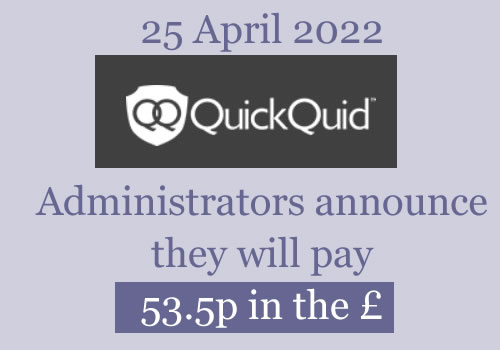

Payments – UPDATE – 25 April 2022

Administrators have started sending emails to everyone with an upheld claim telling them what they will be paid.

“The Joint Administrators are now in a position to declare a first and final dividend of 53.5p in the £”

The average claim value is c £1,700. Someone with that claim value will get a payout of about £910.

The payout details are given in the email:

- This will be paid over the next two weeks.

- If the administrators couldn’t validate your banking details, it will be sent by cheque. I don’t know how the administrators will “validate” your details.

- If you used a claims company, the money will be paid to them.

- Most people are not having any deduction for tax paid to HMRC, so there is no need to reclaim anything.

Credit records

The administrators may decide to :

– remove any negative marks on your credit record

– delete all loans that were upheld

– delete all your loans.

I don’t know what they have chosen to do – if people can check and report in the comments when they see a change, that would be great.

How much your credit score will change will depend on whether there were any negative marks. If you want to get a mortgage, you would like as many payday loans gone as possible, even if they were repaid on time and not hurting your credit score.

In a few months when the administrators no longer talk to the CRAs you can ask for any remaining loans to be “suppressed” so other lenders can’t see them. See https://debtcamel.co.uk/correct-credit-records-lender-administration/ but it is too soon to do that now.

QuickQuid went into administration in October 2019

CashEuroNet (CEU), which owns the QuickQuid, Pounds To Pocket and On Stride brands, stopped giving loans and went into administration on 25 October 2019.

I will be talking about QuickQuid (QQ) rather than CashEuroNet as it is the more familiar name. Everything here also applies to loans from Cashruronet’s other brands, Pounds To Pocket and On Stride.

Grant Thornton were appointed as Administrators. They set up a page about Redress Complaints – this is their term for people who have asked for a refund because they were given unaffordable loans.

Background to the QuickQuid Administration

QuickQuid was one of the “Big Three” payday lenders in Britain, starting out in 2007.

After Wonga and the Money Shop Group had all stopped lending and gone bust over the last fifteen months, QuickQuid was left as the largest UK payday lender.

QuickQuid had well over a million customers. When it went into administration there were c. 500,000 customers with outstanding loans.

Many of these customers had prolonged borrowing from QQ. They either rolling loans over or repaid one loan but were left so short of money that they had to borrow again.

These customers have good reasons to win an affordability complaint and get a refund of the interest they paid.

Affordability complaints started on a small scale in 2015 and increased in the next few years.

In 2018, complaints going to the Financial Ombudsman (FOS) jumped with the involvement of Claims Companies and QuickQuid became the most complained about firm to FOS, excluding PPI complaints.

For a long time QQ refused to refund interest on any loans taken more than 6 years before or where the loans were given in 2015 or afterwards. This resulted in a huge backlog of claims at the Financial Ombudsman, where QQ had made very poor offers to customers and then rejected an adjudicator decision.

In late July 2019, QQ agreed to accept several thousand FOS complaints it had previously rejected.

By accepting the FOS decisions on loans over 6 years, long chains of borrowing, and loans taken after 2015, the scale of QQ’s likely future liability for refunds will have become clear to the company.

After failing to persuade the FCA that a Scheme of Arrangement was appropriate, Enova, CEU’s large and profitable US parent, decided to close the UK business, blaming the UK regulatory environment.

How could the regulators let this happen?

This is an excellent question… Stella Creasy, MP called for an inquiry into the FCA over Wonga and QuickQuid.

What has happened in the administration

Customers with a valid claim for a refund are “unsecured creditors”. This includes:

- any refunds that were in progress after an amount was agreed or a Final Decision from a FOS Ombudsman (FOS);

- complaints that were underway at QQ or FOS when QQ went under;

- any new complaints sent to the Administrators.

All complaints at FOS legally had to stop and were been passed back to the Administrators. It isn’t possible to send any new complaints to FOS.

It is now too late to submit a Claim for unaffordable lending. The last date was 14 February 2021.

The administrators have given the following statistics about claims:

- 169,000 customers made claims for unaffordable lending;

- 78,000 claims were upheld by the administrators;

- the upheld claims had a total value of £136million, so an average of about £1,700 per claim.

Still owe a balance on a QuickQuid or On Stride loan?

More than 300,000 of the current loans were sold to Lantern in summer 2021. You should have been informed if your loan was sold.

The administrators have now stopped collecting any money from the remaining unsold loans.

This page is kept updated

The comments below this article are a good place to ask any questions. And you may be able to see where someone else has already found out the answer.

Daniel says

Hey all, I’m conscious that some say wechavecto be paid by March and others saying it could be later.

My question really is has anyone been paid out yet?

Sara (Debt Camel) says

no.

first everyone will be told what the % payout will be.

When that happens there will be lots of comments here saying it.

Paul Smith says

What on earth is going on here firstly they paying in March now April ! For pity sake talking about dragging their feet totally unacceptable

Sara (Debt Camel) says

they said last year that the March payout was conditional on them getting the tax clearance – it came late – everything pushed back a month.

Kizzy says

Hi,

I contacted them via email on Friday and asked specifically if anyone would be paid before the end of March. They replied and said that it was “unlikely”, but payouts would be completed before 30th April now that they have been given HMRC clearance. They are still unable to give an exact percentage.

Nothing new there, but they are more confident about the redress payments being made before the end of next month.

Robert says

Annoying to say the least. I would’ve thought in this day of computers, spreadsheets & electronic automation they could get some of payments out this month.

Oh well, April 30th it is then. Too late for me, for I will have to find the money I need some otherway.

Jak says

I did ask them as the Hmrc had given authority why did they need the extension as they should have been virtually ready to make the payments to us and she couldn’t answer that. The go ahead from hmrc came through the day after they had applied for an extension. So surely it is not needed, I’m at a loss

Sara (Debt Camel) says

It is pretty pointless getting cross about this. The money will come.

Sara (Debt Camel) says

While everyone is waiting…

Think about whether you can make any other affordability complaints!

I have template letters for different sorts of borrowing, it’s not just payday loans any more…

– SafetyNet Credit, Drafty – the payday loan template works well for these complaints which are often easy to win as the lender could see your bank account! https://debtcamel.co.uk/payday-loan-refunds/

– credit card or catalogue limit raised too high when you were only making minimum payments? See https://debtcamel.co.uk/refunds-catalogue-credit-card/

– have you been in your overdraft for all or almost all of the month for years? See https://debtcamel.co.uk/get-refund-overdraft/

– large loans and car finance: https://debtcamel.co.uk/refunds-large-high-cost-loans/

neil says

Sara, I am considering stocking one in against vanquis. I have a letter that shows they upper my limit automatically back when I was just starting out on all my bad decisions. And I was always paying them like 100 quid a month to cover over limit fees etc only to go over again the following month. Only thing is it was more than 6 years ago they upper my limit. Is it worth doing do you think? And can they cancel my card if I do? Want to put in for a mortgage soon so don’t wanna rock the boat too much. Thanks for everything by the way. You’re a legend and have helped so many people.

Sara (Debt Camel) says

Vanquis will reject it as it is more than 6 years ago but FOS is deciding you can look at a lot of these complaints if you only found out about affordability complaints in the last three years.

In theory they could close the account, but you would still be able to repay it in monthly payments and they can’t record defaults or missed payments if you do. But if you just carry on with the payments they are unlikely to do anything.

Jen says

Thank you Sara for all the advice you give- it’s invaluable! Your advice and templates gave me the confidence to do just this- both Lending Stream and Drafty were very prompt in responding and paying out (less than 2 weeks from my original complaint!!!) . I was VERY (pleasantly!!) shocked to receive £2,516.62 from Lending Stream (but looking back I did have 28 loans in a 3 year period-back then I was taking a new loan out almost every month), and Drafty a £646.75 refund. I have also put a complaint in to 118 118 Money for loans I had but other than an email acknowledging my complaint I’ve not heard anything back yet – it will be 4 weeks tomorrow- I know they have up to 8 weeks to respond- has anybody else any experience of 118 118 Money loans?

Without your templates I don’t think I would have complained – not knowing what to say, etc. and not knowing how simple it was to do- so thanks again Sara!

Sara (Debt Camel) says

118 often reject good claims, so send your straight to the Ombudsman if they do – lots of cases being won there.

The comments below the Large Loans page are the best place for asking about 118 as you may Get a reply from someone who has been in your situation.

Nick says

Hi Jen, I submitted a complaint with 118 and it took its time, they replied on the last day of the 8th week telling me it’s going to be another week, then they rejected my claim. Passed it on to the ombudsman who held up my complaint. All in it took about 14 months.

Roy says

Hi Sara firstly thank you for the updates they have a great help. Am not sure if I have been stupid or not but I have recent seen these pcp and hp claims for car finance over the last 10 years saying I can claim for being miss sold but am not sure if these are genuine companies or these are scams the company I used was xxxxx and am not sure if am being scammed or these are genuine companies.

Sara (Debt Camel) says

These companies mostly seem to be making claims saying that many lenders concealed their commission structure and you may have paid too much for the car finance because of this. I don’t have any idea how likely these claims are to work.

The claims I talk about are affordability complaints.

Roy says

Ok great thank you

Tony says

Hi, my debt was sold to Lantern and (thankfully) I’ve only got £90 left to pay. However, when lantern bought my debt they added the default to my credit file which has pulled my credit score down. I’ve been paying them for a while and have spent the last 3/4 years scrimping and saving to clear debt and improve my credit score. Does anyone know if QuickQuid/Lantern will follow other companies and remove the debts an details from credit files?

Sara (Debt Camel) says

did you make a claim to the administration?

Tony says

Hi Sara,

No, I’ve not made a claim yet. I only just found out about the administration. Is the best course of action to submit a claim of inappropriate lending?

Thanks

Tony

Sara (Debt Camel) says

no you are a year too late to do that. I am sorry there is nothing you can do now.

Tony says

Hi Sara,

Am I too late to have this removed from my credit score? I’m not too bothered about claiming a refund, I’m more focused on repairing my credit score.

Thanks

Tony

MR ASHLEY CLARK says

Hi Tony,

i had a CCJ through Lantern and it has now been set aside and will be off my credit file soon. And they deleted by balance of nearly £400

Tony says

Hi Mr Clark,

Thanks for sharing this. Can I ask how you went about this? Was it a claim you submitted?

Thanks

Steve says

Hi all

Hope you are well

Just to say I finally found out my accepted value claim (I.e the figure my % will be calculated against)

I was really worried as could see many people in this chat before had this info but I didn’t

But after emailing them today they confirmed my value claim. Previous emails told me I had to wait and told me nothing.

Just need to wait on final % and when the funds will be paid.

Daniel Oliver says

Could the final payment amount be reduced if the keep delaying payment as surely this increases overheads?

Sara (Debt Camel) says

There is a months delay because HMRC clearance was slower than expected. There is no sign that this is being delayed so they make more money.

paul says

That’s rubbish and you know it Sara.. they haven’t completed the overpayments, so there is a lot more to it than that. It’s delayed because they are slow and not very good at what they are being paid to do. There are emails going out to people about overpayments today.. the amount of time that has taken is incompetence

Sara (Debt Camel) says

I don’t know that at all. Really I spend a lot of time calling out lenders, debt collectors etc about bad practice. Why do you think I wouldn’t do this with administrators?

Adam says

They haven’t even said that they will make the payments next month only that they anticipate to. If the HMRC bit is complete what is to stop them saying they will make the payments by the promised date? I anticipate this could run on and on.

Sara (Debt Camel) says

And I am saying there is no reason to anticipate this. Just because you are deeply suspicious doesn’t mean there is any reason to be. Nor is there any reason to worry a lot of people reading this.

Dave says

Afternoon folks just got my email to say I’ll receive my overpayment in next 14 days.

This IS NOT the unsecured dividend payment, which I presume will be covered later in another email

Mel says

Can anyone tell me how long from email advising your overpayment is coming to when you receive the money? I have just had an email and to say I’m over the moon it an understatement, overpayment I’d calculated was just over £300, email days almost £500. My redress is going to be small, so this makes up for that

Tim says

I received my overpayment email back in December, and was told told 14 days for payment. It actually cleared in about 3-4 days

Adam says

So surely there is nothing stopping them saying they WILL make payments rather than – anticipate, should, expect, etc….. Just to be clear they have not said payments will definately be made before the end of April?

Sara (Debt Camel) says

there is simply no point in getting worked up about this. Who is it helping? No-one.

They are not delaying things deliberately.

owed 14k says

I said I would not respond in here again but I feel I need to.

Payments were going to be paid by end of March. Everything would have been in place to make payments by end of March. They only needed to wait on HMRC. HMRC came back the day after they requested an extension. IF everything was in place then why could they not just carry on? WHY INDED.. Ask yourself that? There is no need for extension now as HMRC done their bit. So ask yourself WHY.

Now what affect will there be on a months extension? No extra work as this would have been done to pay by end of march if HMRC had done their bit. SO.. what changes. 1. The administrators charge an extra months work. 2. I wonder how much almost 100 million in a bank makes on interest in a month?

Sara (Debt Camel) says

I wonder how much almost 100 million in a bank makes on interest in a month?

very little. And what is earned goes into the pot for refunds.

i am not publishing anything else saying the administrators are making a load of interest from the delay – it is simply wrong.

Adam says

Thanks Sara for all your help. I’m fortunate enough to not be desperate for the money but after two and a half years their reluctance to comit to any deadline is ridiculous.

Sara (Debt Camel) says

https://en.wikipedia.org/wiki/Serenity_Prayer

Mark says

What is the Overpayment? I’m not sure I understand how it works…..Thanks in advance.

Sara (Debt Camel) says

An overpayment happens either when someone has paid too much to a loan in error or when they have made payments to a loan during the administration after the point where it was decided to declare a dividend and that loan has been decided to be unaffordable.

Danny carmody says

hi sara, do not some people say your talking rubbish, your here helping us all, yes QQ are been a right pain, they have replied back when l asked for help and phoned back when asked, we just now have to wait till april, and hope that works out for all of us, if it was not for your site and help no one would not know what is going on, my self wish to thant you for what you are doing,

mark brooks says

well said danny

Bernie73 says

@MR ASHLEY CLARK and Sara

Hi

I also have a CCJ against me from Lantern (or their legal side Moriarty Law) who I rang yesterday to try and resolve this with them. The CCJ was done whilst I was overseas and due to circumstances, I never got the warning they were taking me to court. This was done in April 2018 and I returned to the UK in 2019. Anyway, they have been quite aggressive on the phone and have threatened enforcement if I do not pay 50% of £1151.00. I had to ring the court yesterday to actually find who too me to court! I’m now quite worried about this enforcement and have offered £400 to clear this debt but they have flatly refused. Any advice on how to go forward, Sara? Thanks

Sara (Debt Camel) says

was this for a QuickQuid debt? Did you make a claim to the administrators?

Do you have other problem debts as well?

Bernie73 says

Thank you, Sara, for your prompt reply. Yes, I have had a claim accepted (combined QQ and P2P) and, like everyone else, I am just waiting for the payment. This is why I thought I would offer the £400 to clear the £1151.00 but they want 50% and I just don’t have it. I don’t have any other debt problems. Thanks

Sara (Debt Camel) says

Then I would do as Ashley has just suggested.

Bernie73 says

Hi Ashley/Sara

Thanks for taking the time to comment.

Does it matter that the debt was taken to court before they went into administration? Thanks

Sara (Debt Camel) says

No – the loan was unaffordable. There is a procedure to remove (“set aside” is the legal jargon) CCJs.

MR ASHLEY CLARK says

Hi Bernie,

Have you had your redress confirmed? if so get an email off Casheuronet to say that you shouldnt have a CCJ against this debt now. Then i emailed Moritary Law the details and they passed it on to Lantern. it did take a few months but it has been sorted now. Just waiting for the CCJ to come off my credit report but that should be a matter of weeks now.

Bernie73 says

Thank you both! That’s great news! I will email Cash Euro Net now for the email. Or, could I use the one I was sent that has the loans on that were sold? Thanks

Brian says

Hi everyone did any of you go thru a 3rd party for your redress I went with CLEAR LEGAL MATKETING I’ve not heard a thing from them they have no email address or phone number the only way I was able to message them was thru Facebook Messenger but they haven’t replied to that

Sara (Debt Camel) says

Their website has a phone number. They are FCA regulated so you can make a complaint about them.

Brian says

It’s sorted now I did say to casheuronet about them told them my concerns & they removed the 3rd party from the claim

Sara (Debt Camel) says

OK, But it is possible that in future the claims co may ask you to pay their fee. If they do, consider a complaint to the Ombudsman.

OddBall says

No more Negativity on this page please!!

Anyway This is so true Brian, I am afraid to tell you. I used Ashley Howard. I was originally offered £500 from QQ. Ashley Howard told me to go through the ombudsman, I did this. Then the ombudsman took on my case. Ashley Howard said they have been taken off the claim and I was to pay their Invoice of 33% plus VAT on £500 when I haven’t got anything and they advised me to go to the ombudsman. When QQ went into liquidation I was told but the ombudsman that the claim will now be done through Grant Thornton. I am lucky to say that the refund I hopefully will get will be more than the £500 but the 3rd party people are pretty rubbish really. I wish I went through the ombudsman first. They have a lot of work on but ultimately very good at what they do

Lyns says

Hi Brian. I didn’t hear from my third party claim company for over a year. I went through their contract that we both signed and there was a term for a minimum amount of correspondence. It was supposed to be every 6 months. I complained stating that they were in breach of their own terms and asked to leave the contract by means of repudiation. I got a letter about 3 weeks later and I’m now out of the contract. They’ve since closed the company and I get the redress all to myself.

Dan says

I am reading that people got emails telling them that payout will be April 2022.

I have heard NOTHING since my claim was accepted.

I have tried to ring them twice recently and never get an answer.

Is this usual to have no correspondence while the claim is processing?

Dan

Sara (Debt Camel) says

The people getting the correspondence signed up on the Grant Thornton portal to receive updates on the Scheme.

bob says

hi, whats the latest with quickquid redress payments? this seems to be taking a very long time now, are we still expected to get paid in March?

Sara (Debt Camel) says

No. See the latest update in the article above, Everything pushed back a month.

Adam says

Please do not budget for this payment coming in April. They haven’t said the payment WILL be made, they haven’t said what the percentage will be or even when they will announce what the percentage is to be paid. They are entitled to delay the payment even further.

H says

Hi, I’m sorry this must of been asked 100 times.

Am I too late to change my bank details, if not please could someone supply the best telephone number to update?

Thanks in advance

Danny carmody says

hi l have used QQ customer support team phone no,s 0800 0561515 or 0800 2100923 they were working 8 weeks ago, if any here to you,

Tina M says

Sara

As we have all been told what the amount is that they owe us last year will the payment change that they eventually owe us as a year has passed so would the interest increase on our payout?

Sara (Debt Camel) says

No, there would be no point. Because the amount you will Be paid depends on the the money to be divided. So if everyone’s added 8% interest goes up by one more year of 8%, there is no more money to be divided up so the percentage payout would be lower.

Richard says

Im still waiting for a copy of my claims email since the middle of December, so much for 8 weeks! Just keep getting told the same that its been esculated. With nk time frame, Absolutely yousless they are!

Tara says

I dont get why this money is even being taxed when that money has already been taxed when you earn it ??? I dont quite understand all this tax stuff

Sara (Debt Camel) says

The return of your interest paid is NOT taxed. Only the 8% element is as that is treated as interest you would have received on savings.

AN says

Hi

Am I missing something here but they know the amount of claim .. figure A …. They know how much they have in funds collected.. figure B

Surely it’s a simple maths calculation of figure A divided by figure B and times by 100 ???

Surely someone can pick a calculator up and least let us know the percentage and amount we are to receive????

Tim says

You would assume it would be that simple! I’m sure there’s a lot more involved in an Administration, but at this point, when they were just waiting for HMRC clearance, I would have imagined they could have just adjusted the pot value, and a %redress would have been calculated. Hopefully someone will hear something soon with regards to dividend payouts. Feels like it has lasted forever, but ultimately we will have a positive outcome for everybody.

Jim says

AN, yes I am sure you’re right. They either already know the exact figure, or at least a very close approximation. They are probably waiting for a Grant Thornton audit committee to sign off on the dividend declaration. And don’t forget everybody is working from home, which is making them even more inefficient than usual.

Sara (Debt Camel) says

a very close approximation is not good enough. It has to be exact.

Robert says

Hi,

Has anyone received an email stating redress percentages plus payment timetable. I cannot get a GT email portal notification account because I haven’t been sent the details to log in.

Sara (Debt Camel) says

no. There will be dozens of people reporting the percentage here when the emails start to land.

Sara (Debt Camel) says

No. See my previous answer above

Ashley says

Looks like I’ve been given my overpayment I hope other people are in the same boat :)

paul says

Do you mean you have received your compensation?

Sara (Debt Camel) says

This is an overpayment he made. It is not the refund most people will be getting.

paul roffey says

Sara.

I have been following this thread because I like so many others are anxious.

I really must commend you on how you are helping everyone.

It’s so massively helpful more than you can possibly imagine.

Thank You

Melanie Patterson says

I got mine today too

Dave says

£502 overpayment hit my bank today as well

Bruce says

“We have now received tax clearance from HMRC and will declare the dividend and make the payment to all unsecured creditors as soon as possible.

I did not receive the above email last one I got was about my claim been accepted to the value of £2642. Am I missing something

Sara (Debt Camel) says

I am not publishing some comments at the moment that are very repetitive, argumentative, critical of other people or saying things that are alarming and untrue.

Let’s just keep calm at the moment, fretting and insults will not speed anything up.

If you would like something positive to do think about whether you can make any other affordability complaints!

I have template letters for different sorts of borrowing, it’s not just payday loans any more…

– SafetyNet Credit, Drafty – the payday loan template works well for these complaints which are often easy to win as the lender could see your bank account! https://debtcamel.co.uk/payday-loan-refunds/

– credit card or catalogue limit raised too high when you were only making minimum payments? See https://debtcamel.co.uk/refunds-catalogue-credit-card/

– have you been in your overdraft for all or almost all of the month for years? See https://debtcamel.co.uk/get-refund-overdraft/

– large loans and car finance: https://debtcamel.co.uk/refunds-large-high-cost-loans/

Anthony says

Hi Sara, I’ve been through the list of payday lenders, those still trading, closed and in administration and cashgenie does not seem to be included. I had loans from them in 2013 & 2014, do you have any update on this company? Thanks

Sara (Debt Camel) says

They are long gone – went into liquidation in 2016.

Mike says

Well, i’m actually delighted tbh. I had an accepted claim value of nearly 15k, and prior to the closure of QQ, I would never have thought of getting any monies returned. Whenever my redress arrives, I will be over the moon, irrespective of whether that happens, this month, next month, or whenever.

Chris says

Thanks Sara I totally agree, I used your templates for Everyday Loans and I was awarded £3996 redress. Also Blackhorse Finance and I’ve just received a letter saying we’ve uphold your complaint and you will receive a cheque for £2787 in 7-10 days and this was with using your template letter. So like you say keep on the positive side of things, there a lot of claims that are waiting to be made!

Regards

Chris W

S says

Hi Chris,

If you don’t mind me asking, was Blackhorse Finance for Car finance?

I am with with Blackhorse atm for car finance, it ends next March so a year away.

Do I wait than put in a claim?

Thanks in advance

S

Mark says

Safetynetcredit accepted my redress complaint within 24 hours.

Gary says

Hi Mark did you still owe safetynetcredit when you got this?

Sara (Debt Camel) says

People are getting settlements if they still own money or if it has been repaid. Both very common.

Mark says

Owed them nothing.

Robert James says

Hi,

Regarding using a template letter to other companies, I have an outstanding debt with ‘Loans2Go’. A £250 loan spread over 18 months. I remember selecting to repay over 6 months on the application but they defaulted to 18 months. This means I’m paying very little of the original amount each month to rack up the interest to £600 – £700 pounds over 18 months.

Have you a template for ‘Loans2Go’ . i have threatened them by email with an Ombudsman but they didn’t take much notice of that.

Sara (Debt Camel) says

I have a special page on their horrible loans! https://debtcamel.co.uk/worst-loan-in-britain/

Robert James says

Oh, thank you.

At least we agree on something. I’ll check it out when I get home.

Angela says

Hi, I complained to Loans 2 Go, within a few days they rejected it saying at the time they completed all the necessary affordability checks etc. Didn’t even give me a chance to forward my bank statements and said they did not consent to me referring to ombudsman because loans were over 6 years old. I won an affordability claim with amigo that was over 6 years old. I also only found out in the past couple of years that I could submit these type of complaints. Can they refuse me permission to refer to ombudsman? As far as I’m concerned I have a good case. First loan was 2013, shortly after being discharged from bankruptcy aswell as lots of returned direct debits on my statements resulting in bank charges.

Thanks

Angela

Sara (Debt Camel) says

No they can’t refuse permission. It is FOS’s decision if they look at older complaints and, as you know, they often do.

Angela says

Thanks Sara.

Greg says

Is it possible to reopen a complaint if you have accepted can offer previously?

I would argue that I accepted a couple offers under duress as I was in such a predicament at the time I was not entirely aware of what I was entitled too and Aldi so desperate any offer seemed a good one at the time.

Sara (Debt Camel) says

this was an offer from the QuickQuid administrators?

Lisa Smith says

To note

I filed a claim in 2018 and an offer from QQ/P2P in 2018 which I accepted. I also submitted a claim in this administration and my claim was upheld minus the ones already considered.

So yes you can apply twice but it’s too late for this one now I think.

Danny carmody says

hi greg, i think your late, cut off was feb 2021, no more claim or complaints would be taken up, its on there website, sorry to say

Greg says

No in relation to a loans2go loans and a quid market one. I accepted offers for both but having read through some posts I believe I massively under cut myself.

Sara (Debt Camel) says

Ah, no, you can’t go back and change your mind.

J says

Hi I may be jumping the gun a little but I saw someone mention safetynet on here…do they have anything to do with it?

Thanks

Sara (Debt Camel) says

I am encouraging people to do something positive while they are waiting for the QQ payout.

If you have used Safetynet credit, they are one of the easiest lenders to win a complaint against as they could see your bank account. Use the template for payday loans to make a complaint to SNC: https://debtcamel.co.uk/payday-loan-refunds/

J says

In what respect would you make a complaint about?

Sorry, it just I have been messaging safetynet for months to sort some way of repaying them but don’t get anywhere. Thanks

Sara (Debt Camel) says

a complaint saying their loans were unaffordable – repaying one month left you so short you had to borrow from then again the next month.

Matt says

Hi,

I had loans with SNC from around late 2017 to mid 2018. I was in a spiral at this time and ended up entering a TrustDeed. Looking back into my account even when things were getting bad and they had access to my bank they proceeded to increase my borrowing limit. (Auto withdrew money whenever I got paid). My account was officially closed with them after some time in my TrustDeed. Would I still be eligible for claim? I’ve sent away for one anyway. SNC were a lender that crippled me really with the way they took money from my bank, can see every time I took loans was immediately after the previous loan was repaid.

I’ve sent away anyway just wondering what anyone thinks my chances maybe are of getting some money back, would maybe only be a couple hundred quid but still!

Sara (Debt Camel) says

I can’t comment on a Trust Deed – you need to ask a Scottish advisor. This is a good website: https://www.advicescotland.com/home/protected-trust-deed/ ask in the comments there or use the webchat.

Robert says

Hi J, simple terms below, and received in three days last August. If you don’t complain then don’t complain! Yes, I used Sara’s template.

Having investigated your complaint fully, we are upholding it. This means we agree with you and this letter sets out how we plan to put things right.

Complaint Overview and Outcome

We understand your complaint relates to the creditworthiness assessment on your revolving credit with us, from the initial lend

As we are upholding your complaint, you are due a refund of all interest paid to date on the credit you have borrowed, plus 8% statutory interest. This refund is

£2,657.31.

Please see the below breakdown of this refund minus income tax deduction

Total amount borrowed: £36,866.25

Interest added: £2,811.97

Total repaid: (£38,928.34)

Amount written off: £0.00

Outstanding balance: £748.85

Interest (to be written off): £178.21

Outstanding balance minus interest: £570.64

Total amount repaid: £38,928.34

Amount applied to funds borrowed: £36,295.61

Interest repaid: £2,632.73

Statutory 8% interest: £744.03

HMRC 20% deduction: (£148.81)

Redress due: £3,227.95

New outstanding balance after redress applied: £0.00

Amount written off from your balance: £570.64

Redress to be sent to you: £2,657.31

Nic says

Can i ask was this response 3 days from when you made the complaint? Hoping they are easy to deal with I emailed my complaint off on Sat afternoon

Robert says

Hi Nic, to clarify I made a complaint about SafetyNet using Sara’s template on 17/06/2021

complaints@safetynetmail.co.uk

To:

17/06/21 14:35

Robert – List of loan.pdf

Dear Mr Robert ********

Thank you for contacting SafetyNet.

Please find attached a complete summary of your transaction history with our service. You will receive a receipt for the logging of your complaint via a separate email shortly.

Kind regards,

Complaints Investigator

SafetyNet Team

Important Information from SafetyNet

SafetyNet Credit

To:

10/08/21 09:11

Robert Final response letter

SafetyNet

SafetyNet Important Information.

Dear Mr Robert,

Thank you for your recent contact with SafetyNet.

Attached is our final response letter.

SO TWO MONTHS…

Nic says

Perfect. Thank you. I also used Sarah’s template so shall wait and hear outcome. All the best

Chloe says

Hi Sarah

Unrelated to QQ but in 2020 I tried to make a complaint to everyday loans via resolver about there loads being unaffordable. They did not accept this saying that at the time I said I could afford it ( at the time I bent the truth about my finances as I was in a cycle of debt) Do you think it’s worth trying again?

Thanks

Sara (Debt Camel) says

no – you have left this too late and should have gone to the ombudsman then

Chloe says

Thanks for the quick reply!

J says

Hi I have written to everyone I had a payday loan with including Everyday advising them I am making a Affordability claim. I already had a claim with Satsuma but was told by provident that it wasn’t upheld. But I’m not sure why.

I have been told by the ombudsman that it isn’t too late, if the lender has refused (which they more than likely will) then the ombudsman will deal with it and advise accordingly.

I personally wouldn’t take advise from on here as gospel (no Odense to those trying to help each other as we are all in same boat) but each case is different.

It is the ombudsman that would make the final decision

Thanks

Jack says

Hi all,

I just phoned and spoke to a lovely person who went through my bank details with me and is sending me over my successful claim breakdown as I must have missed signing up for the portal. Payments due end of April if not before.

I got through right away and now have piece of mind.

Tom hooker says

Has there been a cap introduced on how much percentage a claims company can charge you??

Sara (Debt Camel) says

Yes, see https://www.fca.org.uk/news/press-releases/fca-launches-claims-management-companies-fees-cap# but they don’t apply to claims already in progress.

eh says

Hi Sara

when we receive our claim money from quick quid will we be charged tax or does no one know?

Sara (Debt Camel) says

It isn’t known yet.

Danny carmody says

hi eh, you will know when you get sent your redress email, you will see any tax, redress % and your pay out amount due to you, you just have to wait, it now going to be some time in april 22, hope this helps

Adam says

Can’t really see 78,000 claimants being told the percentage being paid and everyone receiving a payment in the next six weeks. It’s not happening. Surely there is yet another extension coming?

Graeme says

Don’t see why they can’t. It’s not as if it’s one stressed out dude with a pocket calculator. This is the digital age, most of it’ll be done by computer.

Noel mccready says

Agreed not long to go now.Keep the faith.

Kay Muir says

Whilst waiting for the latest update on Cashnet Euro I decided to make a claim for unaffordable lending with Oakbrook Finance who trade as

Likely Loans. My original loan in 2017 was for £1000, which ended up being 6 top up loans over the next three years, borrowing a little more each time the loan was topped up after 6 months of paying my monthly payments on time. On the 28th February 2022 I emailed Oakbrook to say I wanted to make a complaint against them for unaffordable lending, as at the time of borrowing I was struggling financially repaying lots of credit card debt and payday loans to support everyday living costs. I also asked for a list of my loan history. To my surprise I received an email from their complaints department on the 10th March upholding my complaint for 5 of the loans. I was offered a Full refund of all interest paid on these 5 loans plus 8% interest. This totalled £2959. After paying off the balance of the loan I today received a payment into my bank of £1779, only 15 days after my original email complaint. If anyone else out there has history of repeated lending with likely Loans drop them a quick line it was so straightforward and easy to do. Complaints@oakbrookfinance.com Good luck

Jackie says

Thank you for sharing this. It’s very useful as I have an outstanding balance with Likely Loans that I can’t repay as I am now unable to work due to ill health. I can’t remember how many times I topped up as it was a few years ago. Did you provide them with the details of your borrowing or did they just check your account history themselves ?

Also, did you supply them with any information from your credit file regarding other debts you were struggling to repay ?

Thanks in Advance

Jackie

Kay says

I just sent an email saying I wanted to start a case for unaffordable lending and asked them to start proceedings by sending me a form to complete. It was not necessary to fill in any forms or find any paperwork of the loans. I heard from Likely Loans 10 days later saying they had looked at my loan history and agreed that I had been lent the money which was unaffordable. I provided no information of the other debts I was repaying at the time or any further bank/income information, it was literally a 2 line email asking for a case to be opened and they did the rest, I was so shocked to have received a refund within 15 days of complaining. Wish I had done it sooner.

Sara (Debt Camel) says

Jackie, just use the template on this page: https://debtcamel.co.uk/refunds-large-high-cost-loans/. That kicks a complaint off and see what happens next.

James Evans says

Hi,

Just to add to this i contacted them on the 12th March and today got a response saying they are upholding my complaint, so have replied and accepted will just wait for the funds to arrive in my account. I was really impressed with the quickness of their response.

Kelly says

Amazing! This has reminded me that I had a loan with them back in 2016 for £1800 so I will be doing the same! Thanks for the info!

Tony says

So does anyone think this is going to happen? It’s 34 working days until the ‘anticpated’ date that all creditors will be paid.. but still deafening silence on a dividend percentage

Sara (Debt Camel) says

yes.

There is no reason to think it won’t.

Timbouk says

Totally agree there is no reason to worry and I am finding them much more upfront than the Wongs redress. We find fund we only find out the percentage once we are emailed to say money is on its way.

Sara (Debt Camel) says

You should be told the payout percentage first. Then the payments will go out in batches.

Martin says

Does anyone have the template please to email over my claim and also the email address?

Thanks

Martin

Sara (Debt Camel) says

A claim to QuickQuid? You are a lot too late to do that I am afraid.

Colin says

If the court ordered the administrators to advise a redress amount and make a payment by March 2022 how can they extend this to April?

Sara (Debt Camel) says

Courts don’t sit and work out what the administrators should be doing. They don’t order the administrators to make certain dates. The administrators send a proposal to the court for an extension and it is approved. There is nothing unusual here.

Graeme says

Also because an outside agency (HMRC) didn’t grant clearance in time for this to be done.

paul says

They haven’t they’ve given them an extension to complete the administration by another 6 months

VH says

Thanks Sara for this page and to everyone who posts useful developments and information – it is appreciated.

I called yesterday to ensure my contact and banking details were correct. I pressed a little for more information and was told I should receive email with percentage and final redress figure by first week of April. And if not, I should call them to chase. A small, but relevant peice of information I thought I should share.

KarenH says

Hi,

Thank you for sharing. A flicker of hope that our redress is round the corner!

Thanks to Sara too, your site has been invaluable.

Brian says

Hi VH,

What numver did you call them on?

I think I’ll need to check they have my correct bank details too.

VH says

Hi Brian

I got this number from an email they’d sent me.

08000163250

VH

Nadine Wood says

Hey!

I never had the email that said they received tax clearence from HMRC etc….does it matter i didnt get that? Ive had everything else x

Sara (Debt Camel) says

You only got that if you signed up on their portal to get general updates. Lots of people didn’t.

Quiggers says

Got this today.

Got this Thank you for contacting CashEuroNet UK, LLC.

In regards to your query, the Joint Administrators have provided an update to inform you that, due to delays in obtaining HMRC clearance (the clearance application was submitted in October 2021), we have had to apply to court to extend the date for the payment of the dividend by 6 months from 14 March 2022, the previous deadline set by the court for the payment of the dividend. The administrators require the HMRC tax clearance in order to calculate the dividend payable on all admitted creditor claims.

We have now received the clearance we require and are working to declare the dividend and make the payment as soon as possible. We now expect to pay the dividend to all creditors by 30 April 2022.

Updates will be provided as they become available and will be forwarded to all creditors. We appreciate your patience.

Yours sincerely,

Pam

For and on behalf of CashEuroNet UK, LLC

The Joint Administrators

Claire says

HI there,

Looking for some advise, my file should have been transferred to Casheuronet by FOS where my position was that the adjudicator had upheld my complaint the monthly prior to entering administration. I had to chase Casheuronet last week as to what was happening, they have now sent within a day, the email that my claim has been processed and assessed and agaist the loan the FOS had upheld the have rejected ? Is this normal, should I appeal this ? any advice would be great. Can I also ask it has accepted claim value with a figure in this bu t the refund for overypayment on loan is £0.00… does this mean I will get nothing.

Sara (Debt Camel) says

So they accepted how many loans? Which was the loan FOS accepted and they rejected, where in the borrowing sequence?

You need to ask them if you can appeal this.

the overpayment figure is just if you have paid more by accident to a loan. it’s normally zero.

Denise says

Good morning everyone.

I telephoned Quickquid yesterday and spoke to an extremely nice lady who reassured me that all payments would be made by April 30th. I have no reason to doubt her statement.

I also asked that, if the loans had gone to a debt collection agency, would the money be paid straight to them?

She told me that they do not deal with third parties and that all money would go to the person who took the loan out.

I hope that this is reassuring news for those who may have had their debt sold on?

The end of April will be here before you know it. It doesn’t seem five minutes since Christmas and yet it is nearly three months…Tempus fugit!

Noel mccready says

Can’t c any problem with the administrators they sent me a small cheque for 150 pounds for redress for loans I had with Wageday Advance I never even put a claim in. It was then I realised if wageday had gone bust QQ might go the same way and do it happened

USHA says

Hi,

Sorry if this has already been asked but just wanted to get a slightly clearer idea when it comes to the numbers. Is the 30 -50p, that has been said might be paid out, the value against our accepted claim value? And will 8% interest be deducted from that too?

I know nothing is certain yet, but I just wasn’t sure if I had understood correctly, especially with the 8%.

Thanks.

j says

hi, nobody knows anything yet, we still do not know the final percentage, we do not know if they are deducting 20% of the interest part…the 8% is the additional interest which is taxable to 20% but as i said we just do not know, we are still awaiting confirmation 6 months after the original pay out date.

Dan says

They have confirmed with HMRC that 8% interest will be ADDED and that will NOT be subject to tax

sharon says

i think for how long we have waited for the payouts they should be giving us the percentage they are just fragging there heels now 3yrs after original date

El says

Yes but if they gave the percentage and payments took six weeks or so to process there would still be huge volumes of complaints on here about how long it was taking. I think the best thing to do is accept that it is coming, be patient and grateful that the offer is likely to be far higher than anyone originally anticipated based on other administrations. Admittedly I was hugely frustrated at the start as my claim was approved by the FOS and I was literally waiting for payment when QQ declared they were going in to administration, but am counting small mercies as and when they come.

Noel mccready says

Totally agree its only 5 weeks which will come soon.Patience guys and I stand to make a few pound off them.

William says

Surely if Casheuronet were just waiting on HMRC clearance they should have had totals agreed and if had to pay tax then deduct the tax. Once tge clearance was given then tge totals are the totals. Is this the administrators taking more money leaving less to be distributed amobg us who have been wronged

Sara (Debt Camel) says

HMRC clearance is for the corporate tax. Nothing to do with the deduction of tax (or not) from the redress paid.

Robert says

Sorry if I’m wrong. But corporate tax, if less than expected, would mean more money to be distributed to the creditors, not given to a loan company in liquidation.

Sara (Debt Camel) says

But corporate tax, if less than expected, would mean more money to be distributed to the creditors

true

and if it is more than was expected there will be less to be distributed.

But so what? This has NOTHING to do with the tax treatment of the 8% part of the dividends that are being paid.

Ian H says

The administrators already allowed for no tax owing so won’t affect things HMRC just confirmed tax affairs were up to date

Tim says

Let’s hope that the uncertainty between 30 and 50%, surrounded the tax liability, and our slice will be closer to 50% then. Either way, we getting close now.

Sara (Debt Camel) says

Let’s hope that the uncertainty between 30 and 50%, surrounded the tax liability, and our slice will be closer to 50% then

Well you can hope, but there is no reason to think that is the case.

Sharon says

it annoys me because if we owed them money they would be straight on our backs! 3 years later and we are still waiting!

owed 14k says

This is why you, and everyone who is owed money, should request detailed accounts of how much the liquidators took for cost and if the extensions benefited the debtors or the liquidators. This information is available under freedom of information. I know Sara is not happy about negativity and I hope this does not come under that. But when the final payment is made I think everyone should request all account information and look into if the extensions was beneficial to the debtors or beneficial to the liquidators.

Sara (Debt Camel) says

This seems pointless to me. There will be lots of excuses why extensions were needed,many of which may be genuine. You won’t be able to work anything out and won’t be able to do anything with the information.

Paul says

I’d be more interested in everyone that comments on here use there energy to put some pressure on GT to get this moving forward. I’m not interested in the ‘positive’ comments or the comments calling people negative for having an opinion, it’s nothing short of ridiculous now. If the update in October and March were the full truth then the percentage would be known by now.

Sara (Debt Camel) says

Nothing anyone does at the moment will make the slightest difference to the date the payments are made.

I am just being realistic. this is just wasting your time and mental energy in thinking about this.

KAH says

Hi,

i have seen a few posts about Likely Loans. i had a loan with them and i could not afford to pay it off and it was sent to a collection company. Cabot Finance. i am paying them a small amount per months.

Could i still make an affordability claim against Likely Loans?

Sara (Debt Camel) says

yes if you think the loan was unaffordable at the time it was given. Use the template letter here: https://debtcamel.co.uk/refunds-large-high-cost-loans/

A loan is only affordable if it is likely you can pay it and all your other debts, bills and living expenses without having to borrow more money.

KAH says

Thank you for the reply

J says

Hi apologies if this is a bit of a dumb question but if I have been told that 11/11 of my claims were successful the last loan never being repaid I know I won’t get an exact figure but does anyone have an idea what this might mean for me? Casheuronet don’t really say much.

And if I have been successful with Quickquid does this mean I’m likely to be successful with my other lenders? Thanks

Ian H says

You don’t need to ask all the costs are set out in the updates in excruciating detail.

Jonathan says

Hi guys, thought I would post this as reading lots of comments about people who had claims accepted but didn’t receive the latest Grant Thornton email update on 3 March 2022. As there’s lots of comments I don’t know if someone has already posted this advice.

I too had claim accepted but didn’t receive the latest update email about pay date being pushed back to April. So investigated my previous emails and found on 21st May 2021 you should have an email from CashEuroNet with your log in credentials for the Grant Thornton portal (details most likely unique to each claimant). When you log in you can see all the documents you would’ve received by email if you signed up to be notified of updates. Like many I didn’t sign up before but you can when you use your credentials to log in, or just view the documents. The 3rd March email sent out was sitting there for me.

Hope this helps relax a few heads.

Sara Flanagan says

My last email from them was in February of last year. Detailing my accepted claim value. I’ve heard absolutely nothing since. No opportunity to sign up for updates.

So I’m just sitting tight and patiently waiting for my payout. Taking it on trust lol. I’m sure there are many others in the same position.

A couple of weeks and then we should all know more …

Ben says

Morning i know we are all getting frustrated that we arent being paid this month and we have to wait but think of it as we getting something which is better than nothing and regarding the percentage well just remember 30p to 50p for every pound based on average claim around £1700 may look promising but theres people with accepted claims 3k to 10k etc if they havent actaully worked out the money thats left against the actaul amout they have to payout the percentage may change so pointless we all getting angry with how long this is taken i agree its taken to long but if we dont get the amounts we hope then you going to be even more upset 2 weeks and we should recieve a update all being well something is better than nothing at all

Robert James says

Hi, nice synopsis.

But when they say average claim is £1700 I assume this average includes the ‘high roller payouts’ of 3K to 10K, so the percentage should be within that bracket mentioned. I am fortunate enough to be in the ‘high-roller’ category, so looking forward to this payment when it comes.

Ben Morgan says

Thats the thing does that include the higher payouts hope it does as 135million to be split between creditors is a lot of money just hope everyone gets there full amount if it comes next month even better but i understand when we get told one thing then somehting happens its gets frustrating i get that fingers crossed after next week we get the email and we know where we stand

Dennis says

Hi Sara

There was an indication from Sunny that they would pay a supplementary dividend about December time

Have you any news on this?

Sara (Debt Camel) says

are you sure you arent thinking of the Money Shop?

Dennis says

Hi Sara

There was an indication from Sunny that they would pay a supplementary dividend about December time

Have you any news on this?

No it was shortly after Sunny paid out I think it was to do with a tax refund

Sara (Debt Camel) says

I don’t remember this. I can’t see a reference to it in any of the administration documents.

Deb says

Hi, 1st time posting, I called Casheuronet this morning to double check my bank details were correct and was informed that we should receive an email very soon and payment will be done before the 30th April deadline.