank statement or proof of income. I applied 2 weeks after paying loan 2 off and it was for 60% mroe than loan 2. I pointed all this out to the adjudicator and she still disagreed. I wasnt happy and asked for it to be looked at by an Ombudsman. One year passes and i receive a letter dated 24th October from the Ombudsman advising he agrees with me and loan 3 should not have been lent. This loan is in my DMP with Step Change and all i really wanted was the remaining £900 balance to be wiped and i have paid more than this in interest to cover it. Typically the next day they went into administration. Do i stand any chance in my complaint going through where the balance is just wiped? Im not too bothered about any redress but if it could be removed this would take months off whats left of my DMP.

Thank you,

Rob

Sara (Debt Camel) says

ignoring the previous loans, how large was loan 3? And you have paid more than that to the loan already?

Rob says

It was £1,600, before i entered my DMP i was paying £98.92 a month back on it and paid it for 21 months before StepChange sent them a reduced amount each month for the last year so i have paid back over the £1,600

Sara (Debt Camel) says

Then if the Ombudsman decision had been upheld, the balance would have been wiped and you would have had a small refund. Now QQ are in administration, you have a claim. Going by what the Administrators did with Wonga you should get the same result, the balance will be cleared, but you will only now get a. small percentage of the additional refund.

On that basis I suggest you tell StepChange to stop paying anything to this debt now.. You don’t want to carry on reducing it for a year until the. QQ administration ends.

Chantal says

My daughter has a QQ loan and wasn’t even able to make the first payment due to being out of work due to mental health issues, she has informed them of this but she keeps getting the 90day overdue notice email, how will this effect her as she can’t pay it back yet, will they keep chasing her for this?

She also has a number of other payday loans that she isn’t able to pay so any advice would be great on how to deal with him, it worries me as she isn’t mentally stable to deal with all the chasing demands?

Thank you

Sara (Debt Camel) says

QQ going into administration isn’t likely to change how she is being chased to repay this debt.

Can I ask if she has just ignored these payday loans – and any other debts she has such as credit cards? Or has she told them she is out of work and has mental health problems? I’m not criticising, it can be really hard for people with mental health problems to talk to anyone on the phone, let alone payday lenders, just trying to find out the situation.

Also do you feel you understand her full financial situation or do you just know about some bits?

Louise says

I was a few payments behind on my pounds to pocket loan. They were hassling me with calls so I sent them an email to say I’d prefer to communicate with them over email and I would be open to negotiating an affordable payment plan.

They ignored this for months and still kept calling.

I’ve just received an email today from them to negotiate on a payment plan. I just replied “nice try”

(Adjudicator agreed this loan shouldn’t have been issued one day before they decided to go into administration)

Ben says

Absolute scum bags. I originally put in my complaint over 2 years ago. 2 months ago I received an email saying the FO agreed and Quickquid agreed to repay me a few thousand. Now this.. after 2 years? dirty tricks. What a way to ruin and waste everyones time.

Ben says

Sara. I had initially submitted my claim over 2 years ago, QQ denied and it went to the FOS, they agreed and quickquid offered me 1000 over a year ago. I declined (looking like a really stupid descision now – lol), FOS then made another descision which QQ agreed to settle around 2 months ago. Now this? Can you explain my position? am I effectively going to be given about 20quid out of a few million which the executives run away with.

:(

Sara (Debt Camel) says

so what was the agreement to settle 2 months ago supposed to be for?

Ben says

it was like a final offer letter i received from Financial ombudsman saying QQ accepted the settlement and would be in touch I guess? I didn’t know the amount but it’s likely I would of had this not happened.

C says

Hi,

I received this from Decision Help @ FOS- after raising a claim nearly 2 years ago.

It’s nearly been 8 weeks and I’ve heard nothing, despite emailing them to confirm my contact details.

What will happen now? Will I never receive the promised value of the upheld claims?

Thanks

Thanks for your email dated 23 September 2019 accepting the businesses offer.

We’ve now sent the acceptance to the business and it should get in touch with you directly within four to eight weeks to arrange the refund.

We’ll now close the complaint but if you don’t hear from the business or have any problems with the refund please let us know.

Sara (Debt Camel) says

You aren’t now going to get that promised refund – you will be paid a percentage of it – possibly a small one – when the administration ends, which may be a year away.

Edward says

I had complaint against Quick Quid and Pounds to Pocket. Complaint was upheld by adjudicator. Casheuronet didn’t agree, so my case was passed to an ombudsman. My question is: as they have gone to admininstration, why Financial Ombudsman is not informing people with claims, like me and thousands other, whats happening. I am really frustrated, my adjudicator upheld my complaint in May 2019, Casheuronet disagreed 2 weeks later, i told adjudicator to put my case to an ombudsman, she was keep sending me emails telling that Casheuronet needs more time, etc. I am really considering to take a legall action against Financial Ombudsman.

Sara (Debt Camel) says

It takes a few weeks for the Administrators to discuss with the Ombudsman what will happen. When that is clear, the Ombudsman will inform you and other people with FOS cases.

I can make a very good guess at what is likely to happen, but the Ombudsman can’t make decisions based on informed guesswork, it needs to tell people exactly what will happen, not what it thinks will happen.

Rachel says

Hi Sara,

I have an onstride case with the FOS I still have an outstanding amount on the loan which I struggle to pay every month and now I am on statutory maternity pay but I thought I would just keep on paying it as I thought I had a good chance of winning my case (I have had numerous other cases which I have won them all) as they have now gone into administration should I email them and say can I pay less?

Thanks in advance.

Sara (Debt Camel) says

Did you have other QuickQuid or Onstride loans before this one?

Rachel says

I had quick quid ones which have been settled with the fos and I won the cases this is my only on stride one. Thanks

Danni says

Hi Sara,

Firstly I want to thank you for all the great advice you provide. I’m a regular to reading DC articles ever since early this year when I accidently happened to come across an article in the Sun (I believe), about a man who got a hefty refund for a Wonga loan.

I wonder if you can answer a question for me as I can’t see a clear answer to this anywhere.

Upon finding out about refunds I first approached QuickQuid, and I previously accepted an offer from them a few months ago, and they were QUICK to offer me a very low offer (compared to the amount I spent on QQ) and refused some as they were 6 years old, and some they just didn’t explain sufficiently. After a tiring back and forth with them trying to negotiate I accepted the offer whilst letting them know I didn’t agree with the odd method they used to decide which should be upheld.

I then proceeded to file affordability complaints with Wonga and WDA who both offered me £4.6K and £6.4k. I knew then what a BIG mistake I made with QQ because I got A LOT more loans from them, over a period of years, and on a monthly basis without breaks.

My question is, now QQ have gone into administration is it worth putting in another claim to see if the previously refused loans can now be considered?

I’m aware that they won’t be paying the full figure to customers, but do you think it would be possible to do that?

Sorry for my lengthy question/comment I want to include as much information as possible.

Sara (Debt Camel) says

I think it is LIKELY you will be able to do this. But you have to wait for the Administrators to explain how people can claim – at that stage I expect they to give details of who exactly can Claim and you can see if your situation is one of them.

Danni says

Thanks so much for your prompt reply Sara.

Caroline De Vere says

I had a loan from quick quid which I couldn’t afford to pay back so it went to another company to collect it which I have been paying off for years and am still paying so how do I make a complaint as I’m not sure how to

Sara (Debt Camel) says

Did you have any loans from QQ before this one?

Caroline says

I’m not sure but I had it about 2007 and am still paying it off so I don’t think it’s fair that I should still be paying with the interest that I’m paying

H says

I keep asking myself how can these people get away with this.

My complaint was rejected on the 26th September 2019.

In my opinion, Quickquid knew I had a valid claim. They purposely rejected because they would of had to pay me on the 24th October, a few days before there collapse.

All of my 16 loans over 2 years were rejected and on the email I was sent the ‘decision reason’ box was left completely blank!

I missed out on Wonga and now QQ and I’m betting Lending stream will be the next to fall.

I’ve paid around £12,000 interest to these companies and I’m going to end up with around £500 at best.

Absolutely disgusting.

Jax says

I recently told Lending Stream that I was no longer going to make anymore payments as I have been unemployed since July last year. I was paying £1.00 p/m. They wrote back saying no further repayments were required and they were closing my account. I nearly fell off my chair!

Clair says

Hi,

I had agreed a settlement with pounds 2 pocket and I had an email from cash euronet on the 16th October saying my refund has been processed and will be in my bank within 7 -21 working days by electronic transfer. Will I still get this as it was processed before they went into administration? I’m guessing not as I would of thought all accounts would of been stopped.

Ciaran says

Hi Clair, I’m in the same situation although my email came on 22nd October. Have you spoken to them?

Clair says

HI Ciaran,

I called the number on the email and there was no reply. I didnt imagine I would get through to be honest. I have replied to the email asking if I will receive it I will advise if I get a response. I’m guessing we will not receive it.

Ciaran says

You can try 08000163114, I’ve been unable to get a straight answer out of them.

Clair says

Hi Ciaran

I have just just spoken to them and they have advised that any refunds that have been processed before the 24th Oct will still go ahead he explained it was sent via an EMT transfer? (I will look into that) so fingers crossed there is a tiny bit of hope. I’m not going to hold my breath it will be a nice surprise if it turns up.

Kj says

I called too as my money was agreed to be sent 15th October and they said this isnt true. No payments will be made until administration is wrapped up and we will be treated as unsecured creditors so please dont anyone get your hopes up. I just did and this has depressed me again

Clair says

It’s bad that everyone gets told different stories! I just wish they would be upfront!

I have no hope it will happen!

Clair says

Thank you I will give them a call.

I will advise if I get anywhere with them.

Jo says

To be honest, I think you’ve been given duff information. Now they have gone into administration nothing with be paid to folk that was agreed, at least for some time. Even then it will only be a small percentage of what people were owed. I spoke to them last week and was told no decisions about cases such as this had been made yet.

Caroline says

Can I ask I’ve had loans from both pounds to pocket and quick quid what do I do now please

james says

hi

can someone advise me i have a loan with ptp now passed over to a debt agency still paying it off? at £1 i did complan to fos both rejected it? now they have gone bust, just put another claim intto ptp,

where do i stand

Sara (Debt Camel) says

It is worth trying a Claim to the administrators when they provide a page to do this in a few months time.

But this may not succeed – the fact you lost the FOS complaint suggests you don’t have a strong case.

We don’t know what the Administrators will do with the outstanding debts. They may be sold to a debt collector.

In the case of Wonga the Administrators decided they couldn’t sell them, they have offered people a chance to settle and 25% of the value and have their credit record cleared. And it isn’t yet know what will happen to Wonga debts where people don’t take up this settlement offer – it is possible they may be written off.

But what happened to Wonga debts may not be the same in this different administration.

MLR says

How the hell did QQ get away with this for all them years. The FCA should hang it’s head in shame. In 2015, the FCA ordered CashEuroNet to write off more than 2,500 loans and refund about 1,500 people at a cost of £1.7m. They must have only looked at 2500 loans lol. The scale of unaffordable/irresponsible lending by QQ was huge. Their whole business model was based on bleeding vulnerable people dry! The FCA clearly did not look at my loans in 2015, or anyone else’s on these threads.

Shaz says

I just received this about a claim from the financial ombudsman. The complaint was about QuickQuid and Pounds2Pocket.

—–

Your complaint against Casheuronet UK LLC

As you may know, Casheuronet went into administration on Friday 25 October 2019. Chris Laverty, Trevor O’Sullivan and Andrew Charters of Grant Thornton UK LLP were appointed as joint administrators (the joint administrators) to wind down the business.

Unfortunately, when a business goes into administration we are required to stop considering complaints against it.

It’s now for the joint administrators to decide whether complaints about Casheuronet will be upheld – and whether the people complaining will become “creditors”. The joint administrators will also decide how much money any creditors will receive.

What does this mean for your complaint?

This means we can’t take your complaint about Casheuronet any further forward ourselves.

The joint administrators have now taken over Casheuronet’s business affairs. So we’ve let them know that you had an open complaint with us, so they can include you in the administration process – and let you know whether your complaint has been upheld and whether you’re a creditor.

Sara (Debt Camel) says

Thanks for sight of that.

Kate says

I had this email too. We will see what happens.

Joseph says

Has anyone received what looks like a scam email from QQ? It’s from the correct QQ email address? I’ve never requested this information. See below:

—

Dear Joseph *********,

Customer # 92*****

We discovered that a recent upgrade had created a “bug” in our system, which resulted in some of our customers not receiving their Summary Cost of Borrowing Statements when due.

As you know, the purpose of this statement is to provide you with information about your loan/s.

You can access your cost of borrowing statement by logging into your account

Jax says

Yes I’m getting those emails right out of the blue, started in March. My debt is from 2011 and I think I stopped paying them in 2012, so it’s over 6 years old. They threaten to hand the debt over to a collection agency if I didn’t pay them £1392 by the 1st April. No idea where that figure comes from anyway I ignored the emails. Then I get an email saying that because of the corona virus they won’t be handing over the debt to a collection agency. Ah gee these guys really have a heart after all………NOT

David says

Hi Sara,

I complained to QQ > Rejected, and then escalated to FOS but was rejected on the grounds was outside 6 month time limit. [Fair enough, I had about 10 other PDL claims at the time so missed it]

Will I be able to enter a claim now with the administrators?

Presume will be better to go via a portal if one opens, rather than customer services who have already offered their final response on irresponsible lending.

All loans were paid in full and on time [albeit using >5 other PDLs at the time as a funding source…]

Many thanks

Tim O says

Dear Sara,

Thanks for your brilliant site!

Can I pass on a few tips with my dealings with Casheuronet UK LLC;

> Both of their current complaint emails are not taking incoming email I suspect they put a stop on their email servers or have simply disabled the addresses.

complaint@quickquid.co.uk QuickQuid

complaint@onstride.co.uk On Stride Financial

> Best advise; I rang both the numbers below and filed;

Affordability Complaint – My current and previous loans sold to were unaffordable and I request a refund on the interest paid.

Unaffordability Complaint – My current loan that was sold to me was unaffordable.

If you have an open loan you are still in a contract so request the current loan to be converted to a hardship loan they send paperwork for you to fill in and return and then you have 6 months to pay so hopefully your claims will wipe out your debt and maybe even give you a late Xmas cash refund!

Good Luck Everyone and Never Give Up!! Tim

Mrs c says

Has anyone received a reply yet from FOS saying they have their best in the speed of sorting complaints ? They have said that 14 months is acceptable. Referring to the independent assessor now.

Joseph says

I referred one of my complaints to the Independent assessor over an 8 month wait that they deemed ‘acceptable’. I got £100 and an apology from FOS saying they are under heavy recruitment right now

Chantal Smith says

This was one of the worst companies I have ever dealt with that took over 2 years to respond to my FOS complaint and then by the time the funds were due to be repaid to me they went in to administration and the case is now all nul and void and I missed out on nearly £1500 refund for them letting me borrow too much. Absolutely devastated for myself and those others like me that missed out on this having waited so blooming long for them to act.

Andrew Kidd says

Hi –

I have been pursuing an affordability complaint with QuickQuid since July 2019. Some of it related to quite old loans, so I received the usual low offer response from QQ in late August. This wasn’t good enough so I decided to escalate to the FOS as per previous advice.

I got around to submitting the FOS complaint on 24 October – QQ went into administration on 25 October! Bad timing, yes, but possibly just in time on may part…

Does anyone have a view on whether my complaint will be captured in those already ‘in progress’ with the FOS, or whether I should submit a further complaint via the administrator’s redress page?

Sadly, it sounds as though I will not get the level of payout I would have done previously but will hopefully still get something slightly higher than I was originally offered. I think my complaint is worth around £2,650 before any statutory interest has been added. They initially offered me just under £100!

Sara (Debt Camel) says

I think your claim will be automatically put forward as you had a “live” FOS complaint. But wait for more details when the Administrators put live their Claims Portal Page.

Chantal Smith says

Complaints are now all null and void and what will happen now is, the same as what all the others have done. They will review their assets and their creditors and they may payout but it will be significantly less amount to you with what is left as they will have to share this amongst millions of claimants. I am going to be one of those claimants now but I was initially due almost 1500.

Sara (Debt Camel) says

Well not “millions” of claimants…

KS says

The adjudicator awarded approx. £8200 and my case was (still is as I have not heard otherwise…) in the queue for Ombudsman decision… I am still trying to find a legal(!) way to hold Enova responsible as what they did – and the way they did it – with CashEuroNet was technically fraud! Others might say I should let it go and nothing I can do about it now, etc. I might be on my own in this fight and against all odds but watch this space!

MLR says

At the moment sunny are playing the same game. It seems the stronger the case and higher amount of redress – the more likely for your case to not be upheld (same as QQ) they know the ombudsman queue has a waiting time of several months. They are just playing the system and testing the water, if they are not making enough profit and redress amounts keep building, they will just pull the plug. They do not care. The system is broken and by the time it gets changed, payday companies will be no more. I wish you all the best with your fight against Enova 👍🏻

Crissy says

Hi

Does anybody know if the Wonga administrators will be paying out a reduced refund by January 2020?

Thanks

Chantal Smith says

Hi, that’s what they have said in their latest email.

Ben says

Hi Sara,

From being offered around 3k in compensation, now what is a more likely figure ill receive ? 10quid? , 100? 300?

Cheers

Alex says

Hello. if I would like to set up payment arrangement plan with on stride, they will register late payment and default or they will update my credit file as up to date ( and will be mark special arrangement on my credit file?). I do not want to damage my score and it is a main factor to set up arrangement or not? they will freeze the interests or not? what the law say about it? what to wait from them in this situation?

Dave says

Hi Sara, I put in a complaint back in January and was told I’m not eligible because I had left the complaint too long as it was more than 6 years since I took out the loan and that I only had 6 months to contest. I dont know if this is them trying to be unjust and fob me off.

I took out roughly 3k in loans and they’re claiming I still owe them 1k. What would you recommend that I do

Sara (Debt Camel) says

I think when the Administrators put live their Claims portal, you are likely to be able to submit a complaint.

Eddie says

My position is somewhat different. QQ had my details down as having made me a loan which is in default. I have had correspondence with them in which they admit that no loan was made and that there is no default. I have sent the admissions from QQ to CheckMyFile but they say that the default on my credit reference can only be changed by QQ. Clearly QQ will now do nothing and I am left with an incorrect default which impacts on my obtaining credit. As I say the written evidence from QQ is that CheckMyFile (and TransUnion) are reporting incorrect information but with QQ now in Admin no one will deal with my issue. Any advice or help please????

Sara (Debt Camel) says

I think the administrators will correct this.

Chantal Smith says

I’ve got the same problem with Lending stream and my checkmyfile. It shows in there that there is a defaulted loan with Lending Stream but one of the resolutions after my complaint was resolved was for all negative information to be removed about any of their loans. I’ve contacted the fos about it, experian and Lending Stream and nothing is happening. They are not in administration or anything so I’m at a loss as this is impacting us getting a mortgage at the moment as it should be removed. Other than keep pestering them does anyone else have any ideas of how I can get this removed?

Sara (Debt Camel) says

Was this decision agreed directly with LS or via FOS?

Chantal Smith says

The FOS wrote to them and told them what they should do. They agreed and this was one of the conditions to resolve my complaint that the FOS told them. When I spoke to Lending Stream they told me they had done it and there was nothing else they needed to do. They also gave me a reference number that Experian gave to them when they logged this. When I went to experian about it they didn’t seem to know and said I needed to contact Lending Stream. I’ve contacted the fos about it and they said they would contact Lending Stream. I’ve chased the Fos about it again today as I found out it still had not been done and they have said they are going to escalate it to the relevant teams and chase Lending Stream again about it. I am frustrated as this is nearly a year ago now that the loan was settled with my funds from the claim and it is still showing as a default on my credit report with Experian only. Not with Trans Union or Equifax. So it looks like some of them updated their records correctly, but not Experian.

Sara (Debt Camel) says

was this an adjudicator decision or an Ombudsman decision?

Chantal Smith says

Hi Sara, it was an adjudicators decision.

Angela Cooper says

How soon will we know if we are receiving any refund? ike some of the others I put this claim in a long tond ago. My claim is with the F.O.S.

Kind Regards

Angela Cooper

Sara (Debt Camel) says

At a guess it will be about 12-18 months. Well you may know sooner what the value of your Claim is, but now what percentage will paid out on it. Sorry.

steven says

I complained to fo and they sided with QQ and said my loan was affordable my question is now they have gone bust should I try again

Sara (Debt Camel) says

did you only have 1 loan from QQ? Any loans from Pounds To Pocket?

Sophie says

Hi

I had an agreed payout from quick quid before they went into administration. I had a debt with quick quid of £934 which they had sold to another company, quick quid had agreed to clear aswell. I am now getting letters from the debt company saying i owe them £934. Not sure what to do????

Thanks

Sara (Debt Camel) says

I suggest you send the debt collector a copy of the QuickQuid decision and ask them not to take any enforcement action until your QQ complaint is resolved with the administrators.

Sophie says

Thank you, I will do that.

Steven says

we should take our cases to court, and we shall do it

Sara (Debt Camel) says

In the UK? You can’t bring a court case now the company is in administration.

In the US? I know nothing about that. I have no reason to think you could win a case in America. Sometimes you are ethically right but the legal structure of companies shields the parent company from being pursued by creditors of a subsidiary which is a limited company.

Michelle says

Hi , My claim went to the Financial Ombudsman and P2P admitted the loans were unaffordable and I was offered £1500 compensation which I accepted on the 2/10/2019, I was told by the financial ombudsman That I should hear within 28days regarding the refund. Yeah right not gonna happen now. Settled my balance in January this year and my credit file is full of Defaults from P2P since then.

Sara (Debt Camel) says

These defaults will eventually be removed. Very frustrating for you.

Len says

I currently have a loan with On Stride, but also have years of Quick Quid loans that I need raise a complaint / claim against. Obviously I know I’m unlikely to get much back now, but should I stop paying my current loan?

Sara (Debt Camel) says

That is a tricky question.

If you have had “years” of QQ loans it is pretty likely you will have your claim accepted by the administrators. And it is also likely that there will be a “set off” between the On Stride loan and the QQ refund. But I can’t say either of those things is completely 100% certain.

If you get a refund calculated and there is a set off you will be MUCH better off if you stop paying the current loan. But if either of those doesn’t work you are risking getting a default on your credit record that won’t be removed.

Are the current repayments actually affordable without leaving you so short of money you have to borrow again?

mirko says

Hi Sara

i was waiting for an ombudsman to decide when quickquid entered admin.

still owe around 130 to them but they charge 60p a day in interest. had few loan with them and likely the decision would have been in my favour.

however , what do you recommend now that they are in admin.

to pay or not to pay the balance off ?

thanks

Mirko

Sara (Debt Camel) says

See my answer to another reader: https://debtcamel.co.uk/quickquid-casheuronet-administration/comment-page-2/#comment-328510

Danny says

Hi Sara

First off thanks to your site i’m now debt free and in the next couple of months should be due around £4,500 back from Sunny! I have a question regarding a couple of loans I had with QuickQuid.

Took out first loan on 03/09/2018 for £200 which was paid back a month later, took out 2nd and final loan on 23/10/2018 for £400, this came with a large final repayment due of £491 at the end of January (as well as £100 a month leading up to it).

Unfortunately I couldn’t pay that and entered into a payment plan, I missed one payment 3 months into the payment plan and spoke to someone on the phone to confirm I will clear the remaining balance of £251 at the end of the month (which I did), after that missed payment a default was put on my credit file. My inital irresponsible lending complaint was rejected by QQ and then was with the FOS when they went under.

Do you think the administrators are more likely to agree with me on the 2nd loan so I can finally get my only default removed? At the time of taking out these QQ loans I had a 5 year history on my credit report of paying back payday loans around £800-£1000 every month without a gap.

Worth noting that the Wonga administrators have agreed that only the first loan out of 69 with Wonga dating back to 2012 was responsible so hoping my payday loan history will work in my favour.

Sara (Debt Camel) says

We don’t know yet how the QQ administrators will be assessing complaints.

Laura says

Hi Sara

Wonder if you can help me. I accepted the FOS settlement offer when it came to my ‘irresponsible lending’ claim against quick quid, when I added the amounts together it came to quite a lot of money. Of course I never receive this amount from Quick Quid or had another offer but today I have received an email from Casheuronet and I am now considered as an unsecured creditor for the value of the offer and that they would not expect to be able to identify a date for distribution of all upheld redress claims until earlier Q2 2020!!!!!!!!! In addition, they have also said, it is highly likely that the payment that I will receive will be much smaller than my claim amount. When they say much smaller, do you have any idea percentage wise??

thanks for you help Sara

Sara (Debt Camel) says

No it’s going to be a long while, but it’s probably best to expect it to be very low :(

Martin says

Hi

I had a loan with them and they put my credit file into default, which I believe was incorrect as certain things where agreed prior to this and I believe (strongly) it should be removed, but who do I contact about this as it should be the company that deals with this but it’s now taken over by administrators?

Thanks in advance

Sara (Debt Camel) says

You can email the company. It may not be resolved speedily but it should be looked at eventually.

Sarah Thomson says

Hi there, I have submitted a claim to Quick Quid. I have been using them for 10 years, approx 6-7 loans per year. They have came back to me asking for bank statements and payslips. Do I have to provide these? It is going to be a real hassle getting that amount of payslips and bank statements. Thanks for any advice

Sara (Debt Camel) says

I don’t know if they would be looked at now QQ are in administration. If you get bank statements there’s no need for payslips.

Chantal Smith says

Hi, when I did my claims I did have to provide bank statements covering the whole period of all my loans, so I’d say bank statements is a fair one, but like you say payslips could prove more difficult. I’d point out that you would struggle to get the pay slips and possibly the bank statements too, but the bank statements should show your salary being credited each month, so this should cover the payslips part. Hope that helps.

Sara (Debt Camel) says

Yes but now QQ is in administration, they may well be taking all decisions by computer and no one will look at paperwork but this isn’t definite.

Allan says

I submitted a claim for irresponsible lending by QQ and received a rejection in July. Can I still refer this to the FOS if before the 6 month deadline from their rejection letter despite QQ being in administration ?

Sara (Debt Camel) says

I doubt FOS will look at the complaint. But as you are getting close to the 6 month deadline, I suggest sending it to them.

Chantal Smith says

I doubt the FOS can do anything now and you will have to wait until the administrators open the claims portal and go through them now. Your claim however will be significantly less than it would have been if the company was still trading. It’s all a waiting game now and just about keeping your eyes pealed on the QQ website if the administrators post anything about a claims portal.

SMW74 says

Not sure why QQ is still sending out these (automated?) emails as surely now it’s in administration, the FOS can’t do anything? Be interested in your thoughts Sara.

Dear XXXX

Customer ID:

Further to your complaint dated Oct 16, I am sorry that we have been unable to provide you with the results of our investigation to date. We require additional time to evaluate and assess your matter in order to fully consider your complaint. We apologise for the delay and hope to respond to you within the next two weeks. Thank you for your continued patience.

If you are dissatisfied with the progress of the investigation into your complaint, you may refer your complaint to the Financial Ombudsman Service (FOS). You have the right to refer your complaint to the Financial Ombudsman Service, free of charge but you must do so within six months of the date of this letter. If you do not refer your complaint in time, the Ombudsman will not have our permission to consider your complaint and so will only be able to do so in very limited circumstances. For example, if the Ombudsman believes that the delay was as a result of exceptional circumstances.

I have provided you with a link to the FOS leaflet to assist you should you decide to pursue this further.

Sara (Debt Camel) says

because they are automated and the administrators will need to get system changes made to stop them.

SMW74 says

Thanks Sara – I assumed that was the case.

Alex says

Hi Sara,

Firstly thanks for all this very valuable information, great work.

I had 4x p2p loans consistently from July 2017 to an ongoing payment plan for the last loan till now.

With the first loan (£1,200), I got a top-up option after 4 months (Nov’17) and took it, so new loan (with old one being paid off) was £1,680. Then in Feb’18 I got a bonus and paid off the current loan. In Apr’18 I took a new one for £1,850, against with a top-up available 4 months later, same thing again, old loan closed and new one was then £1,780. in Aug-18. Then in Feb’19, I couldn’t make payments anymore and arranged a £100 per month payment arrangement, there is still around £950 to pay.

Do you reckon I should stop paying as a bigger change of getting a settlement or continue paying, but risking of never getting more than £900 back? I haven’t made a complaint yet.

Would be great to hear your thought.

Thanks,

Alex

Sara (Debt Camel) says

I think that sounds like a lot of borrowing as the loans were so large. But I can’t tell what the calculated compansation might be.

I think you should make a complaint now. And then if that is larger than your balance, your best move may be to stop paying them now. Or in 9 months time when they may be ready to pay out compensation, you will only get a small part of that.

Yvonne Potter says

https://www.theguardian.com/business/2019/dec/14/whistleblower-reveals-financial-ombudsman-service-in-disarray

Emily Baker says

Hello

First time posting and probably found the site too late. I too was due over £9000 in redress when they went into administration. I’m trying to be realistic but from looking at accounts at company house they don’t seem to have any assets to sell or cash in the bank. I don’t know much about it all if I’m honest but I’d rather know now if it was all over than be years to hear the same thing

Sara (Debt Camel) says

We don’t really know anything until the administrators publish their proposals. I think it’s sensible to keep your expectations low, then any money you get back in the end is a bonus.

Jonathan says

Hi Sara.

I submitted your template email to QQ complaints.

they have now responded, requesting bank statements at the point I took out loans, payslips at the point I tool out loans, any additional information, date of my first loans and wanting to know how long it took for me to realise that QQ were responsible for any financial difficulties I faced.

Do I have to/should I provide this? I wouldn’t know where to begin gathering all this information.

Sara (Debt Camel) says

are any of your loans over 6 years old?

Jonathan says

Yes, probably. Does this make a difference?

Sara (Debt Camel) says

So you don’t have to privide any of this. I suspect this is just an autometed request being sent out and the administrators will not actually look at any of it.

I also expect the administrators to automatically include all loans over 6 years – that is what the Wonga administrators did and it is the same administrators now handling QQ! But if they don’t, you may be asked to say when you first heard you could make an affordabiltiy complaint.

Jonathan says

Thanks Sara. Without having sent any further details to quickquid complaints, I have just received an email assuring me that the investigation of my complaint is still ongoing and that they will contact me again – within eight weeks from the date of my complaint.

Ciaran says

Did anyone just get the joint administrators proposals email?

Crisdy says

No not had anything ? Was expecting refund of £2100 before they went bust ? What does e mail say ?

Sara (Debt Camel) says

here are my detailed thoughts on the proposals and the Voting: https://debtcamel.co.uk/debt-options/less-common/full-final/

Mary says

Hi if I have already had a redress paid would it be reconsidered by the administrators?

Sara (Debt Camel) says

Possibly, but this won’t be known for definite until the Claims Portal goes live in 2 Nd quarter next year.

This was possible with the Wonga administration. What loans were excluded from your refund?

Ben says

What a disgusting disarray the FOS is. I waited 2 years for my case to be processed through to a settlement fee. Only to be quashed at the last minute. I’m sure they were sorting all the little claims first so the resolution rate looks good on paper. Disgrace.

Chantal Smith says

I and thousands of others are in the same boat as you. Now we will be lucky to get anything. It’s terrible that they took so long to process them and just kept making money out of people only to find that they then had too many claims against them that they couldn’t afford to pay and found the easy way out. Let’s go to the administrators and then we don’t have to do anything anymore. Absolutely terrible.

Ben says

Hi Sara, what is a rough idea of the figure people will be receiving if you have any idea? For example, if I was due a settlement of 3000?

Sara (Debt Camel) says

No idea!

Alex says

Hello. what do you think can I win irresponsible lending case if I have only one loan from onstride, but on my credit karma report I had over 10 open accounts and 4 of them was on payment arrangement and one late payment acc on that time when I took loan from them?. now onstride is my second late payment account! actually I want they remove my acc from credit reference agencies

Sara (Debt Camel) says

How large was the loan>

Alex says

I borrowed 1400£ for 16 months. I paid 3 instalments ok, couse I borrowed from another lender some money to pay for onstride loan. but now I I do not have money to pay and they registred late payment straight away. may be better to set up arrangement for now with a small instalments and to wait when they offer low settlement how it was with Wonga? how likely they default my loan and sell to debt collectors while they under administration? what the law say about it?

Sara (Debt Camel) says

That is a big loan so it may be possible to win an affordability claim. If you do, the interest will be removed so overall you will only pay back what you have borrowed. And you may get an offer to settle that for less but its not guaranteed.

Your credit record is already harmed. The administrators will only remove the late payment marker if you do win a complaint.

the administrators can default the loan if you are three moneth behind with payments and can sell it to a debt collector. But they may not.

It is possible they won’t sell debts – they decided not to with Wonga. Or they may sell all outstanding loans even the ones that haven’t been defaulted. or they may sell loans where there hasn’t been a complaint. Or any other combination – the law doesn’t say what they have to do. If they don’t sell the loans at some point you may well get offered a low amount to settle the balance.

Tina says

Hi Sara

How do I get in touch with Onstride to arrange a repayment plan now that they have closed down?

Best regards,

Tina

Sara (Debt Camel) says

Is this your first loan with them? Was it large?

Tina Pousley says

Hi Sara

Thanks for your reply.

Yes it was my first loan with them and no it wasn’t a particularly large loan, just £1500.

I am just wondering how I can get in contact with them to arrange an affordable repayment plan as I am off work sick and cannot afford the contractual repayments at the moment?

Many thanks,

Tina

Sara (Debt Camel) says

£1500 is a large loan if you had a poor credit record. You could put in a complaint about unaffordable lending ny emailing complaint@onstride.co.uk and say you can’t afford the repayments, they should have realised this at the start of the loan and also you are now off work sick and can only afford £5 a month (or whatever you really can manage without getting behind with essential bills) until you are back in work.

Charlie says

Sara, can you help with this one please. So I had a loan with Onstride (pounds to pocket) £1200 in December 2018, I have made 9 payments of £178.99 and one of £198.31 totalling £1809.22. I fell into arrears on this loan in September when I could no longer afford to make payments. I put in an affordability complaint in June and heard nothing, wrote to ombudsman on beginning of October and also emailed onstride at the same time to say I was taking it further. In November I heard back from Onstride to tell me that they would not be upholding my complaint and that I needed to pay back all the remaining amounts. I have now set up a payment plan as I cannot afford to continue paying the full amount. The ombudsman obviously let me know they were unable to continue to investigate. I am now wondering whether I do continue paying or not, I feel that I should have not been given the loan, I had many other loans and credit cards at the time. I have paid back more than I have borrowed too but just feel stuck and helpless with the situation as the ombudsman can’t help and they know that. Any help with this one would be appreciated. Worth pointing out that I already have a default notice on file.

Sara (Debt Camel) says

Some facts (which you probably already know but others reading this may not):

– as someone with an open FOS case, it is possible a Claim will automatically be generated for you but if it isn’t you will be able to submit a Claim on the portal the Administrators will be setting up.

– if your Claim is upheld your balance would be cleared through the right of set off and you will receive a refund of a percentage (unknown, may be small) of the c. £600 over the principal amount that you have already paid.

The key unknown is whether the administrators will uphold your complaint. It is possible to win a “one loan” case at FOS when the loan is large, like yours, but how the Administrators will assess this sort of Claim I don’t know. I’m sorry but there is no useful experience to go on here in administration. Neither Wonga nor Wageday Advance went in for the large loans that OnStride did.

If you carry on paying, you will be worse off if your Claim is upheld than if you stop paying.

As you already have a default for the loan, that isn’t relevant to your decision.

If you stop paying you will no doubt get some cross emails and texts. But really the worse that can happen is that they sell the loan and you lose your claim and you have to then set up a payment arrangement with a debt collector. Who are often easier to deal with than payday lenders!

Reece says

Hi Sara,

I want to put in a claim for both QQ and Pounds for Pocket, can I do this within one email or do I need to do two separate cases? Also I can’t remember what email address I used to apply for them originally as it was nearly 10 years ago now, does that matter?

Sara (Debt Camel) says

One email should do but be clear you borrowed from both brands.

If you don’t remember your original email, give your full name, date of birth and the address if your house at the time.

Michael Taylor says

Hi Sara. I had numerous pay day loans from over 6 years ago with quidkquid that were upheld by the FOS. They gave quick quid 21 days to respond and in that time they went into administration. Any advice on next steps?

Sara (Debt Camel) says

You have a Claim. The administrators will be setting up a page where people can input Claims, it may be yours will be fond automatically but thus isn’t known yet. Your claim will then be assessed and you eill get paid a percentage of the calculated amount at sone point, perhaps 9-12months away. I suggest you keep your expectations low to avoid disappointment.